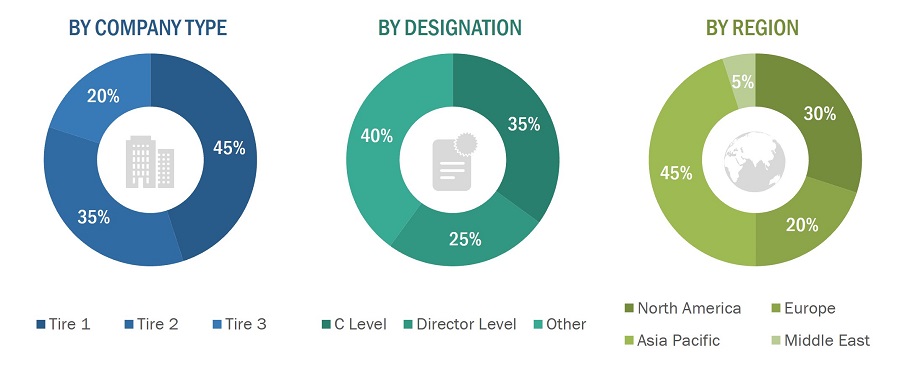

This research study involved the usage of both secondary and primary sources. Secondary sources included directories and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information relevant to the CBRN defense market. Primary sources included industry experts from the CBRN defense market as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information as well as to assess the market prospects.

Secondary Research

The market share of companies operating in the CBRN defense market was arrived at by using secondary data made available through paid and unpaid sources and by analyzing the product portfolios of the major companies and rating them based on their performance and product or service quality. These data points were further validated through primary sources.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, geographic markets, and key developments from the market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the CBRN defense market through secondary research. Several primary interviews were conducted with market experts from both demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (RoW). This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the CBRN defense market.

The research methodology used to estimate the market size also included identifying the key players in the industry through secondary research and determining their market shares through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of the market leaders, including Chief Executive Officers (CEOs), directors, and marketing executives.

All percentage shares, splits, and breakdowns were determined using secondary sources and were verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, added with detailed inputs and analysis by MarketsandMarkets, and presented in this report.

CBRN Defense Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and to arrive at exact statistics for varied market segments and sub-segments. The data was triangulated by studying various factors and trends from both the demand as well as supply sides. In addition to this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

-

To define, describe, segment, and forecast the size of the Chemical, Biological, Radiological, Nuclear (CBRN) defense market based on type, equipment, end user, and region.

-

To forecast the size of various segments of the CBRN defense system market with respect to five major regions: North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (RoW), along with the major countries in each of these regions

-

To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the CBRN defense system market

-

To identify opportunities for stakeholders in the market by studying key market and technology trends

-

To analyze competitive developments such as contracts, agreements, acquisitions & partnerships, divestment new product launches & developments, and R&D activities in the market

-

To estimate the procurement of CBRN defense systems by different countries to track technological advancements in CBRN defense systems

-

To provide a comprehensive competitive landscape of the market along with an overview of the different strategies adopted by key players to strengthen their position in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

-

Additional country-level analysis of the CBRN Defense Market

-

Profiling of additional market players (up to 5)

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the CBRN Defense Market

Growth opportunities and latent adjacency in CBRN Defense Market