Learning Management System Market Size, Size, Growth & Latest Trends

Learning Management System Market by Delivery Mode (Distance Learning, Instructor-led Learning, Blended Learning), Application Area (Corporate Training & Development, Professional Certification & Compliance, Course Management) - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

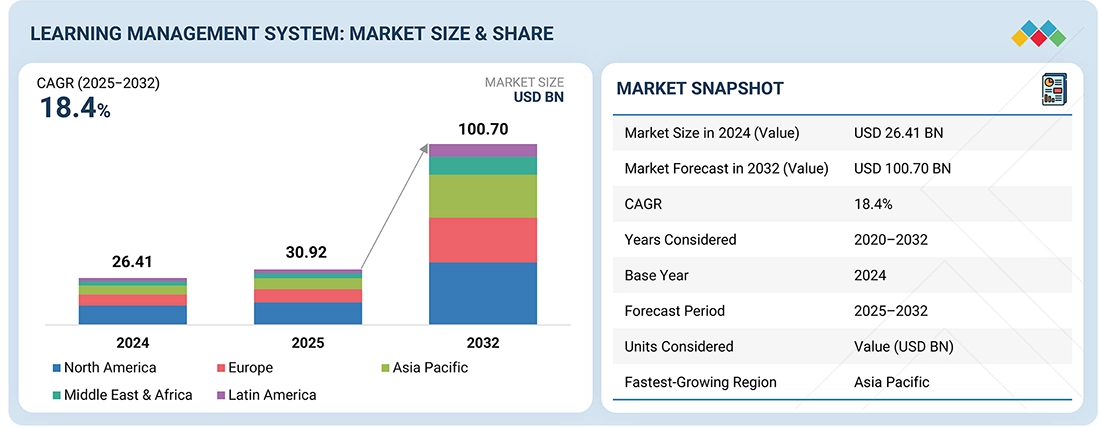

The learning management system market is projected to rise from USD 30.92 billion in 2025 to USD 100.70 billion by 2032 at a CAGR of 18.4%. Market growth is largely driven by organizations and institutions moving toward digital learning. Additionally, companies are using learning management system platforms for upskilling, reskilling, onboarding, and compliance training. Moreover, the rise of remote and hybrid work has propelled the need for online learning tools. Schools and universities are also expanding e-learning and blended learning models. Cloud-based and mobile learning platforms are making learning management system easier, scalable, and more affordable to use. The adoption of AI, analytics, and personalized learning is further improving learning outcomes and driving demand. Overall, learning management system has become an essential tool for continuous learning and workforce development.

KEY TAKEAWAYS

-

By RegionNorth America is estimated to account for largest market share in the learning management system market in 2025.

-

By OfferingBy offering, the solutions segment is estimated to account for a market value of USD 23.26 billion in 2025.

-

By ApplicationBy application, the corporate training & development segment is projected to grow at the highest CAGR of 20.7% during forecast period.

-

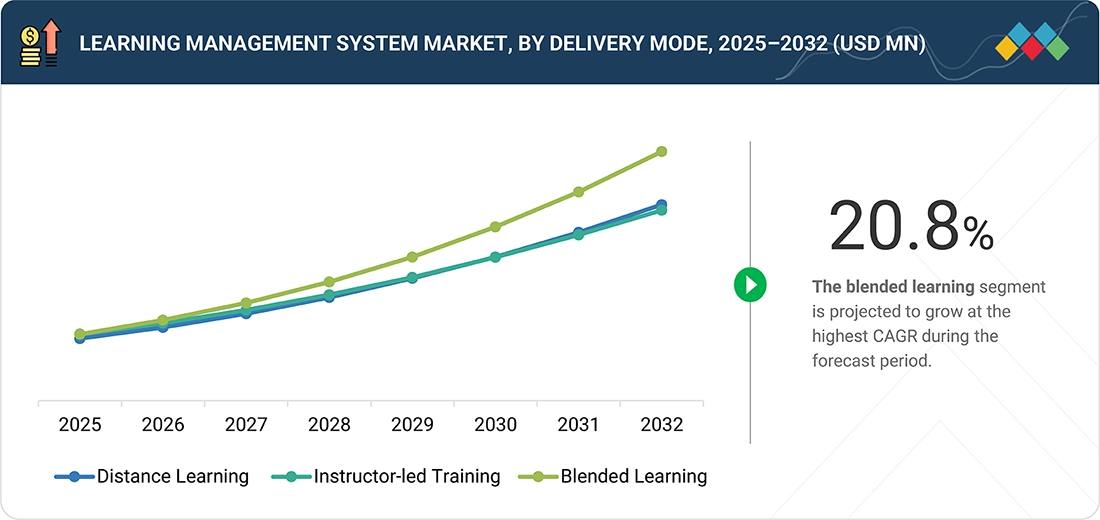

By Delivery ModeBy delivery mode, the instructor-led training is expected to account for the largest market share in 2025.

-

By Organization SizeBy organization size, the SMEs segment is projected to grow at a higher CAGR than the large enterprises segment during forecast period.

-

By User TypeBy user type, the academic users segment is expected to account for the largest market share during forecast period.

-

Competitive Landscape - Key PlayersIn the learning management system market, major players such as Cornerstone OnDemand, Anthology, Moodle, D2L Corporation, and IBM are strengthening their presence through product enhancements, partnerships, technology upgrades, and platform expansion. These companies focus on improving AI-based learning features, personalization, analytics, mobile access, and compliance support to meet the rising need for efficient digital learning. Their strong portfolios help organizations manage large-scale training, support continuous learning, and improve workforce and student performance across different sectors.

-

Competitive Landscape - Startups/SMEsTovuti LMS, SkyPrep, TalentLMS, Acorn LMS, and LearnWorlds have identified themselves as startups/SMEs. These companies are gaining market attention with flexible, easy-to-use, and cost-effective learning management system platforms. They focus on simple deployment, user-friendly design, strong customization, and quick integration to support small and mid-sized businesses, training providers, and institutions. Their solutions help organizations modernize learning, improve engagement, and meet specific training needs in a more accessible way.

Organizations are using learning management system platforms to train employees, build skills, and handle compliance needs in a simpler and more organized way. Schools and universities are depending more on learning management system platforms for online and blended learning. Cloud and mobile-based platforms are making learning easy to access from anywhere. AI features are helping personalize learning and improve outcomes. Overall, learning management system is moving from a support tool to a core part of learning and workforce development.

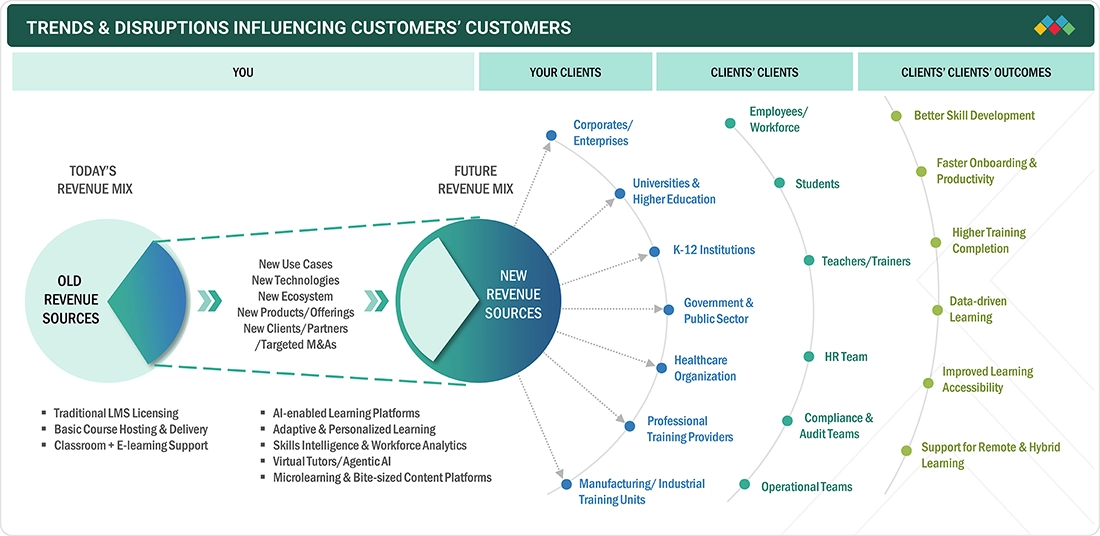

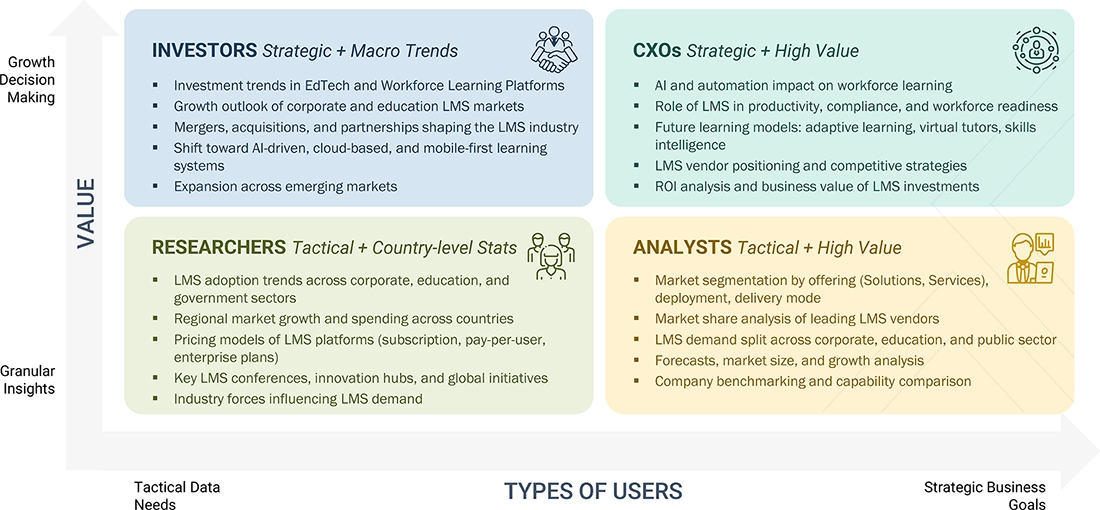

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The learning management systems business is being shaped by the growing shift toward digital learning and wider use of AI in training. Organizations are moving toward smarter platforms that personalize learning, track progress, and support real-time guidance. Remote and hybrid work has increased the need for reliable online learning systems. Mobile learning and short learning modules are becoming common, as users want simple and flexible learning options. Cloud-based learning management system platforms are replacing older systems because they are easier to use and scale. There is also a stronger focus on skills development, compliance training, and continuous learning, which is changing how learning management system platforms are built and used in different sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for customized learning experiences

-

Rising demand for skill-based and objective-driven training

Level

-

Enterprise resistance in moving traditional training content to microlearning formats

-

Difficulty in tracking performance and measuring ROI

Level

-

Rising adoption of adaptive learning solutions

-

Incorporation of advanced technologies for better training environment

Level

-

Absence of multi-language support in learning management system platforms

-

Lack of technical training for teachers and instructors

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for customized learning experiences

The demand for customized learning experiences is increasing as different learners have different needs, roles, and learning speeds. Many organizations now prefer learning management system platforms that can adjust training content based on job requirements, skill levels, and learning progress. This helps make training more useful and relevant instead of giving the same content to everyone. Customized learning also supports better understanding, improves participation, and helps learners achieve learning goals more effectively. As a result, learning management system platforms that offer personalization and flexible learning paths are seeing higher adoption.

Restraint: Enterprise resistance in moving traditional training content to microlearning formats

Many enterprises are hesitant to shift their traditional long training programs into short microlearning formats. They worry that breaking content into smaller modules may leave out important details or reduce training quality. Converting large training material into short, structured lessons also requires time, effort, and investment, which some organizations are not ready for. In many cases, existing training systems and content libraries are designed for long-format learning, which makes the transition more difficult. Some organizations also lack clarity on how to design effective short learning modules. Due to these reasons, many enterprises delay or avoid moving toward microcontent-based learning.

Opportunity: Rising adoption of adaptive learning solutions

The rising adoption of adaptive learning solutions is creating a strong opportunity for the learning management system market. Adaptive learning allows platforms to adjust training based on how each learner performs, which helps make learning more useful and focused. It supports different learning speeds, identifies weak areas, and provides suitable content at the right time. This improves learning outcomes and keeps learners more engaged. Many organizations are now looking for learning management system platforms that can support this kind of personalized learning. As awareness about better learning effectiveness increases, the demand for adaptive learning-enabled learning management system systems continues to grow.

Challenge: Absence of multi-language support in learning management system platforms

The absence of multi-language support in learning management system platforms is a major challenge because many organizations and education institutions serve learners from different regions and language backgrounds. When a platform supports only one language, many users find it difficult to understand content and use the system comfortably. This affects learning participation, reduces engagement, and weakens learning outcomes. It also limits the ability of organizations to run global training programs smoothly. In some regions, this becomes a barrier to learning management system adoption altogether. As a result, lack of multi-language support restricts the wider use and effectiveness of learning management system platforms.

LEARNING MANAGEMENT SYSTEM MARKET SIZE, SIZE, GROWTH & LATEST TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Global workforce training and compliance management using Cornerstone Galaxy Learning Management System | Reduce onboarding time | Improve compliance tracking | Enable consistent global training |

|

Digital learning modernization using Blackboard, digital badging, and learning insights tools | Enable high student engagement | Better course design | Improve employability outcomes |

|

Large-scale, multi-lingual training delivery using Moodle Workplace Learning Management System | Better training access | Strengthen progress tracking | Improve learning efficiency worldwide |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

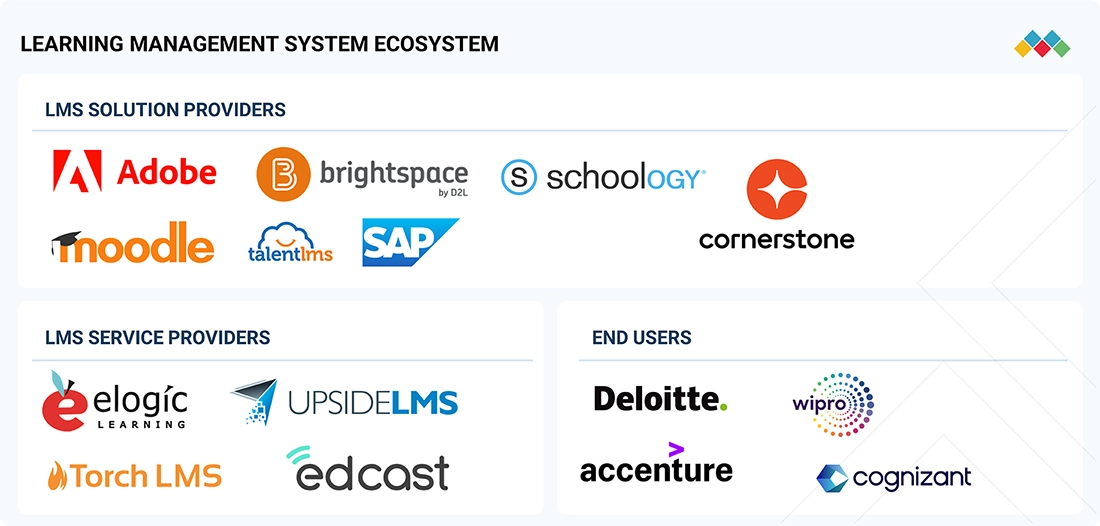

MARKET ECOSYSTEM

The learning management system ecosystem includes LMS solution providers that develop and deliver core learning platforms that support course delivery, learner tracking, assessment, and engagement. It also include LMS service providers that support organizations with platform setup, customization, content services, training, and ongoing technical support. Another important participant of the ecosystem are system integrators. They help enterprises deploy LMS platforms at scale and connect them with other business systems, such as HR, ERP, and analytics platforms. These three participant groups ensure LMS platforms are not only available but also properly implemented, maintained, and integrated. They enable organizations to run structured, reliable, and scalable digital learning programs.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Learning Management System Market, By Offering

The solutions segment is expected to account for a larger share than the services segment during the forecast period as most organizations invest in the core learning platform. Learning management solutions provide essential functions, such as course delivery, content management, assessments, tracking, reporting, and compliance support, which are central to managing training and education programs. With the growing demand for digital learning, remote training, and skill development, organizations need reliable and feature-rich platforms to handle large numbers of learners. The rise of AI, analytics, and mobile learning is also increasing reliance on full learning management solutions rather than basic tools. As a result, spending remains highest on learning management system platforms.

Learning Management System Market, By Delivery Mode

The blended learning segment is expected to grow at the highest CAGR during the forecast period because many organizations and education institutions prefer a mix of online learning and classroom training. This approach allows learners to benefit from digital flexibility and face-to-face support. It helps improve understanding, engagement, and learning outcomes while still keeping training structured. Blended learning also supports personalized learning at a manageable cost. As more institutions move toward flexible learning models, the demand for blended learning through LMS platforms continues to rise.

Learning Management System Market, By Deployment Mode

The public cloud segment is expected to account for the largest market share during the forecast period because most organizations prefer cloud-based platforms that are easy to deploy, cost-effective, and require less IT management. Public cloud learning management solutions do not need heavy hardware investment and allow users to access learning from anywhere. They are also highly scalable and allows organizations to easily handle the growing number of learners. Regular updates, better storage, and stronger security features further support their adoption. As more companies and education institutions move toward flexible digital learning, public cloud learning management system platforms continue to dominate the market.

Learning Management System Market, By Organization Size

The SMEs segment is expected to grow at a higher CAGR than the large enterprises segment during the forecast period because small and medium-sized businesses are investing more in structured digital learning to train their employees. Many SMEs are adopting learning management system platforms to improve workforce skills, support onboarding, and manage compliance training in a simple and affordable way. Cloud-based and subscription-based learning management system models have reduced costs, making it easier for smaller companies to adopt these systems. SMEs also prefer flexible, easy-to-use platforms that do not require large IT setups. As more small and mid-sized firms focus on productivity and skill development, learning management system adoption is increasing rapidly.

Learning Management System Market, By Application

The course management segment is expected to account for the largest market size during the forecast period because managing courses is the core function of most learning platforms. Organizations and education institutions use learning management system to create, organize, deliver, and track training or academic courses in a structured way. Course management helps handle large volumes of learning content, manage enrollments, schedule learning activities, and monitor learner progress. It also supports assessments, certifications, and reporting needs. Since these functions are essential for almost every learning management system user, course management remains the most widely used and highly adopted application area in the market.

Learning Management System Market, By User Type

The corporate segment is expected to grow at the highest CAGR during the forecast period because companies are focusing more on training employees, improving skills, and supporting continuous learning. Many organizations are using learning management system platforms for onboarding, compliance training, and role-based learning. The rise of remote and hybrid work is also pushing businesses to rely more on digital training systems. Cloud-based platforms make it easier and more affordable for companies of all sizes to adopt learning solutions. As businesses aim to stay competitive and build a skilled workforce, learning management system adoption in the corporate sector continues to increase rapidly.

REGION

Asia Pacific is projected to grow at highest CAGR in learning management system market during forecast period

Asia Pacific is expected to grow at the highest rate in the learning management system market during the forecast period. This is because many countries are rapidly moving toward digital learning and modern training systems. Additionally, the growing investments in education technology, rising internet use, and increasing smartphone adoption are supporting wider learning management system usage. Businesses in the region are also focusing more on employee training, skill development, and compliance learning. Governments and education institutions are promoting online and blended learning, which is further increasing demand. The fast-growing economies, expanding corporate sector, and large student population also create strong opportunities. Together, these factors are driving rapid adoption of learning management system across Asia Pacific.

LEARNING MANAGEMENT SYSTEM MARKET SIZE, SIZE, GROWTH & LATEST TRENDS: COMPANY EVALUATION MATRIX

In the learning management market matrix, Cornerstone OnDemand (Star) holds a strong position with a large market presence and a comprehensive learning platform. Its strengths include AI-enabled learning, strong compliance support, advanced analytics, and the ability to manage large and diverse workforces. Cornerstone is widely used across industries such as corporate, government, healthcare, and education, helping organizations strengthen skills and improve workforce readiness. On the other hand, Infor (Emerging Leader) is gaining momentum with its growing learning management system capabilities, focusing on scalable learning, easy integration, and support for industry-specific training needs. With increasing adoption among enterprises looking for flexible and efficient learning solutions, Infor is emerging as a key growth player in the learning management system landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Cornerstone Ondemand (US)

- Anthology (US)

- Moodle (Australia)

- D2L Corporation (Canada)

- IBM (US)

- PowerSchool (US)

- Instructure (US)

- Infor (US)

- Adobe (US)

- LTG (UK)

- Google (US)

- Oracle (US)

- SAP (Germany)

- Docebo (Canada)

- Simpltrain (Switzerland)

- Learning Pool (UK)

- Absorb LMS (Canada)

- CrossKnowledge (France)

- BIZllibrary (US)

- Ispring (US)

- Blue Sky Elearn (US)

- Trakstar (US)

- DigitalChalk (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 26.41 Billion |

| Market Forecast in 2032 (Value) | USD 100.70 Billion |

| Growth Rate | CAGR of 18.4% from 2025–2032 |

| Years Considered | 2020–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Region Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: LEARNING MANAGEMENT SYSTEM MARKET SIZE, SIZE, GROWTH & LATEST TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Learning Management Solution Provider | Global demand mapping for learning management systems across key regions, analysis of enterprise, education and government learning management system usage, study of AI-enabled learning, mobile learning and cloud-based learning management system trends, competitive benchmarking of learning management systems vendors |

|

| Education Institution/University | Regional digital learning readiness assessment, roadmap for hybrid and online learning adoption, best practices for LMS deployment and integration, evaluation of student engagement tools and learning outcomes |

|

| Corporate/Enterprise | Corporate learning management system use case analysis, mapping of training, upskilling and compliance needs, cost-benefit analysis for learning management system implementation, comparison of learning management system platforms for corporate learning |

|

RECENT DEVELOPMENTS

- July 2025 : D2L announced Createspace, a new tool within D2L Brightspace designed to make course creation and collaboration easier for educators. It allows instructors to create, edit, and manage content in one place before publishing it to learners. D2L also introduced several platform enhancements, including better assessment tools, larger group capacity, improved parent visibility, stronger employee learning support, and accessibility features. It launched D2L Academy to provide training resources and upgraded H5P capabilities to support more engaging and efficient content creation.

- May 2025 : Cornerstone announced new partnerships and product innovations at Cornerstone Spark in Las Vegas to help organizations prepare for a future workforce that includes humans and AI agents. The company introduced collaborations with Microsoft and Salesforce to bring AI-driven workforce tools directly into everyday work platforms. Cornerstone also revealed upcoming upgrades in skills intelligence, AI capabilities, immersive learning, and a new mobile app to support frontline workers. These developments aim to improve workforce readiness, skills planning, and productivity in the coming months.

- May 2024 : Anthology announced a partnership with Obrizum to bring advanced AI-powered adaptive learning to Blackboard users worldwide. The collaboration delivered more personalized learning, better analytics, and improved support for students and educators. By using Obrizum’s AI technology, Anthology enhanced course development, engagement levels, and learning outcomes. This partnership strengthened Anthology’s position in AI-driven EdTech innovation.

Table of Contents

Methodology

The study involved four major activities in estimating the Learning management system market. We performed extensive secondary research to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, we used the market breakup and data triangulation procedures to estimate the market size of the various segments in the LMS market.

Secondary Research

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. We used these sources to identify and collect valuable information for this technical, market-oriented, and commercial LMS market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry's value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market's prospects.

We conducted primary interviews to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs); the installation teams of governments/end users using LMS solutions & services; and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of services, which would affect the overall LMS market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the LMS and other dependent submarkets. We deployed a bottom-up procedure to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. We used the overall market size in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

We used top-down and bottom-up approaches to estimate and validate the LMS market and other dependent subsegments.

The research methodology used to estimate the market size included the following details:

- We identified key players in the market through secondary research. We then determined their revenue contributions in the respective countries through primary and secondary research.

- This procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Learning management system market: Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakup procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying several factors and trends from the LMS market's demand and supply sides.

Market Definition

Learning Management System (LMS) is a software application or web-based platform designed to facilitate the administration, documentation, tracking, and delivery of educational courses or training programs. It is commonly used in educational institutions, corporations, and organizations to manage and organize learning materials and activities. With the help of these solutions, companies and institutions can provide specialized training to their employees and students in the most interactive manner.

Key Stakeholders

- IT Service Providers

- LMS Vendors

- Learning Service Providers

- Software Providers

- E-learning Course Providers

- System Integrators

- System Administrators

- Internet Service Providers (ISPs)

- Corporate Trainers

- Compliance Regulatory Authorities

- Cloud Service Providers (CSPs)

- Government Authorities

Report Objectives

- To define, describe, and forecast the LMS market based on offerings, delivery modes, organization sizes, deployment types, application areas, user types, and regions

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the macro and micromarkets1 concerning growth trends, prospects, and their contributions to the overall market

- To analyze the industry trends, patents and innovations, and pricing data related to the LMS market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies across segments and subsegments.

- To track and analyze the competitive developments, such as mergers and acquisitions, product developments, and partnerships and collaborations in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Learning Management System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Learning Management System Market