Europe Precision Farming Market

Europe Precision Farming Market by Automation & Control Systems, Cloud-based Software, System Integration & Consulting Services, Guidance Technology, Variable Rate Technology, Yield Monitoring, Variable Rate Application - Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

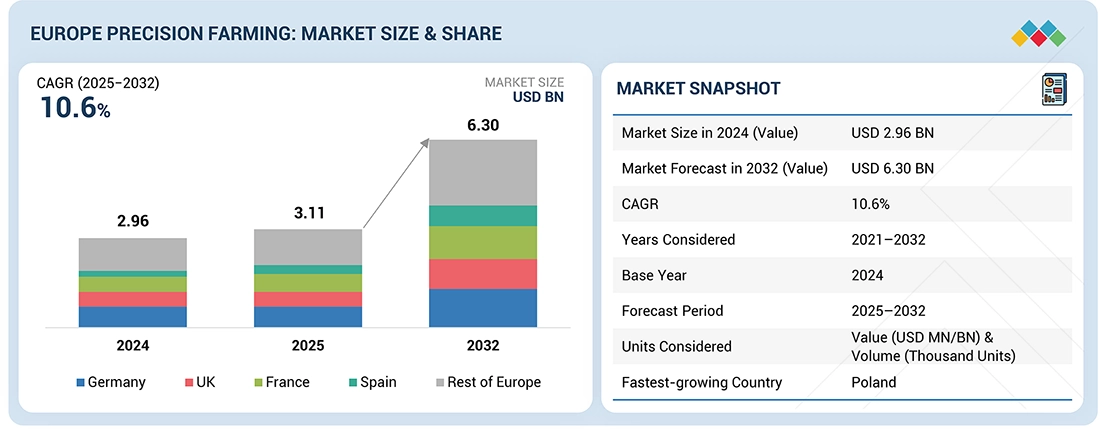

The Europe precision farming market is projected to grow from USD 3.11 billion in 2025 to USD 6.30 billion by 2032, at a CAGR of 10.6%. Growth is driven by stringent EU sustainability targets, rising input costs, and the region’s shift toward climate-resilient agriculture. Adoption of GPS-guided machinery, variable-rate equipment, and advanced sensors is expanding rapidly across Western and Northern Europe. Supportive policies such as the CAP and the Green Deal are accelerating investments in digital technologies. Strong demand from arable farms, dairy operations, and horticulture is creating opportunities in automation, drone analytics, IoT soil networks, and AI-enabled farm management.

KEY TAKEAWAYS

-

By CountryGermany dominates the European precision farming market with a share of ~24% in 2024.

-

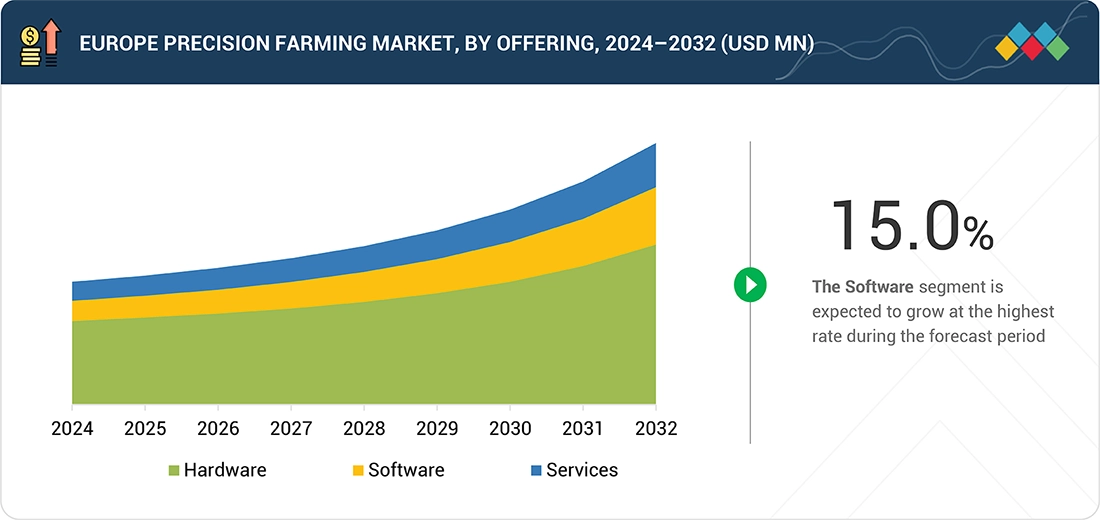

By OfferingBy offering, the software segment is expected to register the highest CAGR of 15.0%.

-

By TechnologyBy technology, the guidance technology segment is dominating the European precision farming market in 2024.

-

By ApplicationBy application, the weather tracking & forecasting segment is registered to grow at the highest CAGR of 13.4% during the forecast period.

-

Competitive LandscapeJohn Deere, CNH Industrial, AGCO Corporation, and CLAAS were identified as some of the star players in the Europe precision farming market, given their strong market share and product footprint.

-

Competitive LandscapeStartups such as Augmenta, Hummingbird Technologies, Agrointelli, and Gamaya have gained traction in precision farming by building strong capabilities in advanced sensing, real-time analytics, and AI-driven crop intelligence, highlighting their potential as emerging market leaders.

The Europe precision farming market is experiencing robust growth, driven by the region’s strong push for sustainable agriculture, efficient input use, and compliance with stringent EU environmental policies. Farmers are rapidly adopting GPS/GNSS-guided machinery, variable-rate technologies, advanced sensors, and AI-driven decision tools to optimize yield performance and reduce operational costs. New developments—including collaborations between OEMs and ag-tech firms, expansion of RTK networks, and EU-funded digital farming initiatives—are accelerating technology deployment across Western and Northern Europe. Innovations in automation, drone-based crop monitoring, and soil health analytics are reshaping farm operations, enabling more efficient, climate-resilient, and data-driven agricultural practices.

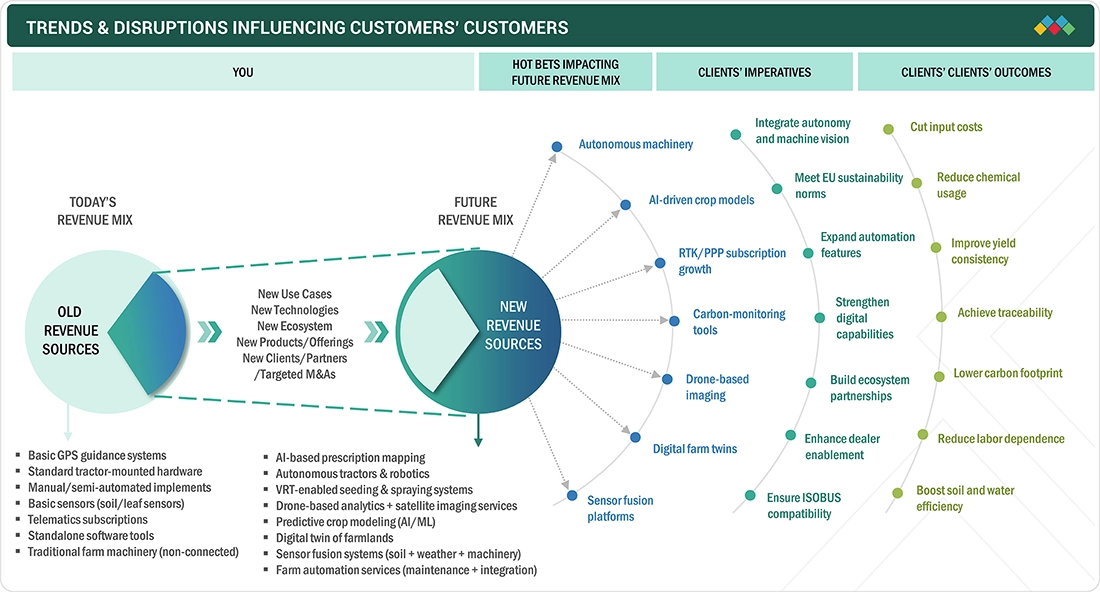

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ business in the Europe precision farming market stems from rapidly evolving farm needs and disruptive digital technologies. Large arable farms, dairy cooperatives, and horticulture producers are the primary users of precision tools, with operational efficiency and sustainability compliance as key priorities. The shift toward autonomous machinery, AI-driven crop intelligence, and digital farm twins is transforming how growers manage inputs, labor, and field variability. At the same time, EU sustainability regulations and traceability mandates have a direct influence on technology adoption and investment decisions. These changes are accelerating demand for advanced guidance systems, VRT solutions, drone analytics, and integrated hardware–software platforms, shaping the region’s long-term trajectory in precision agriculture.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Technological advancements fueling data-driven and efficient farming

-

Growing emphasis on sustainable agricultural practices

Level

-

High initial investment and technology costs

-

Lack of technical knowledge and skilled workforce

Level

-

Adoption of variable rate application (VRA) in precision farming

-

Increasing use of data analytics to optimize farming operations

Level

-

Lack of standardized policies and regulations

-

Data privacy issues and security concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Technological advancements fueling data-driven and efficient farming

Technological innovation is a major growth driver in the Europe precision farming market, with rapid adoption of GNSS guidance systems, AI-based crop analytics, drone imaging, and IoT-enabled sensors. These tools enable farmers to optimize input use, improve field accuracy, and achieve higher productivity amid rising labor shortages and tightening EU sustainability mandates. Advancements in automation, real-time monitoring, and digital farm management platforms are accelerating the shift toward data-driven decision-making, making precision technologies essential for both large-scale and mid-size European farms.

Restraint: High installation and monitoring costs

Despite strong growth potential, high installation, integration, and monitoring costs continue to limit adoption across Europe, especially among small and fragmented farm holdings. Precision farming systems require significant investment in advanced hardware, software subscriptions, and connectivity infrastructure, making it challenging for cost-sensitive farmers to transition from traditional practices. Limited rural broadband coverage in parts of Eastern and Southern Europe further increases setup expenses. As a result, affordability remains a key restraint, slowing widespread deployment across the region.

Opportunity: Adoption of variable rate application (VRA) in precision farming

Variable rate application presents a strong growth opportunity in Europe as farmers seek to reduce fertilizer and pesticide use while increasing yield consistency. VRA technologies enable precise, zone-specific application of inputs based on soil variability, crop condition, and historical yield patterns—aligning directly with EU nutrient reduction targets and sustainability goals. Rising fertilizer prices, coupled with stricter environmental regulations, are accelerating demand for VRA-enabled planters, sprayers, and spreaders. This creates significant opportunities for OEMs and digital agriculture companies to expand advanced VRA solutions across Western and Northern Europe.

Challenge: Lack of standardized policies and regulations

The absence of unified standards for data interoperability, digital compliance, and machine connectivity remains a major challenge in Europe’s precision farming landscape. Regulations vary widely across EU member states, creating inconsistencies in technology adoption, data privacy norms, and equipment compatibility. Farmers and OEMs face difficulties integrating multi-brand machinery, sharing field data securely, and ensuring compliance with evolving sustainability frameworks. This fragmented regulatory environment complicates large-scale implementation and slows the development of a fully harmonized digital agriculture ecosystem in Europe.

EUROPE PRECISION FARMING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

AgriCircle integrates high-resolution satellite imagery, soil nutrient maps, and VRT engines to create precise fertilization plans for large cereal farms across Switzerland and Germany. Its digital platform guides spreaders to apply nutrients only where needed, based on real-time soil variability and crop demand. | 10–15% fertilizer savings, reduction in nitrogen losses, improved field uniformity, stronger compliance with EU nutrient regulations |

|

BayWa’s digital agriculture division deploys drones equipped with multispectral cameras and thermal sensors to scan thousands of hectares of barley, maize, and rapeseed. The imagery is analyzed using AI to detect stress from pests, drought, and nutrient gaps weeks before they are visible to the human eye. | Early risk detection, optimized crop protection planning, targeted spraying zones, improved yield predictability |

|

Arla integrates IoT-based livestock sensors, automated feeding systems, and computer-vision barn monitoring across partner dairy farms. Continuous data streams on health, rumination, feeding, and movement allow real-time interventions and individualized nutrition plans. | Better herd health, reduced feed waste, improved milk yield, data-driven animal welfare compliance |

|

Coop Italia collaborates with fruit and vegetable growers using precision irrigation systems, soil moisture probes, and digital traceability tools. Field-level data is automatically linked to retail labels, enabling full visibility of farming practices from seed to shelf. | Higher-quality produce, transparent supply chains, stronger sustainability marketing, water use savings |

|

Väderstad outfits large demonstration farms with AI-enabled seed drills, real-time seeding depth adjustments, and zone-specific planting algorithms. Machinery automatically calibrates seed placement based on soil texture, historical yield zones, and moisture availability. | Stronger crop emergence, uniform stand establishment, reduced seed wastage, improved yield potential |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Europe precision farming ecosystem is driven by strong collaboration among research institutes, agri-tech startups, hardware suppliers, and leading farm machinery OEMs. Universities and EU-funded research centers advance innovations in AI, robotics, and sustainable agriculture, while software providers deliver analytics, farm management platforms, and sensor-based insights. Hardware players supply GNSS modules, imaging systems, and IoT sensors, supporting OEMs such as John Deere, CNH Industrial, AGCO, and CLAAS. Together, they enable data-driven, automated, and sustainability-aligned farming across Europe.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Precision Farming Market, By Offering

In 2024, hardware accounted for the largest share of the Europe precision farming market and will continue to dominate through 2032, supported by strong adoption of GPS/GNSS receivers, variable-rate controllers, auto-steering systems, and advanced sensor networks across Western and Northern Europe. The region’s rapid transition toward automated machinery, ISOBUS-compatible equipment, and high-precision application tools is driving sustained demand for hardware. Meanwhile, software is projected to grow at the fastest rate, with a CAGR of 15.0%, as farms increasingly rely on cloud-based platforms, AI-driven analytics, and digital farm management solutions. Growing service needs—including integration, maintenance, consultancy, and subscription-based monitoring—will further strengthen the services segment, which is expected to expand in parallel with Europe’s digitized farming ecosystem.

Europe Precision Farming Market, By Technology

Guidance technology remains the largest segment in the Europe precision farming market as of 2025 and will continue to lead through 2032, driven by the strong adoption of GPS/GNSS-based steering systems, auto-guidance, and RTK correction services across large arable farms. Europe’s emphasis on minimizing overlaps, reducing fuel consumption, and improving operator efficiency further supports its dominance. Remote sensing technology is expanding rapidly as satellite imagery, drones, and IoT sensors become increasingly central to field mapping, vegetation analysis, and crop health monitoring—particularly in France, Germany, and the Nordic countries. Variable Rate Technology (VRT) is the fastest-growing segment, supported by strict EU nutrient management rules, rising fertilizer prices, and strong demand for prescription-based seeding, fertilization, and spraying. Increasing digitalization under the CAP, growth of AI-driven crop models, and widespread ecosystem partnerships are accelerating the adoption of all three technologies across Europe’s shift toward data-driven, sustainable farming.

Europe Precision Farming Market, By Application

Yield monitoring holds the largest share of the Europe precision farming market and will maintain its lead through 2032, driven by the region’s strong adoption of combine-mounted sensors, yield maps, and real-time crop analysis tools. Increasing focus on maximizing productivity, meeting EU sustainability targets, and improving traceability continues to fuel investment in advanced yield analytics. Applications such as field mapping and crop scouting are also expanding rapidly as farms integrate GPS/GIS technologies, drone imagery, and remote sensing to optimize input usage and manage large arable lands efficiently. Weather tracking and forecasting is the fastest-growing segment, supported by rising fertilizer prices, stricter nitrogen regulations, and strong adoption of prescription-based seeding, fertilization, and spraying across Western Europe. The demand for weather forecasting tools, inventory management, and financial management software is also rising as digital farm management becomes central to compliance, automation, and cost optimization across Europe’s evolving agricultural landscape.

REGION

Germany accounts for the largest market share in the European precision farming market during the forecast period

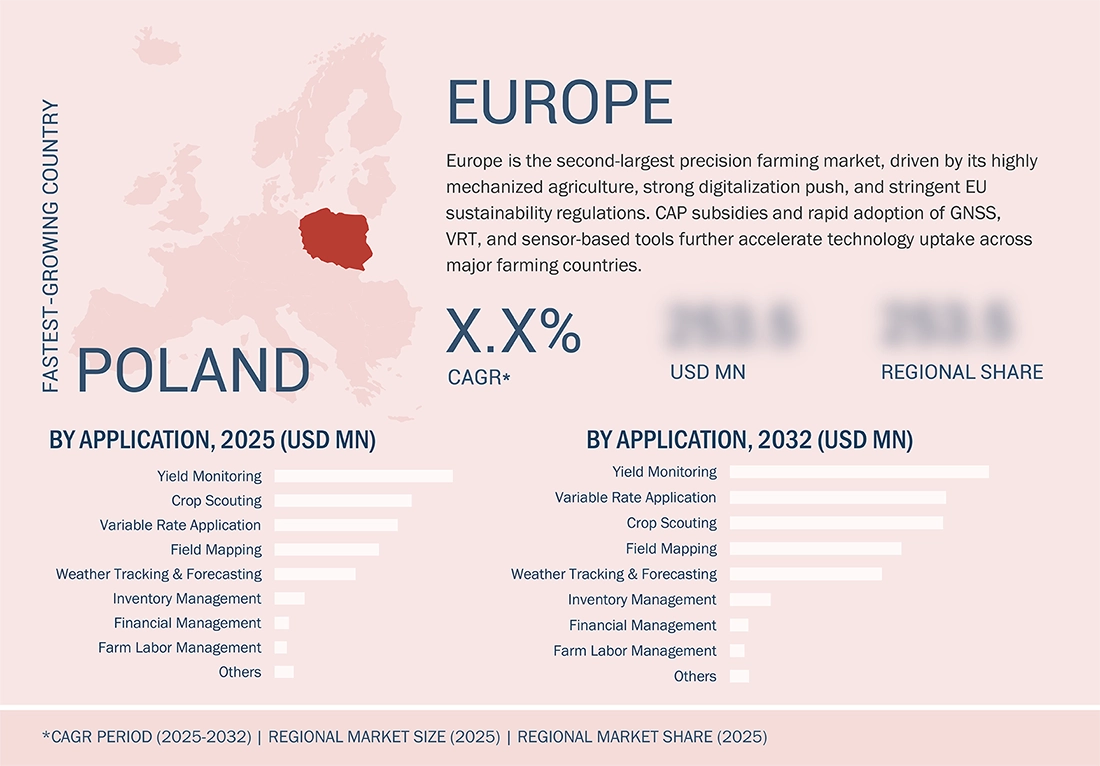

Europe is the second-largest precision farming market globally, driven by its highly mechanized agricultural structure, strong digitalization efforts, and stringent EU sustainability mandates that encourage farmers to adopt data-driven practices. The region benefits from extensive CAP funding, the Green Deal, and national subsidy programs that accelerate the adoption of GNSS-based guidance, VRT systems, drones, and sensor-based monitoring tools. Germany holds the largest market share due to its expansive arable land, rapid uptake of autonomous and GPS-enabled machinery, and strong presence of OEMs and ag-tech innovators. Poland, meanwhile, is the fastest-growing market, supported by the rapid modernization of small and mid-sized farms, rising labor shortages, and increased EU-backed investments in digital agriculture infrastructure. Together, these factors position Europe as a highly advanced and rapidly evolving hub for precision farming technologies.

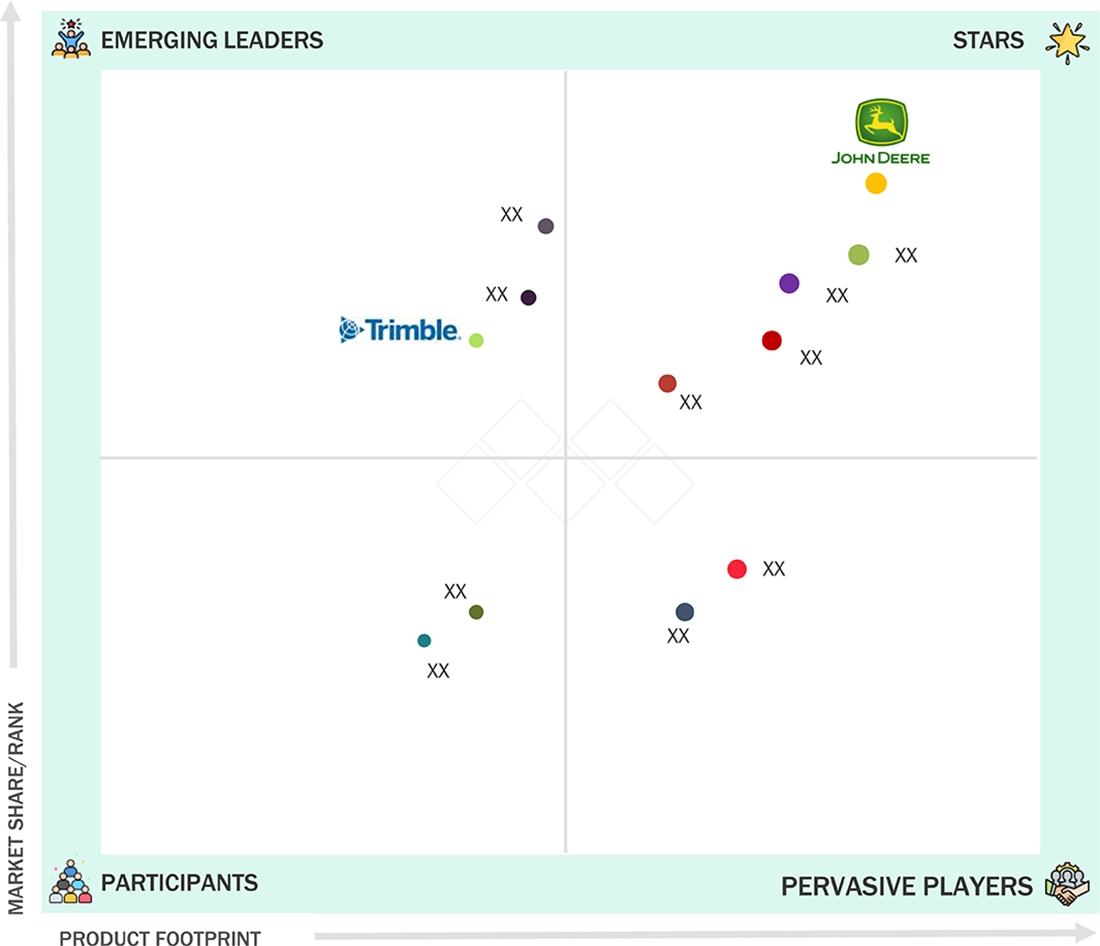

EUROPE PRECISION FARMING MARKET: COMPANY EVALUATION MATRIX

In the Europe precision farming market matrix, John Deere (Star) leads with a dominant market share and an extensive product footprint, driven by its advanced guidance systems, autonomous machinery, and integrated farm management platforms, which are widely adopted across large European farms. Trimble (Emerging Leader) is gaining strong visibility with its precision guidance tools, GNSS solutions, and data-driven analytics, which cater to a diverse range of farm sizes, thereby strengthening its position through continuous innovation and expanding its dealer networks. While John Deere maintains leadership through scale, brand strength, and a comprehensive equipment-software ecosystem, Trimble shows significant potential to advance further in the matrix as adoption of digital mapping, VRT, and connected solutions accelerates across Europe.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Deere & Company (US)

- CNH Industrial N.V. (UK/Netherlands)

- AGCO Corporation (US)

- CLAAS KGaA mbH (Germany)

- Trimble Inc. (US)

- Topcon Positioning Systems (Japan)

- Hexagon Agriculture (Sweden)

- Kubota Corporation (Japan)

- Raven Industries Inc. (US)

- TeeJet Technologies (US)

- Kverneland Group (Norway)

- Amazone Werke (Germany)

- HORSCH Maschinen GmbH (Germany)

- Väderstad AB (Sweden)

- Lemken GmbH & Co. KG (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 3.11 Billion |

| Market Forecast in 2032 (Value) | USD 6.30 Billion |

| Growth Rate | CAGR of 10.6% from 2025-2032 |

| Years Considered | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) & Volume (Thousands Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Germany, UK, France, Spain, Italy, Poland, the Nordics, and the Rest of Europe |

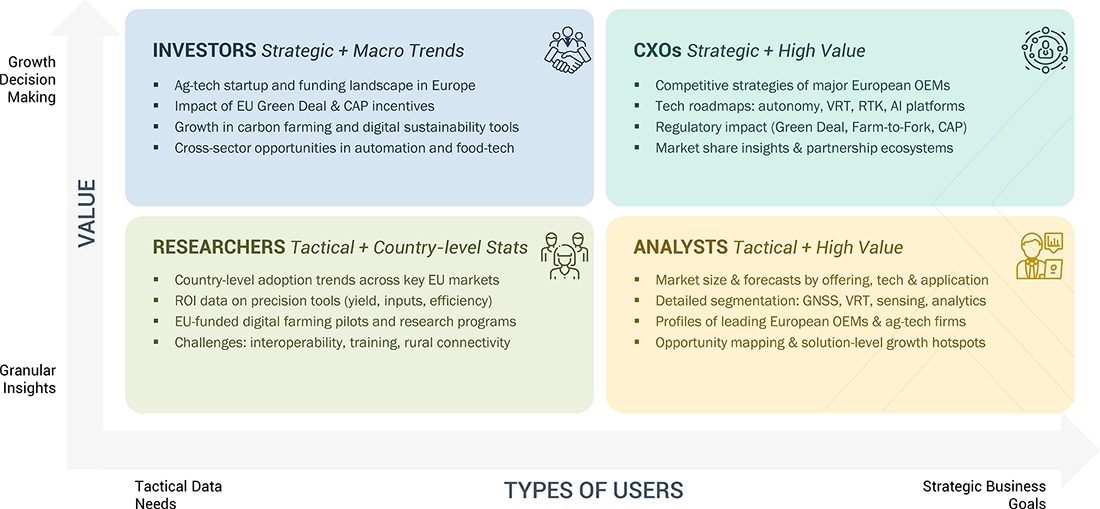

WHAT IS IN IT FOR YOU: EUROPE PRECISION FARMING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Agriculture OEM |

|

|

| Farm Management Software Provider |

|

|

| Sensor & IoT Device Manufacturer |

|

|

| Agri-Input Supplier (Seeds, Fertilizers) |

|

|

| Agri-Cooperatives & Large Farm Groups |

|

|

RECENT DEVELOPMENTS

- May 2025 : The partnership between CNH Industrial N.V. and Starlink provided satellite internet access to farmers in remote areas, enhancing precision farming technologies through autonomous tractors and AI-driven weed detection using Starlink’s network of 7,000+ satellites for real-time data and cloud operations.

- March 2025 : Deere & Company launched SmartDetect Digital, a safety system for mid-size and large wheel loaders that uses stereo cameras and machine learning to detect people and objects, send instant alerts, and connect with the John Deere Operations Center for weekly insights and near-miss reports.

- February 2025 : Ag Leader Technology introduced RightPath, a passive implement steering system that uses tractor guidance lines to steer implements, improving input accuracy, reducing crop damage and fatigue, and supporting multiple GPS correction sources.

- February 2025 : Topcon Agriculture partnered with Bonsai Robotics to enhance precision farming for permanent crops by combining Bonsai’s vision-based navigation with Topcon’s autosteering and telematics systems for automated operations, data-driven decisions, and advanced harvesting.

- August 2024 : Bayer AG introduced FieldView Drive 2.0, offering faster and more secure real-time wireless data transfer and prescription delivery to equipment, enhancing efficiency, compatibility, and supporting Bayer’s focus on sustainable digital farming.

Table of Contents

Methodology

The study involved major activities in estimating the current size of the Europe Precision Farming Market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the supply chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Secondary and primary sources have been used to identify and collect information for an extensive technical and commercial study of the Europe Precision Farming Market.

Secondary Research

Secondary research for this study involved gathering information from various credible sources such as company reports, white papers, journals, and industry publications. This process helped in understanding the supply and value chains, identifying key players, analyzing market segmentation and regional trends, and tracking major market and technology developments. The data collected was used to estimate the overall market size, which was later validated through primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the Europe Precision Farming Market through secondary research. This primary data was collected through questionnaires, emails, and telephonic interviews.

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the Europe Precision Farming Market.

- Analyzed major precision farming hardware, software, and service providers, studied their portfolios, and understood products/solutions/services based on their features and functions

- Analyzed the segmental revenue and scope revenue of the companies profiled in the study

- Arrived at the Europe Precision Farming Market size by adding the scope revenue of key manufacturers in the market

- Conducted multiple discussions with key opinion leaders to understand different precision farming offering (hardware, software, and service), technology, applications, and current trends in the market, and analyzed the breakup of the scope of study by major precision farming hardware, software, and service providers

The top-down approach has been used to estimate and validate the total size of the Europe Precision Farming Market.

- The size of the Europe Precision Farming Market was estimated through the data sanity of major companies offering precision farming products/solutions/services.

- The country-level penetration split was analyzed for each region to estimate the market size.

- The market size for the Europe offering (hardware, software, and service) was determined by understanding the penetration split of each offering in each region.

- The market size for the Europe application segments was estimated by analyzing the penetration split of each offering for each application.

- The market size for the Europe technology segments was estimated by analyzing the penetration split of each offering for each technology.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the Europe Precision Farming Market.

Market Definition

Precision farming, also referred to as precision agriculture, is a modern farm management approach that utilizes advanced technologies to monitor and enhance agricultural operations. It focuses on aligning field inputs with specific crop requirements. Technologies such as satellite positioning systems, including global positioning system (GPS), remote sensing, and variable rate technology (VRT), are used to manage crops efficiently and optimize the use of resources such as fertilizers, pesticides, and water.

Key Stakeholders

- Precision farming component providers

- Precision farming integrators and installers

- Precision farming solution providers

- Product manufacturers

- Precision farming-related associations, organizations, forums, and alliances

- Government and corporate bodies

- Research institutes and organizations

- Venture capitalists, private equity firms, and start-ups

- Distributors and traders

- OEMs

- End users

- Market research and consulting firms

- Agri-food buyers

- Agriculture technology providers

Report Objectives

- To define, describe, and forecast the size of the Europe Precision Farming Market, by offering, technology, application, and region, in terms of value

- To describe and forecast the size of the Market, by offering, in terms of volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market’s growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To provide ecosystem analysis, value chain, trends/disruptions impacting customer business, technology analysis, pricing analysis, technology analysis, key stakeholders & buying criteria, case study analysis, trade analysis, patent analysis, Porter’s five forces, key conferences & events, AI impact, impact of 2025 US tariff, and regulations related to the Europe Precision Farming Market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detailing the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings, core competencies, company valuation, and financial metrics, and product/brand comparison, along with detailing the competitive landscape for the market leaders

- To analyze the competitive developments, such as product launches, software launches, agreements, collaborations, joint ventures, and acquisitions, carried out by market players

- To map the competitive intelligence based on company profiles, key player strategies, and game-changing developments, such as product developments, collaborations, and acquisitions

- To benchmark players within the market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio.

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the company‘s specific needs. The following customization options are available for the report.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Precision Farming Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Precision Farming Market