Automotive Manufacturing Equipment Market Size, Share & Trends, 2025 To 2030

Automotive Manufacturing Equipment Market by Equipment type (CNC Machine, Injection Molding Machine, Robot, Metal Stamping Machine, Augmented Guided Vehicles, DC Torque Tool), Vehicle Type (Passenger, Commercial) Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global automotive manufacturing equipment market is expected to grow from USD 31.99 billion in 2025 to USD 41.70 billion by 2030 at a CAGR of 5.4%. The rising production of electric and hybrid vehicles is pushing automakers to modernize their plants with advanced and specialized machinery. Increasing adoption of automation, robotics, and Industry 4.0 technologies is enhancing production speed, accuracy, and real-time connectivity, fueling the demand for intelligent manufacturing equipment.

KEY TAKEAWAYS

-

BY EQUIPMENTCNC machines are set to dominate the automotive manufacturing equipment market, driven by high precision, efficiency, and integration with automation and Industry 4.0.

-

BY MODE OF OPERATIONThe automatic segment is set to grow strongly in the automotive manufacturing equipment market, driven by rising EV demand, complex vehicle designs, and the adoption of AI- and IoT-enabled smart automation.

-

BY VEHICLE TYPEThe passenger vehicles segment is set to lead the automotive manufacturing equipment market, driven by high global production, rising personal mobility demand, and investments in advanced equipment for EVs and flexible manufacturing.

-

BY REGIONAsia Pacific is set to lead the automotive manufacturing equipment market, driven by rising vehicle demand, rapid industrialization, EV adoption, and investments in advanced, flexible manufacturing technologies.

-

COMPETITIVE LANDSCAPELeading players such as ABB, FANUC CORPORATION, KUKA AG, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Ltd. are adopting both organic and inorganic growth strategies, including product innovation, strategic partnerships, and capacity expansion.

The automotive manufacturing equipment industry is growing steadily, driven by rising demand for passenger vehicles and the shift toward electric and hybrid mobility. Automakers are adopting advanced robotic systems, CNC machines, and stamping equipment to improve efficiency, precision, and scalability. The integration of Industry 4.0 technologies, such as AI, IoT, and real-time data, is making factories smarter and more connected. In addition, supportive government initiatives for clean mobility and domestic production are further encouraging modernization, fueling sustained market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. It illustrates how companies’ revenue mix is expected to evolve over the next 4–5 years, moving from current offerings to new use cases, technologies, and markets. 3D printing and artificial intelligence are the main trends that vendors are channeling for passenger and commercial vehicles.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Elevated sales of electric and hybrid vehicles globally

-

Increased reliance on automation by OEMs in developed countries to boost cost efficiency

Level

-

High installation and ownership costs for SMEs

Level

-

Increasing demand for ML and AI by automobile companies

-

Thriving automotive sector in emerging economies

Level

-

Vulnerability of industrial manufacturing systems to cyberattacks

-

Interoperability and integration-related issues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Elevated sales of electric and hybrid vehicles globally

The rapid rise of electric and hybrid vehicle sales is driving the automotive manufacturing equipment market. Automakers are investing in advanced equipment for batteries, electric drivetrains, and lightweight components. Policy support, better charging infrastructure, and battery innovations are accelerating this shift, while ambitious EV targets from major manufacturers boost demand for automated production systems.

Restraint: High installation and ownership costs for SMEs

Automotive manufacturing equipment is costly and complex, requiring advanced technology, skilled labor, and significant investment in R&D. High costs arise from industrial robots, sensors, and integration, while customization, maintenance, and reprogramming add further expenses. Frequent product updates and evolving vehicle designs can make equipment obsolete, posing financial and operational challenges, especially for SMEs.

Opportunity: Increasing demand for ML and AI by automobile companies

The automotive manufacturing market is increasingly adopting AI and smart automation to boost efficiency, quality, and safety. AI systems monitor production, detect defects, and handle repetitive or hazardous tasks. Companies like BMW and Porsche use AI and autonomous systems for quality control and material handling. Rising industrial robot use generates data that AI analyzes to further improve productivity and precision.

Challenge: Vulnerability of industrial manufacturing systems to cyberattacks

The growing adoption of AI and machine vision in automotive manufacturing exposes robots and control systems to cybersecurity risks, impacting safety, accuracy, and productivity. Connected systems like SCADA and IoT devices are particularly vulnerable to attacks. To mitigate these threats, industries must implement firewalls, access controls, regular system testing, and staff training. Ensuring the security of AI-enabled devices is critical for safe, efficient, and uninterrupted manufacturing operations.

Automotive Manufacturing Equipment Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Used ABB's IRB 360 FlexPicker and PickMaster 3 software for high-precision handling of heavy automotive parts in limited space | Increased productivity by 10%, maintained quality inspection standards, and improved the handling efficiency of steel blanks |

|

Deployed over 160 ABB robots across factory areas like press, painting, and body-in-white stations for electric car production | Boosted the plant’s efficiency, productivity, and flexibility for future expansion |

|

Integrated FANUC robots (M-10, M-710iC Series, ROBODRILL) into automotive lines to tackle labor shortages | Boosted productivity and efficiency by 45%; reduced waste and manual assembly labor |

|

Deployed FANUC CNC machines (65 Star Micronics, 27 Miyano) for diverse precision automotive parts | Enhanced production flexibility and accuracy for auto components |

|

Installed KUKA AG's modular robot cells (100 units with KUKA TECH) for the timely welding of vehicle body parts | Streamlined nuts/brackets welding, sealant, and inspection; ensured reliable auto body production |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The automotive manufacturing equipment ecosystem includes component suppliers, equipment manufacturers, and end users. Suppliers provide sensors, vision systems, and control units, while manufacturers deliver robotics, automation, and CNC machines. Automakers adopt these technologies to improve production efficiency, precision, and scalability. This interconnected network ensures smooth operations and optimized manufacturing performance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Automotive Manufacturing Equipment Market, by Equipment

CNC machines are estimated to hold the largest share of the automotive manufacturing equipment market in 2030 due to their precision, efficiency, and repeatability. Their capability to produce complex, high-accuracy components such as engine parts, transmissions, and chassis elements, combined with integration into automation and Industry 4.0 systems, enhances productivity, reduces errors, and enables real-time monitoring, driving strong market adoption.

Automotive Manufacturing Equipment Market, by Mode of Operation

The automatic segment is expected to see strong growth in the automotive manufacturing equipment market as production shifts toward smarter, more efficient systems. Fully automated equipment ensures consistent output, fewer errors, and reduced dependence on manual labor. Rising EV demand and complex vehicle designs further drive adoption. Integration with AI, IoT, and machine learning enables real-time monitoring, process optimization, and predictive maintenance, supporting flexible and future-ready manufacturing.

Automotive Manufacturing Equipment Market, by Vehicle Type

The passenger vehicles segment is projected to dominate the automotive manufacturing equipment market, driven by strong production volumes and rising consumer demand. Growing income, urbanization, and vehicle ownership, especially in emerging economies, are fueling this trend. Automakers are investing in advanced equipment to enhance efficiency, reduce production time, and support EV integration. Government support and a skilled workforce further strengthen the segment’s leadership in driving demand for modern manufacturing solutions.

REGION

Asia Pacific to hold the largest market share in the global automotive manufacturing equipment market during the forecast period

Asia Pacific is set to lead the automotive manufacturing equipment market, driven by strong economic growth, rising vehicle demand, and expanding automotive production. Key markets like China, India, and Southeast Asia are growing due to urbanization, higher incomes, and a rising middle class. Automakers are investing in advanced technologies to boost productivity, reduce costs, and support EV production. Regional advantages such as a skilled workforce, supportive policies, and increasing foreign investment reinforce its position as a global manufacturing hub.

Automotive Manufacturing Equipment Market: COMPANY EVALUATION MATRIX

In the automotive manufacturing equipment companies market matrix, ABB (Star) leads with a strong market presence and a wide portfolio of robotics, automation, and CNC solutions, driving adoption across global automotive production lines. Universal Robots (Emerging Leader) is gaining traction with flexible and collaborative robotic solutions, expanding its presence in advanced manufacturing systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 30.77 Billion |

| Market Forecast, 2030 (Value) | USD 41.70 Billion |

| Growth Rate | CAGR of 5.4% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand/Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Rest of the World (RoW) |

WHAT IS IN IT FOR YOU: Automotive Manufacturing Equipment Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Company profiles with market share, revenue, product portfolio, strategic initiatives, and recent developments | Enables benchmarking and understanding of key players’ strengths and strategies |

| Regional Market Entry Strategy | Country- or region-specific market insights, including regulations, distribution channels, and competitive scenario | Supports informed market entry and expansion decisions |

| Local Risk & Opportunity Assessment | Analysis of market barriers, risks, and untapped opportunities across automotive manufacturing equipment segments | Helps prioritize investments and mitigate market risks |

| Technology Adoption by Region | Insights on adoption trends of robotics, CNC machines, stamping equipment, and smart manufacturing technologies | Guides technology deployment, product positioning, and strategic planning |

RECENT DEVELOPMENTS

- April 2025 : ABB (Switzerland) announced plans to spin off its Robotics division into a separately listed company by the second quarter of 2026. The objective of the spin-off was to allow both ABB and the Robotics division to sharpen their strategic focus, improve capital allocation, and unlock long-term value. As an independent company, the Robotics unit would be better positioned to leverage rising demand for automation and accelerate its growth in a rapidly evolving market.

- February 2025 : Dassault Systèmes (Germany) partnered with KUKA AG (Germany) to integrate its 3DEXPERIENCE platform into KUKA’s mosaixx digital ecosystem. This collaboration aimed to enhance robotics and automation efficiency by enabling virtual twin simulations and real-time data-driven design. It helped manufacturers accelerate innovation and adaptability across industries, including automotive.

- November 2024 : FANUC America Corporation, a subsidiary of FANUC CORPORATION (Japan), introduced the M-950iA/500, a high-performance industrial robot designed for lifting heavy components up to 500 kg. Ideal for the automotive, EV, and construction industries, it featured a 2,830 mm reach and wide motion range, making it well-suited for tight spaces and demanding applications like welding, drilling, and palletizing.

- October 2024 : ABB (Switzerland) partnered with NAMTECH (India) to launch a School of Robotics in India, aiming to advance automation education. The collaboration focused on developing industry-focused curricula and hands-on training programs to cultivate a skilled workforce in robotics and automation.

Table of Contents

Methodology

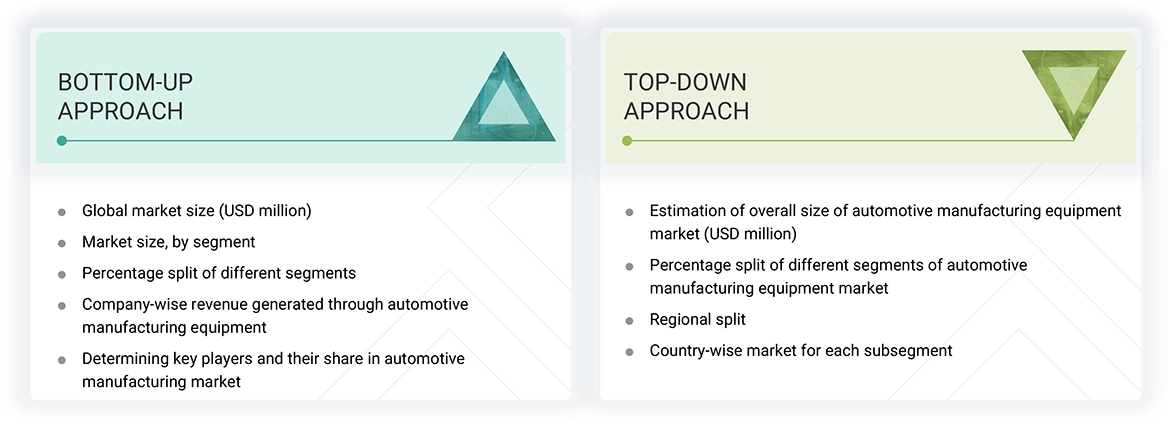

The study involved four major activities in estimating the current size of the automotive manufacturing equipment market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions and sizing with industry experts across the value chain through primary research has been the next step. Both the top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information, secondary and primary, have been used to identify and collect information for an extensive technical and commercial study of the automotive manufacturing equipment market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases. Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers; manufacturing associations; and others.

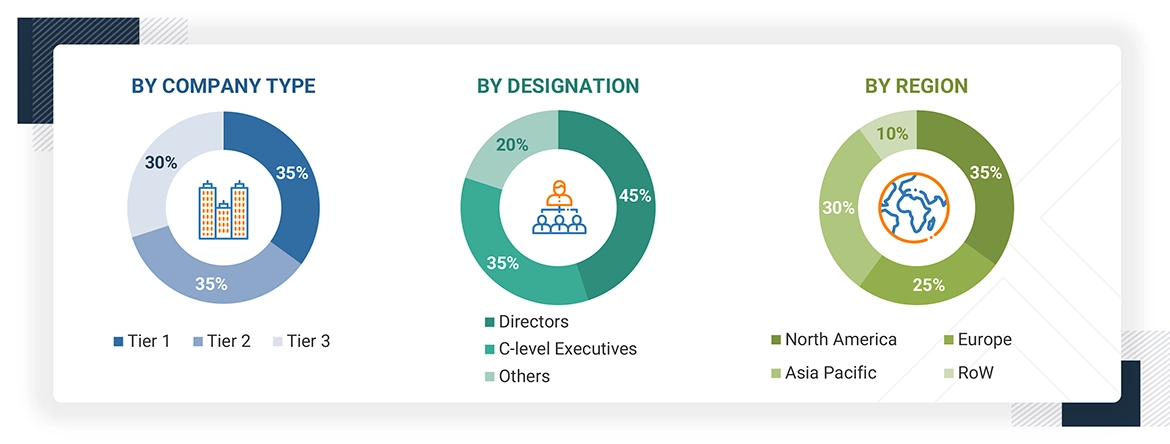

Primary Research

Primary sources mainly consist of several experts from core and related industries, along with preferred automotive manufacturing equipment providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain. In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from automotive manufacturing equipment providers, research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been used to estimate and validate the size of the automotive manufacturing equipment market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market shares in the key regions have been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of top players and extensive interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All possible parameters affecting the markets covered in this study have been accounted for, viewed in detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed input and analysis from MarketsandMarkets and presented in this report.

Automotive Manufacturing Equipment Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the automotive manufacturing equipment market from the market size estimation processes explained above, the total market has been split into several segments and sub-segments. The data triangulation procedure has been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Automotive manufacturing equipment is a tool, machinery, and system used in the manufacturing process of automotive vehicles, such as passenger vehicles and commercial vehicles. This equipment can encompass a diverse range of machines and tools, such as CNC machine, injection molding machine, robot, metal stamping machine, AGV, and DC torque tools. Automotive manufacturing equipment plays an important role in ensuring that vehicles are produced efficiently and fosters flexibility in manufacturing processes to provide cost-effectiveness and agility.

Key Stakeholders

- Raw Material Suppliers

- Component Designers, Manufacturers, and Suppliers

- Original Equipment Manufacturers (OEMs)

- System Integrators

- Technology, Service, and Solution Providers

- Testing, Inspection, and Certification Companies

- Suppliers and Distributors

- Government and Other Regulatory Bodies

- Industry Forums, Alliances, and Associations

- Research Institutes and Organizations

- Market Research and Consulting Firms

- End Users

Report Objectives

- To define, describe, and forecast the size of the automotive manufacturing equipment market based on equipment type, mode of operation, and vehicle type

- To describe and forecast the size of the automotive manufacturing equipment market based on four regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries

- To provide detailed information on drivers, restraints, opportunities, and challenges influencing the market growth

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, key stakeholders and buying criteria, key conferences and events, regulatory bodies, government agencies, and regulations pertaining to the market under study

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the automotive manufacturing equipment market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies, along with a detailed market competitive landscape

- To analyze competitive developments, such as product launches, acquisitions, agreements, and partnerships, in the market

Customization Options:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automotive Manufacturing Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Automotive Manufacturing Equipment Market