HVAC Services Market Size, Share & Growth

HVAC Services Market by Service Type (Installation, Maintenance & Repair, Upgradation/Replacement, Consulting), Implementation Type (New Construction, Retrofit), End User (Data Center, Education, Office, Retail, Manufacturing) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The HVAC services market is projected to reach USD 97.9 billion by 2030 from USD 72.5 billion in 2025, at a CAGR of 6.2% from 2025 to 2030. The HVAC services market is experiencing robust growth driven by rapid infrastructure development, rising retrofitting demand, and increasing emphasis on energy-efficient building operations.

KEY TAKEAWAYS

-

BY REGIONBy region, the Asia Pacific is expected to dominate the market, with a market share reaching ~40% by 2030.

-

BY IMPLEMENTATION TYPEBy implementation type, the new construction buildings segment is expected to grow at the highest CAGR during the forecast period.

-

BY SERVICE TYPEBy service type, the upgradation/replacement services segment is expected to grow at the highest CAGR of 8.1% during the forecasted period.

-

BY END USERBy end user, the commercial segment is expected to grow the fastest during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSDaikin, Carrier, and Trane Technologies were identified as some of the star players in the HVAC services market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMES75F and Futraheat, among others, have distinguished themselves among startups by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The HVAC services industry is growing as buildings increasingly rely on installation, maintenance, repair, and system upgrades to ensure energy efficiency, better indoor air quality, and reliable climate control. Rising retrofit demand and the need to replace aging systems are further accelerating service adoption across residential and commercial spaces.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The shift toward connected, efficient, and service-led HVAC models is accelerating demand for predictive maintenance, retrofits, and energy-efficient upgrades. As traditional installation revenue slows, service-based recurring models and digital-enabled solutions are emerging as major growth drivers. This transition is reshaping customer expectations toward smarter operations, regulatory compliance, and sustainability outcomes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing Demand for Preventive and Predictive Maintenance Contracts

-

Rising HVAC System Aging and Need for Frequent Servicing and Retrofits

Level

-

High Service Contract Pricing and Cost Sensitivity Among End Users

-

Inconsistent Service Quality Due to Fragmented Service Provider Ecosystem

Level

-

Expansion of Remote Diagnostics and Subscription-Based Service Models

-

Increasing Demand for IAQ Testing, Filtration Services, and Compliance-Based Maintenance

Level

-

Shortage of Certified HVAC Service Technicians and Training Ecosystems

-

Integrating Digital Tools with Legacy HVAC Installations During Service Operations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing Demand for Preventive and Predictive Maintenance Contracts

Preventive and predictive maintenance contracts are accelerating as building owners shift from reactive repairs to proactive servicing to avoid costly breakdowns. With IoT-enabled diagnostics, end users gain improved uptime, optimized energy performance, and extended equipment life. For service providers, these contracts ensure recurring revenue, increased customer loyalty, and a strong differentiation in a competitive market transitioning toward service-centric business models.

Restraint: High Service Contract Pricing and Cost Sensitivity Among End Users

Despite clear operational and efficiency benefits, many end users hesitate to adopt advanced HVAC service packages because of high annual contract fees, expensive replacement parts, and hidden service charges. This cost sensitivity is especially prominent among small commercial facilities and residential customers, slowing service penetration and prolonging reliance on reactive or low-cost maintenance alternatives.

Opportunity: Expansion of Remote Diagnostics and Subscription-Based Service Models

Subscription-based service offerings supported by cloud platforms and remote monitoring are reshaping HVAC services. Real-time fault detection, performance analytics, and automated alerts enable faster issue resolution and fewer on-site visits, reducing cost and downtime. This model creates flexible service tiers from basic to premium, attracting commercial and industrial customers seeking scalability, transparency, and long-term operational savings.

Challenge: Shortage of Certified HVAC Service Technicians and Training Ecosystems

The HVAC services market is facing a widening skills gap as advanced systems require knowledge of automation, controls, refrigerants, and IoT platforms. Limited training capacity, slow certification processes, and regional workforce shortages impact service reliability and turnaround times.

HVAC Services Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Daikin upgraded the HVAC infrastructure at its Jebel Ali HQ in Dubai by installing high-efficiency AC systems, upgraded AHUs, and an advanced building management and monitoring service to optimize temperature control, compliance, and long-term service needs. | Improved indoor air quality, reduced maintenance frequency, enhanced operational efficiency, and enabled continuous performance tracking aligned with global sustainability standards. |

|

Carrier provided an energy assessment followed by a chiller plant modernization and long-term maintenance contract at Gateway Tower, India, integrating smart optimization services to monitor equipment health and improve system performance. | Achieved up to 45–50% energy reduction, lower downtime through predictive servicing, and long-term system reliability supported by service-led performance monitoring. |

|

Johnson Controls deployed HVAC service automation at a major US hospital, including remote monitoring, filter replacement programs, service contracts, and IAQ compliance audits to support strict environmental and operational requirements. | Enhanced air quality compliance, reduced unplanned outages, improved patient comfort, and operational continuity through proactive maintenance and continuous system visibility. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The HVAC services ecosystem is transitioning from one-time installation to a full lifecycle management approach supported by digital platforms, predictive maintenance, and service contracts. Various stakeholders, including OEMs, facility management providers, and AI startups, now work together to deliver efficiency, compliance, and sustainability-driven service value.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

HVAC Services Market, By Implementation Type

The retrofit segment is a major contributor in the HVAC services market as aging buildings require compliance upgrades, efficiency improvements, and modernization of mechanical systems. Retrofitting services, including system optimization, component replacement, and recommissioning, are growing as end users seek cost savings, reduced downtime, and alignment with indoor air quality and energy performance regulations. New construction continues to offer opportunities; however, recurring service demand in retrofit environments is driving long-term growth.

HVAC Services Market, By Service Type

Preventive maintenance, repair, and performance optimization services represent the largest share of the HVAC services market. Advanced systems such as heat pumps, VRF systems, and connected HVAC platforms require certified technicians for tuning, software updates, diagnostic checks, and warranty servicing. The shift toward predictive maintenance, remote monitoring, and annual service contracts is strengthening recurring revenue streams.

HVAC Services Market, By End User

Commercial end users, including offices, hospitality, healthcare, and data centers, dominate the demand for HVAC services due to their continuous operational requirements and strict comfort, air quality, and regulatory expectations. These facilities prioritize uptime, energy efficiency, and indoor air quality, resulting in sustained investment in maintenance contracts, remote monitoring, filter services, and performance upgrades.

REGION

Asia Pacific to be fastest-growing region in global HVAC services market during forecast period

The Asia Pacific region is expected to lead the HVAC services market, expanding at the highest CAGR during the forecast period. Increasing construction activities, rising population, higher per capita income, growing demand for energy-efficient devices, and favorable energy efficiency incentives from governments are key factors driving the growth of the HVAC services market in the region.

HVAC Services Market: COMPANY EVALUATION MATRIX

In the HVAC services market matrix, Daikin and Carrier (Star) lead with a strong market presence and a wide product portfolio, driving large-scale adoption across various industries, including commercial and industrial.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Carrier (US)

- DAIKIN INDUSTRIES, Ltd. (Japan)

- Trane Technologies plc (Ireland)

- LG Electronics (South Korea)

- Midea (China)

- Lennox International Inc. (US)

- Honeywell International Inc. (US)

- Mitsubishi Electric Corporation (US)

- Bosch Thermotechnik GmbH (Germany)

- Panasonic Holdings Corporation (Japan)

- Modine (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 70.4 Billion |

| Market Forecast in 2030 (Value) | USD 97.9 Billion |

| Growth Rate | CAGR of 6.2% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, RoW |

WHAT IS IN IT FOR YOU: HVAC Services Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based HVAC Manufacturer |

|

|

| Europe-Based Air Purifier & Ventilation Company |

|

|

| Smart Building Technology Startup |

|

|

| US-based HVAC Raw Material Supplier |

|

|

| Commercial HVAC Customer |

|

|

RECENT DEVELOPMENTS

- December 2025 : Cool Running Air, Inc. expanded its specialized heat-pump repair services in Hialeah (US), adding advanced diagnostics, enhanced technician training (NATE-certified), and faster emergency response to meet growing heat-pump service demand.

- June 2025 : OPTERRA Energy Services (formerly ENGIE Services US) was acquired by LS Power. With this move, the company aims to expand its HVAC maintenance, energy-efficiency upgrades, and facility operations services as part of a broader push on energy and climate-management solutions.

- July 2024 : Bosch acquired Johnson Controls-Hitachi’s residential and light-commercial HVAC unit to expand its heating, ventilation, and cooling portfolio. The acquisition includes manufacturing plants and product lines for boilers, heat pumps, and climate control systems. This move significantly strengthened Bosch’s footprint across Europe in the HVAC equipment market.

Table of Contents

Methodology

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the HVAC Services market. This process involved the extensive use of secondary sources, directories, and databases (Factiva and Oanda) to identify and collect valuable information for the comprehensive, technical, market-oriented, and commercial study of the HVAC Services market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information and assess growth prospects. Key players in the HVAC Services market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

Various sources were used in the secondary research process to identify and collect information important for this study. These include company annual reports, press releases, investor presentations, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of market players, the market classification according to industry trends to the bottom-most level, regional markets, and key developments from market and technology-oriented perspectives.

Primary Research

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the HVAC Services market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Extensive primary research has been conducted after acquiring knowledge about the HVAC Services market scenarios through secondary research. Several primary interviews have been conducted with experts from the demand (end user and region) and supply side (heating equipment, cooling equipment, ventilation equipment, implementation type, system type, technology) across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 60% and 40% of the primary interviews were conducted from the supply and demand sides, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

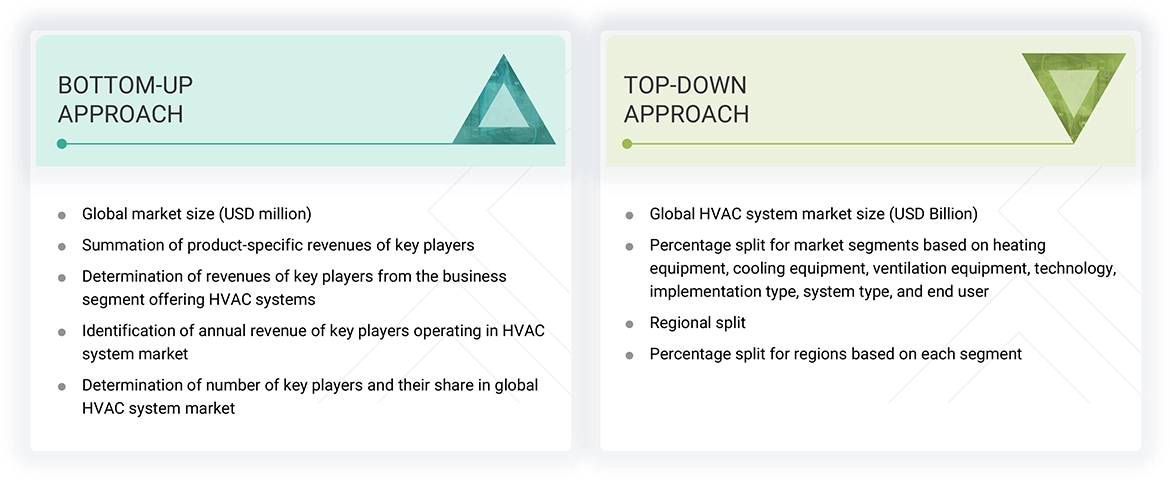

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods were implemented to estimate and validate the size of the HVAC Services market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

HVAC System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using the top-down and bottom-up approaches.

Market Definition

HVAC Services (Heating, ventilation, and air conditioning) is a set of technologies designed to regulate indoor temperature, humidity, and air quality for homes, businesses, or industrial spaces. It includes equipment that controls air circulation, adjusts temperatures via heating and cooling, and ensures adequate ventilation.

It includes various components such as air conditioners, heat pumps, furnaces, ventilation systems, and associated controls and technologies. These components work together to maintain comfortable and healthy indoor environments. Factors like energy efficiency, regulatory standards, climate considerations, and the demand for improved indoor air quality drive the HVAC Services market.

Key Stakeholders

- Component Manufacturers

- Government and Research Organizations

- HVAC System Providers

- HVAC Software and Service Providers

- Maintenance and Service Providers

- Original Equipment Manufacturers (OEMs)

- Professional Services/Solution Providers

- Research Institutions and Organizations

- System Integrators

Report Objectives

- To estimate and forecast the size of the HVAC Services market, in terms of value, based on cooling equipment, heating equipment, ventilation equipment, technology, implementation type, service type, end user, and region

- To describe and forecast the market size, in terms of volume, based on cooling equipment, heating equipment, ventilation equipment, and region.

- To describe and forecast the market size, in terms of value, for four major regions—North America, Europe, Asia Pacific, and RoW

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the HVAC Services market

- To strategically analyze micromarkets with regard to individual market trends, growth prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with a detailed competitive landscape for the market leaders

- To analyze major growth strategies such as product launches, expansions, joint ventures, agreements, and acquisitions adopted by the key market players to enhance their position in the market

- To analyze the AI impact on the HVAC Services market

- To analyze the US tariff impact on the HVAC Services market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report::

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the HVAC Services Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in HVAC Services Market