Law Enforcement & Emergency Services Fleet Management Market

Law Enforcement & Emergency Services Fleet Management Market Operation (Operations Management, Vehicle Maintenance & Diagnostics, Performance Management), Fleet Type (Law Enforcement, Emergency Medical Services) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The law enforcement and emergency services fleet management market is expected to grow from USD 2.50 billion in 2025 to USD 4.46 billion by 2030, reflecting a 12.3% CAGR. Accelerated procurement programs are driven by demands for officer accountability, integrated video and telematics platforms, and secure evidence management across police, EMS, and fire fleets. Agencies are investing in CAD and AVL integration, AI-assisted dash cams, predictive maintenance, and electrification planning to ensure readiness and reduce lifecycle costs. Tighter cybersecurity standards, data privacy rules, and interoperable APIs shape vendor selection and procurement. Grant funding, insurer incentives, and regional modernization mandates further lower adoption barriers, making scalable, audit-ready, and mission-focused solutions essential for resilient public safety operations.

KEY TAKEAWAYS

-

RegionBy region, Asia Pacific is projected to grow at the fastest rate (18.1%) from 2025 to 2030.

-

By OperationBy operation, the vehicle maintenance & diagnostics segment is expected to register the highest CAGR of 13.3%.

-

By Fleet TypeBy fleet type, the emergency medical services segment is projected to grow at the fastest rate from 2025 to 2030.

-

Competitive Landscape - Key PlayersGeotab, Samsara, and Verizon Connect were identified as some of the star players in the law enforcement & emergency services fleet management market, given their strong share and product footprint.

-

Competitive Landscape - StartupsFlock Safety, Peregrine Technologies, and Rekor Systems are some of the progressive companies that stand out by offering specialized, industry-tailored fleet visibility and efficiency for law enforcement & emergency services.

Demand for auditable fleet data, in-car video, and performance metrics is being driven by the need for greater accountability and transparency in the law enforcement sector. The increased deployment of body cameras and car-based video evidence and storage management systems is creating heightened demand for an all-encompassing platform for secure evidence, storage, and metadata management. Cybersecurity threats and IT security concerns within the law and order sector are increasing demand for hardened software and devices for law enforcement applications. Rising costs associated with the police workforce are also increasing demand for automation in the law enforcement sector.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Stakeholders across agencies and vendors form the law enforcement and emergency services fleet ecosystem, collaborating to deliver timely, accountable safety services. Software vendors provide integrated platforms for telematics, CAD, AVL, dispatch coordination, video evidence handling, and analytics that support incident review and rapid resource allocation. Hardware makers produce rugged telematics units, AI dash cams, ANPR cameras, and vehicle sensors that collect high-quality field data. Service partners provide robust connectivity, deployment support, system integration, cybersecurity, and electrification assistance for emergency vehicle fleets. Key dependencies include open APIs, a verifiable chain of custody, data privacy compliance, and reliable networks, which enable situational awareness, predictive maintenance, and defensible evidence handling for agencies and the public they serve.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing Demand for Real-time Data Analytics and Operational Intelligence

-

Urbanization and Rising Frequency of Emergency Response Demands

Level

-

Severe Budget Constraints and Multi-year Funding Uncertainty

-

Legacy System Integration Complexity and Technical Silos

Level

-

Interoperability Standards and Multi-agency Coordination Systems

-

Electric Vehicle Fleet Transition and Regulatory-driven Modernization

Level

-

Complex Government Procurement Processes and Vendor Selection Challenges

-

Infrastructure Readiness Gaps and Rural Connectivity Limitations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Urbanization and Rising Frequency of Emergency Response Demands

Rapid urban growth and more frequent natural disasters, accidents, and medical emergencies are steadily pressuring emergency services to shorten response times and improve service quality. High-density urban areas complicate coordination, while climate-driven disasters require rapid mobilization of personnel and equipment. Fleet management systems that provide accurate vehicle tracking, optimized routing, and efficient resource allocation meet these operational needs and make technology adoption essential for meeting service-level targets and protecting public safety and resilience.

Restraint: Severe Budget Constraints and Multi-year Funding Uncertainty

Public safety agencies operate under tight fiscal constraints and annual appropriation cycles. These cycles often conflict with the multi-year schedules required for technology upgrades. Annual funding levels frequently fall short of actual technology needs, forcing agencies to prioritize immediate operations over longer-term upgrades. Difficulty securing approval for upfront technology spending, even when it promises future savings, remains a persistent barrier to adopting fleet management systems, especially for small municipal and regional agencies with limited resources.

Opportunity: Interoperability Standards and Multi-agency Coordination Systems

Ongoing work on standards-based communication frameworks, including P25 and broadband systems, presents opportunities for tools that connect agency silos and enable reliable information sharing in coordinated emergency response. Solutions that address fragmented governance and support inter-agency coordination provide operational benefits, especially in incidents spanning multiple jurisdictions. Common interoperability standards reduce vendor lock-in and expand the market by making it easier for more agencies to adopt solutions.

Challenge: Complex Government Procurement Processes and Vendor Selection Challenges

Government procurement rules require strict compliance, transparency, and competitive bidding, which lengthen vendor selection timelines and raise complexity for both public agencies and solution vendors. Regulatory rules require multiple stakeholder approvals, detailed specification documents, formal contracting steps, and ongoing oversight requirements. These procurement structures lengthen implementation schedules, limit vendor flexibility for solution customization, and create delays that slow technology deployment and adoption.

LAW ENFORCEMENT & EMERGENCY SERVICES FLEET MANAGEMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The state of Utah deployed Geotab’s telematics across its police fleet to gain real-time vehicle visibility, integrate emergency-light and siren telemetry, and conduct utilization and rightsizing analyses to optimize patrol vehicle allocation and accountability. | Reduced fleet size through rightsizing, improved response readiness, lower operational costs via reduced idling and maintenance, enhanced officer accountability through integrated reports, and measurable safety improvements from data-driven policy and training programs and outcomes |

|

The City of New Orleans deployed Samsara’s AI dashcams and telematics across its EMS fleet to monitor driver behavior, reduce risky driving, and centralize vehicle diagnostics and routing for improved emergency response coordination and accountability. | Significant reductions in speeding and mobile phone use, faster dispatch and routing, improved driver coaching, exoneration from recorded incidents, lower collision rates, and a better asset utilization and maintenance scheduling system-wide |

|

Priority Patient Transport used Webfleet to improve ambulance ETA, routing, and hospital diversion decisions during critical transports, enabling dispatch to locate the nearest hospital and optimize patient handover and response coordination across networks under evolving conditions. | Faster patient transfers, reduced time-to-care, improved on-scene decision-making, better coordination with receiving facilities, minimized diversion delays, enhanced situational awareness for crews, and measurable improvements in patient outcomes, reporting, and operational efficiency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Safe, accountable, and mission-ready operations in law enforcement and emergency services fleets depend on closely linked roles among solution vendors, hardware makers, and service partners. Solution vendors provide combined platforms for telematics, CAD & AVL, dispatch management, video evidence handling, and analytics to support incident reconstruction and resource prioritization. Hardware makers supply rugged telematics units, AI dash cameras, body-worn cameras, ANPR devices, and specialized vehicle sensors to collect forensic-quality field data. Service partners provide reliable connectivity, managed rollouts, system integration, user training, and cybersecurity measures to sustain operations. Key dependencies include interoperable APIs, a verifiable chain of custody, data privacy compliance, and dependable networks. Together, these elements enable real-time situational awareness, predictive maintenance, accountable operations, and operational resilience.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Law Enforcement & Emergency Services Fleet Management Market, By Operation

Operations management will be the largest segment within operations, as agencies need comprehensive platforms to manage dispatch, staff scheduling, inventory, and incident workflows across complex structures. Unified suites combine separate solutions by offering centralized command, resource reallocation during mass-casualty incidents, and automated compliance reporting. Connecting CAD, records, and communication systems integrates data into dashboards and facilitates after-action reviews. Subscription-based software ensures predictable updates, promoting wide adoption. Vendors offering tailored training, simulations, and workflow automation can decrease response variability and labor costs, supporting adoption at various agency levels.

Law Enforcement & Emergency Services Fleet Management Market, By Fleet Type

Law enforcement vehicles are expected to account for the largest market share because each unit spends much more on technology than other fleet categories. These vehicles get specialized upfits such as ANPR cameras, secure evidence storage, emergency lights and sirens, and hardened communications, raising both software and hardware content per vehicle. Ongoing needs for system updates, certified servicing, and sensor calibration support steady aftermarket and subscription revenues. Procurement timing and specific capital budgets for police fleets allow for large, planned rollouts. Integration with records management, CAD, and body camera systems increases platform adoption and professional services. Higher per-unit economics, ongoing support contracts, and integration complexity significantly boost this segment’s market value.

REGION

Asia Pacfiic to be fastest-growing region in law enforcement & emergency services fleet management market during forecast period

Asia Pacific governments are increasing emergency fleets and resilient vehicles due to climate risks and disasters. Growing private EMS and mobility providers demand scalable fleet solutions. Stricter regulations on response times and accountability accelerate demand for telematics and video evidence. Local startups reduce hardware costs and enable quicker regional deployment. Cross-border aid requires interoperable systems. Rising EV adoption boosts demand for battery monitoring and energy management in emergency vehicles.

LAW ENFORCEMENT & EMERGENCY SERVICES FLEET MANAGEMENT MARKET: COMPANY EVALUATION MATRIX

In the law enforcement & emergency services fleet management market, Samsara (Star) remains a leading fleet management provider, supported by a broad product portfolio, advanced tracking capabilities, and strong adoption across transport fleets. CalAmp (Emerging Leader) is emerging as a notable player, gaining traction with affordable, analytics-driven solutions for small and mid-sized operators.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Geotab (Canada)

- Samsara (US)

- Verizon Connect (US)

- CalAmp (US)

- Teletrac Navman (US)

- Zonar Systems (US)

- Fleet Complete (Canada)

- Lytx (US)

- MiX Telematics (South Africa)

- Webfleet (Netherlands)

- Motorola Solutions (US)

- Fleetio (US)

- Gurtam (Poland)

- Trinetra Wireless (India)

- Trackster (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.19 Billion |

| Market Forecast in 2030 (Value) | USD 4.46 Billion |

| Growth Rate | CAGR of 12.3% from 2025-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: LAW ENFORCEMENT & EMERGENCY SERVICES FLEET MANAGEMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Law Enforcement & Emergency Services Agencies |

|

|

RECENT DEVELOPMENTS

- April 2025 : Motorola Solutions launched the SVX device, which combines RSM, a body camera, and an AI assistant (“Assist”), designed to speed evidence capture and reduce report-writing time for public safety agencies.

- November 2024 : Zonar announced that the Kirkland (WA) Police Department adopted EVIR Mobile and ZTrak for digitized pre-shift inspections and asset tracking, improving patrol vehicle readiness, compliance, and inspection auditability.

- August 2024 : CalAmp launched an Inventory Manager feature to simplify device provisioning and large-scale telematics rollouts, improving deployment speed and logistics for municipal and emergency services fleets.

Table of Contents

Methodology

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information for a technical, market-oriented, and commercial study of the global law enforcement & emergency services fleet management market. A few other market-related reports and analyses published by various industry associations, such as the National Security Agency (NSA) and SC Magazine, were considered while doing the extensive secondary research. The primary sources were mainly the industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, and technologists from companies and organizations related to all segments of this industry's value chain.

In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information and assess the prospects. The market has been estimated by analyzing various driving factors, such as improving organizational compliance requirements, enhancing operational efficiency, and simplifying workflows to eliminate bottlenecks.

Secondary Research

The market size of companies offering law enforcement software was derived based on secondary data available through paid and unpaid sources, analyzing the product portfolios of major companies in the ecosystem, and rating the companies based on their product capabilities and business strategies.

Various sources were referenced in the secondary research process to identify and collect information for the study. These sources included annual reports, press releases, investor presentations of companies, product data sheets, white papers, journals, certified publications, and articles from recognized authors, government websites, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the law enforcement & emergency services fleet management market.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology-related trends, segmentation types, industry trends, and regions.

Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), installation teams of governments and end users who utilize law enforcement software platforms, and digital initiatives project teams, were interviewed to understand the buyers’ perspectives on suppliers, products, service providers, and their current use of services, which would influence the overall law enforcement & emergency services fleet management market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the law enforcement & emergency services fleet management market. The first approach involved estimating the market size by summing the companies’ revenue generated through the sale of services.

The research methodology used to estimate the market size included the following.

- Primary and secondary research was conducted to assess the revenue contributions of major market participants in each country, with secondary research identifying these participants.

- Critical insights were obtained by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- Primary sources were used to verify all percentage splits and breakups, which we calculated using secondary sources.

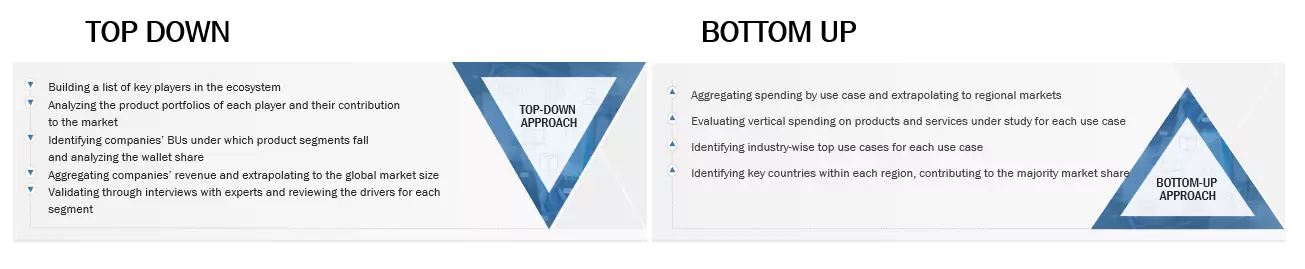

Law Enforcement & Emergency Services Fleet Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall market size was determined, we divided the market into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from the government entities’ supply and demand sides.

Market Definition

Considering the views of various sources and associations, MarketsandMarkets defines “Law enforcement software” as specialized digital solutions designed to support public safety agencies and law enforcement bodies in managing their operational, investigative, and administrative tasks. It enables efficient handling of crime reporting, case management, digital evidence management, records management, incident tracking, and jail management.

These software platforms integrate legal protocols, jurisdiction-specific regulations, and advanced technologies such as AI, analytics, and cloud computing to streamline workflows, enhance data accuracy, and improve decision-making. Law enforcement software helps agencies ensure compliance, maintain public safety, and deliver timely responses through centralized data access and coordination tools.

Stakeholders

- Police Departments

- Federal Law Enforcement Bodies

- Border Control & Immigration Agencies

- Ministry of Home Affairs/Department of Justice

- Municipal & State Governments

- Law Enforcement Software Providers

- Surveillance System Manufacturers

- Fire Departments

- Emergency Response Teams

- Prosecutors & Legal Authorities

Report Objectives

- To define, describe, and forecast the law enforcement management market based on offering, deployment mode, end user, and region

- To forecast the market size of five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze macro and micro markets concerning growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents, innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To analyze the impact of AI/generative AI on the market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments such as mergers & acquisitions, product launches, and partnerships & collaborations in the market

Available Customizations

MarketsandMarkets provides customizations based on the company’s unique requirements using market data. The following customization options are available for the report.

Product Analysis

- The product matrix provides a detailed comparison of each company’s portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the law enforcement & emergency services fleet management market

Company Information

- Detailed analysis and profiling of five additional market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Law Enforcement & Emergency Services Fleet Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Law Enforcement & Emergency Services Fleet Management Market