Latin America Ostomy Dressings Market Size, Growth, Share & Trends Analysis

Latin America Ostomy Dressings Market by Product [Pouches (Colostomy, Ileostomy), Skin Barrier Sheets, Skin Barrier Rings, Film Dressings], Application (Cancer, Crohn's Disease), End User (Hospitals, Home Care, ASCs), & Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

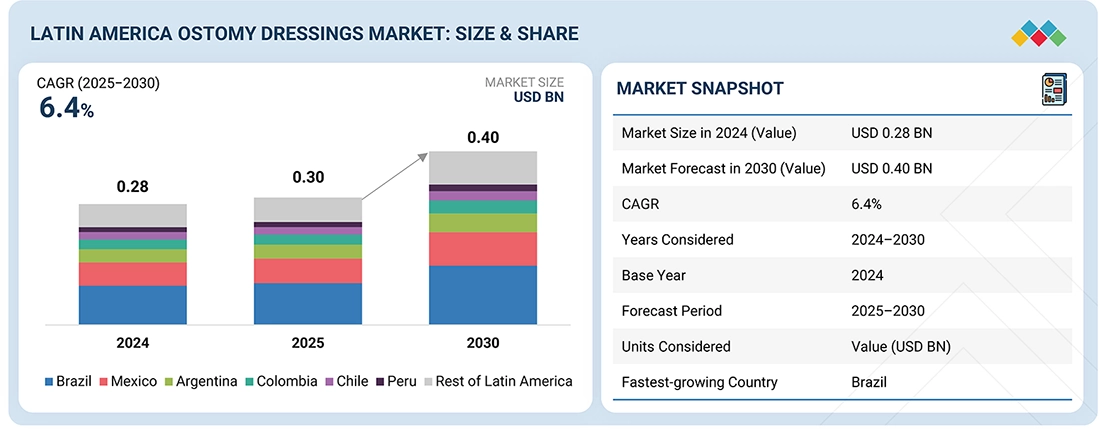

The Latin America Ostomy Dressings market, valued at US$0.28 billion in 2024, stood at US$0.30 billion in 2025 and is projected to advance at a resilient CAGR of 6.4% from 2025 to 2030, culminating in a forecasted valuation of US$0.40 billion by the end of the period. Market growth is driven by several key factors, including the rising incidence of colorectal and bladder cancers, the increasing prevalence of inflammatory bowel diseases, and a rapidly aging population that requires long-term ostomy care. Additionally, improvements in public healthcare coverage and greater accessibility to surgical procedures have led to an increase in the number of ostomies performed across various regions. Furthermore, there is a growing trend toward home care and patient education, along with enhanced availability of new skin barrier and pouching systems, all of which contribute to the increased use of these products.

KEY TAKEAWAYS

-

By CountryBased on country, Brazil accounted for the largest share of 32.5% of the Latin America ostomy dressings market in 2024.

-

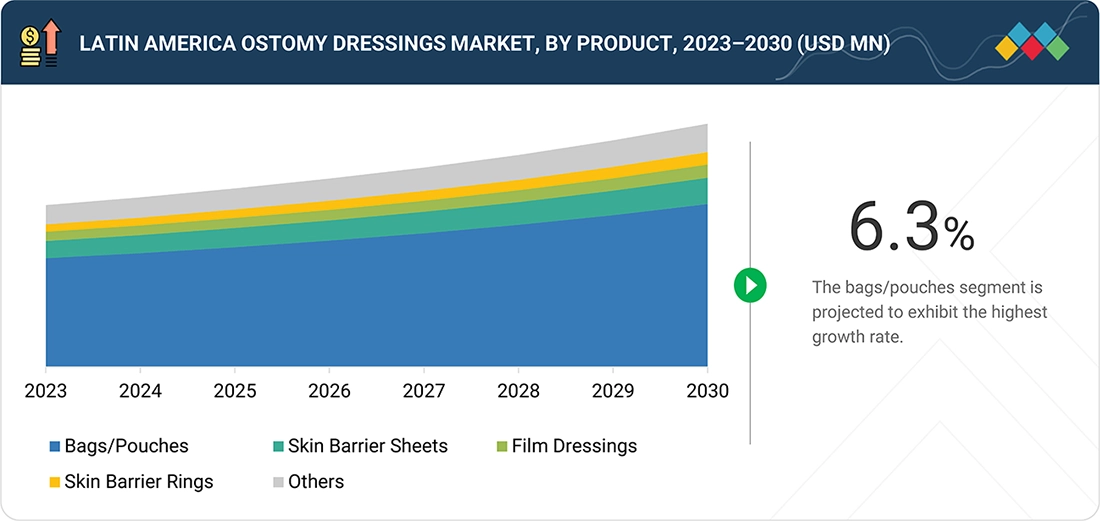

By ProductBased on product, the bags/pouches segment accounted for the largest share, 67.1%, of the Latin America ostomy dressings market in 2024.

-

By ApplicationBased on application, the cancer (colon & bladder) segment accounted for the largest share of 42.8% of the Latin America ostomy dressings market in 2024.

-

By End UserBased on end user, the hospitals & specialty clinics segment held the largest share of 45.0% of the Latin America ostomy dressings market during the forecast period.

-

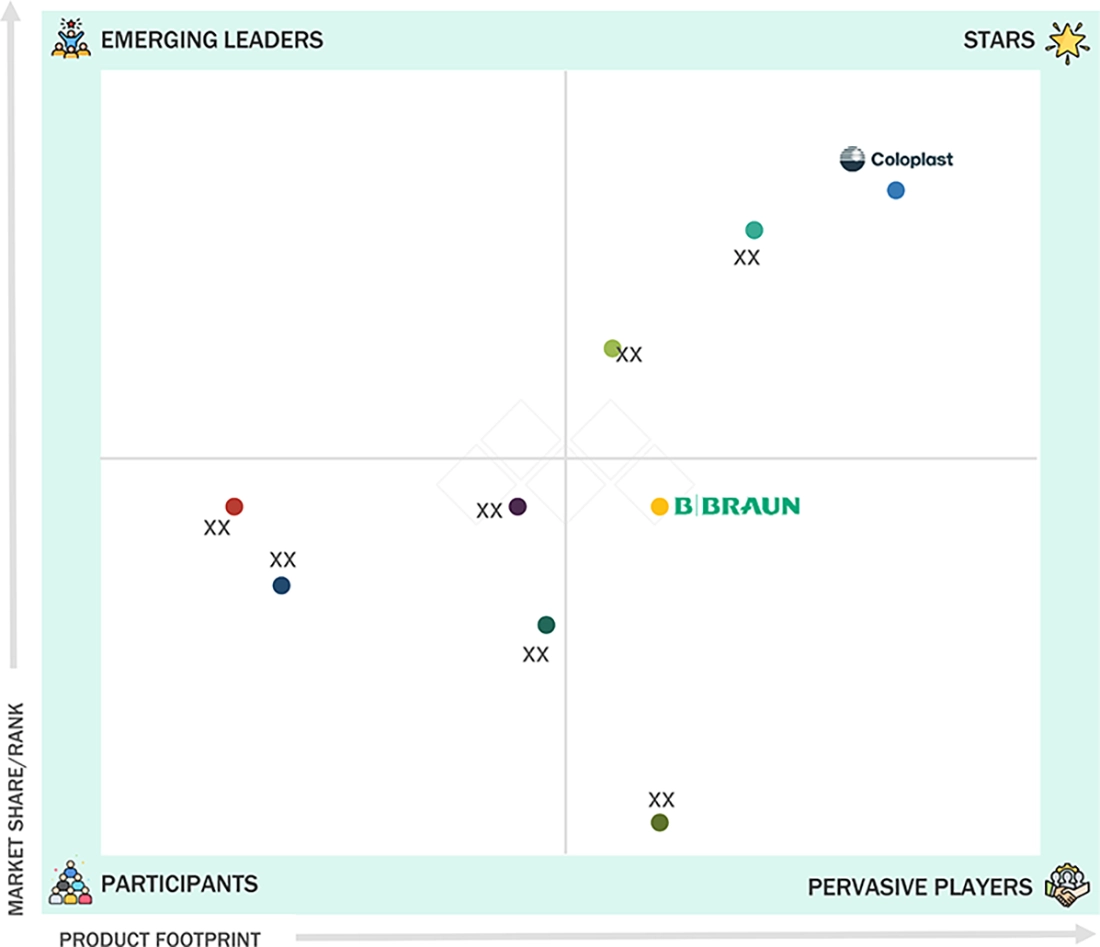

COMPETITIVE LANDSCAPEColoplast A/S (Denmark), Convatec Group Plc (UK), and Hollister Incorporated (US) were recognized as star players due to their established strong product portfolios & geographic presence across Latin America.

The increasing incidence of colorectal and bladder cancers, along with the rise in inflammatory bowel diseases and an aging population, is driving the growth of the ostomy dressings market Latin America. Additionally, improved coverage and access to public healthcare and surgeries are contributing to this market expansion. However, several factors hinder market growth, including limited patient awareness, social stigma, and cost sensitivity within public healthcare systems. There are also significant opportunities for growth in home care settings, as well as the use of ostomy dressing products for skin protection and leakage resistance. Furthermore, there is a greater chance of securing public tenders, and local manufacturing can enhance affordability and market availability.

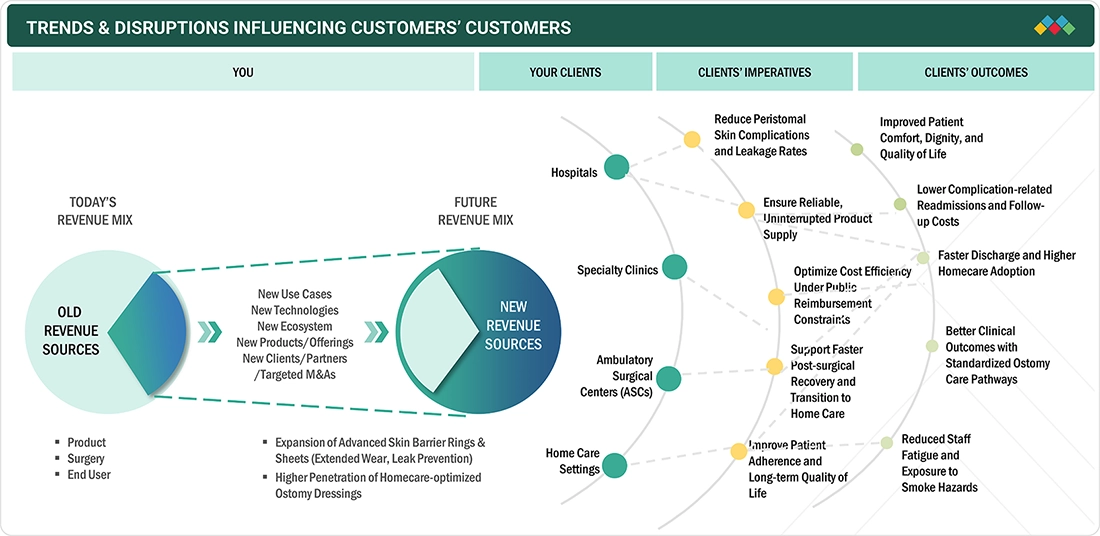

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The trends and disruptions that influence the customers' customers in the Latin America ostomy dressings market are centered on patient outcome improvement, care efficiency, and long-term disease management. Advanced pouching systems and skin barrier technologies that improve wear time, reduce leakage, and lessen peristomal skin complications are being made available in hospitals, specialty clinics, and home care providers. The shift toward earlier discharge and home care is driving demand for ostomy dressings that are easy to use and require minimal maintenance, supported by well-organized patient education. The rise in cancer and inflammatory bowel disease cases is leading to more procedures and longer product usage, thus, more focus is being put on products that are both durable and skin protective. An aging population is contributing to the chronic ostomy patient base. Besides, regional regulatory clarity and improvements in product standardization are enabling innovative ostomy dressings to be adopted more quickly, thereby reshaping purchasing behavior and raising expectations for quality, reliability, and continuity of care across Latin America.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising prevalence of cancer and inflammatory bowel disease

Level

-

Post-surgical complications and quality-of-life concerns

Level

-

Expansion of public healthcare and supportive trade policies

Level

-

Limited awareness and education among patients and caregivers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising prevalence of cancer and inflammatory bowel disease

The increasing prevalence of cancer and IBD is a significant driver of growth in the Latin America ostomy dressings market. Surgical interventions are often necessary for patients with these conditions, which frequently require ostomy procedures. According to GLOBOCAN statistics from 2022, Latin America and the Caribbean reported a total of 1,551,060 new cancer cases, with colorectal cancer being the third most common, accounting for 145,120 new cases. Both colorectal and bladder cancers often necessitate bowel resection or urinary diversion, leading to a heightened demand for ostomy bags, skin barrier rings, sheets, and related accessories. Additionally, IBD, which includes conditions such as Crohn's disease and ulcerative colitis, is becoming more prevalent in Latin America due to lifestyle changes, urbanization, and improved diagnostic rates. Urban areas in countries like Colombia and Mexico are witnessing an increasing number of IBD cases, further propelling growth in the ostomy dressings market across the region.

Restraint: Post-surgical complications and quality-of-life concerns

Post-operative complications and concerns about quality of life have become significant barriers to the adoption of ostomy dressing products in Latin America. Many patients who undergo ostomy procedures experience peristomal skin irritation, leakage, infections, and discomfort, hindering their ability to use the recommended products effectively. Additionally, limited access to stoma care nurses and follow-up services further complicates patients' lives and impacts their quality of life, creating a dependency on ostomy products. Moreover, psychological distress, social stigma, and reduced mobility associated with ostomy use often discourage patients from adopting products in a timely manner or from replacing them regularly. These challenges not only affect individual patients but also serve as substantial obstacles to the broader acceptance of ostomy dressing products in the Latin American market.

Opportunity: Expansion of public healthcare and supportive trade policies

The growth of public healthcare systems, along with supportive trade policies, is expected to significantly drive the expansion of the Latin America ostomy dressings market during the forecast period. Increased government investment in healthcare infrastructure and facilities is improving access to surgical interventions, postoperative care, and long-term illness management. This has led to a rise in the number of patients who require ostomy care products. Public reimbursement coverage also lowers financial barriers, allowing patients to more easily adopt ostomy bags, skin barriers, and related items by reducing out-of-pocket expenses. Additionally, favorable trade policies, simplified import regulations, and incentives for regional manufacturing are enhancing product availability and supply chain efficiency. These developments enable advanced ostomy dressing products to enter the market at competitive price points. As healthcare systems place greater emphasis on chronic disease management and home care, the demand for reliable ostomy products is set to increase. In summary, the expansion of public healthcare, combined with supportive policies, is creating a more favorable environment for continued market development in the Latin America region.

Challenge: Limited awareness and education among patients and caregivers

Limited awareness and insufficient education among patients and healthcare professionals, including caregivers and nurses, present significant challenges for the ostomy dressing market in Latin America. Many patients lack a proper understanding of ostomy care practices, including product selection, replacement frequency, and skin management. This often leads to misuse of products and increased complications. Caregivers, particularly those providing home care, frequently receive minimal training and therefore rely on basic products, lacking confidence in more advanced options. The uneven availability of trained stoma care specialists and structured education programs across the region exacerbates the situation. This not only hinders the adoption of higher-value ostomy dressings but also slows overall market growth. Addressing these gaps in education and awareness is essential for improving patient outcomes and fostering sustained growth in Latin America.

LATIN AMERICA OSTOMY DRESSINGS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides SenSura and Alterna ostomy bags/pouches, supported by Brava skin barrier rings, protective plates, barrier cream, powder, and sprays. These products are widely used in hospitals, specialty clinics, and homecare settings for colostomy, ileostomy, and urostomy patients, with designs focused on secure fit, flexibility, and skin protection across varying stoma profiles | Improves patient comfort and quality of life, reduces leakage and peristomal skin complications, supports faster transition to home care, and enables standardized product adoption under public and private healthcare protocols |

|

Offers ActiveLife, Esteem, and Sur-Fit pouching systems, complemented by Esenta protective barrier products. These products are used across acute care and long-term homecare to support postoperative recovery, chronic ostomy management, and prevention of skin irritation in high-volume patient populations | Enhances skin integrity and wear time, reduces complication-related readmissions, supports clinician-led product standardization, and improves adherence through reliable, easy-to-use ostomy care solutions |

|

Supplies Premier and Suavita pouching systems, CeraPlus skin barriers, barrier rings, and sheets designed for extended wear and ceramide-based skin protection. These products are commonly adopted in hospitals and specialty clinics during initial appliance selection and long-term care planning | Lowers peristomal skin breakdown, improves long-term wear performance, supports protocol-driven care, and strengthens patient confidence and satisfaction through consistent product performance |

|

Provides Flexima and Proxima ostomy bags/pouches, along with Ally accessories, including powder, adhesive remover, and wafer extenders. These products are positioned for routine ostomy care in public hospitals and cost-sensitive healthcare systems across Latin America | Enables cost-efficient ostomy management, supports reliable skin protection, improves appliance adhesion, and aligns well with public procurement and tender-based purchasing models |

|

Offers Confidence and Harmony ostomy bags, Salts Aloe skin barrier rings, stoma paste, remover sprays, and related accessories. These products are widely used in homecare and community care settings, particularly for patients with sensitive skin or complex stomas | Improves skin comfort and leak control, supports patient independence in homecare, enhances adherence through gentle formulations, and expands access to differentiated ostomy care solutions in emerging Latin America markets |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Latin America ostomy dressings market ecosystem consists of several stakeholders that are closely linked and whose actions collectively determine the adoption of a product, its use, and the continuation of demand. Manufacturers create, design, and provide products such as ostomy bags, skin barrier rings, sheets, and accessories suitable for clinical and home care needs. Distributors and logistics partners play a crucial role in ensuring that hospitals, specialty clinics, and home care providers receive products from various regions. Healthcare providers, including surgeons, stoma care nurses, and specialty clinicians, prescribe the choice of products used during surgeries and for patient recovery. Both the public healthcare system and private payers are involved in determining how individuals can access these products through reimbursement and procurement processes. Patients and caregivers are the end users, and their adherence to product usage and replacement cycles directly impacts ongoing demand. Regulatory authorities oversee product approval and enforce quality standards, while education and training providers ensure proper use of these products. Together, all these stakeholders influence market dynamics, competitive positioning, and continuous growth throughout Latin America.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Latin America Ostomy Dressings Market, by Product

The bags and pouches segment held the largest share of the Latin America ostomy dressings market, as it is a core and essential component of ostomy care. These bags and pouches are vital consumables that colostomy, ileostomy, and urostomy patients use daily, resulting in high, ongoing demand. The need for frequent replacements—driven by hygiene requirements, limited wear time, and the prevention of leakage—further increases consumption volumes. The rising number of ostomy surgeries due to colorectal cancer, inflammatory bowel diseases, and traumatic injuries is the main factor contributing to demand growth. Additionally, the increasing adoption of home care and the availability of leak-resistant, skin-friendly pouching systems enhance patient comfort and adherence, thereby reinforcing the segment's dominant position in the market.

Latin America Ostomy Dressings Market, by Surgery

The cancer (colon and bladder) segment held the largest share of the Latin America ostomy dressings market. This is largely due to the high prevalence of these diseases and their strong association with surgical interventions that necessitate ostomies. According to GLOBOCAN 2022, Latin America and the Caribbean reported 1,551,060 new cancer cases, with colorectal cancer being the third-most common, accounting for 145,120 new cases. As a result, the number of patients requiring colostomy procedures is significant. Surgical operations for colon and bladder cancers often result in bowel resections or urinary diversions, leading to temporary or permanent ostomies. These surgeries require the use of ostomy bags, skin barriers, and related accessories for extended periods. This combination of high surgery rates and prolonged use of ostomy products makes cancer the primary application segment in the Latin America ostomy dressings market.

Latin America Ostomy Dressing Market, by End User

The hospitals and specialty clinics segment held the largest share of the Latin America ostomy dressings market. These facilities are the primary centers for ostomy-related surgical procedures and early-stage patient management. Most colostomy, ileostomy, and urostomy surgeries, which are related to colorectal and bladder cancer, inflammatory bowel disease, and traumatic injuries, are performed in hospitals. During hospitalization, the initial selection and prescription of ostomy products, as well as their standardization, are most likely to occur. This concentrated demand plays a significant role in driving the market. Additionally, tasks such as assessing the stoma after surgery, fitting the product, and educating patients about ostomy dressings are carried out by surgeons and stoma care specialists in these settings. These clinicians greatly influence brand preference and the adoption of protocols, which helps reinforce the dominant position of the hospitals and specialty clinics segment across Latin America.

REGION

Brazil to be fastest-growing country in Latin America ostomy dressings market during forecast period

Brazil is expected to be the fastest-growing country in the Latin America ostomy dressings market during the forecast period. This growth is primarily driven by the increasing burden of chronic diseases, the rapid aging of the population, and extensive public healthcare coverage. The high and rising incidence of colon and bladder cancer, along with the growing prevalence of inflammatory bowel disease, is contributing to a sustained increase in ostomy procedures and the long-term use of related products. GLOBOCAN 2022 indicates that the demand for cancer care is significant, and data from IBGE show that the elderly population is rapidly increasing and is more susceptible to oncological and gastrointestinal disorders. Furthermore, the Brazilian government, through the Unified Health System (SUS), subsidizes cancer treatment for nearly 75% of the population, providing better access to surgical procedures and follow-up care. These factors collectively lead to an increase in surgical procedures, recurring product usage, and quicker adoption of ostomy dressing products.

LATIN AMERICA OSTOMY DRESSINGS MARKET: COMPANY EVALUATION MATRIX

In the Latin America ostomy dressings market, star players such as Coloplast A/S (Denmark), Convatec Group Plc (UK), and Hollister Incorporated (US) lead with their unmatched regional presence, strong brand recognition, and comprehensive portfolios of ostomy dressings. B. Braun SE (Germany) (Pervasive) is rapidly gaining traction with its versatile ostomy dressings for various applications, including cancer, Crohn's disease, and ulcerative colitis.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Coloplast A/S (Denmark)

- Convatec Group plc (UK)

- Hollister Incorporated (US)

- B. Braun SE (Germany)

- Solventum (US)

- Owens & Minor, Inc. (US)

- Advin Health Care (India)

- Salts Healthcare (UK)

- Welland Medical Limited (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 0.30 Billion |

| Market Size in 2030 (Value) | USD 0.40 Billion |

| Growth Rate | CAGR of 6.4% from 2025–2030 |

| Actual Data | 2025–2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, and Rest of Latin America |

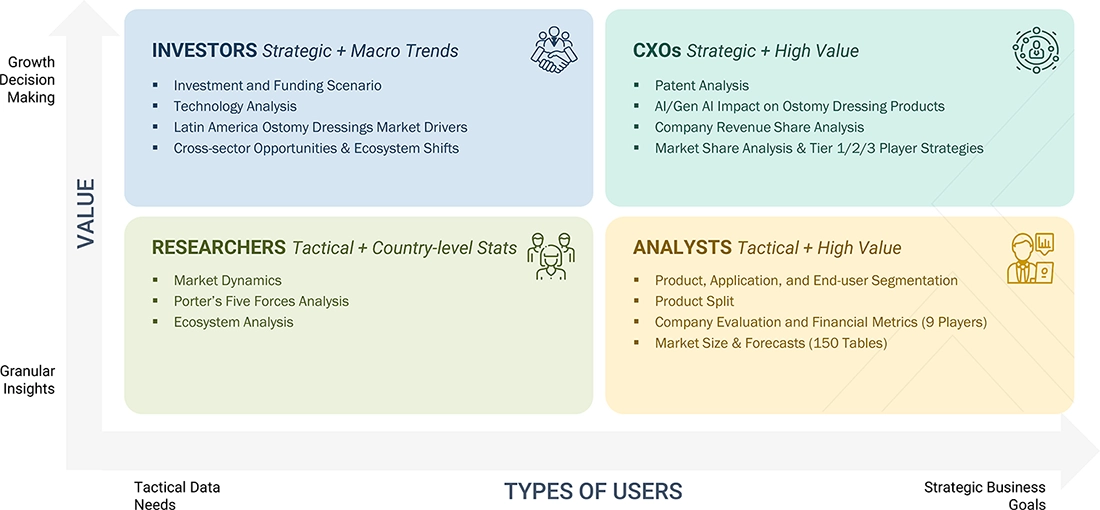

WHAT IS IN IT FOR YOU: LATIN AMERICA OSTOMY DRESSINGS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Company Information | Market share analysis, by Country (Brazil, Mexico), which provides market shares of the top 3 key players in the Latin America ostomy dressings market | Insights on market share analysis by country |

| Geographic Analysis | Further breakdown of the Rest of Latin America ostomy dressings market into Guyana, Bolivia, El Salvador, Ecuador, Paraguay, Uruguay, Panama, and Cuba | Country-level demand mapping for new product launches and localization strategy planning |

RECENT DEVELOPMENTS

- December 2025 : Solventum announced that it has earned the Diamond Level Resiliency Badge from the Healthcare Industry Resilience Collaborative (HIRC), the highest distinction for supply chain resilience in the healthcare sector. This recognition underscores the robustness of Solventum’s MedSurg segment, validating its capability to consistently supply critical healthcare products and maintain continuity of patient care, even amid significant supply chain disruptions.

- May 2024 : Coloplast A/S expanded its SenSura Mio portfolio with the launch of SenSura Mio in black and SenSura Mio Convex Soft with Flex coupling. These additions reflect the company’s focus on product innovation and personalization, enhancing choice and comfort for people living with a stoma.

- February 2024 : Convatec announced the initial launch of Esteem Body with Leak Defense in Italy, marking the first market introduction. The company plans to expand into the US in April, followed by a phased rollout across emerging markets worldwide.

Table of Contents

Methodology

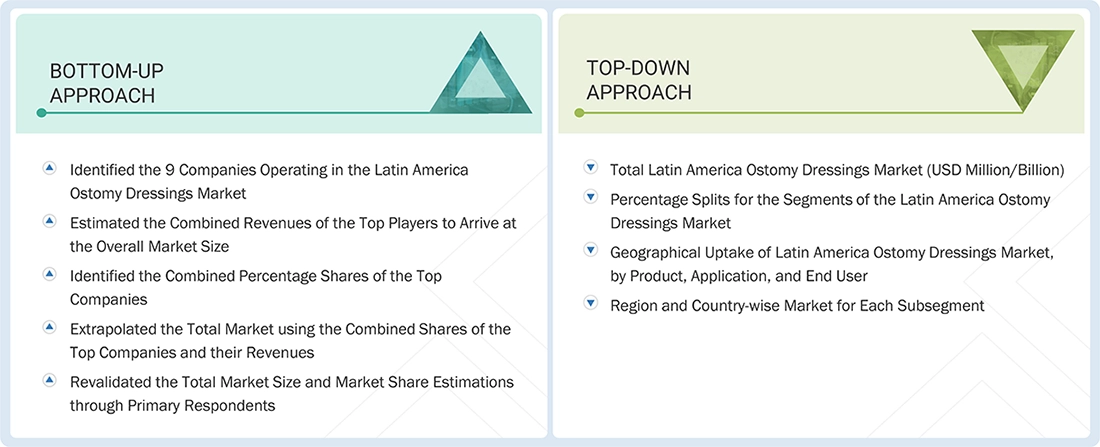

This study involved four major activities in estimating the current Latin America ostomy dressings market size. First, extensive secondary research was conducted to gather information on the market, including related and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and companies’ SEC filings. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the Latin America ostomy dressings market. It was also used to obtain important information on key players, market classification and segmentation aligned with industry trends to the bottom-most level, and key developments from market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

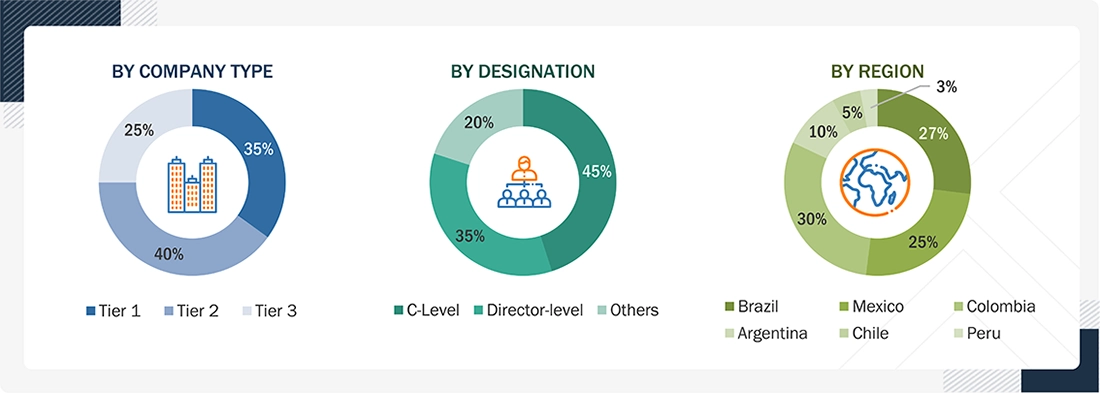

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the Latin America ostomy dressings market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents for the Latin America ostomy dressings market is provided below:

Note 1: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 2: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the Latin America ostomy dressings market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/subsegments was done for the major players. Also, the Latin America ostomy dressings market was split into various segments and subsegments based on:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of various Latin America ostomy dressing manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from Latin America ostomy dressing (or the nearest reported business unit/product category)

- Revenue mapping of major players to be covered

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the Latin America ostomy dressings market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation (Bottom-up Approach & Top-down Approach)

Data Triangulation

After arriving at the overall size of the Latin America ostomy dressings market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macroindicators and regional trends from both demand- and supply-side participants.

Market Definition

Ostomy dressings are medical products designed to manage and protect a surgically created stoma by securely collecting bodily waste and maintaining peristomal skin integrity. They include pouches, skin barriers, accessories, and protective products that support adhesion, prevent leakage, reduce skin complications, and enable safe, long-term ostomy care across clinical and home care settings.

Key Stakeholders

- Suppliers and distributors of ostomy dressing products & other related components

- Ostomy care product manufacturers

- Hospitals & specialty clinics

- Patients

- Ambulatory surgery centers

- Raw material suppliers

- Third-party ostomy care product suppliers

- Government bodies and regulatory bodies

- Business research and consulting service providers

- Venture capitalists

Report Objectives

- To describe, analyze, and forecast the Latin America ostomy dressings market by product, application, end user, and country

- To describe and forecast the Latin America ostomy dressings market in key countries: Brazil, Mexico, Colombia, Argentina, Chile, Peru, and the Rest of Latin America.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing market growth

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To profile the key players and comprehensively analyze their market shares and core competencies in the Latin America ostomy dressings market

- To analyze competitive developments such as partnerships, agreements & acquisitions, product launches, product approvals, and expansions in the Latin America ostomy dressings market.

Available customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

GEOGRAPHIC ANALYSIS

- Further breakdown of the Rest of Latin America ostomy dressings market into Cuba, Panama, Ecuador, and others

COMPETITIVE LANDSCAPE ASSESSMENT

Market share analysis, by country, which provides market shares of the top 3–5 key players in the Latin America ostomy dressings market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Latin America Ostomy Dressings Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Latin America Ostomy Dressings Market