Europe Closed System Transfer Devices Market

Europe Closed System Transfer Devices Market by Closing Mechanism (Color-to-Color System), Type (Needleless Systems), Component (Female Components, Male Luers), Technology (Air Cleaning/Filtration Devices), End User (Hospitals, Clinics) – Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe Closed System Transfer Devices market, valued at USD 0.37 billion in 2025, stood at USD 0.41 billion in 2026 and is projected to advance at a resilient CAGR of 6.8% from 2026 to 2031, culminating in a forecasted valuation of USD 0.57 billion by the end of the period. The European CSTD market is influenced by factors such as increasing cancer cases and the use of hazardous drugs, growing awareness of the risks of occupational exposure, and compliance with EU safety standards and national guidelines. Limitations include differences in regulatory frameworks across countries, price wars in publicly funded healthcare systems, and the slow pace of adoption in small hospitals. Possibilities comprise the CSTD application extension beyond oncology to biologics and mAb-based injectables, the rise of ambulatory infusion services, and the gradual harmonization of safety standards in Europe, facilitating a wider and more uniform adoption.

KEY TAKEAWAYS

-

BY COUNTRYGermany is expected to register the highest CAGR of 7.6%.

-

BY CLOSING MECHANISMBy closing mechanism, Luer lock system led the market, with a share of 30.4%, in 2025.

-

BY TYPEBy type, membrane-to-membrane systems segment dominated the market, with a share of 68.1% in 2025

-

BY COMPONENTBy component, vial access components will be the fastest-growing segment during the forecast period.

-

BY TECHNOLOGYBy technology, the diaphragm-based devices segment led the market, with a share of 38.9% in 2025

-

BY END USERBy end user, the oncology centers segment is expected to register the highest CAGR of 8.4%.

-

COMPETITIVE LANDSCAPE - Key PlayersBD, ICU Medical, and B. Braun were identified as Star players in the Europe CSTD market, as they have focused on innovation and have broad industry coverage and strong operational & financial strengths.

-

COMPETITIVE LANDSCAPE - Start UpsCaragen, Needleless, and Epic Medical distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy.

The CSTD market in Europe is fueled by factors such as the growing use of oncology and hazardous drugs, the increasing awareness of the risks of occupational exposure, and compliance with EU and national safety guidelines. On the other hand, the Europe CSTD market faces some challenges, such as fragmented regulatory frameworks across countries, pricing pressure within publicly funded healthcare systems, and slower adoption in smaller hospitals. The market has a bright future with the potential to grow by pushing the use of CSTD beyond oncology to biologics and specialty injectables, increasing ambulatory infusion services, and the gradual harmonization of safety standards in Europe that will facilitate a wider and more consistent adoption.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Europe CSTD market is witnessing gradual growth due to the increased use of oncology and other hazardous injectable medicines and the stricter compliance with EU and country-specific occupational safety regulations. Healthcare providers across Europe are focusing on pharmacists' and nurses' safety from drug exposure, leading to greater use of CSTDs in hospital pharmacies and infusion settings. The arrival of new devices that are easier to use, compatible with existing compounding and administration systems, and that support standardized workflows is helping to drive uptake. At the same time, the escalating use of biologics and specialty injectables is a cause of anxiety for providers to review their practices of handling hazardous drugs, thereby prompting manufacturers to create the next generation of CSTDs with a focus on better containment, higher efficiency, and greater reliability.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

USP <800> regulatory compliance mandates

-

Rising oncology and hazardous drug use

Level

-

Budget constraints in smaller facilities

Level

-

Expansion beyond oncology applications

Level

-

Pricing pressure from GPOs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising oncology and hazardous drug use

The?????? Europe CSTD market is largely influenced by the rising incidence of cancer in European countries and the increased use of hazardous drugs for its treatment. So, there are more chemotherapies and cytotoxic drugs being developed and administered to patients in hospitals. Almost all of these drugs are classified as hazardous since they have properties that are both cancer-causing and toxic; thus, pharmacists and nurses are the ones who get exposed to these compounds. The increasing awareness of these risks, supported by the European safety at work directives and national guidelines, is the major reason healthcare providers should be equipped with CSTDs. As hospitals deal with increasing drug preparation volumes, CSTDs are becoming the most effective tools to reduce contamination, ensure staff safety, and facilitate the implementation of safe-handling ??????practices.

Restraint: Budget constraints in smaller facilities

Limited?????? budgets in small-sized hospitals and healthcare facilities have been a significant factor restraining the Europe CSTD market during the last few years. This is because the majority of hospitals and clinics are operating within very strict public healthcare budgets. The use of closed system drug transfer devices (CSTDs) entails higher initial costs and recurring expenditure on consumables that are made specifically for the devices. This situation may become a source of trouble for small or rural hospitals, which have limited resources. Procurement decisions are often made in such a way that the most vital medical equipment is purchased first, leaving safety-enhancing technologies for later. Furthermore, the implementation phase needs staff training and changes in the workflow, which contribute to the increase of the indirect costs. Thus, the pace of adoption is so slow that it is sometimes only a partial one in smaller facilities, and therefore, it is impossible to have a wider and more uniform distribution of CSTDs in the European healthcare ??????systems.

Opportunity: Expansion beyond oncology applications

The?????? Europe CSTD market has a major potential to grow outside the oncology applications if properly leveraged as the use of hazardous drugs in non-oncology therapeutic areas like rheumatology, immunology, infectious diseases, and neurology is on the rise. A wide range of biologics, antivirals, and specialty injectables may inherently have the same or similar side effects, such as toxicity or sensitization, as chemotherapy agents. As European hospitals and infusion centers become more aware of these exposure risks, they are seeking safety equipment such as CSTDs (Closed System Drug Transfer Devices) to secure not only oncology pharmacies but also other departments and locations where these drugs are handled. Extensive use of these devices in inpatient wards, specialty clinics, and ambulant infusion services can lead to a considerable increase in the total installed base of devices. As the market diversifies in this way, it remains supported by recurring consumable sales and therefore has the potential for sustainable growth across different European healthcare settings.

Challenge: Pricing pressure from GPOs

One?????? of the major problems for the European CSTD market is the pricing pressure from group purchasing organizations (GPOs), resulting from the fact that centralized and public procurement systems prioritize cost saving over product differentiation. For example, quite a few European hospitals procure medical devices through national or regional tenders, where the price competitiveness is the main factor; thus, advanced safety features are rarely taken into account. As a result, manufacturers are still unable to charge high prices for their products, even though they have invested heavily in R&D, clinical validation, and regulatory compliance. Competitive bidding can reduce CSTDs' margins and slow the adoption of innovative CSTDs. Besides that, long tender cycles diminish the hospitals' flexibility to switch suppliers, thereby slowing the market penetration of more advanced technologies and intensifying competition among existing ??????vendors.

EUROPE CLOSED SYSTEM TRANSFER DEVICES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers the PhaSeal closed system transfer devices widely adopted in European hospitals and oncology pharmacies for hazardous drug preparation and administration | Provides high protection against occupational drug exposure | Supports compliance with European safety guidelines | Benefits from strong clinical evidence and installed base |

|

Provides ChemoLock and ChemoClave CSTDs designed for safe handling of hazardous drugs in centralized hospital pharmacies and infusion centers | Enhances workflow efficiency | Reduces contamination risk | Ensures compatibility with broader infusion therapy platforms used across Europe |

|

Offers CSTDs and closed medication preparation solutions aligned with European hospital pharmacy and compounding practices | Improves medication safety | Supports regulatory compliance | Leverages strong hospital relationships and distribution networks across Europe |

|

Supplies CSTDs integrated with its infusion therapy, IV containers, and pharmacy compounding solutions across European healthcare systems | Enables standardized workflows | Improves safety during drug transfer | Supports compliance within public hospital procurement frameworks |

|

Develops fully closed, membrane-to-membrane CSTDs focused on preventing vapor and aerosol escape in oncology and specialty pharmacy settings | Delivers high containment performance | Minimizes environmental contamination | Supports advanced hazardous drug handling requirements |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

In Europe, the CSTD market is influenced by a strictly regulated, mainly publicly funded healthcare ecosystem that includes device manufacturers, distributors, healthcare providers, and regulatory authorities. Manufacturers create CSTDs not only to securely contain hazardous drugs but also to ensure that the devices are compatible with vials, syringes, and infusion systems commonly used. Market access is mostly determined by centralized or regional procurement bodies and hospital tenders. Pharmacists, nurses, and occupational safety teams are instrumental in product selection, emphasizing safety performance, ease of use, and integration into the workflow. Local regulators and EU workplace safety directives set the standards for handling, thereby determining the level of adoption and influencing market practices in the long run.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe CSTD Market, By Closing Mechanism

Europe?????? is mainly dominated by luer lock–based CSTDs that are compatible with standard syringes, vials, and infusion sets used in public hospital systems. Their tight locking mechanism, less leakage, and closed-system integrity are preferred. Simple integration into the pharmacy and administrative workflows already in place makes training and implementation less time-consuming. High clinician familiarity, standardized procurement practices, and conformity with European safety and compounding guidelines are key factors that facilitate the universal acceptance of luer lock–based CSTD ??????systems.

Europe CSTD Market, By Type

In?????? Europe, membrane-to-membrane CSTD systems have the biggest market share as they offer a fully closed, dry-to-dry drug transfer which is the most effective way of avoiding hazardous drug leakage, release of vapors, and aerosol formation. The robust clinical validation and high containment performance of these systems are in line with the European standards for occupational safety and pharmacy compounding. Their extensive use in centralized hospital pharmacies, high level of trust by the clinicians and the fact that they are in harmony with the most common preparation and administration workflows are the main reasons why membrane-to-membrane systems are the most preferred ones in the European healthcare ??????sector.

Europe CSTD Market, By Component

In?????? terms of volume, female parts dominate the Europe CSTD market of a closed pharmaceutical system. The female parts are instrumental in the drug preparation, transfer, and administration steps, which are the most frequently performed in hospital pharmacies. Generally, these elements are built-in to vial access devices, syringe adaptors, and infusion sets, thereby leading to increased consumption figures. Their vital function in ensuring the integrity of the closed system, being compatible with standardized luer connections, and constantly replaced because of wear and tear, from where the demand is coming, characterize the European healthcare sector as a market with sustained ??????demand.

Europe CSTD Market, By Technology

Diaphragm-based?????? CSTD devices are the major holder of the market share in Europe as they ensure safe containment of hazardous drugs by the most effective mechanical sealing and pressure equalization. Their confirmed method of leakage and vapor release prevention is in accordance with European occupational safety regulations and hospital pharmacy standards. The long clinical use, comprehensive validation data, and the high acceptance by pharmacists and nurses of public healthcare systems are the main reasons for their extensive use, thus these factors form a strong support to the continued dominance of diaphragm-based technology in the different applications of European ??????CSTDs.

Europe CSTD Market, By End User

Hospitals?????? and clinics account for the biggest portion of the market in the Europe CSTD market as they are the places that handle the most significant volumes of hazardous drugs, mainly chemotherapies and specialty injectables. Such venues are under rigorous rules for occupational safety and have centralized pharmacy compounding practices, which is the reason for the steady use of CSTDs there. A greater number of patients, uniform purchasing from public healthcare systems, and a solid focus on the safety of healthcare workers are the main reasons why CSTD is broadly utilized in hospitals and ??????clinics.

REGION

Germany is expected to be the fastest-growing country in the Europe CSTD market during the forecast period.

During?????? the forecast period, Germany is projected to be one of the top 5 countries in Europe, witnessing the highest growth rate in the closed system drug transfer device (CSTD) market. This is mainly due to a mix of factors, including regulations, clinical aspects, and the healthcare system. An increase in oncology and specialty injectable drug use is the main reason for a rise in hazardous drug handling volumes in hospitals. Similarly, strong enforcement of occupational safety regulations and growing awareness of healthcare workers' exposure risks are among the factors driving increased adoption of CSTDs in hospitals. Moreover, CSTD consumption is further supported by advances in hospital pharmacy infrastructure, the centralization of pharmaceutical compounding, and higher healthcare spending in Germany. Besides, it is anticipated that faster market growth in Germany will result from the presence of leading CSTD manufacturers and ongoing investments in modernizing pharmacies, compared to other European countries.

EUROPE CLOSED SYSTEM TRANSFER DEVICES MARKET: COMPANY EVALUATION MATRIX

In the Europe CSTD market, ICU Medical (Star) has a strong and established product portfolio and a vast geographic presence. Codan (Emerging Leader) has substantial product innovations compared to its competitors; while the company has a broad product portfolio, it lacks a strong growth strategy for business development.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Becton, Dickinson and Company (US)

- ICU Medical, Inc. (US)

- Equashield LLC (US)

- B Braun Melsungen AG (Germany)

- JMS Co., Ltd. (Japan)

- Baxter International, Inc. (US)

- Simplivia Healthcare Ltd. (Israel)

- Yukon Medical (US)

- CODAN Medizinische Geräte GmbH (Germany)

- West Pharmaceutical Services, Inc. (US)

- Vygon SA (US)

- PractiVet, Inc. (US)

- Terumo Corporation (Japan)

- Elcam Medical (Israel)

- Amsino International, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2026 (Value) | USD 0.41 BN |

| Market Size in 2031 (Value) | USD 0.57 BN |

| Growth Rate | 6.80% |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD MN/BN), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | Germany, UK, France, Spain, Italy and Rest of Europe |

WHAT IS IN IT FOR YOU: EUROPE CLOSED SYSTEM TRANSFER DEVICES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of CSTDs based on technology type (Diaphragm-Based, Compartmentalized, Air Cleaning/Filtration Devices), design mechanism, connectivity, and compatibility with hazardous drug delivery systems | Evaluation of product performance, containment efficiency, ease of use, and integration with automated pharmacy compounding and oncology drug delivery workflows |

| Company Information | Profiles of leading CSTD manufacturers such as BD (US), ICU Medical (US), Equashield (Israel), Simplivia Healthcare (Israel), and Corvida Medical (US) | Market share benchmarking, strategic partnership mapping, and competitive landscape analysis of key players across North America, Europe, and Asia Pacific |

| Geographic Analysis | In-depth regional assessment of North America, Asia Pacific, Latin America, and the Middle East & Africa with country-level data on adoption trends and regulatory frameworks | Country-level analysis of market adoption drivers, USP <800> and NIOSH compliance rates, oncology drug handling infrastructure, and emerging opportunities in high-growth markets such as China, India, and South Korea |

RECENT DEVELOPMENTS

- May 2023 : B.Braun’s Malaysian subsidiary, BMI, expanded its manufacturing base by expanding its product lines to strengthen automation and innovation capabilities.

- June 2022 : B. Braun expanded its production facility for IV fluids in Nairobi, Kenya.

- May 2022 : Baxter entered into an agreement with a Pfizer Inc. subsidiary to acquire the rights to Zosyn, a premixed, frozen piperacillin-tazobactam product to be supplied in North America. This product is used to treat intra-abdominal infections, nosocomial pneumonia, skin and skin structure infections, female pelvic infections, and community-acquired pneumonia.

- January 2022 : ICU Medical acquired Smiths Medical to broaden its product portfolio, including syringe & ambulatory infusion devices, vascular access, and vital care products.

Table of Contents

Methodology

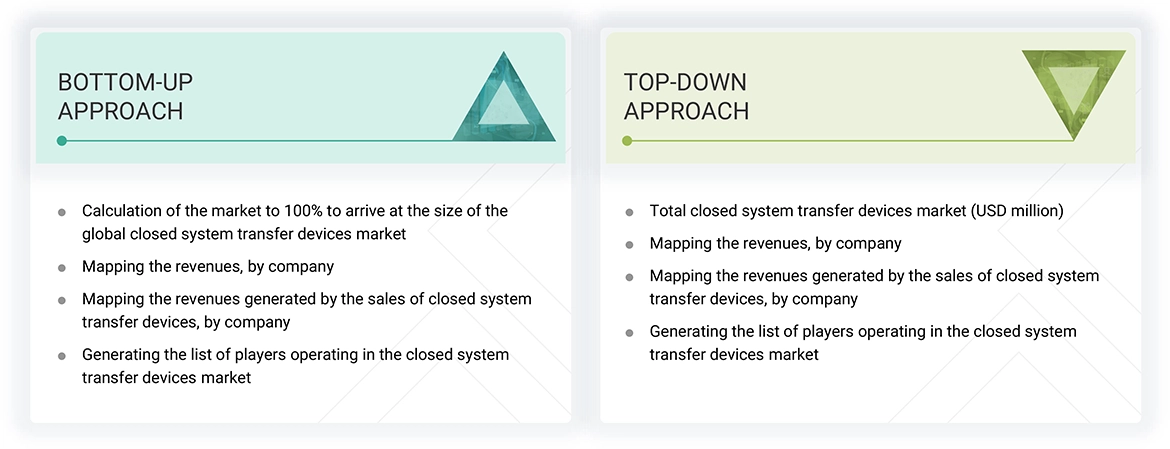

The study involved major activities in estimating the current market size of the Europe closed system transfer devices market. Exhaustive secondary research was done to collect information on the Europe closed system transfer devices market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the europe closed system transfer devices market.

Secondary Research

This research study involved the wide use of secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Businessweek, Factiva, whitepapers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the Europe closed system transfer devices market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply- and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the Europe closed system transfer devices market. Primary sources from the demand side included hospitals, clinics, researchers, lab technicians, purchase managers, and stakeholders in corporate & government bodies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Europe closed system transfer devices market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

The entire market was split into five segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of CSTD. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

Closed system transfer devices are highly specialized devices that mechanically prohibit the transfer of environmental contaminants into a system and the escape of hazardous drug or vapor concentrations outside the system. These devices are uniquely designed to protect healthcare providers and patients from exposure to hazardous drugs.

Stakeholders

- CSTD Manufacturers

- CSTD Suppliers & Distributors

- Original Equipment Manufacturers (OEMs)

- Hospitals and Clinics

- Oncology Centers

- Medical Device Research and Consulting Firms

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Government Associations

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Report Objectives

- To define, describe, and forecast the Europe closed system transfer devices market based on closing mechanism, type, component, technology, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall Europe closed system transfer devices market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze the impact of the economic recession on the growth of the Europe closed system transfer devices market

- To strategically profile the key players in the Europe CSTD market and comprehensively analyze their core competencies

- To track and analyze competitive developments, such as product approvals, launches, expansions, and acquisitions, of the leading players in the market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Closed System Transfer Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Closed System Transfer Devices Market