Microbiology Testing Market Size, Growth, Share & Trends Analysis

Microbiology Testing Market by Product [Instrument, Reagent & Kit, Consumable], Technology [Traditional (Manual Counting, Culture), Rapid (Nucleic Acid, Viability)], End User [Pharma, Biotech, Food, Water, Environmental Testing]-Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

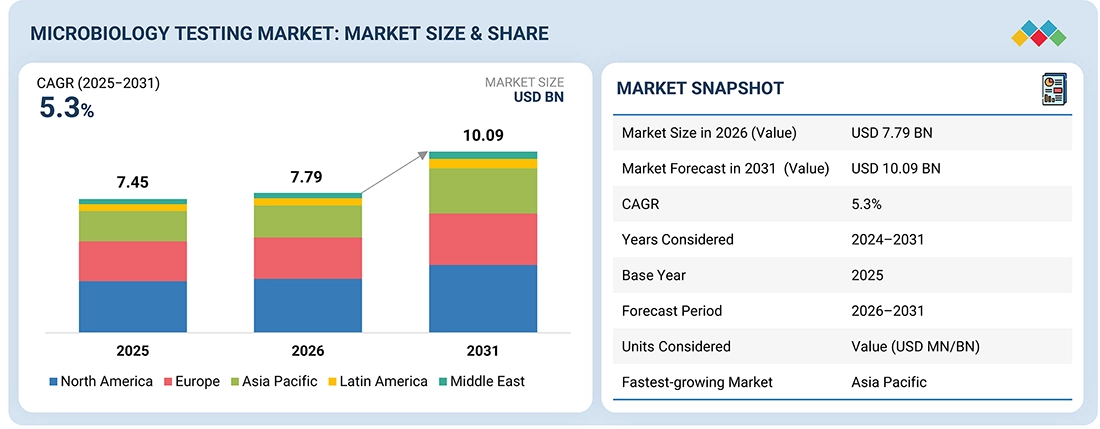

The global microbiology testing market, valued at USD 7.45 billion in 2025, stood at USD 7.79 billion in 2026 and is projected to advance at a resilient CAGR of 5.3% from 2026 to 2031, culminating in a forecasted valuation of USD 10.09 billion by the end of the period. The major factors driving the growth of the market include the rising need for contamination control, rising government regulations in various sectors and continuous innovation in microbiology testing. The rising need for quality assurance in the food, water, pharmaceutical and environmental industries as well as innovations in testing technology are also fueling the growth of the market. The market faces challenges such as the high cost of advanced testing technology and doubts about the accuracy of results from low-cost testing technology. The opportunities in the market include the rising need for rapid and automated testing technology, the rising focus on product safety and government regulations and innovations in sustainable and efficient testing technology.

KEY TAKEAWAYS

-

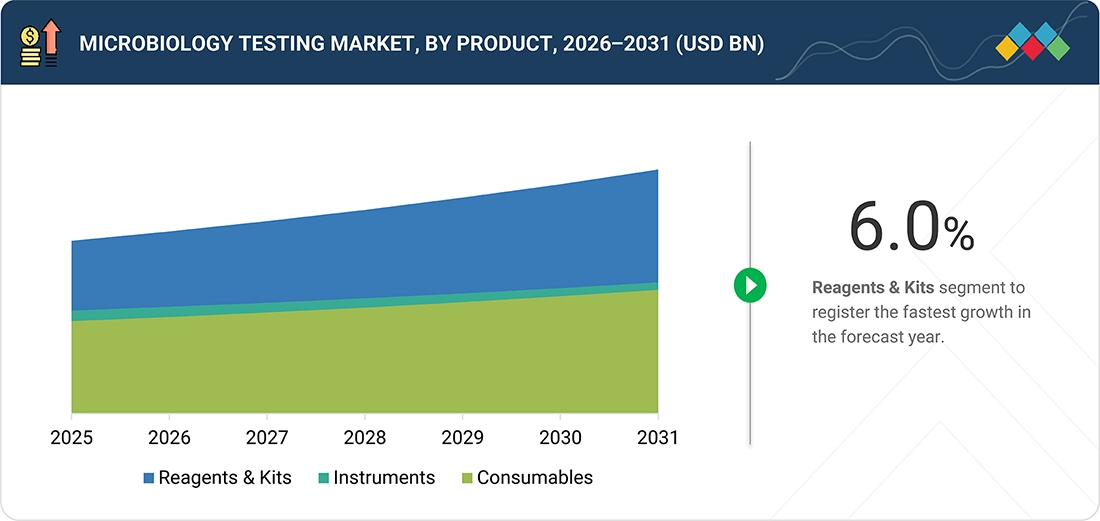

BY PRODUCTThe reagents & kits segment is projected to dominate the market during the forecast period.

-

BY TECHNOLOGYThe Traditional Microbiology Methods (TMM) accounted for the largest market share in 2025 with 63.0% of the shares.

-

BY PATHOGEN TYPEThe bacterial segment accounted for the largest market share in 2025.

-

BY END USERThe Pharmaceutical & Biotech Companies segment is registered to have the fastest growth in the forecasted period of 5.7%

-

BY REGIONThe North America region accounted for the largest market share in 2025 with 38.6% of the shares.

-

COMPETITIVE LANDSCAPEThe global microbiology testing market is steadily growing, driven by strategic partnerships and strong R&D investments. Key players like bioMérieux (France), Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Becton, Dickinson and Company (US), Charles River Laboratories (US), and Neogen Corporation (US) and others leverage diverse product portfolios and innovation to expand globally through collaborations, acquisitions, and new product launches.

The microbiology testing market is driven by the growing focus on contamination control, product safety, and regulatory compliance across industries. Advancements in testing technologies have improved accuracy and efficiency, while increasing production volumes and quality assurance requirements in food, water, pharmaceuticals, and environmental applications continue to support market growth.

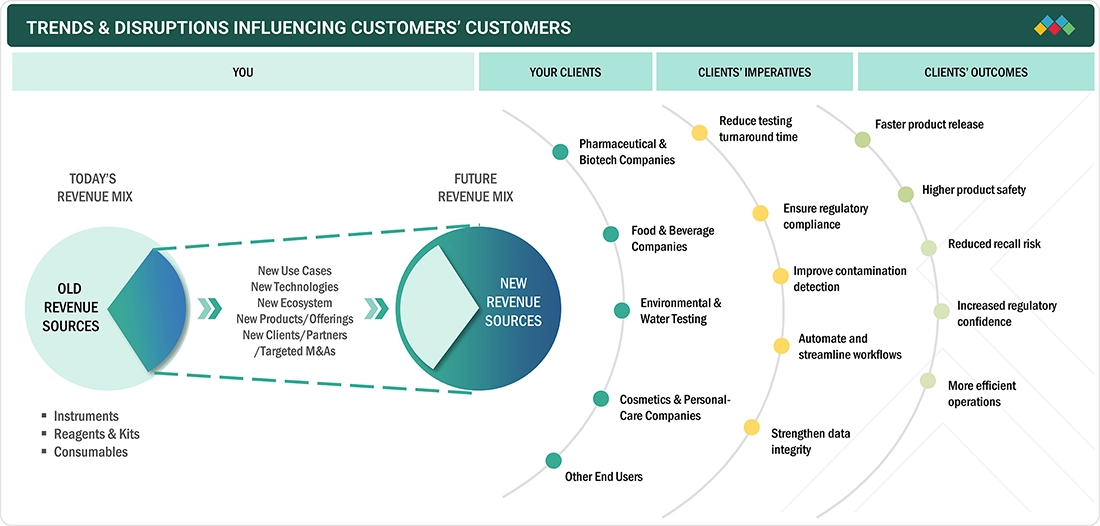

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The microbiology testing market is heavily impacted by shifts in the patterns of industrial demand and quality control measures. The manufacturing units in the pharmaceutical, biotech, food and beverage, water and environmental industries are the key end users of microbiology testing solutions. Shifts in manufacturing processes the use of advanced testing technology or supply chain disruptions in testing products have a direct effect on the volume of testing and the end user demand for microbiology testing solutions. This in turn, affects the demand for microbiology testing solutions and the growth strategies of market players.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Technological advancements in rapid microbiology testing

-

Increased funding for R&D

Level

-

Complexity in testing techniques

-

High Capital investments and low cost benefit ratio

Level

-

Popularity of digital and automated testing platforms

-

Technological advancements in testing industry

Level

-

Operational barriers

-

Increasing cost of procuring microbiology testing equipment

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Technological advancements in rapid microbiology testing

Microbiology testing has moved from traditional culture based testing to rapid microbiological testing technologies to facilitate faster detection, increased efficiency and enhanced contamination control. Although traditional testing is effective it is challenged by the long testing times and the need for human intervention. Rapid testing technologies overcome these challenges through automation, real time monitoring and sophisticated detection systems, which reduce testing times and reliance on human resources. The cost effectiveness, reduced resource requirements and applicability to quality control and quality assurance in food, water, pharmaceutical, biotech, environmental and cosmetic industries have contributed to the increased adoption of rapid microbiology testing technologies. Continued developments in analytical instrumentation and detection systems have broadened the applications of rapid microbiology testing in industrial quality control systems.

Restraint: Complexity in testing techniques

Test results can be affected by technical and operational challenges, especially when samples contain interfering substances, chemical residues or very low levels of contamination. These factors can prevent microbes from being detected, leading to false negative results and potential quality failures which may lead to confusion in the results. This is important to the industry where contamination can trigger product recalls, regulatory penalties or long term damage to brand reputation that can affect the end user. Meeting strict detection limits, validation requirements and regulatory standards also make microbiology tests both labor intensive and costly for the end user.

Opportunity: Popularity of digital and automated testing platforms

The convergence of AI analytics, IoT capable biosensors and automated lab solutions is rapidly changing microbiology testing from a periodic lab based analysis to a real time continuous monitoring process. IoT biosensors and AI analytics enable early contamination detection in food processing, water treatment plants and industrial sites, allowing for quicker action and better compliance. Solutions like IoT refrigeration monitoring, VOC sensors for spoilage detection and intelligent packaging solutions with built in gas sensors improve safety, minimize waste and optimize operational expenses.

Challenge: Operational barriers

Operational barriers are still a major issue in microbiology testing where the processes are labor intensive and time consuming. This makes them prone to errors and reduces their capacity and the lack of standardization in these settings makes it difficult to standardize and audit them. Infrastructure issues, old equipment, poor system integration and shortages of reagents and consumables in the market are some of the factors that hinder the adoption of modern microbiology testing technology.

MICROBIOLOGY TESTING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides microbiology systems for contamination detection. | Improves accuracy and supports regulatory compliance. |

|

Supplies instruments and reagents for microbiology testing. | Enables high-throughput and reliable testing workflows. |

|

Offers culture media and microbiology reagents. | Ensures standardized and consistent quality control. |

|

Delivers microbiology tools and automated systems. | Reduces manual errors and improves efficiency. |

|

Provides rapid tests for food and environmental monitoring. | Enables early detection and routine contamination control. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The microbiology testing market ecosystem comprises a network of manufacturers, distributors, and development partners working together to ensure adequate microbial control in the acquired products. Manufacturers drive innovation by microbiology testing products. Distributors, logistics companies and group purchasing organizations provide for the timely distribution and availability of products in the market. Pharmaceutical & biotech companies, food & beverage companies, environmental & water testing and cosmetics & personal care companies are the major end users who adopt microbiology testing products to enhance patient safety. Strategic collaborations, technological developments and investments are increasing the accessibility of microbiology testing products.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Microbiology Testing Market, By Product

The microbiology testing market is divided into three main segments based on product: instruments, reagents & kits, and consumables. Due to their frequent use, broad applicability throughout routine and specialized testing, and crucial function in sample preparation, microbe detection, and identification, reagents and kits comprise the largest section of the microbiology testing market. Reagents and kits are utilized continuously throughout testing workflows, creating steady demand, in contrast to equipment, which are capital purchases. Contamination monitoring, quality control, and regulatory compliance in pharmaceuticals, biotechnology, food, water, and environmental testing are just a few of the many uses for them. Furthermore, the growing use of standardized, ready-to-use kits enhances testing accuracy, lessens operator reliance, and facilitates quicker turnaround times, all of which contribute to this segment's supremacy.

Microbiology Testing Market, By Technology

The traditional microbiology techniques occupy the largest market in the technology segment, as they have been proven reliable and accepted by the regulatory bodies and have been in use for a long time. The traditional techniques include culture-based techniques and manual counting, which are regarded as gold standards for microbial detection and identification. The traditional techniques are cost effective, require less infrastructure, and are well understood by laboratory personnel, making them the dominant techniques despite the availability of rapid and advanced techniques. The regulatory guidelines and standard operating procedures are also based on the traditional techniques, making them the dominant techniques in the market.

Microbiology Testing Market, By Pathogen Type

the bacterial segment accounted for the largest share in the microbiology testing market in 2025. Bacteria have the largest market share in the pathogen type market for microbiology testing because of their significant impact on the safety and quality of products. Bacterial contamination is one of the significant concerns in the food and beverage industry, water treatment and manufacturing industry. Bacterial testing is critical in ensuring that the products meet the safety standards, detecting spoilage and preventing contamination during the manufacturing process.

Microbiology Testing Market, By End User

Based on end user, the microbiology testing market is divided into pharmaceutical & biotech companies, food & beverage companies, environmental & water testing, cosmetic & personal-care companies, and other end users. Among these end users, the pharmaceutical & biotech companies held the largest market share in 2025 for microbiology testing. Pharmaceutical and biotechnology companies represent the largest end user segment in the microbiology testing market due to their strict regulatory requirements, high sensitivity to contamination risks, and continuous need for quality assurance across manufacturing and research processes. Microbial testing is essential at multiple stages, including raw material validation, in-process monitoring, finished product release, and stability testing, driving high testing volumes

REGION

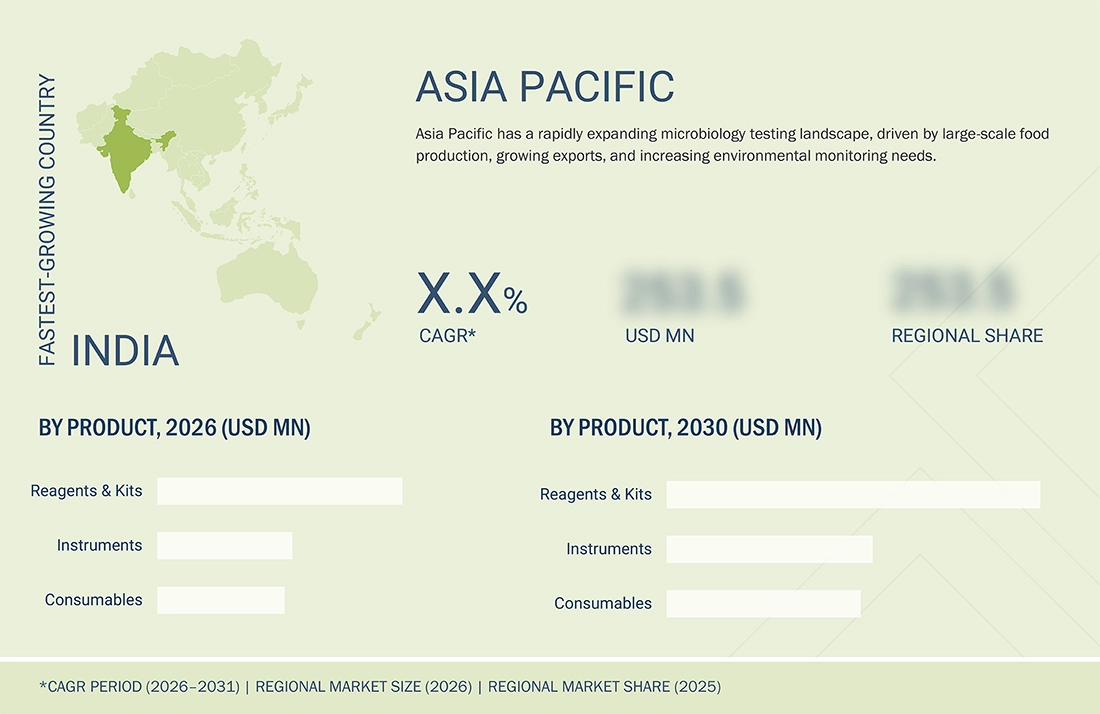

Asia Pacific is projected to be the fastest-growing market of the surgical gowns and drapes market during the forecast period

Asia Pacific represents the most rapidly expanding market in the microbiology testing market and this is attributed to a number of key factors, such as the rapid industrialization of the region, increased investments in the healthcare sector and the growing concern for contamination control in different industries. The region is witnessing a substantial rise in the food and beverage industry, water treatment and environmental monitoring and all these sectors demand extensive microbiological testing to ensure safety and regulatory compliance. Moreover, the improved infrastructure of the healthcare sector along with growing awareness regarding food safety and public health is also contributing to the demand for testing solutions.

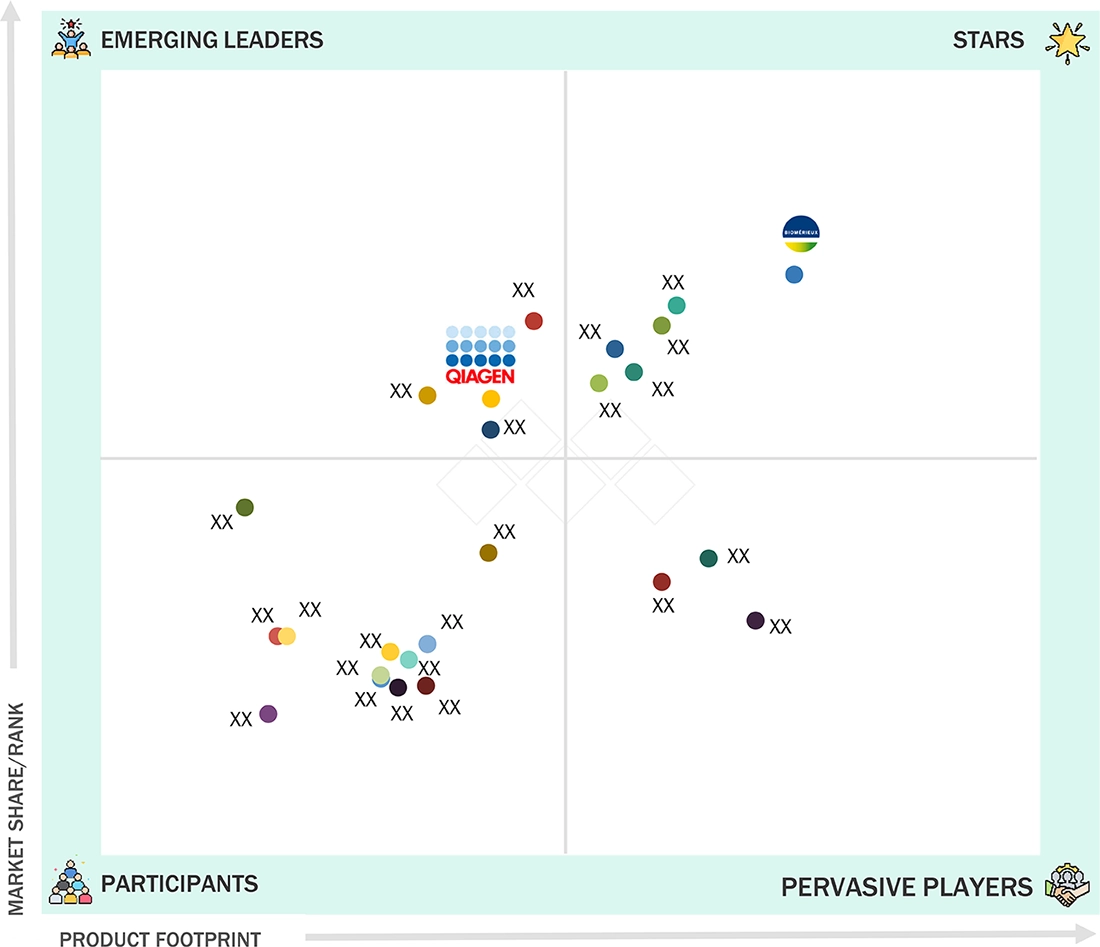

MICROBIOLOGY TESTING MARKET: COMPANY EVALUATION MATRIX

bioMérieux (France) (Star) is an important player in the microbiology testing industry because of its broad range of high quality diagnostic and microbiology products. The company’s strong emphasis on innovation, strict regulatory compliance and efforts to meet the growing demands of microbiology testing have made it a reliable source in the industry. bioMérieux has an established global presence, strong customer base and ongoing focus on research and development which enable it to provide cutting edge microbiology testing systems, reagents and consumables. QIAGEN (Netherlands) (Emerging leader) is one of the most important emerging market players recognized for its innovative approach to offer high quality microbiology testing.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- bioMérieux (France)

- Thermo Fisher Scientific Inc. (US)

- Merck KGaA (Germany)

- Becton, Dickinson and Company (US)

- Neogen Corporation (US)

- Bio-Rad Laboratories, Inc. (US)

- QIAGEN (Netherlands)

- Bruker (US)

- Shimadzu Corporation (Japan)

- Charles River Laboratories (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2026 (Value) | USD 7.79 Billion |

| Market Forecast in 2031 (Value) | USD 10.09 Billion |

| Growth Rate | CAGR of 5.3% from 2026 to 2031 |

| Years Considered | 2024–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Product (Instruments (Incubators, Microscopes, Colony Counters, Mass Spectrometers, Automated Culture Systems, Other Instruments), Reagents & Kits, Consumables), By Technology (Traditional Microbiology Methods (Culture Methods, Microscopy Methods, Manual Counting Methods, Staining Techniques, Other Traditional Microbiology Methods), Rapid Microbiology Methods (Growth-Based Rapid Microbiology Testing, Cellular Component Based Rapid Microbiology Testing, Nucleic Acid-Based Rapid Microbiology Testing, Viability Based Rapid Microbiology Testing)), By Pathogen Type (Bacterial, Viral, Fungal, Other Pathogens), By End User (Pharmaceutical & Biotech Companies, Food & Beverage Companies, Environmental & Water Testing, Cosmetics & Personal-Care Companies, Other End Users) |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

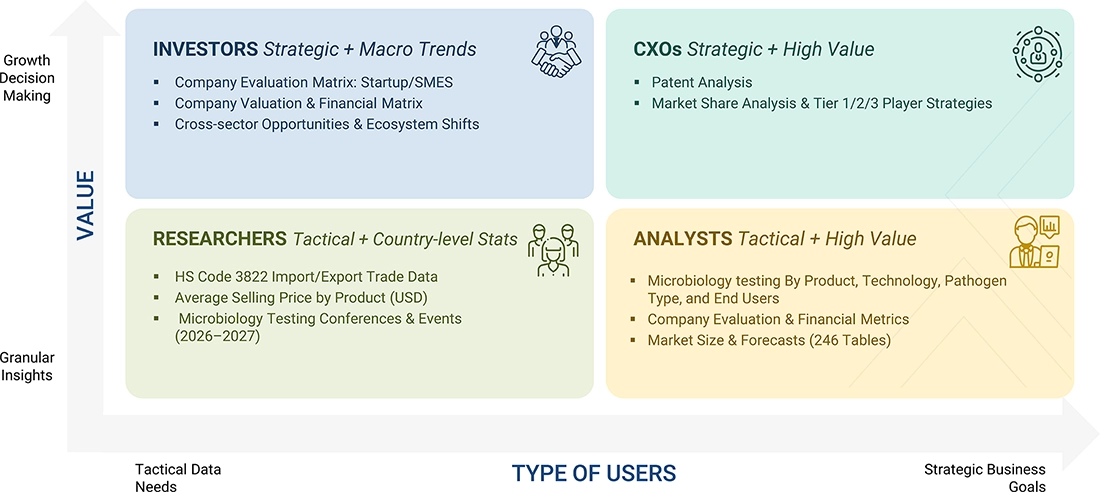

WHAT IS IN IT FOR YOU: MICROBIOLOGY TESTING MARKET REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- November 2025 : Thermo Fisher Scientific introduced the Thermo Scientific SureTect Beverage Spoilage Multiplex qPCR Assay, developed in collaboration with Coca-Cola Europacific Partners. Integrated into the SureTect PCR System, the assay enables early, accurate detection of beverage spoilage organisms, supporting proactive quality control across beverage production workflows.

- February 2025 : bioMérieux launched GENE-UP TYPER, an innovative diagnostic solution for food industries to rapidly analyze the root cause of contamination of Listeria monocytogenes

- February 2025 : Merck’s Life Science business has entered into a global distribution and collaboration agreement with Rapid Micro Biosystems, expanding worldwide access to the Growth Direct platform. The partnership broadens Merck’s global sales channels while creating opportunities for collaboration across supply chain efficiencies, service offerings, and joint product development.

- June 2023 : Becton, Dickinson and Company opened a new USD 4.69 million (€4 million) research and development facility in Blackrock, Dublin, and announced an additional USD 35.18million (€30 million) investment to expand its manufacturing facility in Enniscorthy, Wexford.

Table of Contents

Methodology

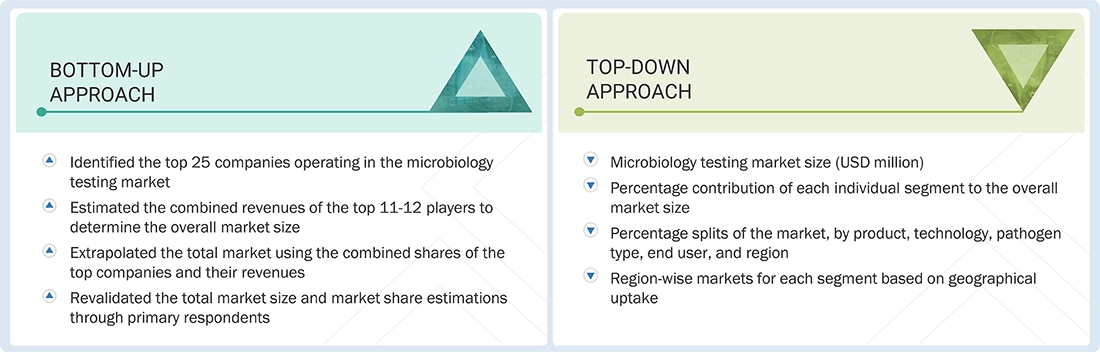

The objective of the study is to analyze the key market dynamics of the microbiology testing sector, including drivers, opportunities, restraints, challenges, and key player strategies. It aims to monitor developments across leading players, including acquisitions, product launches, expansions, agreements, and partnerships. The competitive landscape is evaluated to assess market players across various parameters within the broad categories of business and product strategy. The market size is estimated using top-down and bottom-up approaches, while market breakdown and data triangulation methods are employed to determine segment and subsegment sizes.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

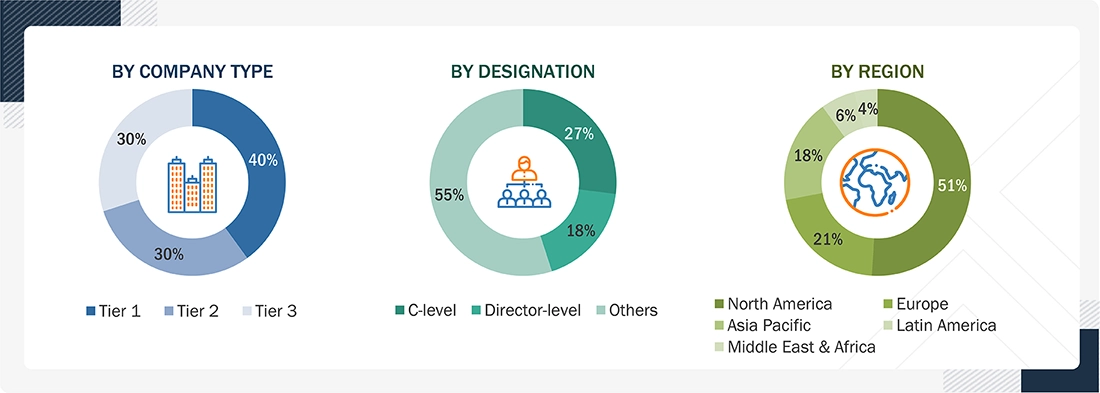

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources included industry experts from core and related industries, as well as preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as assess prospects.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2025, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = <USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the small satellite market.

The top-down and bottom-up approaches were used to estimate and validate the total size of the microbiology testing market. These methods were also widely used to estimate the sizes of various market segments. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The revenues generated by leading players operating in the microbiology testing industry have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Microbiology Testing Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the above-mentioned process, the total market was divided into several segments and subsegments. To complete the overall market engineering process and obtain precise statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, as applicable. The data was triangulated by examining various factors and trends on both the demand and supply sides.

Market Definition

Microbiology testing involves the identification, quantification, and analysis of microorganisms, including bacteria, viruses, fungi, and protozoa, and plays a critical role in ensuring product safety, protecting public health, and preserving environmental integrity. These tests are widely used across pharmaceutical and biotech companies, food and beverage companies, environmental and water testing, cosmetics and personal-care companies, the agriculture and animal feed industry, and academic and research institutes, where they support quality control, regulatory compliance, contamination monitoring, and scientific research activities.

Key Stakeholders

- Manufacturers & distributors of microbiology testing solutions

- Food & beverage companies

- Environmental and water testing organizations

- Pharmaceutical & biotechnology companies

- Cosmetics & personal care companies

- Agriculture & animal feed industry

- Contract testing laboratories

- Academic & research institutes

- Government and regulatory bodies

- Market research & consulting firms

- Venture capitalists & investors

Report Objectives

- To define, segment, and forecast the global microbiology testing market by product, technology, pathogen type, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall microbiology testing market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to six regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

- To benchmark players within the microbiology testing market using the company evaluation matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Available customizations:

MarketsandMarkets offers the following customizations for this market report.

Company Profiles

- An additional five company profiles of players operating in microbiology testing.

Regional Analysis

- Further breakdown of the market segments at the country level

Country Information

- Additional country-level analysis of microbiology testing

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Microbiology Testing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Microbiology Testing Market