Europe Refrigerants Market

Europe Refrigerants Market by Type (HFC & Blends, HFO, Isobutane, Propane, Ammonia, Carbon Dioxide) & Application (Refrigeration System, Air Conditioning System, Chillers, and MAC) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Europe refrigerants market is set for steady growth, driven by the region’s F-Gas phase-down rules, tighter quota reductions, and early bans on high-GWP refrigerants across several applications. Countries are rapidly transitioning toward natural alternatives like CO2, ammonia, and hydrocarbons, along with new-generation HFOs that meet strict sustainability targets. Growth is also supported by the modernization of supermarket and food-retail refrigeration systems, where companies are replacing older HFC-based units with CO2 transcritical technology. In parallel, Europe’s strong policy push for heat-pump adoption and green building standards is increasing the use of A2L refrigerants in residential and commercial HVAC systems. Rising investments in recovery and reclamation infrastructure, combined with the expansion of cold-chain facilities for pharmaceuticals and food logistics, are further accelerating market momentum across the region.

KEY TAKEAWAYS

-

BY TYPEHFO is projected to be the fastest-growing type of refrigerants with a CAGR of 12.81%, in terms of value, between 2025 and 2030.

-

BY APPLICATIONThe air conditioning systems application segment is projected to register the highest CAGR of 7.23%, in terms of value, during the forecast period.

-

BY COUNTRYGermany dominated the Europe refrigerants market in 2024, accounting for a market share of 20.0% in terms of value.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSHoneywell International Inc., The Chemours Company, Arkema, Daikin Industries Ltd., and Orbia Advance Corporation are identified as key players in the Europe refrigerants market. These companies have strong market presence and extensive product portfolios.

-

COMPETITIVE LANDSCAPE - STARTUPSA-Gas International Limited, AGC Inc., and Harp International Limited, along with other emerging players, have established strong positions within specialized niche segments, demonstrating their potential to become future market leaders.

The Europe refrigerants market is advancing as the region enforces some strict environmental policies, led by the EU F-Gas Regulation and HFC quota reductions. The push toward ultra-low-GWP and natural refrigerants is accelerating the transition from traditional HFCs to CO2, ammonia, hydrocarbons, and next-generation HFOs across commercial refrigeration, automotive AC, and industrial cooling. Strong investment in sustainable building retrofits, energy-efficient heat pumps, and decarbonization programs under the Green Deal is also elevating demand for compliant refrigerant solutions. Additionally, expanding district heating and cooling networks and the shift toward eco-friendly cold-chain systems are further reinforcing market growth across the region.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Consumers' business influence on the Europe refrigerants market is largely driven by strict environmental regulations, changing lifestyles, increased demand for processed food, and the accelerating need for low-GWP refrigerants across commercial and industrial cooling systems. Key sectors such as residential and commercial HVAC, supermarkets, cold-chain logistics, automotive air conditioning, and industrial refrigeration are the largest consumers of compliant refrigerants to support regulatory alignment and operational reliability.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Strict EU F-Gas regulation & binding quotas

-

Policy push for decarbonization/heat-pump deployment using natural refrigerants

Level

-

Illegal imports and quota circumvention

-

High upfront costs, installer shortages, and uneven subsidy support

Level

-

Reclaiming, recovery, and circular-economy services

-

Scale-up of natural-refrigerant technologies and retrofit solutions for supermarkets/cold chain

Level

-

Fragmented enforcement & varying national implementation

-

Geopolitical/energy supply shocks and upstream feedstock volatility

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Strict EU F-Gas regulation & binding quotas

The strict EU F-Gas Regulation, supported by progressively tightening quotas, is one of the major drivers in the Europe refrigerants market. These regulations limit the supply of high-GWP refrigerants each year, making them more expensive and harder to access. As a result, manufacturers, installers, and end users are accelerating the shift toward low-GWP and natural refrigerants like CO2, ammonia, propane, and newer HFOs. The regulation has created a sense of urgency across the entire value chain, forcing companies to redesign equipment, invest in new technologies, and adopt long-term climate-friendly solutions. This regulatory pressure is not only pushing compliance but also driving massive innovation in heat pumps, chillers, supermarkets, and cold-chain refrigeration systems. It has effectively placed sustainability at the center of product development and market strategy in Europe.

Restraint: High upfront costs, installer shortages, and uneven subsidy support

One of the most significant restraints for the Europe refrigerants market is the combination of high upfront costs and a shortage of qualified installers. Transitioning to low-GWP or natural refrigerants often requires entirely new systems, safety upgrades, and specialized components, all of which entail a higher initial investment than traditional HFC-based equipment. In addition, natural refrigerants such as CO2, ammonia, and hydrocarbons require technicians with advanced training due to pressure, toxicity, or flammability risks. However, Europe currently faces a skills gap, with too few trained installers available to support widespread adoption. This leads to project delays, higher installation fees, and an uneven ability of businesses, especially SMEs, to switch to modern refrigerant technologies. The cost–skill barrier slows market transformation and makes the transition more challenging for many end users.

Opportunity: Reclaiming, recovery, & circular economy services

As refrigerant quotas shrink and the phase-down accelerates, Europe is witnessing a major opportunity in reclaiming, recovery, and circular economy refrigerant services. Reclaimed refrigerants reprocessed to meet certified purity standards are becoming an essential supply source for servicing existing equipment without relying on newly produced gases. This shift supports environmental goals by reducing waste, lowering emissions, and minimizing the production of high-GWP refrigerants. It also provides financial advantages, as reclaimed gases are often cheaper than new ones under tight quota conditions. The demand for certified reclaimers, recovery specialists, and on-site refrigerant management services is growing rapidly, creating a strong business case for companies that offer these solutions. As the EU tightens its sustainability requirements, circular-economy refrigerant models are evolving from optional to necessary, offering long-term market growth potential.

Challenge: Fragmented enforcement & varying national implementation

A major challenge for the refrigerants market in Europe is the fragmented and inconsistent enforcement of F-Gas regulations across different countries. While the EU provides a unified legislative framework, the actual monitoring, import controls, inspection systems, and penalties vary widely from one member state to another. Some countries maintain strict checks and strong border controls, while others struggle with enforcement capacity, allowing illegal imports and non-compliant products to enter the market. This inconsistency creates an uneven playing field where compliant companies face higher costs than those sourcing illegal or low-quality refrigerants. It also undermines the regulation's environmental impact, as the presence of illegally traded refrigerants keeps high-GWP gases circulating longer than intended. For manufacturers and distributors operating across Europe, navigating these differences increases operational complexity and slows down uniform adoption of low-GWP solutions.

EUROPE REFRIGERANTS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Bosch is shifting its heat pumps to propane (R-290) and other natural refrigerants | It is also designing systems that use very small amounts of refrigerant and keep everything fully sealed to prevent leaks | Full compliance with EU F-Gas regulations, reduced direct emissions, and improved seasonal energy efficiency |

|

Carrier is switching to new, low-GWP refrigerants in its chillers and HVAC systems | It is also adding smart sensors that quickly detect leaks and alert technicians | Improved regulatory compliance, better energy performance, and lower service costs through early leak detection |

|

Arcelik is using natural refrigerants like R-600a and R-290 in home refrigerators | It has upgraded its factories with safer filling equipment and enhanced safety controls for handling flammable refrigerants | Reduced environmental impact, lower flammability risk due to improved protocols, and increased energy efficiency in household appliances |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the Europe refrigerants market is defined by a highly coordinated framework of chemical suppliers, compressor and system manufacturers, distributors, and service companies operating under some of the world’s strictest climate regulations. The EU F-Gas Regulation and national-level decarbonization policies have accelerated the shift toward natural refrigerants, particularly CO2 for supermarkets, ammonia for industrial refrigeration, and hydrocarbons for domestic appliances, while also driving rapid adoption of next-generation HFOs in commercial and residential HVAC systems. Europe OEMs, engineering firms, and installers work closely with certification bodies and safety regulators to ensure compliance with evolving standards, including EN norms and requirements for A2L refrigerants. The ecosystem is also supported by a well-established network of reclamation centers, recycling programs, and leak-detection service providers, reflecting Europe’s strong emphasis on circularity and emissions reduction. As a result, the Europe refrigerants market operates as a policy-driven, sustainability-focused ecosystem, where innovation, safety, and carbon-footprint reduction guide technology choices across refrigeration, heat pumps, cold chain, and HVAC applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Europe Refrigerants Market, by Type

HFOs have emerged as the largest refrigerant type in Europe, supported by the region’s F-Gas Regulation, which limits the use of high-GWP HFCs and promotes rapid adoption of next-generation alternatives. Its ultra-low GWP, strong energy efficiency profile, and drop-in compatibility with modern cooling systems have accelerated its uptake across automotive AC, commercial refrigeration, and building HVAC. With stricter phase-down quotas and frequent regulatory revisions, industries across Europe are shifting decisively toward HFOs to ensure long-term compliance. As a result, HFOs continue to capture increasing market share, solidifying its position as the dominant refrigerant type in Europe’s transition toward climate-aligned cooling technologies.

Europe Refrigerants Market, by Application

Air conditioning systems represent the fastest-growing application in the Europe refrigerants market, driven by rising cooling demand in residential and commercial buildings, expanding heat-pump adoption, and intensifying energy-efficiency targets under the EU Green Deal. Warmer summers, rapid urbanization, and sustainability-led building retrofits have significantly boosted AC installations across the region. The shift toward low-GWP refrigerants such as HFOs, hydrocarbons, and CO2 further supports growth, as manufacturers upgrade equipment to meet environmental and performance standards. With strong policy backing and increasing consumer demand for efficient cooling solutions, the AC segment continues to accelerate, making it the most robust application area in Europe’s refrigerant landscape.

REGION

Germany accounted for largest share of Europe refrigerants market in 2024

Germany holds the largest share in the Europe refrigerants market due to its well-established industrial base, high demand for HVAC and commercial refrigeration systems, and strong regulatory compliance with EU F-gas regulations. The country’s robust automotive and manufacturing sectors drive significant refrigerant consumption for air-conditioning, process cooling, and refrigeration applications. Additionally, Germany has a well-developed infrastructure for research, development, and production of low-GWP and natural refrigerants, enabling faster adoption of next-generation refrigerants. High energy efficiency standards, coupled with growing investments in sustainable and eco-friendly cooling solutions, further boost refrigerant demand, solidifying Germany’s position as the leading market in Europe.

EUROPE REFRIGERANTS MARKET: COMPANY EVALUATION MATRIX

In the Europe refrigerants market, Honeywell International Inc. (Star) leads with a significant market share and an extensive product portfolio, including advanced low-GWP, HFC, and HFO refrigerants for HVAC, commercial refrigeration, cold chain, and industrial applications. Its strong scale, innovation-driven solutions, regulatory compliance, and well-established distribution network make it a preferred partner for OEMs and contractors across Europe. Daikin Industries Ltd. (Emerging Leader) is gaining traction with its eco-friendly refrigerant solutions, focusing on energy-efficient systems, and expanding its presence in low-GWP and natural refrigerant segments. While, Honeywell maintains dominance through scale, technological leadership, and regional reach, Daikin shows strong potential to advance toward the leaders’ quadrant as regulatory-driven demand for sustainable and low-GWP refrigerants continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Honeywell International Inc. (US)

- Arkema (France)

- The Chemours Company (US)

- Linde plc (Ireland)

- Daikin Industries Ltd. (Japan)

- Orbia Advanced Corporation, S.A.B. de C.V. (Mexico)

- AGC Inc. (Japan)

- Dongyue Group Limited (China)

- Harp International Limited (UK)

- A-Gas International Limited (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.46 Billion |

| Market Forecast in 2030 (Value) | USD 2.12 Billion |

| Growth Rate | CAGR of 6.30% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Volume (Kiloton), Value (USD Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | Europe |

WHAT IS IN IT FOR YOU: EUROPE REFRIGERANTS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Current refrigerant usage patterns and future replacement pathways for each application segment |

|

|

| Type by application criss-cross | A detailed matrix comparing each refrigerant type (HFCs, HFOs, CO2, Ammonia, Isobutane) against major applications (AC systems, refrigeration, heat pumps, chillers, cold chain, automotive AC, industrial cooling) |

|

RECENT DEVELOPMENTS

- January 2020 : Central England Co-Operative selected Honeywell’s Solstice L40x refrigerant for its new food chilling systems.

- December 2019 : The Chemours Company announced support for the market transition driven by the European Union’s F-Gas Regulation, including the adoption of lower-GWP alternatives and preparations for the next phase-down in 2021. It is expected that the supply of high-GWP refrigerants, R-404A (GWP 3922) and R-507A (GWP 3985), will be suspended in countries of the European Union.

- December 2019 : Honeywell partnered with Daikin to expand its Solstice N40 (R-448A) refrigerant market in Japan.

- November 2019 : The Chemours Company announced that G.I. Industrial Holding (Italy), a group of leading companies in the comfort and industrial cooling segment in Europe, Africa, the Middle East, and Asia, adopted its Opteon XL41 (R-454B) and Opteon XL55 (R-452B) low GWP HFO refrigerants as R-410A replacements for its scroll chiller systems.

Table of Contents

Methodology

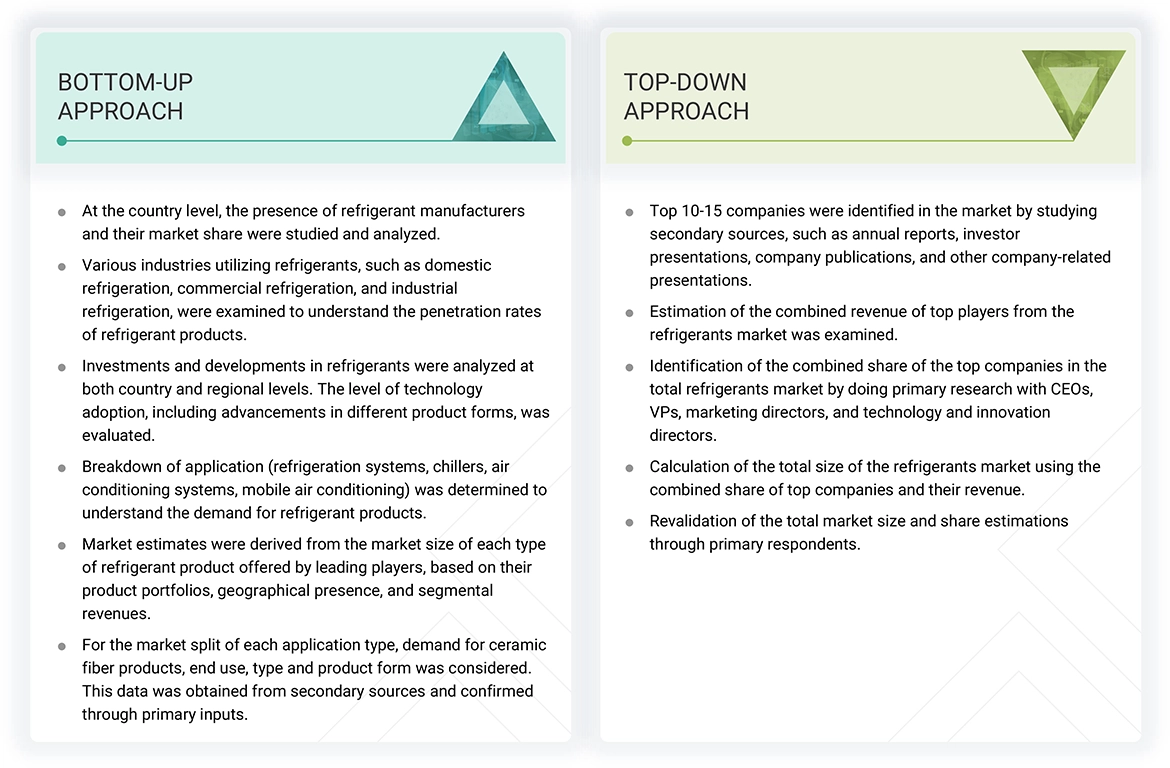

The study involved four major activities in estimating the market size for Europe refrigerants market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The Europe refrigerants market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the automotive, medical, construction and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative informations.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Honeywell International Inc. | Director of Marketing | |

| The Chemours Company | Manager- Sales & Marketing | |

| The Linde Group | Sales Manager | |

| Arkema | Production Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Europe refrigerants market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Europe refrigerants Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Europe refrigerants industry.

Market Definition

According to the International Institute of Refrigeration, refrigerants are cooling mediums that absorb heat at low temperatures and pressure and release heat at high temperatures and pressure. Fluorocarbons are the most widely used refrigerants in equipment, such as refrigerators and air conditioners. However, due to their high ozone depleting potential (ODP) and global warming potential (GWP), they are being replaced by greener refrigerants such as propane, isobutane, ammonia, and carbon dioxide, among others, such as water and propene.

Stakeholders

- Europe refrigerants Manufacturers

- Refrigerants Traders, Distributors, and Suppliers

- End-use Market Participants of Different Segments of Refrigerants

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

Report Objectives

- To define, describe, and forecast the Europe refrigerants market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by type, application, and region

- To strategically analyze micromarkets with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To strategically profile key players and comprehensively analyze their growth strategies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Europe Refrigerants Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Europe Refrigerants Market