The study involved four major activities in estimating the current size of the ELISpot and FluoroSpot Assays Market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to eastimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (Doctors, Surgeons) and supply sides (ELISpot and FluoroSpot manufacturers and distributors).

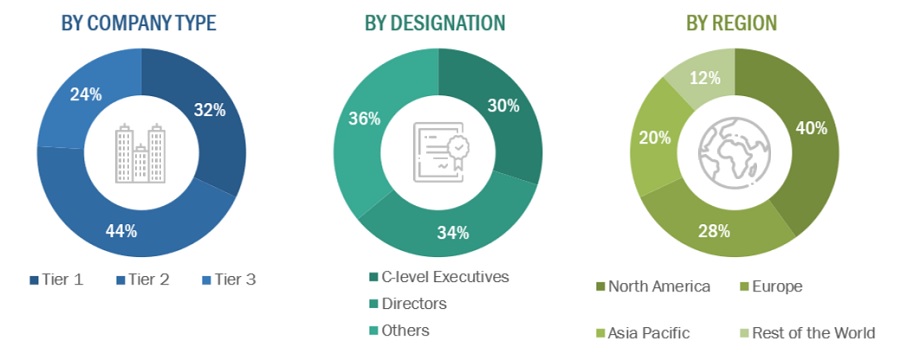

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2. Tiers of companies are defined based on their total revenue. As of 2021: Tier 1 = >USD 5 billion, Tier 2 = USD 500 million to USD 5 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ELISpot and FluoroSpot Assays Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and markets have been identified through extensive secondary research

-

The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the ELISpot and FluoroSpot Assays Market industry.

Market Definition

ELISpot (enzyme-linked immunospot) and FluoroSpot assays are used for the detection of analytes from immune cells. ELISpot assays are extensively used for monitoring immune responses, such as the quantification of cytokine or antibody-secreting cells. FluoroSpot assays, on the other hand, are a modification of the T-cell ELISpot assay. They are used for the detection of two cytokines released by a single T-cell. The FluoroSpot assay is based on the use of fluorescent conjugates, which can be visualized by fluorescence microscopy by an ELISpot reader equipped with a fluorescent light source.

These assays are used widely in immune monitoring and vaccine development. The analytes include T-cell-based cytokines (such as interferon-gamma, interleukins, and B-cell-based antibodies) and other analytes (such as granzymes from NK cells and macrophages). ELISpot and FluoroSpot analyzers examine the spots based on their color and size.

Market Stakeholders

-

Research and Consulting Companies

-

Hospital and Diagnostic Laboratories

-

Government Associations

-

Hospitals, Diagnostic Centers, and Medical Colleges

-

Teaching Hospitals and Academic Medical Centers

-

Venture Capitalists and Investors

-

Manufacturers and Vendors of ELISpot and FluoroSpot Kits, Analyzers, and Ancillary Products

-

Distributors of ELISpot and FluoroSpot Kits, Analyzers, and Ancillary Products

-

Healthcare Institutes

-

Pharmaceutical and Biopharmaceutical Companies

-

Diagnostic Associations

-

Research Institutes

-

Clinical Laboratories

-

Contract Research Manufacturers of ELISpot and FluoroSpot Assays

Report Objectives

-

To define, describe, and forecast the global ELISpot and FluoroSpot Assays Market based on product, Application, End User and Region.

-

To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, and industry-specific challenges)

-

To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the total market

-

To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the size of market segments with respect to four main regions—North America, Europe, Asia Pacific and the Rest of the World (RoW)

-

To strategically profile key players and comprehensively analyze their product portfolios, market shares, and core competencies

-

To track and analyze competitive developments such as acquisitions, expansions, new product launches, and partnerships in the ELISpot and FluoroSpot Assays Market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

-

Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company

-

Geographic Analysis: Further breakdown of the European ELISpot and FluoroSpot Assays Market into specific countries.

Growth opportunities and latent adjacency in EliSpot and FluoroSpot Assay Market