India Automotive Camera Market

India Automotive Camera Market by ICE Application, View Type, Vehicle Type (PC, LCV and HCV), Level of Autonomy (L0, L1 and L2/L2+), EV Application, After Market Application (Dashcam, Reverse Camera, and 360 Degree Camera) - Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Automotive camera market ICE vehicles is projected to grow from USD 65.5 million in 2025 to USD 143.9 million by 2032, at a CAGR of 11.9%. Meanwhile, the market for the EV segment is projected to grow from USD 14.2 million in 2025 to USD 33.7 million by 2032, at a CAGR of 13.2%. The automotive camera market in India is primarily driven by increasing OE fitment as safety features move down from premium to mid and entry segments. Rear cameras are seeing higher penetration driven by regulatory mandates, platform standardization, and OEM efforts to improve basic safety perception. The adoption of 360 cameras is growing with rising sales of SUVs and higher trim variants, where parking assistance, bird-eye view, and driver convenience are key differentiators. Dashcams are also gradually entering the market for select models, influenced by insurance, liability, and connected vehicle roadmaps.

KEY TAKEAWAYS

-

BY ICE APPLICATIONThe parking+bird eye view segment is estimated to have the highest market share of ~55% in 2025.

-

BY VIEW TYPEThe rear view camera segment is projected to grow at the fastest rate from 2025 to 2032.

-

BY TECHNOLOGYBy technology, the digital camera segment is expected to dominate the market.

-

BY VEHICLE TYPEThe passenger car segment is estimated to account for a share of ~94% in 2025.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSCompanies such as Robert Bosch GmbH and ZF Friedrichshafen stand out as star players and emerging leaders, respectively, due to their market presence and robust potential to build strong business strategies across the automotive camera market.

-

COMPETITIVE LANDSCAPE - SMESSafe Cam, Vantrue and NAYAN are the leading progressive companies in automotive camera market.

Model shift toward SUVs and higher trim mixes is increasing automotive camera demand in India. Maruti Suzuki is gradually migrating rear cameras from dealer accessories into factory packages as platforms refresh, lifting baseline fitment on high-volume models. Similarly, Hyundai is accelerating penetration by embedding multi-camera setups and ADAS into mid-class vehicles such as Creta, pushing cameras into the core C segment. Meanwhile, Tata Motors is using feature-rich positioning to introduce 360 cameras and ADAS at lower price points, expanding camera adoption beyond premium buyers. Further, Mahindra is reinforcing this trend by standardizing multi-camera systems on SUV-led portfolios, making cameras a default expectation rather than an add-on.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The automotive camera market is undergoing a clear shift from basic rear-view cameras and entry-level dashcams toward multi-camera, software-enabled platforms that support safety, ADAS readiness, and future vehicle upgrades. OEMs and fleet operators are increasingly using camera systems to strengthen safety positioning, trim differentiation, and urban usability, particularly in SUVs and EVs. Over the next few years, revenue is expected to move toward 360-degree surround-view systems, ADAS-ready front and side cameras, and in-cabin monitoring, supported by software and analytics. This transition reflects a broader disruption where cameras evolve from standalone hardware components into strategic enablers of safety, brand value, and lifecycle monetization in the Indian automotive ecosystem

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Indian Standard and Bharat NCAP safety mandates

-

Shift to multi-camera architecture (360 Degree/Surround View)

Level

-

High system cost and trim-level differentiation

-

Limited aftermarket and service ecosystem readiness

Level

-

Growth in driver monitoring systems (DMS) and occupant monitoring systems (OMS)

-

Shift to electric vehicles

Level

-

Performance variability of camera systems in Indian driving conditions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver - Shift to multi-camera architecture (360 Degree/Surround View)

Shift toward multi-camera (360 degree/surround-view) architectures is accelerating in the automotive camera market as OEMs move beyond basic rear-view cameras to deliver full-vehicle visibility. Rising SUV penetration, larger blind-spot areas, and stronger safety awareness are driving demand for surround-view systems as a practical safety and convenience feature rather than a premium add-on. Dense urban traffic, narrow roads, and constrained parking conditions further support the value of bird’s-eye visualization in daily driving. Supported by declining sensor costs and more capable vehicle electronics, OEMs such as Maruti Suzuki and Tata Motors are now offering 360-degree camera systems in sub ?15-lakh vehicles, including EVs, positioning multi-camera systems as a core element of India’s evolving vehicle safety and user experience.

Restraint: Limited aftermarket and service ecosystem readiness

Automotive camera systems require precise installation, calibration, and software configuration to function reliably, especially for surround-view and ADAS-linked applications. However, a large part of the independent aftermarket in India lacks the specialized tools, trained technicians, and standardized procedures needed to support advanced camera systems. As a result, improper installation or calibration can lead to poor image quality, inaccurate views, or system malfunction, which negatively impacts user experience and trust in camera-based safety features. From an OEM and consumer perspective, this ecosystem gap increases after-sales complexity and ownership costs. Camera replacement or repair often requires access to OEM-specific diagnostic tools and recalibration processes, limiting serviceability outside authorized service networks. This restricts scalability in the used-car and retrofit markets and discourages broader aftermarket adoption. Until technician training, calibration infrastructure, and standardization improve across the service ecosystem, limited aftermarket readiness will continue to constrain the wider deployment and lifecycle support of automotive camera systems in India.

Opportunity: Growth in driver monitoring systems (DMS) and occupant monitoring systems (OMS)

In India, OEMs place greater emphasis on driver behavior, in-cabin safety, and accident prevention. Camera-based DMS solutions that track eye movement, head position, and attention levels are gaining relevance, especially in vehicles equipped with ADAS, where driver engagement is critical. Additionally, OMS adoption is increasing to support occupant detection, seatbelt monitoring, child presence alerts, and adaptive airbag logic, enhancing both safety and user experience. As connected vehicles, premium SUVs, and EV platforms expand in India, the integration of in-cabin cameras becomes more scalable and cost-efficient. Over time, rising safety awareness and regulatory focus are expected to move DMS and OMS from premium features to mainstream safety enablers in the Indian market.

Challenge: Performance variability of camera systems in Indian driving conditions

Vehicles in India are exposed to high dust levels, heavy monsoon rain, glare from strong sunlight, poorly lit rural roads, and wide temperature fluctuations, all of which can degrade image quality and affect the reliability of rear-view, surround-view, and front ADAS cameras. Inconsistent lane markings, mixed traffic with two-wheelers and pedestrians, and unstructured road environments further complicate accurate image interpretation, particularly for forward-facing perception systems. For OEMs and suppliers, this necessitates reinforced camera housings, advanced coatings, and India-specific image-processing algorithms, increasing development effort, validation time, and system cost while affecting long-term durability and customer satisfaction.

AUTOMOTIVE CAMERA MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

High-resolution front camera used in Honda Amaze, City, and Elevate in India to support lane detection, object recognition, and predictive braking as part of ADAS suite | Enhances forward collision awareness, lane keep assistance, and predictive safety in real traffic conditions |

|

Victoris compact SUV (and e Vitara EV) includes multi-camera surround view and level-2 ADAS features such as adaptive cruise control, lane keeping, and collision alerts, enhancing full-vehicle visibility and automated warning support | Improves low-speed maneuvering in urban traffic, reduces blind spots, and supports active driver assistance for safer highway cruising |

|

Tata Curvv EV equipped with a 360-degree surround camera system, alongside level-2 ADAS features such as adaptive cruise control and lane-keeping assist, complemented by high safety ratings | Provides comprehensive environment visualization and automated assistance on highways and urban streets |

|

Tata Punch and Altroz include rear-view camera systems (Altroz offers 360° camera on select variants) integrated with parking assist and guideline overlay | Improves safety and convenience for parking in tight urban spaces and enhances accessory camera coverage for everyday use |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Indian automotive camera ecosystem is supported by a tightly integrated supply chain spanning sensor and lens suppliers, software providers, Tier-1 integrators, cloud platforms, and vehicle OEMs. Semiconductor players such as STMicroelectronics and optics specialists like Sony enable high-performance imaging hardware, while Tier-1 suppliers, including Bosch and Valeo, integrate cameras into scalable vehicle systems. Software and engineering partners such as Tata Elxsi support perception algorithms and system validation, with OEMs like Tata Motors and Maruti Suzuki driving large-scale deployment across mass-market vehicles. This collaborative ecosystem enables faster localization, cost optimization, and wider adoption of camera-based safety and visibility solutions in India.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Automotive Camera Market, By ICE Application

By ICE application, the parking segment emerges as the largest contributor to the Indian automotive camera market, driven by widespread adoption of rear-view and surround-view camera systems across high-volume passenger cars and SUVs. Dense urban traffic, narrow roads, and limited parking infrastructure in Indian cities make low-speed maneuvering and reverse visibility the most frequent and practical camera use cases for ICE vehicles. OEMs such as Maruti Suzuki, Hyundai, Tata Motors, and Mahindra deploy parking cameras across multiple trims, enabling features like dynamic guidelines, obstacle visualization, and 360-degree bird’s-eye views without requiring complex vehicle control integration. The broad trim-level penetration of parking cameras on ICE platforms, combined with lower system cost and simple ECU interfacing, results in significantly higher unit volumes compared with ADAS-led applications, firmly positioning parking as the dominant ICE camera application in India.

Automotive Camera Market, By View Type

By view type, rear-view cameras dominate the automotive camera market due to their near-universal fitment across ICE and EV vehicles for reverse parking and low-speed maneuvering in congested urban conditions. In contrast, e-mirrors are the fastest-growing segment, driven by adoption in premium passenger and commercial vehicles where wider field-of-view, improved night visibility, and aerodynamic benefits over conventional mirrors are increasingly valued.

Automotive Camera Market, By Level of Autonomy

By level of autonomy, the L0 segment accounts for the largest share of the Indian automotive camera market because camera deployment is primarily driven by visibility and driver-assistance functions rather than automated control. L0 cameras, such as rear-view and surround-view systems, are widely adopted across high-volume hatchbacks, compact SUVs, and entry-level EVs, where they support parking, low-speed maneuvering, and blind-spot awareness without intervening in steering or braking. Their low system complexity, minimal calibration needs, and cost-effective integration allow OEMs to deploy them across multiple trims, resulting in significantly higher unit volumes than L1 or L2 ADAS camera systems.

Automotive Camera Market, By Vehicle Type

By vehicle type, the passenger cars segment accounts for the largest share of the automotive camera market, driven by their overwhelming dominance in overall vehicle production and sales volumes. Camera adoption in India is heavily concentrated in passenger cars due to widespread fitment of rear-view cameras, parking assist systems, 360 degree surround-view, and entry-level ADAS cameras across hatchbacks, sedans, and compact and mid-size SUVs. High-volume OEMs such as Maruti Suzuki, Hyundai, Tata Motors, and Mahindra deploy cameras across multiple trims to address urban driving, parking safety, and consumer demand for convenience features. In contrast, commercial vehicle camera penetration remains selective and application-specific, reinforcing passenger cars as the primary contributor to camera volumes and market share in India.

Automotive Camera Market, By Aftermarket

By aftermarket, rear-view cameras represent the largest segment of the automotive camera market, driven by the country’s large in-service passenger car parc and the growing need for affordable safety upgrades. Rear cameras are widely retrofitted in hatchbacks, sedans, SUVs, and taxis to improve reverse parking visibility, obstacle detection, and low-speed maneuvering, especially in congested urban environments. Their plug-and-play installation, compatibility with existing infotainment displays, and lower price point make rear cameras the most preferred aftermarket camera solution among private vehicle owners and fleet operators.

AUTOMOTIVE CAMERA MARKET: COMPANY EVALUATION MATRIX

The figure illustrates the competitive landscape of the automotive camera market. It positions key players based on their market share and product footprint. Robert Bosch GmbH (Star) leads with a strong market presence, strategic growth, strong business networks, and a broad product portfolio. This reinforces the company's position as a leader and ability to meet evolving market demands for efficient and compact equipment, enhancing its brand recognition and customer trust. ZF Friedrichshafen AG emerges as the emerging leader in the automotive camera market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Robert Bosch GmbH (Germany)

- Magna International Inc. (Canada)

- DENSO Corporation (Japan)

- Aumovio (Germany)

- Valeo (France)

- ZF Friedrichshafen AG (Germany)

- Aptiv (Ireland)

- Forvia (France)

- Motherson (India)

- Uno Minda (India)

- Ficosa Internacional SA (Spain)

- Qubo (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size (Value) in 2024 | USD 55.1 MILLION |

| Market Size Forecast in 2032 | USD 143.9 MILLION |

| Growth Rate | 11.90% |

| Years Considered | 2021–2032 |

| Base Year | 2025 |

| Forecast Period | 2032 |

| Units considered | USD Million and Units |

| Report Coverage | Revenue forecast, competitive landscape, driving factors, trends & disruptions, market size and forecast for automotive camera, industry trends, and others |

| Segments Covered |

|

WHAT IS IN IT FOR YOU: AUTOMOTIVE CAMERA MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global analysis of automotive camera market by application | Delivered a global application-level breakdown covering rear-view/parking, surround-view, front ADAS (ACC, FCW, LKA, TSR), DMS/OMS, and fleet/dashcam use cases | Enables stakeholders to distinguish between volume-driven visibility applications and value-driven ADAS and in-cabin camera growth areas |

| EV camera market analysis by application for North America and Europe | Delivered a region-wise application mapping covering ACC, FCW, TSR, BSD, LKA/LDW, adaptive lighting, parking assist, DMS, and night vision | Helps identify which camera applications drive EV adoption in each mature market |

| Global automotive camera market by view type | Delivered a view-type-based segmentation covering rear-view, front-view (ADAS), side-view, surround-view (360°), in-cabin (DMS/OMS), and camera monitoring systems (e-mirrors) | Enables clear understanding of camera placement-driven demand patterns rather than generic camera counts |

RECENT DEVELOPMENTS

- January 2026 : ZF announced a collaboration with Qualcomm Technologies to deliver a scalable advanced driver assistance system (ADAS) compute platform that combines ZF’s ProAI automotive supercomputer with Qualcomm’s Snapdragon Ride compute and perception stack enabling robust ADAS functions across camera-based perception, sensor fusion, and support for automated driving up to Level 3.

- January 2026 : Aptiv PLC announced its first ADAS partnership with a leading Indian commercial vehicle OEM, supplying its Gen 6 Advanced Driver Assistance System which integrates radar and smart camera vision technology tailored to Indian road conditions for future trucks and buses ahead of upcoming 2027 safety regulations.

- January 2026 : Hyundai Mobis and Qualcomm Technologies signed a comprehensive MoU at CES 2026 to jointly develop next-generation Software-Defined Vehicle (SDV) and Advanced Driver Assistance System (ADAS) solutions, with a strong emphasis on emerging markets such as India.

- November 2025 : Valeo announced multi-million-dollar investments in India to localize and expand offerings in ADAS and high-performance computing (HPC) solutions for software-defined vehicles, reflecting growing regional demand for advanced camera-based safety and computing systems.

- July 2025 : Robert Bosch GmbH announced the launch of a cost-optimized Advanced Driver Assistance System (ADAS) tailored for Indian road conditions and pricing expectations. The solution features a single-camera architecture designed to deliver essential driver-assist functions, such as lane departure warning, emergency braking, and adaptive cruise control.

Table of Contents

Methodology

The research study involved various secondary sources, such as company annual reports/presentations, industry association publications, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, which were used to identify and collect information for an extensive study of the India automotive camera market. Primary sources experts from related industries, OEMs, and suppliers were interviewed to obtain and verify critical information and assess prospects and market estimations.

Secondary Research

Secondary sources included the automotive camera industry association, internal databases, corporate filings (such as annual reports, investor presentations, and financial statements), and data from trade and business. Secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

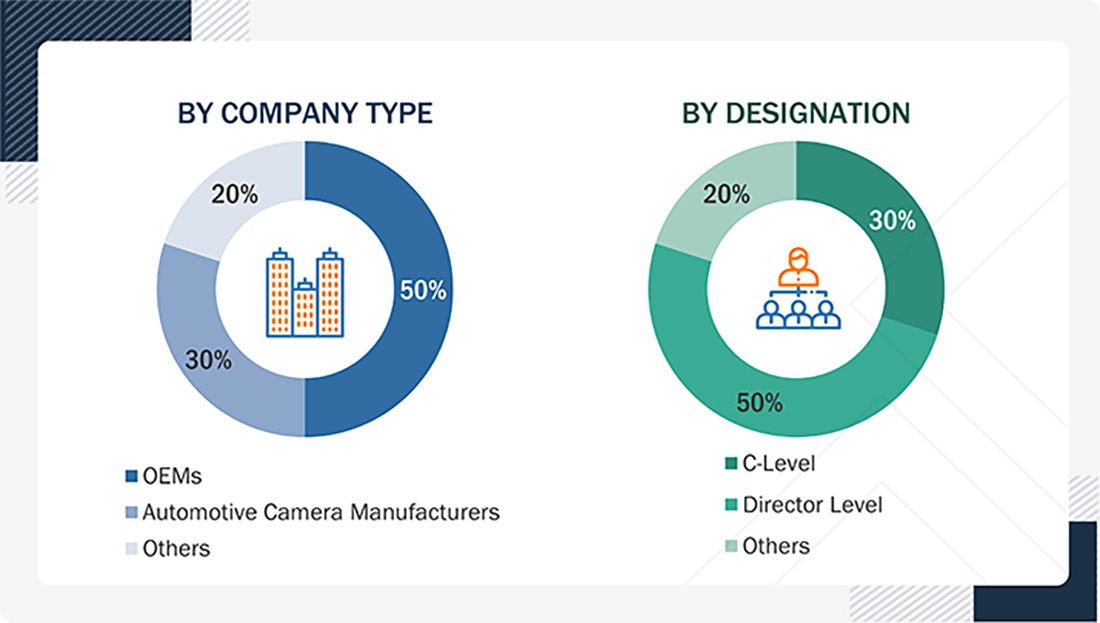

Extensive primary research was conducted after understanding the India automotive camera market scenario through secondary research. Several primary interviews were conducted with market experts from the demand (OEMs) and supply (Manufacturers and distributors) sides across India. 50% of primary interviews were conducted with Indian OEMs, and 30% of the primary interviews were conducted with automotive camera manufacturers from India.

Primary data was collected through questionnaires, e-mails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to validate the findings from the primaries. This and insights by in-house subject-matter experts led to the conclusions described in the remainder of this report.

Note: Others include Sales, Marketing, and Product Managers.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

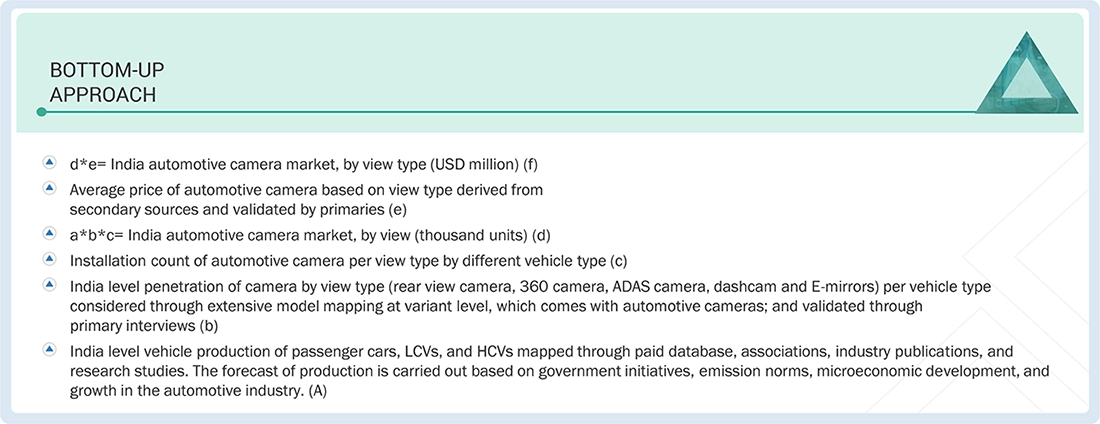

- The bottom-up approach derived the market size based on volume and value. This was followed by primary interviews and feature mapping for Indian vehicle models from the MarketsandMarkets repository.

- The market size was validated through in-depth interviews with industry experts. The report-writing phase begins after arriving at the final numbers for the market size.

BOTTOM-UP APPROACH:

The bottom-up approach used to estimate the Indian automotive camera market by view type is based on camera demand at the vehicle, trim, and installation level. The detailed mapping of camera penetration by view type includes rear-view, 360 surround-view, ADAS cameras, dashcams, and e-mirrors across passenger cars, LCVs, and HCVs. This mapping is carried out at the variant level, identifying which trims are equipped with specific camera systems, and is validated through primary interviews with OEMs, Tier-1 suppliers, and system integrators.

For each view type, the installation count per vehicle is determined by analyzing how many cameras are used in each application. These installation counts are then multiplied by India-level vehicle production volumes by vehicle type, which are compiled from industry databases, OEM disclosures, and automotive associations. Production forecasts are developed using India-specific factors such as emission regulations, electrification trends, infrastructure development, and macroeconomic conditions.

The resulting camera unit volumes (in thousand units) are then multiplied by average selling prices for each camera view type, giving the market for India automotive camera in value (USD million). Pricing benchmarks are derived from secondary technical sources and cross-validated through primary discussions with suppliers and OEM purchasing teams.

Data Triangulation

After arriving at the overall size of the India automotive camera market through the methodology mentioned above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact data of the market by volume and value for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from the supply and demand sides.

Market Definition

A camera is a device that records visual images in the form of photographs, film, or video signals. In the automotive sector, the camera is used as an advanced safety device for enhancing the visibility of the surrounding environment of a driver to improve vehicle safety. An automotive camera records images through lenses and converts them into electrical signals. The growing demand for advanced driver assist systems (ADAS) in developed and emerging economies is attributed to the use of cameras in various applications such as parking assist, cross-traffic alert, and pedestrian detection systems.

Stakeholders

- Automotive Camera Manufacturers and Component Suppliers in India

- Software and Platform Providers for automotive cameras

- Autonomous Driving Platform Providers

- Government and Research Organizations

- ICE and Electric Vehicle manufacturers

- Raw Material Suppliers for Automotive Cameras

Report Objectives

- To define, describe, and forecast the India automotive camera market, in terms of value and volume, based on the categories given below:

- By ICE application (parking; parking + bird eye view; parking + security; ACC; ACC + BSD; ACC + FCW +LKA +LDW +BSD + AHW and ACC + FCW +LKA +LDW +BSD + AHW + TSR)

- By view type (rear view, surround view, sensing/ADAS camera, dashcam, and e-Mirrors)

- By level of autonomy (L0, L1, and L2/2.5)

- By vehicle type (Passenger cars, Light commercial vehicles, and heavy trucks)

- By EV application (parking; parking + bird eye view; ACC + FCW +LKA +LDW +BSD + AHW and ACC + FCW +LKA +LDW +BSD + AHW + TSR)

- By aftermarket application (reverse park assist, dashcam, and 360 degree/surround view camera).

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To understand India automotive camera market size, forecast, and trends

- To strategically analyze trade analysis, pricing analysis, case study analysis, patent analysis, technology analysis, regulatory analysis, key conferences and events, trends/disruptions impacting buyers, and the investment and funding case scenario.

- To analyze the competitive landscape of the Indian players in the market, along with their market share/ranking.

- To analyze the strategic partnership & OEMs’ tie-ups

- To understand the dynamics of competitors and distinguish them into stars, emerging leaders, pervasive players, and participants according to the strength of their product portfolio and business strategies

- To analyze a detailed listing of OEMs and their brands, OEM-wise technical specifications, mergers & acquisitions, partnerships, collaborations, expansions, and product launches/developments; company evaluation matrix, competitive scenario, company valuation and financial metrics, and brand and product comparison undertaken by key participants in the market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the India Automotive Camera Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in India Automotive Camera Market