Automotive Automated Storage and Retrieval System (ASRS) Market

Automotive Automated Storage and Retrieval System (ASRS) Market by Type (Unit Load, Mini Load, Mid-Load, VLM, Vertical & Horizontal Carousel), Deployment (Standalone, Integrated), Payload (<500 kg, 500-1,500 kg, 1,500 kg) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

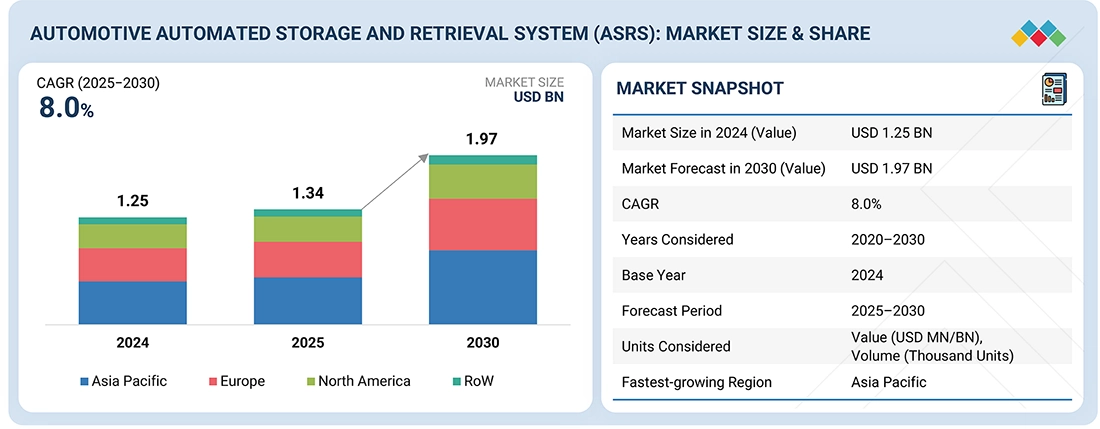

The Automotive Automated Storage and Retrieval System (ASRS) Market is projected to grow from USD 1.34 billion in 2025 to USD 1.97 billion by 2030, registering a CAGR of 8.0%. Market expansion is driven by increasing automation of internal logistics within automotive manufacturing plants, rising production volumes, and the need for accurate and high-speed handling of components, subassemblies, and finished goods. The adoption of advanced ASRS is supported by the integration of control software, robotics, real-time tracking, and automated material flow management, which improves throughput stability, inventory accuracy, and space utilization. In addition, continued modernization of automotive production facilities, growth in electric vehicle and battery manufacturing, and investments aimed at improving operational efficiency and production continuity are strengthening demand across the global automotive sector.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific is expected to grow at the highest CAGR of 9.4%.

-

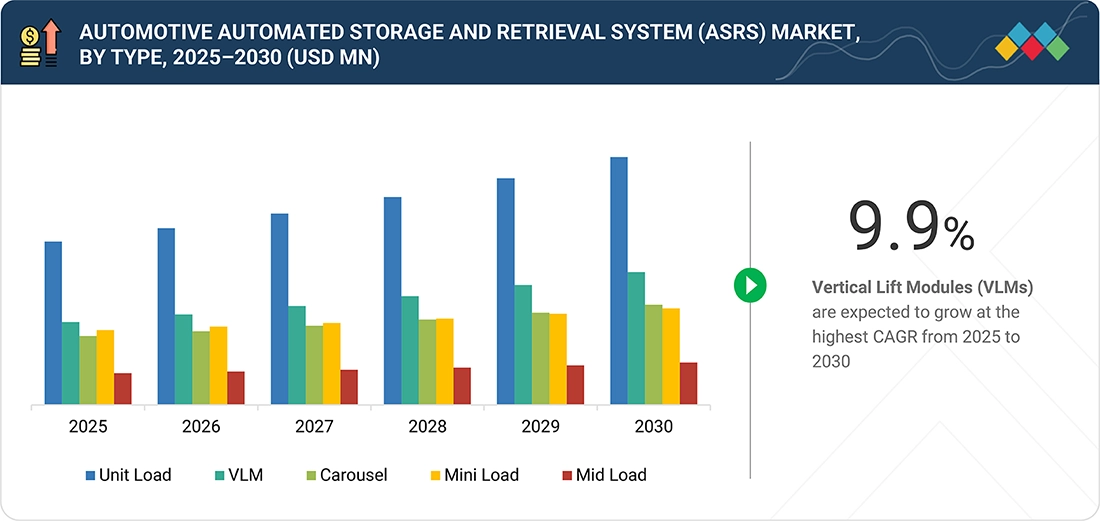

BY TYPEVertical Lift Modules (VLMs) are expected to grow at the highest CAGR of 9.9%.

-

BY PAYLOAD CAPACITYThe 500–1,500 kg payload capacity segment is expected to account for 35-40% of the market by 2030.

-

COMPETITIVE LANDSCAPEDaifuku Co., Ltd., Murata Machinery, Ltd., and TGW LOGISTICS were identified as key players in the market, supported by their strong presence in automotive manufacturing automation and comprehensive ASRS portfolios.

The market is set for steady growth as automotive manufacturers and suppliers drive automation in storage, buffering, and component distribution. The demand for reliable material availability, high-throughput logistics, and efficient use of space supports the adoption of advanced solutions for automated storage, retrieval, and real-time inventory. Improvements in control software, system coordination, and integration with production systems enhance the reliability, scalability, and long-term performance of these solutions.

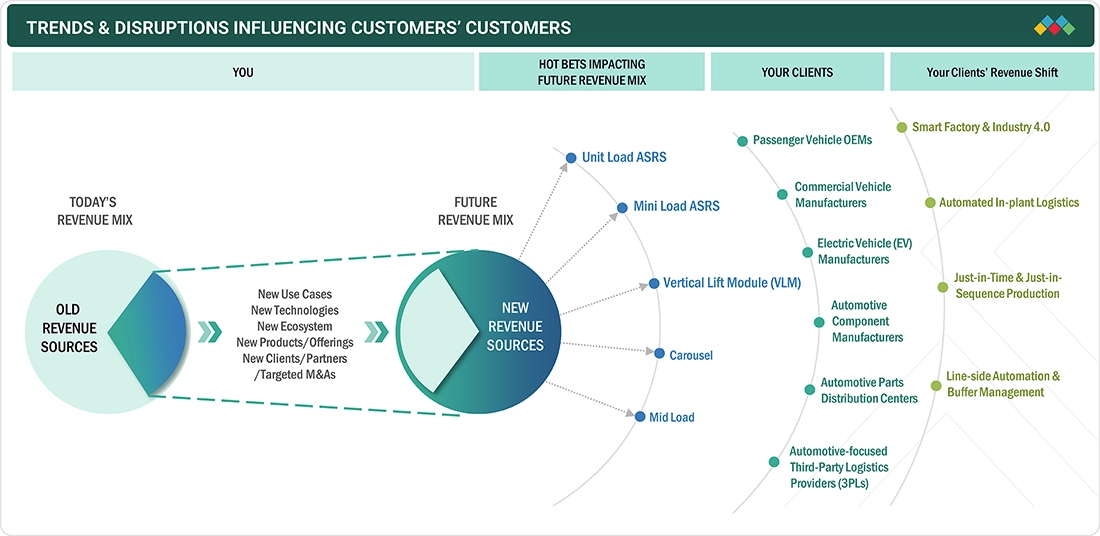

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers' businesses is driven by the need to improve internal logistics efficiency, maintain a stable production flow, and optimize space usage within manufacturing and component handling environments. Automotive manufacturers are adopting advanced ASRS solutions to automate storage and retrieval, reduce manual handling, and enhance part availability and inventory accuracy, thereby supporting continuous production operations. Integration of intelligent control software, real-time visibility, and predictive maintenance is lowering downtime, improving system reliability, and reducing operating costs. These capabilities help customers streamline material flow, minimize production disruptions, and scale output efficiently, making ASRS adoption a key contributor to long-term cost control, production stability, and operational resilience in automotive operations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing Production Automation in Automotive Manufacturing

-

Rising Complexity of Automotive Components and Assembly Operations

Level

-

High Capital Investment Requirements

-

Integration Challenges with Existing Production Systems

Level

-

Expansion of Electric Vehicle and Battery Manufacturing

-

Adoption of Software-Driven Intralogistics

Level

-

Custom Engineering Requirements Across Automotive Facilities

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing Production Automation in Automotive Manufacturing

Automotive plants are expanding automation across internal logistics to ensure uninterrupted material flow, reduce manual handling, and maintain consistent throughput in high-volume production environments. ASRS further supports just-in-time production by synchronizing parts availability with assembly line demand and reducing line-side inventory congestion.

Restraint: High Capital Investment Requirements

Automotive-grade ASRS systems involve high upfront costs for equipment, software integration, and installation, which can limit adoption among cost-sensitive manufacturers. Extended payback periods and the need for customized system engineering increase financial risk, particularly for mid-sized suppliers.

Opportunity: Adoption of Software-Driven Intralogistics

The increasing adoption of MES, WMS, and real-time analytics is creating opportunities for intelligent, connected ASRS solutions that enhance operational visibility and responsiveness. Software-led orchestration enables tighter coordination between storage, material transport, and production scheduling across multi-line facilities.

Challenge: Custom Engineering Requirements Across Automotive Facilities

Each automotive plant has unique material flows and layout constraints, increasing engineering complexity and project execution timelines for ASRS implementation. Frequent model changeovers and evolving production mixes further complicate standardization and long-term system scalability.

Automotive Automated Storage and Retrieval System (ASRS) Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Daifuku delivers automotive-focused ASRS solutions designed to support high-throughput material handling, line-side buffering, and sequenced component storage within vehicle assembly and component manufacturing facilities. Its systems integrate automated storage, conveyors, and control software to manage inbound materials, work-in-process inventory, and finished components while ensuring smooth coordination with production operations. | Improves material flow stability and line-side availability while reducing manual handling and internal congestion | Enhances space utilization, inventory accuracy, and operational reliability, supporting continuous automotive production and scalable plant operations |

|

Murata Machinery supplies automotive ASRS platforms, including unit load, mini-load, and multi-level systems, used for the storage and retrieval of heavy components, subassemblies, and palletized materials. Its solutions integrate material handling equipment with warehouse management and control systems to support stable, high-speed operations across automotive production and logistics facilities. | Enhances retrieval speed, load handling stability, and inventory visibility across complex automotive storage environments | Supports efficient coordination of material movement, improved system uptime, and consistent support for automated production workflows |

|

TGW Logistics Group offers ASRS solutions for automotive parts storage, line replenishment, and buffer management, utilizing shuttle-based systems, mini-load ASRS, and software-driven control platforms. These solutions support synchronized delivery of components to assembly lines and efficient handling of high-SKU automotive parts within production and spare parts environments. | Enables precise, sequence-based component delivery while reducing line-side inventory levels | Improves picking accuracy, response to production schedule changes, and overall throughput consistency in automotive manufacturing and parts distribution operations |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

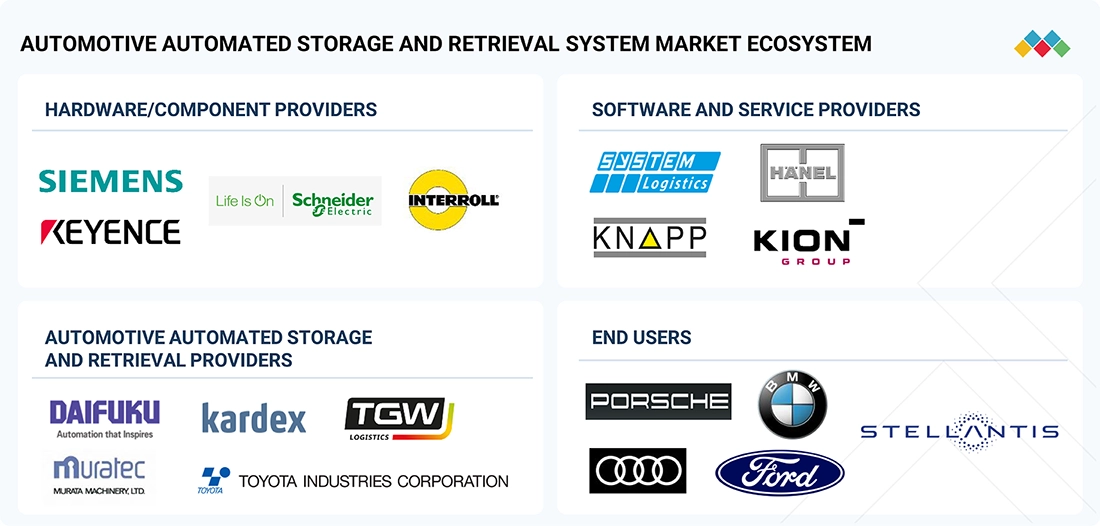

MARKET ECOSYSTEM

The market ecosystem comprises hardware and component providers supporting mechanical and automation infrastructure, software and service providers delivering warehouse control, warehouse management, manufacturing execution systems, and lifecycle support, automotive ASRS providers supplying production-integrated unit load, mini-load, shuttle, and vertical lift solutions, and end users across automotive manufacturing, component production, EV and battery facilities, spare parts warehouses, and in-plant logistics operations. This tightly aligned ecosystem enables end-to-end deployment of reliable, high-throughput, and space-efficient ASRS solutions that support stable material flow, system uptime, and production efficiency in automotive environments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Automotive Automated Storage and Retrieval System (ASRS) Market, By Type

Vertical Lift Modules (VLMs) are expected to grow at the highest CAGR, driven by increasing demand for compact and high-accuracy storage solutions within production and parts handling environments. Automotive manufacturers are deploying VLMs to manage high-SKU small components, tools, and service parts near assembly and maintenance areas, while maximizing vertical space utilization. Adoption is accelerating as facilities seek to improve picking accuracy, reduce manual handling, and enable faster part access without major layout changes. Growing emphasis on ergonomic operations, real-time inventory visibility, and scalable automation is strengthening VLM deployment, reinforcing their role in supporting efficient, space-optimized automotive manufacturing and internal logistics operations.

Automotive Automated Storage and Retrieval System (ASRS) Market, By Payload Capacity

The 500 kg–1,500 kg payload capacity segment is expected to hold a significant market share, supported by its suitability for handling palletized and containerized automotive components across production and internal logistics operations. This payload range is widely used for storing and moving engines, transmissions, battery modules, and subassemblies, where load stability and consistent throughput are critical. Adoption is increasing as automotive facilities strive to optimize vertical storage, minimize manual handling, and ensure a reliable material flow between production stages. The ability of 500–1,500 kg ASRS systems to balance load capacity, speed, and space efficiency is strengthening their role in large-scale automotive manufacturing and component distribution environments.

REGION

Asia Pacific to be fastest-growing region in the Automotive Automated Storage and Retrieval System (ASRS) Market during forecast period

The Asia Pacific is the fastest-growing region, driven by high automotive production volumes, rapid adoption of factory automation, and increasing investment in production-linked intralogistics systems. The expansion of vehicle assembly, component manufacturing, and battery production activities is increasing the demand for reliable, high-throughput material handling solutions within automotive facilities. In addition, cost pressures, rising labor constraints, and ongoing modernization of automotive plants are accelerating the shift toward automated storage and retrieval systems across the region.

KEY MARKET PLAYERS

- Daifuku Co., Ltd. (Japan)

- Murata Machinery, Ltd. (Japan)

- SSI SCHAEFER (Germany)

- Kardex (Switzerland)

- TGW LOGISTICS (Austria)

- Toyota Industries Corporation (Japan)

- IHI Corporation (Japan)

- KION GROUP AG (Germany)

- KNAPP AG (Austria)

- KUKA AG (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.25 Billion |

| Market Forecast in 2030 (Value) | USD 1.97 Billion |

| Growth Rate | CAGR of 8.0% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, RoW |

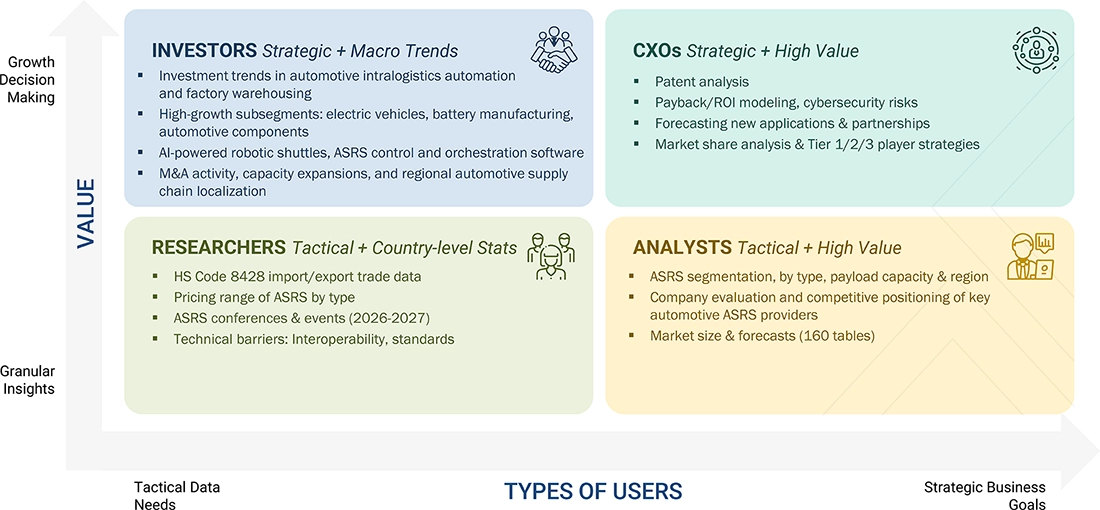

WHAT IS IN IT FOR YOU: Automotive Automated Storage and Retrieval System (ASRS) Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive OEM / Vehicle Assembly Plant |

|

|

| Tier 1 Automotive Component Manufacturer |

|

|

| Automotive Parts Distribution & Aftermarket Operations |

|

|

RECENT DEVELOPMENTS

- October 2024 : KION Group AG opened the KION Automation Center in Antwerp, Belgium, establishing a new Center of Excellence for the EMEA region. The facility will serve as a central hub for research, development, testing, and production of automated solutions. Spanning approximately 11,800 square meters, the center employs around 400 professionals from 40 nationalities and is strategically located near the Port of Antwerp, strengthening KION’s automation capabilities and regional presence.

- March 2024 : SSI SCHAEFER launched LOGIONE, a standalone software solution for the SSI LOGIMAT Vertical Lift Module. The solution features an intuitive and self-explanatory user interface that simplifies storage location and article management, eliminating the need for user training.

- October 2023 : TGW Logistics Group announced the expansion of its international headquarters in Marchtrenk, Austria, adding new office space along with expanded production and storage areas. The development reinforces the company’s commitment to its Upper Austrian base and enhances its capacity to deliver advanced automated material handling and ASRS solutions globally.

Table of Contents

Methodology

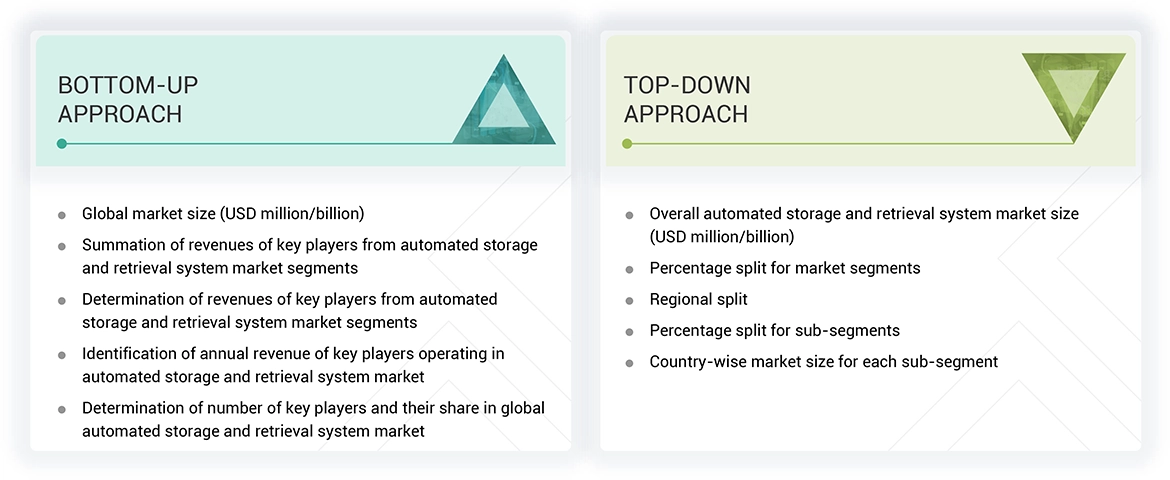

The study involved four major activities in estimating the current size of the automated storage & retrieval system market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the automated storage & retrieval system market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research..

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the automated storage & retrieval system market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the automated storage & retrieval system market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Automotive Automated Storage and Retrieval System (ASRS) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the automated storage & retrieval system market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

The Automated Storage & Retrieval System market develops, produces, and implements sophisticated systems to automate the storage and retrieval of goods in industrial, commercial, and logistics environments. Unit-load, mini-load, vertical lift modules (VLM), carousels, and Mid load ASRS solutions include automated storage & retrieval systems with the latest technologies of robotics, machine learning, and advanced sensors for optimized storage density, increased retrieval speed, and minimum human intervention. With the growing trend of Industry 4.0, an increasing focus on efficient inventory management, and a rapidly growing trend toward automation to minimize operational costs, ASRS has become an essential component of modern warehousing, manufacturing, and supply chain operations that support higher productivity and accuracy in material handling processes.

Key Stakeholders

- Associations, forums, and alliances related to automotive automated storage and retrieval systems

- Assembly and packaging vendors

- Electronic hardware equipment manufacturers

- Companies from verticals such as automotive, chemicals, aviation, semiconductor & electronics, e-commerce, retail, food & beverages, healthcare, and metals & heavy machinery

- Integrated device manufacturers (IDMs)

- Original device manufacturers (ODMs)

- Original equipment manufacturers (OEMs)

- Original technology designers and suppliers

- Raw material suppliers

- Research institutes and organizations

- Standard organizations and regulatory authorities related to the material-handling industry

- System integrators

Report Objectives

- To define, describe, and forecast the automated storage & retrieval system market, in terms of value, by type, payload capacity, industry, and region.

- To forecast the market size, in terms of value, by region—North America, Europe, Asia Pacific, and the Rest of the World.

- To provide detailed information regarding the major factors influencing the growth of the market, namely, drivers, restraints, opportunities, and challenges.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the probable impact of the recession on the market in the future.

- To study the complete value chain of the automated storage & retrieval system ecosystem, along with market trends and use cases.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market.

- To strategically profile key players and comprehensively analyze their core competencies along with detailing the competitive landscape for market leaders.

- To analyze competitive developments such as product launches, acquisitions, partnerships, and expansions in the automated storage & retrieval system market.

- To benchmark market players using the company evaluation quadrant, which analyzes players based on various parameters within broad business categories and product strategies.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automotive Automated Storage and Retrieval System (ASRS) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Automotive Automated Storage and Retrieval System (ASRS) Market