Industrial Control System (ICS) Security Market

Industrial Control System (ICS) Security Market by Solution (Encryption, Security Information and Event Management (SIEM), Firewall, Identity & Access Management (IAM), DDoS Mitigation, Antivirus), by Security Type (Network, Endpoint, Database) - Global Forecast to 2030

OVERVIEW

-security-market-img-overview.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The ICS Security market is projected to reach USD 32.89 billion by 2030 from USD 13.27 billion in 2025, at a CAGR of 16.5% from 2025 to 2030. The market growth is driven by a rapid upward trajectory due to the high rate of integration between IT and operational technology (OT), growing cyberattacks on critical infrastructure, and growing regulatory pressures against the need to protect industrial environments. Industrial operators are implementing the ICS security to provide real-time visibility over the OT networks and to identify threats and defend the mission-critical systems against ransomware, malware, and unauthorized access. Connected infrastructure of energy and utilities, proliferation of smart factories, and industrial IoT are further expanding the attack surface. Also, the increasing use of modern technologies including AI-based threat detection, real-time monitoring, zero-trust models, and combined IT-OT security systems are adding pressure to the demand of ICS security systems and services.

KEY TAKEAWAYS

-

BY REGIONThe North America ICS Security market accounted for a 28.28% revenue share in 2025.

-

BY REGIONUS Industrial control systems (ICS) security market is projected to reach USD 6.25 billion by 2030.

-

BY REGIONAsia Pacific Industrial control systems (ICS) security market is projected to reach USD 7.26 billion by 2030

-

BY REGIONEurope Industrial control systems (ICS) security market size is projected to reach USD 6.40 billion by 2030

-

BY REGIONMiddle East & Africa Industrial control systems (ICS) security market is projected to reach USD 7.67 billion by 2030

-

BY OFFERINGBy offering, the services segment is expected to register the highest CAGR of 19.2%.

-

BY SOLUTIONBy solution, the IAM segment is projected to grow at the fastest rate from 2025 to 2030.

-

BY SERVICEBy service, the managed segment is projected to grow at the fastest rate from 2025 to 2030.

-

BY SECURITY TYPEBy security type, the network security segment is expected to dominate the market.

-

BY VERTICALBy vertical, the power segment will grow the fastest during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSLeading ICS security vendors, such as ABB, Honeywell, Palo Alto Networks, Fortinet, and Cisco, are recognized as dominant players due to their extensive OT/IT security expertise, broad industrial coverage, and integrated cyber-physical security solutions.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSEmerging players, including Nozomi Networks, Dragos, Darktrace, and Xage Security, are gaining traction by offering specialized ICS monitoring, AI-driven anomaly detection, and industrial threat intelligence solutions.US Industrial control systems (ICS) security market is projected to reach USD 6.25 billion by 2030.

-

Asia Pacific Industrial control systems (ICS) security market is projected to reach USD 7.26 billion by 2030

-

Europe Industrial control systems (ICS) security market size is projected to reach USD 6.40 billion by 2030

-

Middle East & Africa Industrial control systems (ICS) security market is projected to reach USD 7.67 billion by 2030

The convergence of ICS security solutions with cloud, edge, and enterprise IT environments is enhancing scalability, centralized visibility, and real-time threat detection in industrial settings. Organizations are prioritizing single ICS security architectures to enable digital transformation programs like Industry 4.0, IIoT and remote operations as well as to support multifaceted security needs across OT platforms, critical infrastructure, and supply chains. The development of AI, automation, and behavioral analytics is facilitating a process of constant asset discovery, anomaly detection, automated incident response and predictive risk evaluation that enhances the resilience of operations, safety and OT governance across the enterprise.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The ICS industries are transitioning from old, reactive defenses to smart, cloud-based platforms. Whereas the existing revenues depend on simple firewall and signature-based monitoring, the future growth is driven by extensive asset understanding, industrial protocol analytics, zero-trust infrastructures, AI anomaly recognition, and cloud OT tracking. Adoption is increasing in power, utilities, manufacturing, transportation, and oil and gas to not only detect threats in real-time, but also provide operational resilience and secure distributed operations.

-security-market-img-disruption.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Government initiatives and regulations in critical infrastructure protection

-

Confluence of digital technologies and industrial system integration

Level

-

Legacy system vulnerabilities

-

Elevated acquisition expenses for ICS security solutions

Level

-

Rising government R&D investments driving advancements in ICS security solutions

-

Escalating demand for professional and managed security services in small and medium-sized enterprises

Level

-

Limited awareness about ICS security techniques

-

Shortage of skilled ICS cybersecurity analysts with expertise in OT environments and industrial protocols

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Government initiatives and regulations in critical infrastructure protection

Government policies are enhancing cybersecurity in critical infrastructure industries like energy, transportation, IT, and manufacturing. In the US, Canada, Australia and European Union, there are policies that dictate standardized ICS security practices, workforce training and compliance. The systems of international cooperation also enhance resilience in interdependent infrastructure. These programs are hastening the uptake of the high-level ICS security mechanisms.

Restraint: Legacy system vulnerabilities

A large number of ICS environments are based on legacy systems, which do not have inbuilt cybersecurity. More connectivity to the IT networks to these systems opens them to ransomware, malware, and unauthorized access. The limits to modernization are the great cost of upgrades, the dangers of operational downtime, and even compatibility issues. Consequently, vulnerabilities in security still exist in major industrial processes.

Opportunity: Rising government R&D investments driving advancements in ICS security solutions

Governments and private organizations are increasing investments in R&D to strengthen ICS security. Programs such as CISR and ENCRPC support the development of advanced threat mitigation tools, security frameworks, and information-sharing platforms. These initiatives help convert real-world threat intelligence into practical defense solutions, creating strong growth opportunities for vendors aligned with such programs.

Challenge: Limited awareness about ICS security techniques

Most organizations do not have adequate knowledge of cyber threats related to ICS as well as mitigation strategies. IT-OT convergence has increased attack surfaces, and skills and training gaps exist. This will lead to ineffective security measures and old security measures. The essential factor to enhance ICS resilience is the creation of workforce awareness and cybersecurity culture.

INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

An industrial enterprise deployed Cisco’s ICS and OT security solutions to secure converged IT-OT networks, enable deep packet inspection of industrial protocols, and monitor remote access to PLCs and SCADA systems across multiple plants. | Improved OT network visibility, reduced cyber risk from lateral movement, secure remote operations, and stronger segmentation between IT and OT environments. |

|

A utilities provider implemented ABB’s industrial cybersecurity solutions to protect control systems, monitor asset behavior, and manage vulnerabilities across power generation and distribution facilities. | Enhanced operational resilience, early threat detection, reduced downtime risks, and improved compliance with critical infrastructure security standards. |

|

A manufacturing organization adopted Fortinet’s OT security platform to segment industrial networks, secure IIoT devices, and detect anomalies in real time across production lines and remote facilities. | Real-time threat detection, secure industrial communications, reduced attack surface, and centralized management of IT and OT security policies. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ICS security market ecosystem is a varied combination of IT and OT-sensitive specialists and layered industrial threat vectors. Cisco, Fortinet, and Palo Alto Networks are the vendors that provide DDoS protection against availability-oriented attacks to protect industrial networks. Players such as Trellix, Fortinet, and Palo Alto Networks provide antivirus and antimalware services to offer both endpoint-level and system-level security to OT environments. Vendors like CyberArk, Honeywell, Cisco, Claroty, and Nozomi Networks have identity and access control solutions that can be used to protect privileged access and industrial resources. Fortinet, Palo Alto Networks, Dragos, Belden and Trellix have firewall solutions that offer network segregation and extensive scrutiny of industrial protocols to augment OT perimeter security.

-security-market-img-ecosystem.webp)

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

-security-market-img-segment.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

ICS Security Market, By Offering

The solutions segment is the most dominant sector in the market as a result of increased demand of integrated security framework, real time monitoring, and advanced threat detection within an industrial setting. Solutions give centralized access to OT and IT systems, allowing proactive threat mitigation. They also assist in adherence to industrial guidelines, as well as, augment continuity of operation.

ICS Security, by Solution

The firewall segment is the most dominating in the market, as it is absolutely vital in defending the industrial control networks, implementation of access policies, and avoiding unauthorized intrusion. Intrusion detection systems are being supplemented by firewalls with advanced threat intelligence. They are also assisted in the segmentation of networks to minimize the effect of any possible cyber-attack.

ICS Security, by Service

Managed services segment holds the largest market share because industrial networks are highly complex, there is a limited availability of skilled ICS cybersecurity professionals, and continuous monitoring with rapid incident response is essential. Managed services provide professional management, round the clock threat monitoring and quicker incident response. They also enable organizations to expand security operations without substantial internal investments

ICS Security, by Security Type

The network security segment is the most dominant segment, as threats of cyber-physical attacks, the implementation of connected industrial equipment and the need to secure the perimeter and internal network are increasing. Network security solutions are based on early warning on anomaly monitoring and the use of AI-based threat detection. They also facilitate safe distance access to industrial processes.

ICS Security, by Vertical

The energy and utilities vertical accounts for the largest share of the market due to the high complexity of its infrastructure, stringent regulatory compliance requirements, and strong adoption of advanced industrial cybersecurity solutions. This sector is increasingly targeted by ransomware and state-sponsored attacks, driving sustained investments in robust ICS security to ensure operational resilience and service continuity.

REGION

Asia Pacific to be fastest-growing region in global ICS Security market during forecast period

Rapid industrialization and large-scale digital transformation across manufacturing, energy & utilities, transportation, and smart infrastructure in countries such as China, Japan, and India are driving strong demand for ICS security solutions. Growing number of cyberattacks on critical infrastructure, combined with more stringent government controls and national cyber resilience programs are forcing companies to protect OT and ICS environments. Accelerated IT-OT convergence, smart factory and smart grid expansion, and rise in usage of industrial IoT augment the attack surface even more. Moreover, the government spending on the protection of critical infrastructure and personnel training is also increasing the use of advanced ICS security platforms in the Asia Pacific region.

-security-market-img-region.webp)

INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET: COMPANY EVALUATION MATRIX

In the ICS security market, Cisco stands out as a Star, offering a comprehensive and scalable ICS security portfolio with strong network segmentation, threat detection, and IT–OT integration, making it a preferred choice for large critical infrastructure operators. ABB, positioned as an Emerging Leader, is gaining momentum through its deep industrial automation expertise and integrated OT security capabilities embedded within control systems, enabling secure, resilient, and reliable operations across mission-critical industrial environments.

-security-market-img-evaluation.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Cisco (US)

- ABB (Switzerland)

- Lockheed Martin (US)

- Fortinet (US)

- Honeywell (US)

- Palo Alto Networks (Canada)

- BAE Systems (US)

- RTX (Netherlands)

- Trellix (US)

- Check Point (Israel)

- Darktrace (UK)

- Kaspersky Lab (Russia)

- Tenable (US)

- Belden(US)

- Sophos (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 13.27 Billion |

| Market Forecast in 2030 (Value) | USD 32.89 Billion |

| Growth Rate | CAGR of 16.5% from 2025-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: INDUSTRIAL CONTROL SYSTEM (ICS) SECURITY MARKET REPORT CONTENT GUIDE

-security-market-img-content.webp)

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | Product Analysis: Product Matrix, which gives a detailed comparison of the product portfolio of each company | Improved clarity on competitive positioning and product strengths to drive informed decision-making. |

| Leading Service Provider (EU) | Company Information: Detailed analysis and profiling of additional market players (up to 5) | Comprehensive insights into market landscape and opportunities for strategic collaborations. |

RECENT DEVELOPMENTS

- May 2025 : Honeywell partnered with Nutanix, a leading provider of hybrid multi-cloud computing, to deliver modernized, secure, and scalable infrastructure for Honeywell’s Integrated Control and Safety System (ICSS). This collaboration will enable enterprises across critical sectors to accelerate digital transformation while enhancing operational efficiency, cybersecurity, and resilience.

- February 2024 : Cisco and Rockwell Automation partnered to accelerate digitalization, automation, cybersecurity and workforce upskilling in the industrial sector.

- October 2023 : Cloud Range and Fortinet collaborated within the Fortinet Fabric-Ready Technology Alliance Partner Program to offer live-fire simulation exercises tailored for OT, IT, IoT, and converged environments. This collaboration empowers cybersecurity teams with the capabilities to safeguard critical infrastructure and ICS against cyber threats while ensuring uptime and safety.

- May 2023 : Wipro and Palo Alto Networks extended their partnership to offer a robust Zero Trust OT Security Solution for manufacturing, electric utilities, and transportation industries. This strategic partnership enhances cybersecurity by integrating AI and ML-powered tools for granular visibility and control over OT assets, mitigating security risks in interconnected environments.

Table of Contents

Methodology

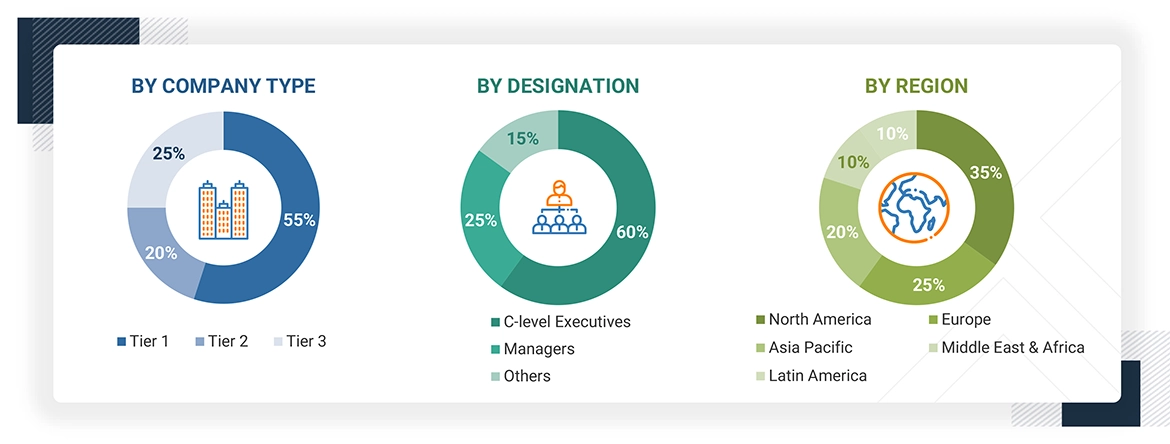

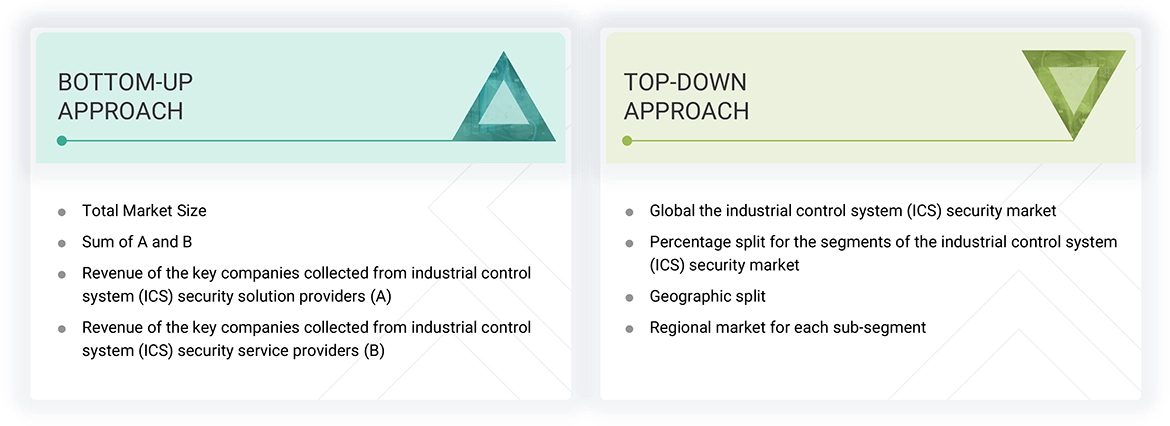

This study significantly estimated the current industrial control system (ICS) security market size. Exhaustive secondary research was done to collect information on the Industrial Control System (ICS) Security industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the industrial control system (ICS) security market.

Secondary Research

The market for the companies offering industrial control system (ICS) security solutions and services was arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of industrial control system (ICS) security vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain essential information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the industrial control system (ICS) security market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types, industry trends, competitive landscape of industrial control system (ICS) security solutions offered by various market players, and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Note: The companies have been categorized based on their total annual revenue; tier 1

companies = revenue greater than USD 10 billion; tier 2 companies = revenue between USD 1 billion and USD 10 billion;

tier 3 companies = revenue between USD 500 million and USD 1 billion. Other designations include sales managers, marketing managers, and product managers.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global industrial control system (ICS) security market and the size of various other dependent sub-segments. The research methodology used to estimate the market size included the following details: key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added to detailed input and analysis from MarketsandMarkets.

Industrial Control System (ICS) Security Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to Forcepoint, industrial control systems can consist of a complex network of interactive control systems or a small number of controllers. These systems receive information from remote sensors that measure and monitor process variables. From control valves to pressure gauges, an ICS sends commands and receives alerts from many different components. ICS security is a security framework that protects these systems against accidental or intentional breaches and risks.

ICS security solutions consist of a comprehensive array of technologies such as Distributed Denial of Service (DDoS), Intrusion Detection and Prevention System (IDPS), anti-malware/antivirus, firewall, virtualization security, Security Information and Event Management (SIEM), SCADA encryption, Unified Threat Management (UTM), Data Loss Prevention (DLP), and Identity and Access Management (IAM).

Stakeholders

- Anticorruption and antibribery heads

- Auditors

- Business resilience specialists

- Chief compliance officers

- Consulting firms

- Cybersecurity vendors

- Due diligence heads

- Ethics directors

- Government agencies

- ICS security solution vendors

- IT security agencies

- Investors and venture capitalists

- Operations officers

- Oversight officers

- Privacy specialists

- Research organizations

- Risk officers

- Software vendors

- Suppliers, distributors, and contractors

- System integrators

- Third-party providers

- Value-Added Resellers (VARs)

Report Objectives

- To define, describe, and forecast the industrial control system (ICS) security market based on offering, solution, service, security type, vertical, and region

- To forecast the market size of the five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the primary factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market size and core competencies

- To track and analyze competitive developments, such as new product launches, mergers and acquisitions, partnerships, agreements, and collaborations in the industrial control system (ICS) security market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Control System (ICS) Security Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Industrial Control System (ICS) Security Market