This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the hematology analyzers and reagents market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the hematology analyzers and reagents market. The primary sources from the demand side include OEMs, private and contract testing organizations and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

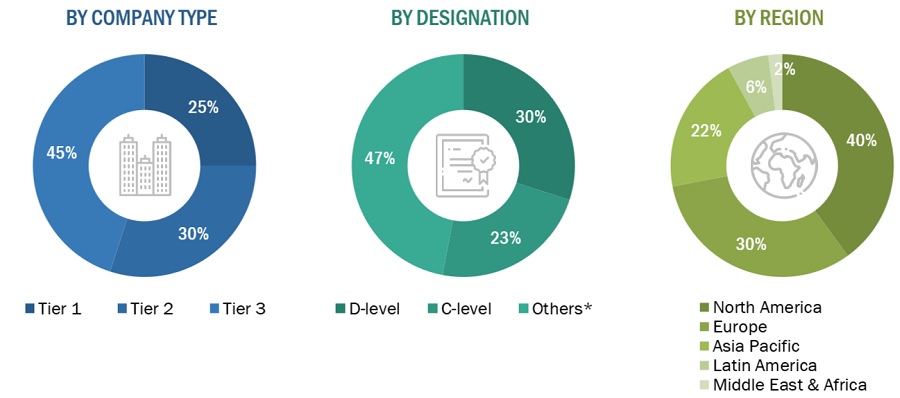

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2022, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = <USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

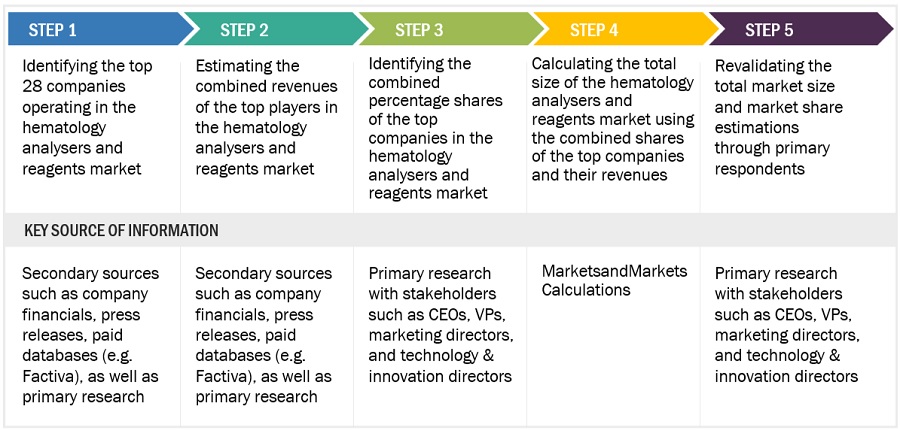

To determine the size of the global hematology analyzers and reagents market, revenue share analysis was employed in relation to the leading players. In this case, key players in the market have been identified, with their hematology products business revenues determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of top market players' annual and financial reports. On the other hand, primary research incorporated in-depth interviews with key opinion leaders, in particular, chief executive officers, directors, and key marketing executives.

Approach 1: Top-down revenue-based estimation.

Firstly, installation/volume consumption of hematology analyzers and reagents products has been calculated for their global market value estimation. The steps used for the same are as follows:

-

Revenues of individual companies were sourced from open domains and databases.

-

The shares of leading players in individual product segments of hematology analyzers and reagents market were obtained from secondary information available to the fullest extent. In some cases, shares of individual product segments were determined after detailed analysis of various parameters such as product portfolios, market positioning, average selling price and geographic reach of the company.

-

Individual shares or revenue estimates were validated through expert interviews.

To know about the assumptions considered for the study, Request for Free Sample Report

Approach 2: Procedure-based market estimation

The total sales revenue of hematology analysis, at the start of the secondary research, was independently approximated and cross-validated at a country and regional level, triangulated, and subject to further validation to estimate the global market.

-

List of top hematology procedures within each region and country

-

Identifying the average number of hematology product supplies used by major customer facilities across each product type at the regional/country level, annually

-

Identifying the percentage contribution of major customer facilities to the overall hematology analysis spend and consumption at the regional/country level, every year

-

Extrapolating the annual consumption patterns of different products by major customer facilities to forecast the size of each product segment at the regional/country level, every year

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global hematology analyzers and reagents market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the hematology analyzers and reagents market was validated using both top-down and bottom-up approaches.

Market Definition

Hematology is defined as the study of blood components, blood-forming organs, and blood disorders. Hematology analyzers are highly specialized instruments used to count and characterize blood cells for disease detection and monitoring, while hematology reagents are chemical compounds that are used to establish points of reference/calibration during hematology assays.

Key Market Stakeholders

-

Manufacturers of hematology analyzers and reagents

-

Suppliers, distributors, and channel partners of hematology analyzers and reagents

-

Clinical research organizations

-

Research laboratories and academic institutes

-

Hospitals and clinics

-

Research laboratories and CROs

-

Research and academic institutes

-

Government and private laboratories

-

Market research and consulting firms

Objectives of the Study

-

To define, describe, and forecast the hematology analyzers and reagents market on the basis of on product and services, prize range, application, usage type, end user and region.

-

To provide detailed information regarding the major factors influencing the growth potential of the global hematology analyzers and reagents market (drivers, restraints, opportunities, challenges, and trends).

-

To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global hematology analyzers and reagents market.

-

To analyze key growth opportunities in the global hematology analyzers and reagents market for key stakeholders and provide details of the competitive landscape for market leaders.

-

To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East and Africa (GCC Countries and Rest of MEA).

-

To profile the key players in the global hematology analyzers and reagents market and comprehensively analyze their market shares and core competencies.

-

To track and analyze the competitive developments undertaken in the global hematology analyzers and reagents market, such as agreements, expansions, and product launches.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global hematology analyzers and reagents market report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolios of the top fifteen companies

Company Information

-

Detailed analysis and profiling of additional market players (up to 13)

Geographic Analysis

-

Further breakdown of the Rest of Europe's hematology analyzers and reagents market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

-

Further breakdown of the Rest of Asia Pacific hematology analyzers and reagents market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

-

Further breakdown of the Rest of the Latin America hematology analyzers and reagents market into Argentina, Chile, Peru, and Colombia, among other

Growth opportunities and latent adjacency in Hematology Analyzers and Reagents Market