Digital Twin in Marine Market

Digital Twin in Marine Market by Offering (Platform & Solutions, Services), End User (Shipbuilders, Ship Operators, Offshore & Energy Operators, Ports & Terminals), Component, Type, Enabling Technology, & Region – Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The digital twin in marine market is expected to be valued at USD 0.59 billion in 2025 and is projected to reach USD 2.40 billion by 2032, at a CAGR of 23.2% from 2026 to 2032, driven by the increasing adoption of digital twins across shipbuilding, fleet operations, ports & terminals, and offshore & energy assets. Growing pressure to improve operational efficiency, asset reliability, and emissions compliance, along with the need to manage complex, capital-intensive marine assets across their full lifecycle, is accelerating digital twin adoption. Additionally, the transition toward digital shipyards, smart ports, predictive maintenance, and data-driven maritime operations, supported by advancements in IoT, simulation, cloud platforms, and analytics, is further driving market expansion.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is expected to dominate the digital twin in marine market, with a share of 37.4% in 2025.

-

BY OFFERINGBy offering, the services segment is expected to register the highest CAGR of 20.2% during the forecast period.

-

BY END USERThe ship operators segment is expected to register the highest CAGR of 21.5% during the forecast period.

-

COMPETITIVE LANDSCAPE (KEY PLAYERS)Siemens and Dassault Systèmes were identified as star players in the digital twin in marine market due to their strong market share and extensive product footprint.

-

COMPETITIVE LANDSCAPE (STARTUPS/SMES)NAPA and Bachmann electronic GmbH, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders in the digital twin in marine market.

The digital twin in marine market is positioned for strong growth as maritime organizations increasingly deploy digital twins across shipbuilding yards, vessel fleets, ports & terminals, and offshore energy operations. The rising demand for operational efficiency, asset reliability, emissions compliance, and lifecycle cost optimization is driving the adoption of digital twin solutions, which enable real-time asset monitoring, predictive maintenance, performance simulation, and scenario-based decision support. Continuous advancements in IoT connectivity, high-fidelity simulation models, cloud platforms, and advanced analytics are enhancing the accuracy, scalability, and effectiveness of marine digital twins. As digital transformation investments intensify to improve safety, sustainability, and operational resilience, digital twins are emerging as a core enabler of connected, intelligent, and data-driven marine asset and operations management.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The figure highlights the structural shift underway in the marine digital transformation landscape, where revenue is progressively moving away from traditional ship design, engineering, and asset operations toward digital twin-driven solutions and intelligent maritime systems. New use cases, technologies, and digital ecosystems are reshaping the future revenue mix, with ship & vessel, engine & propulsion, fleet performance, port & terminal, offshore platform, and navigation optimization digital twins becoming central to maritime strategies. Growth is driven by rising demand from shipbuilders, ship operators, offshore & energy operators, and ports & terminals for predictive maintenance, performance optimization, and operational efficiency, positioning digital twins as a key enabler of future revenue expansion.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing need to manage lifecycle costs of capital-intensive marine assets

-

Growing demand for predictive maintenance and reduced unplanned downtime

Level

-

High initial investment and integration costs

-

Complexity of retrofitting legacy fleets and infrastructure

Level

-

Rising investment in smart ports and offshore renewable energy projects

-

Growing adoption of system-level digital twins across connected marine ecosystems

Level

-

Interoperability and integration across diverse marine stakeholders

-

Organizational and operational challenges in scaling beyond pilot projects

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing need to manage lifecycle costs of capital-intensive marine assets

Marine assets such as vessels, offshore platforms, and port infrastructure involve high capital expenditure and long operational lifecycles, making cost control a critical priority for stakeholders. Digital twins enable continuous performance monitoring, predictive maintenance, and lifecycle optimization by combining real-time operational data with simulation models. This allows shipbuilders, operators, and port authorities to reduce unplanned downtime, extend asset life, and improve operational efficiency. As cost pressures increase across the maritime industry, digital twins are becoming essential tools for managing total lifecycle costs.

Restraint: High initial investment and integration costs

The adoption of digital twin solutions in the marine market is constrained by high upfront costs associated with sensor retrofitting, data integration, simulation software, and system customization. Many vessels, ports, and offshore assets operate on legacy infrastructure that was not designed for digital integration, increasing deployment complexity and cost. Smaller ship operators and port authorities often struggle to justify these investments due to budget limitations and uncertain short-term returns, slowing large-scale digital twin adoption across the industry.

Opportunity: Rising investment in smart ports and offshore renewable energy projects

Growing investments in smart port development and offshore renewable energy projects are creating significant opportunities for digital twin adoption in the marine market. Digital twins are increasingly used to support port master planning, terminal operations optimization, offshore wind farm monitoring, and lifecycle asset management. Government-led infrastructure programs and private sector investments are accelerating the deployment of digital technologies across maritime infrastructure. As these projects scale, demand for advanced digital twin solutions that support operational efficiency and sustainability is expected to rise.

Challenge: Interoperability and integration across diverse marine stakeholders

Interoperability and integration across diverse marine stakeholders remain a key barrier to scaling digital twin solutions in the maritime sector. Ship owners, operators, ports, equipment manufacturers, service providers, and regulatory bodies operate on different IT systems, data formats, and communication standards. This fragmented digital landscape makes it difficult to create a unified, real-time digital twin ecosystem. Limited data compatibility, lack of common data frameworks, and concerns around secure data sharing further restrict seamless collaboration. Overcoming these integration challenges is essential to enable connected operations, end-to-end visibility, and value realization from digital twin investments across the marine industry.

DIGITAL TWIN IN MARINE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implemented an end-to-end digital twin for Hyundai Heavy Industries’ shipyards in South Korea, covering ship design, production planning, shipyard operations, and vessel lifecycle management through a digital shipyard approach. | Improves ship design accuracy, reduces production rework, shortens construction timelines, enhances coordination across shipyard operations, and establishes a single source of truth across the vessel lifecycle. |

|

Deployed ship lifecycle digital twins using the 3DEXPERIENCE platform at Samsung Heavy Industries shipyards, enabling virtual modeling and validation of ship design and construction processes. | Reduces engineering errors, improves collaboration between design and production teams, enables virtual validation before physical construction, and lowers cost and delivery risk. |

|

Implemented vessel and fleet performance digital twins for Norwegian Cruise Line Holdings’ cruise fleet, using Eniram and Voyage Benchmark solutions to compare actual vessel performance against optimal operating models. | Optimizes fuel consumption, reduces CO2 emissions, improves voyage efficiency, minimizes unplanned downtime, and strengthens performance management across the fleet. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The digital twin in marine industry ecosystem includes digital twin solution providers, cloud service platforms, hardware and sensor manufacturers, and end users working together to support connected maritime operations. Solution providers deliver simulation, analytics, and lifecycle management tools, while cloud platforms enable scalable data processing and integration. Hardware and sensor manufacturers supply real-time operational data from ships, ports, and offshore assets. End users such as shipbuilders, ship operators, ports, and offshore energy companies use these solutions to improve efficiency, reliability, and lifecycle performance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Digital Twin in Marine Market, by Offering

The services segment is expected to record the highest CAGR in the digital twin in marine market due to its critical role across shipbuilding, fleet operations, ports & terminals, and offshore energy applications. These services provide essential capabilities such as system integration, legacy asset retrofitting, customization, and lifecycle support, enabling effective deployment of digital twin solutions. The increasing adoption of digital shipyards, smart ports, predictive maintenance programs, and offshore asset optimization initiatives, along with a growing reliance on professional and managed services, is accelerating demand for digital twin services across the maritime industry.

Digital Twin in Marine Market, by End User

The ship operator segment is expected to account for the largest market share in the digital twin in marine market due to its strong focus on improving fleet efficiency, reducing operating costs, and meeting emissions and safety regulations. Digital twins enable ship operators to monitor vessel performance in real time, optimize fuel consumption and voyages, and implement predictive maintenance strategies. Growing adoption across commercial shipping and cruise fleets, driven by cost pressures and regulatory compliance needs, is accelerating the demand for digital twin solutions among ship operators.

REGION

Asia Pacific to be fastest-growing region in digital twin in marine market during forecast period

Asia Pacific is expected to be the fastest-growing region in the digital twin in marine market due to strong shipbuilding activity, rapid port modernization, and rising investments in offshore energy projects across China, South Korea, Japan, and India. Increasing pressure to improve operational efficiency, emissions compliance, and asset lifecycle management, along with large-scale adoption of digital shipyard and smart port initiatives, is accelerating digital twin deployment. In addition, the presence of major shipbuilders, expanding maritime trade, and government-backed maritime digitalization programs are further supporting high growth across the region.

DIGITAL TWIN IN MARINE MARKET: COMPANY EVALUATION MATRIX

In the digital twin in marine market matrix, Siemens (Star) leads with a broad and mature digital twin portfolio covering digital shipyards, vessel lifecycle management, propulsion and energy systems, and fleet-level optimization. Its strength lies in combining high-fidelity simulation, PLM integration, and real-time operational data to support large-scale shipbuilding programs and complex marine assets. Bentley Systems (Emerging Leader) is gaining momentum through strong adoption of infrastructure- and port-focused digital twins, particularly in smart ports, asset performance monitoring, and infrastructure lifecycle management. Continuous enhancements in interoperability, data integration, and system-level modeling are strengthening Bentley’s upward movement toward the leaders’ quadrant within the marine digital twin ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Siemens (Germany)

- Hexagon AB (Sweden)

- ABB (Switzerland)

- Konsberg (Norway)

- Wärtsilä (Finland)

- Dassault Systèmes (France)

- Schnieder Electric (France)

- Digital Twin Marine (Singapore)

- Prevu3D (Canada)

- Cadmatic (Finland)

- NAPA (Finland)

- Bentley Systems, Incorporated (US)

- Aveva (UK)

- SailPlan (Norway)

- BMT (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 0.59 Billion |

| Market Forecast in 2032 (Value) | USD 2.40 Billion |

| Growth Rate | CAGR of 23.2% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2025 |

| Forecast Period | 2026–2032 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, RoW |

WHAT IS IN IT FOR YOU: DIGITAL TWIN IN MARINE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape |

|

|

| Regional Market Entry Strategy |

|

|

| Application-specific Opportunity Assessment |

|

|

| Technology Adoption by End Users |

|

|

RECENT DEVELOPMENTS

- December 2025 : Kongsberg Digital signed a multi-year enterprise agreement with Vår Energi to deploy its AI-powered Kognitwin digital twin platform, enabling advanced operations and maintenance planning across offshore energy assets through predictive analytics and AI-driven decision-support workflows.

- November 2025 : Siemens and HD Hyundai signed a memorandum of understanding to modernize US shipbuilding by deploying the Siemens Xcelerator platform across shipyards, enabling digital twin-driven design, integrated PLM, and model-based systems engineering to enhance production efficiency, automation, and workforce development.

- January 2025 : Kongsberg consolidated its maritime digital twin business into Kongsberg Maritime, integrating digital twin technologies from Kongsberg Digital to sharpen its focus on marine decarbonization and digitalization while strengthening twin-driven solutions for fleet management and offshore asset operations.

Table of Contents

Methodology

The study involved major activities in estimating the current size of the digital twin in marine market. Exhaustive secondary research was done to collect information on the industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, including top-down and bottom-up methods, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the digital twin in marine market.

Secondary Research

The market for companies offering digital twin solutions in the marine industry is derived through secondary data available from paid and unpaid sources, analyzing the solution portfolios of major companies in the ecosystem and evaluating them based on performance and solution quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, industry journals, certified publications, and articles from recognized authors, maritime associations, directories, and databases. In the secondary research process, multiple sources were consulted to identify and gather information related to digital twin adoption across shipbuilding, ship operations, ports & terminals, and offshore energy applications. Secondary sources included annual reports, press releases, investor presentations of technology vendors, industry forums, certified publications, and technical whitepapers. The secondary research was used to obtain critical information on the marine industry value chain, the total pool of key players, market classification, and segmentation from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the digital twin in marine market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions: North America, Europe, Asia Pacific, and the Rest of the World. Approximately 30% of the primary interviews were conducted with the demand-side respondents, while approximately 70% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

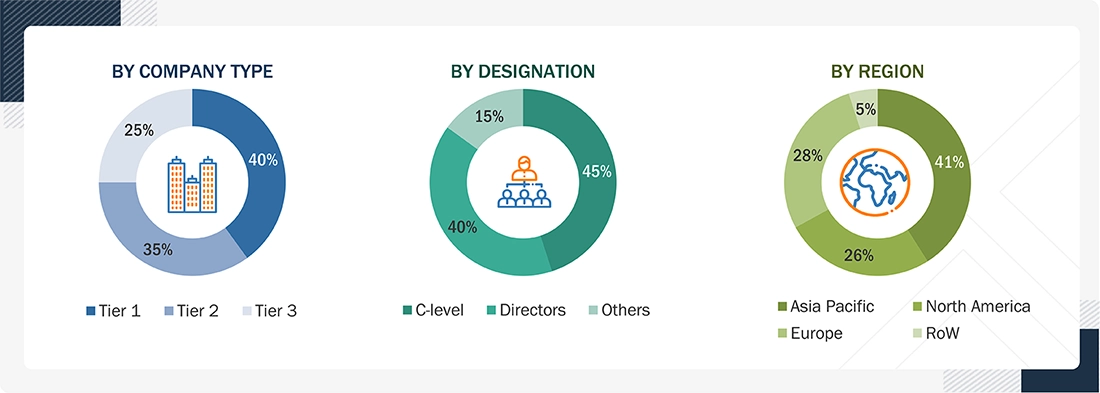

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the opinions of our in-house subject-matter experts, has led us to the findings described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the digital twin in marine market. These methods were also used extensively to estimate the size of various market segments. The research methodology used to estimate the market size includes the following:

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down Approach-

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes as explained above. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

A digital twin in the marine market refers to a dynamic virtual representation of marine assets, operations, or systems that continuously synchronizes with real-world data from physical counterparts. These virtual models replicate vessels, shipyard processes, port infrastructure, and offshore facilities, enabling real-time monitoring, simulation, and performance analysis. Marine digital twins integrate data from onboard sensors, control systems, and operational platforms to create an accurate digital representation that reflects the actual conditions and behaviors of the asset. The primary purpose of marine digital twins is to enhance decision-making, improve asset reliability, and optimize operational efficiency across maritime activities. By analyzing digital twin models, stakeholders can simulate voyage conditions, test design modifications, predict equipment failures, and optimize maintenance schedules before implementing actions in real operations. Digital twin applications in the marine industry span ship design and construction, fleet performance optimization, smart port management, offshore asset monitoring, and lifecycle management, making them essential tools for intelligent and data-driven maritime transformation.

Key Stakeholders

- Government bodies and policymakers

- Industry organizations, forums, alliances, and associations

- Market research and consulting firms

- Raw material suppliers and distributors

- Research institutes and organizations

- Analysts and strategic business planners

- End users of digital twins in the marine industry include shipbuilders, ship operators, offshore & energy operators, and ports & terminals.

The main objectives of this study are as follows:

- To define, describe, and forecast the digital twin in marine market size, by offering, end user, and end user, in terms of value

- To assess the size of the digital twin in marine market across four regions, namely, North America, Europe, Asia Pacific, and the RoW, along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To give ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter's five forces analysis, key stakeholders and buying criteria, key conferences and events, regulatory bodies, government agencies, and regulations pertaining to the market under study

- To analyze the impact of AI and US tariffs on the digital twin in marine market

- To offer a detailed overview of the process flow of the digital twin in marine market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the digital twin in marine market

- To understand opportunities for stakeholders by identifying high-growth segments of the digital twin in marine market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2

- To analyze competitive developments, such as product launches, deals (mergers, acquisitions, partnerships, alliances, collaborations, agreements, contracts, and investments), and expansions in the digital twin in marine market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information:

-

Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Digital Twin in Marine Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Digital Twin in Marine Market