Fab Automation Market Size, Share & Growth 2025 To 2032

Fab Automation Market By Automated Material Handling Systems, Robotics & Handling Equipment, Equipment Control Software, Advanced Process Control, 200 mm, 300 mm, Integrated Device Manufacturers (IDMs), Foundries, and OSATs - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The fab automation market is projected to reach USD 41.44 billion by 2032 from USD 25.24 billion in 2025, at a CAGR of 7.3% from 2025 to 2032. The market is projected to grow steadily, driven by the rapid expansion of 300 mm fabs, rising adoption of AMHS, robotics, and AI-driven factory software, and the accelerating shift toward advanced-node, EUV, and high-volume semiconductor manufacturing.

KEY TAKEAWAYS

-

By RegionAsia Pacific accounted for the largest share of the fab automation market in 2024, driven by strong 300 mm capacity expansion across China, Taiwan, South Korea, and Japan.

-

By OfferingBy offering, the hardware segment dominated the market in 2024 and will continue to lead through 2032 due to rising demand for AMHS, robotics, and environmental control systems in advanced-node fabs.

-

By Wafer SizeThe 300 mm segment held the largest share in 2024 and is expected to remain dominant through 2032 as manufacturers accelerate EUV-enabled and high-volume production.

-

By Deployment TypeIn 2024, greenfield fabs led the market; however, by 2032, brownfield fabs are expected to dominate as modernization and automation upgrades intensify globally.

-

By End UserBy end user, foundries dominated in 2024 and will continue to lead due to strong demand for advanced logic, automotive semiconductors, and AI/HPC chip production.

-

Competitive LandscapeDaifuku, Murata Machinery, Atlas Copco, Rorze Automation, and Ebara were identified as leading players, supported by extensive automation portfolios and strong market presence.

-

Competitive LandscapeCompanies such as Hirata Corporation, Kawasaki Heavy Industries, Yaskawa, FANUC, and KUKA are strengthening their positions through innovations in robotics, modular automation, and flexible handling solutions.

The fab automation industry is experiencing strong growth driven by rising 300 mm capacity expansion, advanced-node and EUV manufacturing, and increasing adoption of AMHS, robotics, and factory software. New partnerships, digital-twin investments, and AI-driven automation are reshaping semiconductor production globally.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Trends in AI, automotive electronics, 5G, consumer devices, and cloud computing are reshaping fab automation needs, pushing semiconductor manufacturers to adopt advanced AMHS, robotics, APC, YMS, and digital twin systems to deliver higher yield, faster ramps, and reliable chip supply for downstream industries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid growth in 300 mm fab capacity

-

Increasing adoption of AI/ML-driven predictive analytics and digital-twin platforms

Level

-

Shortages of skilled automation and software specialists

-

Limited interoperability between legacy and next-generation systems

Level

-

Adoption of modular AMHS and collaborative robotics

-

Deployment of advanced automation for 2.5D/3D packaging and heterogeneous integration

Level

-

Stringent ultra-clean manufacturing requirements increasing contamination and reliability risks

-

Integration complexity across multi-vendor MES, APC, YMS, and AMHS ecosystems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid growth in 300 mm fab capacity

The expansion of 300 mm semiconductor fabs worldwide is significantly accelerating demand for advanced automation systems. As manufacturers scale high-volume production for logic, memory, and advanced packaging, fabs require robust AMHS, precision robotics, and factory automation software to maintain high throughput, tight process control, and consistent yields. Rapid investments in sub-7 nm and EUV-enabled lines further amplify automation needs, as larger wafer sizes and complex processes demand seamless tool-to-tool coordination, minimized contamination, and optimized wafer flow. The surge in 300 mm capacity additions, particularly in Asia Pacific, the US, and Europe, continues to be a major driver shaping automation adoption globally.

Restraint: Shortages of skilled automation and software specialists

Despite rising demand for automation, the semiconductor industry faces a critical shortage of skilled personnel specializing in robotics, MES, APC, AI/ML analytics, and cleanroom automation. Many fabs struggle to hire and retain engineers capable of integrating and maintaining advanced automation stacks. This talent gap slows modernization of brownfield fabs, increases implementation timelines, and creates dependency on external integration partners. As automation becomes more data-driven and software-intensive, the shortage of qualified specialists poses a significant barrier to scaling next-generation fab automation solutions.

Opportunity: Adoption of modular AMHS and collaborative robotics

The shift toward modular, flexible AMHS architectures and collaborative cleanroom robotics presents significant growth opportunities. Unlike traditional fixed automation, modular systems enable faster installation, easier reconfiguration, and lower upgrade costs, critical for fabs transitioning to advanced nodes or expanding capacity. Collaborative robots (cobots) designed for cleanroom use offer precision handling, reduced manual interventions, and adaptability across wafer, reticle, and packaging workflows. These advancements support both greenfield and brownfield automation strategies, enabling fabs to scale automation more cost-effectively while improving productivity and operational agility.

Challenge: Stringent ultra-clean manufacturing requirements increasing contamination and reliability risks

Semiconductor manufacturing, especially at advanced nodes, demands exceptionally stringent contamination control and equipment reliability. Even minor particle generation, vibration, or handling errors can compromise yields at sub-7 nm geometries. Automation systems must therefore meet ultra-clean standards, maintain stable operation, and integrate seamlessly with EUV tools and sensitive process equipment. Achieving this level of precision is challenging due to complex cleanroom environments, dense tool layouts, and multi-vendor system interactions. Ensuring contamination-free, highly reliable automation remains a persistent challenge for fabs striving to meet next-generation manufacturing requirements.

fab-automation-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of AMHS and OHT systems in advanced 300 mm semiconductor fabs | Higher wafer-handling throughput | Reduced contamination risk | Improved cycle-time efficiency |

|

Integration of wafer-handling robots and cleanroom transport systems in front-end fabrication lines | Enhanced precision in wafer transfer | Lower defect rates | Improved operational stability |

|

Vacuum and atmospheric robotics deployed for ultra-clean wafer transfer in advanced-node lithography and etch processes | Minimal particle generation | High-precision positioning | Improved yield in sub-7 nm production |

|

Industrial and cleanroom robots used in semiconductor assembly, packaging, and automated inspection workflows | Higher automation flexibility | Faster handling speed | Reduced labor dependency and operational errors |

|

Automated wafer-handling modules integrated into metrology, inspection, and process tools across front-end fabs | Increased tool uptime | Consistent wafer placement accuracy | Enhanced throughput and equipment utilization |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The fab automation market ecosystem includes automation solution providers delivering AMHS, robotics, and factory software; component and technology suppliers offering sensors, controls, and cleanroom systems; system integrators ensuring seamless tool-to-tool automation; and end users such as foundries, IDMs, and OSATs driving adoption through advanced-node and high-volume manufacturing needs.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Fab Automation Market, by Offering

In 2024, the hardware segment held the largest share of the fab automation market and is expected to maintain its dominance through 2032. Growth is driven by rapid expansion of 300 mm fabs, adoption of EUV-enabled production, and increasing reliance on Automated Material Handling Systems (AMHS), robotics, environmental control systems, and advanced utility automation. Hardware solutions remain essential for high-throughput wafer transport, contamination control, and continuous equipment connectivity. With major IDMs, foundries, and OSATs upgrading their fabs to handle advanced-node manufacturing, demand for robotics, OHT systems, cleanroom material-handling equipment, and utility automation continues to accelerate. As fabs scale capacity and complexity, the hardware segment will stay central to enabling efficiency, yield stability, and fab uptime.

Fab Automation Market, by Deployment Type

In 2024, greenfield fabs dominated the market as large-scale semiconductor expansion initiatives, particularly in Asia Pacific, the US, and Europe, drove demand for fully integrated automation ecosystems from the ground up. These new facilities emphasize end-to-end automation, including AMHS, robotics, factory software, and advanced environmental control. However, by 2032, brownfield fabs are expected to overtake greenfield deployments, supported by extensive modernization programs aimed at enhancing yield, reducing cycle-time variability, and upgrading existing lines to support 300 mm and advanced-node manufacturing. Increasing retrofitting of legacy fabs with digital-twin software, predictive analytics, and AMHS upgrades will accelerate brownfield adoption during the forecast period.

Fab Automation Market, by Wafer Size

The 300 mm segment dominated the fab automation market in 2024 and is expected to remain the largest through 2032. As leading manufacturers transition to advanced-node logic, DRAM, and high-density packaging technologies, 300 mm fabs require high-throughput automation systems, precision robotics, and advanced process control to maintain ultra-low defectivity. The rise of 3D architectures, EUV lithography, and heterogeneous integration further strengthens the demand for full-scale automation across 300 mm facilities. With significant 300 mm capacity additions in Asia Pacific, the US, and Europe, this segment will continue to anchor market growth. Smaller wafer sizes (<150 mm, 200 mm) remain relevant for specialty devices but represent a lower automation intensity compared to 300 mm fabs.

Fab Automation Market, by End User

In 2024, foundries accounted for the largest share of the fab automation market and are expected to maintain dominance through 2032. Foundries operate at high wafer volumes and serve diverse applications, AI, 5G, HPC, and automotive electronics, requiring stringent contamination control, continuous wafer flow, and optimized cycle times. Leading foundries aggressively deploy AMHS, factory automation software, APC/YMS platforms, and AI-driven analytics to support sub-7 nm and EUV-enabled production. As global demand for advanced logic and specialty semiconductors continues to rise, foundries will remain the primary adopters of cutting-edge fab automation solutions. IDMs and OSATs also show strong adoption, but foundries lead due to scale, diversification, and faster technology migration.

REGION

Asia Pacific to hold largest share of the global fab automation market during the forecast period

The Asia Pacific regon is expected to hold the largest share of the fab automation market during the forecast period, driven by significant semiconductor capacity expansion, rapid adoption of advanced-node manufacturing, and strong government-backed investments. Leading chipmakers across China, Taiwan, South Korea, and Japan are accelerating automation to enhance throughput, yield, and production efficiency.

fab-automation-market: COMPANY EVALUATION MATRIX

In the fab automation market matrix, Daifuku (Star) leads with a strong market share and an expansive product footprint, supported by its advanced AMHS platforms, high-reliability cleanroom transport systems, and deep integration capabilities across 300 mm and EUV-enabled fabs. The company’s broad portfolio and long-standing partnerships with major IDMs and foundries position it firmly in the upper-right quadrant. Kawasaki Heavy Industries (Emerging Leader) is steadily advancing with its robotics and precision-handling solutions, gaining recognition for high-performance wafer transfer, assembly automation, and scalable cleanroom robotics. While Daifuku maintains dominance through scale, global presence, and comprehensive automation offerings, Kawasaki demonstrates strong upward momentum and is well-positioned to move toward the leaders’ quadrant as fabs accelerate adoption of intelligent robotics and next-generation handling systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Daifuku (Japan)

- Murata Machinery (Japan)

- Atlas Copco (Sweden)

- Rorze Corporation (Japan)

- Ebara Corporation (Japan)

- FANUC (Japan)

- Kawasaki Heavy Industries (Japan)

- Hirata Corporation (Japan)

- Yaskawa (Japan)

- KUKA AG (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 23.96 Billion |

| Market Forecast in 2032 (Value) | USD 41.44 Billion |

| Growth Rate | CAGR of 7.3% from 2025-2032 |

| Years Considered | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion), Volume (Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | Americaa, Asia Pacific, EMEA |

WHAT IS IN IT FOR YOU: fab-automation-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading IDM |

|

|

| Foundry |

|

|

| OSAT Provider |

|

|

| Fab Equipment Manufacturer |

|

|

| Government / Policy Body |

|

|

RECENT DEVELOPMENTS

- April 2025 : Daifuku introduced a next-generation Overhead Hoist Transport (OHT) system optimized for EUV-enabled production lines, delivering higher throughput, improved routing intelligence, and enhanced vibration control for advanced-node fabs.

- February 2025 : Murata Machinery launched an upgraded cleanroom intra-bay transport platform incorporating AI-based diagnostics and predictive maintenance capabilities to support 300 mm wafer handling in high-density fab layouts.

- November 2024 : Rorze Automation unveiled a new vacuum robotics series designed for ultra-clean wafer transfer in sub-5 nm processes, with improved precision and contamination control for high-volume manufacturing.

- September 2024 : Tokyo Electron Limited expanded its factory software portfolio by releasing an advanced Equipment Control Software (ECS) module enabling tighter tool integration, real-time process optimization, and automated fault recovery.

- June 2024 : Brooks Automation announced the expansion of its semiconductor automation facility in the US to increase production of wafer-handling robots and atmospheric transfer systems for growing demand from 300 mm greenfield fabs.

Table of Contents

Methodology

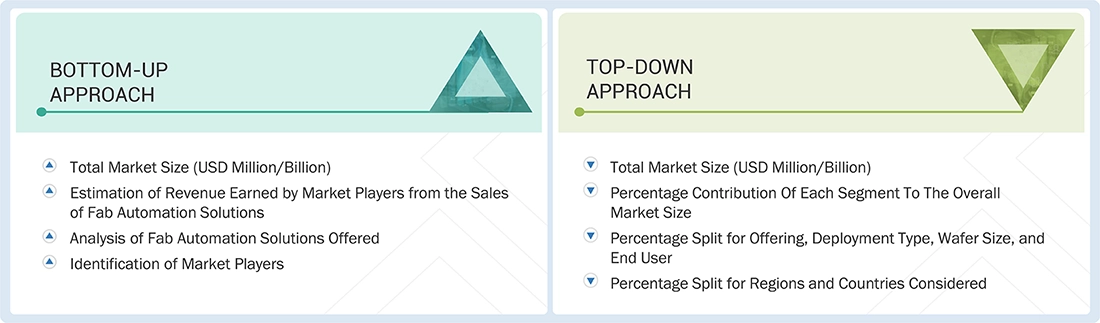

The research study involved four major activities in estimating the size of the fab automation market. Exhaustive secondary research has been conducted to gather key information about the market and its peer markets. The next step has been to validate these findings and assumptions, and size them up with the help of primary research involving industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Following this, market breakdown and data triangulation have been employed to estimate the market sizes of segments and sub-segments.

Secondary Research

During the secondary research process, various secondary sources have been consulted to identify and collect the information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has primarily been conducted to gather key information about the market’s value chain, the pool of key market players, market segmentation based on industry trends, regional outlook, and developments from both market and technology perspectives.

The fab automation market report estimates the global market size using both top-down and bottom-up approaches, as well as several dependent submarkets. Major players in the market have been identified through extensive secondary research, and their presence in the market has been determined using both secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

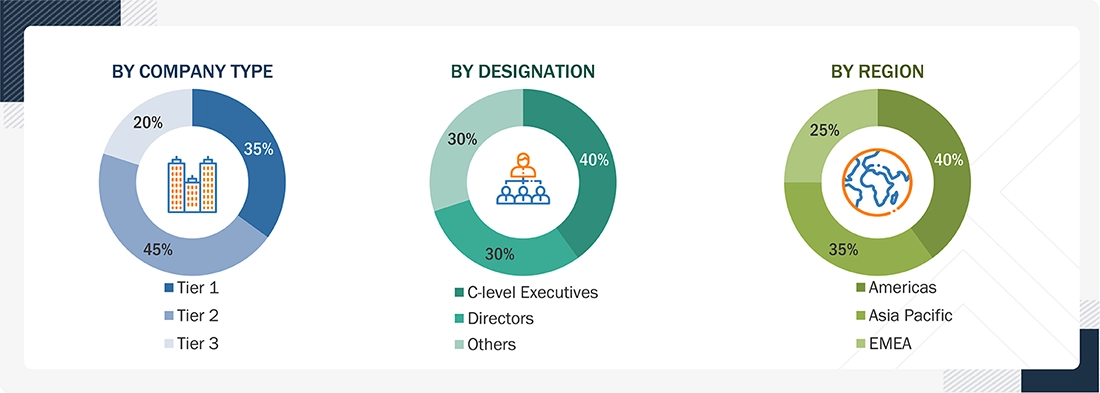

Primary Research

Extensive primary research has been conducted following an understanding of the fab automation market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across three major regions—Americas, Europe, Asia Pacific, and EMEA. Approximately 25% of the primary interviews have been conducted with demand-side vendors, while 75% have been conducted with supply-side vendors. Primary data has been collected mainly through telephonic interviews, which comprised 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions have been conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the opinions of our in-house subject-matter experts, has led us to the findings described in the report.

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches, along with data triangulation methods, have been employed to estimate and validate the size of the fab automation market and its dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying key stakeholders in the fab automation market, including semiconductor manufacturers (IDMs, foundries, OSATs), fab equipment vendors, automation solution providers, software suppliers, system integrators, and cleanroom infrastructure companies across the value chain.

- Analyzing major providers of fab automation solutions and their key offerings, including automated material handling systems (AMHS), robotics and wafer-handling equipment, environmental control systems, power and utility automation systems, manufacturing execution systems (MES), equipment control software (ECS), advanced process control (APC), yield management software (YMS), AI/ML analytics platforms, and digital-twin simulation tools.

- Studying adoption trends of fab automation across wafer sizes (<150 mm, 200 mm, 300 mm), automation layers, fab types (advanced node, mainstream node, mature node, legacy node), deployment types (greenfield, brownfield), and end users, based on offering, technology integration level, and region.

- Tracking recent market developments, including new fab announcements, government semiconductor incentive programs, automation-driven process upgrades, AI-integrated optimization platforms, and product launches in AMHS, robotics, and APC/MES software, to forecast market size and future growth trajectories accurately.

- Conducting multiple discussions with key opinion leaders across fab automation engineers, operations managers, process control experts, cleanroom specialists, and equipment vendors to understand real-time deployment patterns, integration challenges, and the growing focus on predictive operations, contamination control, and automated decision-making.

- Validating market estimates through in-depth consultations with R&D heads of automation companies, fab operations directors, software architects, and technical advisors in semiconductor ecosystem organizations, and aligning all insights with MarketsandMarkets semiconductor domain experts to ensure accuracy, robustness, and reliability of market projections.

Fab Automation Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall fab automation market has been divided into several segments and subsegments. The data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply perspectives. In addition to data triangulation and market breakdown, the market has been validated through both top-down and bottom-up approaches.

Market Definition

Fab automation refers to the integrated use of hardware, software, and intelligent control systems to automate and optimize semiconductor manufacturing processes across front-end and back-end fabrication facilities. The fab automation market encompasses solutions such as automated material handling systems (AMHS), robotics, environmental and utility control systems, manufacturing execution systems (MES), advanced process control (APC), yield management software (YMS), and AI-driven analytics platforms. These technologies enable precise wafer handling, real-time process monitoring, predictive maintenance, and seamless coordination between tools and factory systems. As semiconductor production advances toward smaller nodes, higher wafer volumes, and increasingly complex device architectures, fab automation has become essential for improving throughput, enhancing yield consistency, reducing contamination risks, and supporting scalable, high-efficiency manufacturing operations worldwide.

Key Stakeholders

- Component suppliers

- Semiconductor research institutes & R&D labs

- Fab automation solution providers

- Factory software vendors

- Semiconductor equipment manufacturers

- Cleanroom & environmental control system providers

- Utility automation and facility infrastructure providers

- System integrators

- Consulting and automation engineering service firms

- Industry associations & standards organizations

- Integrated Device Manufacturers (IDMs)

- Foundries

- Outsourced Semiconductor Assembly & Test (OSAT) providers

- Government agencies & semiconductor policy bodies

Report Objectives

- To define, describe, segment, and forecast the fab automation market, by offering, deployment type, wafer size, and end user, in terms of value

- To define, describe, and segment the fab automation market across qualitative dimensions, including automation layer, fab type, and automation level

- To forecast the market, in terms of volume, for the robotics and handling equipment segment under the offering category

- To describe and forecast the market for various segments, with respect to three main regions: Americas, Asia Pacific, and Europe, the Middle East & Africa (EMEA), along with their respective countries, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the fab automation market

- To provide a detailed overview of the fab automation market’s supply chain, along with the ecosystem, technology trends, use cases, regulatory environment, Porter’s five forces analysis, the impact of Gen AI/AI, and the impact of the 2025 US tariff

- To analyze industry trends, pricing data, patents, and trade data (export and import data) related to fab automation

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To analyze opportunities for stakeholders and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as product launches, expansions, contracts, partnerships, acquisitions, and research & development (R&D) activities, in the fab automation market

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for Americas, EMEA, and Asia Pacific

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

1

INTRODUCTION

2

EXECUTIVE SUMMARY

3

PREMIUM INSIGHTS

4

MARKET OVERVIEW

5

INDUSTRY TRENDS

6

STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

7

REGULATORY LANDSCAPE

8

CUSTOMER LANDSCAPE & BUYER BEHAVIOR

9

NORTH AMERICA 3D PRINTING MARKET, BY OFFERING (MARKET SIZE, VOLUME, AND FORECAST TO 2030 – USD MILLION)

10

NORTH AMERICA 3D PRINTING MARKET, BY TECHNOLOGY (MARKET SIZE & FORECAST TO 2030 – USD MILLION)

11

NORTH AMERICA 3D PRINTING MARKET, BY PROCESS (MARKET SIZE & FORECAST TO 2030 – USD MILLION)

12

NORTH AMERICA 3D PRINTING MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2030 – USD MILLION)

13

NORTH AMERICA 3D PRINTING MARKET, BY VERTICAL (MARKET SIZE & FORECAST TO 2030 – USD MILLION)

14

NORTH AMERICA 3D PRINTING MARKET, BY COUNTRY (MARKET SIZE & FORECAST TO 2030 – USD MILLION)

15

NORTH AMERICA 3D PRINTING MARKET, COMPETITIVE LANDSCAPE

16

NORTH AMERICA 3D PRINTING MARKET, COMPANY PROFILES

17

RESEARCH METHODOLOGY

18

APPENDIX

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Fab Automation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Fab Automation Market