2

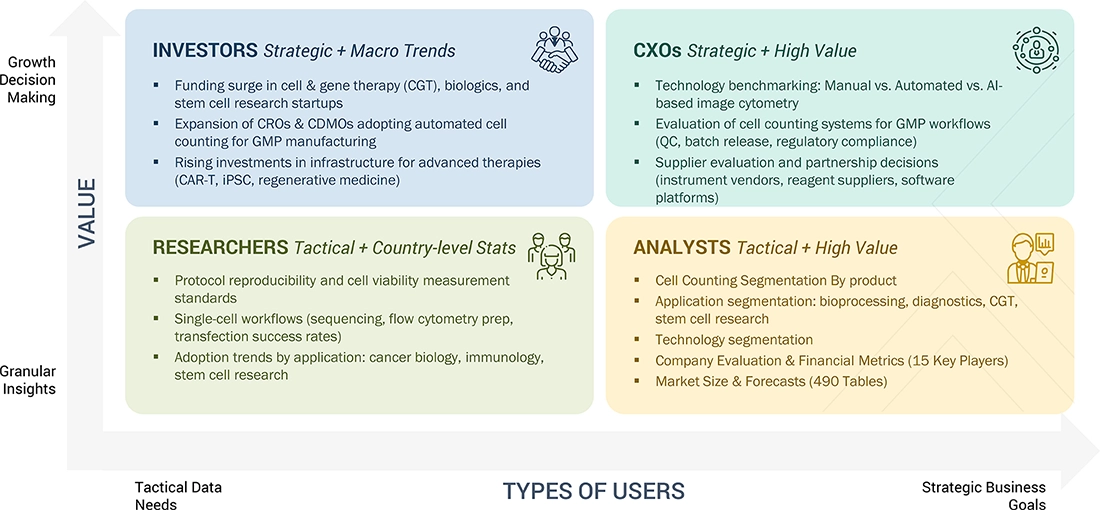

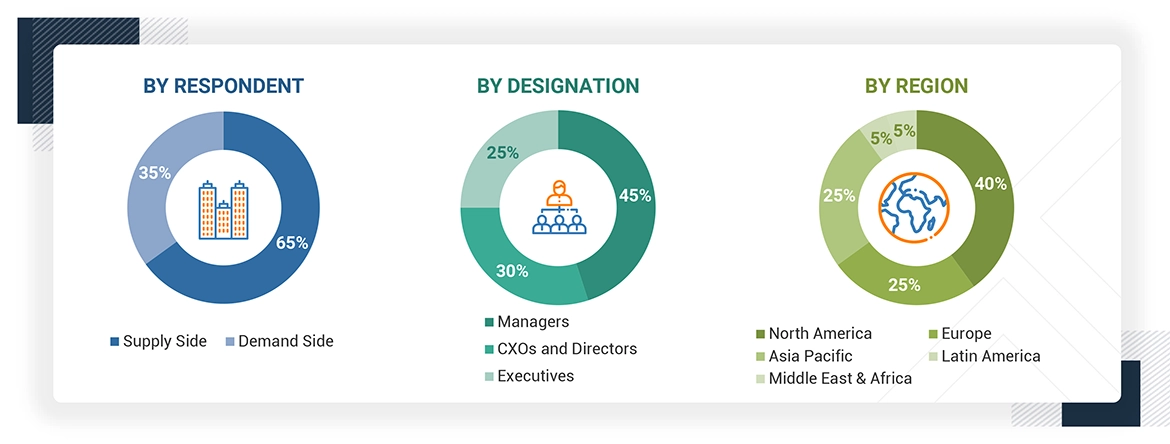

RESEARCH METHODOLOGY

51

5

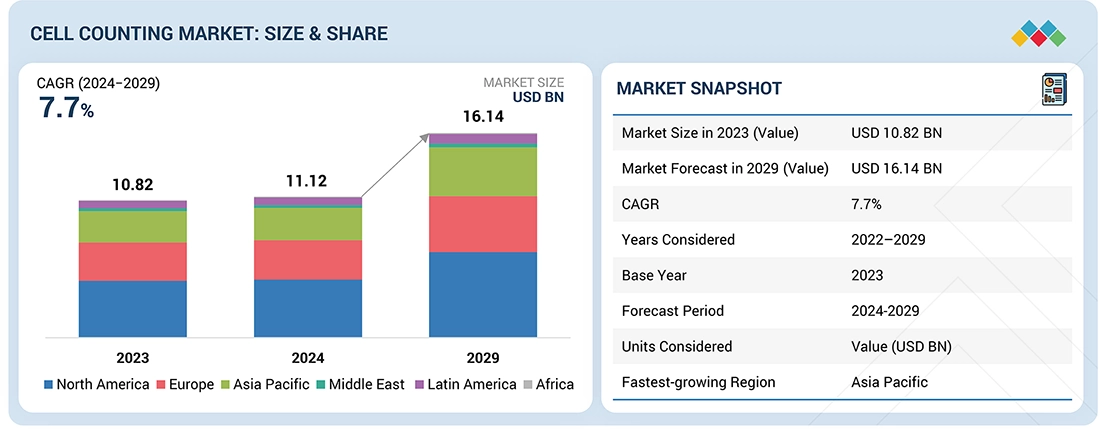

MARKET OVERVIEW

Market poised for growth with tech advancements and rising demand in personalized medicine and diagnostics.

69

5.2.1.1

TECHNOLOGICAL ADVANCEMENTS

5.2.1.2

EXPANDING APPLICATIONS IN RESEARCH AND DIAGNOSTICS

5.2.1.3

RISE IN PERSONALIZED MEDICINE

5.2.2.1

HIGH COST OF ADVANCED SYSTEMS

5.2.3.1

ADVANCEMENTS IN STEM CELL RESEARCH

5.2.3.2

RISING DEMAND FOR POINT-OF-CARE DIAGNOSTICS

5.2.4.1

REGULATORY AND COMPLIANCE CHALLENGES

5.3

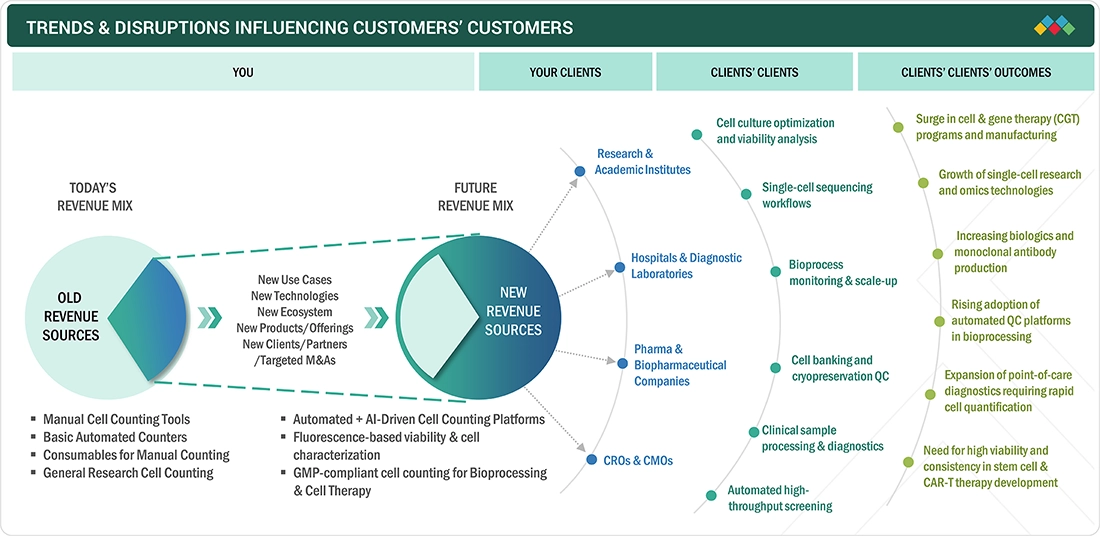

TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.4.1

AVERAGE SELLING PRICE TREND, BY KEY PLAYER

5.4.2

AVERAGE SELLING PRICE TREND, BY REGION

5.5

SUPPLY CHAIN ANALYSIS

5.7.1

CELL COUNTING MARKET: RAW MATERIAL PROVIDERS

5.7.2

CELL COUNTING MARKET: PRODUCT MANUFACTURERS/PROVIDERS

5.7.3

CELL COUNTING MARKET: END USERS

5.7.4

CELL COUNTING MARKET: REGULATORY BODIES

5.8

INVESTMENT & FUNDING SCENARIO

5.9.1.1

AUTOMATED CELL COUNTING

5.9.1.3

IMAGE-BASED CELL COUNTING

5.9.2

COMPLEMENTARY TECHNOLOGIES

5.9.2.3

CELL VIABILITY TESTING

5.9.3

ADJACENT TECHNOLOGIES

5.9.3.1

GENOMIC SEQUENCING

5.9.3.2

POLYMERASE CHAIN REACTION (PCR)

5.9.3.3

TISSUE ENGINEERING

5.11.1

TRADE DATA FOR FLOW CYTOMETERS

5.11.1.1

IMPORT DATA FOR FLOW CYTOMETERS

5.12

KEY CONFERENCES & EVENTS, 2025–2026

5.13

REGULATORY LANDSCAPE

5.13.1

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.2

REGULATORY FRAMEWORK

5.14

PORTER’S FIVE FORCES ANALYSIS

5.14.1

THREAT OF NEW ENTRANTS

5.14.2

BARGAINING POWER OF SUPPLIERS

5.14.3

BARGAINING POWER OF BUYERS

5.14.4

THREAT OF SUBSTITUTES

5.14.5

INTENSITY OF COMPETITIVE RIVALRY

5.15

KEY STAKEHOLDERS & BUYING CRITERIA

5.15.1

KEY STAKEHOLDERS IN BUYING PROCESS

5.16

IMPACT OF AI/GENERATIVE AI ON CELL COUNTING MARKET

5.16.2

IMPACT OF AI ON CELL COUNTING ECOSYSTEM

5.16.3

FUTURE OF GENERATIVE AI IN CELL COUNTING ECOSYSTEM

6

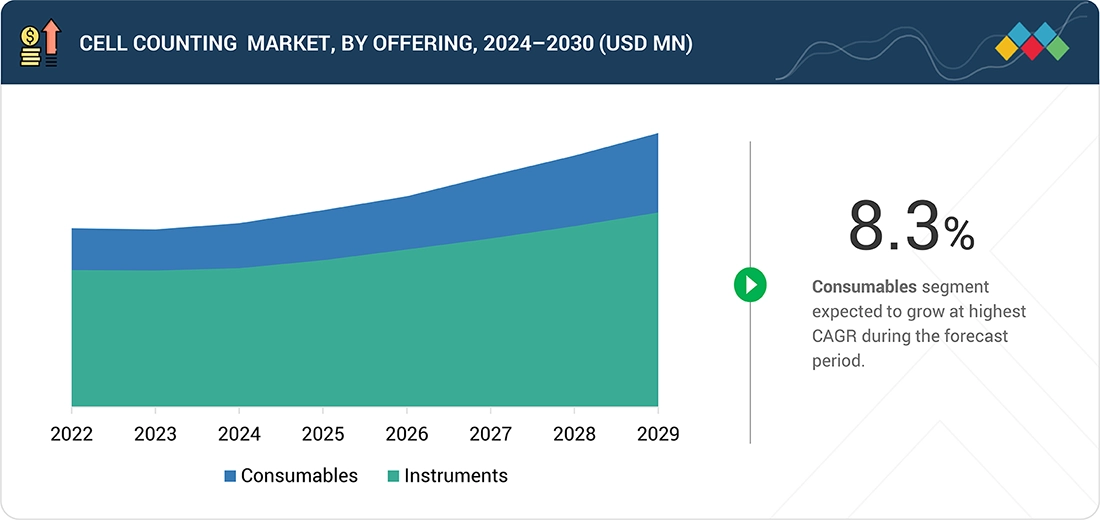

CELL COUNTING MARKET, BY PRODUCT

Market Size & Growth Rate Forecast Analysis to 2029 in USD Million | 207 Data Tables

102

6.2.1

MEDIA, SERA, AND REAGENTS

6.2.1.1

RISING DEMAND FOR BUFFERS & SOLVENTS IN RESEARCH & DIAGNOSTICS TO DRIVE MARKET

6.2.2.1

CELL VIABILITY ASSAYS

6.2.2.2

CELL STAINING ASSAYS

6.2.2.3

CYTOTOXICITY ASSAYS

6.2.2.4

CALORIMETRIC ASSAYS

6.2.3.1

RISING UTILIZATION IN HIGH-THROUGHPUT RESEARCH TO DRIVE MARKET

6.2.4.1

INCREASING DEMAND FOR ESSENTIAL COMPONENTS LIKE SENSORS & ELECTRICAL ACCESSORIES TO SUPPORT MARKET GROWTH

6.3.1.1

SINGLE-MODE READERS

6.3.1.2

MULTI-MODE READERS

6.3.2.1

WIDE UPTAKE IN CLINICAL & RESEARCH APPLICATIONS TO PROPEL MARKET

6.3.3

HEMATOLOGY ANALYZERS

6.3.3.1

FULLY AUTOMATED ANALYZERS

6.3.3.2

SEMI-AUTOMATED ANALYZERS

6.3.4.1

CELL COUNTERS, BY MODE

6.3.4.2

CELL COUNTERS, BY TECHNIQUE

6.3.5.1

ADVANCEMENTS IN CELL-BASED THERAPIES TO DRIVE MARKET

7

CELL COUNTING MARKET, BY APPLICATION

Market Size & Growth Rate Forecast Analysis to 2029 in USD Million | 94 Data Tables

186

7.2

RESEARCH APPLICATIONS

7.2.1.1

RISING PREVALENCE OF CANCER AND GROWING FOCUS ON EARLY DETECTION TO DRIVE MARKET

7.2.2

IMMUNOLOGY RESEARCH

7.2.2.1

RISING PREVALENCE OF AUTOIMMUNE DISEASES TO FUEL MARKET

7.2.3.1

RISING INCIDENCE OF NEUROLOGICAL DISORDERS TO PROPEL MARKET

7.2.4.1

FAVORABLE R&D INVESTMENTS TO BOOST DEMAND

7.2.5

OTHER RESEARCH APPLICATIONS

7.3.1

HEMATOLOGY & COMPLETE BLOOD COUNT

7.3.1.1

UPTAKE OF HEMATOLOGY ANALYZERS IN DIAGNOSIS OF ANEMIA & LEUKEMIA TO DRIVE MARKET

7.3.2

NON-INVASIVE PRENATAL DIAGNOSTICS

7.3.2.1

PROVISION OF CRITICAL INSIGHTS INTO FETAL HEALTH TO SUPPORT MARKET GROWTH

7.3.3

IN VITRO FERTILIZATION

7.3.3.1

INCREASING PREVALENCE OF INFERTILITY AND ADVANCEMENTS IN ASSISTED REPRODUCTIVE TECHNOLOGIES TO DRIVE MARKET

7.3.4

CIRCULATING TUMOR CELL DETECTION

7.3.4.1

GROWING FOCUS ON PRECISION ONCOLOGY AND LIQUID BIOPSIES TO FUEL MARKET

7.3.5

OTHER MEDICAL APPLICATIONS

7.4

OTHER INDUSTRIAL APPLICATIONS

8

CELL COUNTING MARKET, BY END USER

Market Size & Growth Rate Forecast Analysis to 2029 in USD Million | 29 Data Tables

225

8.2

ACADEMIC & RESEARCH INSTITUTES

8.2.1

ADVANCEMENTS IN STEM CELL RESEARCH AND GROWING FOCUS ON LIFE SCIENCES TO PROPEL MARKET

8.3

HOSPITALS & DIAGNOSTIC LABORATORIES

8.3.1

RISING PREVALENCE OF CHRONIC & INFECTIOUS DISEASES TO DRIVE MARKET

8.4

PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

8.4.1

EXPANDING PIPELINE OF BIOLOGICS TO FUEL MARKET

9

CELL COUNTING MARKET, BY REGION

Comprehensive coverage of 7 Regions with country-level deep-dive of 16 Countries | 349 Data Tables.

239

9.2.1

MACROECONOMIC OUTLOOK FOR NORTH AMERICA

9.2.2.1

US TO DOMINATE NORTH AMERICAN CELL COUNTING MARKET DURING STUDY PERIOD

9.2.3.1

RISING DEMAND FOR ADVANCED RESEARCH TOOLS IN BIOPHARMACEUTICAL AND ACADEMIC RESEARCH TO DRIVE MARKET

9.3.1

MACROECONOMIC OUTLOOK FOR EUROPE

9.3.2.1

ROBUST BIOPHARMA MANUFACTURING AND SUBSTANTIAL FEDERAL R&D INVESTMENTS TO AID MARKET GROWTH

9.3.3.1

FAVORABLE GOVERNMENT FUNDING FOR PHARMACEUTICAL & BIOTECHNOLOGY RESEARCH TO SUPPORT MARKET GROWTH

9.3.4.1

FAVORABLE GOVERNMENT INITIATIVES AND INCREASED INVESTMENTS BY FOREIGN PHARMACEUTICAL COMPANIES TO AID MARKET GROWTH

9.3.5.1

ADVANCED LIFE SCIENCE RESEARCH BIOMANUFACTURING FACILITIES TO AUGMENT MARKET GROWTH

9.3.6.1

EMPHASIS ON BIOPHARMACEUTICAL INNOVATION AND CANCER RESEARCH TO STIMULATE MARKET GROWTH

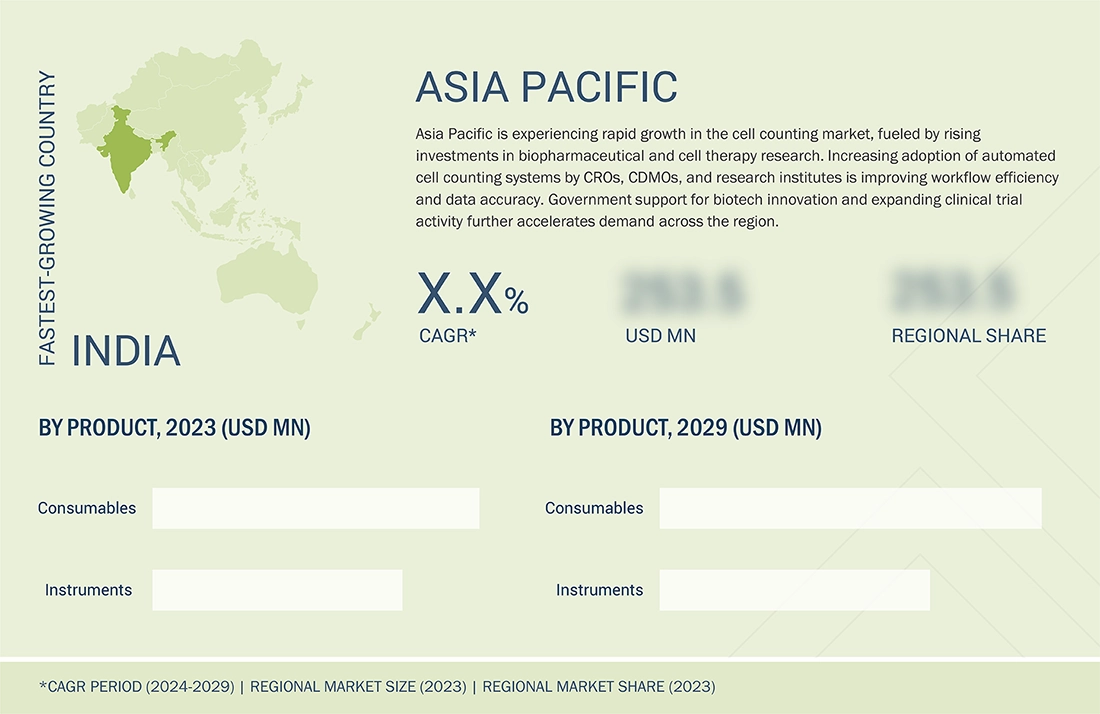

9.4.1

MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

9.4.2.1

GROWING PROMINENCE IN CLINICAL TRIALS AND BIOLOGICS PRODUCTION TO FUEL MARKET GROWTH

9.4.3.1

HIGH AVAILABILITY OF FUNDING AND TECHNOLOGICAL EXPERTISE TO SUPPORT MARKET GROWTH

9.4.4.1

FAVORABLE FDI REGULATIONS IN PHARMACEUTICAL INDUSTRY TO BOOST MARKET GROWTH

9.4.5.1

INCREASING HEALTHCARE EXPENDITURE AND RISING GOVERNMENT R&D BUDGET TO FUEL UPTAKE

9.4.6.1

FOCUS ON TRANSLATIONAL RESEARCH AND CLINICAL TRIALS IN CANCER THERAPIES AND REGENERATIVE MEDICINES TO DRIVE MARKET

9.4.7

REST OF ASIA PACIFIC

9.5.1

MACROECONOMIC OUTLOOK FOR LATIN AMERICA

9.5.2.1

ROBUST HEALTHCARE INFRASTRUCTURE AND HIGH PREVALENCE OF CHRONIC DISEASES TO PROPEL DEMAND FOR CELL-COUNTING TECHNOLOGIES

9.5.3.1

BURGEONING PHARMACEUTICAL INDUSTRY AND INCREASED COLLABORATIONS AMONG INDUSTRY LEADERS TO PROPEL MARKET GROWTH

9.5.4

REST OF LATIN AMERICA

9.6.1

MACROECONOMIC OUTLOOK FOR MIDDLE EAST

9.6.2.3

REST OF GCC COUNTRIES

9.6.3

REST OF MIDDLE EAST

9.7.1

HIGH GOVERNMENT HEALTHCARE BUDGET AND INCREASED POPULARITY AS BIOTECH HUB TO SUPPORT MARKET GROWTH

9.7.2

MACROECONOMIC OUTLOOK FOR AFRICA

10

COMPETITIVE LANDSCAPE

Discover strategic market dominance through key player tactics and valuation insights.

389

10.2

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2025

10.2.1

OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN CELL COUNTING MARKET

10.3

REVENUE ANALYSIS, 2019–2023

10.4

MARKET SHARE ANALYSIS, 2023

10.5

COMPANY VALUATION AND FINANCIAL METRICS

10.6

BRAND/PRODUCT COMPARISON

10.7

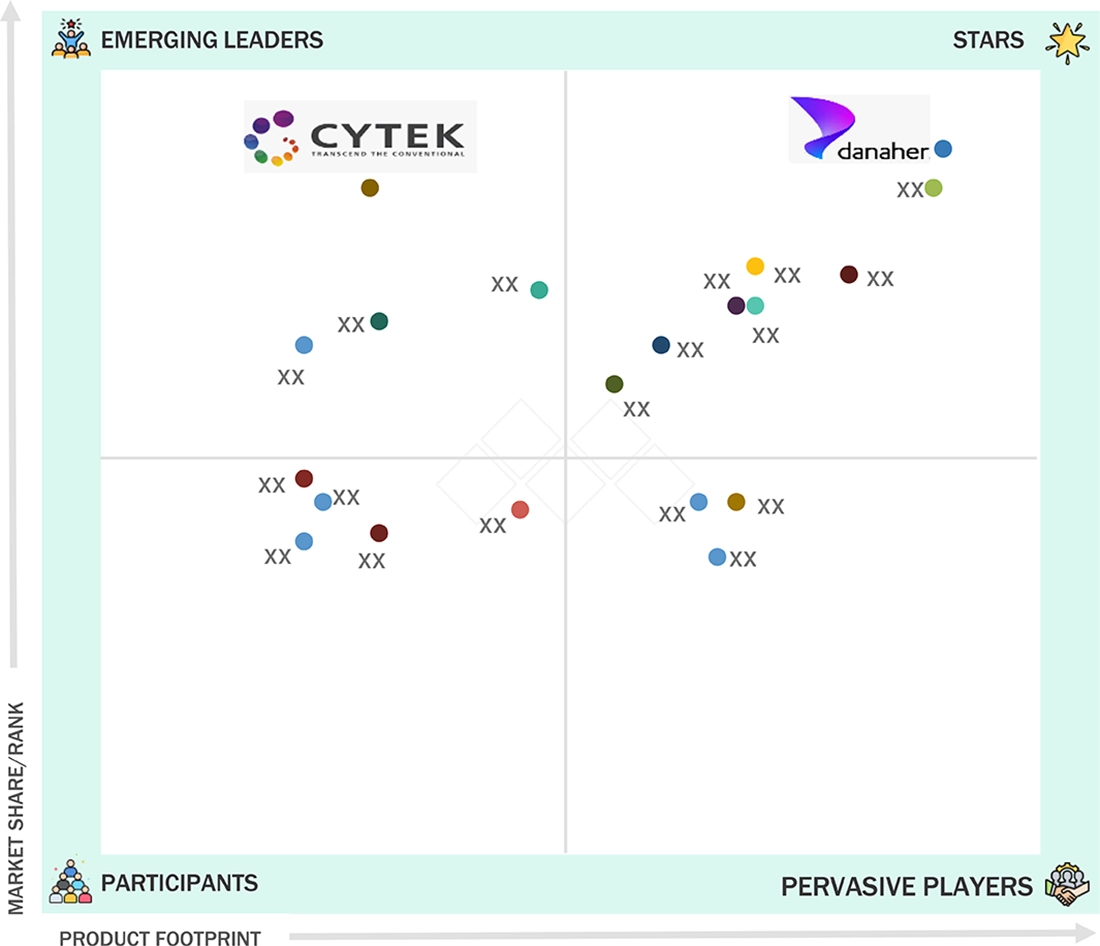

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

10.7.5

COMPANY FOOTPRINT: KEY PLAYERS, 2023

10.7.5.1

COMPANY FOOTPRINT

10.7.5.2

REGION FOOTPRINT

10.7.5.3

PRODUCT FOOTPRINT

10.7.5.4

APPLICATION FOOTPRINT

10.8

COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

10.8.1

PROGRESSIVE COMPANIES

10.8.2

RESPONSIVE COMPANIES

10.8.5

COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

10.8.5.1

DETAILED LIST OF KEY STARTUPS/SMES

10.8.5.2

COMPETITIVE BENCHMARKING OF STARTUPS/SMES

10.9

COMPETITIVE SCENARIO

11

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

410

11.1.1

DANAHER CORPORATION

11.1.1.1

BUSINESS OVERVIEW

11.1.1.2

PRODUCTS OFFERED

11.1.1.3

RECENT DEVELOPMENTS

11.1.2

THERMO FISHER SCIENTIFIC INC.

11.1.3

AGILENT TECHNOLOGIES, INC.

11.1.5

ABBOTT LABORATORIES

11.1.8

BIO-RAD LABORATORIES, INC.

11.1.9

CORNING INCORPORATED

11.1.13

SIEMENS HEALTHINEERS AG

11.1.15

F. HOFFMANN-LA ROCHE LTD

11.1.16

SYSMEX CORPORATION

11.2.4

YOKOGAWA ELECTRIC CORPORATION

11.2.5

COLE-PARMER INSTRUMENT COMPANY, LLC

11.2.8

BIOLINE TECHNOLOGIES

11.2.10

AXON BIOSYTEMS, INC.

11.2.11

CREATIVE BIOARRAY

12.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3

CUSTOMIZATION OPTIONS

TABLE 1

IMPACT ANALYSIS OF SUPPLY-SIDE AND DEMAND-SIDE FACTORS

TABLE 2

CELL COUNTING MARKET: RISK ANALYSIS

TABLE 3

CELL COUNTING MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

TABLE 4

AVERAGE SELLING PRICE TREND OF CELL COUNTERS, BY KEY PLAYER, 2022–2024

TABLE 5

AVERAGE SELLING PRICE TREND OF FLOW CYTOMETRY, BY KEY PLAYER, 2022–2024

TABLE 6

AVERAGE SELLING PRICE TREND OF PRODUCTS, BY REGION, 2022–2024

TABLE 7

CELL COUNTING MARKET: RAW MATERIAL PROVIDERS

TABLE 8

CELL COUNTING MARKET: PRODUCT MANUFACTURERS/PROVIDERS

TABLE 9

CELL COUNTING MARKET: END USERS

TABLE 10

CELL COUNTING MARKET: REGULATORY BODIES

TABLE 11

INNOVATIONS AND PATENT REGISTRATIONS, 2023–2024

TABLE 12

IMPORT AND EXPORT DATA FOR FLOW CYTOMETERS (HS CODE 902789), BY COUNTRY, 2022–2023 (USD THOUSAND)

TABLE 13

IMPORT DATA FOR FLOW CYTOMETERS (HS CODE 902789), BY COUNTRY, 2022–2023 (UNITS)

TABLE 14

CELL COUNTING MARKET: KEY CONFERENCES & EVENTS, 2025–2026

TABLE 15

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18

LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19

MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20

CELL COUNTING MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 21

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT

TABLE 22

KEY BUYING CRITERIA FOR CELL COUNTING PRODUCTS, BY END USER

TABLE 23

CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 24

CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 25

CELL COUNTING CONSUMABLES MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 26

NORTH AMERICA: CELL COUNTING CONSUMABLES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 27

EUROPE: CELL COUNTING CONSUMABLES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 28

ASIA PACIFIC: CELL COUNTING CONSUMABLES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 29

LATIN AMERICA: CELL COUNTING CONSUMABLES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 30

MIDDLE EAST: CELL COUNTING CONSUMABLES MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 31

GCC COUNTRIES: CELL COUNTING CONSUMABLES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 32

CELL COUNTING MEDIA, SERA, AND REAGENTS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 33

NORTH AMERICA: CELL COUNTING MEDIA, SERA, AND REAGENTS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 34

EUROPE: CELL COUNTING MEDIA, SERA, AND REAGENTS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 35

ASIA PACIFIC: CELL COUNTING MEDIA, SERA, AND REAGENTS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 36

LATIN AMERICA: CELL COUNTING MEDIA, SERA, AND REAGENTS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 37

MIDDLE EAST: CELL COUNTING MEDIA, SERA, AND REAGENTS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 38

GCC COUNTRIES: CELL COUNTING MEDIA, SERA, AND REAGENTS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 39

CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 40

CELL COUNTING ASSAY KITS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 41

NORTH AMERICA: CELL COUNTING ASSAY KITS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 42

EUROPE: CELL COUNTING ASSAY KITS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 43

ASIA PACIFIC: CELL COUNTING ASSAY KITS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 44

LATIN AMERICA: CELL COUNTING ASSAY KITS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 45

MIDDLE EAST: CELL COUNTING ASSAY KITS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 46

GCC COUNTRIES: CELL COUNTING ASSAY KITS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 47

CELL VIABILITY ASSAYS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 48

NORTH AMERICA: CELL VIABILITY ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 49

EUROPE: CELL VIABILITY ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 50

ASIA PACIFIC: CELL VIABILITY ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 51

LATIN AMERICA: CELL VIABILITY ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 52

MIDDLE EAST: CELL VIABILITY ASSAYS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 53

GCC COUNTRIES: CELL VIABILITY ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 54

CELL STAINING ASSAYS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 55

NORTH AMERICA: CELL STAINING ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 56

EUROPE: CELL STAINING ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 57

ASIA PACIFIC: CELL STAINING ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 58

LATIN AMERICA: CELL STAINING ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 59

MIDDLE EAST: CELL STAINING ASSAYS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 60

GCC COUNTRIES: CELL STAINING ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 61

CYTOTOXICITY ASSAYS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 62

NORTH AMERICA: CYTOTOXICITY ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 63

EUROPE: CYTOTOXICITY ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 64

ASIA PACIFIC: CYTOTOXICITY ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 65

LATIN AMERICA: CYTOTOXICITY ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 66

MIDDLE EAST: CYTOTOXICITY ASSAYS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 67

GCC COUNTRIES: CYTOTOXICITY ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 68

CALORIMETRIC ASSAYS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 69

NORTH AMERICA: CALORIMETRIC ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 70

EUROPE: CALORIMETRIC ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 71

ASIA PACIFIC: CALORIMETRIC ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 72

LATIN AMERICA: CALORIMETRIC ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 73

MIDDLE EAST: CALORIMETRIC ASSAYS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 74

GCC COUNTRIES: CALORIMETRIC ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 75

OTHER ASSAYS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 76

NORTH AMERICA: OTHER ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 77

EUROPE: OTHER ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 78

ASIA PACIFIC: OTHER ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 79

LATIN AMERICA: OTHER ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 80

MIDDLE EAST: OTHER ASSAYS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 81

GCC COUNTRIES: OTHER ASSAYS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 82

CELL COUNTING MICROPLATES MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 83

NORTH AMERICA: CELL COUNTING MICROPLATES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 84

EUROPE: CELL COUNTING MICROPLATES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 85

ASIA PACIFIC: CELL COUNTING MICROPLATES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 86

LATIN AMERICA: CELL COUNTING MICROPLATES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 87

MIDDLE EAST: CELL COUNTING MICROPLATES MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 88

GCC COUNTRIES: CELL COUNTING MICROPLATES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 89

CELL COUNTING ACCESSORIES MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 90

NORTH AMERICA: CELL COUNTING ACCESSORIES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 91

EUROPE: CELL COUNTING ACCESSORIES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 92

ASIA PACIFIC: CELL COUNTING ACCESSORIES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 93

LATIN AMERICA: CELL COUNTING ACCESSORIES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 94

MIDDLE EAST: CELL COUNTING ACCESSORIES MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 95

GCC COUNTRIES: CELL COUNTING ACCESSORIES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 96

OTHER CONSUMABLES MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 97

NORTH AMERICA: OTHER CONSUMABLES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 98

EUROPE: OTHER CONSUMABLES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 99

ASIA PACIFIC: OTHER CONSUMABLES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 100

LATIN AMERICA: OTHER CONSUMABLES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 101

MIDDLE EAST: OTHER CONSUMABLES MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 102

GCC COUNTRIES: OTHER CONSUMABLES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 103

CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 104

CELL COUNTING INSTRUMENTS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 105

NORTH AMERICA: CELL COUNTING INSTRUMENTS, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 106

EUROPE: CELL COUNTING INSTRUMENTS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 107

ASIA PACIFIC: CELL COUNTING INSTRUMENTS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 108

LATIN AMERICA: CELL COUNTING INSTRUMENTS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 109

MIDDLE EAST: CELL COUNTING INSTRUMENTS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 110

GCC COUNTRIES: CELL COUNTING INSTRUMENTS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 111

CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 112

CELL COUNTING SPECTROPHOTOMETERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 113

NORTH AMERICA: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 114

EUROPE: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 115

ASIA PACIFIC: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 116

LATIN AMERICA: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 117

MIDDLE EAST: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 118

GCC COUNTRIES: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 119

SINGLE-MODE READERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 120

NORTH AMERICA: SINGLE-MODE READERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 121

EUROPE: SINGLE-MODE READERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 122

ASIA PACIFIC: SINGLE-MODE READERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 123

LATIN AMERICA: SINGLE-MODE READERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 124

MIDDLE EAST: SINGLE-MODE READERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 125

GCC COUNTRIES: SINGLE-MODE READERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 126

MULTI-MODE READERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 127

NORTH AMERICA: MULTI-MODE READERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 128

EUROPE: MULTI-MODE READERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 129

ASIA PACIFIC: MULTI-MODE READERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 130

LATIN AMERICA: MULTI-MODE READERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 131

MIDDLE EAST: MULTI-MODE READERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 132

GCC COUNTRIES: MULTI-MODE READERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 133

CELL COUNTING FLOW CYTOMETERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 134

NORTH AMERICA: CELL COUNTING FLOW CYTOMETERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 135

EUROPE: CELL COUNTING FLOW CYTOMETERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 136

ASIA PACIFIC: CELL COUNTING FLOW CYTOMETERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 137

LATIN AMERICA: CELL COUNTING FLOW CYTOMETERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 138

MIDDLE EAST: CELL COUNTING FLOW CYTOMETERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 139

GCC COUNTRIES: CELL COUNTING FLOW CYTOMETERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 140

CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 141

CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 142

NORTH AMERICA: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 143

EUROPE: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 144

ASIA PACIFIC: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 145

LATIN AMERICA: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 146

MIDDLE EAST: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 147

GCC COUNTRIES: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 148

FULLY AUTOMATED ANALYZERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 149

NORTH AMERICA: FULLY AUTOMATED ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 150

EUROPE: FULLY AUTOMATED ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 151

ASIA PACIFIC: FULLY AUTOMATED ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 152

LATIN AMERICA: FULLY AUTOMATED ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 153

MIDDLE EAST: FULLY AUTOMATED ANALYZERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 154

GCC COUNTRIES: FULLY AUTOMATED ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 155

SEMI-AUTOMATED ANALYZERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 156

NORTH AMERICA: SEMI-AUTOMATED ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 157

EUROPE: SEMI-AUTOMATED ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 158

ASIA PACIFIC: SEMI-AUTOMATED ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 159

LATIN AMERICA: SEMI-AUTOMATED ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 160

MIDDLE EAST: SEMI-AUTOMATED ANALYZERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 161

GCC COUNTRIES: SEMI-AUTOMATED ANALYZERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 162

CELL COUNTERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 163

NORTH AMERICA: CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 164

EUROPE: CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 165

ASIA PACIFIC: CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 166

LATIN AMERICA: CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 167

MIDDLE EAST: CELL COUNTERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 168

GCC COUNTRIES: CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 169

COMPARISON OF MANUAL VS. AUTOMATED CELL COUNTERS

TABLE 170

CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 171

AUTOMATED CELL COUNTERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 172

NORTH AMERICA: AUTOMATED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 173

EUROPE: AUTOMATED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 174

ASIA PACIFIC: AUTOMATED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 175

LATIN AMERICA: AUTOMATED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 176

MIDDLE EAST: AUTOMATED CELL COUNTERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 177

GCC COUNTRIES: AUTOMATED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 178

MANUAL CELL COUNTERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 179

NORTH AMERICA: MANUAL CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 180

EUROPE: MANUAL CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 181

ASIA PACIFIC: MANUAL CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 182

LATIN AMERICA: MANUAL CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 183

MIDDLE EAST: MANUAL CELL COUNTERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 184

GCC COUNTRIES: MANUAL CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 185

CELL COUNTERS, BY TECHNIQUE

TABLE 186

COMPARISON FLUORESCENCE AND BRIGHTFIELD CELL COUNTERS

TABLE 187

CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 188

FLUORESCENCE-BASED CELL COUNTERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 189

NORTH AMERICA: FLUORESCENCE-BASED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 190

EUROPE: FLUORESCENCE-BASED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 191

ASIA PACIFIC: FLUORESCENCE-BASED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 192

LATIN AMERICA: FLUORESCENCE-BASED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 193

MIDDLE EAST: FLUORESCENCE-BASED CELL COUNTERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 194

GCC COUNTRIES: FLUORESCENCE-BASED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 195

IMAGE-BASED CELL COUNTERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 196

NORTH AMERICA: IMAGE-BASED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 197

EUROPE: IMAGE-BASED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 198

ASIA PACIFIC: IMAGE-BASED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 199

LATIN AMERICA: IMAGE-BASED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 200

MIDDLE EAST: IMAGE-BASED CELL COUNTERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 201

GCC COUNTRIES: IMAGE-BASED CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 202

BRIGHTFIELD CELL COUNTERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 203

NORTH AMERICA: BRIGHTFIELD CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 204

EUROPE: BRIGHTFIELD CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 205

ASIA PACIFIC: BRIGHTFIELD CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 206

LATIN AMERICA: BRIGHTFIELD CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 207

MIDDLE EAST: BRIGHTFIELD CELL COUNTERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 208

GCC COUNTRIES: BRIGHTFIELD CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 209

OTHER CELL COUNTERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 210

NORTH AMERICA: OTHER CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 211

EUROPE: OTHER CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 212

ASIA PACIFIC: OTHER CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 213

LATIN AMERICA: OTHER CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 214

MIDDLE EAST: OTHER CELL COUNTERS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 215

GCC COUNTRIES: OTHER CELL COUNTERS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 216

CELL COUNTING MICROSCOPES MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 217

NORTH AMERICA: CELL COUNTING MICROSCOPES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 218

EUROPE: CELL COUNTING MICROSCOPES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 219

ASIA PACIFIC: CELL COUNTING MICROSCOPES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 220

LATIN AMERICA: CELL COUNTING MICROSCOPES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 221

MIDDLE EAST: CELL COUNTING MICROSCOPES MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 222

GCC COUNTRIES: CELL COUNTING MICROSCOPES MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 223

OTHER INSTRUMENTS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 224

NORTH AMERICA: OTHER INSTRUMENTS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 225

EUROPE: OTHER INSTRUMENTS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 226

ASIA PACIFIC: OTHER INSTRUMENTS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 227

LATIN AMERICA: OTHER INSTRUMENTS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 228

MIDDLE EAST: OTHER INSTRUMENTS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 229

GCC COUNTRIES: OTHER INSTRUMENTS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 230

CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 231

CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 232

CELL COUNTING RESEARCH APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 233

NORTH AMERICA: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 234

EUROPE: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 235

ASIA PACIFIC: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 236

LATIN AMERICA: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 237

MIDDLE EAST: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 238

GCC COUNTRIES: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 239

CANCER RESEARCH APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 240

NORTH AMERICA: CANCER RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 241

EUROPE: CANCER RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 242

ASIA PACIFIC: CANCER RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 243

LATIN AMERICA: CANCER RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 244

MIDDLE EAST: CANCER RESEARCH APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 245

GCC COUNTRIES: CANCER RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 246

IMMUNOLOGY RESEARCH APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 247

NORTH AMERICA: IMMUNOLOGY RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 248

EUROPE: IMMUNOLOGY RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 249

ASIA PACIFIC: IMMUNOLOGY RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 250

LATIN AMERICA: IMMUNOLOGY RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 251

MIDDLE EAST: IMMUNOLOGY RESEARCH APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 252

GCC COUNTRIES: IMMUNOLOGY RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 253

NEUROLOGY RESEARCH APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 254

NORTH AMERICA: NEUROLOGY RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 255

EUROPE: NEUROLOGY RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 256

ASIA PACIFIC: NEUROLOGY RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 257

LATIN AMERICA: NEUROLOGY RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 258

MIDDLE EAST: NEUROLOGY RESEARCH APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 259

GCC COUNTRIES: NEUROLOGY RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 260

STEM CELL RESEARCH APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 261

NORTH AMERICA: STEM CELL RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 262

EUROPE: STEM CELL RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 263

ASIA PACIFIC: STEM CELL RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 264

LATIN AMERICA: STEM CELL RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 265

MIDDLE EAST: STEM CELL RESEARCH APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 266

GCC COUNTRIES: STEM CELL RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 267

OTHER RESEARCH APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 268

NORTH AMERICA: OTHER RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 269

EUROPE: OTHER RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 270

ASIA PACIFIC: OTHER RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 271

LATIN AMERICA: OTHER RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 272

MIDDLE EAST: OTHER RESEARCH APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 273

GCC COUNTRIES: OTHER RESEARCH APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 274

CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 275

CELL COUNTING MEDICAL APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 276

NORTH AMERICA: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 277

EUROPE: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 278

ASIA PACIFIC: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 279

LATIN AMERICA: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 280

MIDDLE EAST: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 281

GCC COUNTRIES: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 282

HEMATOLOGY & COMPLETE BLOOD COUNT MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 283

NORTH AMERICA: HEMATOLOGY & COMPLETE BLOOD COUNT MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 284

EUROPE: HEMATOLOGY & COMPLETE BLOOD COUNT MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 285

ASIA PACIFIC: HEMATOLOGY & COMPLETE BLOOD COUNT MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 286

LATIN AMERICA: HEMATOLOGY & COMPLETE BLOOD COUNT MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 287

MIDDLE EAST: HEMATOLOGY & COMPLETE BLOOD COUNT MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 288

GCC COUNTRIES: HEMATOLOGY & COMPLETE BLOOD COUNT MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 289

NON-INVASIVE PRENATAL DIAGNOSTICS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 290

NORTH AMERICA: NON-INVASIVE PRENATAL DIAGNOSTICS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 291

EUROPE: NON-INVASIVE PRENATAL DIAGNOSTICS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 292

ASIA PACIFIC: NON-INVASIVE PRENATAL DIAGNOSTICS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 293

LATIN AMERICA: NON-INVASIVE PRENATAL DIAGNOSTICS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 294

MIDDLE EAST: NON-INVASIVE PRENATAL DIAGNOSTICS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 295

GCC COUNTRIES: NON-INVASIVE PRENATAL DIAGNOSTICS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 296

IN VITRO FERTILIZATION MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 297

NORTH AMERICA: IN VITRO FERTILIZATION MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 298

EUROPE: IN VITRO FERTILIZATION MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 299

ASIA PACIFIC: IN VITRO FERTILIZATION MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 300

LATIN AMERICA: IN VITRO FERTILIZATION MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 301

MIDDLE EAST: IN VITRO FERTILIZATION MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 302

GCC COUNTRIES: IN VITRO FERTILIZATION MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 303

CIRCULATING TUMOR CELL DETECTION MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 304

NORTH AMERICA: CIRCULATING TUMOR CELL DETECTION MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 305

EUROPE: CIRCULATING TUMOR CELL DETECTION MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 306

ASIA PACIFIC: CIRCULATING TUMOR CELL DETECTION MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 307

LATIN AMERICA: CIRCULATING TUMOR CELL DETECTION MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 308

MIDDLE EAST: CIRCULATING TUMOR CELL DETECTION MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 309

GCC COUNTRIES: CIRCULATING TUMOR CELL DETECTION MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 310

OTHER MEDICAL APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 311

NORTH AMERICA: OTHER MEDICAL APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 312

EUROPE: OTHER MEDICAL APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 313

ASIA PACIFIC: OTHER MEDICAL APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 314

LATIN AMERICA: OTHER MEDICAL APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 315

MIDDLE EAST: OTHER MEDICAL APPLICATIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 316

GCC COUNTRIES: OTHER MEDICAL APPLICATIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 317

CELL COUNTING MARKET FOR OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

TABLE 318

NORTH AMERICA: CELL COUNTING MARKET FOR OTHER INDUSTRIAL APPLICATIONS, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 319

EUROPE: CELL COUNTING MARKET FOR OTHER INDUSTRIAL APPLICATIONS, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 320

ASIA PACIFIC: CELL COUNTING MARKET FOR OTHER INDUSTRIAL APPLICATIONS, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 321

LATIN AMERICA: CELL COUNTING MARKET FOR OTHER INDUSTRIAL APPLICATIONS, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 322

MIDDLE EAST: CELL COUNTING MARKET FOR OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2022–2029 (USD MILLION)

TABLE 323

GCC COUNTRIES: CELL COUNTING MARKET FOR OTHER INDUSTRIAL APPLICATIONS, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 324

CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 325

CELL COUNTING MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2022–2029 (USD MILLION)

TABLE 326

NORTH AMERICA: CELL COUNTING MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 327

EUROPE: CELL COUNTING MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 328

ASIA PACIFIC: CELL COUNTING MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 329

LATIN AMERICA: CELL COUNTING MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 330

MIDDLE EAST: CELL COUNTING MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2022–2029 (USD MILLION)

TABLE 331

GCC COUNTRIES: CELL COUNTING MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 332

CELL COUNTING MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY REGION, 2022–2029 (USD MILLION)

TABLE 333

NORTH AMERICA: CELL COUNTING MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 334

EUROPE: CELL COUNTING MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 335

ASIA PACIFIC: CELL COUNTING MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 336

LATIN AMERICA: CELL COUNTING MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 337

MIDDLE EAST: CELL COUNTING MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY REGION, 2022–2029 (USD MILLION)

TABLE 338

GCC COUNTRIES: CELL COUNTING MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 339

CELL COUNTING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2022–2029 (USD MILLION)

TABLE 340

NORTH AMERICA: CELL COUNTING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 341

EUROPE: CELL COUNTING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 342

ASIA PACIFIC: CELL COUNTING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 343

LATIN AMERICA: CELL COUNTING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 344

MIDDLE EAST: CELL COUNTING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2022–2029 (USD MILLION)

TABLE 345

GCC COUNTRIES: CELL COUNTING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 346

CELL COUNTING MARKET FOR OTHER END USERS, BY REGION, 2022–2029 (USD MILLION)

TABLE 347

NORTH AMERICA: CELL COUNTING MARKET FOR OTHER END USERS, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 348

EUROPE: CELL COUNTING MARKET FOR OTHER END USERS, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 349

ASIA PACIFIC: CELL COUNTING MARKET FOR OTHER END USERS, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 350

LATIN AMERICA: CELL COUNTING MARKET FOR OTHER END USERS, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 351

MIDDLE EAST: CELL COUNTING MARKET FOR OTHER END USERS, BY REGION, 2022–2029 (USD MILLION)

TABLE 352

GCC COUNTRIES: CELL COUNTING MARKET FOR OTHER END USERS, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 353

CELL COUNTING MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 354

NORTH AMERICA: KEY MACROINDICATORS

TABLE 355

NORTH AMERICA: CELL COUNTING MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 356

NORTH AMERICA: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 357

NORTH AMERICA: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 358

NORTH AMERICA: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 359

NORTH AMERICA: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 360

NORTH AMERICA: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 361

NORTH AMERICA: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 362

NORTH AMERICA: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 363

NORTH AMERICA: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 364

NORTH AMERICA: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 365

NORTH AMERICA: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 366

NORTH AMERICA: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 367

NORTH AMERICA: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 368

US: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 369

US: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 370

US: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 371

US: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 372

US: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 373

US: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 374

US: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 375

US: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 376

US: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 377

US: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 378

US: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 379

US: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 380

CANADA: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 381

CANADA: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 382

CANADA: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 383

CANADA: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 384

CANADA: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 385

CANADA: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 386

CANADA: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 387

CANADA: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 388

CANADA: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 389

CANADA: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 390

CANADA: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 391

CANADA: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 392

EUROPE: KEY MACROINDICATORS

TABLE 393

EUROPE: CELL COUNTING MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 394

EUROPE: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 395

EUROPE: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 396

EUROPE: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 397

EUROPE: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 398

EUROPE: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 399

EUROPE: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 400

EUROPE: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 401

EUROPE: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 402

EUROPE: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 403

EUROPE: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 404

EUROPE: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 405

EUROPE: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 406

GERMANY: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 407

GERMANY: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 408

GERMANY: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 409

GERMANY: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 410

GERMANY: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 411

GERMANY: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 412

GERMANY: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 413

GERMANY: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 414

GERMANY: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 415

GERMANY: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 416

GERMANY: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 417

GERMANY: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 418

UK: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 419

UK: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 420

UK: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 421

UK: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 422

UK: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 423

UK: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 424

UK: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 425

UK: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 426

UK: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 427

UK: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 428

UK: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 429

UK: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 430

FRANCE: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 431

FRANCE: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 432

FRANCE: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 433

FRANCE: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 434

FRANCE: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 435

FRANCE: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 436

FRANCE: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 437

FRANCE: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 438

FRANCE: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 439

FRANCE: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 440

FRANCE: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 441

FRANCE: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 442

ITALY: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 443

ITALY: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 444

ITALY: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 445

ITALY: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 446

ITALY: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 447

ITALY: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 448

ITALY: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 449

ITALY: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 450

ITALY: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 451

ITALY: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 452

ITALY: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 453

ITALY: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 454

SPAIN: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 455

SPAIN: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 456

SPAIN: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 457

SPAIN: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 458

SPAIN: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 459

SPAIN: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 460

SPAIN: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 461

SPAIN: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 462

SPAIN: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 463

SPAIN: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 464

SPAIN: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 465

SPAIN: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 466

REST OF EUROPE: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 467

REST OF EUROPE: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 468

REST OF EUROPE: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 469

REST OF EUROPE: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 470

REST OF EUROPE: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 471

REST OF EUROPE: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 472

REST OF EUROPE: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 473

REST OF EUROPE: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 474

REST OF EUROPE: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 475

REST OF EUROPE: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 476

REST OF EUROPE: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 477

REST OF EUROPE: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 478

ASIA PACIFIC: KEY MACROINDICATORS

TABLE 479

ASIA PACIFIC: CELL COUNTING MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 480

ASIA PACIFIC: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 481

ASIA PACIFIC: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 482

ASIA PACIFIC: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 483

ASIA PACIFIC: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 484

ASIA PACIFIC: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 485

ASIA PACIFIC: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 486

ASIA PACIFIC: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 487

ASIA PACIFIC: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 488

ASIA PACIFIC: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 489

ASIA PACIFIC: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 490

ASIA PACIFIC: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 491

ASIA PACIFIC: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 492

CHINA: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 493

CHINA: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 494

CHINA: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 495

CHINA: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 496

CHINA: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 497

CHINA: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 498

CHINA: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 499

CHINA: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 500

CHINA: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 501

CHINA: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 502

CHINA: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 503

CHINA: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 504

JAPAN: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 505

JAPAN: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 506

JAPAN: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 507

JAPAN: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 508

JAPAN: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 509

JAPAN: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 510

JAPAN: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 511

JAPAN: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 512

JAPAN: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 513

JAPAN: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 514

JAPAN: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 515

JAPAN: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 516

INDIA: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 517

INDIA: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 518

INDIA: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 519

INDIA: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 520

INDIA: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 521

INDIA: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 522

INDIA: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 523

INDIA: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 524

INDIA: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 525

INDIA: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 526

INDIA: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 527

INDIA: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 528

SOUTH KOREA: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 529

SOUTH KOREA: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 530

SOUTH KOREA: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 531

SOUTH KOREA: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 532

SOUTH KOREA: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 533

SOUTH KOREA: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 534

SOUTH KOREA: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 535

SOUTH KOREA: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 536

SOUTH KOREA: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 537

SOUTH KOREA: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 538

SOUTH KOREA: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 539

SOUTH KOREA: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 540

AUSTRALIA: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 541

AUSTRALIA: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 542

AUSTRALIA: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 543

AUSTRALIA: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 544

AUSTRALIA: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 545

AUSTRALIA: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 546

AUSTRALIA: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 547

AUSTRALIA: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 548

AUSTRALIA: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 549

AUSTRALIA: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 550

AUSTRALIA: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 551

AUSTRALIA: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 552

REST OF ASIA PACIFIC: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 553

REST OF ASIA PACIFIC: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 554

REST OF ASIA PACIFIC: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 555

REST OF ASIA PACIFIC: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 556

REST OF ASIA PACIFIC: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 557

REST OF ASIA PACIFIC: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 558

REST OF ASIA PACIFIC: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 559

REST OF ASIA PACIFIC: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 560

REST OF ASIA PACIFIC: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 561

REST OF ASIA PACIFIC: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 562

REST OF ASIA PACIFIC: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 563

REST OF ASIA PACIFIC: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 564

LATIN AMERICA: KEY MACROINDICATORS

TABLE 565

LATIN AMERICA: CELL COUNTING MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 566

LATIN AMERICA: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 567

LATIN AMERICA: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 568

LATIN AMERICA: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 569

LATIN AMERICA: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 570

LATIN AMERICA: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 571

LATIN AMERICA: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 572

LATIN AMERICA: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 573

LATIN AMERICA: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 574

LATIN AMERICA: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 575

LATIN AMERICA: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 576

LATIN AMERICA: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 577

LATIN AMERICA: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 578

BRAZIL: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 579

BRAZIL: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 580

BRAZIL: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 581

BRAZIL: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 582

BRAZIL: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 583

BRAZIL: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 584

BRAZIL: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 585

BRAZIL: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 586

BRAZIL: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 587

BRAZIL: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 588

BRAZIL: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 589

BRAZIL: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 590

MEXICO: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 591

MEXICO: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 592

MEXICO: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 593

MEXICO: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 594

MEXICO: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 595

MEXICO: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 596

MEXICO: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 597

MEXICO: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 598

MEXICO: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 599

MEXICO: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 600

MEXICO: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 601

MEXICO: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 602

REST OF LATIN AMERICA: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 603

REST OF LATIN AMERICA: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 604

REST OF LATIN AMERICA: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 605

REST OF LATIN AMERICA: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 606

REST OF LATIN AMERICA: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 607

REST OF LATIN AMERICA: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 608

REST OF LATIN AMERICA: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 609

REST OF LATIN AMERICA: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 610

REST OF LATIN AMERICA: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 611

REST OF LATIN AMERICA: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 612

REST OF LATIN AMERICA: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 613

REST OF LATIN AMERICA: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 614

MIDDLE EAST: KEY MACROINDICATORS

TABLE 615

MIDDLE EAST: CELL COUNTING MARKET, BY REGION, 2022–2029 (USD MILLION)

TABLE 616

MIDDLE EAST: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 617

MIDDLE EAST: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 618

MIDDLE EAST: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 619

MIDDLE EAST: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 620

MIDDLE EAST: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 621

MIDDLE EAST: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 622

MIDDLE EAST: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 623

MIDDLE EAST: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 624

MIDDLE EAST: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 625

MIDDLE EAST: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 626

MIDDLE EAST: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 627

MIDDLE EAST: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 628

GCC COUNTRIES: CELL COUNTING MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

TABLE 629

GCC COUNTRIES: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 630

GCC COUNTRIES: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 631

GCC COUNTRIES: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 632

GCC COUNTRIES: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 633

GCC COUNTRIES: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 634

GCC COUNTRIES: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 635

GCC COUNTRIES: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 636

GCC COUNTRIES: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 637

GCC COUNTRIES: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 638

GCC COUNTRIES: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 639

GCC COUNTRIES: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 640

GCC COUNTRIES: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 641

SAUDI ARABIA: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 642

SAUDI ARABIA: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 643

SAUDI ARABIA: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 644

SAUDI ARABIA: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 645

SAUDI ARABIA: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 646

SAUDI ARABIA: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 647

SAUDI ARABIA: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 648

SAUDI ARABIA: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 649

SAUDI ARABIA: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 650

SAUDI ARABIA: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 651

SAUDI ARABIA: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 652

SAUDI ARABIA: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 653

UAE: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 654

UAE: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 655

UAE: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 656

UAE: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 657

UAE: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 658

UAE: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 659

UAE: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 660

UAE: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 661

UAE: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 662

UAE: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 663

UAE: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 664

UAE: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 665

REST OF GCC COUNTRIES: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 666

REST OF GCC COUNTRIES: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 667

REST OF GCC COUNTRIES: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 668

REST OF GCC COUNTRIES: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 669

REST OF GCC COUNTRIES: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 670

REST OF GCC COUNTRIES: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 671

REST OF GCC COUNTRIES: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 672

REST OF GCC COUNTRIES: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 673

REST OF GCC COUNTRIES: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 674

REST OF GCC COUNTRIES: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 675

REST OF GCC COUNTRIES: CELL COUNTING MEDICAL APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 676

REST OF GCC COUNTRIES: CELL COUNTING MARKET, BY END USER, 2022–2029 (USD MILLION)

TABLE 677

REST OF MIDDLE EAST: CELL COUNTING MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

TABLE 678

REST OF MIDDLE EAST: CELL COUNTING CONSUMABLES MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 679

REST OF MIDDLE EAST: CELL COUNTING ASSAY KITS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 680

REST OF MIDDLE EAST: CELL COUNTING INSTRUMENTS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 681

REST OF MIDDLE EAST: CELL COUNTING SPECTROPHOTOMETERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 682

REST OF MIDDLE EAST: CELL COUNTING HEMATOLOGY ANALYZERS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 683

REST OF MIDDLE EAST: CELL COUNTERS MARKET, BY MODE, 2022–2029 (USD MILLION)

TABLE 684

REST OF MIDDLE EAST: CELL COUNTERS MARKET, BY TECHNIQUE, 2022–2029 (USD MILLION)

TABLE 685

REST OF MIDDLE EAST: CELL COUNTING MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

TABLE 686

REST OF MIDDLE EAST: CELL COUNTING RESEARCH APPLICATIONS MARKET, BY TYPE, 2022–2029 (USD MILLION)

TABLE 687