Europe eGRC Market

Europe eGRC Market by Solution (Risk Management, Compliance Management, Audit Management, Policy Management, Privacy Management), Service (Professional, Managed), Business Function (Legal, Finance, Operations), Vertical, Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

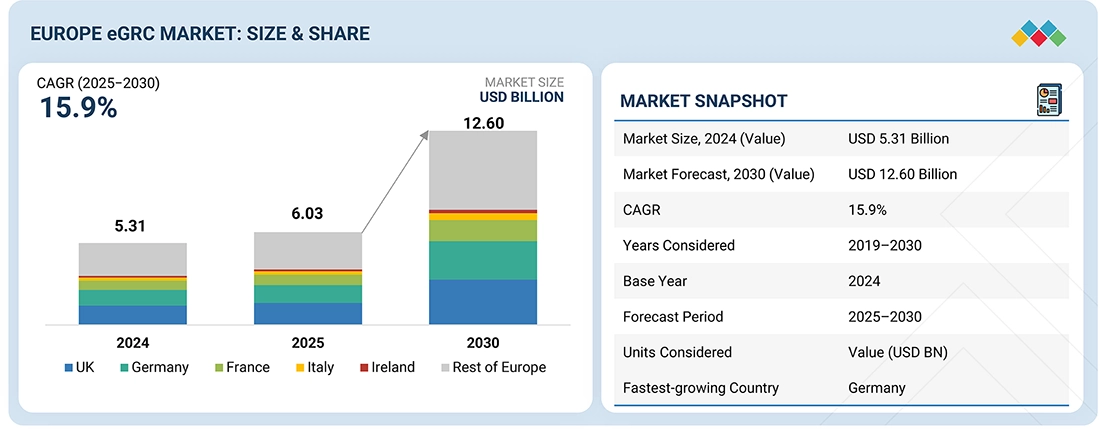

In Europe, the eGRC Market is projected to grow from USD 6.03 billion in 2025 to USD 12.60 billion by 2030, a CAGR of 15.9%. The market's growth is a result of regulatory requirements, such as GDPR, DORA, NIS2, and ESG reporting, as well as the evolution of sector-specific requirements for organizations within the financial services, healthcare, and critical infrastructure sectors. To address the increasing threats of cyber, operational, and third-party risk, organizations are adopting cloud-based data-driven governance platforms to provide better visibility over control and policy compliance and to manage their risks. There is also an increase in demand for real-time risk intelligence, automated audit and evidence workflows, and integrated privacy and compliance monitoring. Additionally, opportunities in the market exist with the introduction of AI-enabled continuous control monitoring, SaaS-first eGRC deployments in mid-market enterprises, the expansion of third-party and supply chain risk programs, and the growth of cybersecurity, operational resilience.

KEY TAKEAWAYS

-

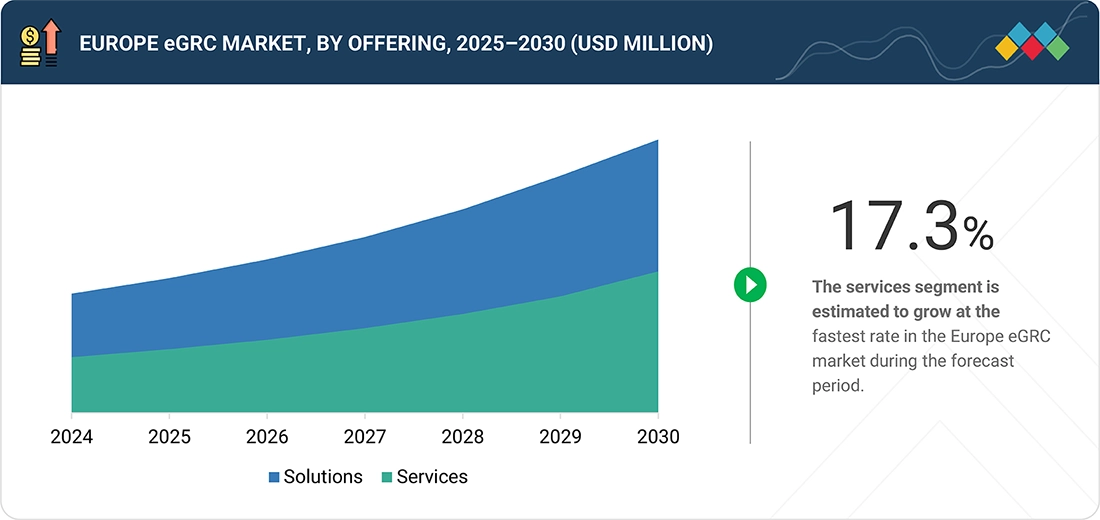

BY OFFERINGBy offering, the solutions segment is estimated to dominate in terms of market share in the forecast period.

-

BY SOLUTIONBy solution, the risk management segment is projected to dominate in terms of market share.

-

BY SERVICEProfessional services are expected to dominate in terms of market share in the forecast period.

-

BY ORGANIZATION SIZEAdoption of eGRC among SMEs is projected to grow at the highest CAGR of 16.7%.

-

BY BUSINESS FUNCTIONBy business function, the IT segment is projected to grow at the fastest rate of 16.3%.

-

BY VERTICALBy vertical, the healthcare segment is set to grow the fastest during the forecast period at a CAGR of 19.2%.

-

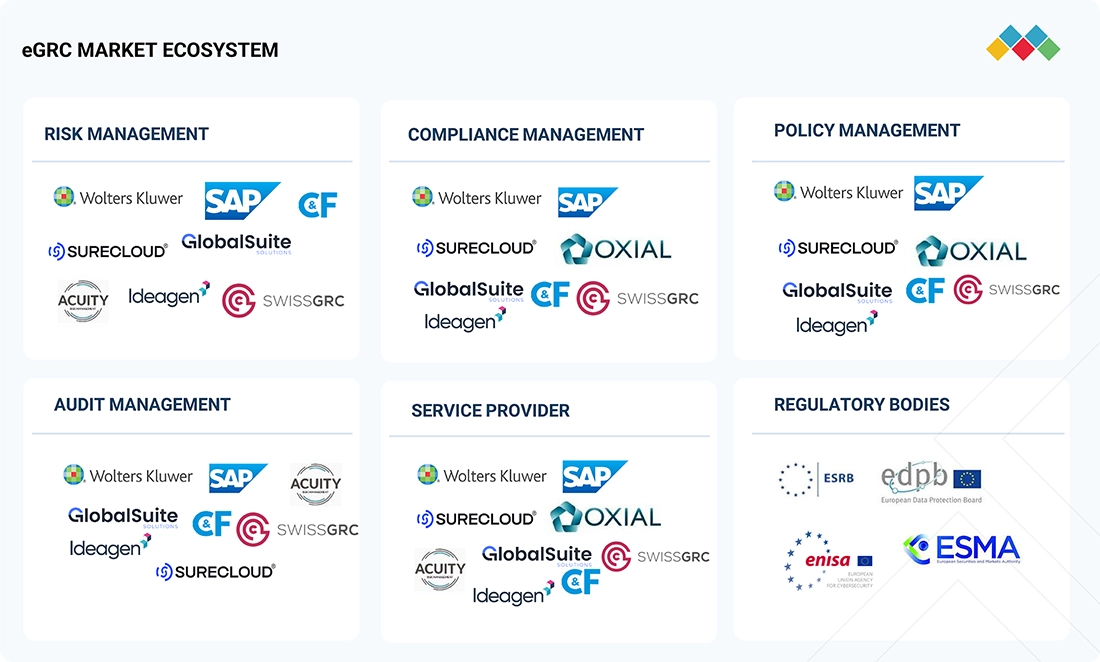

COMPETITIVE LANDSCAPE - KEY PLAYERSThe eGRC market in Europe is led by established vendors such as Wolters Kluwer, SAP SE, MetricStream, Ideagen, Swiss GRC, Oxial, and GlobalSuite Solutions. These vendors offer mature, integrated governance platforms covering risk, compliance, audit, policy, and third-party management solutions and services.

-

COMPETITIVE LANDSCAPE - STARTUPSEurope also hosts a growing ecosystem of innovative eGRC SMEs and startups, including SureCloud, Acuity Risk Management, C&F S.A., and Riskonnect. These companies offer innovative eGRC solutions that deliver agile, cloud-native platforms, focusing on rapid onboarding, automated compliance workflows, continuous control monitoring, and seamless integrations.

The need for centralized and real-time visibility into all aspects of an organization's operation, including emerging risks that may affect future growth, is necessary for consistent control, informed and effective decision-making and action, and ultimately the ability to meet compliance requirements across multiple operations in Europe.

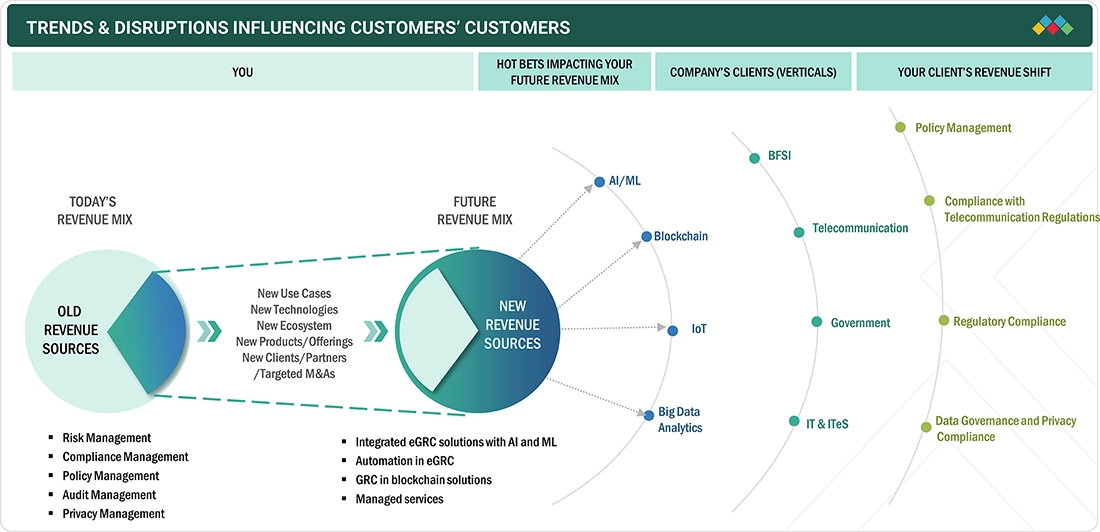

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Europe eGRC Market solutions is currently experiencing a shift from traditional tools focused on risk assessment and compliance to advanced, artificial intelligence (AI) powered and cloud-based governance solutions. In addition, as new revenue streams arise from advances in analytics through machine learning (ML) and AI, as well as from blockchain technology and IoT-based operational monitoring, organizations across many sectors (i.e., BFSI, telecommunications, government, IT & ITeS) have begun to emphasize the importance of policy governance, regulatory alignment, operational resilience, and data privacy. Vendors are expanding their offerings into AI-enabled eGRC solution suites, automated compliance workflows, and managed services in order to develop future revenue opportunities within Europe.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Stringent regulations (GDPR, CSRD, DORA)

-

ESG & sustainability reporting

Level

-

Shortage of skilled professionals

-

High deployment/integration costs

Level

-

AI- and automation-led eGRC innovation

-

Cloud-based eGRC + EU data sovereignty initiatives

Level

-

Data privacy/sovereignty constraints

-

EU-member regulatory fragmentation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: ESG & sustainability reporting

European Union (EU) regulations, including the Corporate Sustainability Reporting Directive (CSRD), Taxonomy (EU Taxonomy), and Sustainable Finance Disclosure Regulation (SFDR), as well as various sector-specific ESG-related legislative initiatives (skilled workforce shortages), have driven the need for eGovernance Risk Control (eGRC) platforms. eGRC platforms allow organizations to deliver sustainability reporting, create audit-ready disclosures, and assess the risks associated with carbon emissions. Companies are utilizing eGRC tools to demonstrate that they are ready for audit, ongoing compliance, and proactive monitoring of changing EU regulations.

Restraint: Shortage of skilled professionals

The overall complexity of the EU regulatory environment and the cross-border nature of data management mean that in many cases, companies (especially SMEs) lack the requisite level of expertise to deploy, implement, and maintain an advanced eGRC solution. This skill shortage results in delayed timeframes for modernizing and high costs associated with implementing an eGRC solution.

Opportunity: AI- and automation-led eGRC innovation

There are significant business development opportunities in Europe to provide organizations with AI-driven cloud-native eGRC solutions. These solutions will allow organizations to automate and provide real-time updates for risk monitoring controls and provide real-time insights into risks as they relate to regulatory compliance. In Europe, mid-market, highly regulated industries and cross-border companies are already pursuing the implementation of Software-as-a-Service (SaaS) based eGRC solutions that offer predictive analytics, automated workflows, and integrated ESG Risk Intelligence with a high level of growth potential for solution providers.

Challenge: Data privacy & sovereignty constraints

Under the General Data Protection Regulation (GDPR), national data residency laws, and industry-specific standards, it is difficult for businesses operating in multiple countries to consolidate their risk and compliance data, connect operations in multiple countries, and expand their cloud-based eGRC systems to other EU countries. Therefore, businesses must take extra time to establish a unified governance structure for businesses operating within the EU.

EUROPE EGRC MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A leading European bank implemented Wolters Kluwer OneSumX to unify regulatory reporting, risk management, and compliance across multiple EU jurisdictions. OneSumX helped the bank replace fragmented legacy systems. The platform automated regulatory updates aligned with CRR II, CRD V, and ESG-related disclosure requirements. | Improved regulatory reporting accuracy | Reduced compliance workload by automating updates | Strengthened auditability | Ensured consistent governance across all European branches |

|

A European manufacturing group deployed SAP GRC to streamline access control, automate SoD (Segregation of Duties) monitoring, and integrate IT risk management across their SAP and non-SAP systems. The implementation helped them prepare for stricter EU cybersecurity and data-governance requirements. | Enhanced visibility into IT and operational risks | Reduced manual access reviews | Ensured compliance with GDPR and Internal audit standards | improved overall security posture |

|

A UK-based retail chain adopted SureCloud’s Risk & Compliance Suite to move from spreadsheet-based risk tracking to a centralized risk register with automated workflows. This enabled real-time reporting for compliance with GDPR, PCI DSS, and ISO 27001. | Accelerated risk assessment cycles | Improved collaboration across compliance teams | Delivered dynamic dashboards that helped leadership prioritize high-impact risks |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The eGRC ecosystem comprises established technology vendors delivering risk, compliance, policy, and audit management platforms, supported by consulting and managed service providers enabling implementation and operationalization. Regulatory bodies shape requirements, driving adoption across industries as organizations seek integrated governance solutions to meet data privacy, financial, and cybersecurity standards.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe eGRC Market, by Offering

The Europe eGRC market is represented by comprehensive governance, risk, and compliance platforms that serve to centralise controls, automate workflows, and allow for multi-regulatory jurisdictional reporting. In addition, vendors are increasingly developing and integrating ESG reporting, GDPR, DORA, and cyber-risk intelligence into their solutions. Cloud-based or hybrid deployment models have gained popularity as European companies want to utilise scalable and secure solutions which comply with the EU's data-sovereignty requirements and harmonised regulatory frameworks.

Europe eGRC Market, by Deployment Mode

European organisations are adopting cloud and hybrid eGRC models to improve flexibility, lower operational costs, and enable real-time monitoring of compliance. There is a trend of increased adoption of cloud solutions due to the availability of EU-based data centres and Sovereign Cloud initiatives, which address data residency under GDPR. On-premise deployment models are still being used in banking, financial services, and insurance; government; and energy due to the need for stricter national governance or due to the existence of outdated technology in those sectors, which requires renegotiation or control over sensitive data.

Europe eGRC Market, by Organization Size

For large enterprises, there is a strong emphasis on the need for an integrated risk platform that incorporates cybersecurity, operational resilience, ESG reporting, and supply chain risk management into one foundation platform. Small to medium enterprises (SMEs) are quickly adopting affordable, SaaS-based eGRC solutions to meet their increasing compliance obligations without making significant infrastructure investments.

Europe eGRC Market, by Business Function

Finance and Information Technology in Europe have the highest rate of adoption for eGRC solutions, as these functions have stringent compliance obligations from PSD2, MiFID II, Basel III, SOX equivalents, and cyber-resilience regulations. eGRC solutions assist both risk and audit teams to perform real-time analytics of risk using automated control testing and workflows for internal audit. Human Resources and Legal benefit from eGRC, which manages GDPR governance, manages compliance for employees, and automates the policy life cycle.

Europe eGRC Market, by Vertical

BFSI organizations are increasing spending on DORA compliance and AMLD6 compliance, while the healthcare industry uses eGRC to manage GDPR compliance, protect patient data, and assess operational risk. Government agencies are increasing transparency and cyber-resilience; Manufacturers are addressing supply chain compliance and gaining ESG ratings; and telecommunications companies are introducing new regulations for managing NIS2 and protecting data. As such, each of these verticals requires more advanced automation, audit preparedness, and integrated risk visibility.

REGION

Germany to be the fastest-growing country in Europe eGRC market during the forecast period

Germany stands out as the leading and one of the fastest-growing eGRC markets in Europe. Factors supporting the growth of the German eGRC market include stringent regulations, a mature and complex industrial/financial sector, substantial digital transformation, and a growing demand for automated risk/compliance management. For vendors and solution providers, Germany remains a key market, especially in regulated sectors.

EUROPE EGRC MARKET: COMPANY EVALUATION MATRIX

The eGRC market in Europe combines mature enterprise platforms with the rapid growth and adoption of cloud-native solutions. Wolters Kluwer leads with a comprehensive suite for risk, compliance, audit, and third-party management, while other vendors offer modular capabilities, analytics, and expanding integrations. Emerging SaaS players like C&F S.A. are gaining traction with intuitive interfaces, faster deployment, and flexible cloud models. Across the market, vendors focus on automation, simplified workflows, and integration with security, ESG, and data governance to meet evolving enterprise needs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- SAP (Germany)

- Wolters Kluwer (Netherlands)

- SureCloud (UK)

- Acuity Risk Management (UK)

- C&F SA (Poland)

- GlobalSuite Solutions (Spain)

- Oxial (Switzerland)

- Ideagen (UK)

- Swiss GRC AG (Switzerland)

- PWC (UK)

- EY (UK)

- KPMG (Netherlands)

- Deloitte (UK)

- SAS Institute (Europe, UK & Ireland)

- RiskXchange (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 5.31 Billion |

| Market Forecast, 2030 (Value) | USD 12.60 Billion |

| Growth Rate | CAGR of 15.9% from 2025 to 2030 |

| Years Considered | 2019–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Countries Covered | UK, Germany, France, Italy, Ireland, Rest of Europe |

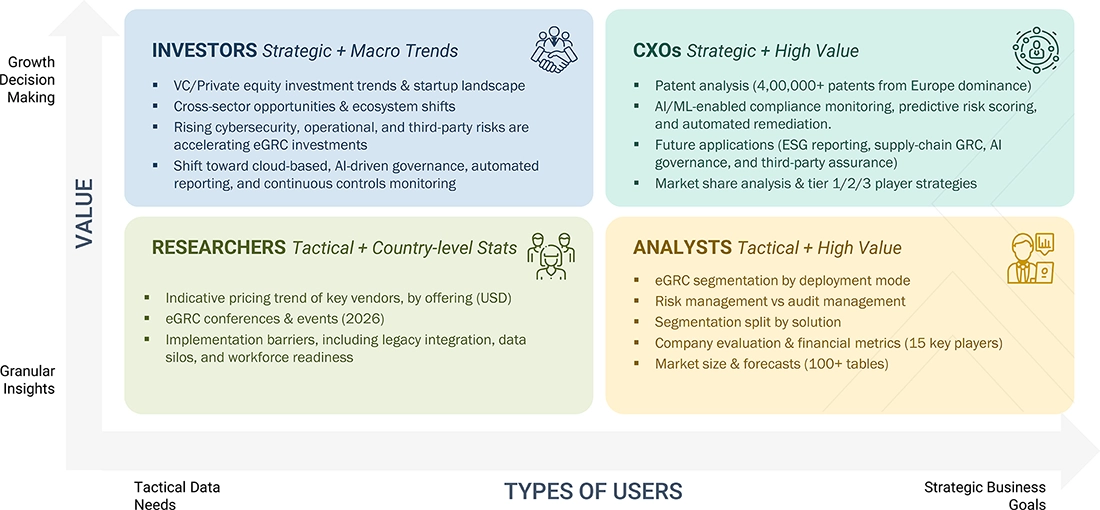

WHAT IS IN IT FOR YOU: EUROPE EGRC MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (EU) |

|

Comprehensive overview of the evolving eGRC landscape, highlighting managed service growth opportunities, rising compliance outsourcing demand, vendor collaboration potential, and expansion areas |

RECENT DEVELOPMENTS

- April 2024 : SureCloud added IT process automation functionality to help organizations more easily meet their ISO 27001 compliance obligations.

- February 2024 : Arab Developers Holding entered a strategic partnership with SAP to transform planning, operations, and resource management systems. This partnership was integral to Arab Developers Holding's strategy for modernization and sustainable digital transformation across all services. It aimed to streamline workflows, enhance procedural control and data management, and boost operational efficiency to meet evolving customer needs.

- January 2024 : Wolters Kluwer launched its first Enablon Vision Platform enhancements of 2024, bringing enhanced ease-of-use, analytics, and data visualization capabilities to operations, environmental, and safety teams worldwide. It included improved mobile functionality, new process hazard analysis, control of work, and Environmental, Health, Safety, and Quality (EHSQ) processes.

Table of Contents

Methodology

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for this technical, market-oriented, and commercial study of the Europe eGRC Market. The primary sources were mainly several industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to this industry's value chain segments. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to to identify and collect information regarding the study. The secondary sources included annual reports, press releases, investor presentations of Europe eGRC Market solution vendors; forums; certified publications, such as GRCI Publications, Compliance, and Regulatory Journal, GRC Professional Magazine, GRC Journal, From GRC 1.0 to GRC 5.0: A History of Technology for GRC; and whitepapers such as "Governance, Risk and Compliance (GRC) Framework" by MetricStream, "Governance, Risk, and Compliance Whitepaper" by Secure Digital Solutions. Secondary research was mainly used to obtain key information about the industry's value chain, the total pool of key players, market classification, and segmentation from the market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides of the Europe eGRC Market were interviewed to obtain qualitative and quantitative information for the study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives of various vendors providing eGRC solutions and services, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research helped identify and validate the segmentation types, industry trends, key players, a competitive landscape of eGRC solutions and services offered by several market vendors, and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, the bottom-up and top-down approaches and several data triangulation methods were extensively used to perform the market estimation and forecasting for the overall market segments and subsegments listed in this report. An extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Following is the breakup of the primary study:

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the Europe eGRC Market and the size of various other dependent sub-segments in the overall Europe eGRC Market. The research methodology used to estimate the market size includes the following details: critical players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

MarketsandMarkets defines eGRC as the umbrella term that covers an organization's approach across the areas of GRC. GRC typically encompasses corporate governance, enterprise risk management, and compliance with applicable laws and regulations. It allows organizations to achieve their goals by automating workflows while complying with policy guidelines and government regulations, reducing financial risks, and safeguarding the company's brand image. The latest development of artificial intelligence (AI)-)-enabled eGRC solutions would enhance the compliance process, making it more effective.

Key Stakeholders

- eGRC solution and service providers

- GRC staff

- IT governance directors/managers

- IT risk directors/managers

- IT compliance directors/managers

- IT audit directors/managers

- Information security directors/managers

- IT directors/consultants

- End-users/consumers/enterprise users

- Government organizations

- Consultants/advisory firms

- System integrators and resellers

- Training and education service providers

- Managed service providers

Report Objectives

- To describe and forecast the Europe eGRC Market by offering, deployment mode, organization size, solution usage, business function, vertical, and region from 2024 to 2029, and analyze the various macroeconomic and microeconomic factors that affect market growth

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the major players

- To profile the key market players; provide a comparative analysis based on the business overviews, regional presence, product offerings, business strategies, and critical financials; and illustrate the market's competitive landscape.

- To track and analyze the competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and research development (R&D) activities, in the market

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North America market into countries contributing 100% to the regional market size

- Further breakup of the Latin America market into countries contributing 75% to the regional market size

- Further breakup of the Middle East and Africa market into countries contributing 75% to the regional market size

- Further breakup of the Europe market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe eGRC Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe eGRC Market