Europe Data Center Colocation Market

Europe Data Center Colocation Market by Service Type (Traditional and Managed), Service Scale (Retail and Wholesale), Workload Type (General Purpose IT and HPC & AI), End User (Enterprises and Hyperscalers) with Impact of AI/Gen AI - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The data center colocation market in Europe is projected to grow from USD 21.97 billion in 2025 to USD 41.08 billion by 2030, at a 13.3% CAGR. Growth reflects rising deployment of AI workloads, hyperscale cloud regions, high-density power infrastructure, advanced cooling systems, and interconnection-rich campuses supporting hybrid enterprise architectures.

KEY TAKEAWAYS

-

Europe Data Center Colocation Market, By Service ScaleThe wholesale colocation segment is projected to exhibit a higher CAGR (15.6%) than the retail colocation segment.

-

Europe Data Center Colocation Market, By Service TypeThe managed colocation segment is projected to witness a higher CAGR of 19.6% compared to the traditional colocation segment.

-

Europe Data Center Colocation Market, By Workload TypeThe HPC & AI segment is expected to witness a high CAGR of 28.9%.

-

Europe Data Center Colocation Market, By End UserHyperscalers are expected to exhibit a faster growth rate than enterprises.

-

Europe Data Center Colocation Market, By Organization SizeLarge enterprises are set to witness a higher CAGR than SMEs.

-

Europe Data Center Colocation Market, By Enterprise VerticalManufacturing is projected to be the fastest-growing enterprise vertical segment.

-

Competitive LandscapeEquinix, Digital Realty, and NTT Data lead Europe market through dense interconnection and AI-ready campuses.

-

Competitive LandscapeCtrlS, BDx, and AirTrunk are expanding rapidly in Europe through high-density, regulation-aligned campus developments.

The data center colocation market in Europe is shifting as enterprises move toward scalable, high-density infrastructure to support cloud, AI, and data-intensive workloads. Demand is strongest from hyperscale and large enterprise customers that require reliable power, dense interconnection, and rapid deployment. Operators are responding by developing high-power, energy-efficient campuses designed for compliance, resilience, and long-term growth, making colocation a core enabler of enterprise digital strategy.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

As AI continues to grow, the colocation market will enter a more disruptive era due to the pressure that AI places on available power and cooling capacity. The challenges of accessing the grid and dealing with lengthy permitting timelines impact how operators plan for their sites and capital expenditures. With many more edge deployments combined with data sovereignty requirements, operators are creating new models that focus on a large amount of distribution and local operations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surging demand for AI-ready, high-density colocation capacity

-

Rapid expansion of cloud-adjacent and hyperscale colocation campuses

Level

-

Power delivery constraints and extended utility interconnection timelines

-

Escalating construction costs and long equipment lead times

Level

-

Growing enterprise adoption of hybrid and multicloud interconnection ecosystems

-

Rising demand for liquid-cooled and next-generation colocation facilities

Level

-

Retrofitting legacy data centers to support high-density AI workloads

-

Severe shortage of skilled labor for advanced data center construction and operations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surging demand for AI-ready, high-density colocation capacity

AI training and inference workloads are increasing demand for high-density colocation capacity across Europe. Key growth hubs include Frankfurt, London, Paris, Amsterdam, and Dublin. Enterprises are prioritizing high-power racks and scalable power blocks. Low-latency connectivity to cloud regions and regional networks remains a critical selection factor.

Restraint: Power delivery constraints and extended utility interconnection timelines

Power availability is one of the major hurdles for colocation markets in Europe. Delays in utility interconnections, substation upgrades, and permitting requirements are leading to a rise in capital exposure and delay revenue realization. They can also limit near-term capacity for power-intensive AI deployments.

Opportunity: Growing enterprise adoption of hybrid and multicloud interconnection ecosystems

Enterprises increasingly use colocation as an interconnection hub between on-premises infrastructure and public cloud platforms. Network providers also anchor these ecosystems. This supports demand for carrier-dense and cloud-adjacent campuses. It also enables low-latency data exchange and workload portability. These requirements make interconnection-focused colocation a durable growth opportunity.

Challenge: Retrofitting legacy data centers to support high-density AI workloads

A large share of installed colocation capacity was built for lower-density enterprise workloads. Upgrading sites for higher power densities often necessitates significant electrical and mechanical modifications. Liquid-cooling readiness can also require structural modifications. These retrofit programs increase capital intensity and execution risk. Risk is higher when upgrades occur in active production environments.

EUROPE DATA CENTER COLOCATION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Digital Realty worked with SAP to quickly grow SAP's global cloud infrastructure across more than 150 countries. SAP's own proprietary data centres were both slow and costly to expand, resulting in delays ranging from 12 to 24 months for deployment. SAP sought a colocation partner that could grow quickly, provide a global footprint, and offer flexibility in supporting hybrid models, sustainability goals, and gen AI workloads. | 6× faster infrastructure scaling (18 months → 3 months) | Centralized global vendor engagement | 99.999% uptime | Green-certified deployments using 100% renewable energy | Faster cloud expansion across three continents | Improved operational flexibility and sustainability alignment. |

|

BMW partnered with NTT data to improve and automate its global colocation and network environment, supporting over 30,000 servers and approximately 1,000 WANs. BMW was looking for a very stable and independent global network operations with the cloud-based architecture that provides a "cloud ready" architecture to minimize any interruptions and follow the strictest processes and security standards. | 85% faster server deployments | 99% accuracy in diagnosing issues | Reduced manual IT workloads | Improved service quality | Seamless integration of cloud-ready on-prem systems | Enhanced operational stability across 30,000+ servers and 40,000 network devices. |

|

CBS Interactive worked with Iron Mountain to replace an older colocation option that was not able to handle traffic spikes in the range of 15-18 GB/sec with a newer colocation option providing a scalable, energy-efficient solution that would provide 100% uptime, while allowing them to efficiently support applications used by their customers and meeting specific SLA requirements. | State-of-the-art high-density colocation | 100% uptime SLA | Two-thirds reduction in colocation costs | Improved cooling through sealed racks and ultrasonic humidification | Enhanced energy efficiency | Disaster-resilient Phoenix facility optimized for long-term IT stability. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The colocation market for data centers has two main types of providers - Carrier-Neutral, which enables a connection to several networks and Carrier-Owned, which provides colocation as part of a telecommunication service package. These two provider types together offer the ability to connect, grow, and develop digital enterprise at various geographically dispersed locations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Data Center Colocation Market, By Service Scale

Retail colocation is the largest service-scale segment in Europe. Enterprises favor flexible rack-level deployments. Predictable pricing supports cost control. Dense interconnection ecosystems improve cloud and network access. Rapid deployment timelines support hybrid-cloud strategies, reinforcing retail colocation as the preferred operating model.

Europe Data Center Colocation Market, By Service Type

Traditional colocation remains the dominant service type in Europe. Enterprises continue to rely on cabinet, cage, and power-based provisioning. Familiar operating models simplify management. Strong control and compatibility with legacy systems sustain demand from industries with stable and predictable workloads.

Europe Data Center Colocation Market, By End User

Enterprises account for the largest end-user segment in the data center colocation market in Europe. Ongoing digital transformation is a primary driver of demand. Hybrid-cloud expansion is increasing infrastructure complexity. Rising compliance requirements are reinforcing the need for secure environments. Demand for scalable and cost-efficient infrastructure continues to strengthen enterprise reliance on colocation services.

Europe Data Center Colocation Market, By Organization Size

Large enterprises lead colocation adoption in Europe. They operate workloads across multiple regions. Governance and resiliency requirements are high. Larger IT budgets support sustained capacity investment. Continuous hybrid-cloud expansion makes large enterprises the primary revenue contributors.

Europe Data Center Colocation Market, By Workload Type

General Purpose IT is the largest workload category. ERP, CRM, analytics, and storage migrations drive demand. Hybrid compatibility and steady compute requirements sustain dominance.

Europe Data Center Colocation Market, By Enterprise Vertical

IT & ITeS is the leading enterprise vertical. Cloud consumption is high. Digital services scale rapidly. Strong uptime, interconnection density, and scalable compute drive revenue leadership.

REGION

France to be fastest-growing country in Europe data center colocation market during forecast period

France is seeing faster growth in colocation demand than other European markets as cloud providers continue to expand their local footprints. Enterprises are gradually transitioning toward facilities that can accommodate higher power densities and advanced computing requirements. Supportive energy policies and a strong focus on sustainability are also helping drive digital expansion, which is steadily increasing colocation demand across the country.

EUROPE DATA CENTER COLOCATION MARKET: COMPANY EVALUATION MATRIX

The Company Evaluation Matrix categorizes colocation vendors into four distinct quadrants based on their market position and respective capabilities. Equinix is clearly the standout for the Stars quadrant as it has a very strong market presence and the largest portfolio of colocation service offerings. China Telecom is in the Emerging Leaders quadrant, while the remainder of the vendors exist within the Participants and Pervasive Players quadrants and represent varying levels of scale and execution capabilities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Equinix (US)

- Digital Realty (US)

- NTT Data (Japan)

- QTS Data Centers (US)

- KDDI Corporation (Japan)

- Colt Data Centre Services (UK)

- NorthC Group (Netherlands)

- CyrusOne (US)

- CenterSquare (US)

- Vantage Data Centers (US)

- DataBank (US)

- EdgeConneX (US)

- Switch (US)

- CoreSite (US)

- Aligned Data Centers (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 21.97 Billion |

| Market Forecast in 2030 (Value) | USD 41.08 Billion |

| Growth Rate | CAGR of 13.3% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, vendor positioning, segment-wise analysis, regional trends, technological developments, key commercial use cases, and growth factors. |

| Segments Covered |

|

| By Country |

|

WHAT IS IN IT FOR YOU: EUROPE DATA CENTER COLOCATION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Cloud Service Provider |

|

|

| Telecom Operator (Edge Deployments) |

|

|

| Enterprise (IT, BFSI, Retail, Manufacturing) |

|

|

RECENT DEVELOPMENTS

- November 2025 : Equinix reserved the first 250MW of power from Stellaria’s inaugural small modular reactor, as part of a wider pre-order pipeline exceeding 1GW of advanced nuclear capacity. The deal aims to secure resilient, 24/7 carbon-free energy for Equinix’s future AI-dedicated and high-density colocation data centers across Europe.

- November 2025 : Digital Realty continued to strengthen its partnership with NVIDIA through the development of the NVIDIA AI Factory Research Center at its Virginia data center. The center is intended to create AI factory blueprints and develop advances in liquid cooling and power efficiency in the context of deploying an AI-enabled data center and utilizing the Digital Realty colocation platform to test new and upcoming generations of AI-based data center designs.

- August 2025 : maincubes secured zoning approval and a 200 MW grid connection to launch the mainHub Berlin campus in Nauen. The project targets hyperscale and AI demand. It features liquid-ready design, renewable energy integration, waste-heat reuse, and a dedicated 110 kV substation onsite.

- May 2025 : To accommodate about one gigawatt of additional data centre capacity, NTT DATA purchased land in seven locations across North America, Europe, and Asia Pacific. Future campuses in Hillsboro (Oregon), Phoenix (Arizona), Milan (Italy), Frankfurt (Germany), London (UK), Tochigi (Japan), and Osaka (Japan) are planned to add a variety of wholesale and hyperscale colocation options for the rapidly expanding volume of work related to Artificial Intelligence and Cloud Computing.

Table of Contents

Methodology

This research study on the Europe Data Center Colocation market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred Europe Data Center Colocation service providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the Europe Data Center Colocation spending of various countries was extracted from the respective sources.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and Europe data center colocation service providers. It also included key executives from Europe data center colocation vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

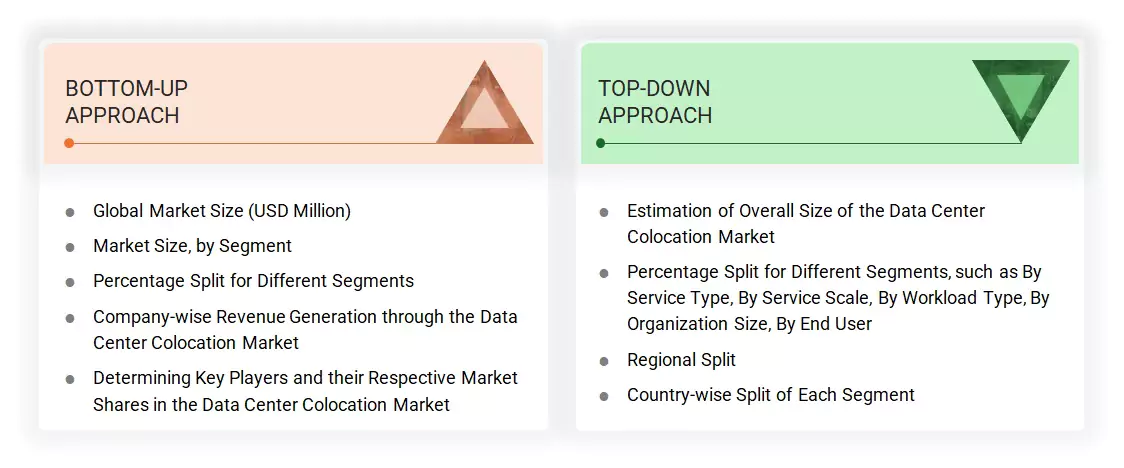

Multiple approaches were adopted to estimate and forecast the Europe Data Center Colocation market. The first approach involved estimating the market size by companies’ revenue generated through the sale of europe data center colocation services.

Market Size Estimation Methodology- Top-down approach

The top-down approach prepared an exhaustive list of all the vendors offering products in the Europe Data Center Colocation market. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on platform, degree of customization, type, application, end user, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of Europe data center colocation services among different verticals in key countries concerning their regions contributing the most to the market share was identified. For cross-validation, the adoption of Europe data center colocation services among enterprises, along with different use cases for their regions, was identified and extrapolated. Weightage was given to use cases identified in different areas for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the Europe Data Center Colocation market's regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of major europe data center colocation providers, and organic and inorganic business development activities of regional and global players were estimated.

Europe Data Center Colocation Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. Data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Data center colocation refers to the segment where businesses rent space, power, cooling, and connectivity within third-party data center facilities to host their own servers, storage, and networking equipment. Colocation providers offer physical security, redundant power and cooling systems, and access to multiple network carriers, allowing different enterprises to operate in a shared yet secure environment while maintaining control over their infrastructure. This model enables companies to reduce capital expenditures, improve uptime and scalability, and meet compliance requirements more effectively. The market is expanding due to the rising adoption of cloud computing, big data analytics, and IoT, along with a growing emphasis on modular infrastructure and sustainable operations.

Stakeholders

- Europe data center colocation service providers

- Hyperscalers & Cloud service providers

- Networking companies

- Information technology (IT) infrastructure providers

- Consultants/Consultancies/Advisory firms

- Component providers

- Telecom service providers

- System integrators (SIs)

- Support and maintenance service providers

- Support service providers

- Third-party providers

- Government organizations and standardization bodies

- Datacenter providers

- Regional associations

- Independent hardware and software vendors

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the Europe Data Center Colocation market based on service type, service scale, workload type, organization size, end user, and region

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets concerning growth trends, prospects, and their contribution to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product developments, and partnerships & collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company’s product portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the North America data center colocation market

- Further breakup of the Europe data center colocation market

- Further breakup of the Asia Pacific data center colocation market

- Further breakup of the Middle East & Africa data center colocation market

- Further breakup of the Latin America data center colocation market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Data Center Colocation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Data Center Colocation Market