Europe Managed Services Market Size, Share, Trends & Outlook

Europe Managed Services Market by Service Type (IT Infrastructure & Data Center Services, Network Services, Security Services, Communication & Collaboration Services, Mobility Services, and Information Services) – Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

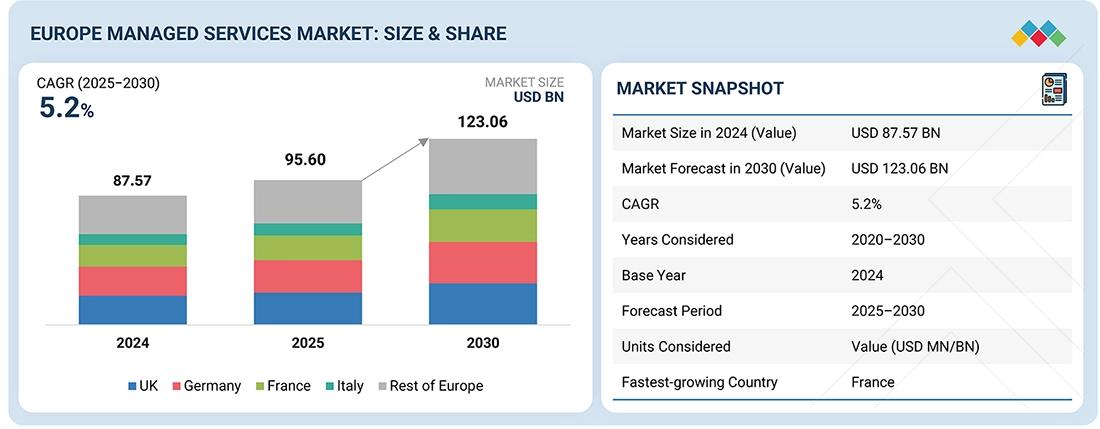

The Europe Managed Services Market is projected to grow from USD 95.60 billion in 2025 to USD 123.06 billion by 2030. This growth is supported by rising cloud complexity and stronger security needs across enterprises adopting hybrid and multicloud operating models.

KEY TAKEAWAYS

-

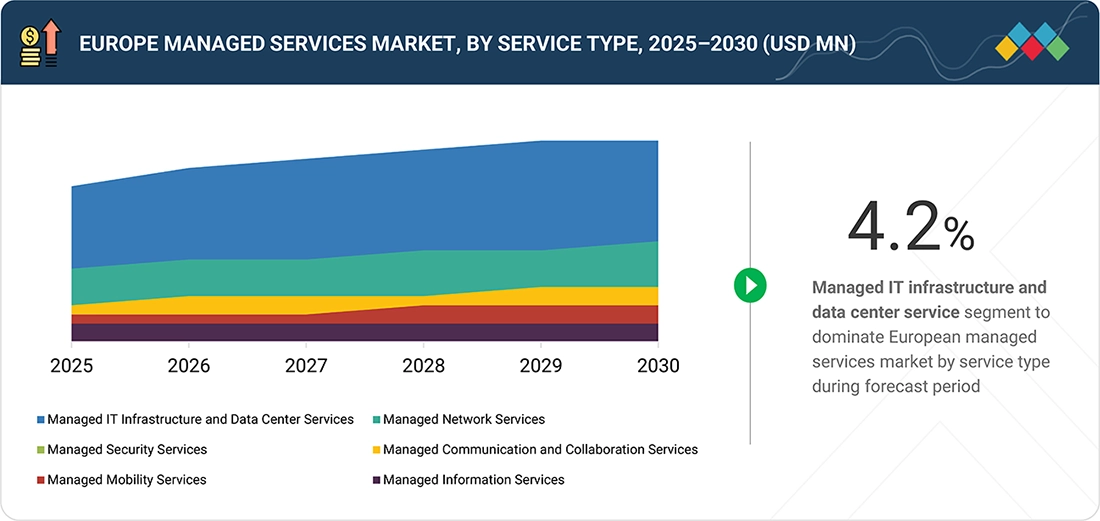

By Service TypeManaged security services are projected to be the fastest-growing service type in Europe, at a CAGR of 5.2%.

-

By Managed Security ServiceManaged detection & response is the fastest-growing subsegment in Europe, forecasted to have a CAGR of 16.5%.

-

By Managed Network ServiceManaged network security is fastest-growing network service in Europe, projected at CAGR of 6.6%.

-

By Managed IT Infrastructure & Data Center ServicesServer management is the fastest-growing segment in Europe, driven by migration.

-

By Managed Communication & Collaboration ServicesManaged VOIP is the fastest-growing segment in Europe.

-

By Managed Mobility ServicesUnified endpoint management services are the fastest-segment in Europe as remote work increases.

-

By Managed Information ServicesManaged information services represent a rapidly growing segment in Europe as enterprises automate workflows.

-

By Deployment TypeCloud-based managed services are the fastest-growing deployment model in Europe, supported by cloud ecosystems.

-

By Organization SizeSMEs are the fastest-growing customer segment in Europe as outsourcing enables cost control.

-

By VerticalHealthcare and life sciences are fastest-growing vertical in Europe due to digital health expansion.

-

Competitive Landscape – Key PlayersIBM, Microsoft, and Accenture lead the Europe managed services market through global delivery scale, automation depth, and enterprise trust.

-

Competitive Landscape – Startups/SMEsAtera and Optanix gain European market traction by offering agile delivery, rapid onboarding, and cost-efficient managed service models.

The managed services market in Europe is growing steadily as enterprises prioritize cloud optimization, AI-driven automation, and advanced cybersecurity. Organizations increasingly outsource IT management to reduce operational complexity, improve uptime, support hybrid work environments, and accelerate digital transformation across highly competitive, innovation-led industries and large distributed enterprise networks.

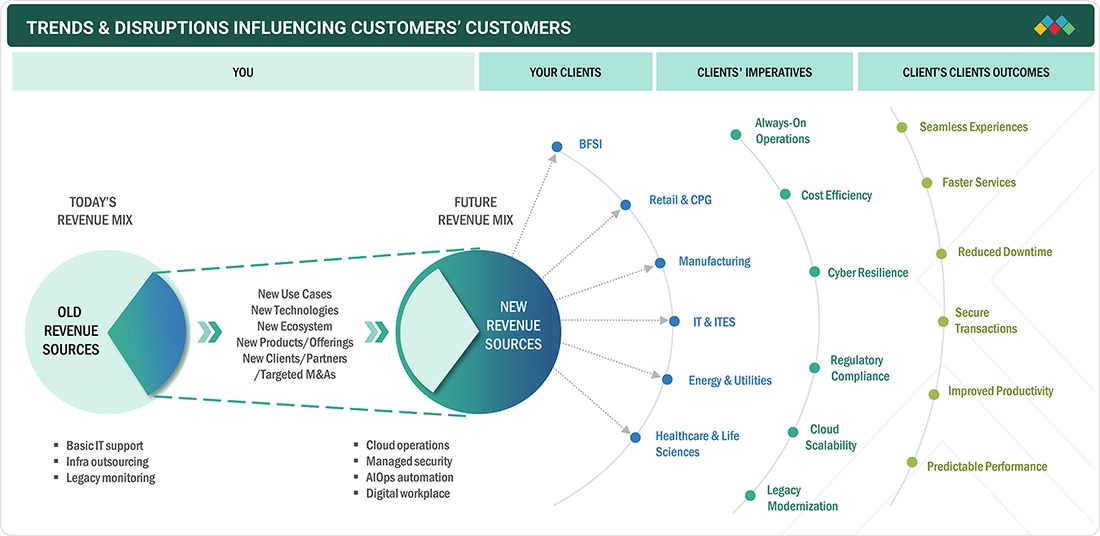

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Managed Services Market is being reshaped by enterprise cloud modernization and the expanding adoption of AI-driven automation across large, distributed organizations globally. Enterprises increasingly select specialized partners to manage cybersecurity exposure, support hybrid cloud operations, deliver compliance assurance, and control costs in multivendor environments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing need to minimize downtime and ensure business continuity

-

Growing emphasis on cybersecurity and stronger data protection investments

Level

-

Shortage of specialized IT talent limiting advanced service delivery

-

Slow internal decision-making delaying outsourcing initiatives

Level

-

Rising demand for MSP-led compliance and regulatory alignment

-

Expanding adoption of multicloud operations requiring unified management

Level

-

Complex cloud migration and legacy IT integration requirements

-

Ongoing integration and maintenance issues across legacy infrastructure

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver — Increasing need to minimize downtime and ensure business continuity

Large enterprises in the managed services market in Europe increasingly prioritize uninterrupted digital operations across hybrid and multicloud environments. Managed service providers deliver proactive monitoring, automated failover, and disaster recovery capabilities that reduce outage exposure and protect revenue continuity.

Restraint — Shortage of specialized IT talent limiting advanced service delivery

The managed services market in Europe continues to face shortages of experienced cloud security and automation professionals nationwide. This talent gap increases delivery costs, extends deployment timelines, and constrains scalability for advanced managed services in complex enterprise environments.

Opportunity — Rising demand for MSP-led compliance and regulatory alignment

Regulatory pressure across healthcare, financial services, and critical infrastructure is intensifying in the Managed Services Market in Europe. Managed service providers are increasingly engaged to deliver centralized governance, continuous monitoring, and audit readiness, thereby lowering compliance risk across distributed enterprise systems.

Challenge — Complex cloud migration and legacy IT integration requirements

Enterprises in Europe's managed services market are operating legacy systems alongside modern cloud platforms at scale. Migration programs are expected to require architectural redesign and disciplined data alignment, increasing execution risk, raising costs, and slowing large-scale modernization initiatives.

EUROPE MANAGED SERVICES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

DNB partnered with Ericsson to use the AI-based Ericsson Operations Engine to manage six nationwide 5G networks. The solution simplified operations, automated network management, and supported reliable SLA delivery during rapid 5G rollout. | 99.8% network uptime | 500% reduction in alarm counts within six months | 90% faster complaint resolution through automation | New business outcomes enabled through predictive and intent-based operations. |

|

WaFd Bank partnered with AWS Managed Services to move core systems from on-premises infrastructure to the cloud. The engagement automated routine tasks and supported large-scale migration while limiting disruption across more than 200 branches. | 80% workload migration within one year | Lower operational overhead through automation | IT teams freed to focus on innovation | Improved development of customer-facing banking applications. |

|

O-I Glass collaborated with DXC Technology to deploy the DXC Uptime Experience Platform to modernize global IT operations. AI-driven automation and self-service tools improved system reliability and strengthened IT service consistency for more than 20,000 employees. | Enhanced system reliability and reduced downtime | Faster incident resolution | 35% reduction in IT costs | Improved employee experience using AI digital assistants. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the managed services market in Europe includes API gateways, API security platforms, service providers, and connectivity providers that support hybrid integration. Together, these layers enable secure data exchange, strengthen governance, and ensure resilient service delivery across distributed enterprise digital environments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Managed Services Market, By Service Type

Managed IT infrastructure and data center services are the largest segment in Europe. Enterprises are moving more workloads to the cloud and modernizing older systems, increasing the need for outsourced infrastructure management and day-to-day operational support.

Europe Managed Services Market, By Managed Security Service

Managed detection & response is the leading security service in Europe, as cyber threats continue to rise. Enterprises rely on continuous monitoring and automated response to keep critical systems and sensitive data secure.

Europe Managed Services Market, By Managed Network Service

Managed IP and VPN services are the largest network services segment in Europe. Organizations rely on secure private connectivity to support distributed operations and ensure reliable access to cloud environments.

Europe Managed Services Market, By Managed Communication & Collaboration Service

Managed UCaaS dominates communication services in Europe due to sustained adoption of hybrid work. Enterprises prefer cloud-based voice and collaboration platforms that offer reliability and centralized management.

Europe Managed Services Market, By Managed Mobility Service

Unified endpoint management is the largest mobility service category in Europe. Growth is driven by rising device usage and stronger requirements for security, visibility, and regulatory compliance.

Europe Managed Services Market, By Managed Information Service

Business process management leads information services adoption in Europe. Enterprises use BPM to automate workflows and improve efficiency across customer-facing and internal business functions.

Europe Managed Services Market, By Deployment Type

Cloud-based delivery is the most widely used deployment model in Europe. Enterprises favor cloud services for their scalability, flexibility, and reduced operational complexity.

Europe Managed Services Market, By Organization Size

Large enterprises constitute the majority of managed services adoption across Europe. Their intricate IT infrastructures and elevated technology budgets underpin sustained outsourcing strategies.

Europe Managed Services Market, By Vertical

BFSI is the largest vertical adopting managed services in Europe. Demand is driven by cybersecurity priorities, cloud modernization initiatives, and strict regulatory requirements.

REGION

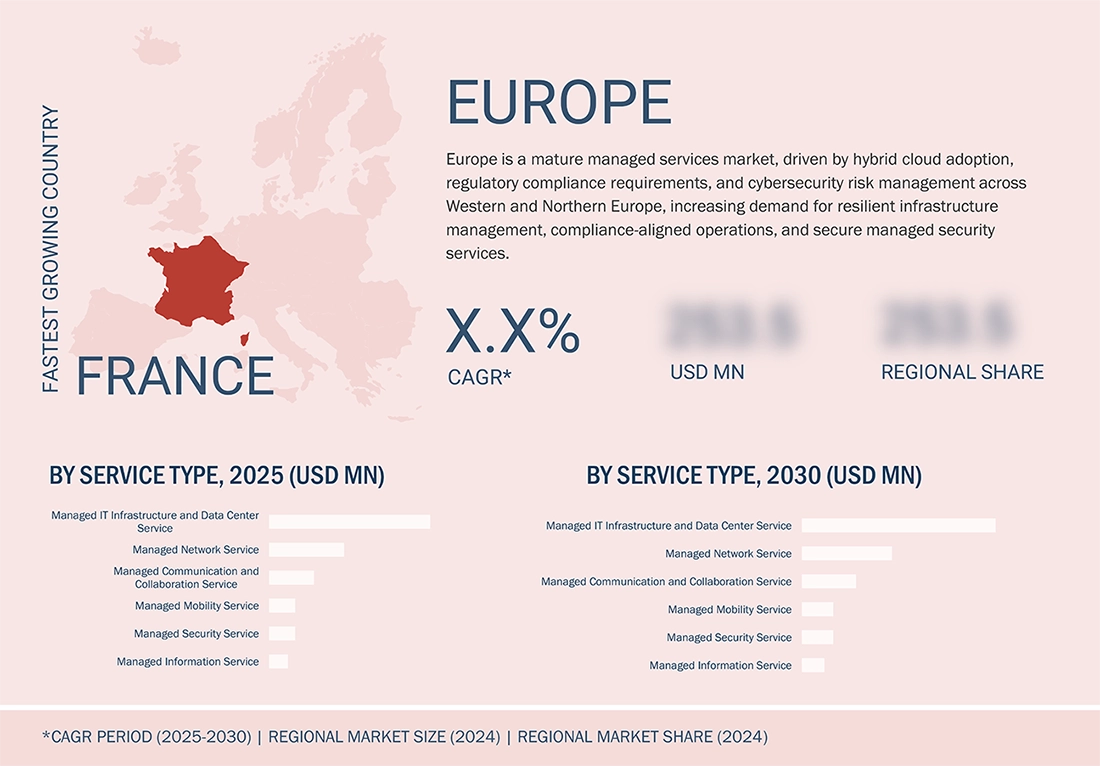

France to be fastest-growing country in Europe managed services market during forecast period

The managed services market in Europe is expected to see France record the fastest growth during the forecast period. Growth is projected to be driven by accelerating cloud adoption and rising cybersecurity requirements among enterprises adopting hybrid and multicloud operating models.

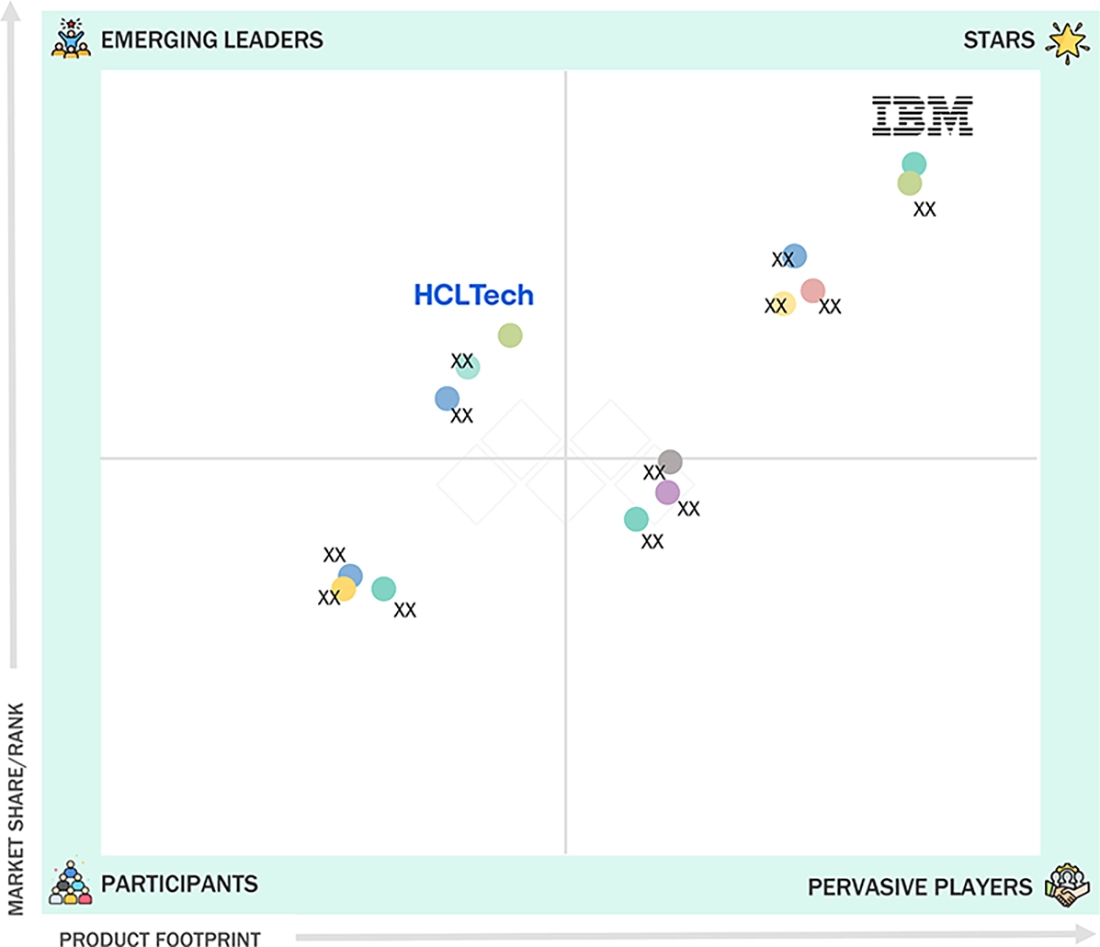

EUROPE MANAGED SERVICES MARKET: COMPANY EVALUATION MATRIX

The Company Evaluation Matrix places IBM in the Stars quadrant because of its strong market presence and mature service portfolio. HCLTech appears in the Emerging Leaders quadrant as its capabilities and service reach continue to expand. Other vendors fall across Participants and Pervasive Players, reflecting differences in scale, innovation readiness, and outsourcing depth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- IBM (US)

- Microsoft (US)

- Cisco (US)

- Google (US)

- DXC Technology (US)

- Capgemini (France)

- Atos (France)

- T-Systems (Germany)

- Sopra Steria (France)

- Getronics (Netherlands)

- MetTel (US)

- Hughes Network Systems (US)

- Optanix (US)

- EMPIST (US)

- Essential Enterprise Solutions (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 87.57 Billion |

| Market Forecast in 2030 (Value) | USD 123.06 Billion |

| Growth Rate | CAGR of 5.2% from 2025–2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, vendor positioning, segment-wise analysis, regional trends, technological developments, key commercial use cases, and growth factors |

| Segments Covered |

|

| Countries Covered | UK, Spain, Germany, France, Italy, Rest of Europe |

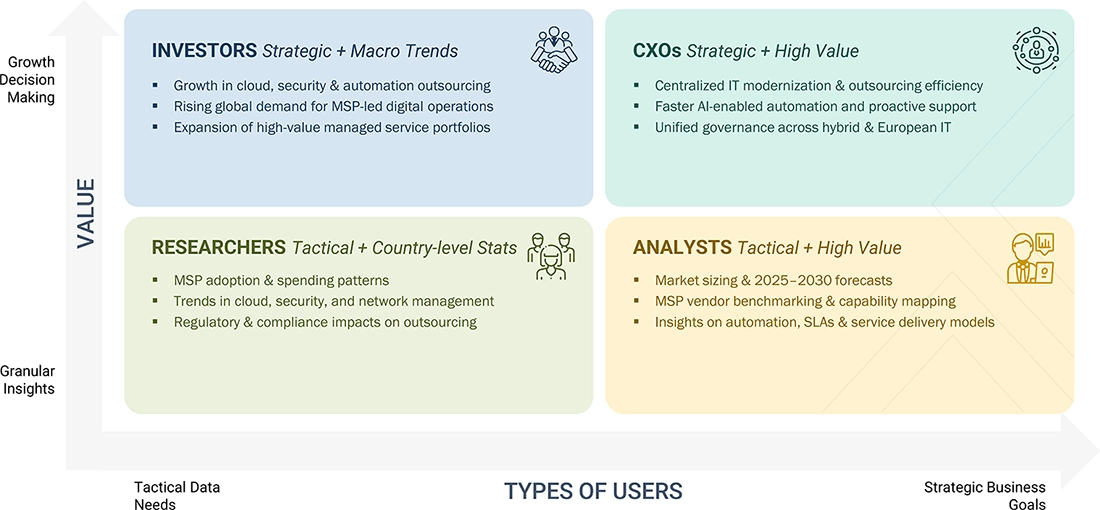

WHAT IS IN IT FOR YOU: EUROPE MANAGED SERVICES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Enterprise (IT, BFSI, Retail, Manufacturing) |

|

|

| Telecom Operator (Network Modernization & 5G Rollout) |

|

|

| Cloud & Data Center Provider (Hybrid Cloud Services) |

|

|

RECENT DEVELOPMENTS

- November 2025 : Kyndryl to acquire Solvinity, a Netherlands-based provider of secure managed cloud platforms and services. The acquisition will enhance Kyndryl's cloud services by combining Kyndryl's capabilities with Solvinity's. Both companies will collaborate to ensure that critical workloads are up to date, secure, and automated. These workloads must comply with numerous rules and regulations. The goal of Kyndryl and Solvinity is to help these workloads run smoothly and securely. Kyndryl and Solvinity will achieve this by using their skills and experience to modernize and protect these workloads.

- August 2025 : Capgemini entered into an agreement to acquire Cloud4C, a provider of automation-focused managed services for hybrid and sovereign cloud environments. The acquisition reinforces Capgemini’s position in cloud managed services by expanding its AI-ready capabilities, low-code platforms, and industry-specific frameworks. The expanded portfolio supports complex cloud migrations, day-to-day operations, security management, and business continuity programs.

- August 2025 : Vodafone Idea collaborated with IBM to enhance its computer systems with intelligence. They launched an AI Innovation Hub to streamline their development process. This helped Vodafone Idea operate more smoothly, made its services more stable, and allowed tasks to be completed more efficiently. The company aimed to use automation and artificial intelligence to understand customer needs and improve overall satisfaction. Vodafone Idea and IBM collaborated to enhance Vodafone Idea's services with the aid of intelligence.

- August 2025 : NTT DATA and Google Cloud established a global partnership focused on accelerating agentic AI adoption and broader cloud modernization efforts. Under the partnership, NTT DATA is responsible for delivering end-to-end AI and cloud solutions on Google Cloud, covering design, deployment, hosting, and ongoing management. The offering includes sovereign and distributed cloud models and is supported by dedicated Google Cloud resources and a large pool of certified specialists.

Table of Contents

Methodology

The study comprised four main activities to estimate the Europe Managed Services Market size. We conducted significant secondary research to gather data on the market, the competing market, and the parent market. The following stage involved conducting primary research to confirm these conclusions and hypotheses and sizing with industry experts throughout the value chain. The overall market size was evaluated using a blend of top-down and bottom-up approach methodologies. After that, we estimated the market sizes of the various Europe Managed Services Market segments using the market breakup and data triangulation techniques.

Secondary Research

We determined the size of companies offering managed services based on secondary data from paid and unpaid sources. We also analyzed major companies' product portfolios and rated them based on their performance and quality.

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the spending of various countries on the Europe Managed Services Market was extracted from the respective sources. We used secondary research to obtain the critical information related to the industry's value chain and supply chain to identify the key players based on platform, services, market classification, and segmentation according to components of the major players, industry trends related to components, users, and regions, and the key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, we interviewed various primary sources from the supply and demand sides of the Europe Managed Services Market to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from vendors providing offerings, associated service providers, and is operating in the targeted countries. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), we conducted extensive primary research to gather information and verify and validate the critical numbers arrived at. The primary research also helped identify and validate the segmentation, industry trends, key players, competitive landscape, and market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies. In the complete market engineering process, the bottom-up approach and several data triangulation methods were extensively used to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. We conducted an extensive qualitative and quantitative analysis of the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The Europe Managed Services Market and related submarkets were estimated and forecasted using top-down and bottom-up methodologies. We used the bottom-up method to determine the market's overall size, using the revenues and product offerings of the major market players. This research ascertained and validated the precise value of the total parent market size through data triangulation techniques and primary interview validation. Next, using percentage splits of the market segments, we utilized the overall market size in the top-down approach to estimate the size of other individual markets.

The research methodology used to estimate the market size included the following:

- We used primary and secondary research to determine the revenue contributions of the major market participants in each country after secondary research helped identify them.

- Throughout the process, we obtained critical insights by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- We used primary sources to verify all percentage splits and breakups, which we calculated using secondary sources.

Data Triangulation

Once the overall market size was determined, we divided the market into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

Considering the views of various sources and associations, MarketsandMarkets defines Managed Services as the practice of outsourcing the responsibility for proactively maintaining and managing a range of business functions or IT infrastructure. Managed services allow organizations to offload specific tasks, such as network management, security, and system maintenance, to a third-party provider, a Managed Service Provider (MSP). MSPs assume ongoing responsibility for managing and improving the outsourced services while ensuring they align with an organization's goals, often operating under a subscription model.

Stakeholders

- Global Managed Services Providers

- Cloud Service Providers (CSPs)

- Independent Software Vendors (ISVs)

- System Integrators

- Value-Added Resellers (VARs)

- Managed Service Providers (MSPs)

- Chief Financial Officers (CFOs)

- Information Technology (IT) Directors

- Small and Medium-sized Enterprises (SMEs)

- IT Strategy Consultants

- Managed Services Consulting Vendors

- Technology Partners

- Research Organizations

- Enterprise Users

- Technology Providers

Report Objectives

- To define, describe, and forecast the global Europe Managed Services Market based on service type, managed security services, managed network services, managed IT infrastructure & data center services, managed communication & collaboration services, managed mobility services, managed information services, deployment type, organization size, vertical, and region.

- To strategically analyze the market subsegments to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets concerning growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the Europe Managed Services Market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for prominent players

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product developments, and partnerships & collaborations in the market.

Available Customizations

MarketsandMarkets provides customizations based on the company's unique requirements using market data. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's portfolio.

Company Information

- Detailed analysis and profiling of five additional market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Managed Services Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Managed Services Market