CT Simulators Market Size, Growth, Share & Trends Analysis

CT Simulators Market by Technology (2D, 3D/4D Simulation), Product Type (Multi-slice, Single-slice), Application (IGRT, 3D Conformal Radiation Therapy, Brachytherapy, SGRT, Proton Therapy), End User (Radiotherapy Center, Hospital) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global CT simulators market is expected to experience substantial growth, with projections indicating it will reach USD 741.7 million by 2030, up from USD 591.8 million in 2025, with a CAGR of 4.6%. The a key factor driving the CT simulators market is the rising prevalence of cancer and chronic diseases, which has intensified demand for precise diagnostic and treatment planning solutions. Technological advancements, including AI integration, 3D/4D imaging, and low-dose CT scanning, along with the incorporation of other imaging modalities, have further enhanced the accuracy and efficiency of CT simulators.

KEY TAKEAWAYS

-

BY TECHNOLOGYThe key CT simulators technology includes 2D/3D CT simulation technology, 3D/4D CT simulation technology. The 3D/4D simulation technology-based simulators observe more demand as they deliver volumetric imaging (3D) and time-resolved datasets (4D), enabling clinicians to capture not only tumour geometry but also organ motion, due to such features, 3D/4D based simulators have become the industry benchmark for radiotherapy planning.

-

BY PRODUCT TYPEThe key product type includes single slice CT simulators, and multi-slice CT simulators. Multi-slice systems support faster acquisition, thinner slices, volumetric / 4D scanning, and integration with treatment planning for techniques like IMRT, VMAT, adaptive radiotherapy, and motion management. These capabilities drive their preferred use in cancer centers and advanced radiotherapy departments.

-

BY APPLICATIONThe key application segments include Image-Guided Radiation Therapy, 3D Conformal Radiation Therapy, Brachytherapy, Adaptive Radiotherapy/ Surface-Guided Radiotherapy, Proton Therapy, and Other Applications. IGRT is now mainstream: in a national survey of US radiation oncologists, 93.5% reported using IGRT across indications—evidence of widespread clinical reliance on image-guided workflows that begin with high-quality CT simulation.

-

BY END USERThe key end user segments include Independent Radiotherapy Centers, Hospitals, and Other End Users. Independent radiotherapy centers hold the largest share of the CT simulators market due to their increasing number, focus on advanced technology, and high equipment utilization rates.

-

BY REGIONThe key regions include Europe, North America, the Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share, while the Asia Pacific experienced the fastest growth.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Siemens Healthineers (Germany) and GE Healthcare (US) have entered into a number of agreements and partnerships to cater the growing demand for CT simulators across innovative applications. These activities have helped them to acquire a dominant share in the market.

3D and 4D imaging capabilities have further enhanced the utility of CT simulators by offering volumetric and time-resolved imaging, enabling clinicians to track organ motion, such as lung movement during breathing, which is vital for thoracic and abdominal radiotherapy. Systems like Varian’s TrueBeam 4D CT enable oncologists to visualize tumor motion in real-time, resulting in more precise radiation dose delivery and reduced exposure to healthy tissue. The integration of AI facilitates automated image analysis, allowing for rapid detection of abnormalities, tumor segmentation, and accurate delineation of anatomical structures. These advancements have helped increase the adoption of CT simulators to provide more sophisticated and accurate patient care.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

CT simulators are becoming essential tools in contemporary radiation therapy and diagnostic planning. The integration of artificial intelligence (AI) enables automated image analysis, allowing for quick detection of abnormalities, tumor segmentation, and accurate delineation of anatomical structures. 3D and 4D imaging capabilities have further enhanced the usefulness of CT simulators by providing volumetric and time-resolved images, helping clinicians monitor organ movement, such as lung motion during breathing, which is vital for thoracic and abdominal radiotherapy. Systems like Varian’s TrueBeam 4D CT enable oncologists to visualize tumor motion in real time, leading to more precise radiation dose delivery and reduced exposure to healthy tissue. Additionally, low-dose CT scanning techniques improve patient safety without sacrificing image quality. Modern CT simulators, including Siemens SOMATOM Definition Edge, employ iterative reconstruction algorithms and dose modulation to produce high-resolution images with significantly less radiation. This makes repeated imaging safer, especially for vulnerable groups like pediatric or elderly patients undergoing ongoing cancer treatment. Overall, these advancements not only enhance image quality and diagnostic accuracy but also boost operational efficiency by shortening scan times and facilitating personalized treatment plans, promoting wider use of CT simulators in hospitals and specialized cancer centers worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

1. Evolving Radiotherapy Paradigms Driving CT Simulator Uptake. 2. SBRT and Hypofractionation Driving Precision Imaging Needs. 3. Increased Caseloads Fuel Demand for High-Throughput CT Simulators

-

Global push toward hypofractionation and stereotactic body radiotherapy (SBRT)

Level

-

1. Emerging CBCT-Based Planning Solutions Reducing Standalone CT Dependence 2. Perceived Overlap with Diagnostic Imaging Decreases Simulator Uptake

Level

-

1. AI and PCCT Unlocking High-Performance Simulation Opportunities 2. Hybrid CT-Linac and CT-on-Rails Solutions Unlock Integrated Opportunities

Level

-

High Capital Costs Hindering CT Simulator Adoption

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Evolving Radiotherapy Paradigms Driving CT Simulator Uptake.

The increasing adoption of image-guided and adaptive radiotherapy (IGRT/ART) is transforming clinical workflows and boosting demand for advanced CT simulators. With tumor motion, anatomical variability, and the need for precise dose delivery, radiotherapy is moving from static, one-time planning to dynamic, daily adaptation. High-quality CT datasets remain essential—serving as the gold standard for treatment planning and as key references for synthetic CT generation, online adaptation, and quality assurance (QA). As vendors expand adaptive product lines with AI-based segmentation and real-time planning tools, the reliance on CT simulation grows stronger across both planning and verification phases. Looking ahead, market growth is expected to accelerate with increased ART adoption, particularly in advanced cancer centers across North America, Europe, and APAC. This will drive demand for CT simulators with advanced features such as 4D imaging, dual-energy acquisition, and respiratory motion management, while also encouraging recurring upgrades to incorporate adaptive-ready software and QA modules. Ultimately, ART elevates CT simulators from mere planning tools to central components of workflow that ensure the reliability and precision of adaptive treatments, creating ongoing growth opportunities for vendors aligned with this shift.n

Restraint: Emerging CBCT-based Planning Solutions Reducing Standalone CT Dependence

Recent advances in AI-driven CBCT-to-synthetic CT (sCT) conversion are creating a potential substitution pathway for traditional CT simulators in radiotherapy planning. Clinical studies from 2022–2024 demonstrate that CBCT-generated sCT achieves dosimetric accuracy within 2% of planning CT for select indications, such as prostate and head-neck cases. If clinical guidelines validate these workflows, hospitals—particularly in cost-sensitive regions—may reduce reliance on standalone CT simulators, favoring CBCT-based adaptive imaging. While high-precision and multi-site treatments will still require conventional CT simulation, widespread adoption of sCT could moderate overall market growth. This shift may accelerate investment in AI-based software, CBCT upgrades, and hybrid imaging solutions, encouraging vendors to adapt product portfolios to maintain revenue streams in a gradually transforming planning ecosystem.

Opportunity: AI and PCCT Unlocking High-Performance Simulation Opportunities

Photon-counting CT (PCCT) is transitioning from niche uses to wider clinical adoption, as seen with systems like Siemens Naeotom Alpha (2024–25). PCCT offers higher spatial resolution, spectral imaging, and better dose efficiency, while AI-driven automation improves reconstruction, motion correction, and workflow. These advances set new standards for “simulator-grade” imaging, encouraging healthcare providers to seek next-generation CT simulators that meet these higher expectations. This technological progress creates a significant opportunity for vendors to target premium market segments and stand out with their products. Hospitals are likely to upgrade current systems or prioritize new purchases to utilize PCCT and AI features, especially in high-volume or advanced cancer centers. By adopting these innovations, CT simulator manufacturers can stimulate market growth, enhance clinical results, and justify higher investments from customers.

Challenge: High Capital Costs Hindering CT Simulator Adoption

Dedicated CT simulators, essential for accurate radiation therapy planning, often involve significant capital costs. For example, a recent purchase by Olean General Hospital totaled USD 518,000, with a USD 195,985 grant from the Milliman Fund. Such large investments can be difficult for many institutions,, especially when budgets are reserved for other high-priority equipment like linear accelerators. To address this issue, vendors might consider offering flexible financing options, leasing plans, or bundled packages that include simulators, planning software, and training services. These strategies could make CT simulators more accessible to a wider range of healthcare facilities, supporting their adoption and improving the quality of radiation therapy planning.

CT Simulators Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Somatom Go.Open Pro and Go.Sim wide-bore CT simulators designed for radiotherapy planning, with Direct i4D and Direct Organs auto-contouring. | Personalised 4D imaging for motion management; up to 70% reduction in OAR contouring time; improved workflow efficiency in adaptive RT. |

|

Discovery RT and Revolution RT simulators with large-bore design and AI-based reconstruction for oncology workflows. | High image quality at lower dose, robust integration with treatment planning, and optimized positioning for complex radiotherapy cases. |

|

Big Bore CT simulators optimized for radiation oncology with wide bore clearance and advanced imaging packages. | Improved patient positioning and immobilization, compatibility with brachytherapy and proton workflows, and enhanced treatment accuracy. |

|

Aquilion Exceed LB and Aquilion RT systems offering ultra-wide bore and advanced 4D CT imaging for radiotherapy. | Greater bore size for flexible patient setup, precise motion management, and reliable datasets for adaptive and proton therapy planning. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The CT simulators market ecosystem includes equipment manufacturers, raw material suppliers, distributors, and end users. Leading companies such as Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical, and Fujifilm Healthcare develop advanced CT simulator systems that play a key role in radiotherapy planning and precision oncology. These manufacturers depend on raw material suppliers, including providers of X-ray tubes (Dunlee, Varex), scintillation detectors (Hamamatsu, Teledyne DALSA), specialty alloys and materials (Mitsubishi Materials, Hitachi Metals), and shielding solutions (3M, Corning), to ensure high-quality imaging, durability, and compliance with radiation safety standards. End users include cancer treatment centers, academic hospitals, and integrated health networks such as Union Health, VCU Health, HSHS St. Vincent, and Radiotherapy Centers of Kentuckiana, which use CT simulators for patient simulation, adaptive radiotherapy, brachytherapy, and proton therapy planning. Collaboration throughout this ecosystem is crucial to supporting efficiency, fostering innovation, and expanding global access to advanced radiotherapy workflows, ultimately enabling highly precise, image-guided treatments for cancer patients worldwide.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

CT Simulators market, By Product Type

Multi-slice CT simulators lead the global CT simulator market because of their ability to produce high-resolution, cross-sectional images for precise anatomical visualization. This feature is especially important in radiation therapy, where accurate tumor delineation and treatment planning are vital. By using multiple detector rows, these systems significantly cut scan times, improving patient comfort, streamlining workflows, and increasing patient throughput. The growing global cancer burden further boosts the demand for advanced imaging solutions that enable accurate diagnosis and targeted treatment planning. Multi-slice systems are increasingly preferred in oncology for their detailed imaging, integration with cutting-edge treatment protocols, and capacity to support complex clinical decision-making. Furthermore, they offer improved image quality at lower radiation doses, enhancing patient safety while maintaining operational efficiency. By combining speed, accuracy, and sophisticated imaging features, multi-slice CT simulators have become the preferred choice worldwide for healthcare providers. These benefits solidify their leading market position and emphasize their vital role in delivering better treatment outcomes in FY 2024.4.

CT Simulators market, By Technology

3D/4D CT simulation has established itself as the leading technology in the CT simulators market, driven by its ability to deliver superior imaging accuracy and improve clinical outcomes. By providing volumetric, high-resolution images, 3D simulation enables precise delineation of tumors and surrounding healthy tissues, which is essential for advanced radiation therapy. This level of accuracy enhances treatment planning by supporting optimal beam placement and effective dose distribution, reducing the risks of both under-treatment and unnecessary exposure. The increasing global incidence of cancer has boosted the demand for radiation therapy solutions that focus on precision and safety. In this environment, 3D simulation has become the standard preferred by oncology centers worldwide. Its seamless integration with advanced treatment techniques such as intensity-modulated radiotherapy (IMRT), image-guided radiotherapy (IGRT), and adaptive radiotherapy further reinforces its position. Additionally, 3D/4D CT simulation aligns with the broader trend toward personalized medicine by enabling patient-specific treatment strategies. Combined with workflow efficiencies like faster imaging and automated segmentation, the technology improves both efficiency and patient throughput. Overall, these factors have established 3D/4D CT simulation as the market leader, securing its highest market share in FY 2024.4.

CT Simulators market, By Application

Image-guided Radiation Therapy (IGRT) holds the largest share of the CT simulators market, propelled by its capacity to provide highly precise and personalized cancer treatments. The rising global cancer incidence has increased demand for technologies that reduce damage to healthy tissues while enhancing treatment accuracy, making IGRT-enabled CT simulators the preferred option. The integration of advanced imaging techniques, including 3D/4D CT and motion-management systems, allows clinicians to account for respiratory and anatomical changes, especially in complex tumor locations such as the lung and abdomen. Technology convergence with linear accelerators has further boosted IGRT adoption, as hospitals increasingly seek seamless end-to-end workflows that combine imaging, planning, and treatment delivery. Artificial intelligence and automation now improve contouring, image registration, and anomaly detection, increasing efficiency and consistency in planning. Clinical guidelines and reimbursement models are increasingly favoring image-verified therapies, solidifying IGRT’s role as the standard of care..

REGION

Asia Pacific to be fastest-growing region in global CT simulators market during forecast period

The rapid growth in Asia-Pacific is mainly driven by the region’s quickly increasing cancer burden, with the International Agency for Research on Cancer (IARC) predicting that over 50% of new global cancer cases will happen in Asia by 2040. To meet this growing demand, governments in China, India, Japan, and South Korea are focusing on investing in oncology infrastructure, including installing advanced radiotherapy equipment like CT simulators. The expansion of proton therapy and the adoption of advanced techniques such as IMRT, VMAT, and adaptive radiotherapy in top hospitals further boost the demand for high-end 3D/4D CT systems. Additionally, local manufacturing efforts by companies like Canon Medical in Japan and Shinva in China are making these technologies more affordable and accessible, while increasing private sector participation is speeding up adoption in urban cancer centers. All these factors position Asia Pacific as the fastest-growing market for CT simulators.

CT Simulators Market: COMPANY EVALUATION MATRIX

In the CT simulators market matrix, Siemens Healthineers leads with a strong market share and extensive product portfolio. Siemens Healthineers maintains a leadership position in the CT simulators market due to its robust technological offerings, early specialization in radiotherapy-focused CT solutions, and global commercial reach. Additionally, Siemens benefits from a well-established worldwide presence and distribution network, ensuring solid penetration across mature markets in North America and Europe, while also expanding aggressively in the Asia Pacific through collaborations with leading cancer centers. GE Healthcare (US) is recognized as a leading player in the global CT simulators market, building on its established expertise in diagnostic imaging and oncology solutions. Its CT simulators are widely used in radiation therapy planning across North America, Europe, and key emerging markets. The company’s flagship big-bore CT simulator is purpose-built for radiation oncology, featuring an 80 cm bore, flat couch, and advanced simulation workflows.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 569.0 Million |

| Market Forecast in 2030 (value) | USD 741.7 Million |

| Growth Rate | CAGR of 4.6% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Installed Base) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Technology: 2D/3D CT Simulation Technology, 3D/4D CT Simulation Technology; Product Type: Single Slice CT Simulators, Multi-Slice CT Simulators, Application: Image-Guided Radiation Therapy, 3D Conformal Radiation Therapy, Brachytherapy, Adaptive Radiotherapy/ Surface-Guided Radiotherapy, Proton Therapy, and Other Applications; End User: Independent Radiotherapy Centers and Hospitals |

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: CT Simulators Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Key Maufacurer | • Competitive benchmarking of major brands and SME’s operating in the ecosystem. • Competitive Landscape for major players in the market. | • Insights on supply chain resilience • Pinpoint risks in supplier concentration • Enable strategic sourcing for critical biologics |

RECENT DEVELOPMENTS

- July 2025 : Siemens Healthineers (Germany) launched Somatom Go. Now which is A computed tomography system that works on X-ray instrumentation, got market approval from US FDA

- April 2025 : Siemens Healthineers and Tower Health entered into a 10-year partnership to improve Tower Health’s radiology, cardiology, and oncology departments with Siemens Healthineers equipment, including computed tomography, and magnetic resonance.

- April 2024 : Philips Healthcare (Netherlands) announced a new facility in India to house research and development teams to produce more sustainable MRI technology options.

Table of Contents

Methodology

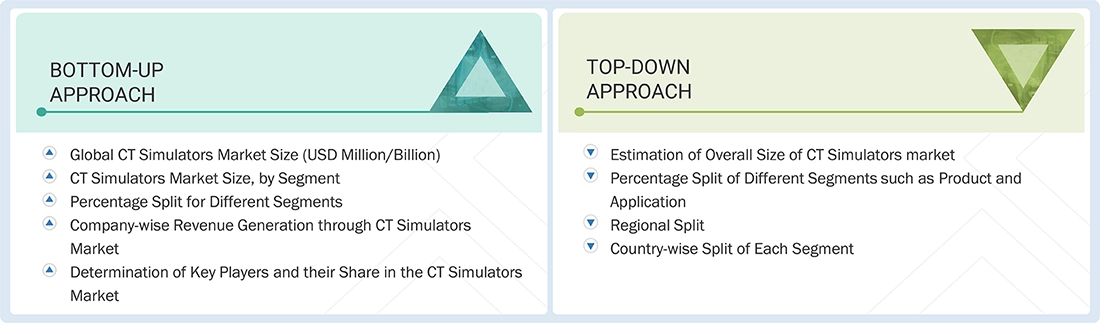

The size of the CT simulators market was determined based on primary studies to ensure precision. Initial data for the market and related niches were collected from 3 to 5 secondary sources. This information was then validated through primary research to confirm assumptions and overall market size. Both top-down and bottom-up methods were used to estimate the total market, which was then broken down into segment and subsegment sizes. Finally, data triangulation was performed to verify the accuracy of the data findings.

Secondary Research

Secondary research sources included directories, Factiva, white papers, Bloomberg Business, annual reports, SEC filings, business filings, and investor presentations. These sources provided valuable insights into market leaders, sector divisions, and technological differences within various segments of the CT simulators industry.

Primary Research

Primary research involved both quantitative and qualitative insights collected through interviews with key stakeholders. On the demand side, participants included physicians, researchers, department heads, and staff from diagnostic centers, hospitals, and research institutes. On the supply side, interviews were held with CEOs, area sales managers, territory and regional sales managers, and other top executives from relevant companies. These direct conversations helped verify the secondary research findings and provided an opportunity to directly ask questions and confirm details and assumptions.

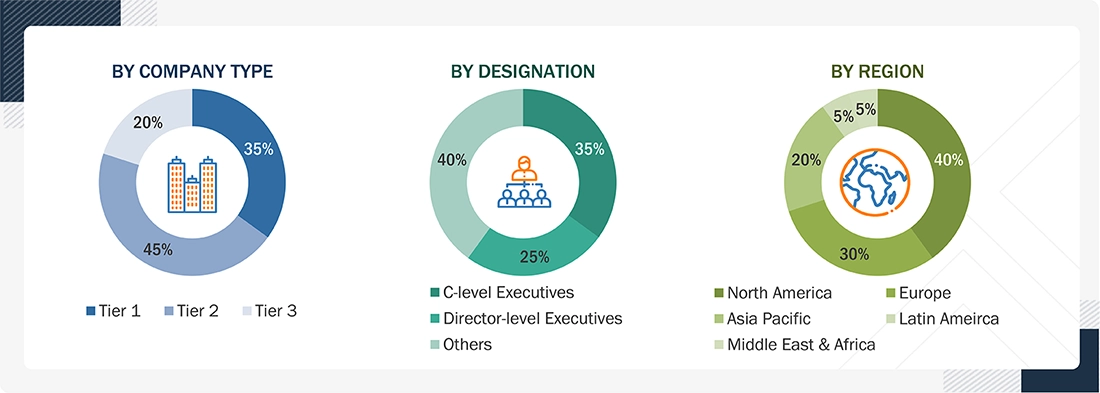

A breakdown of the primary respondents is provided below.

Note 1: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers

Note 2: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 1 billion, Tier 2 = < USD 500 million, and Tier 3 = < USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report used the revenue share analysis of major companies to assess the size of the global CT simulators market. This analysis involved identifying key market players and calculating their revenue from CT simulators using data collected during both primary and secondary research phases. One part of the secondary research included reviewing the annual and financial reports of leading market companies. In contrast, primary research consisted of detailed interviews with influential thought leaders, including directors, CEOs, and key marketing executives.

To determine the overall market value, the segmental revenue was calculated by mapping the revenue of the leading solution and service providers. The process involved several steps.

- Making a list of leading international companies in the CT Simulators industry

- Charting annual profits made by leading companies in the CT Simulators sector (or the closest stated business unit/product category)

- 2024 revenue mapping of leading companies to cover a significant portion of the global market

- Calculating the global value of the CT Simulators industry

Global CT Simulators Market: Bottom-up and Top-down Approach

Data Triangulation

CT simulators are specialized medical imaging devices used in radiation therapy planning. They combine the processes of acquiring CT images and designing radiation treatment fields, allowing clinicians to accurately outline tumor volumes and nearby organs for precise and effective treatment planning. They provide three-dimensional images of patient anatomy in the treatment position. The CT simulators assist with patient positioning and immobilization, ensuring reproducibility during daily treatment. They integrate with treatment planning systems for dose calculation and optimal targeting of tumours.

Market Definition

To ensure accurate data, the CT simulators market was divided into various segments and subsegments. A data triangulation process that used both top-down and bottom-up approaches was applied. This involved analyzing factors and trends from both the demand and supply sides to validate the findings for each segment. The combination of this segmentation with the triangulation process helps ensure that the market data is both accurate and reliable.

Stakeholders

- Manufacturers of CT simulators

- Healthcare providers such as hospitals, independent radiotherapy centers

- Patients using CT simulators for various conditions

- Healthcare professionals, including radiologists, radiotherapists

- Regulatory bodies overseeing product standards and safety

- Suppliers and distributors of CT simulators products

- Research & development firms focusing on innovation and technology in CT simulators

Report Objectives

- To define, describe, and forecast the CT simulators market based on product type, technology, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To benchmark players within the market using a proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To analyze competitive developments such as product launches, agreements, expansions, collaborations, and acquisitions in the CT Simulators market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the CT Simulators Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in CT Simulators Market