Europe Flexible Plastic Packaging Market

Europe Flexible Plastic Packaging Market by Packaging Type (Pouches, Bags, Films & Wraps, Rollstock), By Application (Food, Beverages, Pharmaceuticals & Healthcare, Personal Care & Cosmetics), and Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe flexible plastic packaging market is expected to reach USD 39.04 billion by 2030, up from USD 35. 97 billion in 2025, growing at a CAGR of 1. 66% during the forecast period. Rising urbanization, an increasing number of single households, and lifestyle changes are boosting demand for flexible, lightweight, and protective packaging across Europe. Urban Europe, which comprises 75% of the population and is projected to reach 84% by 2050, drives this growth. The food, beverage, pharmaceutical, and e-commerce sectors are expanding their use of flexible plastics to meet high-volume distribution needs. Additionally, Europe accounts for 22. 75% of the global prescription drug industry, valued at USD 1.53 trillion in 2024, emphasizing the need for high-barrier blister films, medical pouches, and contamination-resistant formats. The food and beverage industry is the largest manufacturing sector in the EU, employing 4.7 million people, generating nearly USD 130 trillion in revenue, and creating USD 270 billion in value added. Consequently, demand remains high for pouches, wraps, and multilayer films that extend shelf life and reduce transportation weight. The region's strong trading ecosystem supports this demand: 65% of food and beverage exports stay within the Single Market, while exports to non-EU countries reach approximately USD 197 billion, resulting in a trade surplus of USD 86 billion. Supportive government policies, such as setting recycling targets, promoting extended producer responsibility, and mandating plastic usage reductions, are further driving innovation in barrier technology, digital printing, and smart packaging, fueling continuous growth in the Europe flexible plastic packaging market.

KEY TAKEAWAYS

-

By CountryThe UK dominates the market with a share of 25.52% in 2024.

-

By Packaging TypeBy packaging type, the bags segment is expected to register the highest CAGR of 2.30% from 2025 to 2030, in terms of value.

-

By ApplicationBy application, the personal care & cosmetics segment is expected to dominate the market, growing at the highest CAGR of 2.35%.

-

Competitive Landscape - Key PlayersAmcor plc, Constantia Flexibles, Huhtamaki Oyj, Mondi, and Coveris were identified as Star players in the market, as they have focused on innovation, broad industry coverage, and strong operational & financial strength.

-

Competitive Landscape- StartupsWipack Group, RKW Group, Traceless Materials GmbH, among others, have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy.

The Europe flexible plastic packaging industry is experiencing significant growth as nations encounter increasing demands for lighter, more sustainable, and cost-effective solutions in response to rising e-commerce volumes and changing consumer lifestyles. The European Commission mandates that the EU attain 100% recyclable packaging by 2030, incorporating a minimum of 30% recycled content in plastic packaging, while decreasing overall packaging waste by 5% from 2018 levels and prohibiting specific single-use formats such as fresh produce wraps and mini toiletry portions (Source: EC Packaging and Packaging Waste Regulation). Conventional rigid or multi-material packaging is having difficulty keeping up with the increased demand for convenient, shelf-stable formats of food, beverages, pharmaceuticals, and online retail, in particular, as more people live in cities and worry about plastic pollution. Flexible plastic packaging provides a longer shelf life, lighter weight, and higher recyclability, providing a growing end-user value proposition for companies in this market

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The influence on end-use sectors in the Europe flexible plastic packaging market is driven by rising demand for lightweight, sustainable, and cost-efficient packaging solutions. Key sectors, including food & beverage, pharmaceuticals, personal care, and consumer goods, increasingly prefer flexible plastics due to evolving consumer preferences, stricter recyclability requirements, and efficiency in supply chains. EU circular economy directives, packaging waste regulations, and national sustainability initiatives further accelerate adoption across both retail and industrial applications. Differences in regional standards, extended producer responsibility schemes, and government incentives also shape uptake. Together, these factors drive demand for flexible packaging, guide investment in recyclable and mono-material solutions, and support the development of innovative, standardized yet versatile packaging formats across Europe.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

E-Commerce Acceleration Boosting Demand for Lightweight Flexible Packaging

-

Rising Preference for Convenience Foods Fueling Growth of Single-Serve Flexible Formats

Level

-

Rising Packaging Waste Pressures Intensify Regulatory and Cost Burdens

-

Inadequate Recycling Infrastructure Limiting Recovery of Multi-Layer Flexible Laminates

Level

-

Rising Healthcare Needs Driving Demand for Specialized Pharma Packaging

-

Smart and Personalized Packaging Opportunities in E-Commerce

Level

-

Consumer Shift Away from Conventional Plastics

-

Low Recycling Rates for Multi-Layer Laminates

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: E-Commerce Acceleration Boosting Demand for Lightweight Flexible Packaging

The demand for adaptable plastic packaging, such as lightweight mailers, courier bags, and stand-up pouches, is rising due to the swift expansion of e-commerce in Europe, which is also changing consumer behavior and the logistics industry. In 2024, B2C e-commerce turnover increased by 7% to approximately USD 926 billion from about USD 862 billion in 2023. Accounting for inflation, real growth reached 4.6%, reflecting the resilience of the sector. When adjusted for inflation, real growth was 4.6%, indicating the sector's robustness (Source: Ecommerce Europe). After 2024, the momentum is likely to be maintained in 2025, with the support of the rising internet penetration and the growing number of shoppers, mainly in Eastern Europe, where turnover went up by 18% to almost USD 22 billion. In 2024, 77% of EU internet users made purchases online, which is significantly higher than 59% ten years ago. Such a tendency increases demand for space-saving and protective packaging that cuts down shipping weights by up to 20% per parcel and, as such, brings down logistics costs on one side and decreases carbon emissions by increased transport efficiency on the other. As the number of cross-border deliveries increases, presently making up 81% of regional turnover, recyclable and mono-material flexible films are becoming the main means to facilitate sector growth and, at the same time, comply with Europe's tough sustainability standards.

Restraint: Rising Packaging Waste Pressures Intensify Regulatory and Cost Burdens

Europe’s packaging waste data from the recent past shows a major limitation for the flexible packaging sector. In 2023, the region produced 79.7 million tonnes of packaging waste (177.8 kg per person), and while this shows an 8.7 kg per person reduction of waste from 2022, it is still 21.2 kg higher than in 2013 (Source: Eurostat). Plastics made up 19.8% of the total waste, or 35.3 kg per person, but only 14.8 kg were recycled, a modest 42% rate. Over the past ten years, plastic packaging waste increased by 22%, while recycling barely improved (Source: Eurostat). The flexible packaging sector, which is heavily reliant on multi-layer films and pouches, is seeing these developments as the growing limitations, especially since “hard-to-recycle” formats will be subject to the highest modulated EPR fees under the PPWR from 2026. Besides PFAS restrictions and limited recycling capacity, producers are exposed to increasing costs and fewer viable material options unless they quickly move to mono-material structures, scalable chemical recycling, or validated reuse systems. If the redesign is not accelerated, flexible packaging may become economically unviable in the EU by 2030 (Source: European Commission/PPWR).

Opportunity: Rising Healthcare Needs Driving Demand for Specialized Pharma Packaging

Europe’s rapidly aging population and growing chronic-disease prevalence are accelerating demand for patient-centric, tamper-evident flexible packaging, a category largely insulated from the strictest PPWR and EPR cost pressures. There is a growing need for unit-dose pouches, stick-packs, strip packs, and high-barrier medical laminates for oral-film drugs, biologics, and home-care therapies that require the correct dosing, an opening that is easy for seniors, and a shelf life that is stable for a long time, even without refrigeration. What is more, medical and pharmaceutical packaging is a beneficiary of partial PPWR exemptions and lower eco-modulated EPR fees when they are justified for hygiene and patient safety (Source: PPWR). Even after PFAS restrictions take effect, essential high-barrier aluminium structures and specific medical-grade plastics may continue to be used where no safe alternatives exist. Converters with capabilities in cleanroom production, laser-scored tear features, and serialised track-and-trace systems are experiencing strong, premium-priced demand. For a flexible packaging sector facing regulatory and cost pressures in mainstream segments, healthcare and pharma represent a resilient, high-margin growth opportunity.

Challenge: Consumer Shift Away from Conventional Plastics

Increased public knowledge of ocean pollution, microplastics, and "forever chemicals" has elicited a significant consumer backlash against traditional plastic packaging. Recent pan-European polls (2024–2025) indicate that 72% of consumers consciously avoid brands utilizing non-recyclable flexible packaging, while 64% are prepared to spend an additional 5–15% for paper or compostable alternatives, and 58% endorse outright prohibitions on single-use plastic pouches. Big retailers (Carrefour, Tesco, REWE, Aldi) and brands (Danone, PepsiCo, L’Oréal) have reacted to this by announcing bold plans to reduce their plastic usage, thus aiming at cutting down the use of virgin fossil-based flexibles by 30–100% by 2030. This shift in demand is already leading to the reduction of traditional multi-layer film volumes, thus paving the way for paper-based and certified compostable pouches that are growing at a double-digit rate. Converters who are still using conventional PE/PET/Alu laminates and are oblivious to the consumer-driven exodus of their products face an existential threat that regulations alone could not accomplish.

EUROPE FLEXIBLE PLASTIC PACKAGING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Developed diaper packaging with 30% post-consumer recycled (PCR) content, maintaining the durability and quality required for heavy, bulky products like diapers. | Reduces virgin plastic usage by 30%, supports circular economy initiatives, provides a sustainable packaging option for diaper brands, and meets consumer demand for eco-friendly packaging. |

|

Collaborated with Scan Sverige to replace unrecyclable multi-material packaging for Parsons brand sliced ham, salami, and plant-based products with WalletPack, a polypropylene (PP)-based mono-material packaging. The solution ensures recyclability, maintains high oxygen barrier protection to extend shelf-life, and includes an easy-peel design for consumer convenience. | Supports sustainability by being 93% recyclable, reduces environmental impact, facilitates efficient sorting at recycling facilities, aligns with Scan Sverige’s goal of 100% recyclable packaging by 2025, and enhances consumer experience with convenient, protective packaging. |

|

Constantia launched EcoLam mono-PE laminates for pharmaceutical strip-pack applications across Europe, replacing aluminum-heavy structures while ensuring barrier protection. | Delivers high-barrier performance with lower environmental impact, improves recyclability, and supports pharmaceutical companies’ sustainability reporting requirements. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe flexible plastic packaging market features a connected value chain supporting efficient, sustainable, and high-performance packaging. Suppliers of polymers, films, and additives feed converters producing pouches, bags, wraps, and specialty formats. Printing, laminating, and logistics partners ensure smooth production, customization, and distribution. The ecosystem is supported by brands, retailers, and e-commerce platforms across key end-use sectors, including Food & Beverage, Pharmaceuticals, Personal Care, Consumer Goods, and Industrial applications. Regulatory agencies, recycling frameworks, and sustainability standards guide quality, safety, and environmental compliance, reinforcing the adoption of flexible plastic packaging across Europe.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Flexible Plastic Packaging Market, By Packaging Type

In 2024, pouches were the largest segment of the Europe market for flexible plastic packaging. Their dominance is, in fact, mostly a result of consumer demand for such packaging that is light in weight, can be resealed, is of a simple nature, and has all these additional benefits, such as improving shelf appeal, extending product shelf life, and reducing logistics costs. Pouches are proliferating in food, beverage, pharmaceutical, and personal care industries as a result of their structural advantages and also due to their being excellent carriers for both liquid and solid items. At the same time, the European regulatory systems, e.g., the Packaging and Packaging Waste Regulation (PPWR), are favouring packaging designs that facilitate recycling and lessen the waste generated, thus inspiring the development of flexible packaging that is compatible with the circular economy goals.

Europe Flexible Plastic Packaging Market, By Application

The food application segment led the market in 2024, with increased demand for convenient, safe, and shelf-stable packaging solutions. Snacks, dairy, frozen, and ready-to-eat meals have all widely adopted flexible formats like pouches, bags, and wraps due to their ability to maintain freshness, extend shelf life, and reduce transportation costs. FoodDrinkEurope’s Data & Trends 2024 indicates that the EU food and drink industry employs 4.7 million individuals, creates USD 1.3 trillion in turnover, and contributes USD 270 billion in value added, establishing it as the largest manufacturing sector in the EU. Approximately 65% of EU food exports are directed towards the Single Market, while USD 200 billion is sent beyond the EU; this sector's magnitude and export focus underscore the substantial demand for flexible packaging. Sustainability initiatives and legislative measures promote recyclable and resource-efficient packaging, establishing the food sector as the primary catalyst for market growth in Europe.

REGION

Spain to be the fastest-growing country in the Europe flexible plastic packaging market during the forecast period

Spain is emerging as the fastest-growing flexible plastic packaging market in Europe due to increasing demand for sustainable, recyclable, and lightweight packaging across food & beverages, pharmaceuticals, and consumer goods. Furthermore, these are strongly endorsed by regulatory frameworks. Among others, Royal Decree?1055/2022 embraces circular economy practices, targets recyclability, enforces EPR, and regulates the separate collection of plastic fractions. Parallel legislation, like Law?7/2022, lays down national recycling targets of 50?% in 2025 and 55?% in 2030, and supportive measures related to the use of recycled content in packaging and taxation on non-reusable containers. Backed by associations like ASPAPEL, Spanish converters are rapidly adopting recyclable flexible films and mono-material packaging, reinforcing the position of the country as a leader in sustainable flexible plastic packaging innovation across the EU.

EUROPE FLEXIBLE PLASTIC PACKAGING MARKET: COMPANY EVALUATION MATRIX

Amcor plc (Star) leads the Europe flexible plastic packaging market with its extensive regional presence, innovation-driven product portfolio, and focus on high-performance, recyclable, and cost-efficient packaging solutions across food & beverage, healthcare, personal care, and industrial segments. Leveraging advanced materials and sustainability initiatives, Amcor meets evolving regulatory and consumer demands efficiently. Bischof?+?Klein?SE?&?Co.?KG (Emerging Leader) is rapidly expanding by offering tailored, sustainable, and high-quality flexible packaging solutions, including recyclable films and specialty products, capturing growing demand across multiple sectors. Its agility, local expertise, and commitment to innovation strengthen its position in the Europe market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Amcor plc

- Constantia Flexible

- Huhtamaki Oyj

- Mondi

- Coveris

- Bischof+Klein SE & Co. KG

- Wihuri Group

- Guala Packa S.p.a

- Clondalkin Group

- Polymaterial Limited

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 35.23 Billion |

| Market Size in 2030 (Value) | USD 39.04 Billion |

| CAGR | CAGR of 1.66% from 2025–2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | Germany, France, UK, Spain,Italy, Russia, Rest of Europe |

WHAT IS IN IT FOR YOU: EUROPE FLEXIBLE PLASTIC PACKAGING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| German-based Flexible Plastic Packaging Manufacturers |

|

|

| UK-based Flexible Plastic Packaging Manufacturers |

|

|

| Polypropylene-based Flexible Plastic Packaging Manufacturers |

|

|

RECENT DEVELOPMENTS

- June 2024 : Greiner Packaging and Constantia Flexibles have partnered to launch a fully home-compostable coffee capsule solution featuring Greiner’s capsule body and Constantia’s EcoPressoLid.

- March 2024 : Constantia ColorCap, a subsidiary of Constantia Flexibles in Poland, celebrated a major milestone on March 13, 2024, with its new production and warehouse hall opening.

- February 2024 : Amcor has partnered with Stonyfield Organic and Cheer Pack North America to introduce the first all-polyethylene (PE) spouted pouch, marking a significant advancement in sustainable packaging.

- November 2023 : Amcor signed an agreement with NOVA Chemicals to source mechanically recycled polyethylene (rPE) for use in flexible packaging films. This multiyear agreement underscores both companies’ commitment to enhancing packaging circularity by increasing the use of rPE in their products.

- July 2023 : Huhtamaki invested ~USD 30 million to expand its Paris, Texas, facility, increasing manufacturing capacity and consolidating operations at an external warehouse.

Table of Contents

Methodology

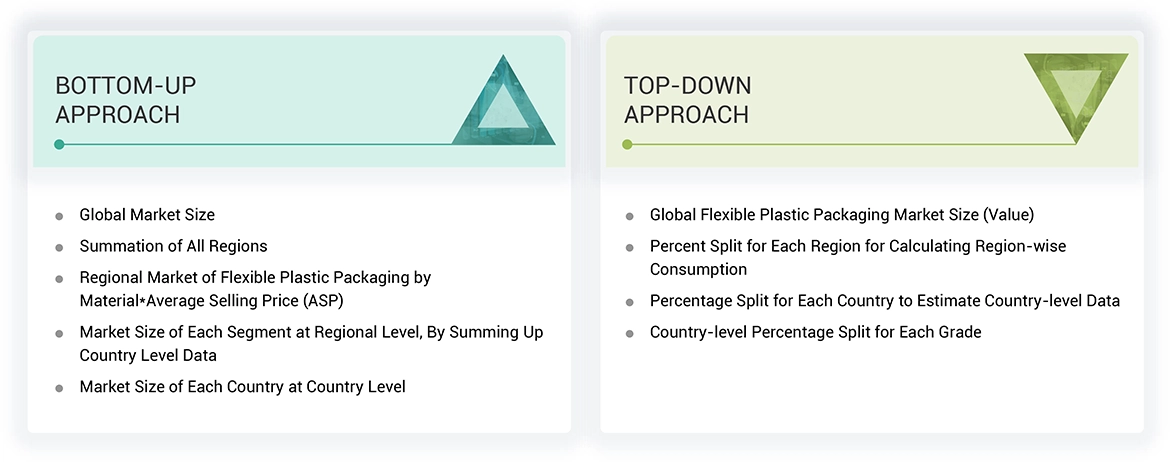

The study involved four major activities for estimating the current size of the Europe flexible plastic packaging market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of Europe flexible plastic packaging through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the Europe flexible plastic packaging market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred, to identify and collect information for this study on the Europe flexible plastic packaging market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The Europe flexible plastic packaging market comprises several stakeholders in the supply chain, which include raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the Europe flexible plastic packaging market. Primary sources from the supply side include associations and institutions involved in the Europe flexible plastic packaging industry, key opinion leaders, and processing players.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the Europe flexible plastic packaging market by packaging type, material, application, printing technology, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the Europe flexible plastic packaging market from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Flexible plastic packaging refers to any packaging or any constituent part of packaging made from a thin, flexible plastic film or sheet. These can be molded into an infinite amount of shapes, including a pouch, bag, wrapper, shrink film, tube, or liner with the ability to hold all kinds of products. Its adaptability makes way for effective, space-efficient designs and can bend to various sizes and shapes. It is highly utilized in a wide array of industries for functional as well as aesthetic packaging solutions. Flexible packaging is a dynamic approach in packaging wherein products are packed in non-rigid materials to provide economical as well as customized solutions. Probably, flexible plastic packaging is among the most versatile, lightweight, and rigid packing options in use today. This innovative solution gives good barrier properties, shielding the products from moisture, oxygen, light, and any other environmental factors that can contribute to degradation and shortening of shelf life. The flexible plastic packaging is mostly used in food and beverages, pharmaceutical, and personal care industries. It ensures the protection of a product, reduces waste, and facilitates ease in terms of portability for consumers.

Stakeholders

- Europe flexible plastic packaging manufacturers

- Raw Material Suppliers

- Regulatory Bodies and Government agencies

- Flexible Packaging Traders, Distributors, and Suppliers

- Flexible Packaging End-use Industries

- Associations and Industrial Bodies

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the Europe flexible plastic packaging market in terms of value and volume.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To forecast the market size based on material, packaging type, application, printing technology, and region.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders.

- To strategically profile leading players and comprehensively analyze their key developments such as new product launches, expansions, and acquisitions in the Europe flexible plastic packaging market.

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Flexible Plastic Packaging Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Flexible Plastic Packaging Market