RFID Market Size, Share, Trends and Growth Analysis

RFID Market by Tag, Reader, Software & Service, Card, Label, Sensor-based, Inventory & Asset Management, Security & Access Control, Contactless Payment, Retail, Animal Tracking, and Industrial & Manufacturing - Global Forecast to 2034

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The RFID market is projected to reach USD 30.47 billion by 2034 from USD 14.58 billion in 2025, at a CAGR of 8.5%. The market is expected to grow steadily, driven by the rising adoption of automated identification, real-time tracking, and RFID-enabled digitalization across the retail, transportation, logistics & warehousing, industrial & manufacturing, and medical, healthcare & pharmaceutical sectors.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific is expected to register the fastest growth in the RFID market, expanding at a CAGR of 10.5%, driven by rapid retail expansion, increased manufacturing scale, and digitalization of logistics across China, India, Japan, and South Korea.

-

By OfferingBy offering, the tags segment accounted for the largest share of approximately 51% in 2024, driven by large-scale item-level tagging and asset tracking deployments across retail and supply chain operations.

-

By Frequency RangeThe high frequency (HF) segment held the largest share of 57% in 2024, supported by strong adoption in contactless payments, access control, ticketing, and secure identification applications.

-

By Form FactorThe labels segment is expected to register the highest CAGR of 12.4% from 2025 to 2034, driven by high-volume usage in retail inventory management, logistics, and warehouse automation.

-

By ApplicationThe contactless payments segment is projected to grow at the highest CAGR of 11.8%, supported by rising adoption of digital payments, NFC-enabled systems, and transit fare collection platforms.

-

By End UseRetail represents the largest vertical in the RFID market, driven by widespread item-level tagging, inventory accuracy initiatives, and omnichannel fulfillment strategies among global retailers.

-

By MaterialThe paper segment accounted for the largest share, supported by its cost-effectiveness, scalability, and extensive use in RFID labels for retail and logistics applications.

-

Competitive LandscapeZebra Technologies Corp., Avery Dennison Corporation, Honeywell International Inc., HID Global Corporation, and Datalogic S.p.A. are identified as leading players, supported by broad product portfolios and strong enterprise deployments.

-

Competitive LandscapeCompanies such as ORBCOMM, Mojix, eAgile Inc., and Omni-ID are strengthening their positions through innovation in RFID hardware, software platforms, and industry-specific solutions.

-

OmnitaasOmnitaas is pushing the boundaries of traditional SCM by evolving from 'Top-floor to Shop-floor' integration to a true 'Shop-floor to Shop-floor' visibility model. By enabling real-time collaboration across different partners' production environments, their TaaS-AI™ suite provides the predictive foresight and cross-organizational transparency essential for modern, high-velocity supply chains.

The RFID market is witnessing steady growth driven by increasing adoption of automated identification, real-time tracking, and data-driven operations across retail, logistics, manufacturing, and healthcare. Rising deployment of RFID tags, readers, and software platforms, along with growing integration with IoT and enterprise systems, is reshaping operational visibility and efficiency globally.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends in retail digitalization, e-commerce growth, smart logistics, and contactless services are reshaping RFID adoption, pushing enterprises to deploy RFID tags, readers, and software platforms for real-time visibility, automation, and secure identification. These trends are driving broader use of RFID across inventory management, supply chain tracking, access control, ticketing, and payment systems to improve efficiency, transparency, and customer experience across downstream industries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Supply chain digitalization and real-time visibility demand

-

Automation growth in logistics and warehousing

Level

-

High total cost of ownership for large-scale deployments

-

Integration complexity with legacy IT and WMS/ERP systems

Level

-

Industry 4.0 and smart manufacturing adoption

-

RFID-enabled traceability in healthcare and pharmaceuticals

Level

-

RF signal interference and read accuracy constraints in metal- and liquid-intensive RFID deployments

-

Managing interoperability in heterogeneous RFID ecosystems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Supply chain digitalization and rising demand for real-time visibility

Global supply chains are becoming increasingly complex, driving strong demand for real-time visibility across inventory, assets, and shipments. Enterprises are adopting RFID to automate data capture, improve inventory accuracy, and enable end-to-end traceability across warehouses, distribution centers, and retail networks. As omnichannel retail, e-commerce fulfillment, and just-in-time operations expand, RFID supports faster cycle counts, reduced stockouts, and improved decision-making. Integration of RFID with IoT platforms, analytics, and enterprise systems further strengthens its role as a core enabler of digital supply chain transformation.

Restraint: High total cost of ownership for large-scale RFID deployments

Despite declining tag prices, large-scale RFID deployments continue to face high total cost of ownership due to infrastructure investments, system integration, software customization, and ongoing maintenance. Costs related to reader installation, network upgrades, middleware configuration, and change management can be significant, particularly for multi-site deployments. These factors can delay adoption in cost-sensitive industries and limit expansion beyond pilot projects, especially among small and mid-sized enterprises.

Opportunity: RFID-enabled traceability in healthcare and pharmaceuticals

Healthcare and pharmaceutical sectors present strong growth opportunities for RFID due to increasing focus on product authentication, patient safety, and regulatory compliance. RFID enables real-time tracking of medical devices, pharmaceuticals, and high-value assets across hospitals and supply chains. Adoption is further supported by requirements for drug traceability, cold-chain monitoring, and inventory control. RFID-based systems improve visibility, reduce errors, and enhance compliance, positioning healthcare as a high-value growth segment for advanced RFID solutions.

Challenge: RF signal interference and read accuracy issues in metal- and liquid-intensive environments

RFID performance can be constrained in environments with high metal content or liquid exposure, where RF signal reflection and absorption reduce read accuracy. These challenges are common in industrial manufacturing, healthcare equipment, and food processing applications. Addressing these issues requires specialized tag designs, optimized reader placement, and environment-specific system tuning. Managing performance consistency across diverse operating conditions remains a key technical challenge for large-scale and mission-critical RFID deployments.

RFID MARKET SIZE, SHARE, TRENDS AND GROWTH ANALYSIS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of enterprise-grade RFID readers, printers, and mobile devices for item-level inventory tracking in retail stores and distribution centers | Improved inventory accuracy | Faster cycle counts | Reduced stockouts and shrinkage |

|

Large-scale deployment of RFID labels and inlays for supply chain visibility, apparel tagging, and logistics tracking. |

Scalable item-level traceability | Lower manual scanning effort | Enhanced supply chain transparency |

|

|

Implementation of Premise-on-Cloud AI-driven RFID platform for unified Asset and Manufacturing Intelligence & Collaboration, providing real-time Work-in-Process (WIP) and lifecycle monitoring. | Achieves 99.9% data accuracy from sensor to cloud via AI-powered phantom read filtering | Delivers a 30x reduction in stock-take time and an 18% decrease in WIP bottlenecks | Enables Industry 5.0 collaboration through mobile-first visibility and automated predictive alerts | Redefines SCM by enabling real-time "Shop-floor to Shop-floor" visibility across external partners. |

|

Use of RAIN RFID tag chips and reader ICs for high-volume retail, logistics, and asset tracking applications | Long read range | High tag-read accuracy | Cost-efficient mass deployment |

|

Deployment of HF and NFC-based RFID solutions for secure access control, identification, and authentication systems | Enhanced security | Reliable identity management | Reduced fraud and unauthorized access |

|

Implementation of cloud-based RFID software for real-time work-in-progress, asset visibility, and manufacturing intelligence | Real-time operational visibility | Improved asset utilization | Data-driven decision-making |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The RFID market ecosystem includes tag and label manufacturers, reader and antenna suppliers, and software providers enabling automated identification and real-time data capture. System integrators support deployment by integrating RFID hardware and software into enterprise IT environments. End users such as retailers, logistics operators, manufacturers, and consumer brands drive adoption through inventory management, supply chain visibility, and operational automation use cases.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

RFID Market, by Offering

In 2024, the tags segment held the largest share of the RFID market and is expected to remain dominant through the forecast period. Growth is driven by large-scale item-level tagging across retail, logistics, and supply chain operations. RFID tags are central to enabling real-time visibility, inventory accuracy, and automated data capture. As enterprises expand omnichannel fulfillment, warehouse automation, and asset tracking initiatives, demand for high-volume, cost-efficient RFID tags continues to rise.

RFID Market, by Application

In 2024, inventory and asset management applications dominated RFID adoption due to strong demand for real-time tracking and operational efficiency. However, contactless payments are expected to register the fastest CAGR, supported by increasing adoption of NFC-enabled payment systems, transit fare collection, and access-based transactions. Growing preference for touchless and secure payment experiences continues to accelerate RFID deployment in payment-related applications.

RFID Market, by Frequency Range

The high-frequency (HF) segment held the largest share in 2024, driven by widespread use in contactless payments, access control, ticketing, and secure identification systems. HF RFID offers reliable short-range performance and strong security features, supporting continued adoption across mobility, banking, and authentication use cases.

RFID Market, by Form Factor

RFID labels represented the most widely used form factor in 2024 due to their low cost, scalability, and ease of integration into packaging, apparel, and logistics workflows. In addition, the labels segment is expected to register the highest CAGR over the forecast period, supported by growing item-level tagging and warehouse automation initiatives across retail and supply chains.

RFID Market, by Material

The paper segment accounted for the largest share of the RFID market in 2024, supported by its cost-effectiveness, lightweight properties, and suitability for high-volume label production. Paper-based RFID tags are widely used in retail, logistics, and warehousing applications where disposability, print compatibility, and scalability are key requirements.

RFID Market, by End Use

Retail emerged as the largest vertical in the RFID market, driven by widespread adoption of item-level tagging, inventory accuracy programs, and omnichannel fulfillment strategies. Retailers continue to deploy RFID to reduce stockouts, improve shelf availability, and enhance in-store and online integration, reinforcing the sector’s leading contribution to overall market demand.

REGION

Asia Pacific to register highest growth in the global RFID market during forecast period

The Asia Pacific region is expected to register the highest CAGR in the RFID market from 2025 to 2034, driven by rapid retail expansion, supply chain digitalization, and large-scale logistics automation. Strong growth in e-commerce, manufacturing, and contactless payment infrastructure across China, India, Japan, and Southeast Asia is accelerating RFID adoption.

RFID MARKET SIZE, SHARE, TRENDS AND GROWTH ANALYSIS: COMPANY EVALUATION MATRIX

In the RFID market matrix, Zebra Technologies Corp. is positioned as a Star, supported by strong market share, a broad end-to-end RFID portfolio, and deep penetration across retail, logistics, and manufacturing applications. Alien Technology, LLC is an Emerging Leader, driven by its focused RAIN RFID tag and reader offerings and rising adoption in cost-sensitive, high-volume supply chain deployments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Zebra Technologies Corp. (US)

- Honeywell International Inc. (US)

- Avery Dennison Corporation (US)

- HID Global Corporation (US)

- Datalogic S.p.A. (Italy)

- Impinj, Inc. (US)

- Alien Technology, LLC (US)

- CAEN RFID S.r.l. (Italy)

- GAO RFID Inc. (Canada)

- OMNITASS

- Xemelgo, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 13.71 Billion |

| Market Forecast in 2034 (Value) | USD 30.47 Billion |

| Growth Rate | 8.5% |

| Years Considered | 2021-2034 |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Units Considered | Value (USD Billion), Volume (Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, RoW |

WHAT IS IN IT FOR YOU: RFID MARKET SIZE, SHARE, TRENDS AND GROWTH ANALYSIS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Large Retailer / Omnichannel Brand |

|

|

| Logistics & Warehousing Operator |

|

|

| Manufacturing Enterprise |

|

|

| Healthcare Provider / Pharma Company |

|

|

| Transportation Authority / Transit Operator |

|

|

| RFID Solution Provider / Vendor |

|

|

RECENT DEVELOPMENTS

- January 2026: Omnitaas Unveils AI-Native Integration for Cross-Partner Collaboration Omnitaas has integrated AI-driven intelligence across its TaaS-AI™ suite, bridging Asset and Manufacturing Intelligence to enable real-time shop-floor to shop-floor visibility. This development facilitates seamless, secure collaboration across disparate partner organizations, delivering a true end-to-end supply chain ecosystem.

- November 2025 : Impinj, Inc. expanded its Gen2X RAIN RFID protocol enhancements, enabling faster inventory reads, improved reader sensitivity, stronger counterfeit protection, and enhanced privacy for large-scale enterprise deployments.

- October 2025 : Avery Dennison Corporation partnered with Walmart to develop sensor-enabled RFID labels for high-moisture and cold environments, improving freshness tracking and inventory accuracy in meat, bakery, and deli categories.

- October 2025 : Honeywell International Inc. announced the CT70 mobile computer, featuring AI capabilities and planned RAIN RFID integration in early 2026, to improve inventory accuracy and workforce productivity in retail and logistics operations.

- July 2025 : Zebra Technologies Corp. made a strategic investment in Xemelgo, Inc., strengthening AI-driven RFID visibility and automation capabilities for manufacturing and industrial workflows.

- April 2025 : HID Global Corporation launched the OMNIKEY SE Plug, a compact, cable-free RFID reader designed to enable secure, passwordless authentication for mobile professionals and field workers.

Table of Contents

Methodology

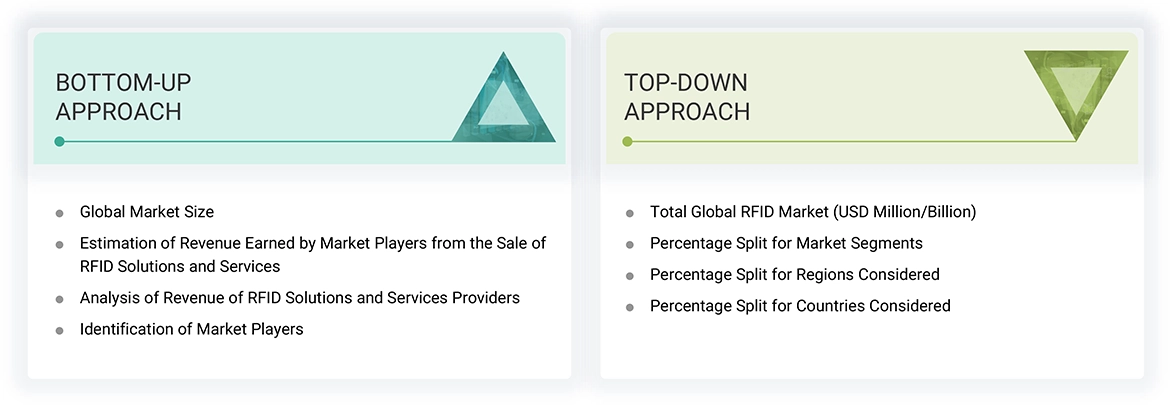

The research study involved 4 major activities in estimating the size of the RFID market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

In the RFID market report, the global market size has been estimated using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

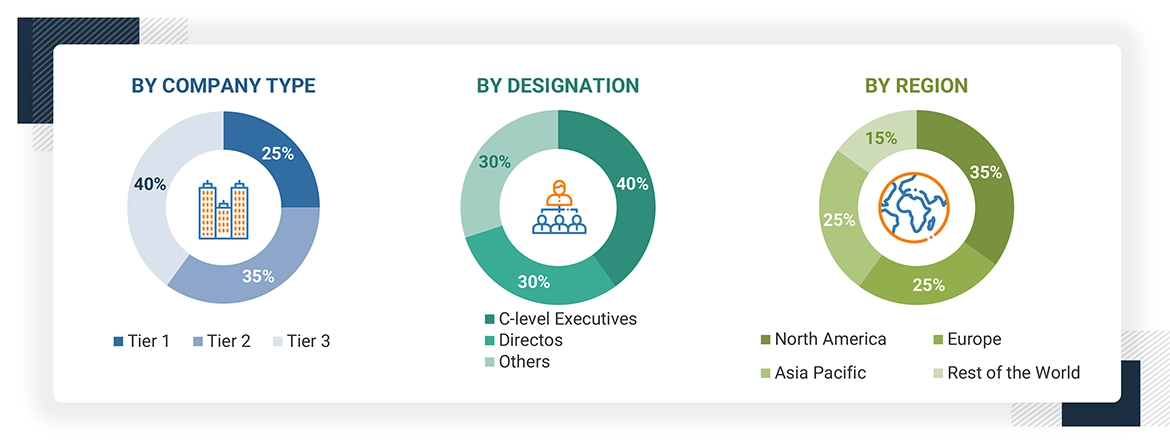

Primary Research

Extensive primary research has been conducted after understanding the RFID market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions—North America, Europe, Asia Pacific, and Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the RFID solutions and services and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying top-line investments and spending in the ecosystem and considering segment-level splits and major market developments

- Identifying different stakeholders in the RFID market that influence the entire market, along with participants across the supply chain

- Analyzing major manufacturers and service providers in the RFID market and studying their solutions

- Analyzing trends related to the adoption of RFID

- Tracking recent and upcoming market developments, including investments, R&D activities, product launches, expansions, collaborations, acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of RFID solutions and services

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

RFID Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall RFID market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

Radio Frequency Identification (RFID) is a technology that uses electromagnetic fields to automatically identify and track tags attached to objects. The tags contain electronically stored information and are either active, powered by a battery, or passive, by the signal of the RFID reader. There are three main parts of an RFID system: a tag, a reader, and a software system for data processing. This technology allows for efficient collection and management of data, greatly reducing human effort and error. RFID technology is applied in many industries, such as retail, logistics & warehousing, healthcare, aerospace & defense, and automotive. In retail, it is used in managing the inventory, preventing theft, and optimizing the supply chain. It enhances tracking and tracing in the logistics sector. In the healthcare sector, it is applied in patient tracking, equipment management, and drug authentication. The growth in the RFID market is heavily dependent on factors like automation, real-time data visibility, and upgrading the tracking system. The key benefits associated with it include tiny size for RFID tags, maximum range of reading, IoT-based, and cloud integration. In the near future, further research and development about the technology are expected to explore new applications and strengthen RFID technology in modern industrial as well as commercial practices.

Key Stakeholders

- Raw Material Supplier

- RFID Chip Manufacturers

- Tag, Readers, and Label Manufacturers

- System Integrators

- Software Developers

- Platform Providers

- Distributors and Resellers

- Consultants and Service Providers

- Regulatory Bodies

- Research and Development Institutes

- End Users

Report Objectives

- To define, describe, and forecast the size of the RFID market, by offering, tag type, form factor, frequency, material, wafer size, application, vertical, and region, in terms of value

- To forecast the market for tag type, in terms of volume

- To forecast the size of various segments with respect to four regions, namely, North America, Asia Pacific, Europe, and Rest of the World (Middle East & Africa and South America)

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the RFID market

- To study the value chain and related industry segments of the market

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To assess the trends and disruptions impacting customers’ businesses’ pricing trends, patents and innovations, trade data, regulatory landscape, Porter’s five forces, case studies, key stakeholders and buying criteria, technology trends, market ecosystem, key conferences and events, and impact of AI/Gen AI related to the RFID market

- To analyze opportunities for various stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of revenue, market share, and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments such as product launches, acquisitions, partnerships, collaborations, and expansions carried out by players in the RFID market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

- o Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the RFID Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in RFID Market

Ethan

Apr, 2022

I need the report, for analyzing RFID manufacturing companies .

Vinit

Apr, 2022

Iím doing market research as an investor. COuld you please provide me a sample of the report. Thank you for your help. .

Matthew

Apr, 2022

Sample for RFID overview, including LF, HF, UHF markets and products by type. .

mohammad

Apr, 2022

I would like to have a big picture (map) of RFID tag consumers (sectors, companies, buyers, applications, etc.) and providers (tag manufacturers, chip manufacturers, solution providers, distributors, etc.) worldwide. thanks.

Nagendra

Apr, 2022

Keener to know about the Indian market, Applications, verticals.. etc .

Commodore

Jun, 2022

Can we get a sample of the report on LF/HF.UHF segment? If specific info on India is available, same would be useful. Please treat this on priority..

Manuel

Sep, 2022

Training about RFID markets, and internal knowledge..