Layered Double Hydroxide Market

Layered Double Hydroxide Market by Type (Mg-Al, Zn-Al, Ca-Al), Application (Catalysts & Precursors, Additives, Absorbent, Water Treatment), End-Use (Chemicals, Electronics, Construction, Agriculture), Grade, Form, and Region - Global Forecast to 2030

Updated on : November 27, 2025

LAYERED DOUBLE HYDROXIDE MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global layered double hydroxide market is projected to grow from USD 0.81 billion in 2025 to USD 1.22 billion by 2030, at a CAGR of 8.5% during the forecast period. The market is witnessing steady growth driven by its expanding applications across industries such as construction, pharmaceuticals, water treatment, and others. Rising demand for flame retardants, catalysts, and adsorbents is fueling adoption. Increasing environmental regulations and the global push for sustainable materials are also accelerating the use of LDHs.

KEY TAKEAWAYS

-

BY PRODUCT TYPELayered double hydroxides with anionic intercalation are a specialized class of LDHs in which various anions are incorporated between the positively charged layers, enhancing their functionality and versatility. This allows LDHs to act as effective ion exchangers, adsorbents, and controlled-release carriers, making them suitable for applications in catalysis, water treatment, environmental remediation, and agriculture.

-

BY GRADEThe pharmaceutical grade is expected to be the fastest-growing grade segment in the market. This growth is bolstered by the expanding specialty-grade applications in water treatment, catalysis, and energy storage. Increasing emphasis on sustainable and multifunctional materials is accelerating demand for high-performance LDH grades tailored for advanced industrial applications.

-

BY TYPEMg-Al LDH is the largest and fastest-growing type in the layered double hydroxide market, driven by the increasing demand for sustainable, high-performance materials in environmental remediation, renewable energy, and polymer industries.

-

BY APPLICATIONLayered double hydroxides are multifunctional materials with diverse applications across industrial, environmental, and energy sectors. They serve as catalysts and catalyst precursors, enhancing reactions such as oxidation, hydrogenation, and polymerization, while also supporting environmental catalysis for pollutant degradation and greenhouse gas capture. As additives, LDHs improve stability, mechanical and thermal performance, and act as non-toxic stabilizers in polymers, rubber, and coatings. Their high anion-exchange capacity makes them effective absorbents for dyes, heavy metals, and industrial effluents.

-

BY FORMPowdered layered double hydroxides are commonly produced via co-precipitation or hydrothermal synthesis and have a high surface area and flexible ion exchange capacity. They are predominantly used for polymer additives, flame retardants, UV shielding, and catalysis. Granular layered double hydroxides are produced by pelletizing or agglomerating powders, offering improved mechanical stability and easier handling than powders. While their larger particle size reduces surface area and ion-exchange efficiency, granular layered double hydroxides are utilized in environmental technologies such as phosphate adsorption for water treatment and slow-release fertilizers.

-

BY DISTRIBUTION CHANNELDistribution channels include direct sales, online retail, distributors & wholesalers, and specialty chemical stores. Collectively, these channels ensure that LDHs reach diverse markets efficiently, supporting applications ranging from catalysis and additives to water treatment and environmental remediation. The growth of these distribution avenues reflects the increasing demand for tailored solutions, convenience, and reliable supply chains across industries.

-

BY END-USEThe end uses in the LDH market include chemicals, electronics, construction, agriculture, and other end uses. The chemicals segment is projected to be the fastest-growing during the forecast period. The LDH market is growing in the chemicals segment as these materials are increasingly used as catalysts, stabilizers, and adsorbents in various chemical processes. Their tunable composition and eco-friendly properties make them ideal for replacing conventional additives and supporting sustainable chemical manufacturing.

-

BY REGIONThe market covers Europe, North America, Asia Pacific, South America, and the Middle East & Africa. Asia Pacific is the largest and fastest-growing region in the market. The global LDH market is witnessing strong growth driven by increasing demand across varied industries, including pharmaceuticals, electronics, and construction, due to the multifunctional properties of LDHs, such as anion exchange, flame retardancy, and biocompatibility.

-

COMPETITIVE LANDSCAPEKyowa Chemical Industry Co., Ltd. (Japan), Clariant (Switzerland), DOOBON (South Korea), Shandong Repolyfine Additives Co., Ltd. (China), Sakai Chemical Industry Co., Ltd. (Japan), Sasol (South Africa), and Saekyung Chemical Co., Limited (China) are the leading manufacturers of layered double hydroxide.

Layered Double Hydroxides, also known as hydrotalcite-like compounds, are versatile materials valued for their unique layered structure and anion-exchange capacity. Unlike acids, LDHs are alkaline in nature and are widely used as stabilizers, flame retardants, adsorbents, and catalysts in industrial processes. Their role in the plastics and polymer industry is where they act as effective acid scavengers and halogen-free flame retardants, supporting the shift toward sustainable materials. LDHs are also gaining prominence in water treatment for removing heavy metals and anions, as well as in pharmaceuticals for drug delivery and controlled release. In the chemical sector, they serve as catalysts and catalyst supports, enabling cleaner and more efficient production pathways. With rising demand across construction, agriculture, and environmental remediation, coupled with stricter environmental regulations and a global push for sustainable solutions, the LDH market is experiencing strong and steady growth

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses arises from evolving customer trends or market disruptions. The growth of end-use industries, such as electric vehicles, energy storage, consumer electronics, and others, leads to the growing demand for layered double hydroxide. These megatrends are expected to drive growth and increase the revenue of the layered double hydroxide market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in Water and Wastewater Treatment Applications

-

Growing Demand for Efficient and Sustainable Catalysts

Level

-

High Production and Processing Costs

-

Competition from Cheaper and Established Alternatives

Level

-

Advancements of Nanostructured LDH Materials

-

Growth in Advanced Drug Delivery Solutions

Level

-

Safety and Regulatory Constraints

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in water and wastewater treatment applications

The demand for clean water has increased significantly over time, mainly driven by rapid urbanization, rising consumer needs, and expanding industrial and agricultural activities. These factors have boosted the need for effective water and wastewater treatment to ensure safe drinking water and proper disposal of contaminated water. According to the United Nations Statistics Division Development Data and Outreach Branch, untreated or partially treated domestic wastewater heavily pollutes freshwater sources. Globally, only around 56% of domestic wastewater is safely treated, highlighting the ongoing difficulties faced by authorities and industries in upgrading treatment facilities. Pollutants from sectors such as textiles, pharmaceuticals, agriculture, and chemical manufacturing release toxic substances like dyes, heavy metals, pharmaceuticals, and emerging contaminants, which pose serious health risks to humans and aquatic ecosystems. To address this issue, industries must develop advanced adsorption materials, with Layered Double Hydroxides (LDHs) being among the most effective adsorbents. LDHs offer high adsorption capacities thanks to their large surface area, tunable chemical makeup, and multiple removal mechanisms, including ion exchange, intercalation, and surface complexation.

Restraint: High Production and Processing Costs

Layered Double Hydroxides (LDHs) are costly to produce and process, limiting their large-scale application. Standard methods like co-precipitation, hydrothermal, and sol–gel require strict control of temperature, pressure, and special equipment, increasing energy use and complexity. Using ultra-pure reagents raises raw material costs, making mass production economically challenging. LDHs are often transformed into useful forms such as catalysts, drug delivery systems, or environmental cleaners, but their tendency to agglomerate and difficulty to coalesce complicate production, often needing special methods and additives. Variations in the availability and cost of primary metals like aluminum and magnesium further impact stability and expense. These challenges supply strong motivation to develop more cost-effective and scalable methods for commercial application.

Opportunity: Advancement of Nanostructured LDH Materials

Nanostructuring Layered Double Hydroxides (LDHs) enhances performance and expands applications in various sectors. It allows precise control over structure and chemistry, increasing surface area, stability, and catalytic activity. Adding conductive materials further boosts electrochemical performance, benefiting energy storage devices like batteries and supercapacitors. These modifications can make LDH nanostructures competitive with traditional materials, offering more efficient, eco-friendly industrial options. Beyond catalysis and energy, nanostructured LDHs enable pollutant removal, environmental restoration, and chemical transformations in moderate conditions. They can be integrated into composites or coatings to improve mechanical, thermal, and chemical properties, suitable for high-performance materials. Advancing synthesis and functionalization methods can unlock new industrial opportunities, positioning LDHs as versatile, high-value materials with long-term implications across catalysis, energy, and environmental sectors.

Challenge: Safety and Regulatory Constraints

Implementing new materials in biomedical and food contact uses faces regulatory hurdles and safety tests. While promising, these materials require rigorous biocompatibility, toxicity, and stability assessments due to their novelty. Authorities like the FDA and EMA demand extensive testing, including in vitro, in vivo, and long-term studies, which can delay development and increase costs. A lack of harmonized testing standards for emerging materials complicates demonstrating consistent protection across different formulations or processes. Variability in composition and processing can affect how materials interact with biological systems or food, impacting effectiveness and safety. Systematic testing, monitoring, and quality control are essential. Without thorough verification and approval, commercial use and market potential remain limited despite technological promise.

Layered Double Hydroxide Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Produces LDH-based additives (Hycite series) for plastics and polyolefins as acid scavengers and halogen-free stabilizers | Improves polymer stability, prevents degradation, supports high-performance and eco-friendly plastics |

|

Utilizes LDHs in catalyst formulations and specialty chemicals for refining and petrochemical processes | Enhances catalytic efficiency, enables cleaner fuel production, and reduces environmental impact |

|

Boosts energy storage performance, improves color stability in pigments, and supports advanced material innovation | Boosts energy storage performance, improves color stability in pigments, and supports advanced material innovation |

|

Produces synthetic hydrotalcite (Kyowatalc series) for PVC stabilization and polymer applications | Provides non-toxic heat stabilizers, enhances flame retardancy, and ensures product safety in consumer goods |

|

Develops advanced LDH nanocomposites for water treatment, coatings, and specialty applications | Improves contaminant adsorption, enhances coating durability, and enables sustainable environmental solutions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The layered double hydroxide ecosystem consists of raw material suppliers (e.g., Vizag Chemicals International, RX Chemicals), LDH producers (e.g., Kyowa Chemical Industry, Sasol, Clariant), distributors (e.g., Riverland Trading, Wego), and end users (e.g., Veolia, Thermax, Phosagro). Layered double hydroxide is used in various end-uses such as chemicals, electronics, construction, agriculture, and others

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Layered Double Hydroxide Market, By Application

Among application segments, the water treatment sector is expected to have the highest CAGR in the layered double hydroxide market during the forecast period. This is due to the increasing popularity of LDHs in water treatment through adsorption, ion exchange, and contaminant removal. LDHs can effectively extract toxic anions such as nitrates, phosphates, and fluorides, making them useful for purifying water for both municipalities and industries. Their functions are broad, including wastewater purification, where they help neutralize acidity and trap harmful ions before discharge. Additionally, the properties of LDHs, such as being non-toxic, reusable, and cost-effective, make them a promising material for sustainable water treatment, balancing industrial needs with environmental protection.

Layered Double Hydroxide Market, By Grade

Among grade segments, the pharmaceuticals segment is expected to record the highest CAGR in the layered double hydroxide market during the forecast period. Pharmaceutical grade LDH is a product of special design with drug delivery and medical formulations as its major applications, in which its biocompatibility and controlled release properties are the most outstanding ones. Its multi-layered structure makes it possible for the active pharmaceutical ingredients to be intercalated, thus allowing for targeted and sustained drug release. In this way, the therapeutic efficiency is empowered, and the side effects are lowered to a minimum. The desire for personalized medicine and the development of advanced drug delivery systems are the main reasons for the demand for this grade.

REGION

Asia Pacific to be fastest-growing region in global LDH market during forecast period

The Asia Pacific is expected to record the highest CAGR in the value of the layered double hydroxide market during the forecast period, driven by rapid industrialization, urbanization, and growing end-user sectors such as chemicals, construction, and farming. Countries like China, Japan, India, and others are leading in the use of LDHs, employing them in applications from catalysts and flame retardants to soil remediation and drinking water purification. Increased infrastructure development and escalating environmental regulations are additional factors that will drive demand for LDH-based materials.

Layered Double Hydroxide Market: COMPANY EVALUATION MATRIX

In the layered double hydroxide market matrix, Kyowa Chemical Industry Co., Ltd. (Star) leads with a strong market share and extensive product footprint, focusing on offering a diverse range of LDH materials tailored for various applications, including pharmaceuticals, PVC stabilizer systems, and polymer additives. BASF (Emerging Leader) is gaining visibility with its Hydrotalcite produced by which is primarily applied as a stabilizer and acid scavenger in polymers, especially in PVC processing, where it improves thermal stability and extends product lifespan.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.75 Billion |

| Market Forecast in 2030 (Value) | USD 1.22 Billion |

| CAGR (2025–2030) | 8.5% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Layered Double Hydroxide Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Energy & Storage Technologies |

|

Identify reliable LDH suppliers for solid-state and next-gen batteries Highlight structure–performance trade-offs for ionic conductivity and thermal stability Support adoption of LDH composites in high-energy, high-safety battery chemistries |

| Automotive & Mobility |

|

|

| Construction & Infrastructure |

|

|

| Industrial Chemicals & Materials |

|

|

RECENT DEVELOPMENTS

Table of Contents

Methodology

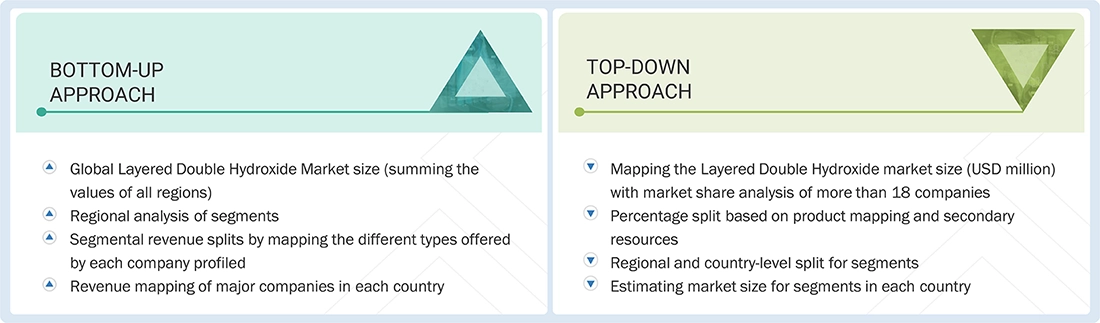

The research encompassed four primary actions in assessing the present market size of layered double hydroxide. Comprehensive secondary research was conducted to gather information on the market, the peer market, and the parent market. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists throughout the layered double hydroxide value chain via primary research. The total market size is ascertained with both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to determine the dimensions of the market segments and sub-segments.

Secondary Research

The research approach employed to assess and project the access control market begins with the collection of revenue data from prominent suppliers using secondary research. During the secondary research, various sources, including Hoover's, Bloomberg Businessweek, Factiva, the World Bank, and industry magazines, were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations; white papers; accredited periodicals; writings by esteemed authors; announcements from regulatory agencies; trade directories; and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

The layered double hydroxide market encompasses a range of stakeholders, including manufacturers, suppliers, traders, associations, and regulatory agencies, across the entire supply chain. The demand side is driven by developments in chemicals, electronics, construction, agriculture, and other sectors. Advances in technology define the supply side. Interviews with key sources from both the supply and demand sides provided qualitative and quantitative data.

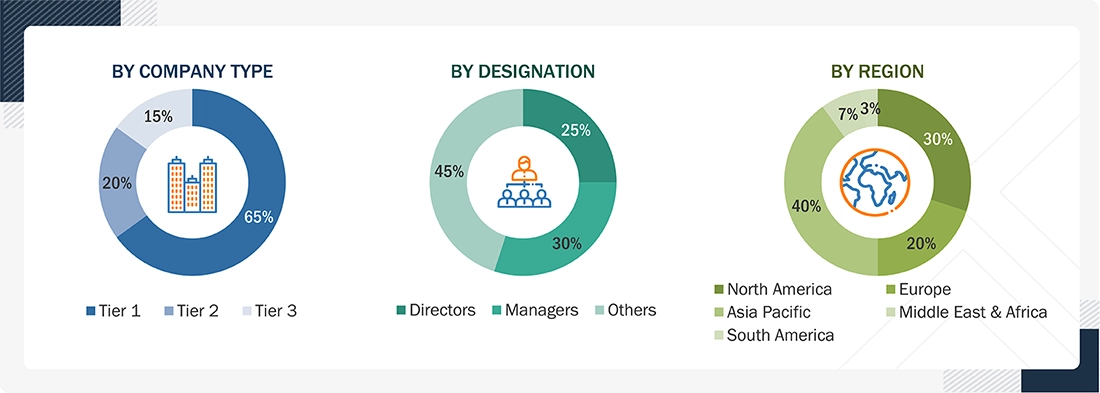

The following is the list of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the layered double hydroxide market. These methods were also used extensively to determine the size of various market segments. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the layered double hydroxide market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Layered Double Hydroxide Market Size: Bottom-Up and Top-Down Approach

Data Triangulation

After determining the overall market size using the market size estimation processes explained above, the market was divided into several segments and sub-segments. To complete the overall market engineering process and determine the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed, as applicable. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Layered Double Hydroxides (LDHs), also known as hydrotalcite-like compounds or anionic clays, are a class of nanostructured materials made up of positively charged metal hydroxide layers separated by interlayer regions containing anions and water molecules. Their unique layered structure allows for ion exchange, tunable composition, and controlled release properties, making them highly versatile. LDHs are widely used in catalysis, flame retardancy, polymer stabilization, pharmaceuticals, and other applications.

Stakeholders

- Layered Double Hydroxide Manufacturers

- Layered Double Hydroxide Suppliers

- Layered Double Hydroxide Traders, Distributors, And Suppliers

- Investment Banks and Private Equity Firms

- Raw Material Suppliers

- Government and Research Organizations

- Consulting Companies/Consultants in the Chemicals and Materials Sectors

- Industry Associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the size of the global layered double hydroxide market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global layered double hydroxide market

- To analyze and forecast the size of various segments (raw material and application) of the layered double hydroxide market based on five major regions—North America, Asia Pacific, Europe, the Middle East & Africa, and South America, along with key countries in each of these regions

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Layered Double Hydroxide Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Layered Double Hydroxide Market