Europe Anti-Drone Market

Europe Anti-Drone Market by Electronic Systems, Kinetic Systems, Laser Systems, Hybrid Systems, Ground-based, Handheld, UAV-based, Detection & Disruption, Detection, Military & Defense, Commercial, and Homeland Security - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe anti-drone market is projected to reach USD 4.16 billion by 2030 from USD 1.24 billion in 2025, at a CAGR of 27.5% from 2025 to 2030. The Europe anti-drone market is driven by the steady rise in unauthorized drone activities around airports, critical infrastructure, military facilities, and public event venues, prompting governments and security agencies to adopt advanced counter-UAS solutions. Growing investments by the European Union, NATO member states, and national defense ministries are accelerating the deployment of radar, RF-based detection, EO/IR, and AI-enhanced mitigation platforms across both border protection and civilian airspace management operations.

KEY TAKEAWAYS

-

BY COUNTRYBy country, the UK led the market in 2024 with a share of ~20%.

-

BY SYSTEM TYPEThe laser systems segment is expected to register the highest CAGR during the forecast period.

-

BY PLATFORM TYPEThe ground-based segment is expected to dominate the market with a market share of ~70-75% in 2024.

-

BY VERTICALThe commercial segment is expected to grow at the highest CAGR of 30.9% during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSLeonardo S.p.A. and Thales were identified as key players in the European Anti-Drone market, given their strong market share and extensive product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESDrone Defense, Drone Major Ltd, among others, have distinguished themselves among SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The European anti-drone market is driven by the increasing frequency of unauthorized drone activity across airports, defense bases, government buildings, and critical infrastructure, prompting accelerated adoption of multi-layered counter-UAS systems. In the EU, strengthened border-security initiatives, expanding NATO defense modernization programs, and rising drone-related airspace violations near sensitive sites are significantly boosting market growth. Countries such as Germany, France, and the UK are advancing the procurement of integrated detection and mitigation technologies to safeguard airports, energy facilities, correctional institutions, and military zones.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The European anti-drone market is transitioning from traditional RF-, radar-, and optical-based systems toward integrated AI-enabled surveillance, electronic warfare (EW)-grade mitigation, and cybersecurity-focused counter-UAS architectures. This evolution is driven by rising drone incursions near airports, defense installations, power plants, prisons, and public events across the EU and UK—intensifying the need for faster, automated, and more precise threat response capabilities. Growing incidents of drone misuse for espionage, contraband delivery, and critical-infrastructure disruption are accelerating the adoption of advanced layered defense solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising Drone Intrusions Around Critical Infrastructure

-

Intensifying Defense Modernization and NATO Security Initiatives

Level

-

Highly Fragmented Regulatory Environment Across EU States

-

High System Costs and Complex Integration Requirements

Level

-

Expansion of Counter-UAS Solutions for Urban Security & Civil Protection

-

Growth of AI/ML-Driven, Sensor-Fusion-Based Counter-UAS Technologies

Level

-

Cybersecurity Risks and Vulnerabilities in Connected Counter-UAS Systems

-

Rapid Proliferation of Low-Cost, Evasive, and Autonomous Drones

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising Drone Intrusions Around Critical Infrastructure

A major driver for the market is the surge in unauthorized drone activity around airports, energy facilities, prisons, and government buildings. Incidents such as airport shutdowns, drone-assisted smuggling attempts, and surveillance near sensitive installations have pushed European governments to adopt advanced counter-UAS solutions. This growing threat landscape is accelerating the procurement of detection, identification, and mitigation systems, particularly in countries such as the UK, Germany, and France, which maintain stringent protocols for airspace safety and the protection of critical infrastructure.

Restraint: Highly Fragmented Regulatory Environment Across EU States

One of the restraints is Europe’s fragmented regulatory structure, where each country has different rules governing detection, jamming, and drone interception. Unlike the US, Europe lacks a unified framework that permits the active neutralization of drones using jammers or kinetic systems. This complicates product standardization, slows cross-border deployments, and forces vendors to tailor compliance for each market, significantly increasing cost and deployment timelines.

Opportunity: Expansion of Counter-UAS Solutions for Urban Security & Civil Protection

Europe’s dense urban environments and vulnerability to drone-enabled crime, protests, espionage, and unauthorized videography present a major opportunity. Cities are increasingly investing in airspace monitoring systems to protect public events, transportation hubs, and high-profile locations. The growing demand for cost-effective, scalable counter-UAS solutions tailored for law enforcement agencies—including handheld jammers, mobile units, and AI-based detection—offers significant growth potential for vendors.

Challenge: Cybersecurity Risks and Vulnerabilities in Connected Counter-UAS Systems

Counter-UAS platforms are increasingly integrated into digital command-and-control networks, making them vulnerable to potential cyberattacks. Cyber vulnerabilities, data interception risks, and system spoofing could compromise real-time threat identification or disrupt mitigation functions. As adversaries adopt cyber-enabled drone tactics, Europe faces rising challenges in securing counter-UAS networks, ensuring interoperability, and maintaining resilience against advanced electronic warfare techniques.

Europe Anti-Drone Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Thales deployed its EagleSHIELD counter-UAS solution at major European public events and critical infrastructure facilities, including government buildings and nuclear power stations. The system integrated multi-sensor fusion, jamming modules, and non-kinetic effectors to support layered airspace security under strict EU regulatory frameworks. | The solution delivered rapid threat classification and safe drone neutralization while maintaining compliance with European electromagnetic and safety regulations. Its interoperability with law-enforcement command centers strengthened coordinated responses, improved situational awareness, and enabled secure protection during high-density gatherings and VIP events. |

|

HENSOLDT deployed its Xpeller counter-UAS system at several European airports, defense bases, and public-event venues to strengthen protection against unauthorized drone intrusions. The deployments combined RF direction-finding, radar, electro-optical sensors, and AI-based threat evaluation to ensure end-to-end detection and tracking in dense civilian airspace. | The system enhanced detection accuracy in RF-congested environments, reduced false alarms, and enabled faster alerting to airport security teams. Seamless integration with European air-traffic management systems improved operational continuity, while modular components offered scalable protection for both small and large infrastructure sites. |

|

Dedrone partnered with several European police forces and border-security agencies to deploy its DedroneTracker.AI platform across urban areas, prisons, and sensitive border regions. The system utilized AI-driven RF analytics and cloud-enabled detection capabilities to monitor unauthorized drones and potential smuggling or surveillance attempts. | The deployments enhanced real-time drone identification and tracking across complex urban geographies, enabled faster response times for law enforcement teams, and reduced operational burden through automated classification. The cloud-based platform ensured continuous updates, improving threat recognition accuracy and long-term system performance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The European anti-drone ecosystem is shaped by strong defense modernization programs, EU-wide regulatory harmonization, and extensive R&D initiatives driven by national defense agencies, technology institutes, and cross-border industrial collaborations. Leading system developers—ranging from long-established defense primes to advanced electronic warfare and sensor-analytics firms—contribute to a mature manufacturing and integration landscape. Specialized integrators and certified distributors support deployment across military, homeland security, and civilian infrastructures, ensuring compliance with stringent EU aviation safety and counter-UAS standards. Demand is fueled by armed forces, border security agencies, airport authorities, energy infrastructure operators, and law-enforcement bodies seeking multilayered protection against increasingly sophisticated aerial threats.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Anti-Drone Market, By System Type

Directed-energy Laser Systems are expected to witness the fastest CAGR in Europe, driven by growing investment in next-generation counter-UAS technologies under EU defense cooperation programs and national modernization roadmaps. European defense ministries are increasingly prioritizing high-precision, low-collateral, and low-expenditure interception solutions to address the rising number of drone incursions near borders, airports, and critical infrastructure. Laser-based systems offer rapid engagement capabilities and high effectiveness against coordinated drone swarms—key concerns for European security planners. Ongoing demonstrations, NATO-aligned interoperability requirements, and expanding procurement of directed-energy prototypes further strengthen adoption momentum.

Europe Anti-Drone Market, By Platform Type

The UAV-based platform segment is expected to grow at the fastest CAGR across Europe as mobile airborne interceptors gain traction for real-time surveillance, rapid deployment, and enhanced engagement flexibility. European defense and internal security agencies are increasingly integrating interceptor drones with advanced sensor payloads to complement ground-based radars, RF analyzers, and jamming units. This approach enables better response against fast-moving or terrain-masked threats commonly encountered in dense urban environments and border zones. The ability of UAV-based counter-UAS platforms to provide extended coverage, dynamic threat tracking, and autonomous pursuit capabilities significantly boosts operational effectiveness.

Europe Anti-Drone Market, By Application

The Detection & Disruption segment is gaining strong traction in Europe as defense ministries, aviation regulators, and security agencies demand integrated counter-UAS capabilities to counter the rising number of UAV incursions around airports, military bases, power plants, prisons, and government facilities. European nations—including Germany, France, the UK, Italy, and the Netherlands—are investing heavily in multi-layered systems combining advanced radar, RF analyzers, EO/IR payloads, and AI-driven detection with robust disruption tools such as RF jammers, GNSS spoofing modules, laser- and microwave-based neutralizers. EU-led airspace protection mandates, NATO modernization programs, and heightened concerns over drone-enabled espionage, sabotage, and critical-infrastructure breaches are accelerating deployment of integrated detect-and-defeat architectures across both civilian and defense environments.

Europe Anti-Drone Market, By Vertical

The Military & Defense vertical is anticipated to lead the Europe anti-drone market, supported by heightened defense spending, NATO-aligned modernization programs, and the increasing frequency of drone-based surveillance and electronic warfare incidents across borders and conflict-adjacent regions. European armed forces are prioritizing multi-layered counter-UAS solutions that integrate detection, jamming, interception, and directed-energy capabilities to ensure rapid situational awareness and neutralization of threats. Ongoing procurement initiatives, driven by defense ministries in the UK, France, Germany, Poland, and other European nations, are further strengthening market growth within this segment. The rising need to protect military bases, forward-deployed units, ammunition depots, and strategic command centers reinforces the dominance of the defense vertical.

REGION

The UK is expected to be the fastest-growing country across the Europe Anti-Drone market during the forecast period

The UK is expected to exhibit the fastest CAGR in the Europe anti-drone market, driven by the rapid surge in drone-related security incidents near airports, defense sites, and public infrastructure. The country is accelerating large-scale adoption of counter-UAS technologies across defense, homeland security, and law enforcement agencies as part of its national airspace protection and counter-terrorism modernization programs. Significant investments in advanced radar, RF analytics, AI-based detection systems, and automated interception solutions are expanding the country’s counter-UAS capability footprint. Furthermore, the UK’s strong collaboration with NATO partners, increasing focus on protecting critical infrastructure such as airports, energy facilities, and government establishments, and active testing of emerging technologies—such as directed-energy systems and autonomous interceptors—are strengthening market growth.

Europe Anti-Drone Market: COMPANY EVALUATION MATRIX

The competitive landscape in Europe positions companies based on their technological sophistication, cross-border interoperability, and alignment with NATO and EU defense objectives. Established defense primes maintain strong market influence through mature, multi-layered counter-UAS portfolios and deep integration with national armed forces. HENSOLDT stands out with its advanced radar, RF detection, and electronic warfare capabilities, supported by broad deployment across European air-defense programs—reflecting high adoption in military, border protection, and critical infrastructure security. Thales is similarly prominent, leveraging its extensive command-and-control systems, sensor fusion expertise, and partnerships with European security agencies to reinforce its leadership position.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Leonardo S.p.A. (Italy)

- Thales (France)

- Blighter Surveillance Systems Limited (UK)

- MBDA (France)

- Saab AB (Sweden)

- HENSOLDT AG (Germany)

- ART (Advanced Radar Technologies) (Spain)

- Drone Defense (UK)

- Drone Major Ltd (UK)

- CERBAIR (France)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.04 Billion |

| Market Forecast in 2030 (Value) | USD 4.16 Billion |

| Growth Rate | CAGR of 27.5% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion/Million) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | UK, Germany, France, Italy, Spain, Nordics, Poland, Russia, Rest of Europe |

WHAT IS IN IT FOR YOU: Europe Anti-Drone Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| European Defense OEM | Comprehensive benchmarking of European counter-UAS technologies—covering radar-based detection, RF monitoring, EO/IR imaging, electronic warfare mitigation, and AI-assisted autonomous interception—across key regional vendors (Hensoldt, Leonardo, Thales, Rheinmetall, MBDA). The study also evaluated NATO-aligned interoperability, modular deployment architectures, and integration with European air-defense networks. |

|

| European Homeland Security & Border Protection Agency | Assessment of counter-UAS deployment models for airports, seaports, urban security zones, power plants, and border regions, with emphasis on compliance with EASA, EUROCONTROL, and national aviation safety guidelines. Included scenario-based evaluation of RF-jam-resistant sensors, passive monitoring solutions, and low-collateral mitigation tools suited for civilian airspace. |

|

| European Defense Systems Integrator | Performance analysis of AI/ML-driven threat detection algorithms, multi-sensor fusion engines, automated classification pipelines, and integrated command-and-control workflows tailored for European multi-domain defense missions. Included stress-testing for high-density civilian environments and electronic interference scenarios. |

|

RECENT DEVELOPMENTS

- June 2025 : Blighter Surveillance Systems Limited launched the B422LR, a long-range smart border surveillance radar capable of detecting a person up to 15 km away using only 4 Watts of power. This low-power, electronic-scanning radar supports all-weather operation and integrates AI-assisted software for improved target detection, making it ideal for border security and drone detection applications.

- April 2025 : Leonardo DRS introduced a modular and platform-agnostic Maritime Mission Equipment Package (MEP) for Unmanned Surface Vehicles (USVs). The system integrates advanced radars, EO/IR sensors, GPS spoofing tools, and kinetic/non-kinetic effectors to provide comprehensive counter-UAS capabilities for naval fleet protection.

- April 2025 : The Defence Science and Technology Agency (DSTA) and Thales established a joint laboratory to develop AI-driven technologies to enhance the Singapore Armed Forces’ counter-drone capabilities. The collaboration focuses on machine-learning software that enhances radar sensor performance, enabling faster and more accurate drone detection, thereby reducing false alarms and improving situational awareness.

Table of Contents

Methodology

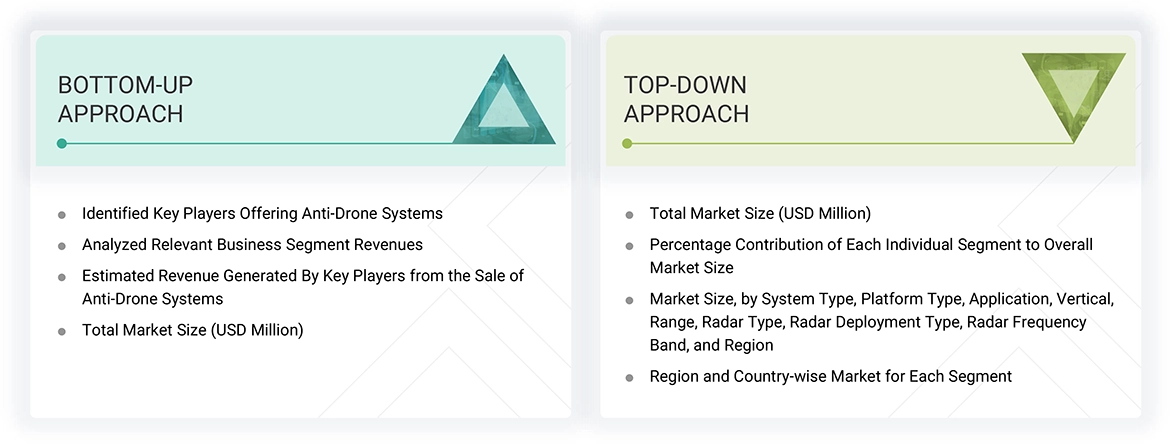

The study involved major activities in estimating the current market size for the Europe anti-drone market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Europe anti-drone market.

Secondary Research

The secondary research for this study involved gathering information from various credible sources. These included company annual reports, investor presentations, press releases, whitepapers, certified publications, and articles from reputable associations and government publications. Additional data was obtained from corporate filings, professional and trade associations, journals, and industry-recognized authors. Research from consortia, councils, and gold- and silver-standard websites, directories, and databases also contributed to the qualitative framework. Key global sources, such as the International Trade Centre (ITC) and the International Monetary Fund (IMF), were consulted to support and validate the market analysis.

Primary Research

Extensive primary research was conducted after understanding and analyzing the Europe anti-drone market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from demand- and supply-side vendors. Primary data was collected through questionnaires, e-mails, and telephonic interviews. Various departments within organizations, such as sales, operations, and administration, were contacted to provide a holistic viewpoint in the report..

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the anti-drone market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Europe Anti-Drone Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Europe anti-drone market through the process explained above, the overall market has been split into several segments. Data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using top-down and bottom-up approaches.

Market Definition

An anti-drone system refers to a comprehensive set of technologies and solutions designed to detect, monitor, identify, and mitigate threats posed by unauthorized or hostile drones. These systems are increasingly essential as the use of drones grows across various sectors, raising concerns over security, privacy, and safety. Anti-drone technologies employ a combination of sensors such as radar, radio frequency (RF) detectors, electro-optical and infrared cameras, and acoustic sensors to detect and track drones in real time accurately. Once detected, these systems can neutralize the threat through various disruption methods, including RF jamming, GPS spoofing, directed energy weapons such as lasers, or physical interception. Anti-drone solutions safeguard critical infrastructure, military installations, airports, public gatherings, and sensitive government or commercial sites from potential risks, such as espionage, smuggling, sabotage, or attacks.

Key Stakeholders

- Brand Product Manufacturers/Original Equipment Manufacturers (OEMs)/Original Device Manufacturers (ODMs)

- Anti-drones Product Manufacturers

- Anti-Drone Material and Component Suppliers

- Manufacturing Equipment Suppliers

- System Integrators

- Technology/IP Developers

- Consulting and Market Research Service Providers

- Government and Military Agencies

- Anti-drones-related Associations, Organizations, Forums, and Alliances

- Venture Capitalists and Startups

- Research and Educational Institutes

- Distributors and Resellers

- End Users

Report Objectives

- To define, describe, and forecast the Europe anti-drone market size, by system type, platform type, application, vertical, range, radar type, radar deployment type, and radar frequency band, in terms of value

- To define, describe, and forecast the Europe anti-drone market size, by vertical, in terms of volume

- To provide detailed insights regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze emerging applications and standards in the Europe anti-drone market

- To examine manufacturers of anti-drone solutions, their strategies, production plans, and the overall value chain, including material and component suppliers

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the market opportunities for stakeholders and provide a comprehensive competitive landscape analysis

- To provide a detailed overview of the anti-drone ecosystem

- To provide a detailed overview of the impact of AI/Gen AI, the macroeconomic outlook for all regions, and the 2025 US tariff impact on the Europe anti-drone market

- To provide information about the key technology trends, trade analysis, and patents related to the Europe anti-drone market

- To strategically analyze average selling price trends, trends impacting customer business, regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios, trade landscape, and case studies pertaining to the market under study

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes them on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments, such as partnerships, acquisitions, expansions, collaborations, and product launches, in the market

- To strategically profile key players and analyze their market share, ranking, and core competencies

Customization Options

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Anti-Drone Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Anti-Drone Market