Europe Machine Vision Market

Europe Machine Vision Market by Component (Cameras, Frame Grabbers, Optics, LED Lighting, Processors, AI-based Machine Vision Software), Type (PC-based, Smart Camera-based), Deployment (General, Robotic Cell), Vision Type (1D, 2D, 3D) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The machine vision market in Europe is projected to reach USD 5.43 billion by 2030, up from USD 3.61 billion in 2024, with a CAGR of 7.3% from 2025 to 2030. Market growth is driven by the rising adoption of automation across the european manufacturing sector, increasing demand for high-precision inspection, rapid advancements in AI-enabled vision technologies, and strong momentum toward smart factories supported by EU digitalization initiatives.

KEY TAKEAWAYS

-

By CountryGermany dominates the machine vision market in Europe, accounting for a 25% share in 2024.

-

By ComponentBy component, the software segment is expected to register the highest CAGR of 8.7%.

-

By IndustryBy industry, the food & beverages segment is projected to grow at the fastest rate from 2025 to 2030.

-

Competitive LandscapeBasler AG, SICK AG, and Cognex Corporation were identified as some of the key players in the market, given their strong market share and extensive product footprint.

-

Competitive LandscapeBaumer, MVTec Software GmbH, and IDS Imaging Development Systems GmbH have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The machine vision market in Europe is witnessing strong growth, driven by the rising adoption of automated inspection and quality assurance across manufacturing, increasing demand for operational efficiency in automotive, electronics, and pharmaceutical sectors, and rapid advancements in AI-enabled vision systems, 3D imaging, and edge processing technologies that improve accuracy, productivity, and real-time decision-making across european industrial operations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ businesses in the market is being accelerated by the transition from traditional inspection methods to AI-driven and automated vision technologies. Advancements in deep learning inspection, 3D and robotic vision, embedded vision, edge AI cameras, and cloud-enabled analytics are enhancing quality control, traceability, and automation across the automotive, electronics, pharmaceutical, and industrial manufacturing sectors. This shift is fueling demand for zero-defect production, predictive quality monitoring, and fully automated inspection, enabling higher productivity, reduced downtime, and improved operational efficiency throughout european industries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid adoption of vision-guided robotics supported by Europe’s strong industrial automation ecosystem

-

Growing integration of AI-enabled and deep-learning machine vision systems in manufacturing and logistics

Level

-

High initial investment and integration costs, particularly for SMEs across Europe

Level

-

Expanding adoption in food & beverage and packaging due to strict EU hygiene and labeling requirements

-

Rising use of compact smart cameras, edge AI processors, and embedded vision modules

Level

-

Shortage of skilled professionals specialized in computer vision, robotics, and automation engineering

-

Growing cybersecurity concerns with connected automation and smart factory setups

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid adoption of vision-guided robotics supported by Europe’s strong industrial automation ecosystem

Europe’s advanced manufacturing base and strong investments in Industry 4.0 are accelerating the adoption of vision-guided robotics for precision inspection, assembly, and material handling. The automotive, electronics, and pharmaceutical sectors are increasingly deploying AI-enabled vision systems to enhance accuracy, reduce defects, and improve production efficiency, thereby strengthening Europe’s leadership in automated manufacturing technologies.

Restraint: High initial investment and integration costs, particularly for SMEs across Europe

Small and mid-sized manufacturers across Europe often struggle with the high upfront cost of machine vision hardware, software, and system integration. Budget constraints, limited technical resources, and the need for specialized engineering support slow adoption. For many SMEs, scaling automation requires phased investment strategies, government incentives, and easier-to-deploy plug-and-play vision solutions.

Opportunity: Expanding adoption in food & beverage and packaging due to strict EU hygiene and labeling requirements

Strict EU regulations regarding food safety, traceability, and packaging standards are driving the adoption of machine vision across the food and beverage sector. Vision systems enable precise label verification, contaminant detection, fill-level inspection, and verification of packaging integrity. This regulatory-driven demand is creating strong growth opportunities for vision suppliers in highly automated european processing facilities.

Challenge: Shortage of skilled professionals specialized in computer vision, robotics, and automation engineering

Europe faces a growing talent gap in computer vision, robotics, and automation engineering, limiting companies’ ability to deploy and maintain advanced vision systems. Manufacturers struggle with hiring specialists for AI training, system integration, and vision tuning. This talent shortage increases deployment timelines and highlights the need for workforce upskilling and intuitive, low-code vision tools.

Europe Machine Vision Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Machine vision systems ensure weld seam inspection, paint surface defect detection, battery-cell quality inspection, and robotic guidance across EV and ICE vehicle production lines. | Improved product precision | Reduced rework | Enhanced paint and surface quality | Faster inspection cycles |

|

Vision applications validate assembly accuracy, detect part misalignment, support automated fastening, and enable real-time quality checks in powertrain and EV battery pack assembly. | Lower defect rates | Increased automation efficiency | Better traceability | Reduced warranty claims. |

|

Machine vision supports composite material inspection, rivet and fastener verification, guided robot drilling, and structural integrity assessment for fuselage and wing components. | Higher manufacturing accuracy | Reduced production errors | Enhanced aerospace safety compliance. |

|

Vision systems monitor electronics assembly, perform PCB inspection, identify micro-defects in components, and support AI-driven predictive quality analysis in manufacturing plants. | Higher production yield | Improved process stability | Reduced inspection times | Better defect prediction |

|

Automated vision tools inspect stamping, welding, and painting operations, validate body panel alignment, and support robotic automation in multi-brand european manufacturing facilities | Improved throughput | Lower operational errors | Enhanced quality assurance | Reduced labor dependency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market ecosystem is supported by leading hardware and software providers such as Basler, IDS Imaging, SICK, Baumer, TKH, Atlas Copco, and FRAMOS, which collectively deliver industrial cameras, 3D vision systems, optics, sensors, processors, and advanced vision software. These technologies enable deployment across key european end-user industries, including automotive (Volkswagen, BMW, Volvo), consumer products (Philips, Bosch), pharmaceuticals (Roche, Novartis), food & beverages (Nestlé, Danone), and industrial machinery (Siemens, ABB). This interconnected ecosystem strengthens inspection accuracy, factory automation, traceability, and data-driven decision-making across Europe’s advanced manufacturing landscape.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Machine Vision Market, By Component

Cameras hold the largest share of the machine vision market in Europe and are expected to maintain this lead throughout the forecast period, driven by the adoption of AI-enabled inspection, high-resolution CMOS sensors, edge processing, and Industry 4.0. Their critical role in defect detection, measurement, and monitoring enhances quality, reduces downtime, and strengthens their market position.

Europe Machine Vision Market, By Industry

As of 2024, the food & beverages segment held the largest share of the machine vision market in Europe and is expected to maintain its lead through the forecast period. The growing use of machine vision for packaging verification, labeling compliance, contaminant detection, and hygiene monitoring, driven by stringent EU regulations, is enhancing quality, reducing defects, and strengthening this segment’s role in Europe’s automated production landscape.

REGION

France is expected to be the fastest-growing region in the Europe machine vision market during the forecast period

France held a significant share of the market in 2024 and is expected to post strong growth through the forecast period. The country’s increasing adoption of industrial automation, AI-enabled vision systems, and smart manufacturing technologies, supported by strong digital infrastructure and national Industry 4.0 initiatives, is driving market expansion. The growing deployment of real-time inspection, robotic vision, and quality control solutions across the automotive, aerospace, pharmaceutical, electronics, and food processing industries is reinforcing France’s leadership position in the regional market.

Europe Machine Vision Market: COMPANY EVALUATION MATRIX

Basler AG and SICK AG (Star Players) lead with strong market positions and advanced product portfolios. Basler’s extensive camera lineup, high-resolution CMOS technology, and broad adoption across inspection, measurement, and robotics strengthen its dominance. SICK AG reinforces its position through sophisticated 3D vision systems, vision-guided automation, and smart sensors that enable real-time inspection and defect detection. As demand for intelligent inspection, edge-AI analytics, and automated quality control accelerates across Europe’s automotive, electronics, pharmaceutical, and industrial sectors, both companies continue to serve as key drivers of next-generation machine vision adoption in the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Basler AG (Germany)

- SICK AG (Germany)

- TKH (Netherlands)

- Atlas Copco AB (Sweden)

- Cognex Corporation (US)

- KEYENCE CORPORATION (Japan)

- Sony Group Corporation (Japan)

- Teledyne Technologies Inc. (US)

- Omron Corporation (Japan)

- Canon Inc. (Japan)

- AMETEK.Inc. (US)

- Zebra Technologies Corp. (US)

- Texas Instruments (US)

- Emerson Electric Co. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.61 Billion |

| Market Forecast in 2030 (Value) | USD 5.43 Billion |

| Growth Rate | CAGR of 7.3% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe (Germany, UK, France, Italy, Spain, Netherlands, Switzerland, Nordics, Rest of Europe) |

WHAT IS IN IT FOR YOU: Europe Machine Vision Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape |

|

|

| Regional Market Entry Strategy |

|

|

| Application-Specific Opportunity Assessment |

|

|

| Technology Adoption by End-use Industries |

|

|

RECENT DEVELOPMENTS

- August 2024: TKH acquired LIBERTY ROBOTICS, a 3D vision guidance systems provider for robotic applications, particularly in the automotive sector. This acquisition strengthens TKH's 3D vision sensor technology and market presence, complementing its existing automation solutions.

- June 2024: Basler's ace 2 V series introduced compact CoaXPress 2.0 cameras (29x29 mm) with Sony Pregius S sensors (5-24 MP, up to 212 fps), offering high bandwidth (12.5 Gbps) and diverse resolutions. These new models expand Basler's CoaXPress 2.0 portfolio, providing customers with integrated hardware and software solutions from a single vendor.

- June 2024: SICK AG launched the Inspector83x 2D vision sensor, introducing out-of-the-box AI machine vision for high-speed inline inspections. This sensor simplifies complex inspections with AI, enabling efficient quality control in demanding production environments.

Table of Contents

Methodology

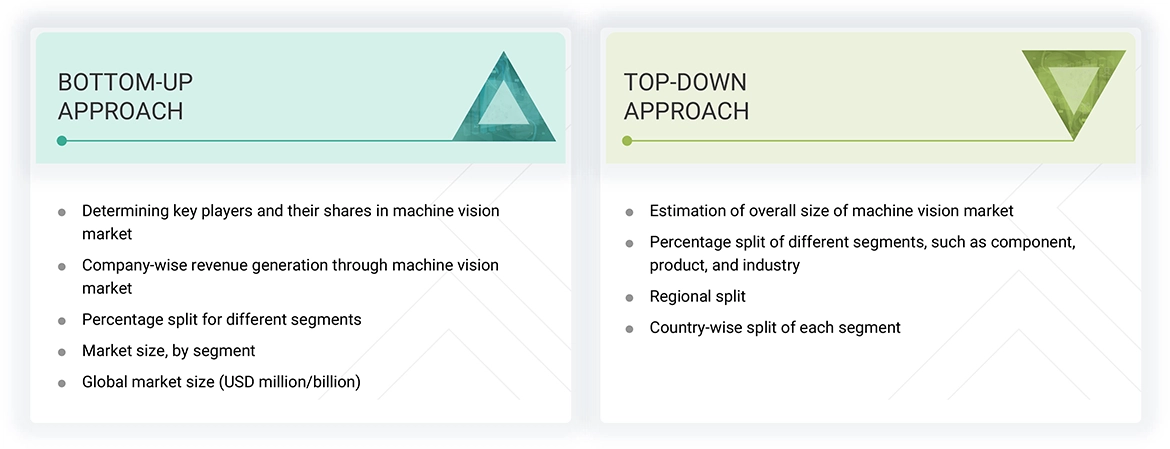

The study involved four major activities for estimating the current size of the Europe machine vision market. Exhaustive secondary research has been done to collect information on the market. The next step is to validate these findings, assumptions, and size with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of the segments and subsegments. Two sources of information, secondary and primary, have been used to identify and collect information for an extensive technical and commercial study of the Europe machine vision market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, which is further validated through primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the Europe machine vision market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across Europe. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the Europe machine vision market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the market have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Europe Machine Vision Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Europe machine vision market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both the top-down and bottom-up approaches.

Market Definition

Machine vision systems use a combination of hardware and software to provide operational guidance to devices in executing their functions. Visual inspections are automated, and product assembly equipment are precisely guided using sensors (cameras), processing hardware, and software algorithms. The system relies on digital sensors installed in cameras with specialized optics to acquire images. These images are then processed, analyzed, and measured by artificial intelligence (AI) technology embedded in the computer hardware for decision-making. AI allows machines to learn from experience, intercept new inputs, and perform human-like tasks. Machine learning and natural language processing (NLP), used to train computers, are also used in Europe machine vision to perform specific tasks by processing large data captured by cameras. Europe machine vision systems offer fast response, a tailored approach, accurate information, and fewer redundancies—all essential to achieving higher organizational efficiency. Europe machine vision systems encompass all industrial and non-industrial applications.

Key Stakeholders

- Government bodies and policymakers

- Industry organizations, forums, alliances, and associations

- Raw material suppliers and distributors

- Research institutes and organizations

- Original equipment manufacturers (OEMs)

- Technology, service, and solution providers

- Intellectual property (IP) core and licensing providers

- Market research and consulting firms

Report Objectives

- To describe, segment, and forecast the overall Europe machine vision market by application, vision type, deployment, component, system type, and industry, in terms of value

- To provide an overview of the recent trends in the market

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze the supply chain, trends/disruptions impacting customer business, market/ecosystem map, pricing analysis, and regulatory landscape pertaining to the Europe machine vision market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the Europe machine vision market

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, value chain analysis, trends/disruptions impacting customer business, impact of AI/Gen AI, key conferences and events, pricing analysis, Porter’s five forces analysis, and regulations pertaining to the market under study

- To provide a macroeconomic outlook based on all the regions in the region chapter

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Machine Vision Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Machine Vision Market