Blood Pressure Cuffs Market: Growth, Size, Share, and Trends

Blood Pressure Cuffs Market By Type (Automated, Manual), Size, Usage (Reusable, Disposable), Age Group (Adults, Infants & Children), Distribution Channel (Retail, Online), End User (Hospitals, Clinics, Homecare), Region-Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The blood pressure cuffs market is projected to reach USD 1.35 billion by 2032 from USD 0.74 billion in 2025, at a CAGR of 9.0% from 2025 to 2032. To measure blood pressure, blood pressure cuffs are used in conjunction with a sphygmomanometer, which is placed around the upper arm and inflated to temporarily halt blood flow in the artery. The global blood pressure cuffs market is experiencing strong growth, driven by the rising geriatric population and the subsequent increase in cardiovascular diseases and hypertension, as well as the higher adoption of single-use disposable cuffs to mitigate infection risks. The growing awareness of the importance of regular blood pressure monitoring, technological advancements in automated and digital devices that enhance accuracy and ease of use, the rapid expansion of home healthcare and remote patient monitoring, and supportive government initiatives and screening programs aimed at early detection and management of hypertension are all supporting market growth.

KEY TAKEAWAYS

-

BY TYPEThe blood pressure cuffs market is divided into automated and manual. Automated cuffs are gaining popularity for their convenience and accuracy in both clinical and home settings, while manual cuffs continue to be widely used by healthcare professionals for precise, stethoscope-based measurements.

-

BY SIZEThe blood pressure cuffs market is segmented into infants to young adults, adults to long adults, and large to extra-large adults. Cuffs designed for infants to young adults support monitoring in pediatric and adolescent populations, while large to extra-large adult cuffs address the needs of patients with higher arm circumference. The adults-to-long-adults segment currently leads the market, driven by the high prevalence of hypertension and cardiovascular conditions within the adult population.

-

BY USAGEKey segments include reusable and disposable blood pressure cuffs, with demand influenced by growing healthcare needs, infection control protocols, and cost considerations. Reusable blood pressure cuffs currently lead the market, driven by their durability, cost-effectiveness, and widespread use across hospitals, clinics, and home care settings, while disposable cuffs are gaining traction due to rising emphasis on hygiene and infection prevention

-

BY AGE GROUPThe increasing demand for blood pressure cuffs across the adult, infant, and child segments is driven by the growing prevalence of hypertension, rising awareness of preventive healthcare, and the need for accurate and regular monitoring. The adult segment currently leads the market, supported by the high burden of cardiovascular conditions and the widespread adoption of monitoring devices in both clinical and home care settings.

-

BY DISTRIBUTION CHANNELThe blood pressure cuffs market is segmented into healthcare facilities, retail pharmacies, and online pharmacies. Healthcare facilities account for a significant share, as hospitals and clinics remain the primary centers for diagnosing and monitoring hypertension. Retail pharmacies play a vital role in enhancing accessibility and convenience for patients, while online pharmacies are experiencing rapid growth due to the increasing popularity of e-commerce platforms, home delivery options, and the growing preference for remote healthcare solutions.

-

BY END USERHospitals lead the blood pressure cuffs market, supported by high patient volumes, advanced infrastructure, and the need for accurate monitoring in critical care and routine checkups. This is followed by home care settings, ambulatory care centers, urgent care centers, primary care centers, and other end users, which are increasingly adopting blood pressure cuffs to support preventive healthcare, chronic disease management, and wider access to timely monitoring.

-

BY REGIONThe Asia Pacific region is expected to witness the fastest growth, with a CAGR of 10.8%, driven by increasing prevalence of hypertension, rising awareness about cardiovascular health, expanding healthcare infrastructure, and growing investments in medical devices across countries like China, India, and Japan.

-

COMPETITIVE LANDSCAPEThe major market players have employed a mix of organic and inorganic strategies, including product launches, partnerships, and acquisitions. Leading companies such as Omron, Baxter, and Koninklijke Philips have expanded their product portfolios and formed strategic collaborations to enhance their medical device offerings and address the growing demand for advanced blood pressure monitoring solutions.

The blood pressure cuffs market is projected to witness significant growth over the next decade, driven by the rising prevalence of hypertension and cardiovascular diseases, the growing geriatric population, and continuous innovations in monitoring technologies. Devices such as digital and automated sphygmomanometers, along with disposable single-use cuffs, are being increasingly adopted to ensure accurate measurement, patient safety, and infection control. The growing emphasis on preventive healthcare, combined with the increasing demand for home-based monitoring solutions, is further driving market adoption. Moreover, the expansion of healthcare facilities, higher spending on patient care, and the integration of connected and point-of-care monitoring solutions are enhancing efficiency and accessibility in blood pressure measurement. With a growing global patient base and heightened focus on early detection and management of chronic conditions, blood pressure cuffs are set to play a pivotal role in shaping the future of cardiovascular healthcare delivery.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hospitals, clinics, and home care providers are clients of blood pressure cuff manufacturers, and their target applications are also clients of these manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users, the blood pressure cuff manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing geriatric population and subsequent rise in CVD and hypertension

-

High incidence of HAIs to fuel adoption of single-use pressure cuffs

Level

-

Availability of alternative methods & devices for monitoring blood pressure

Level

-

Rising technological advancements in bloodpressure monitors

-

Growing demand for telehelath & remote patient monitoring services

Level

-

Miscuffing challenges

-

Technical limitations and accuracy issues

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing geriatric population and subsequent rise in CVD and hypertension

"The increasing prevalence of hypertension and cardiovascular diseases associated with high blood pressure is a major driver of the blood pressure cuffs market. With millions of people affected worldwide, the demand for reliable and accurate blood pressure monitoring devices is becoming ever more critical. Hypertension—commonly defined as a blood pressure reading of 140/90 mmHg or higher—can only be diagnosed through precise measurement by healthcare professionals. Despite the widespread impact of hypertension, fewer than 42% of those affected are correctly diagnosed and receiving treatment. Only about 21% have their blood pressure adequately controlled, underscoring a significant gap in detection and management."

Restraint: Availability of alternative methods & devices for monitoring blood pressure

The growing digitization of healthcare has driven the adoption of wearable and cuffless blood pressure monitoring devices. These advanced solutions provide greater comfort, continuous tracking, and enhanced accuracy in various settings, facilitating improved detection of conditions such as masked hypertension and blood pressure variability. Cuffless devices, which estimate blood pressure using metrics like pulse wave velocity and pulse transit time, are increasingly favored for their convenience and non-invasive nature. Innovations including miniaturization, smartphone connectivity, and wireless functionality have made these devices more practical for daily use, especially in home and outpatient care. However, challenges such as motion artifacts, improper device placement, and slightly lower accuracy continue to limit their widespread clinical acceptance.

Opportunity: Rising technological advancements in blood pressure monitors

Innovative biomedical technologies are driving the adoption of wireless blood pressure cuffs. Equipped with sensors and mobile connectivity, these devices enable real-time monitoring, integration with electronic health records, and improved chronic disease management. Cuffless monitors using optical sensors are gaining popularity for their convenience and accuracy. Wireless upper arm cuffs and smart wearables offer automated, Bluetooth-enabled functionality, reducing manual errors and enhancing user experience

Challenge: Miscuffing challenges

A major challenge in the blood pressure cuffs market is inaccurate readings caused by improper cuff sizing. This issue arises from discrepancies between the widely accepted '80% rule,' which recommends that the cuff bladder cover at least 80% of the patient’s arm circumference, and the sizing guidelines provided by manufacturers. These manufacturer-recommended ranges often conflict with the 80% rule, resulting in measurement errors. This highlights the critical need for standardized cuff sizing protocols to ensure accurate blood pressure monitoring and better clinical outcomes

Blood Pressure Cuffs Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Digital upper-arm and wrist blood pressure cuffs integrated with home monitoring systems | Provides accurate readings, user-friendly design, and supports remote patient monitoring for chronic disease management |

|

Antimicrobial-coated blood pressure cuffs for hospital use | Reduces risk of cross-contamination and healthcare-associated infections (HAIs), enhances patient safety, and lowers hospital infection control costs |

|

Connected blood pressure cuffs integrated with telehealth platforms | Enables real-time data transmission, supports personalized care, improves patient adherence, and facilitates remote clinical decision-making |

|

Blood pressure cuffs compatible with multi-parameter patient monitoring systems | Ensures accurate, continuous monitoring in critical care settings, enhances workflow efficiency, and supports advanced clinical diagnostics |

|

Affordable, disposable blood pressure cuffs for large-scale hospital procurement | Cost-effective, ensures hygiene in high-volume use, and minimizes cross-patient contamination risks |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The blood pressure cuffs market ecosystem comprises raw material suppliers (DuPont, EM), device manufacturers (Omron, Baxter, Philips), and end-users (HCA Healthcare, Cleveland Clinic). Raw materials, including plastics, sensors, and electronic components, are processed into reliable, high-performance blood pressure monitoring devices. End users drive demand for accuracy, durability, and ease of use, while manufacturers deliver precision-engineered products. Collaboration across the value chain is essential for innovation and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Blood Pressure Cuffs Market, By Type

As of 2024, the automated segment held the largest share of the blood pressure cuffs market. This dominance is primarily due to advancements in blood pressure monitoring technologies, which provide enhanced accuracy, ease of use, and real-time data tracking. These devices are increasingly utilized in routine measurements. Furthermore, rising public awareness of the importance of regular blood pressure monitoring—particularly for managing chronic conditions like hypertension—has driven demand for convenient, user-friendly automated blood pressure monitoring solutions.

Blood Pressure Cuffs Market, By Size

In 2024, the adult-to-long adult segment held the largest share of the blood pressure cuffs market. This is mainly driven by the rising prevalence of hypertension and cardiovascular diseases among adults, particularly those with larger arm circumferences. The segment is further supported by an increased focus on preventive healthcare and early diagnosis, which encourages more frequent blood pressure monitoring. Healthcare providers are recommending regular screenings for at-risk populations, boosting demand for larger-sized cuffs. Additionally, the rising global obesity rates necessitate larger cuffs for accurate and reliable measurements. The availability of customizable, size-specific cuffs also contributes to the segment’s growth, improving patient comfort and measurement precision.

Blood Pressure Cuffs Market, By Usage

The reusable segment accounts for a significant share of the blood pressure cuffs market, driven by growing awareness of environmental sustainability and the need to minimize medical waste. Designed for durability and repeated use, these cuffs are well-suited for high-volume healthcare environments such as hospitals and clinics. Their long-term cost-effectiveness makes them attractive to institutions aiming to optimize operational budgets without sacrificing quality. Moreover, improvements in cleaning and sterilization methods have enhanced the safety and hygiene of reusable cuffs, further promoting their adoption.

Blood Pressure Cuffs Market, By Age Group

The adult segment holds a significant share of the blood pressure cuffs market. This is largely driven by the growing global geriatric population, which is more prone to hypertension and other cardiovascular conditions. Adults, particularly those aged 40 and above, face a higher risk of chronic diseases such as diabetes, heart disorders, and obesity, all of which are associated with elevated blood pressure. Increased awareness of preventive healthcare and routine monitoring has further boosted demand for reliable blood pressure devices. Additionally, the widespread adoption of home monitoring systems and regular clinical assessments in this age group contributes to the segment’s strong market presence.

Blood Pressure Cuffs Market, By Distribution channel

The healthcare facilities segment held the largest share of the blood pressure cuffs market in 2024. This is primarily due to the high volume of blood pressure monitoring performed in hospitals, clinics, and diagnostic centers, where accurate and routine measurements are essential for patient care. These facilities often purchase medical equipment in bulk, including blood pressure cuffs, to meet clinical needs and maintain operational efficiency.

Blood Pressure Cuffs Market, By End user

The hospitals segment accounted for the largest share of the blood pressure cuffs market. This is driven by high patient volumes and increasing demand for continuous blood pressure monitoring across departments, including emergency care, ICUs, and general wards. The presence of trained medical professionals ensures accurate and standardized measurements. Hospitals also prioritize investment in high-quality, durable equipment and often operate under reimbursement frameworks that facilitate the adoption of advanced monitoring devices. Their capacity for bulk procurement and adherence to strict medical standards further reinforce hospitals as the primary setting for blood pressure cuff usage, contributing significantly to market growth.

REGION

Asia Pacific to be fastest-growing region in global blood pressure cuffs market during forecast period

The Asia Pacific blood pressure cuffs market is expected to register the highest CAGR during the forecast period, driven by the rising prevalence of hypertension, increasing awareness of cardiovascular health, and the expansion of healthcare infrastructure. Leading manufacturers in countries such as China, India, and Japan are introducing advanced, automated, and wearable blood pressure monitoring devices to enhance accuracy, convenience, and patient outcomes. Growing investments in digital health technologies, telemedicine, and home monitoring solutions are further accelerating the adoption of blood pressure cuffs across the region.

Blood Pressure Cuffs Market: COMPANY EVALUATION MATRIX

In the blood pressure cuffs market matrix, Omron (Star) leads with a strong market share and a broad product portfolio, driven by its advanced and reliable monitoring devices, which are widely adopted in hospitals and clinical settings. B. Braun Melsungen AG (Emerging Leader) is gaining visibility with its innovative and specialized blood pressure solutions, strengthening its position through product innovation and targeted offerings. While Baxter dominates through scale and a diverse portfolio, B. Braun Melsungen AG shows significant potential to move toward the leaders’ quadrant as demand for high-accuracy and user-friendly monitoring devices continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- OMRON corporation, Inc. (Japan)

- Baxter International (US)

- Philips N.V. (Netherlands)

- GE HealthCare Technologies, Inc. (US)

- McKesson Corporation. (US)

- B Braun AG (Germany)

- Halma plc (UK)

- OSI Systems, Inc. (US)

- American Diagnostic Corporation (US)

- Medline Industries, LP. (US)

- Microlife Corporation (Switzerland)

- BIOS Medical (UK)

- ACCOSON (UK)

- Midmark Corporation (US)

- CellBios (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.64 Billion |

| Market Forecast in 2032 (Value) | USD 1.35 Billion |

| Growth Rate | CAGR of 9.0% from 2025-2032 |

| Years Considered | 2023-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Blood Pressure Cuffs Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | "A comparison of volume data for blood pressure cuff types—reusable and disposable—for North Americans was provided. Reusable cuffs hold the largest volume share in hospitals and diagnostic centers, owing to their durability, cost-effectiveness, and suitability for high-volume clinical use. Disposable cuffs are increasingly used in home care and outpatient settings, driven by the need for infection control and convenience. Comparitive Volume data for end users shows that hospitals lead overall adoption, followed by diagnostic centers and home care providers, with reusable cuffs dominating hospital usage and disposable cuffs representing a larger share in home and outpatient monitoring." | Enables identification of technology adoption trends across end users; highlights efficiency, accuracy, and usability factors that influence purchasing decisions in blood pressure monitoring |

RECENT DEVELOPMENTS

- May 2025 : OMRON Corporation launched home blood pressure monitors featuring an AI-driven IntelliSense AFib algorithm, enhancing accuracy and user convenience.

- April 2024 : OMRON Healthcare acquired Luscii Healthtech (Netherlands) to promote the adoption of remote patient monitoring solutions in Europe.

- June 2023 : OMRON Corporation inaugurated a new manufacturing facility at ORIGINS by Mahindra in Chennai, Tamil Nadu, aimed at expanding market penetration and supporting hypertension management in India.

- May 2023 : Baxter International, Inc. (US) entered into a definitive agreement to divest its BioPharma Solutions business to Advent International and Warburg Pincus.

Table of Contents

Methodology

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, investor presentations, SEC filings of companies and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), and Global Burden of Disease Study, and Centers for Medicare and Medicaid Services (CMS) were referred to identify and collect information for the global blood pressure cuffs market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the blood pressure cuffs market. The primary sources from the demand side include clinics, hospitals, and research academics and universities. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

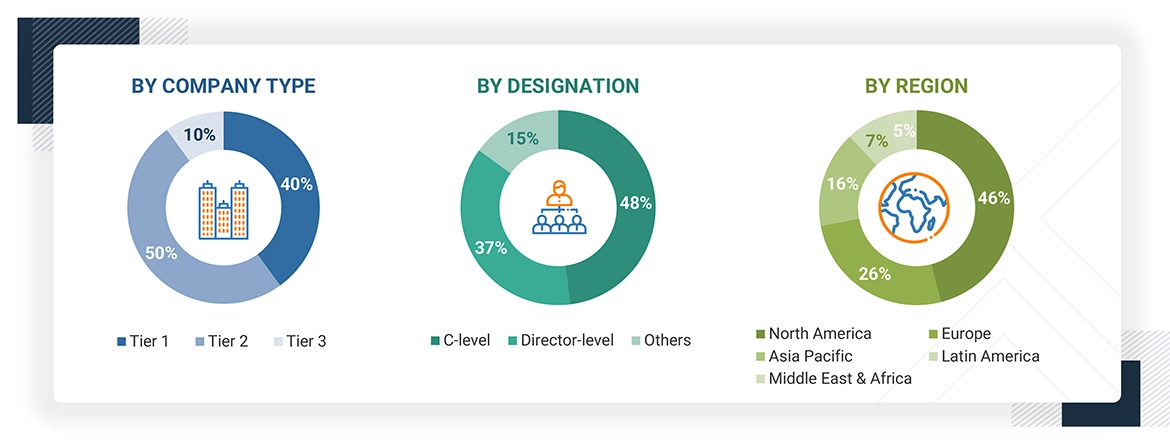

A breakdown of the primary respondents is provided below

Note 1: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 2: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global blood pressure cuffs market. All the major service providers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players. Also, the global blood pressure cuffs market was split into various segments and sub-segments based on:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of blood pressure cuff providers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from blood pressure cuffs (or the nearest reported business unit/product category)

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global blood pressure cuffs market

As mentioned earlier, the data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

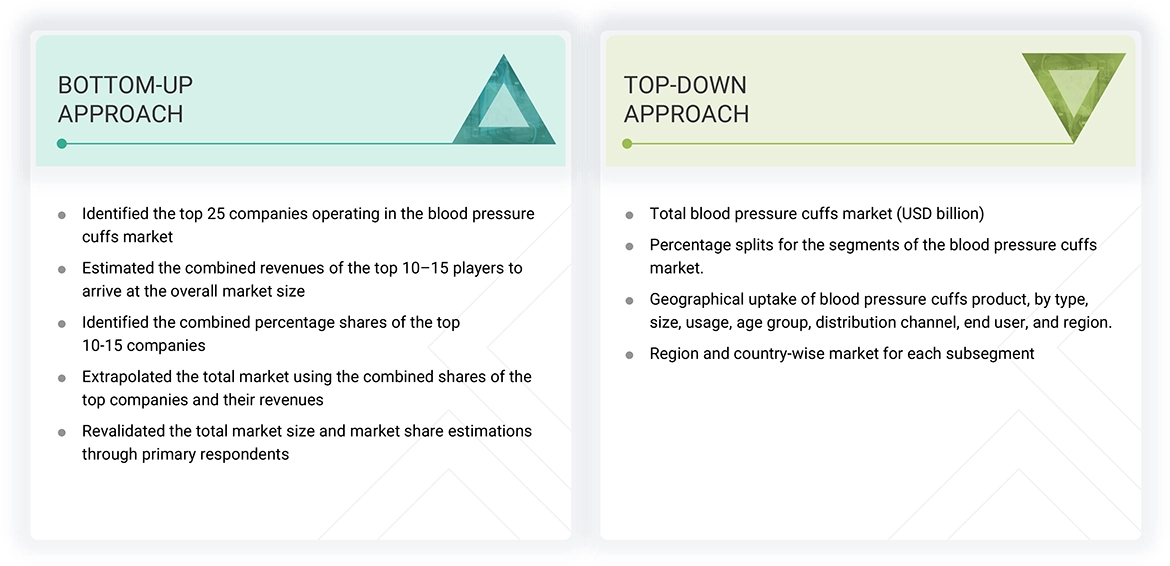

Bottom-up Approach and Top-down Approach

Data Triangulation

After arriving at the overall size of the global blood pressure cuffs market through the methodology mentioned above, this market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

To measure blood pressure, a healthcare provider uses an instrument known as a sphygmomanometer, commonly referred to as a blood pressure cuff. The cuff is placed around the upper arm and inflated to temporarily halt blood flow in the artery. As the cuff is slowly deflated, the healthcare provider listens to the blood flow using a stethoscope to detect the sound of blood pumping through the artery. This sound is then recorded on a gauge attached to the cuff. This process is essential for accurately measuring blood pressure in clinical settings.

Stakeholders

- Manufacturers & vendors of blood pressure cuffs

- Vital sign diagnostic & monitoring associations

- Associations involved in cardiac research

- Research & consulting firms

- Distributors of blood pressure cuffs

- Contract research manufacturers of blood pressure cuffs consumables

- Healthcare institutes

- Research institutes

Report Objectives

- To define, describe, segment, and forecast the blood pressure cuffs market by type, size, usage, age group, distribution channel, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To assess the blood pressure cuffs market associated with Technology Analysis, Porter’s Five Forces Analysis, Regulatory Landscape, Value & Supply Chain Analysis, Ecosystem Analysis, Patent Analysis, Trade Analysis, Pricing Analysis, Reimbursement Analysis, Key Conferences & Events, Unmet Needs/End-User Expectations, Impact Of Ai/Generative AI, Case Study Analysis, Adjacent Markets, Trends/Disruptions Impacting Customer Business, Investment & Funding scenario and Key Stakeholders & Buying Criteria

- To analyze the micromarkets1 concerning individual growth trends, prospects, and contributions to the overall blood pressure cuffs market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments for North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players & comprehensively analyze their product portfolios, market positions, and core competencies2

- To benchmark players within the market using the proprietary company evaluation matrix framework, which analyzes market players on various parameters within the broad categories of business & product excellence

Key Questions Addressed by the Report

Which are the top industry players in the blood pressure cuffs market?

The major players in the market include OMRON Corporation, Baxter International Inc., Koninklijke Philips N.V., GE HealthCare Technologies, McKesson Corporation, B. Braun Melsungen AG, Halma plc, OSI Systems, American Diagnostic Corporation, Medline Industries, Microlife Corporation, BIOS Medical, ACCOSON, Midmark Corporation, and Beurer GmbH.

What are some of the leading drivers in the market?

Key drivers include the rapidly increasing geriatric population susceptible to hypertension, the growing adoption of single-patient blood pressure cuffs to reduce infection risks, and the rising focus on accurate and safe blood pressure measurement. Demand is further supported by the increasing use of advanced and automated monitoring devices that enhance diagnostic precision and improve hypertension management.

By type, which segment dominates the blood pressure cuffs market?

The automated segment accounted for the largest share of the market in 2024.

What are the end users profiled in the market?

The main end users in the market include hospitals, home care settings, ambulatory care centers, urgent care centers, primary care centers, and other healthcare facilities.

Which region is projected to grow at the highest CAGR during the forecast period?

The Asia Pacific region is expected to register the highest growth, driven by rising cardiovascular disease prevalence, improving living standards, increasing demand for high-quality healthcare, greater healthcare spending, government support initiatives, and growing awareness of home-based blood pressure monitoring.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Blood Pressure Cuffs Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Blood Pressure Cuffs Market