Automotive Solid-state LiDAR Market

Automotive Solid-state LiDAR Market by Technology (Flash LiDAR, Phased Array LiDAR), Detector, ICE Vehicle Type (PC, CV), Location, EV Type, Range, Measurement Process, Level of Autonomy, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The automotive solid-state LiDAR market is expected to grow from USD 0.85 billion in 2025 to USD 6.761 billion by 2032 at a CAGR of 34.5%. The main reason for this expansion is the widespread use of small, reliable, and cost-effective LiDAR units that support the advancement of driver assistance and self-driving vehicle technologies.

KEY TAKEAWAYS

-

By RegionAsia Pacific is expected to be the leading market for automotive solid-state LiDAR during the forecast period.

-

By ICE Vehicle TypeThe commercial vehicles segment is expected to register the fastest growth rate during the forecast period.

-

By Electric Vehicle TypeThe BEV segment is projected to grow at the highest CAGR during the forecast period.

-

By DetectorPAD/APD is expected to be the largest segmnet during the forecast period.

-

By Level of AutonomyThe semi-autonomous segment is expected to exhibit faster growth during the forecast period.

-

By LocationThe bumpers & grills segment is expected to lead the market during the forecast period.

-

By Measurement ProcessThe time of flight (ToF) segment is expected to dominate the market during the forecast period.

-

By TechnologyThe flash LiDAR segment is expected to hold the largest share during the forecast period.

-

By RangeThe long-range segment is expected to grow at a higher rate than the short- & mid-range segment during the forecast period.

-

Competitive LandscapeHesai Group, RoboSense, and Continental AG were identified as star players in the automotive solid-state LiDAR market, as they have focused on innovation and have broad technology and range coverage, as well as strong operational & financial strength.

The automotive solid-state LiDAR market is growing steadily due to the increasing demand for compact, reliable sensor technologies in automotive and smart infrastructure applications. Solid-state LiDAR enables the functionality of advanced driver assistance and autonomous systems, while offering better durability and meeting rigorous safety standards. The adoption of such devices is being hastened by strategic partnerships between OEMs and LiDAR manufacturers, as well as advances in affordable, high-resolution solid-state designs, which are significantly transforming the competitive landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The automotive solid-state LiDAR industry is gradually shifting its focus from mechanically operated designs to small, scalable, and software-controlled sensing products. The growth of ADAS and autonomous vehicles drives the need for more accurate detection, improved reliability, and reduced system complexity. Car manufacturers and technology suppliers are leading the adoption of solid-state LiDAR to meet safety regulations, optimize sensor footprint, and cut costs. This transition enables enhanced road and pedestrian safety, better navigation and perception, and vehicle safety systems that are efficient and prepared for the future.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing penetration of autonomous vehicles globally

-

Favorable government policies for autonomous driving

Level

-

High initial costs of automotive solid-state LiDAR sensors

-

Lengthy automotive safety validation and qualification processes

Level

-

Rising investments in smart cities

-

Rapid adoption of advanced ADAS and partial autonomy

Level

-

Ensuring consistent sensing performance across diverse driving and environmental conditions

-

Slow development of public infrastructure

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing penetration of autonomous vehicles globally

A steady push toward autonomous and driver-assist vehicles is creating a need for compact solid-state LiDAR systems that can deliver real-time sensing.

Restraint: High initial costs of automotive solid-state LiDAR sensors

The high initial costs of solid-state LiDAR sensors continue to be a major barrier to their adoption, especially in price-sensitive, mass-market vehicles.

Opportunity: Rising investments in smart cities

Rising investment in smart cities is increasing the demand for solid-state LiDAR across various applications, including traffic management, urban planning, and public infrastructure.

Challenge: Ensuring consistent sensing performance across diverse driving and environmental conditions

In the automotive solid-state LiDAR market, the main challenge for widespread adoption remains the ability to ensure consistent sensing performance across various environments and to lower overall system costs.

AUTOMOTIVE SOLID-STATE LIDAR MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of automotive solid-state LiDAR sensors in luxury passenger cars to enable highway autonomy and advanced driver assistance features. | Enables long-range object detection, improves reaction time, makes highways safer, and facilitates higher levels of driving automation. |

|

Offering compact solid-state LiDAR sensors and perception software for OEM ADAS and automated driving systems. | Reduces system complexity and cost, enables scalable vehicle integration, and enhances reliability through solid-state architecture. |

|

Developing automotive-grade solid-state LiDAR technology for ADAS features such as automatic braking, lane keeping, and traffic assistance. | Offers superior 3D perception, making pedestrian and obstacle detection more accurate and reducing the risk of accidents. |

|

Combining solid-state LiDAR with multi-sensor fusion platforms that include cameras, radar, and AI algorithms. | Increases detection confidence, enhances decision-making accuracy, and contributes to the overall vehicle safety performance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The automotive solid-state LiDAR market ecosystem is a connected network of industries that drive technological progress in autonomous driving and sensing. It includes component manufacturers like Hamamatsu Photonics (Japan), which produces photodetectors, and Osram Opto Semiconductors (Germany), providing the lasers and optics needed for solid-state LiDAR systems. The ecosystem also covers LiDAR system providers such as Velodyne Lidar (US) and RoboSense (China), which design and manufacture solid-state LiDAR solutions that combine sensors and scanning technology for accurate 3D mapping. Additionally, technology companies like NVIDIA (US) and Waymo (US) support this transition by offering AI-based data processing and perception algorithms that enable quick decision-making for autonomous driving. Major OEMs, including Mercedes-Benz (Germany) and Baidu Co., Ltd. (China), are actively involved in the solid-state LiDAR ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

By ICE Vehicle Type

The passenger cars segment is expected to dominate the automotive solid-state LiDAR market. This growth is driven by the increased adoption of driver assistance systems and the gradual shift toward autonomous driving. As a result, features like automatic emergency braking, adaptive cruise control, and lane-keeping assistance have encouraged car manufacturers to integrate compact and reliable solid-state LiDAR solutions into vehicle platforms.

By EV Type

The BEV segment is expected to lead the automotive solid-state LiDAR market, primarily due to global efforts toward vehicle electrification and the need for advanced sensing technologies in EVs. China plays a significant role in this landscape, with many premium and mass-market EV models equipped with solid-state LiDAR to support higher levels of driving automation. Strong collaborations between OEMs and suppliers are further easing the adoption process.

By Level of Autonomy

The semi-autonomous segment is expected to dominate the solid-state LiDAR market, owing to the rapid adoption of Level 2 and Level 3 driver assistance features in passenger vehicles. To enhance perception accuracy, automakers are increasingly adopting solid-state LiDAR to enable functions like lane keeping, adaptive cruise control, and collision avoidance, which improve safety and driving comfort.

By Measurement Process

The frequency modulated continuous wave (FMCW) segment is expected to experience significant growth in the automotive solid-state LiDAR market. By utilizing the Doppler effect, FMCW technology enables direct velocity measurement, improves accuracy, and reduces interference, which is why it is becoming increasingly attractive for future autonomous driving systems and advanced ADAS.

REGION

Europe to be fastest-growing region in global automotive Solid state LIDAR market during forecast period

Europe is expected to be the fastest-growing market for automotive solid-state LiDAR during the forecast period. This growth is mainly driven by strong demand for next-generation autonomous and advanced driver assistance systems. OEMs and suppliers from Germany, France, and the UK are increasingly adopting automotive solid-state LiDAR technologies to improve perception accuracy, navigation reliability, and road safety. The integration of solid-state LiDAR into passenger cars is facilitated by supportive regulatory frameworks, such as Euro NCAP requirements and the EU General Safety Regulation (GSR). Additionally, market growth is bolstered by Germany's leadership in Level 3 autonomy, increased investments in urban mobility projects, and the rapid adoption of EVs.

AUTOMOTIVE SOLID-STATE LIDAR MARKET: COMPANY EVALUATION MATRIX

In the automotive solid-state LiDAR market, Hesai Group remains the leader mainly because of its wide range of products, strong market share, and efficient scaling of production. Its solid relationships with automakers like BYD and Geely also support its position in the industry. Meanwhile, Valeo is gradually entering the market with advanced solid-state LiDAR solutions, and the growing demand for sensor fusion could be the factor that helps the company move closer to the industry leaders.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Hesai group (China)

- RoboSense (China)

- Seyond (US)

- Luminar Technologies, Inc. (US)

- Valeo (France)

- Innoviz Technologies Ltd (Israel)

- Ouster Inc. (US)

- Denso Corporation (Japan)

- ZF Friedrichshafen AG (Germany)

- Aptiv (Ireland)

- Continental AG (Germany)

- Sony Semiconductor Solutions

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.59 BN |

| Market Forecast in 2032 (Value) | USD 6.76 BN |

| Growth Rate | CAGR of 34.5% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD MN/BN) and Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, Europe, North America |

WHAT IS IN IT FOR YOU: AUTOMOTIVE SOLID-STATE LIDAR MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive OEM |

|

|

| LiDAR Sensor Manufacturer |

|

|

| Tier 1 System Integrator |

|

|

| Semiconductor/Laser Diode Supplier |

|

|

| Mapping & Autonomous Fleet Operator |

|

|

RECENT DEVELOPMENTS

- November 2025 : RoboSense revealed that IM Motors’ LS9 SUV would be equipped with a custom-developed 520 beam ultra-wide FOV digital automotive solid-state LiDAR as a standard feature, enabling L3-level perception with a maximum detection range of up to 300 m.

- September 2025 : Hesai Group unveiled a range of new automotive solid-state LiDAR devices at IAA Mobility 2025, such as the ETX long-range automotive-grade LiDAR for L3 autonomous driving and the FTX ultra-wide short-range LiDAR (180° × 140° FOV) aimed at providing complete vehicle blind spot coverage.

- September 2025 : Seyond declared a supply agreement with a top-tier Chinese automotive group to be the exclusive supplier of its 905 nm Robin E1X automotive solid-state LiDAR to multiple vehicle brands, with models going into mass production.

- September 2025 : Valeo and Capgemini announced a cooperation to pilot and validate Valeo’s integrated Level 2+ ADAS platform featuring solid-state LiDAR, which is targeted to facilitate system validation faster and production readiness by 2028.

- May 2025 : Seyond communicated the ongoing momentum of its Robin E1X automotive solid-state LiDAR technology, with plans for mass production starting in 2026 and vehicle volumes projected to reach hundreds of thousands over the subsequent years.

Table of Contents

Methodology

The research uses extensive secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the automotive solid-state LiDAR market. Primary sources, such as experts from related industries, OEMs, and suppliers, have been interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study include corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; whitepapers and autonomous vehicles and ADAS-related journals; certified publications; articles by recognized authors; directories; and databases. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

After understanding the automotive solid-state LiDAR market scenario through secondary research, extensive primary research has been conducted. Primary interviews have been conducted with market experts from both demand and supply sides across North America, Europe, and Asia Pacific. Approximately 35% of interviews have been conducted from the demand side, while 65% of primary interviews have been conducted from the supply side. The primary data has been collected through questionnaires, emails, and telephone interviews.

In the canvassing of primaries, various departments within organizations, such as sales and operations, have been covered to provide a holistic viewpoint in this report. Primary sources from the supply side include various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders have also been interviewed.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the web content management market. The first approach involves estimating the market size by companies’ revenue generated through the sale of WCM products.

Market Size Estimation Methodology- Top-down approach

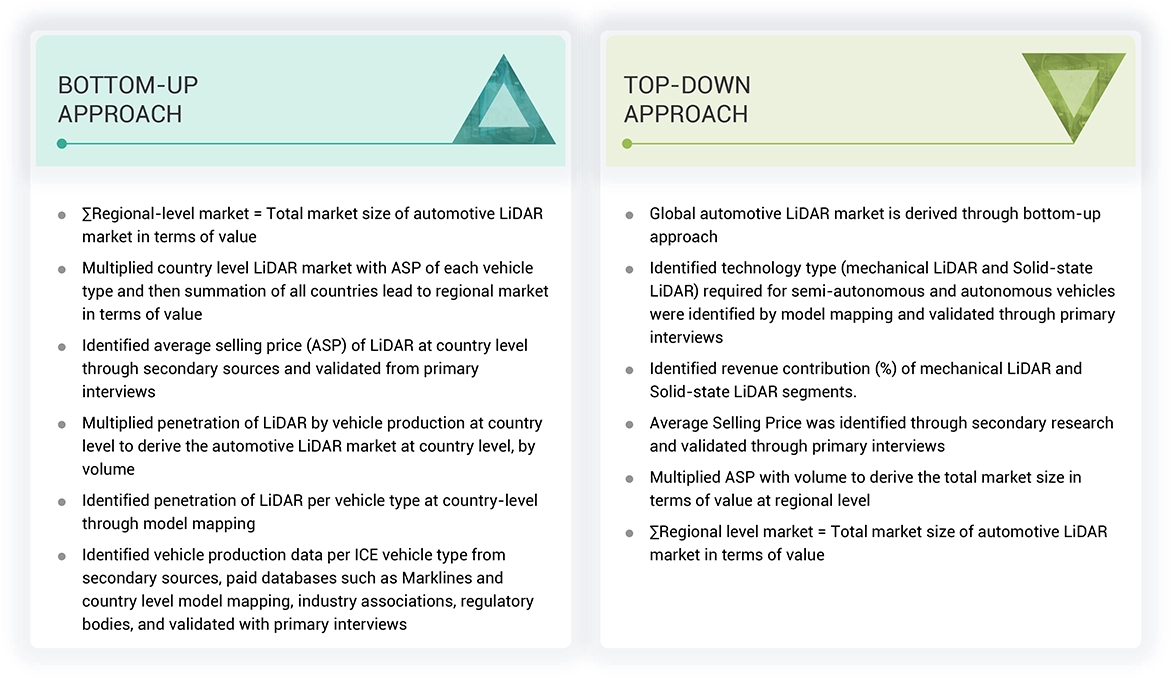

Both top-down and bottom-up approaches were used to estimate and validate the total size of the automotive solid-state LiDAR market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Automotive Solid-state LiDAR Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size of the global market through the methodology mentioned above, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and sub-segments, wherever applicable. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply-side participants.

Market Definition

According to Texas Instruments, LiDAR is a sensing technology that detects objects and maps their distances. The technology works by illuminating a target with an optical pulse and measuring the characteristics of the reflected return signal.

Stakeholders

- ADAS System Manufacturers

- Automobile Original Equipment Manufacturers (OEMs)

- Automotive Parts Manufacturers’ Association (APMA)

- Automotive Component Manufacturers

- Governments, Financial Institutions, and Investment Communities

- European Automobile Manufacturers Association (ACEA)

- LiDAR Hardware Suppliers

- LiDAR Software Suppliers

- LiDAR System Integrators

- Manufacturers of Automotive Solid-state LiDAR Microprocessors

- Original Device Manufacturer (ODM) and OEM Technology Solution Providers

- National Highway Traffic Safety Administration (NHTSA)

- Raw Material and Manufacturing Equipment Suppliers

- Research Institutes and Organizations

- Semiconductor Foundries

- Technology Investors

- Technology Standards Organizations, Forums, Alliances, and Associations

- Vehicle Safety Regulatory Bodies

Report Objectives

- To analyze and forecast the automotive solid-state LiDAR market in terms of volume (thousand units) and value (USD million) from 2024 to 2030

-

To segment the market by Technology, Image Type, ICE Vehicle Type, Location, Electric Vehicle, Range, Laser Wavelength, Measurement Process, Level of Autonomy, and region

- To segment and forecast the market by Technology (Mechanical LiDAR and Solid-state LiDAR)

- To segment and forecast the market by Image Type (2D and 3D)

- To segment and forecast the market by ICE Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles)

- To segment and forecast the market by Location (Bumper & Grill, Headlight & Taillight, Roof & Upper Pillars, and Others)

- To segment and forecast the market by Electric Vehicle Type (Battery Electric Vehicles, Plug-In Hybrid Electric Vehicles, Fuel Cell Electric Vehicles, and Hybrid Electric Vehicles)

- To segment and forecast the market by Range (Short and Mid-range and Long-range)

- To segment and forecast the market by Laser Wavelength (Near Infrared, Short-wave Infrared, and Long-wave Infrared)

- To segment and forecast the market by Measurement Process (Frequency Modulated Continuous Process and Time of Flight)

- To segment and forecast the market by Level of Autonomy (Semi-autonomous and Autonomous)

- To forecast the market by region (North America, Europe, and Asia Pacific)

- To identify and analyze key drivers, challenges, restraints, and opportunities influencing the market growth

- To strategically analyze the market for individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Pricing Analysis

- Investment and Funding Scenario

- Value Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- HS Code

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To analyze the impact of AI on the market

- To track and analyze competitive developments such as deals, product launches/developments, expansions, and other activities undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company's specific needs.

- Additional Company Profiles (Up to 5)

- Global Automotive Solid-state LiDAR market, By Level of Autonomy, at Country Level

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automotive Solid-state LiDAR Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Automotive Solid-state LiDAR Market