Europe Lubricants Market

Europe Lubricants Market by Base Oil Type (Mineral Oil Lubricant, Synthetic Lubricants, Bio-based Lubricants), Product Type (Engine Oil, Turbine Oil, Metalworking Fluid, Hydraulic Oil), End-use Industry (Transportation and Industrial) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe lubricants industry is expected to reach USD 50.08 billion by 2030 from USD 44.67 billion in 2025, with a CAGR of 2.31%. Europe's market is advanced and regulation-driven, supported by a mature automotive and industrial sector, with strict environmental policies in Germany, the UK, France, Italy, and Russia. As a leading consumer of high-performance lubricants, the region’s automotive and industrial applications are fueled by standards like ACEA, Euro 6/7, and the European Green Deal, promoting eco-friendly, energy-efficient, low-viscosity formulations. Innovations in additive tech, anti-wear, and high-performance oils boost competitiveness. Manufacturers invest in bio-lubricants, circular solutions, and CO2 reductions to meet sustainability goals. With emphasis on electrification and digitalization, Europe's market is focused on premium, eco-friendly, and specialized lubricants.

KEY TAKEAWAYS

-

By CountryGermany dominated the Europe lubricants market, accounting for a 13.1% share in 2024.

-

By Base OilSynthetic lubricants are projected to show the highest CAGR of 2.48% during the forecasted period.

-

By Product TypeThe metalworking fluid is estimated to register the highest CAGR of 2.98% in the Europe lubricants market, between 2025 and 2030.

-

By End-use IndustryThe transportation end-use industry accounted for the largest share of the Europe lubricants market in 2024.

-

Competitive Landscape - Key PlayersExxon Mobil Corporation, TotalEnergies SE, and Shell plc stand out as dominant participants in the Europe lubricants market, supported by their extensive offerings and established industry reach.

-

Competitive Landscape - StartupsCompanies like FUCHS SE, Motul S.A., and ENEOS Corporation are gaining visibility in specialized segments, positioning them as promising up-and-coming players in the market.

The Europe lubricants market is expected to experience steady growth in the coming years, supported by rising demand across automotive, industrial, marine, energy, and transportation applications. Market expansion is driven by the region’s advanced automotive manufacturing base, strong logistics and commercial fleet activity, and the robust industrial output of key economies such as Germany, the UK, France, Italy, and Eastern Europe. End users are increasingly prioritizing high-performance, fuel-efficient, and environmentally compliant lubrication solutions, accelerating the adoption of synthetic, semi-synthetic, and bio-based formulations. Additionally, tightening ACEA standards, Euro emissions regulations, and the broader EU sustainability agenda are reinforcing the shift toward low-viscosity, long-drain, and high-efficiency lubricant systems across both automotive and industrial sectors.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers' businesses is driven by rapidly evolving end-use requirements and a highly regulated industry environment. Key clients include automotive OEMs and aftermarket service networks, commercial fleet operators, industrial and metalworking manufacturers, marine and offshore operators, energy and power generation companies, and a wide base of machinery-intensive industries across Germany, the UK, France, Italy, Russia, and Eastern Europe. Each represents major application segments in the region. Trends such as stricter EU sustainability and emissions regulations, the accelerated shift toward synthetic and low-viscosity lubricants, growth in bio-lubricants and re-refined base oils, increasing electrification of vehicles and industrial systems, and the rising adoption of smart maintenance, IIoT-based condition monitoring, and predictive lubrication technologies are reshaping formulation, sourcing, and performance requirements. As Europe transitions toward cleaner, more efficient, and digitally integrated lubrication solutions, companies across the value chain must adapt to maintain profitability in an increasingly innovation-driven market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Strong industrial base and demand for high-performance, energy-efficient lubricants

-

Increase in supply of Group II and Group III base oil

Level

-

Stringent environmental rules limiting conventional lubricant formulations

-

Rising demand for electric vehicles and reducing price of batteries

Level

-

Growing shift toward bio-based and environmentally acceptable lubricants (EALs)

-

Increasing demand for renewable energy

Level

-

Economic uncertainty and fluctuating automotive production

-

Volatile raw material prices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Strong industrial base and demand for high-performance, energy-efficient lubricants

Europe’s well-established industrial ecosystem, spanning automotive manufacturing, metalworking, machinery, chemical processing, marine, and power generation, continues to drive strong demand for advanced lubricants. The region’s focus on energy efficiency, lower friction, reduced emissions, and improved equipment reliability fuels the adoption of synthetic and semi-synthetic formulations. Additionally, EU sustainability objectives and carbon-neutrality commitments push industries toward longer-drain-interval, premium-grade lubricants that reduce downtime and extend machinery life. Growing demand from automotive OEMs in Germany, the U.K., Italy, and Central Europe further reinforces market expansion.

Restraint: Stringent environmental rules limiting conventional lubricant formulations

Europe’s regulatory environment, among the strictest globally, poses a major restraint on the use of traditional mineral-oil-based lubricants. Regulations such as REACH, ACEA emission standards, and EU directives on chemical safety restrict certain additives, viscosity modifiers, and base oils. These standards increase formulation complexity and require continuous reformulation to comply with biodegradability, toxicity, and eco-labeling requirements. The shift away from older, petroleum-heavy lubricants increases production costs and limits the availability of specific raw materials, particularly affecting small and mid-sized lubricant blenders.

Opportunity: Growing shift toward bio-based and environmentally acceptable lubricants (EALs)

Europe’s strong sustainability agenda creates significant growth opportunities for bio-based lubricants and Environmentally Acceptable Lubricants (EALs), especially in applications such as marine, forestry, agriculture, construction, and hydraulics. Government incentives, green procurement policies, and corporate ESG commitments support increased adoption of biodegradable and low-toxicity lubricants. Countries such as Germany, the Netherlands, Norway, and Sweden are accelerating their transition to eco-friendly lubrication solutions. Lubricant manufacturers investing in esters, synthetic bio-oils, and advanced renewable feedstock technologies stand to gain a substantial competitive advantage.

Challenge: Economic uncertainty and fluctuating automotive production

Europe faces ongoing economic uncertainty due to geopolitical tensions, inflationary pressures, and volatile energy prices, all of which directly affect lubricant consumption. Declines or slowdowns in automotive production, especially in Germany, France, and Eastern Europe, limit demand for engine oils, transmission fluids, and metalworking lubricants. Additionally, the rapid transition toward electric vehicles (EVs) reduces long-term demand for conventional automotive lubricants, creating structural challenges for lubricant manufacturers dependent on ICE-related volumes. Navigating these shifts requires strategic adaptation toward specialty, industrial, and EV-compatible lubrication technologies.

EUROPE LUBRICANTS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Automotive, industrial, marine, and energy-sector lubricants supplied across major European economies.? | Broad OEM approvals and premium synthetic ranges that support fuel efficiency, extended drains, and CO2-reduction targets in fleets and industrial assets.? |

|

Passenger car, commercial vehicle, motorcycle, and industrial lubricants serving OEM, workshop, and industrial channels.? | Strong brand in automotive and motorsport, high-performance synthetics tuned to European emission and fuel-economy norms, and digital tools for service and monitoring.? |

|

Automotive and industrial lubricants supplied to car makers, fleets, and process industries.? | Long-drain synthetic technologies and gear/hydraulic fluids helping reduce downtime and energy losses in high-value industrial and logistics operations.? |

|

Independent European specialist providing automotive, industrial, metalworking, and specialty lubricants with strong German base.? | Custom formulations for OEMs and industrial customers, deep application engineering, and advanced fluids for metal forming, food-grade uses, and specialty niches.? |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe lubricants ecosystem comprises a complex and highly integrated network of stakeholders, including base oil producers, additive suppliers, lubricant blenders, distributors, service providers, and a broad spectrum of end-use industries. Base oil suppliers provide Group I, II, III, and IV base stocks along with an expanding range of re-refined and bio-based alternatives to lubricant manufacturers. Additive suppliers provide essential components, including anti-wear agents, detergents, dispersants, VI improvers, friction modifiers, and oxidation inhibitors, enabling high-performance, low-emission, and long-drain formulations that meet Europe’s stringent standards. Lubricant blenders develop automotive, industrial, marine, metalworking, energy-sector, food-grade, and specialty lubricant formulations designed to meet Europe’s technical specifications, sustainability mandates, and ACEA/Euro regulatory requirements. Distributors, wholesalers, authorized service networks, and workshop channels serve as the bridge between manufacturers and end users by managing supply chains, providing technical support, and ensuring timely product availability across mature and emerging European markets. End-use sectors, including automotive OEMs and aftermarket workshops, commercial fleets, industrial and manufacturing units, marine and offshore operations, power generation, chemicals, and heavy engineering, depend on lubricants for equipment protection, energy efficiency, reduced downtime, and regulatory compliance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Lubricants Market, By Base Oil

Mineral oil–based lubricants hold the largest share of the Europe lubricants market in 2024, primarily due to their widespread use across heavy industries, metalworking, marine operations, legacy machinery, and general-purpose applications. Their cost-effectiveness, broad availability, and compatibility with a wide range of industrial equipment make them the preferred choice in sectors such as manufacturing, steel, chemicals, construction, and transportation, especially where high volumes and moderate performance requirements dominate.

Europe Lubricants Market, By Product Type

Engine oils dominate the Europe lubricants market by product type, supported by the region’s large and technologically advanced passenger vehicle fleet, strong commercial transportation activity, and stringent ACEA and Euro emission standards that demand high-performance, fuel-efficient formulations. Their widespread use across passenger cars, light commercial vehicles, heavy-duty trucks, and off-highway machinery drives consistent demand. The shift toward synthetic and low-viscosity engine oils, such as 0W-20 and 5W-30, further strengthens this segment as OEMs prioritize extended drain intervals, lower emissions, and improved engine protection.

Europe Lubricants Market, By End-use Industry

The transportation sector dominates the Europe lubricants market, driven by the region’s extensive passenger vehicle fleet, commercial trucking operations, public transport systems, and strong automotive OEM presence. High lubricant consumption across passenger cars, light commercial vehicles, heavy-duty trucks, buses, off-highway equipment, and marine transport reinforces this segment’s leadership. The growing adoption of synthetic and low-viscosity lubricants, aligned with ACEA specifications and Euro emission norms, further strengthens demand as end users prioritize fuel efficiency, reduced emissions, longer drain intervals, and enhanced engine durability.

REGION

Germany held the largest share of the Europe lubricants market in 2024

Germany holds the largest share of the Europe lubricants market on account of its highly advanced automotive manufacturing base, strong industrial machinery sector, extensive metalworking activities, and significant demand from engineering, chemicals, and transportation industries. The country’s well-established OEM network and stringent performance standards further drive the consumption of high-grade synthetic and specialty lubricants.

EUROPE LUBRICANTS MARKET: COMPANY EVALUATION MATRIX

In the Europe lubricants market, Shell holds a leading position with an extensive regional presence and a comprehensive portfolio spanning automotive, industrial, marine, energy, and specialty lubricants. The company enables widespread adoption across passenger vehicles, commercial fleets, manufacturing units, heavy engineering, and power generation sectors by delivering high-performance, long-drain, and environmentally compliant lubrication solutions. Shell’s strong focus on innovation, supported by advanced synthetic technologies, low-viscosity fuel-efficient formulations, and investments in bio-lubricants and re-refined base oil integration, further strengthens its market leadership. The company’s robust distribution and service network, long-standing partnerships with OEMs and industrial operators, and commitment to sustainability and carbon-reduction initiatives empower end users to meet evolving regulatory requirements, enhance equipment reliability, and achieve superior operational efficiency across diverse applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Shell plc (UK)

- TotalEnergies SE (France)

- BP plc (UK)

- ExxonMobil Corporation (US)

- FUCHS SE (Germany)

- Chevron Corporation (US)

- Motul S.A. (France)

- PJSC LUKOIL (Russia)

- ENEOS Corporation (Japan)

- PETRONAS Lubricants International (Malaysia)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 43.70 Billion |

| Revenue Forecast in 2030 | USD 50.08 Billion |

| Growth Rate | CAGR of 2.31% from 2025-2030 |

| Actual data | 2020-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million/Billion), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Europe |

WHAT IS IN IT FOR YOU: EUROPE LUBRICANTS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Industrial Lubricants Manufacturer |

|

|

| Automotive Lubricants Producer serving European OEMs |

|

|

RECENT DEVELOPMENTS

- December 2024 : TotalEnergies SE and Ford Trucks, a major player in the heavy-commercial truck industry, signed an international agreement to strengthen their strategic partnership in Europe. This five-year partnership will enable both companies to offer European Ford Trucks fleet managers high-quality products and services tailored to the specific needs of vehicles and local markets.

- July 2024 : TotalEnergies SE acquired Tecoil, a Finnish company specializing in the production of regenerated base oils (RRBOs). Tecoil has a 50,000-ton-per-year production facility in Hamina, Finland, and has developed a circular economy network to collect used lubricants in Europe. Due to the optimized 're-refining' process, the oils used by Tecoil have properties comparable to the best virgin base oils.

- January 2024 : Shell plc acquired MIDEL and MIVOLT from Manchester-based M&I Materials Ltd. The acquisition of MIDEL enables Shell to complement its differentiated position in transformer oils used for power distribution, offshore wind parks, utility companies, and traction power systems.

Table of Contents

Methodology

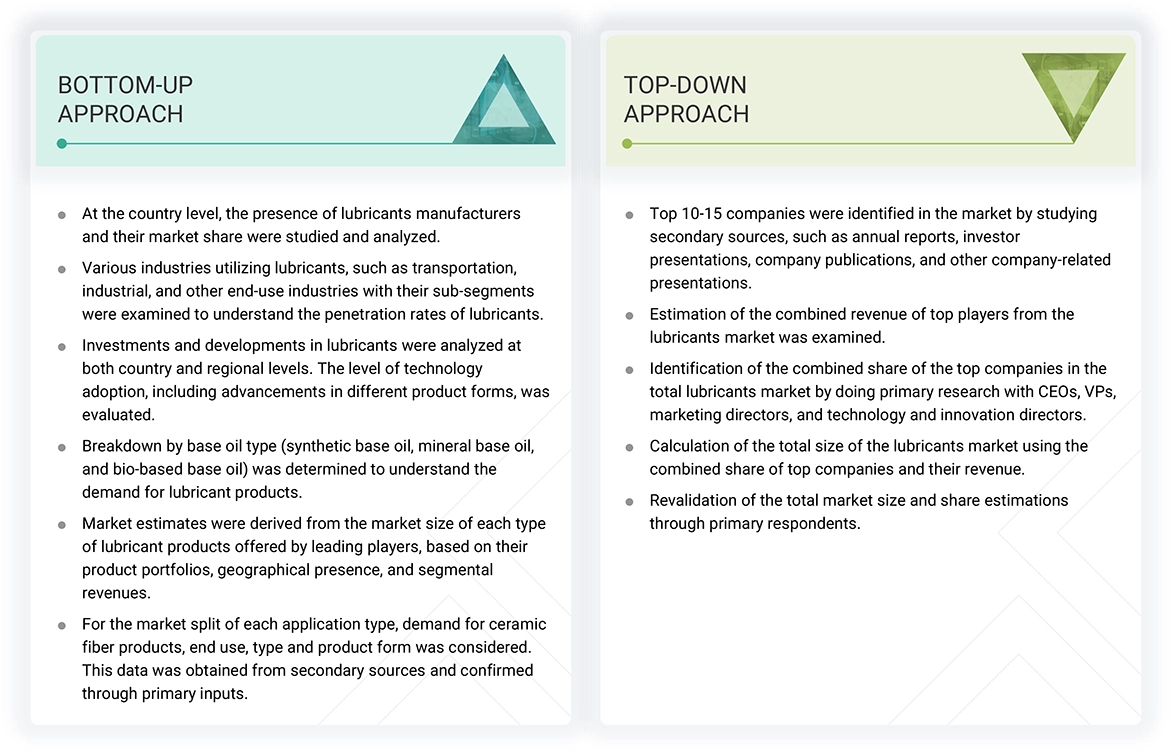

The study involved four major activities in estimating the Europe lubricants market size. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below.

Primary Research

The Europe lubricants market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by engine oil, turbine oil, gear oil, grease, hydraulic oil, compressor oil, metalworking fluid, and others. Advancements in technology and diverse application industries characterize the supply side. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Exxon Mobil Corporation | Senior Manager | |

| Shell plc | Innovation Manager | |

| Indian Oil Corporation Limited | Vice-president | |

| BP p.l.c. | Production Supervisor | |

| Chevron Corporation | Sales Manager | |

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the Europe lubricants market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following parameters:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the europe lubricants industry.

Market Definition

The lubricants market encompasses a range of substances engineered to diminish friction between surfaces, thereby reducing heat generation and facilitating the transmission of forces during movement. These substances also serve to transport foreign particles and regulate surface temperatures. Employed across diverse applications, from industrial machinery and cooking to bioapplications such as artificial joints, medical procedures, and intimate relations, europe lubricants are pivotal in mitigating friction, wear, heat generation, noise, and vibrations within mechanical systems.

Stakeholders

- Lubricants manufacturers

- Lubricants suppliers

- Raw material suppliers

- Service providers

- Application sector companies

- Government bodies

Report Objectives

- To define, describe, and forecast the Europe lubricants market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by base oil type, product type, end-use industry, and region

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To strategically profile key players and comprehensively analyze their growth strategies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Lubricants Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Lubricants Market