Breath Analyzer Market by Technology (Fuel Cell, Semiconductor Oxide Sensor, Others), End User (Law Enforcement Agencies, Enterprises, Individuals), Application, Region (North America, Europe, APAC, RoW) - Global Forecast to 2025

Market Growth Outlook Summary

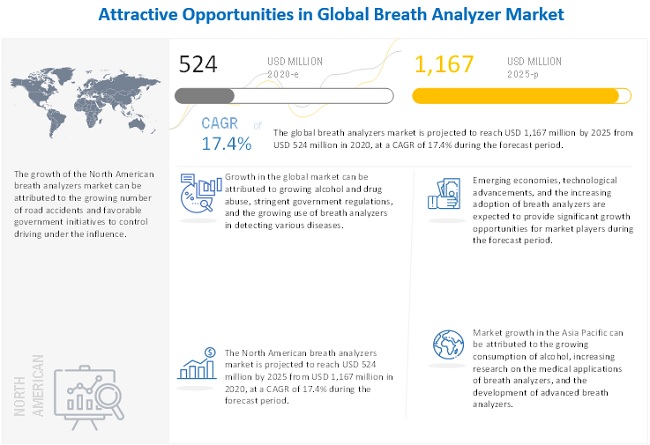

The global breath analyzer market growth forecasted to transform from $524 million in 2020 to $1,167 million by 2025, driven by a CAGR of 17.4%. Growth in this market can primarily be attributed to factors such as alcohol and drug abuse, stringent government regulations and increasing use of breathalyzers in detecting various diseases.

To know about the assumptions considered for the study, Request for Free Sample Report

Breath Analyzer Market Dynamics

Driver: Growing alcohol and drug abuse

In 2018, about 10,511 people in the US died because of drunk driving. Excessive alcohol consumption leads to an increased risk of developing more than 200 diseases, including liver cirrhosis and some cancers. In US almost 30 people die every day due to driving under the influence (DUI) Also, high blood alcohol content was observed in~20% of fatally injured drivers in accidents in developed countries. The growing number of road accidents caused by drunk driving and drug abuse has increased the demand for breath analyzers, as these devices assist in monitoring the presence of different compounds and measuring the blood alcohol content in a breath sample.

Restraint: Accuracy Concerns

At times, breath analyzers provide inaccurate results failing to distinguish alcohol from any other chemical compound that contains a methyl group structure. Some alcohol testing machines identify not only ethyl alcohol (found in alcoholic drinks) but also any compound with a similar molecular structure. In addition to this, lip gloss, mouthwash, dentures, paint, glue, thinners, cleaning solvents, foam used for hand hygiene, cigarettes, and even inhalers used for asthma can also alter the test results of breath analyzers.

Opportunity: Technological advancements

The global market is technology-driven and is projected to grow at a significant rate in the coming years. Owing to the lucrative potential of the market, a number of players are focusing on developing novel technologies and are continuously introducing accurate and easy-to-use breath analyzers. In August 2019, Y Combinator, an investment company, invested in SannTek Labs to work on a new kind of breathalyzer. This breathalyzer is designed to detect blood alcohol levels as well as the type of cannabis a person has consumed in the past 3 to 4 hours.

The fuel cell breath analyzer segment to hold the largest share of the global breath analyzer industry.

Based on technology, the global breath analyzer market is segmented into fuel cells, semiconductor oxide sensors, and other technologies (infrared spectroscopy and chemical crystals). The fuel cells segment accounted for the largest share of the global market. Fuel cells are the most widely used technology in breath analyzers. Fuel cell-based breath analyzers offer an extremely high level of accuracy, sensitivity, and reliability. They are specifically tuned to detect alcohol and do not require multiple sensors. These analyzers are considered the gold standard of handheld alcohol testers for both personal and professional use.

The alcohol detection segment to hold the largest share of the breath analyzer industry.

On the basis of application, the global breath analyzer market is segmented into alcohol detection, drug abuse detection, and medical applications. The alcohol detection segment accounted for the largest market share. This segment is also projected to register the highest CAGR during the forecast period. The growth of this segment is primarily driven by stringent government regulations for driving under the influence (DUI).

The law enforcement agencies segment to hold the largest share of the breath analyzer industry.

Based on end users, the global breath analyzer market is segmented into law enforcement agencies, enterprises, and individuals. The law enforcement agencies segment accounted for the largest share of the global market. Stringent safety laws against DUI and the rising scale of screening and evidential testing are driving the adoption of breath analyzers in law enforcement.

To know about the assumptions considered for the study, download the pdf brochure

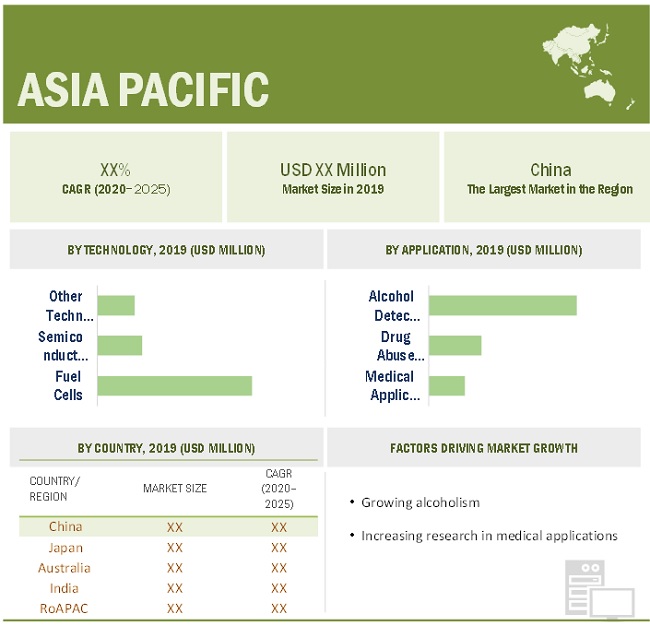

The Asia Pacific region of the breath analyzer industry to witness the highest growth during the forecast period.

Geographically, North America dominated the global breath analyzer market. However, the Asia Pacific market is expected to register the highest during the forecast period. The major factors driving the growth of the Asia Pacific market include as growing consumption of alcohol, increasing research on the medical applications of breath analyzers, and the development of advanced breath analyzers.

Some of the key players in this market are Drägerwerk AG & Co. KGaA (Germany), MPD, Inc (US), Lifeloc Technologies (US), BACtrack, Inc. (US), Quest Products, Inc. (US), Akers Biosciences, Inc. (US), Intoximeter, Inc. (US), AK GlobalTech Corporation (US), Alcohol Countermeasure Systems Corporation (Canada), EnviteC-Wismar GmbH (Germany), Lion Laboratories Ltd. (UK), Pas Systems International (US), Guth Laboratories, Inc (US), Alcolizer Technology (Australia), Alcopro, Inc (US), Andatech Private Ltd (Australia), Alere (US), C4 development (China), Advanced Safety Devices (US), Bedfont Scientific Limited (UK).

Scope of the Breath Analyzer Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$524 million |

|

Projected Revenue Size by 2025 |

$1,167 million |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 17.4% |

|

Market Driver |

Growing alcohol and drug abuse |

|

Market Opportunity |

Technological advancements |

This research report categorizes the global Breath Analyzer market to forecast revenue and analyze trends in each of the following submarkets:

By Technology

- Fuel Cell

- Semiconductor Oxide Sensor

- Others

By Application

- Alcohol Detection

- Drug abuse detection

- Medical Applications

By End User

- Law Enforcement Agencies

- Enterprises

- Individuals

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- RoE

-

Asia Pacific

- China

- Japan

- India

- Australia

- RoAPAC

-

RoW

- LATAM

- MEA

Recent Developments of Breath Analyzer Industry

- In 2020, Lifeloc Technologies launched LT7 and LX9 breathalyzers. These are US DOT/NHTSAapproved breath alcohol testers for law enforcement and workplace markets designed to be user-friendly.

- In 2019, Y Combinator, an investment company, invested in SannTek Labs to work on a new kind of breathalyzer. This breathalyzer is designed to detect blood alcohol levels as well as the type of cannabis a person has consumed in the past 3 to 4 hours.

- In 2019, Abbott and Intoximeters today signed an agreement for Intoximeters to market Abbott's SoToxaTM Mobile Test System – a handheld oral fluid roadside testing solution that rapidly and reliably detects recent drug use – alongside Intoximeters' Alco-Sensor brand breath alcohol-testing products

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the breath analyzer market?

The breath analyzer market boasts a total revenue value of $1,167 million by 2025.

What is the estimated growth rate (CAGR) of the breath analyzer market?

The global market for breath analyzer has an estimated compound annual growth rate (CAGR) of 17.4% and a revenue size in the region of $524 million in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 BREATH ANALYZER INDUSTRY SCOPE (INCLUSIONS & EXCLUSIONS)

1.2.2 MARKETS COVERED

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

2.2 RESEARCH METHODOLOGY STEPS

FIGURE 1 RESEARCH METHODOLOGY: BREATH ANALYZER MARKET

FIGURE 2 RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 Secondary sources

2.2.2 PRIMARY DATA

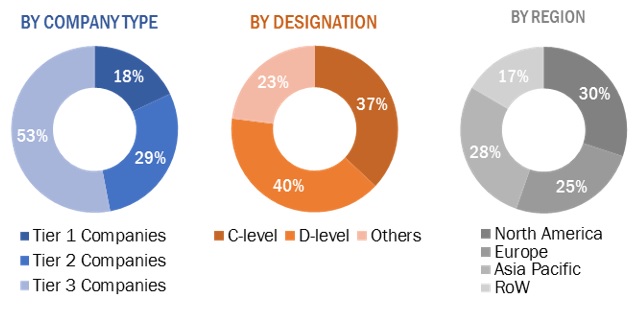

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2.2.1 Primary sources

TABLE 1 GLOBAL MARKET: PRIMARY RESEARCH

FIGURE 1 KEY INDUSTRY INSIGHTS

2.3 MARKET SIZE ESTIMATION METHODOLOGY

FIGURE 2 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 3 REVENUE-BASED MARKET SIZE ESTIMATION: GLOBAL MARKET

2.4 MARKET DATA ESTIMATION AND TRIANGULATION

FIGURE 4 DATA TRIANGULATION METHODOLOGY

2.5 ASSUMPTIONS FOR THE STUDY

2.5.1 COVID-19 SPECIFIC ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 5 BREATH ANALYZER MARKET, BY TECHNOLOGY, 2020 VS. 2025

FIGURE 6 BREATH ANALYZER INDUSTRY, BY APPLICATION, 2020 VS. 2025

FIGURE 7 MARKET, BY END USER, 2020 VS. 2025

FIGURE 8 GEOGRAPHICAL SNAPSHOT OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 BREATH ANALYZER MARKET OVERVIEW

FIGURE 9 GROWING ALCOHOL & DRUG ABUSE TO DRIVE THE ADOPTION OF BREATH ANALYZERS

4.2 NORTH AMERICA: BREATH ANALYZER INDUSTRY, BY TECHNOLOGY & COUNTRY (2019)

FIGURE 10 THE US ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2019

4.3 MARKET SHARE, BY TECHNOLOGY, 2020 VS. 2025

FIGURE 11 FUEL CELLS SEGMENT WILL CONTINUE TO DOMINATE THE MARKET IN 2025

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 12 BREATH ANALYZER MARKET: DRIVERS, RESTRAINTS, AND OPPORTUNITIES

5.2.1 DRIVERS

5.2.1.1 Growing alcohol and drug abuse

5.2.1.2 Stringent government regulations

5.2.1.3 Growing use of breath analyzers in detecting various diseases

5.2.2 RESTRAINTS

5.2.2.1 Accuracy concerns

5.2.2.2 Hygiene concerns

5.2.3 OPPORTUNITIES

5.2.3.1 Technological advancements

5.2.3.2 Emerging markets

5.2.3.3 Increasing adoption of breath analyzers

5.3 VALUE CHAIN ANALYSIS

FIGURE 13 MAJOR VALUE IS ADDED DURING THE MANUFACTURING & ASSEMBLY PHASE

5.3.1 RESEARCH & DEVELOPMENT (R&D)

5.3.2 MANUFACTURING & ASSEMBLY

5.3.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

5.4 ECOSYSTEM ANALYSIS OF THE BREATH ANALYZER MARKET

FIGURE 14 ECOSYSTEM ANALYSIS

5.5 IMPACT OF THE COVID-19 PANDEMIC ON THE MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 TABLE BREATH ANALYZER MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 BARGAINING POWER OF SUPPLIERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 REGULATORY GUIDELINES: BREATH ANALYZER MARKET

5.8 PATENT ANALYSIS

FIGURE 15 TOP COMPANIES WITH THE HIGHEST NUMBER OF PATENTS

FIGURE 16 NO. OF PATENTS GRANTED IN THE LAST 10 YEARS

TABLE 3 US: TOP PATENT OWNERS IN THE LAST 10 YEARS

5.9 PRICING ANALYSIS

TABLE 4 PRICING RANGE OFFERED BY VENDORS ON VARIED DEVICES

6 BREATH ANALYZER MARKET, BY TECHNOLOGY (Page No. - 51)

6.1 INTRODUCTION

TABLE 5 BREATH ANALYZER MARKET, BY TECHNOLOGY, 2018–2025

6.2 FUEL CELLS

6.2.1 HIGH LEVEL OF ACCURACY AND CONSTANT INNOVATION ARE FUELING THE MARKET GROWTH

TABLE 6 FUEL CELL-BASED BREATH ANALYZER MARKET, BY REGION, 2018–2025

TABLE 7 NORTH AMERICA: FUEL CELL-BASED BREATH ANALYZER MARKET, BY COUNTRY, 2018–2025

TABLE 8 EUROPE: FUEL CELL-BASED BREATH ANALYZER MARKET, BY COUNTRY, 2018–2025

TABLE 9 APAC: FUEL CELL-BASED BREATH ANALYZER MARKET, BY COUNTRY, 2018–2025

TABLE 10 ROW: FUEL CELL-BASED BREATH ANALYZER MARKET, BY REGION, 2018–2025

6.3 SEMICONDUCTOR OXIDE SENSORS

6.3.1 NORTH AMERICA SHOWS HIGHEST DEMAND FOR SEMICONDUCTOR-BASED ANALYZERS

TABLE 11 SEMICONDUCTOR OXIDE SENSOR BREATH ANALYZER MARKET, BY REGION, 2018–2025

TABLE 12 NORTH AMERICA: SEMICONDUCTOR OXIDE SENSOR BREATH ANALYZER MARKET, BY COUNTRY, 2018–2025

TABLE 13 EUROPE: MARKET, BY COUNTRY, 2018–2025

TABLE 14 APAC: MARKET, BY COUNTRY, 2018–2025

TABLE 15 ROW: BREATH ANALYZER INDUSTRY, BY REGION, 2018–2025

6.4 OTHER TECHNOLOGIES

TABLE 16 OTHER BREATH ANALYZER TECHNOLOGIES, BY REGION, 2018–2025

TABLE 17 NORTH AMERICA: OTHER BREATH ANALYZER TECHNOLOGIES, BY COUNTRY, 2018–2025

TABLE 18 EUROPE: OTHER BREATH ANALYZER TECHNOLOGIES, BY COUNTRY, 2018–2025

TABLE 19 APAC: OTHER BREATH ANALYZER TECHNOLOGIES, BY COUNTRY, 2018–2025

TABLE 20 ROW: OTHER BREATH ANALYZER TECHNOLOGIES, BY REGION, 2018–2025

7 BREATH ANALYZER MARKET, BY END USER (Page No. - 59)

7.1 INTRODUCTION

TABLE 21 GLOBAL BREATH ANALYZER INDUSTRY, BY END USER, 2018–2025

7.2 LAW ENFORCEMENT AGENCIES

7.2.1 INCREASING ACCIDENTS LINKED TO DUI RESULTING IN HIGHER ADOPTION OF BREATH ANALYZERS

TABLE 22 BREATH ANALYZER INDUSTRY FOR LAW ENFORCEMENT AGENCIES, BY REGION, 2018–2025

TABLE 23 NORTH AMERICA: MARKET FOR LAW ENFORCEMENT AGENCIES, BY COUNTRY, 2018–2025

TABLE 24 EUROPE: MARKET FOR LAW ENFORCEMENT AGENCIES, BY COUNTRY, 2018–2025

TABLE 25 APAC: MARKET FOR LAW ENFORCEMENT AGENCIES, BY COUNTRY, 2018–2025

TABLE 26 ROW: BREATH ANALYZER INDUSTRY FOR LAW ENFORCEMENT AGENCIES, BY REGION, 2018–2025

7.3 ENTERPRISES

7.3.1 INCREASING ADOPTION OF BREATHALYZERS AT WORKPLACES IS DRIVING THE MARKET GROWTH

TABLE 27 BREATH ANALYZER INDUSTRY FOR ENTERPRISES, BY REGION, 2018–2025

TABLE 28 NORTH AMERICA: MARKET FOR ENTERPRISES, BY COUNTRY, 2018–2025

TABLE 29 EUROPE: MARKET FOR ENTERPRISES, BY COUNTRY, 2018–2025

TABLE 30 APAC: MARKET FOR ENTERPRISES, BY COUNTRY, 2018–2025

TABLE 31 ROW: MARKET FOR ENTERPRISES, BY COUNTRY, 2018–2025

7.4 INDIVIDUALS

7.4.1 AWARENESS AND AFFORDABILITY OF PERSONAL BREATHALYZERS ARE DRIVING DEMAND AMONG INDIVIDUALS

TABLE 32 BREATH ANALYZER INDUSTRY FOR INDIVIDUALS, BY REGION, 2018–2025

TABLE 33 NORTH AMERICA: FOR INDIVIDUALS, BY COUNTRY, 2018–2025

TABLE 34 EUROPE: MARKET FOR INDIVIDUALS, BY COUNTRY, 2018–2025

TABLE 35 APAC: MARKET FOR INDIVIDUALS, BY COUNTRY, 2018–2025

TABLE 36 ROW: MARKET FOR INDIVIDUALS, BY REGION, 2018–2025

8 BREATH ANALYZER MARKET, BY APPLICATION (Page No. - 67)

8.1 INTRODUCTION

TABLE 37 GLOBAL MARKET, BY APPLICATION, 2018–2025

8.2 ALCOHOL DETECTION

8.2.1 INCREASING ROAD ACCIDENTS AND STRINGENT DUI LAWS TO DRIVE THE MARKET GROWTH

TABLE 38 BREATH ANALYZER INDUSTRY FOR ALCOHOL DETECTION, BY REGION, 2018–2025

TABLE 39 NORTH AMERICA: MARKET FOR ALCOHOL DETECTION, BY COUNTRY, 2018–2025

TABLE 40 EUROPE: MARKET FOR ALCOHOL DETECTION, BY COUNTRY, 2018–2025

TABLE 41 APAC: MARKET FOR ALCOHOL DETECTION, BY COUNTRY, 2018–2025

TABLE 42 ROW: MARKET FOR ALCOHOL DETECTION, BY REGION, 2018–2025

8.3 DRUG ABUSE DETECTION

8.3.1 TECHNOLOGICAL ADVANCEMENTS TO SUPPORT MARKET GROWTH

TABLE 43 BREATH ANALYZER INDUSTRY FOR DRUG ABUSE DETECTION, BY REGION, 2018–2025

TABLE 44 NORTH AMERICA: BREATH ANALYZER INDUSTRY FOR DRUG ABUSE DETECTION, BY COUNTRY, 2018–2025

TABLE 45 EUROPE: MARKET FOR DRUG ABUSE DETECTION, BY COUNTRY, 2018–2025

TABLE 46 APAC: MARKET FOR DRUG ABUSE DETECTION, BY COUNTRY, 2018–2025

TABLE 47 ROW: MARKET FOR DRUG ABUSE DETECTION, BY REGION, 2018–2025

8.4 MEDICAL APPLICATIONS

8.4.1 HIGH PREVALENCE OF TUBERCULOSIS TO DRIVE MARKET GROWTH

TABLE 48 BREATH ANALYZER INDUSTRY FOR MEDICAL APPLICATIONS, BY REGION, 2018–2025

TABLE 49 NORTH AMERICA: FOR MEDICAL APPLICATIONS, BY COUNTRY, 2018–2025

TABLE 50 EUROPE: MARKET FOR MEDICAL APPLICATIONS, BY COUNTRY, 2018–2025

TABLE 51 APAC: MARKET FOR MEDICAL APPLICATIONS, BY COUNTRY, 2018–2025

TABLE 52 ROW: MARKET FOR MEDICAL APPLICATIONS, BY REGION, 2018–2025

9 BREATH ANALYZER MARKET, BY REGION (Page No. - 76)

9.1 INTRODUCTION

TABLE 53 GLOBAL BREATH ANALYZER INDUSTRY, BY REGION, 2018–2025

9.2 NORTH AMERICA

FIGURE 17 NORTH AMERICA: BREATH ANALYZER INDUSTRY SNAPSHOT

TABLE 54 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025

TABLE 55 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2018–2025

TABLE 56 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2025

TABLE 57 NORTH AMERICA: MARKET, BY END USER, 2018–2025

9.2.1 US

9.2.1.1 Growing number of road accidents to drive market growth

TABLE 58 US: BREATH ANALYZER MARKET, BY TECHNOLOGY, 2018–2025

TABLE 59 US: MARKET, BY APPLICATION, 2018–2025

TABLE 60 US: MARKET, BY END USER, 2018–2025

9.2.2 CANADA

9.2.2.1 Government initiatives to support market growth

TABLE 61 CANADA: BREATH ANALYZER INDUSTRY, BY TECHNOLOGY, 2018–2025

TABLE 62 CANADA: MARKET, BY APPLICATION, 2018–2025

TABLE 63 CANADA: MARKET, BY END USER, 2018–2025

9.3 EUROPE

TABLE 64 EUROPE: BREATH ANALYZER MARKET, BY COUNTRY, 2018–2025

TABLE 65 EUROPE: MARKET, BY TECHNOLOGY, 2018–2025

TABLE 66 EUROPE: MARKET, BY APPLICATION, 2018–2025

TABLE 67 EUROPE: MARKET, BY END USER, 2018–2025

9.3.1 GERMANY

9.3.1.1 Germany dominates the breath analyzer industry in Europe

TABLE 68 GERMANY: MARKET, BY TECHNOLOGY, 2018–2025

TABLE 69 GERMANY: MARKET, BY APPLICATION, 2018–2025

TABLE 70 GERMANY: MARKET, BY END USER, 2018–2025

9.3.2 UK

9.3.2.1 Government initiatives to drive the adoption of breath analyzers in the UK

TABLE 71 UK: BREATH ANALYZER MARKET, BY TECHNOLOGY, 2018–2025

TABLE 72 UK: MARKET, BY APPLICATION, 2018–2025

TABLE 73 UK: MARKET, BY END USER, 2018–2025

9.3.3 FRANCE

9.3.3.1 Growing number of road accidents to propel the adoption of breath analyzers in France

TABLE 74 FRANCE: BREATH ANALYZER INDUSTRY, BY TECHNOLOGY, 2018–2025

TABLE 75 FRANCE: BREATH ANALYZER INDUSTRY, BY APPLICATION, 2018–2025

TABLE 76 FRANCE: MARKET, BY END USER, 2018–2025

9.3.4 ROE

TABLE 77 ROE: BREATH ANALYZER MARKET, BY TECHNOLOGY, 2018–2025

TABLE 78 ROE: MARKET, BY APPLICATION, 2018–2025

TABLE 79 ROE: MARKET, BY END USER, 2018–2025

9.4 ASIA PACIFIC

FIGURE 18 ASIA PACIFIC: BREATH ANALYZER INDUSTRY SNAPSHOT

TABLE 80 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025

TABLE 81 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2025

TABLE 82 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2025

TABLE 83 ASIA PACIFIC: BREATH ANALYZER INDUSTRY, BY END USER, 2018–2025

9.4.1 CHINA

9.4.1.1 China dominates the APAC market

TABLE 84 CHINA: BREATH ANALYZER MARKET, BY TECHNOLOGY, 2018–2025

TABLE 85 CHINA: MARKET, BY APPLICATION, 2018–2025

TABLE 86 CHINA: MARKET, BY END USER, 2018–2025

9.4.2 JAPAN

9.4.2.1 Harsh drunken driving laws and technological development drive market growth in Japan

TABLE 87 JAPAN: BREATH ANALYZER INDUSTRY, BY TECHNOLOGY, 2018–2025

TABLE 88 JAPAN: MARKET, BY APPLICATION, 2018–2025

TABLE 89 JAPAN: MARKET, BY END USER, 2018–2025

9.4.3 AUSTRALIA

9.4.3.1 Strict government regulations to spur the market growth

TABLE 90 AUSTRALIA: BREATH ANALYZER MARKET, BY TECHNOLOGY, 2018–2025

TABLE 91 AUSTRALIA: MARKET, BY APPLICATION, 2018–2025

TABLE 92 AUSTRALIA: MARKET, BY END USER, 2018–2025

9.4.4 INDIA

9.4.4.1 India is among the fastest-growing markets for breath analyzers

TABLE 93 INDIA: BREATH ANALYZER INDUSTRY, BY TECHNOLOGY, 2018–2025

TABLE 94 INDIA: MARKET, BY APPLICATION, 2018–2025

TABLE 95 INDIA: BREATH ANALYZER INDUSTRY, BY END USER, 2018–2025

9.4.5 ROAPAC

TABLE 96 ROAPAC: BREATH ANALYZER MARKET, BY TECHNOLOGY, 2018–2025

TABLE 97 ROAPAC: MARKET, BY APPLICATION, 2018–2025

TABLE 98 ROAPAC: MARKET, BY END USER, 2018–2025

9.5 REST OF THE WORLD

TABLE 99 ROW: BREATH ANALYZER INDUSTRY, BY REGION, 2018–2025

TABLE 100 ROW: MARKET, BY TECHNOLOGY, 2018–2025

TABLE 101 ROW: MARKET, BY APPLICATION, 2018–2025

TABLE 102 ROW: MARKET, BY END USER, 2018–2025

9.5.1 LATIN AMERICA

9.5.1.1 Increasing incidence of DUI and drug overdose cases form a key growth driver in LATAM

TABLE 103 LATAM: BREATH ANALYZER MARKET, BY TECHNOLOGY, 2018–2025

TABLE 104 LATAM: MARKET, BY APPLICATION, 2018–2025

TABLE 105 LATAM: MARKET, BY END USER, 2018–2025

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Rising alcohol consumption and a growing emphasis on stringent laws support market growth in the MEA

TABLE 106 MEA: BREATH ANALYZER INDUSTRY, BY TECHNOLOGY, 2018–2025

TABLE 107 MEA: MARKET, BY APPLICATION, 2018–2025

TABLE 108 MEA: BREATH ANALYZER INDUSTRY, BY END USER, 2018–2025

10 COMPETITIVE LANDSCAPE (Page No. - 104)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES

FIGURE 19 MARKET EVALUATION FRAMEWORK: BREATH ANALYZER MARKET

10.2.1 MARKET PLAYER RANKING, 2019

FIGURE 20 GLOBAL BREATH ANALYZER INDUSTRY RANKING, BY KEY PLAYER, 2019

10.3 COMPANY EVALUATION MATRIX

10.3.1 STARS

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE PLAYERS

10.3.4 PARTICIPANTS

FIGURE 21 MNM VENDOR DIVE COMPARISON MATRIX: GLOBAL BREATH ANALYZER INDUSTRY

10.4 COMPETITIVE LEADERSHIP MAPPING (START-UPS)

10.4.1 PROGRESSIVE COMPANIES

10.4.2 STARTING BLOCKS

10.4.3 RESPONSIVE COMPANIES

10.4.4 DYNAMIC COMPANIES

FIGURE 22 MNM VENDOR DIVE COMPARISON MATRIX FOR START-UPS: GLOBAL MARKET

10.5 PRODUCT FOOTPRINTS OF MAJOR PLAYERS IN THE GLOBAL BREATH ANALYZER INDUSTRY

FIGURE 23 PRODUCT PORTFOLIO ASSESSMENT: GLOBAL BREATH ANALYZER INDUSTRY

10.6 GEOGRAPHIC FOOTPRINTS OF MAJOR PLAYERS IN THE GLOBAL BREATH ANALYZER INDUSTRY

FIGURE 24 GEOGRAPHIC REACH ASSESSMENT: GLOBAL BREATH ANALYZER INDUSTRY

10.7 COMPETITIVE SCENARIO

10.7.1 PRODUCT LAUNCHES

TABLE 109 PRODUCT LAUNCHES (2018–2020)

10.7.2 DEALS

TABLE 110 DEALS: GLOBAL BREATH ANALYZER INDUSTRY (2018–2020)

10.7.3 OTHER DEVELOPMENTS

TABLE 111 OTHER DEVELOPMENTS: BREATH ANALYZERS MARKET (2018–2020)

11 COMPANY PROFILES (Page No. - 114)

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1 MAJOR PLAYERS

11.1.1 ALCOHOL COUNTERMEASURE SYSTEMS CORPORATION

11.1.2 BACTRACK

11.1.3 DRÄGERWERK AG & CO. KGAA

FIGURE 25 DRÄGERWERK: COMPANY SNAPSHOT (2019)

11.1.4 LIFELOC TECHNOLOGIES

FIGURE 26 LIFELOC TECHNOLOGIES: COMPANY SNAPSHOT (2019)

11.1.5 INTOXIMETERS

11.1.6 ALERE

FIGURE 27 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2019)

11.1.7 AK GLOBALTECH CORPORATION

11.1.8 AKERS BIOSCIENCES

FIGURE 28 AKERS BIOSCIENCES: COMPANY SNAPSHOT (2019)

11.1.9 ENVITEC WISMAR

11.1.10 QUEST PRODUCTS

11.2 OTHER PLAYERS

11.2.1 LION LABORATORIES

11.2.2 ANDATECH PRIVATE LIMITED

11.2.3 C4 DEVELOPMENT

11.2.4 CMI (AN MPD COMPANY)

11.2.5 ADVANCED SAFETY DEVICES

11.2.6 ALCOLIZER TECHNOLOGY

11.2.7 BEDFONT SCIENTIFIC

11.2.8 PAS SYSTEMS INTERNATIONAL

11.2.9 ALCOPRO

11.2.10 GUTH LABORATORIES

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 150)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for Breath analyzer market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter market breakdown and data triangulation was used to estimate the market size of segments and subsegments

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, D&B, Bloomberg Business, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases.

Primary Research

The breath analyzer market comprises several stakeholders such as breath analzyer device vendors, manufacturers, suppliersdistributors and service providers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the breath analyzer market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the breath analyzer market.

Report Objectives

- To define, describe, and forecast the breath analzyer market on the basis of technology, application and end user

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints and opportunities)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the breath analzyer market segments with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To profile the key players and analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches & approvals; agreements, partnerships, & collaborations; expansions; and acquisitions in the breath analzyer market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global breath analyzer market report

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Market outlook for the top 10 for Breath testing Market

Alere Inc. (Abbott Laboratories): Alere has a strong presence in the breath testing market, offering a variety of testing products including breathalyzers for alcohol testing and breath-based tests for diagnosing various health conditions. With a focus on innovation and research, the company is well-positioned to maintain its dominance in the market.

Koninklijke Philips N.V.: Philips has a strong position in the medical device industry, and its breath testing products include breath analysis systems for diagnosing and monitoring a range of health conditions. The company is well-positioned to take advantage of growing demand for non-invasive, portable diagnostic devices.

Oridion Systems Ltd. (Medtronic plc): Oridion Systems specializes in breath sampling and analysis technologies for medical applications. With a focus on improving patient care through accurate and reliable diagnostics, the company is poised for continued growth in the breath testing market.

Siemens Healthineers AG: Siemens Healthineers offers a range of breath testing products for various medical applications, including the diagnosis and monitoring of respiratory diseases. The company's innovative products and strong research and development capabilities make it well-positioned to capitalize on the growing demand for breath testing.

Drägerwerk AG & Co. KGaA: Drägerwerk offers a variety of breath testing products for both medical and industrial applications, including breathalyzers for alcohol testing and breath-based tests for detecting drugs and other substances. The company's focus on innovation and quality has helped it establish a strong presence in the breath testing market.

Aerocrine AB (Circassia Pharmaceuticals plc): Aerocrine specializes in breath testing products for the diagnosis and management of respiratory diseases, such as asthma and COPD. The company's focus on precision medicine and patient-centered care has helped it gain a strong foothold in the market.

Bedfont Scientific Ltd.: Bedfont Scientific offers a range of breath testing products for medical and industrial applications, including breathalyzers for alcohol testing and breath-based tests for diagnosing various health conditions. With a focus on innovation and quality, the company is well-positioned to capitalize on the growing demand for breath testing.

Ndd Medizintechnik AG: Ndd Medizintechnik specializes in diagnostic and monitoring devices for respiratory diseases, including a range of breath testing products. The company's focus on precision and accuracy has helped it establish a strong reputation in the market.

MGC Diagnostics Corporation (Hill-Rom Holdings, Inc.): MGC Diagnostics offers a range of breath testing products for the diagnosis and management of respiratory diseases, as well as for metabolic testing. With a focus on improving patient care through accurate and reliable diagnostics, the company is well-positioned to capitalize on the growing demand for breath testing.

FAN GmbH: FAN offers a range of breath testing products for medical and industrial applications, including breathalyzers for alcohol testing and breath-based tests for detecting drugs and other substances. With a focus on innovation and quality, the company is well-positioned to take advantage of the growing demand for breath testing.

Growth drivers for Breath testing Market from macro to micro

Macro-level drivers:

- Increasing prevalence of respiratory diseases: The rising prevalence of respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), and lung cancer is driving demand for diagnostic tools such as breath tests.

- Growing focus on non-invasive diagnostics: There is a growing trend towards non-invasive diagnostics, as patients seek less invasive and more comfortable diagnostic procedures. Breath testing offers a non-invasive, painless and easy-to-administer diagnostic option, making it an attractive choice for both patients and healthcare providers.

- Technological advancements: Advancements in technology have led to the development of more accurate and reliable breath testing devices, which are increasingly being used for a wide range of applications.

- Increasing awareness of the benefits of early diagnosis: Early diagnosis is essential for effective treatment of respiratory diseases, and there is growing awareness among patients and healthcare providers of the importance of early diagnosis. This is driving demand for more accurate and reliable diagnostic tools such as breath tests.

- Growing demand for personalized medicine: The trend towards personalized medicine is driving demand for diagnostic tools that can provide targeted and personalized treatment options. Breath testing offers a non-invasive way to monitor disease progression and response to treatment, making it an attractive option for personalized medicine.

Micro-level drivers:

- Increasing adoption of breath testing in clinical settings: Breath testing is increasingly being used in clinical settings for the diagnosis and management of respiratory diseases, as well as for other applications such as drug testing and alcohol testing.

- Rising demand for portable and point-of-care testing devices: There is a growing demand for portable and point-of-care breath testing devices that can provide rapid and accurate results in a variety of settings, from hospitals to remote locations.

- Expansion of breath testing applications: Breath testing is being increasingly used for a wider range of applications, including the diagnosis and monitoring of metabolic disorders, cancer, and infectious diseases.

- Growing investment in research and development: There is a growing investment in research and development in the breath testing market, with companies investing in new technologies and applications to meet the growing demand for more accurate and reliable diagnostic tools.

Hypothetic challenges of Breath testing Market in Future

Limited accuracy: Although breath testing has improved significantly over the years, there are still limitations to its accuracy. False-positive and false-negative results can occur due to factors such as environmental contaminants, diet, and medication use. If the accuracy of breath testing is not improved, it could limit the adoption of this technology in clinical practice.

Competition from other diagnostic methods: While breath testing is non-invasive and convenient, it may face competition from other diagnostic methods that are more accurate or provide more detailed information. For example, imaging tests such as CT scans and X-rays can provide detailed information on the structure of the respiratory system, while blood tests can provide more comprehensive information on the body's chemistry.

Regulatory challenges: The breath testing market is subject to regulatory oversight, and changes in regulatory requirements could impact the development and commercialization of new breath testing products. In addition, compliance with regulatory requirements can be costly and time-consuming, which could limit the growth of smaller companies in the market.

Reimbursement challenges: The reimbursement landscape for breath testing can be complex and varies by geography and application. The lack of reimbursement or low reimbursement rates for breath testing products could limit their adoption and use in clinical practice.

Limited awareness and adoption: Despite the benefits of breath testing, there may be limited awareness and adoption of the technology among healthcare providers and patients. This could limit the growth of the breath testing market, particularly in regions where healthcare systems are less developed.

Privacy concerns: Breath testing involves the collection of personal data, and there may be privacy concerns related to the storage and use of this data. As with other medical devices, regulatory bodies will need to ensure that breath testing products comply with privacy regulations and protect patient data.

Future use cases of Breath testing Market along with commentary of adaption, market potential, risk

Infectious disease diagnosis: Breath testing has the potential to be used for the diagnosis of infectious diseases such as COVID-19 and tuberculosis. Breath testing for infectious diseases could be faster, cheaper, and less invasive than traditional testing methods, making it an attractive option for screening large populations. However, there are risks associated with the potential spread of contagious diseases through breath testing devices, which would need to be carefully managed.

Cancer screening and diagnosis: Breath testing has shown promise for the detection of early-stage lung cancer, and there is potential for its use in the diagnosis and monitoring of other types of cancer. The market potential for breath testing in cancer diagnosis is significant, as it could lead to earlier detection and better outcomes. However, accuracy and specificity are still major challenges in the use of breath tests for cancer screening and diagnosis.

Metabolic disorder diagnosis: Breath testing has the potential to be used for the diagnosis and monitoring of metabolic disorders such as diabetes and obesity. The market potential for breath testing in metabolic disorder diagnosis is significant, as it could lead to earlier detection and better management of these diseases. However, accuracy and specificity are still major challenges in the use of breath tests for metabolic disorder diagnosis.

Drug and alcohol testing: Breath testing is already widely used for the detection of alcohol and drug use, and there is potential for its use in other applications such as monitoring medication adherence. The market potential for breath testing in drug and alcohol testing is significant, as it could lead to more accurate and reliable testing methods. However, privacy concerns and regulatory requirements are important factors that need to be considered in this application.

Sports and fitness: Breath testing has the potential to be used in sports and fitness applications, such as measuring oxygen consumption and lactate levels during exercise. The market potential for breath testing in sports and fitness is significant, as it could lead to more accurate and personalized training regimens. However, accuracy and reliability are important factors that need to be considered in this application.

Industry impact of Breath testing Market

Healthcare: The healthcare industry is likely to be one of the biggest beneficiaries of the breath testing market. Breath testing has the potential to revolutionize the diagnosis and monitoring of several diseases, such as infectious diseases, cancer, and metabolic disorders. As a result, the healthcare industry could see significant improvements in patient outcomes and reduced costs associated with traditional diagnostic methods.

Pharmaceutical: The pharmaceutical industry could also be heavily impacted by the breath testing market. Breath testing has the potential to improve drug development and testing by providing a non-invasive and convenient way to measure drug efficacy and toxicity. In addition, breath testing could be used to monitor patient response to treatment and identify patients who may benefit from personalized medicine.

Automotive: The automotive industry could also be impacted by the breath testing market. Breath testing devices could be integrated into vehicles to monitor the driver's alcohol or drug use and prevent impaired driving. This could lead to increased safety on the roads and reduced costs associated with accidents caused by impaired driving.

Sports and fitness: The sports and fitness industry is also likely to be impacted by the breath testing market. Breath testing could be used to measure oxygen consumption and lactate levels during exercise, which could lead to more personalized and effective training regimens. This could benefit athletes and fitness enthusiasts by improving their performance and reducing the risk of injury.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Breath Analyzer Market