The study involved four major activities in estimating the current size of the Brain Monitoring market. Exhaustive secondary research was done to collect information on the market and its different sub-segments. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the extensive usage of secondary sources; directories; databases such as Bloomberg Business, Factiva, and Wall Street Journal; white papers and annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the brain monitoring market. It was also used to obtain important information about the key market players, market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information important for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various key companies and organizations operating in the brain monitoring market. After the complete market engineering process (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at.

Some of the major objectives of primary research are:

-

To validate market segmentation defined through an assessment of the product portfolios of leading players

-

To understand the key industry trends and technologies defining the strategic growth objectives of market players

-

To gather both demand- and supply-side validation of the key factors affecting the market growth

-

To validate assumptions for the market sizing and forecasting model used for this study

-

To understand the market position of leading players in the brain monitoring market and their market share/ranking

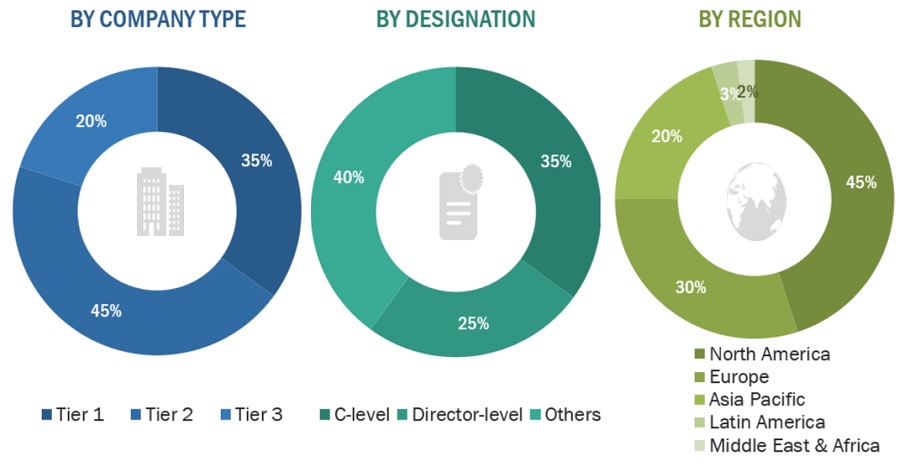

Breakdown Of Primary Participants

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue. As of 2019, Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Brain Monitoring market. These methods were also used extensively to estimate the size of various subsegments in the market.

Bottom-up approach

The bottom-up procedure was adopted to arrive at the overall size of the Brain Monitoring market from the revenue of key players (companies), their shares in the market, and their annual sales of Brain Monitoring products.

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down approach

The overall Brain Monitoring market size was used in the top-down approach to estimate the sizes of other individual markets (mentioned in the market segmentation by product, medical condition, end user, and region) through percentage splits from secondary and primary research.

For the calculation of each type of specific market segment, the most appropriate immediate-parent market size was used for implementing the top-down approach. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the market segment revenues obtained. Market shares were then estimated for top companies to verify the total market revenue arrived earlier in the bottom-up approach.

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the Brain Monitoring market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Brain Monitoring industry.

Market Definition

Brain Monitoring is a procedure that monitors the activity of various parameters associated with the functioning of brain, which includes electrical activity, blood flow, magnetic activity, the pressure surrounding the brain, and cerebral oxygen saturation.

Key Stakeholders

-

World Health Organization (WHO)

-

National Center for Biotechnology Information (NCBI)

-

World Federation of Neurology (WFN)

-

Centers for Disease Control and Prevention (CDC)

-

Epilepsy Foundation

-

American Brain Foundation (ABF)

-

Brain Injury Association of America (BIAA)

-

Neurology Asia Journal

-

Alzheimer's Association

-

American Neurological Association (ANA)

-

European Journal of Neurology

Report Objectives

-

To define, describe, and forecast the brain monitoring market based on the product, procedure, modality, medical condition, end user, and region.

-

To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges).

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall brain monitoring market.

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

-

To profile the key players in the market and comprehensively analyze their market shares and core competencies.

-

To forecast the size of the market segments with respect to four main regions, namely, North America, Asia Pacific, Europe, Latin America, and Middle East & Africa.

-

To track and analyze competitive developments such as new product launches, agreements, collaborations, and expansions.

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

Company Information

-

Profiling of additional market players (up to 3)

-

Additional country-level analysis of sub-segments such as media, reagents, flow cytometers, and centrifuges.

Growth opportunities and latent adjacency in Brain Monitoring Market