Drone (UAV) Communication (Radio) Market Size, Share & Growth, 2025 To 2029

Drone (UAV) Communication Market by Technology (Radio Frequency, Cellular (LTE/4G, 5G/6G), Satellite, Meshed Network), Application (Military (ISR, Combat), Commercial), Component (Transmitter, Receiver, Antenna, Data Link) and Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Drone Communication Market was estimated to be USD 2.46 billion in 2024 to USD 3.67 billion by 2029, at a CAGR of 8.3%. The Drone Communication Industry is growing rapidly, driven by advancements in communication technologies, rising UAV adoption across defense and commercial sectors, and innovations like BVLOS, IoD, and SATCOM that enhance real-time connectivity and operational efficiency.

KEY TAKEAWAYS

- North America accounted for a 41.6% share of the drone communication market in 2024.

- By technology, the meshed network segment is expected to register the highest CAGR of 11.6%.

- By application, the commercial segment is projected to grow at the fastest rate from 2024 to 2029.

- By component, the transmitter and receiver segment is expected to dominate the market.

- DJI, RTX, and Northrop Grumman were identified as some of the star players in the drone communication market, given their strong market share and product footprint.

- Elsight Ltd., Silvus Technologies, and Persistent Systems, LLC, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The drone communication market is witnessing rapid growth driven by advancements in communication technologies, increasing UAV adoption in defense, and the demand for secure data transfer. Emerging areas like urban air mobility, logistics, and emergency response are creating new opportunities. Innovations such as BVLOS communication, IoD, and SATCOM integration are enhancing connectivity, safety, and operational efficiency across industries.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ business in the drone communication market is driven by rapid advances in connectivity and the growing need for secure, high-speed data exchange. Key users across defense, civil, and commercial sectors are focusing on operational efficiency and reliability. The adoption of 5G, AI-driven network management, satellite connectivity, and cybersecurity solutions is enhancing real-time coordination and autonomy, fueling demand for intelligent, high-performance communication systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Advancements in communication technologies

-

Increasing procurement of UAVs in military applications

Level

-

Cybersecurity risks and data vulnerabilities

-

Regulatory and airspace restrictions

Level

-

Emergence of swarm drone communication

-

Commercial expansion in urban air mobility (UAM) and logistics

Level

-

Interoperability and standardization issues

-

Limited spectrum availability and frequency congestion

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advancements in Communication Technologies

Rapid advancements in technologies such as 5G, IoT, and AI are transforming drone communication, enabling real-time data exchange, enhanced connectivity, and improved operational safety. Innovations in embedded systems, low-power microcontrollers, and RTOS integration are further enhancing efficiency, autonomy, and performance of drones across industries.

Restraint: Cybersecurity Risks and Data Vulnerabilities

The rising use of drones in defense, surveillance, and critical missions has increased exposure to cyber threats like GPS spoofing and data breaches. High costs and lack of standard security frameworks continue to hinder adoption, despite growing deployment of encryption, AI-based anomaly detection, and blockchain authentication solutions.

Opportunity: Emergence of Swarm Drone Communication

The growing adoption of swarm drones for defense, emergency, and environmental missions is creating strong opportunities for advanced, secure, and high-speed communication networks. As swarm technologies evolve, demand for robust encryption, AI-enabled coordination, and GPS-independent systems is driving innovation and competitiveness in the market.

Challenge: Interoperability and Standardization Issues

The lack of global communication standards for data transfer and frequency use limits cross-platform integration and scalability. Industry-wide collaboration on standards such as ASTM and ISO frameworks is crucial to enhancing interoperability, improving operational efficiency, and unlocking long-term market growth.

Drone Communication Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Developed microchips enabling drones to navigate without GPS using time-of-flight calculations to counter GPS jamming. | Improved reliability, survivability, and mission success in military operations. |

|

Partnered with Elsight to integrate Halo cellular connectivity for large-scale delivery drone operations. | Ensured continuous connectivity, higher efficiency, and expanded service coverage. |

|

Deployed UAVs with advanced sensors for aerial pipeline inspections across 40,000 km. | Increased inspection frequency, reduced costs, and enhanced safety. |

|

Conducted BVLOS medical drone trials to improve healthcare access in remote areas. | Enabled faster medicine delivery and improved healthcare reach during crises. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The drone communication market ecosystem comprises drone manufacturers, communication system providers, and end users such as defense, government, and commercial operators. Key participants include companies like DJI, Boeing, Honeywell, and Viasat, which play a vital role in advancing connectivity, data transmission, and operational efficiency. Supported by investors, integrators, and regulatory bodies, this collaborative ecosystem is driving innovation and shaping the future of secure and intelligent drone communication networks.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Drone communication market, By Technology

The radio frequency (RF) segment holds the largest share of the drone communication market, driven by its established use in line-of-sight and beyond visual line-of-sight (BVLOS) operations. RF-based systems provide reliable, low-latency, and cost-effective communication between drones and control stations, making them indispensable for both commercial and defense applications. Their ability to support real-time telemetry, command, and payload data transmission under varying operational conditions has enabled RF technology to dominate the market, especially in tactical and long-range drone missions.

Drone communication market, By Application

The military segment accounts for the highest share of the drone communication market, owing to the increasing deployment of unmanned aerial systems for surveillance, reconnaissance, and combat operations. Defense organizations worldwide are investing heavily in secure and high-bandwidth communication systems to support mission-critical operations and enhance situational awareness. The growing emphasis on encrypted data links, anti-jamming technologies, and satellite-based communication further strengthens the dominance of the military segment, as reliability and security remain top priorities in defense-grade drone systems.

Drone communication market, By Component

The transmitters & receivers segment represents the largest and most vital component of the drone communication market, as these systems form the backbone of data exchange between drones and ground control stations. The demand for high-performance, multi-band transmitters and receivers capable of secure and uninterrupted communication is rising with the expansion of BVLOS and autonomous drone operations. Advanced modulation techniques, adaptive frequency selection, and AI-driven signal optimization have positioned this segment as a key driver of market dominance, ensuring precision, efficiency, and robust connectivity across diverse applications.

REGION

Asia Pacific to be fastest-growing region in global drone communication market during forecast period

The Asia Pacific is expected to register the highest CAGR during the forecast period, driven by rapid advancements in 5G, AI, and autonomous technologies that enhance real-time data transmission and operational efficiency. Strong government initiatives across China, Japan, and South Korea, along with rising adoption in agriculture, infrastructure, and disaster management, are fueling market expansion. Additionally, strategic collaborations such as Skydio’s partnership with KDDI to integrate 5G-based drone solutions are accelerating innovation and deployment. The region’s vast geography and growing need for monitoring and delivery services further reinforce its dominant growth trajectory in this market.

Drone Communication Market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the drone communication market evaluates players based on product footprint and market share. It highlights their competitive positioning and ranks them according to market strength and growth strategies. DJI is positioned as a leading player with a strong focus on advanced technologies, while BAE Systems is recognized as an emerging leader in this market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

List of Top Drone (UAV) Communication Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.46 Billion |

| Market Forecast in 2029 (Value) | USD 3.67 Billion |

| Growth Rate | CAGR of 8.3% from 2024-2029 |

| Years Considered | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Drone Communication Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segmetns covered at regional/global level to gain an understanding on market potential by each coutnry |

| Emerging Leader | Additional Company Profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for a more targeted undertanding on the Total Addressable Market |

RECENT DEVELOPMENTS

- December 2024 : Elbit Systems secured a USD 40 million contract with the Israel Defense Forces (IDF) to supply advanced drones and autonomous systems. The contract includes intelligence-collecting drones for seek & strike swarms, mission drones with ISR and combat capabilities, mini-drone-based strike solutions for urban missions, and communication solutions for unmanned systems.

- December 2024 : The Israel Ministry of Defense (MOD), through its Directorate of Defense Research & Development (DDR&D), signed a series of deals worth USD 130 million with Elbit Systems. The contracts include the supply of advanced communication systems such as software-defined radios, satellite communication systems, datalinks for autonomous platforms, and the expansion of regional maintenance centers supporting combat forces.

- October 2024 : BAE Systems’ FAST Labs received a USD 6 million Phase 2 contract from the Defense Advanced Research Projects Agency (DARPA) to develop software for the Mission-Integrated Network Control (MINC) Program. This program aims to create secure, autonomous communication networks for multi-domain operations.

- August 2024 : Israel Aerospace Industries secured a contract to supply the Israeli Defense Forces (IDF) with ARC 840 NCO SDR airborne radios for Heron UAVs conducting maritime patrols over Israel’s Economic Exclusion Zone (EEZ).

- April 2024 : Israel Aerospace Industries secured a contract to supply the CellDart cellular intelligence system to an international client for airborne platforms.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

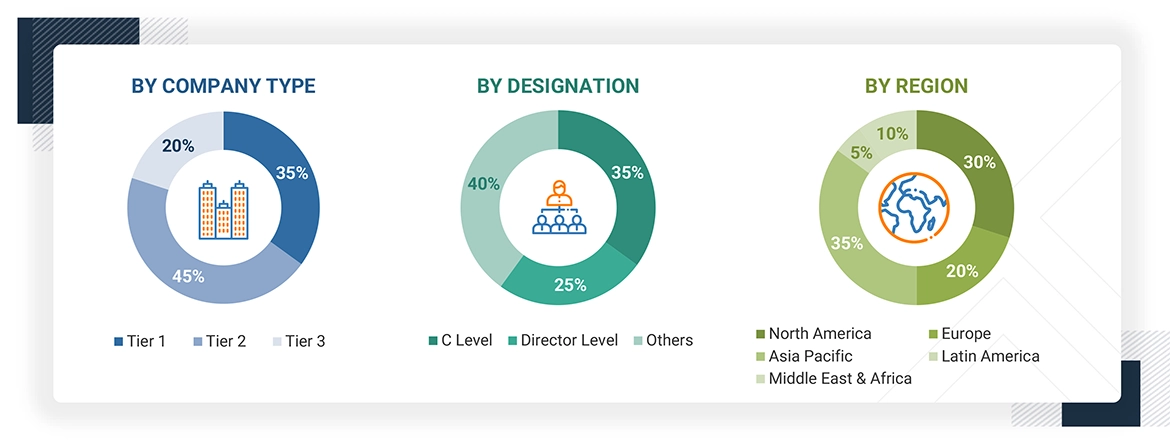

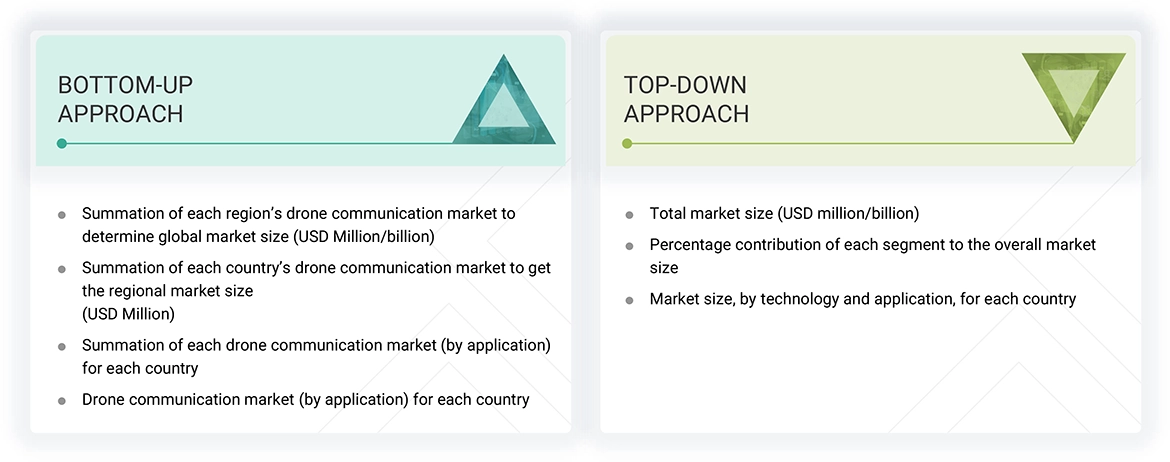

The research study conducted on the drone communication market involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, and Factiva, to identify and collect relevant information. Primary sources included industry experts from the market as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry. In-depth interviews of various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market as well as assess the growth prospects of the market. A deductive approach, also known as the bottom-up approach combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The share of companies in the drone communication market was determined based on secondary data made available through paid and unpaid sources and an analysis of the product portfolios of major companies. These companies were rated based on their performance and quality. These data points were further validated by primary sources. Secondary sources for this research study included corporate filings, such as annual reports, investor presentations, and financial statements from trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the drone communication market through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across different regions. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note 1: Others include sales, marketing, and product managers

Note 2: The tiers of companies have been defined based on their total revenue as of 2022.

Note 3: Tier 1 => USD 1 billion; tier 2 = between USD 100 million and USD 1 billion; and tier 3 = USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the Drone communication market. The research methodology used to estimate the market size includes the following details.

Key players in the market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews with industry stakeholders such as CEOs, technical advisors, military experts, and SMEs of leading companies operating in the Drone communication market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the Drone communication market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Drone Communication Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Drone communication market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the Drone communication market size was validated using the top-down and bottom-up approaches.

Market Definition

The drone communication market encompasses airborne technologies and systems enabling seamless data transmission and real-time communication between drones, ground control stations, and other platforms. It includes communication technologies, such as radio frequency (RF), satellite communication (SATCOM), and cellular networks (4G, 5G) to facilitate command and control, video streaming, telemetry data exchange, and beyond-visual-line-of-sight (BVLOS) operations. The market also covers systems and solutions for military, commercial, government & law enforcement, and consumer applications. These solutions and systems focus on enhancing operational range, network security, and reliability for critical missions.

Key Stakeholders

- Drone manufacturers

- Communication system providers

- Satellite operators

- Defense & government agencies

- Network & connectivity providers

- Unmanned Traffic Management (UTM) solution providers

- System integrators & technology firms

- Research & academic institutions

- Commercial & enterprise drone operators

Report Objectives

- To define, describe, segment, and forecast the size of the drone communication market based on component, application, technology, and region, and the drone communication service market based on connectivity.

- To forecast the size of various market segments within five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe

- To identify industry trends, market trends, and technology trends that are currently prevailing in the market

- To provide an overview of the regulatory landscape with respect to drone detection regulations across regions

- To analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders by identifying key market trends.

- To profile key market players and comprehensively analyze their market share and core competencies.

- To analyze the degree of competition in the market by identifying key growth strategies adopted by leading market players, such as acquisitions, product launches, contracts, and partnerships.

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market.

- To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

- Beyond Visual Line of Sight (BVLOS) Communication: It helps drones fly beyond the pilot’s direct view, making long-distance missions and autonomous operations more efficient.

- Mesh Networking: It allows drones to connect and communicate with each other, creating a flexible and self-repairing network for better reliability and coverage.

- Drone Communication Encryption: It protects drone data by securing transmissions, preventing cyber threats, hacking, and unauthorized access.

- Internet of Drones (IoD) and Vehicle-to-Everything (V2X) Communications: They support smooth data sharing between drones, ground systems, and vehicles, improving real-time awareness.

- Hybrid Communications: It combines different technologies like cellular, satellite, and radio links to ensure strong connectivity in various environments.

- SATCOM Integration: It uses satellite communication for long-distance drone operations, providing global coverage, low delay, and secure data transfer.

- Advancements in communication technologies

- Increasing procurement of UAVs in military applications

- Growing need for secure and encrypted communication

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Drone (UAV) Communication Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Drone (UAV) Communication Market