China & Japan Peripheral Vascular Devices Market

China & Japan Peripheral Vascular Devices Market by Type [Catheters (Guiding, Angiography), Inferior Vena Cava Filters (Retrievable, Permanent), Plaque Modification Devices (Atherectomy, Thrombectomy), Guidewires, Introducer Sheaths] – Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The China & Japan peripheral vascular devices market, valued at USD 0.87 billion in 2025, stood at USD 0.92 billion in 2026 and is projected to advance at a resilient CAGR of 6.9% from 2026 to 2031, culminating in a forecasted valuation of USD 1.30 billion by the end of the period. The growing prevalence of peripheral arterial disease, diabetes-related vascular complications, and various chronic cardiovascular conditions is propelling the China & Japan peripheral vascular devices market. Additionally, the rising preference for minimally invasive and endovascular procedures also fuels the market. Enhancing the need for high-quality, patient-tailored vascular solutions has led to increased investment in the development and production of advanced vascular devices. The emergence of a strong product pipeline consisting of drug eluting-stents, drug-coated balloons, atherectomy systems, and intravascular imaging systems (IVUS & OCT) solutions, along with increased procedural counts, aging demographics, and adoption of digitization and AI technology in the clinical setting, also drive the market.

KEY TAKEAWAYS

-

By CountryJapan is expected to register a CAGR of 8.1% during the forecast period.

-

By TypeHemodynamic flow alteration devices segment is expected to register the highest CAGR of 10.8% in Japan and 9.6% in China during the forecast period.

-

By Angioplasty StentDrug-eluting stents segment is expected to dominate the market with a 64.5% share in China and 64.2% in Japan.

-

By Endovascular Aneurysm Repair Stent GraftAbdominal aortic aneurysm stent grafts segment is projected to grow at the fastest rate from 2026 to 2031.

-

By CatheterGuiding catheters segment accounted for the largest share of 50.6% in China and 49.9% in Japan.

-

By Inferior Vena Cava FilterRetrievable filters segment is expected to register the highest CAGR of 9.4% in Japan & 8.1% in China.

-

By Angioplasty BalloonOld/normal balloons segment dominated the market, with a share of 48.2% in China and 48.7% in Japan.

-

By Plaque Modification DeviceAtherectomy devices is expected to register the highest CAGR of 9.9% in Japan and 8.6% in China.

-

By Hemodynamic Flow Alteration DeviceEmbolic protection devices segment dominated the market, with a share of 62.3% in China and 61.3% in Japan.

-

By Other Peripheral Vascular DeviceVascular closure devices segment is expected to register the highest CAGR of 8.9% in Japan and 7.6% in China.

-

Competitive Landscape - Key PlayersTerumo Corporation, Medtronic, and Boston Scientific Corporation were identified as some of the star players in the China & Japan peripheral vascular devices market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsZYLOX-TONBRIDGE MEDICAL TECHNOLOGY CO., LTD., Zhejiang Barty Medical Technology Co., Ltd., and Global Vascular Co., Ltd., among others, have distinguished themselves among startups and SMEs by due to their strong product portfolio and business strategy.

Market demand for peripheral vascular devices in China and Japan is progressing steadily. Factors that propel this market include rising numbers of procedures performed for PAD, as well as the adoption of minimally invasive endovascular techniques. Additionally, growth is fueled by the demand for high-end stents, drug-eluting balloons, catheters, and intravascular imaging systems. Emerging technology trends include AI-based imaging systems and clinical decision platforms, robotic/sensor-based devices, advanced materials and designs for better performance and durability, and more for high-end quality manufacturing. Partnership developments between international companies and indigenous companies in the field of device manufacturing are also impacting this market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in clinical practices and the healthcare system are the main factors that influence the China & Japan peripheral vascular devices market. Hospitals, specialized vascular centers, and cath labs are the major customers of peripheral vascular device manufacturers, where the most crucial applications are in peripheral arterial disease, diabetic vascular complications, and complex endovascular interventions. Increased preference for minimally invasive, image, guided procedures, the growing use of advanced stents, drug, coated balloons, and intravascular imaging systems, along with a stricter regulatory oversight, are the factors that most directly impact hospital spending patterns. These changes in the number of procedures and the level of technology adopted affect provider purchasing decisions, which constitute a feedback loop to revenue growth, product innovation, and competitive positioning among peripheral vascular device manufacturers in these countries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increase in aging population

-

Rising prevalence of peripheral arterial disease (PAD), diabetes, and cardiovascular disorders

Level

-

High cost of advanced devices

-

Stringent and time-consuming regulatory approval processes

Level

-

Rapid growth of drug-eluting stents and drug-coated balloon adoption

-

Localization of manufacturing

Level

-

Limited trained specialists

-

Pricing pressures and reimbursement limitations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increase in aging population

The growing elderly populations in China and Japan have been instrumental in increasing the demand for peripheral vascular devices. Aged populations mean an increase in age, dependent vascular diseases, especially peripheral arterial disease (PAD), as well as cardiovascular complications. These diseases have become the most prevalent, and there has been a rise in the demand for diagnostic and interventional devices, such as stents, balloons, and catheters. The alteration of age structure is resulting in a bigger market for vascular treatments in both countries.

Restraint: High cost of advanced devices

The prohibitive high prices of devices such as drug-eluting stents, drug-coated balloons, and imaging systems have been the main reasons for the limited use of advanced vascular devices. While these devices offer better clinical outcomes, their high prices may limit the availability of patients, particularly those in remote areas and small healthcare facilities, where there is a shortage of funds. The cost of personnel training to operate these advanced technologies may also be a reason for the peripheral vascular devices market to be limited in certain regions, thus causing the overall market growth to slow down.

Opportunity: Rapid growth of drug-eluting stents and drug-coated balloon adoption

The fast uptake of drug-eluting stents and drug-coated balloons is one of the growth opportunities of the China & Japan peripheral vascular devices market. These innovative devices have been proven to lower the risk of restenosis, increase the long-term results in patients with peripheral arterial disease, and decrease the necessity of repeat operations. Due to the popularization of less invasive interventions, these devices are getting more and more popular in both countries, expanding the market. Their effectiveness and the rising occurrence of PAD are two major factors that create huge opportunities for the market to expand.

Challenge: Limited trained specialists

The limited number of vascular specialists trained in the use of advanced peripheral vascular devices is a major challenge that hampers the uptake of these devices in China and Japan. The use of these sophisticated devices in operations requires medical staff who are highly skilled. There is a shortage of professionals who have the necessary qualifications to carry out these complex interventions. Lack of training may cause delays in new technology introduction and reduction of devices' overall efficiency.

CHINA & JAPAN PERIPHERAL VASCULAR DEVICES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops and manufactures peripheral catheters, guidewires, sheaths, and stents used in endovascular interventions, with strong expertise in radial-to-peripheral access technologies | Improves procedural access | Enhances device deliverability | Supports minimally invasive peripheral interventions with high procedural safety |

|

Offers a broad portfolio of peripheral vascular devices including angioplasty balloons, drug-eluting stents, guidewires, embolic protection systems, and atherectomy solutions | Enables effective treatment of peripheral arterial disease with improved vessel patency | Reduces restenosis | Wide clinical applicability |

|

Provides advanced peripheral stents, drug-coated balloons, atherectomy systems, and intravascular imaging solutions for complex vascular lesions | Enhances treatment precision | Improves long-term outcomes | Supports complex and calcified lesion management |

|

Develops peripheral stents, balloon catheters, and intravascular imaging systems (IVUS/OCT) used for diagnosis and image-guided vascular interventions | Improves lesion assessment | Optimizes device placement | Reduces procedural complications through image-guided precision |

|

Manufactures cost-effective peripheral stents, balloons, and endovascular devices with a strong focus on localized production in China | Increases accessibility and affordability of peripheral vascular treatments while supporting domestic supply and faster market penetration |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The China & Japan peripheral vascular devices ecosystem is a complex network of stakeholders who are working to improve endovascular care. The main entities include medical device manufacturers, component suppliers, and contract manufacturing partners that provide support in device design, materials engineering, and sterile production. These entities engage closely with hospitals, physicians, and research institutes to create and authenticate sophisticated drug, eluting stents, balloons, and intravascular imaging systems. The communication with the technology partners offering AI-enabled imaging, digital workflow tools, and automation is getting more frequent, they are also becoming indispensable in design optimization, quality control, and procedural efficiency. Hence, this ecosystem is facilitating the pace of innovation, regulatory alignment, and the marketing of the next, generation peripheral vascular devices in China and Japan.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

China & Japan Peripheral Vascular Devices Market, By Type

In 2025, angioplasty stents represented the largest share of the China & Japan peripheral vascular devices market as they are the central therapy conventionally used for re-establishing blood flow within patients suffering from peripheral arterial disease. The high degree of clinical effectiveness, established safety for use, and compatibility with minimally invasive techniques make high volumes of the therapy widely preferred. Ongoing developments within drug-eluting technology also support this high demand within the Chinese and Japanese markets.

China & Japan Peripheral Vascular Devices Market, By Endovascular Aneurysm Repair Stent Graft

Abdominal aortic aneurysm (AAA) stent grafts represented a major part of the market since they are the first-line-of-care treatment for the management of abdominal aortic aneurysms, thus, emerging a less invasive option compared with open surgery is given to the patients. The increased use is mainly attributed to strong clinical evidence, reduced perioperative risk, and quicker recovery time, especially for the elderly population. In addition, the continuous changes in the stent graft structure, their durability, and the delivery systems as well as the increasing number of hospitals that are endovascular repair, equipped, are some of the factors that have been pushing their dominance in the market.

China & Japan Peripheral Vascular Devices Market, By Catheter

In 2025, guiding catheters accounted for the largest share as they are the most necessary in almost all endovascular operations, being the main access and support tool for device delivery. Their extensive use in diagnostic angiography, angioplasty, stenting, and complex interventions is the main reason for the high turnover of these procedures. Moreover, ongoing enhancements in catheter design, flexibility, torque control, and multi-device compatibility have been a significant factor in the preference of the physicians and their habitual use in China and Japan.

China & Japan Peripheral Vascular Devices Market, By Inferior Vena Cava Filter

Retrievable inferior vena cava (IVC) filters accounted for the major market share in 2025 as these devices provide more clinical flexibility and better patient safety than permanent ones. Doctors are opting for retrievable filters more and more as these can be taken out after the pulmonary embolism risk has been alleviated, lowering the possibility of complications in the long term. The increase in the awareness of risks associated with the filter, favorable clinical guidelines, and progress in retrieval methods have all contributed to the rapid uptake of these devices.

China & Japan Peripheral Vascular Devices Market, By Angioplasty Balloon

Old/Normal angioplasty balloons accounted for the largest share in 2025 since they are still the standard first line device for a range of peripheral vascular interventions. As they are inexpensive, easily accessible, and familiar to the physicians, they are the most utilized devices in the majority of hospitals with high patient flow. Additionally, they are frequently applied for vessel preparation prior to stenting and in mildly complex lesions. They maintain a stable high consumption level in comparison to advanced balloon technologies.

REGION

Japan to be fastest-growing country in China & Japan peripheral vascular devices market during forecast period

Due to a growing elderly population, a large number of patients suffering from peripheral artery diseases and cardiovascular diseases, and a growing need for minimal invasive devices, such as endovascular techniques, Japan is forecast to experience the highest CAGR. This is because the Japanese market has a highly developed medical infrastructure, large adoption of latest technology such as drug-eluting stents, and intravascular imaging (IVUS/OCT) at an early stage. Furthermore, favorable regulations, massive investments, and collaboration between device, hospital, and institution sectors are resulting in rapid growth in the Japan peripheral vascular devices market.

CHINA & JAPAN PERIPHERAL VASCULAR DEVICES MARKET: COMPANY EVALUATION MATRIX

In the China & Japan peripheral vascular devices market matrix, Medtronic (Star) is the star company with the widest range of vascular products, such as stents, balloons, guidewires, and atherectomy systems, combined with its substantial R&D investments, state-of-the-art manufacturing capabilities, and solid market presence in China and Japan. MicroPort Scientific Corporation (Emerging Leader) is becoming a notable player especially by the broadening of its vascular devices portfolio comprising of stents and balloons, and the commitment to minimally invasive technologies. With increasing investments in local manufacturing, strategic partnerships, and a rapidly growing market footprint in China and Japan, MicroPort is setting itself as a close challenger who is making substantial progress in the local market of peripheral vascular devices.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Terumo Corporation (Japan)

- Medtronic (Ireland)

- Boston Scientific Corporation (US)

- Abbott (US)

- MicroPort Scientific Corporation (China)

- W. L. Gore & Associates, Inc. (US)

- ASAHI INTECC CO., LTD. (Japan)

- Cook (US)

- Nipro (Japan)

- B. Braun SE (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 0.87 Billion |

| Market Forecast in 2031 (Value) | USD 1.30 Billion |

| Growth Rate | CAGR of 6.9% |

| Years Considered | 2024-2031 |

| Base Year | 2025 |

| Forecast Period | 2026-2031 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Country Covered | China |

WHAT IS IN IT FOR YOU: CHINA & JAPAN PERIPHERAL VASCULAR DEVICES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparative assessment of key peripheral vascular devices used in China and Japan, including angioplasty balloons, drug-eluting and bare-metal stents, drug-coated balloons, guidewires, catheters, atherectomy systems, and IVUS/OCT imaging catheters. The analysis covered technology maturity, procedure adoption trends, and differences in usage across hospitals and vascular centers in both countries. | Enabled a clear understanding of technology adoption levels, clinical preferences, and product positioning, supporting strategic portfolio planning, market entry prioritization, and investment decisions in high-growth peripheral vascular segments. |

| Company Information | Profiled leading peripheral vascular device manufacturers operating in China and Japan, such as Terumo, Medtronic, Boston Scientific, Abbott, MicroPort Scientific, W. L. Gore & Associates, and Asahi Intecc. Evaluated product portfolios, local manufacturing presence, regulatory positioning, and competitive strengths. | Provided insights into competitive dynamics, partnership and localization opportunities, and innovation focus areas such as drug-eluting technologies, imaging-guided interventions, and minimally invasive endovascular solutions shaping the China & Japan market. |

| Country-level volume Analysis | Delivered detailed volume analysis for various product types in the China & Japan market for peripheral vascular devices | Provided assistance and supported strategic decisions on high volume product segments, regional hotspots, and pockets for product growth. |

RECENT DEVELOPMENTS

- July 2025 : Medtronic signed an exclusive distribution agreement with Future Medical Design, a company located in Japan, to sell its stainless-steel peripheral guidewires. The agreement includes F-14 and F-18 guidewires intended for transradial access, also featuring a groundbreaking 400 cm, 0.018-inch peripheral guidewire.

- December 2024 : Terumo Corporation announced the launch of its R2P NaviCross peripheral support catheter. This launch expands the company's radial-to-peripheral (R2P) portfolio.

- January 2024 : W. L. Gore & Associates, Inc. announced FDA approval for a lower-profile GORE VIABAHN VBX Balloon Expandable Endoprosthesis, expanding treatment options for patients with complex vascular disease.

Table of Contents

Methodology

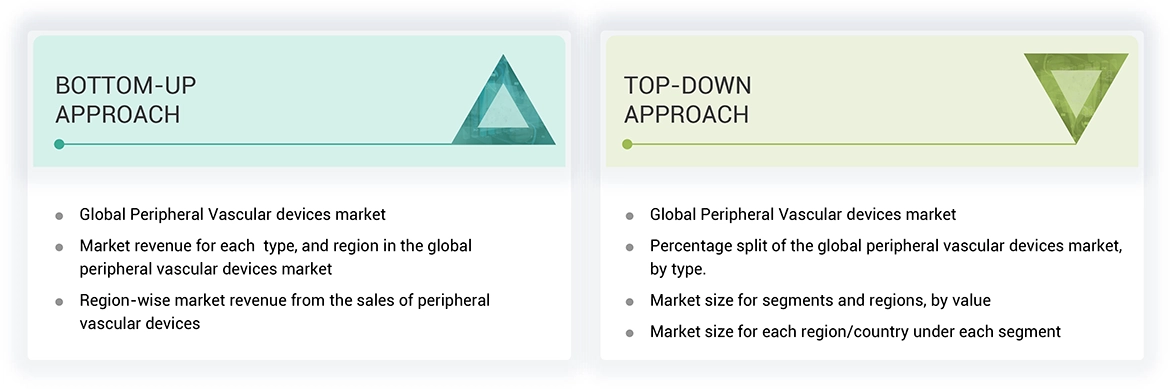

The study involved four major activities to estimate the current size of the China & Japan Peripheral Vascular Devices market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to to identify and collect information for the study of China & Japan Peripheral Vascular Devices market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after obtaining information regarding the China & Japan Peripheral Vascular Devices market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of China and Japan. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from manufacturers; distributors operating in the China & Japan Peripheral Vascular Devices market.; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side customers/end users who are using infection control products were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage and the future outlook of their business, which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the transfection technologies market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The research methodology used to estimate the size of the China & Japan Peripheral Vascular Devices market includes the following details.

The market sizing of the market was undertaken from the global side.

Country-level Analysis: The size of the China & Japan Peripheral Vascular Devices market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products in the overall China & Japan Peripheral Vascular Devices market was obtained from secondary data and validated by primary participants to arrive at the total China & Japan Peripheral Vascular Devices market. Primary participants further validated the numbers.

Geographic market assessment (by region & country):The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall China & Japan Peripheral Vascular Devices market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size—using the market size estimation processes. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment. The data was triangulated by studying various factors and trends from both the demand and supply sides in the China & Japan Peripheral Vascular Devices market.

Market Definition

Peripheral Vascular Devices are medical equipment and instruments used in the diagnosis, treatment, or management of peripheral blood vessel illnesses of the patient. It pertains to diseases, disease, or disorders involving the arteries, veins, and lymphatic vessels outside the heart and brain. The overall application of peripheral vascular devices is in treating PAD and DVT, as well as other vascular disorders. It facilitates procedures that are intended to restore normal blood flow, remove clots, and keep the vessel open. Examples include balloon catheters, stents, guidewires, atherectomy devices, and vascular grafts.

Stakeholders

- Medical Device Manufacturers

- Cardiologists

- Interventional Cardiologist

- Healthcare institutions (hospitals and outpatient clinics)

- Distributors and suppliers

- Research institutes

- Health insurance payers

- Market research and consulting firms

Report Objectives

- To define, describe, segment, and forecast the China & Japan Peripheral Vascular Devices market by types and region.

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges) in China & Japan

- To analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall China & Japan Peripheral Vascular Devices market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the China & Japan Peripheral Vascular Devices market along with their respective key countries

- To profile key players in the China & Japan Peripheral Vascular Devices market and comprehensively analyze their core competencies and market shares.

- To track and analyze competitive developments such as acquisitions, expansions, partnerships, agreements, and collaborations; and product launches and approvals in the China & Japan Peripheral Vascular Devices market

- To benchmark players within the China & Japan Peripheral Vascular Devices market using the "Company Evaluation Matrix" framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the China & Japan Peripheral Vascular Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in China & Japan Peripheral Vascular Devices Market