Clean Power VFD Market

Clean Power VFD Market by Voltage (Low, Medium), Power Rating (Micro Power Drives, Low Power Drives, Medium Power Drives and High Power Drives), End User (Commercial Construction, Data Centers, Defense, EV Charging Infrastructure, Industrial Facilities, Infrastructure, Mining, Oil & Gas, Renewables, Transportation and Utilities), Application, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The clean power VFD market is projected to reach USD 1.52 billion by 2030 from USD 1.11 billion in 2024, at a CAGR of 5.6% from 2025-2030. There is a growing need to use clean power Variable Frequency Drive due to the growing industrialization, strict government policies on energy use, and rising costs of electricity that leave industrialists with no other option but to adopt efficient technology in an effort to cut down on operational costs and prevent the harmful effects of power inefficiencies. These systems help reduce energy loss, improve motor control, and achieve long-term cost savings, thereby increasing their popularity among industries such as manufacturing, data centers, and utilities. Furthermore, the development of clean power VFD technology and financial incentives encourage mass adoption, as corporate organizations strive to reach sustainability goals and meet changing energy requirements.

KEY TAKEAWAYS

-

BY END USERThe end user segment includes Commercial Construction, Data Centers, Defense, EV Charging Infrastructure, Industrial Facilities, Infrastructure, Mining, Oil & Gas, Renewables, Transportation and Utilities. Industrial facilities consume vast amounts of electricity, primarily through AC motors in processes like fluid handling, material transport, and mixing, making clean power VFDs essential for optimizing performance and reducing operational costs.

-

BY POWER RATINGThe power rating segment includes Micro Power Drives, Low Power Drives, Medium Power Drives and High Power Drives. The high power clean power VFDs are employed in heavy industries like mining, oil & gas, and large-scale renewable energy plants for pumps, fans, and cranes. They offer energy reduction, ensuring stable operation with low distortion, and are critical for high-capacity systems requiring robust, sustainable motor control in demanding environments.

-

BY VOLTAGEThe voltage segment includes low and medium. Medium-voltage clean power VFDs cater to large-scale industrial and utility applications, including power plants, oil & gas facilities, and high-capacity pumps or compressors. They ensure low harmonic impact and high reliability, making them essential for renewable energy integration, EV charging infrastructure, and smart grid systems in heavy industries.

-

BY APPLICATIONThe application segment includes Pumps, Compressors, Fans and Blowers, Conveyors, Chillers and Cooling Systems, Elevators and Escalators, Medical Devices and Imaging Systems, Clean Rooms and Precision Environmental Controls, Marine and Space Limited Equipment, and Cranes and Hoisting Equipment. Clean power VFDs are widely utilized in water treatment, irrigation, and industrial fluid handling, offering precise speed control to optimize flow and reduce energy consumption, with low-harmonic output ensuring grid stability.

-

BY REGIONThe regions considered are North America, Europe, Asia Pacific, Latin America and Middle East & Africa. Asia Pacific is on the forefront of the worldwide renewable energy drive, especially in the solar and wind power plants where the clean power VFDs are very essential in reducing energy losses and incorporating the distributed energy systems into the national electricity grid.

-

COMPETITIVE LANDSCAPEMajor market players use organic and inorganic strategies like partnerships and investments to drive growth in clean power VFDs. Companies such as ABB, Eaton, Danfoss, Rockwell Automation and Schneider Electric have entered various acquisitions, contracts and product launches to meet the increasing demand for clean power VFDs in innovative uses.

The clean power VFD market is experiencing robust growth, fueled by the global push toward energy efficiency, electrification, and sustainable industrial practices. With rising electricity costs and stringent environmental regulations, industries are increasingly adopting clean power VFDs to optimize motor performance, reduce energy losses, and lower operational expenses. These advanced drives, equipped with technologies such as wide-bandgap semiconductors, are gaining traction in sectors including manufacturing, renewable energy, and data centers, where they enhance grid stability and support the integration of renewable energy sources. Additionally, government incentives and the rapid expansion of smart infrastructure projects are accelerating market adoption, particularly in regions focused on achieving net-zero emissions by 2050.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The clean power VFD market is projected to grow at a CAGR of 5.6% during the forecast period by value. With increasing energy costs and strict regulatory frameworks aimed at reducing carbon emissions, industries are turning to clean power VFDs to enhance operational efficiency, minimize power losses, and support renewable energy integration.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising need for enhancing efficiency and decreasing energy consumption

-

Increasing need of motion control systems in automated production plants

Level

-

High installation and maintenance costs

Level

-

Government regulations for sustainability

-

Growing use of industrial internet of things and robotics technologies

Level

-

Lack of skilled workforce for installation, programming and maintenance of clean power variable frequency drives

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising need for enhancing efficiency and decreasing energy consumption

The rapid growth in electricity demand, particularly in emerging economies like China, underscores the urgent need to enhance energy efficiency and reduce overall energy consumption. According to the International Energy Agency (IEA) 2024, 85% of additional electricity demand through 2026 will come from emerging economies, with China alone adding approximately 1,400 TWh—more than half of the European Union’s (EU) annual electricity consumption. Despite structural shifts in its economy, China’s electricity demand is expected to grow by 4.9% in 2025 and 4.7% in 2026, driven by industrial and service sectors. This rising demand necessitates energy-efficient solutions to manage consumption without overburdening power infrastructure. The increasing production of solar PV modules, electric vehicles, and material processing industries further amplifies energy consumption in China. With per capita electricity usage in China already surpassing that in the EU by 2022, industries must prioritize efficient motor control technologies like VFDs to optimize energy usage, reduce wastage, and support sustainable economic growth. Energy experts agree that 90% of motor life-cycle expenditures for fans and pumps are spent on energy. When these motors are equipped with VFDs in centrifugal load service, their efficiency increases. Motors find applications in pumps, compressors, conveyors, and machines that depend on the rotational force for functioning. VFDs enable motors to run based on the required current demand rather than running at full speed and reducing output using mechanical controls such as throttles, dampers, or gears. Electric motors can be equipped with frequency converters to operate pumps and fans more efficiently.

Restraint: High installation and maintenance costs

The cost of integrating VFDs into electric motor systems ranges from USD 150 to 500 per kW of power, making the initial investment significantly higher than that of other energy-saving alternatives. While VFDs offer long-term energy efficiency benefits, their upfront installation cost can be a deterrent for many companies. The total installation cost is further influenced by factors such as the type of drive, necessary wiring, cooling requirements, and foundational modifications. The need for skilled technicians to install and configure VFD systems adds to the overall expense, making companies cautious about large-scale adoption. Beyond installation, the long-term maintenance and replacement costs of VFDs contribute to higher operational expenses. Components such as controllers and solid-state electronics typically need replacement every four to five years due to rapid technological advancements, leading to additional costs. The average lifespan of a VFD ranges between 7–10 years, depending on the application and environmental conditions, necessitating periodic replacements. This creates a recurring financial burden, especially for industries relying on multiple VFDs across their operations.

Opportunity: Government regulations for sustainability

The global push toward sustainability and energy efficiency is driving the adoption of VFDs across industries. Many countries have set ambitious carbon reduction targets, with net-zero emission commitments by 2050 or sooner. Governments worldwide are implementing stringent energy efficiency regulations to reduce industrial energy consumption and carbon footprints. The introduction of Minimum Energy Performance Standards (MEPS) for electric motors in EU, the US, and China, and other markets has mandated higher efficiency levels, accelerating the adoption of VFDs. By enabling precise motor speed control, VFDs optimize energy usage, making them essential for industries looking to meet regulatory compliance while reducing operational costs. Energy efficiency policies in the industrial and building sectors are further promoting VFD deployment. The EU’s Ecodesign Directive and the US Department of Energy’s energy efficiency standards require motor-driven systems to improve energy performance, indirectly driving VFD adoption. China’s Dual Control policy on energy intensity and total consumption compels industries to implement energy-saving technologies, according to the Centre for Research on Energy and Clean Air (CREA) in 2024. These policies, alongside growing carbon pricing mechanisms and incentives for energy-efficient solutions, are pushing industries worldwide to integrate VFDs into their operations to enhance energy conservation and meet sustainability goals.

Challenge: Lack of skilled workforce for installation, programming and maintenance of clean power variable frequency drives

The installation, programming, and maintenance of VFDs require expertise. VFDs play a crucial role in optimizing motor control and improving energy efficiency in industries, but their complexity necessitates trained professionals who can configure drive parameters, troubleshoot faults, and integrate them with broader industrial automation systems. However, the growing demand for automation in manufacturing, HVAC, and other industries has outpaced the availability of skilled technicians and engineers proficient in VFD operation and diagnostics. This gap often leads to improper installation, inefficient system performance, and increased downtime, reducing the overall effectiveness of VFD adoption in industrial applications. This skill shortage is particularly pronounced in areas such as industrial networking, IIoT integration, and predictive maintenance, which are becoming increasingly important for modern VFD systems. As VFDs are now equipped with advanced communication protocols and remote monitoring capabilities, companies require professionals to manage and analyze real-time data for system optimization. Without a well-trained workforce, industries may struggle to fully leverage the benefits of VFDs, limiting their potential for energy savings and operational efficiency. To address this challenge, governments, industry leaders, and educational institutions must invest in targeted training programs, certifications, and apprenticeships that equip workers with the necessary technical skills to support the growing VFD market.

Clean Power VFD Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

SmartD's Clean Power VFD retrofitted a Saint-Sauveur city pump station, replacing a contactor system with a 600V SiC-based solution featuring pure sine wave output, 4-wire plug-and-play installation in under an hour, and seamless Modbus TCP integration for demand-responsive water pumping | It delivered 35% energy savings, 15 dBA noise reduction, <5% THD, extended pump life via harmonic-free operation, and enabled remote control all while eliminating extra filters and reducing long-term maintenance costs |

|

SmartD's Clean Power VFD was installed as a direct replacement, featuring active front-end (AFE) for harmonic reduction, pure sine wave output, 480V/600V compatibility, and mobile app-based integration for seamless control system connectivity and quick recovery from interruptions | It achieved <5% harmonic distortion for grid stability, extended motor life via bearing protection and smooth operations, enabled 24/7 uptime with minimal downtime installation, cut costs by eliminating external filters, and provided French-language support for easier maintenance in extreme conditions. |

|

Silicon carbide (SiC)-based clean power VFDs are deployed in pump systems for variable-speed motor control in industrial and commercial settings, such as a 30 kW (40 hp) pump running 8,000 hours annually at varying speed, where motors are located hundreds of meters from the power room and must comply with IEEE519 harmonic limits to prevent grid issues | They deliver 16% lower power losses and 16,080 kWh annual energy savings ($1,608/year at $0.10/kWh) with a 1.9-year ROI on the $3,000 premium, alongside <3% THDi to avoid utility fines, overheating, and equipment failures |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market map provides a quick snapshot of the key stakeholders involved in the clean power VFD market, from component providers and end users to regulatory bodies/standards organizations. This list is not exhaustive and is meant to give an idea of the key market players.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Clea Power VFD Market, by End user

The clean power VFD market serves a diverse range of end users, including commercial construction, data centers, defense, EV charging infrastructure, industrial facilities, infrastructure, mining, oil & gas, renewables, transportation, and utilities. clean power VFDs are increasingly used in HVAC systems, elevators, and escalators within office buildings and shopping complexes, offering low-harmonic performance to enhance indoor air quality and grid stability in urban settings. These VFDs optimize cooling systems and power distribution in data centers, reducing energy use with minimal EMI, supporting the growing demand for AI and cloud computing infrastructure worldwide. Clean power VFDs provide reliable motor control for ventilation and equipment, ensuring low-distortion operation in critical, high-security environments. Clean power VFDs enhance efficiency in charging station cooling and auxiliary systems, supporting the rapid expansion of electric vehicle networks with clean power output. These VFDs stabilize power distribution and pump systems in water and electricity networks, ensuring grid reliability with advanced harmonic control. Clean power VFDs improve motor efficiency for escalators and conveyor belts, with low-noise operation. These VFDs power heavy-duty equipment like crushers and hoists, offering rugged designs to withstand harsh mining conditions with low harmonic impact. Widely adopted in manufacturing, chemicals, and food processing, these VFDs offer precise speed control for pumps and conveyors, while meeting stringent industrial standards.

Clean Power VFD Market, by Application

The clean power VFD market is segmented by application into pumps, compressors, fans and blowers, conveyors, chillers and cooling systems, elevators and escalators, medical devices and imaging systems, clean rooms and precision environmental controls, marine and space limited equipment, and cranes and hoisting equipment, each benefiting from the advanced efficiency and low-harmonic performance of these drives. Pumps utilize VFDs for precise fluid control in water treatment and irrigation; Compressors leverage them for efficient air handling in HVAC and manufacturing; Fans and Blowers optimize ventilation in data centers and industrial drying with 20-30% energy cuts; Conveyors enhance material handling in logistics with smooth speed regulation; Medical Devices and Imaging Systems maintain reliable power for MRI machines with low EMI; Clean Rooms and Precision Environmental Controls provide stable conditions in semiconductors and pharma; Marine and Space Limited Equipment support rugged applications like propulsion with compact designs; and Cranes and Hoisting Equipment boost lifting precision in construction, saving 20-30% energy, all underpinned by clean power VFDs' sustainable technology.

Clean Power VFD Market, by Voltage

The clean power VFD market is segmented by voltage into low voltage (380 to 690 V) and medium voltage (690 to 35 kV), each serving distinct applications with advanced efficiency and low-harmonic performance. Low voltage clean power VFDs are widely adopted in small to medium-scale settings such as HVAC systems, residential pumps, and light industrial conveyors, cost-effective designs ideal for smart homes and commercial buildings. Medium voltage clean power VFDs, on the other hand, cater to large-scale industrial and utility needs like oil & gas facilities, mining operations, and renewable energy plants, leveraging silicon carbide (SiC) technology for reliable, low-distortion power control over long distances, making them essential for high-capacity infrastructure projects globally.

Clean Power VFD Market, by Powe Rating

The clean power VFD market is segmented by material into micro power drives (0-5 kW), low power drives (6-40 kW), medium power drives (41-200 kW), and high power drives (201-3000 kW), each tailored to specific applications with enhanced efficiency and low-harmonic performance. Micro power drives are ideal for small-scale residential fans and pumps, low-EMI designs; low power drives support HVAC systems and light industrial conveyors, and growing fastest due to smart home and EV charging demand; medium power drives cater to industrial compressors and chillers, delivering 25-50% energy reductions with robust control for manufacturing; and high power drives serve heavy-duty applications like mining and renewable energy plants, with advanced SiC technology for large-scale, low-distortion power management.

REGION

Asia Pacific to be fastest-growing region in global clean power VFD market during forecast period

Asia Pacific is the fastest-growing region in the global clean power VFD market during the forecast period, fueled by rapid industrialization, urbanization, and surging energy demand in key economies like China, India, Japan, and South Korea. The region's leadership stems from extensive infrastructure development, including smart cities, commercial buildings, and IT parks in India, alongside China's government-backed energy reforms and renewable integration in solar farms, wind plants, and EV charging networks, where clean power VFDs—leveraging silicon carbide technology for low-harmonic efficiency—optimize motor control in HVAC, pumps, and compressors, reducing consumption by 20-50%. Stringent regulations like China's 2024-2025 energy-saving plan targeting 13.5% GDP energy cuts, coupled with market liberalization and cost-effective local manufacturing from players like ABB and Schneider Electric, further accelerate adoption in high-growth sectors such as automotive, petrochemicals, and utilities, outpacing other regions amid the push for net-zero emissions and automation.

Clean Power VFD Market: COMPANY EVALUATION MATRIX

In the clean power VFD market matrix, ABB (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across industries like industrial and commercial. GE Vernova (Emerging Leader) is gaining traction with high efficiency clean power VFDs. While ABB dominates with scale, GE Vernova shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.11 BN |

| Market Forecast in 2030 (Value) | USD 1.52 BN |

| Growth Rate | CAGR 5.6% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Clean Power VFD Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Clean Power VFD Manufacturer | Transformative improvements in efficiency and performance, balancing initial cost challenges with long-term operational and system-level economic advantages | Support entry into utilities value chain with tailored opportunity mapping |

| Clean Power VFD Customer | Patent landscape & IP strength mapping in Clean Power VFD in utilities | Support backward integration into clean power VFDs |

RECENT DEVELOPMENTS

- November 2024 : Danfoss entered into partnership with Innomotics GmbH, a global leader in motors and medium-voltage drives. This partnership aims to enhance competitiveness, expand product offerings, and improve technical compatibility, efficiency, and customer satisfaction through tailored solutions and joint customer approaches in Motor & Drives combinations.

- November 2024 : ABB inaugurated a new campus in New Berlin, Wisconsin. The company expects to increase the production capacity of industrial electrical drives and services. The new facility will feature a digital customer experience center and innovation lab, as well as a warehouse distribution center on the campus.

- December 2022 : Schneider Electric announced plans to invest USD 51.1 million in Bengaluru to develop a new smart factory, doubling its manufacturing capabilities. This expansion will consolidate 6 factories into one and will allow the company in producing a wide range of products including low voltage drives, contributing VFD market growth by enhancing local manufacturing.

- January 2022 : Eaton acquired Royal Power Solutions, a US-based manufacturer specializing in high-precision electrical connectivity components. This strategic move aims to bolster Eaton’s capabilities in electric vehicle, energy management, industrial, and mobility markets. The acquisition aligns with Eaton’s focus on capitalizing on electrification trends and expanding its product offerings in high-growth sectors.

- June 2021 : ABB entered into an agreement with Saneago, a water and wastewater treatment company in Brazil. ABB provided smart drives, motors, sensors, and ABB Ability Digital Powertrain solutions to improve energy efficiency at four pumping stations. Remote condition-based monitoring also ensures a secure drinking water supply to residential, industrial, and agricultural end users.

Table of Contents

Methodology

The study involved major activities in estimating the current size of the clean power VFD market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the clean power VFD market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect valuable information for a technical, market-oriented, and commercial study of the global clean power VFD market. The other secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

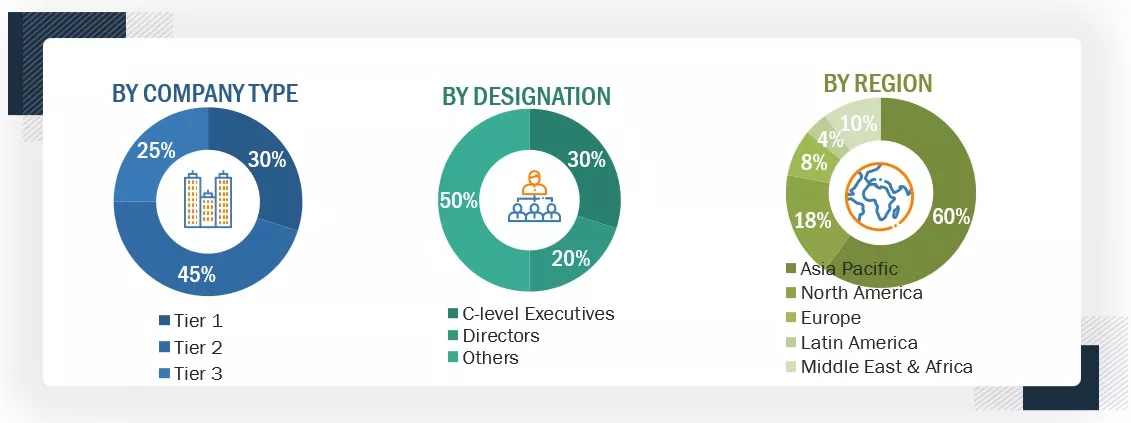

The clean power VFD market comprises stakeholders such as clean power VFD manufacturers, technology providers, and support providers in the supply chain. On the demand side, the market is driven by growing adoption of clean power VFD in various sectors, including data centers, renewable energy, industrial, and commercial applications, due to their high energy efficiency, compact design, and superior performance compared to conventional motor control systems. Rising infrastructure development and urbanization in emerging economies further fuel demand for advanced drive solutions. On the supply side, manufacturers are witnessing increasing opportunities through contracts from utility and industrial distribution networks, as well as strategic initiatives such as mergers, acquisitions, and partnerships among major players to expand their market presence and technological capabilities. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

Note: "Others" include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were employed to estimate and validate the size of the clean power VFD market, as well as its dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through a combination of primary and secondary research. The research methodology involves analyzing the annual and financial reports of top market players and conducting interviews with industry experts, including chief executive officers, vice presidents, directors, sales managers, and marketing executives, to gather key quantitative and qualitative insights related to the clean power VFD market.

Clean Power VFD Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the estimation process explained above, the total market has been divided into several segments and subsegments. To complete the overall market engineering process and obtain the exact statistics for all segments and subsegments, data triangulation and market breakdown processes have been employed, where applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market has been validated using both top-down and bottom-up approaches.

Market Definition

A clean power variable frequency drive (VFD) is an advanced electronic component that simplifies complex motor control systems, making them more affordable and efficient. It is a sophisticated controller, typically housed within compact enclosures, designed for precise high-performance power distribution to AC motors. The clean power VFD system utilizes wide-bandgap semiconductor technology, such as silicon carbide (SiC) or gallium nitride (GaN), and integrated circuitry to ensure a low-distortion output. It allows for seamless speed and torque adjustments throughout the motor's operating range, rather than relying on fixed-speed settings. A clean power VFD is an electrical junction that collects power from the supply and distributes it to the motor with minimal harmonic distortion. The main purpose of a clean power VFD is to regulate motor performance and enhance energy efficiency. It is used to make the systems more reliable and sustainable. They can be an excellent solution for complicated industrial applications.

Stakeholders

- Government & research organizations

- Institutional investors

- Investors/Shareholders

- Environmental research institutes

- Manufacturers' associations

- Clean power VFD manufacturers, dealers, and suppliers

- Organizations, forums, alliances, and associations

- Renewable power generation and equipment manufacturing companies

- Process industries and power and energy associations

- Public and private operators of power plants

- State and national regulatory authorities

- Venture capital firms

Report Objectives

- To describe and forecast the clean power VFD market, by voltage, power rating, application, end user, and region, in terms of value.

- To describe and forecast the clean power VFD market for various segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, in terms of value

- To describe and forecast the clean power VFD market, by region, in terms of volume

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the clean power VFD supply chain analysis, use case analysis, key stakeholders and buying criteria, patent analysis, trade analysis, tariff analysis, regulations, macroeconomic outlook, pricing analysis, Porter's five forces analysis, impact of gen AI/AI, and the 2024 US tariff impact

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the market's competitive landscape.

- To analyze growth strategies, such as acquisitions, investments, expansions, and product launches, adopted by market players in the clean power VFD market

1 Micromarkets are defined as the segments and subsegments of the clean power VFD market included in the report.

2 Core competencies of companies are defined in terms of key developments and strategies adopted to sustain their positions in the clean power VFD market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the clean power VFD, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Clean Power VFD Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Clean Power VFD Market