Cleanroom Technologies Market Size, Growth, Share & Trends Analysis

Cleanroom Technologies Market by Product (Equipment (HEPA Filter, Fan Filters, HVAC), Consumables {Safety/Cleaning Consumables}, Controls), Type (Standard, Modular (Hardwall, Softwall), Mobile Cleanrooms), End User - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Cleanroom Technologies market, valued at USD 8.85 billion in 2025, stood at USD 9.39 billion in 2026 and is projected to advance at a resilient CAGR of 6.6% from 2026 to 2031, culminating in a forecasted valuation of USD 12.93 billion by the end of the period. Market growth is being driven by the tightening of global regulatory standards, the rapid expansion of high-purity manufacturing industries, and the increasing adoption of advanced contamination-control technologies. Stricter compliance requirements under EU GMP Annex 1, ISO 14644 revisions, and heightened FDA expectations for aseptic processing are compelling pharmaceutical, biotechnology, and medical device companies to upgrade cleanroom infrastructure, monitoring systems, and sterilization workflows.

KEY TAKEAWAYS

-

By RegionThe North American cleanroom technologies market accounted for a share of 35.4% in 2025.

-

By ProductThe consumables segment is projected to register the highest CAGR of 7.9% during the forecast period.

-

By TypeThe modular cleanrooms segment dominated the market with a 51.4% share in 2025.

-

By End UserThe pharmaceutical industry segment dominated the market with a share of 48.5% in 2025.

-

Competitive Landscape - Key PlayersExyte AG (Germany), Bouygues Group (France), Kimberly-Clark Corporation (US), DuPont (US), and Taikisha, Ltd. (Tokyo, Japan) were identified as some of the key players in the cleanroom technologies market, given their extensive global reach and comprehensive service portfolios.

-

Competitive Landscape - StartupsABN Cleanroom Technology (Belgium), Clean Rooms International, Inc. (US), Angstrom Technology Ltd (US), OCTANORM-Vertriebs-GmbH (Germany), and Parteco srl (Italy), among others, have distinguished themselves among startups and SMEs due to their specialized veterinary expertise and focused service capabilities.

The global cleanroom technologies market is propelled forward by several factors, including strict regulatory standards and quality requirements internationally, fast growth in the use of high-purity production in pharmaceuticals, biotechnology, semiconductors, and medical devices, growing money put into research & development and superior manufacturing plants, heightened need for solutions to control contamination, and continuous technological advancements like IoT-enabled monitoring, modular cleanrooms, and energy-efficient systems that not only improve operational efficiency but also their global acceptance.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Major trends and disruptions are shaping the cleanroom technologies market, including smart, automated cleanrooms powered by IoT sensors, AI-driven environmental monitoring, and real-time data analytics. Modular and prefabricated cleanrooms are disturbing traditional construction by allowing faster deployment and scalability, besides the growing demand from biologics, semiconductors, and precision electronics, pushing manufacturers toward the adoption of higher-grade, energy-efficient systems. Robotics, touchless workflows, and advanced VHP decontamination are cutting down on human-driven contamination, thus changing the operational models in industries. At the same time, global supply chains' everyday pressures, stricter GMP and ISO standards, and ESG requirements are driving the adoption of more sustainable, compliant, and digitally integrated cleanroom solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for biologicals and growth of global biopharmaceutical industry

-

Advancements in cleanroom technologies and development of modular designed cleanrooms

Level

-

High operational costs associated with cleanrooms

-

Stringent regulatory framework and quality check parameters

Level

-

Increasing demand for cleanrooms in emerging economies

-

Growing focus on energy-efficient cleanrooms by pharmaceutical and medical device manufacturers

Level

-

Customization of cleanroom designs based on customer requirements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for biologicals and growth of global biopharmaceutical industry

The rising demand for biologics, vaccines, and advanced therapies, along with the rapid expansion of the global biopharmaceutical industry, is significantly driving the cleanroom technologies market, as these products require strict, sterile, contamination-free environments for development and manufacturing. Biologics and cell & gene therapies are highly sensitive to microbial and particulate contamination, pushing companies to invest in higher-grade cleanrooms, isolators, advanced HVAC systems, and real-time environmental monitoring to ensure regulatory compliance and product safety. As biopharma companies expand production capacity, build new GMP facilities, and increasingly outsource to CDMOs, the need for state-of-the-art modular cleanrooms, automated decontamination systems, and enhanced filtration technologies continues to accelerate, fueling strong market growth.

Restraint: High operational costs associated with cleanrooms

The cleanroom technologies market is significantly restrained by high operational costs required in the maintaining of controlled environments. It is an energy-consuming process that involves continuous HVAC operation, frequent filter replacements, rigorous cleaning and sterilization cycles, and strict environmental monitoring to meet GMP and ISO standards. High costs of skilled labor, specialized consumables, and ongoing validation and compliance activities are also contributing to market restrain, and thus, cleanroom operations are financially burdensome, particularly for small and mid-sized manufacturers. In turn, many companies opt for upgrading, cleanroom expansion, or low-cost alternatives, all of which prolong the process of adopting advanced cleanroom technologies.

Opportunity: Increasing demand for cleanrooms in emerging economies

The cleanroom technologies market is experiencing significant growth due to the higher demand for these technologies in new industries like nanotechnology, advanced semiconductor fabrication, quantum computing, aerospace optics, micro-LEDs, electric vehicle batteries, and regenerative medicine. These industries require cleanrooms along with very precise control of humidity and temperature, as well as the highest standard of contamination management. This is where cleanrooms of the next generation, modular systems, ultra-high-efficiency filtration, and smart environmental monitoring come into the picture. Cleanroom solutions are in great demand as the countries of the Asia Pacific, the Middle East, and Eastern Europe are heavily investing in the high-tech manufacturing and R&D infrastructure. This trend not only enables cleanroom technology suppliers to tap into new markets but also pushes them to deliver more customized systems and profit from the worldwide wave of high-purity, innovation-driven production.

Challenge: Customization of cleanroom designs based on customer requirements

The increasing demand for very specific cleanroom designs, which are to be made depending on the particular industry process, regulatory demands, and the layout of the building, is a big challenge for the cleanroom technologies market, as it brings in more complexity to the designs, longer project duration, and higher costs overall. Compared to standard modular systems, customized cleanrooms require extensive engineering, unique HVAC systems, specialized materials, and multiple validation cycles, making the process harder to scale and more resource-intensive for manufacturers. Customization to this extent can lead to a bottleneck in production capacity, reduced standardization efficiency, and a more complex global deployment process, particularly for suppliers operating in areas with different regulations. Hence, the demand for customization frequently results in longer lead times, higher costs, and operational bottlenecks, thereby testing the ability of cleanroom technology providers to offer quick, cost-effective solutions.

CLEANROOM TECHNOLOGIES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Delivers end-to-end cleanroom construction, modular cleanroom units, and facility design engineering for biologics, cell & gene therapy, and advanced manufacturing sectors | Enables rapid deployment, scalable facility expansions, and lower lifecycle costs with modular, future-ready cleanroom infrastructures |

|

Offers turnkey cleanroom commissioning, HVAC engineering, and high-efficiency filtration systems tailored for electronics manufacturing and life science industries | Reduces energy consumption, maintains stable environmental conditions, and accelerates facility readiness with optimized airflow and temperature control |

|

Supplies cleanroom consumables such as apparel, gloves, wipes, and contamination-control products designed for GMP and ISO-certified environments | Enhances personnel hygiene compliance, minimizes particulate shedding, and reduces contamination risks in critical manufacturing zones |

|

Develops high-performance cleanroom garments, protective materials, and barrier fabrics used in pharmaceutical, semiconductor, and microelectronics facilities | Improves product and worker protection, reduces contamination events, and meets stringent global regulatory and safety standards |

|

Designs and delivers turnkey cleanroom infrastructure, controlled-environment facilities, and high-specification technical buildings for pharmaceutical, biotech, semiconductor, and advanced manufacturing industries. Their services include full project engineering, HVAC integration, contamination-control architecture, and modular cleanroom construction | Ensures high-quality, regulatory-compliant cleanroom environments, accelerates facility construction timelines, and lowers lifecycle costs through efficient engineering, robust project management, and sustainable building technologies |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The cleanroom technologies market is a part of an extensive ecosystem that includes manufacturers of cleanroom equipment, suppliers of HVAC and filtration systems, civil and technical engineering firms, manufacturers of consumables, environmental monitoring specialists, and customers from various fields like pharmaceuticals, biotechnology, semiconductors, medical devices, and advanced manufacturing. The ecosystem's main drivers are the strict global regulatory frameworks (such as GMP and ISO standards), the growing production of biologics and semiconductors, and the increasing investment in high-precision manufacturing. The providers of solutions team up with the design-build firms to create cleanrooms that are modular and scalable, while the monitoring and automation companies help in the real-time control of contamination, energy optimization, and compliance assurance. The providers of consumables play a supporting role in the operations of the day-to-day and the service companies bring validation, maintenance, and certification, thus making the market highly interdependent and innovation-driven at the same time.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cleanroom Technologies Market, By Product

In 2025, the consumables segment held the largest share of the cleanroom technologies market. Increasing cleanroom consumables are consequent to the growing need for continuous contamination control in the pharmaceutical, biotech, semiconductor, and medical device industries that require stringent regulatory standards. Biologics, sterile injectables, and advanced electronics production are on the rise, which in turn leads to the demand for cleanroom supplies like disposable gloves, gowns, wipes, disinfectants, and particle-free packaging to be in place for aseptic conditions. The transition to single-use systems in bioprocessing, increased post-COVID-19 hygiene awareness, and the emergence of high-precision manufacturing are among the factors contributing to the growing use of consumables. In addition, the trend of preferring the more cost-effective, easy-to-replace, and contamination-free materials over reusable ones is likely to result in the steady, recurring demand for consumables in the cleanroom technologies market.

Cleanroom Technologies Market, By Type

Modular cleanrooms hold the largest share of the cleanroom technologies market. The need for fast, flexible, and cost-efficient cleanroom deployment is increasing and pushing the modular cleanroom technologies' growth across the pharmaceuticals, biotechnology, semiconductor, and advanced manufacturing industries. The modular systems provide rapid installation, scalability, and easy reconfiguration, which makes them perfect for companies that are moving production, changing over to biologics manufacturing, or adopting new high-precision processes. Global investments in CDMOs, vaccine production, and cell & gene therapy facilities further generate demand for modular cleanrooms. Their construction timelines are shorter, and validation processes are more predictable. In addition, modular designs cut down on downtime, lower capital expenditure, and help in keeping up with the stringent GMP and ISO cleanroom standards, thus making them the preferred choice over traditional cleanroom constructions.

Cleanroom Technologies Market, By End User

In 2025, the pharmaceutical industry was the largest end user of cleanroom technologies. This growth is mainly attributed to biological products, vaccines, sterile injectables, and advanced therapeutic modalities that are produced for and in the best possible contamination-free environments. The stringent regulations imposed by the FDA and EMA are among the major reasons for enforcing the use of cleanrooms compliant with GMP standards, thus persuading the pharma manufacturing industry to either upgrade or expand its cleanroom facilities. Moreover, the rise in the prevalence of chronic diseases, the practice of personalized medicine, and the continuous global activity of clinical trials necessitate the use of high-grade cleanrooms to guarantee the characteristics of the product stated before – purity, sterility, and safety. Also, the new large-scale medicine-producing plants in the emerging markets, combined with their continued funding of Contract Development and Manufacturing Organizations (CDMOs) and new drug pipelines, are driving the entire pharmaceutical industry toward the adoption of the latest and most improved cleanroom technologies at an increasingly rapid pace.

REGION

Asia Pacific to be fastest-growing region in global cleanroom technologies market during forecast period

During the forecast period, the cleanroom technologies market in the Asia Pacific is forecast to grow at the highest CAGR. The region is the fastest-growing market, mainly due to rapid growth in pharmaceuticals, biotechnology, semiconductor, and electronics manufacturing in countries like China, India, South Korea, and Singapore. Government support for the development of the domestic drug industry, increasing biologics and vaccine manufacturing capacity, and the region's leadership in electronics and microelectronics fabrication are the main factors driving the market. Moreover, the continuous inflow of investments from global pharmaceutical and semiconductor companies in the cost-effective manufacturing bases of the Asia Pacific, combined with stringent regulatory requirements and healthcare infrastructure development, is promoting the use of advanced cleanroom technologies. Rising population, R&D investment, and the substantial presence of CDMOs in the region further substantiate its claim as the world's fastest-growing market for cleanroom technologies.

CLEANROOM TECHNOLOGIES MARKET: COMPANY EVALUATION MATRIX

Exyte comes out as a leading global player in the cleanroom technologies market matrix with a strong presence throughout North America, Europe, and the Asia Pacific, and its profound knowledge in the fields of high-tech facilities, advanced cleanroom engineering, as well as end-to-end EPC capabilities. The company has built its reputation mainly through its skill of coordinating and executing huge-scale cleanroom projects for the pharmaceuticals, biotechnological, semiconductor, and data-intensive manufacturing, where the industry standards of quality, speed, and regulatory compliance are paramount. The top rank of Exyte is supported by its competencies in modular and fast-track cleanroom construction, energy-efficient HVAC and airflow management systems, and integrated digital planning and automation tools that allow for quick project execution and high operational reliability. Having worked closely with emerging biopharmaceuticals, CDMOs, and semiconductor manufacturers, Exyte is constantly growing its global project pipeline, thereby making itself a preferred partner for the next generation of cleanroom infrastructure in a domain that is becoming more regulated and requiring higher purity levels in manufacturing.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Exyte GmbH (Germany)

- Kimberly-Clark Corporation (US)

- Bouygues Group (France)

- DuPont De Nemours, Inc. (US)

- Taikisha Ltd. (Japan)

- Ardmac (Ireland)

- Clean Air Products (US)

- Illinois Tools Works (US)

- Labconco Corporation (US)

- Dynarex Corporation (US)

- COLANDIS GmbH (Germany)

- ABN Cleanroom Technology (Belgium)

- Azbil Corporation (Japan)

- Cleanroom International Inc. (US)

- Terra Universal, Inc (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 8.85 BN |

| Market Forecast in 2031 (Value) | USD 12.93 BN |

| Growth Rate | CAGR of 6.6% from 2026-2031 |

| Years Considered | 2024-2031 |

| Base Year | 2025 |

| Forecast Period | 2026-2031 |

| Units Considered | Value (USD Million), Volume (Thousand/Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Related Segment & Geographic Reports | Europe Cleanroom Technologies Market |

WHAT IS IN IT FOR YOU: CLEANROOM TECHNOLOGIES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Compared key cleanroom technologies, including HVAC and filtration systems, cleanroom consumables, modular cleanroom units, contamination-control equipment, and environmental monitoring solutions; highlighted technology adoption trends, regulatory compliance needs (ISO, GMP), energy-efficient systems, automation integration, and differentiation among leading providers across pharmaceutical, semiconductor, and biotechnology industries | Enabled identification of preferred technology specifications, performance requirements, and compliance benchmarks across end-use industries; supported decisions on equipment upgrades, vendor comparison, sustainability-focused solutions, and alignment of cleanroom infrastructure with evolving manufacturing needs such as biologics, microelectronics, and high-precision production |

| Company Information | Profiled major players, including Bouygues Group, Exyte, Ardmac, Kimberly-Clark, Terra Universal, and Clean Air Products; delivered insights into each company’s cleanroom portfolios, engineering capabilities, global presence, R&D strengths, modular construction expertise, and differentiation across industries such as pharma, healthcare, and semiconductors | Provided clarity on competitive positioning, partnership models, innovation capabilities, and market expansion strategies; supported evaluation of strategic suppliers for cleanroom design, construction, consumables, and environmental monitoring, helping identify high-value collaborations for facility upgrades and new builds |

| Geographic Analysis | Provided region-by-region analysis of cleanroom technology adoption in North America, Europe, and the Asia Pacific, including regulatory frameworks, manufacturing growth hotspots, and investment activity; focused on the region's rapid expansion in pharmaceuticals, electronics, and biotech; assessed market maturity, technology needs, and cleanroom infrastructure potential across emerging economies | Supported global strategy planning by identifying high-growth regional markets for cleanroom installations, modular facility deployment, and consumables demand; helped clients evaluate localization opportunities, regulatory readiness, and optimal regions for capacity expansion and partnerships, particularly in fast-growing Asia Pacific manufacturing hubs |

RECENT DEVELOPMENTS

- December 2024 : Camfil (Sweden) announced the expansion of its global cleanroom filtration portfolio with the launch of the Megaflow Pro ULPA Series, designed to support next-generation pharma, semiconductor, and biotech facilities. This product line enhancement reinforces Camfil’s position as a leader in high-efficiency particulate filtration and demonstrates its commitment to delivering advanced air-quality control solutions across Europe, the Asia Pacific, and North America.

- November 2024 : ABN Cleanroom Technology (Belgium) introduced its new SmartCleanroom 4.0 Platform, integrating IoT-based monitoring, predictive airflow control, and automated contamination-response systems. This launch strengthened ABN’s focus on digital cleanroom ecosystems and supports its expansion in high-growth sectors such as cell & gene therapy and high-purity manufacturing.

- July 2024 : Ansell, a global leader in protection solutions, announced it has successfully completed the acquisition of Kimberly-Clark's Personal Protective Equipment (KCPPE) business.

Table of Contents

Methodology

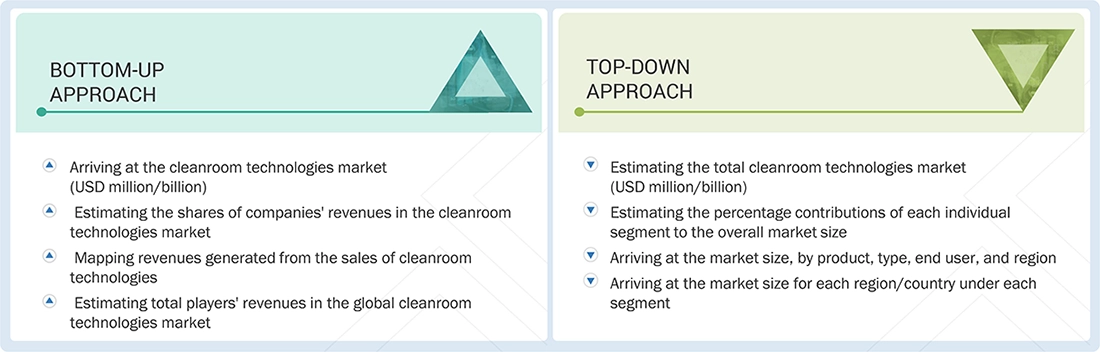

This study involves four major activities in estimating the size of the cleanroom technologies market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. The next step has been to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach has been employed to estimate the overall market size. After that, market breakdown and data triangulation have been used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research has been used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the cleanroom technologies market. It has also been used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders has also been prepared using secondary research.

Primary Research

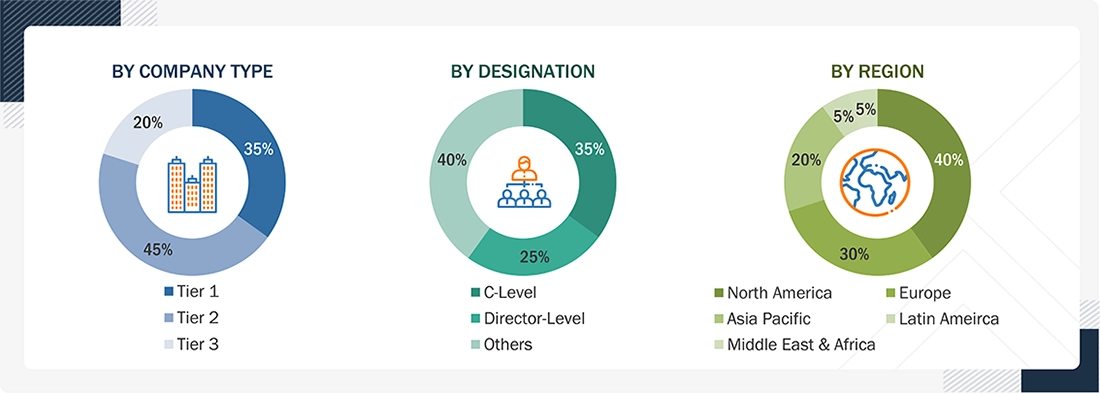

In the primary research process, various sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the cleanroom technologies market. The primary sources from the demand side include industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research has been conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

Breakdown of Primary Interviews

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other designations include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2025: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3 = <USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the cleanroom technologies market includes the following details.

The market sizing of the market has been undertaken from the global side.

Cleanroom Technologies Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Cleanroom technologies are specialized systems, processes, and equipment designed to produce an environment with low concentrations of airborne particulates, contaminants, and pollutants. Such technologies have significant applications in industries, including pharmaceuticals, biotechnology, electronics, and aerospace, where a minute contaminant might compromise product quality or safety. Cleanroom technologies include such things as air filtration with HEPA and ULPA, environmental control for temperature, humidity, and pressure, and advanced monitoring systems that could be instituted in order to ensure particular standards of cleanliness are met, for instance ISO and GMP.

Key Stakeholders

- International Organization for Standardization (ISO) – ISO 14644 & ISO 14698 Standards

- US Food and Drug Administration (FDA)

- European Medicines Agency (EMA)

- European Commission – EU GMP (Annex 1)

- World Health Organization (WHO)

- International Society for Pharmaceutical Engineering (ISPE)

- Institute of Environmental Sciences and Technology (IEST)

- Cleanroom Technology Providers & EPC Companies (e.g., Exyte, Bouygues Group, Ardmac, Clean Air Products, M+W Group)

- HVAC, Filtration, and Airflow System Manufacturers (HEPA/ULPA suppliers)Annual Reports/SEC Filings, Investor Presentations, and Press Releases of Key Players

- White Papers, Journals/Magazines, and News Articles

- Paid Databases, such as Factiva, D&B Hoovers, and Bloomberg Business

Report Objectives

- To define, describe, segment, and forecast the cleanroom technologies market by product, type, end user, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the cleanroom technologies market in five main regions (along with their respective key countries): North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

- To profile the key players in the market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, partnerships, and R&D activities of the leading players in the market

- To benchmark players within the market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographi Analysis

- Further breakdown of the Rest of the Asia Pacific cleanroom technologies market into Indonesia, the Philippines, Vietnam, Hong Kong, and other countries

- Further breakdown of the Rest of the European cleanroom technologies market into Belgium, Russia, the Netherlands, Switzerland, and other countries

- Further breakdown of the Rest of the Latin American cleanroom technologies market into Argentina, Peru, and other countries

- Further breakdown of the Rest of Middle East & African cleanroom technologies market into Israel, Iran, Iraq, Jordan, Yemen, and other countries.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cleanroom Technologies Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Cleanroom Technologies Market

Andrea

Mar, 2022

I want detailed information on the recent developments in the global Cleanroom Technologies Market.

Terry

Mar, 2022

Which product segment is accounting for the largest share of the global Cleanroom Technologies Market?.

Ann

Mar, 2022

Which factors are proving to be the game changer for the global growth of Cleanroom Technologies Market?.