This study encompassed significant efforts in determining the present size of the diesel power engine market. It commenced with a thorough secondary research process to gather data related to the market, similar markets, and the overarching industry. Subsequently, these findings, assumptions, and market size calculations were rigorously validated by consulting industry experts across the entire supply chain through primary research. The total market size was assessed by conducting an analysis specific to each country. Following that, the market was further dissected, and the data was cross-referenced to estimate the size of various segments and sub-segments within the market.

Secondary Research

In this research study, a wide range of secondary sources were utilized, including directories, databases, and reputable references such as Hoover's, Bloomberg BusinessWeek, Factiva, World Bank, International Monetary Fund (IMF), the US Department of Energy (DOE), and the International Energy Agency (IEA). These sources played a crucial role in gathering valuable data for a comprehensive analysis of the global diesel power engine market, covering technical, market-oriented, and commercial aspects. Additional secondary sources included annual reports, press releases, investor presentations, whitepapers, authoritative publications, articles authored by well-respected experts, information from industry associations, trade directories, and various database resources.

Primary Research

The diesel power engine market involves a range of stakeholders, including raw material suppliers, component manufacturers, diesel power engine manufacturers/assemblers, distributors, end users, and post-sale services within the supply chain. The demand for this market is primarily driven by end users such as power utilities, residential & commercial. On the supply side, there is a notable trend of heightened demand for contracts from the industrial sector and a significant presence of investments and expansions among major players.

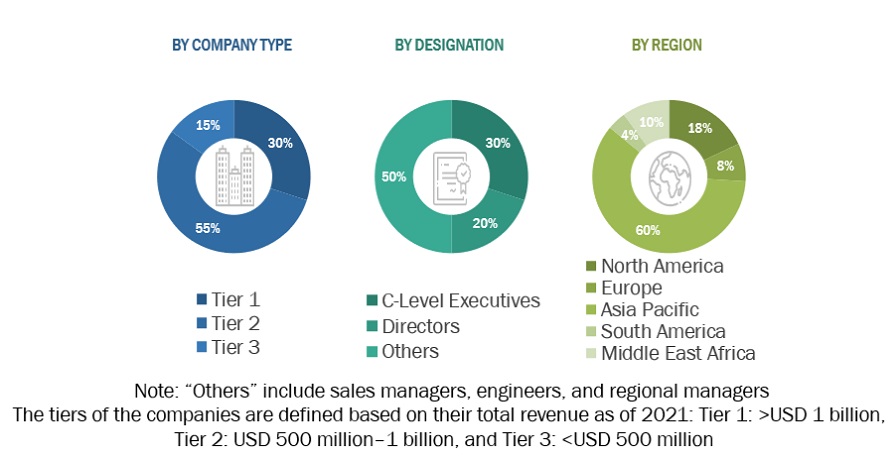

To gather qualitative and quantitative insights, various primary sources from both the supply and demand sides of the market were interviewed. The following breakdown presents the primary respondents involved in the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

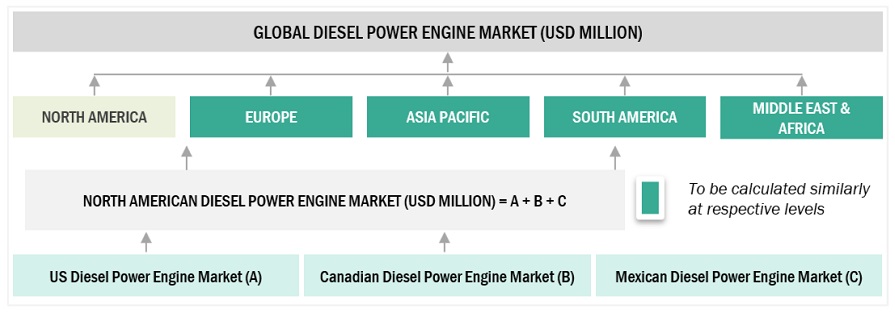

The estimation and validation of the diesel power engine market size have been conducted using a bottom-up approach. This approach was rigorously employed to ascertain the dimensions of multiple subsegments within the market. The research process comprises the following key stages.

In this method, the production statistics for each type of diesel power engine have been examined at both the country and regional levels.

Thorough secondary and primary research has been conducted to gain a comprehensive understanding of the global market landscape for various segments of diesel power engines.

Numerous primary interviews have been undertaken with key experts in the field of diesel power engine development, encompassing important OEMs and Tier I suppliers.

When calculating and forecasting the market size, qualitative factors such as market drivers, limitations, opportunities, and challenges have been taken into account.

Global Diesel Power Engine Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The process of determining the overall market size involved the methodologies described earlier, followed by segmenting the market into multiple segments and subsegments. To finalize the comprehensive market analysis and obtain precise statistics for each market segment and subsegment, data triangulation and market segmentation techniques were applied, as appropriate. Data triangulation was accomplished by examining various factors and trends from both the demand and supply perspectives within the ecosystem of the diesel power engine market.

Market Definition

A diesel power engine is an internal combustion engine that operates on the principle of compression ignition. It uses diesel fuel, a type of petroleum-derived liquid fuel, as its primary source of energy. In a diesel engine, air is compressed within the combustion chamber to a high temperature, causing the diesel fuel to ignite spontaneously upon injection into the chamber. This combustion process generates mechanical energy, which is harnessed to drive various applications such as vehicles, generators, construction equipment, marine vessels, and industrial machinery. Diesel engines are renowned for their fuel efficiency, durability, and high torque output, making them widely used across diverse industries for both stationary and mobile power generation.

Key Stakeholders

-

Government & research organizations

-

Institutional investors

-

Investors/shareholders

-

Environmental research institutes

-

Manufacturers’ associations

-

Diesel power engine raw material and component manufacturers

-

Diesel power engine manufacturers, dealers, and suppliers

-

State and national regulatory authorities

-

Manufacturing industry

-

Energy efficiency consultancies

-

Smart grid project developers

-

Public & private power generation, transmission & distribution companies (utilities)

-

Sub-station equipment manufacturing companies

Objectives of the Study

-

To describe and forecast the diesel power engine market, in terms of value, by operation, power rating, speed, end user, and region

-

To forecast the market for various segments, in terms of value, with regard to five regions: North America, South America, Europe, Asia Pacific, and the Middle East & Africa, along with their key countries

-

To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the market’s growth

-

To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

-

To study the complete supply chain and allied industry segments and perform a supply chain analysis of the diesel power engine landscape

-

To strategically analyze the regulatory landscape, tariff, standards, patents, Porter’s five forces, import and export scenarios, trade values, and case studies pertaining to the market under study

-

To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the diesel power engine market

-

To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies1, along with detailing the competitive landscape for the market leaders

-

To analyze competitive developments such as agreements, partnerships, product launches, acquisitions, contracts, expansions, and investments in the diesel power engine market

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

-

Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Diesel Power Engine Market