Middle East & Africa Identity Verification Market

Middle East & Africa Identity Verification Market by Service, Application (Access Control & User Monitoring, KYC, KYB & Onboarding, Identity Fraud Compliance & Forensics), & Type (Biometrics, Non-Biometrics) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Middle East and Africa identity verification market is projected to reach USD 2.38 billion by 2030 from USD 1.17 billion in 2025, at a CAGR of 15.2% during the forecast period. The increasing adoption of digital technologies and the rise in telecommuting are driving the demand for secure identity verification systems. Investments in digital banking, mobile payment systems, e-government platforms, and telecommunications identity verification are on the rise. Key countries like the UAE and Saudi Arabia are advancing their national digital identity initiatives, while many African economies are improving biometric SIM card registration and mobile money verification systems.

KEY TAKEAWAYS

-

BY COUNTRYBy country, South Africa is projected to grow at the fastest rate during the forecast period.

-

BY OFFERINGBy offering, the services segment is estimated to grow at the highest CAGR during the forecast period.

-

BY TYPEBy type, the biometrics segment is expected to witness the highest CAGR of 17.2% during the forecast period.

-

BY ORGANIZATION SIZEBy organization size, the large enterprises segment is expected to account for the largest market share from 2025 to 2030.

-

BY DEPLOYMENT MODEBy deployment mode, the cloud segment is projected to grow at the highest CAGR of 16.7% during the forecast period.

-

BY APPLICATIONBy application, the KYC, KYB, & onboarding segment is expected to hold the largest market size during the forecast period.

-

BY VERTICALBy vertical, the gaming & gambling segment is projected to register the highest CAGR of 21.6% from 2025 to 2030.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSIdemia, LexisNexis Risk Solutions, and Experian stand out in the Middle East and Africa. Their cutting-edge biometric technologies and ready-to-use solutions help governments implement national ID programs and expand their digital services.

-

COMPETITIVE LANDSCAPE - STARTUP & SMEAmong startups, Shufti Pro, AU10TIX, and Digified are growing rapidly. Their dynamic, AI-driven solutions are particularly well-suited for the fintech sector and money transfer services.

The expansion of online shopping and mobile commerce in the Middle East and Africa is reshaping identity verification needs. Investment is increasing in cross-border e-commerce, digital marketplaces, and last-mile delivery platforms. Countries such as Saudi Arabia and the UAE are linking digital identity systems to e-commerce and logistics ecosystems, while African markets are using identity checks to support mobile merchants and informal sellers. Advanced identity checks reduce transaction risk and help businesses scale digital operations with minimal friction.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Middle East & Africa identity verification market is transitioning from traditional solutions to AI-based biometrics and automated verification. The increasing adoption of digital banking, telecom services, cross-border transactions, and e-governance services is contributing to this shift. The growing threat of fraud and subsequent industry regulations have made these developments inevitable. The BFSI, government, telecom, fintech, and travel industries in the Middle East & Africa thus require secure, user-friendly verification solutions. The next phase in this market will be driven by the growing prevalence of synthetic identities and deepfake fraud. Mobile services and remote onboarding in the industry are altering the demands for verification solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of national digital ID and e-government programs

-

Growth of digital banking, fintech, and mobile money ecosystems

Level

-

Data privacy and regulatory uncertainty

-

Limited awareness and trust in digital identity technologies

Level

-

Growing demand for biometric solutions across public and private sectors

-

Expansion of financial inclusion and digital identity for the unbanked

Level

-

Rising sophistication of fraud and identity crime

-

Integration complexity with legacy and fragmented systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of national digital ID and e-government programs

The rapid rollout of national digital ID systems and growing adoption of e-government platforms are significantly increasing the need for secure, reliable identity verification. As public services, social benefits, and healthcare records move online, strong verification becomes essential to ensure trust, reduce fraud, and streamline citizen interactions. This shift is driving widespread adoption of biometrics, remote onboarding, and AI-enabled verification technologies.

Restraint: Data privacy and regulatory uncertainty

Fragmented data protection laws and unclear regulations remain a key restraint for identity verification adoption. Organizations face uncertainty around biometric data use, user consent, and data residency requirements, which slows decision-making. Inconsistent enforcement and changing privacy expectations add further complexity. These restraints increase compliance effort and operational risk, especially for cloud-based, AI-driven, and cross-border identity verification solutions.

Opportunity: Growing demand for biometric solutions across public and private sectors

One of the major opportunities in the Middle East & Africa identity verification market is the growing demand for biometric solutions from both the public and private sectors. The growth of fingerprint, facial, and iris recognition technologies is being propelled by rapid digitalization, rising security concerns, and government-run identity programs. These solutions facilitate safe citizen services, financial inclusion, border control, and fraud prevention in the region.

Challenge: Rising sophistication of fraud and identity crime

The rising prevalence of fraud and identity crime presents a significant challenge for identity verification. Fraudsters are becoming increasingly skilled at exploiting remote onboarding processes using innovative techniques. They utilize deepfakes, fake identities, social engineering tactics, and stolen identification documents. As these methods continue to evolve, it is essential for organizations to stay one step ahead. Implementing layered verification processes can help organizations effectively combat these threats.

MIDDLE EAST & AFRICA IDENTITY VERIFICATION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implementation of Jumio’s identity verification to automate KYC onboarding for iCard, replacing a five-minute manual video-chat identity check and enabling instant ID authenticity and selfie matching at scale. | Eliminated slow manual video checks, increased onboarding efficiency, and fraud detection | Delivered a 35% lift in conversion in the first year and reduced manual review costs while maintaining compliance. |

|

Deployment of Trulioo’s Global Identity Platform and data sources to verify customers for eToro’s international onboarding as the platform expanded into new markets. | Provided high match rates via a large marketplace of data sources, enabled rapid market expansion with compliant customer onboarding, reduced manual KYC workload and improved onboarding completion as eToro scaled globally. |

|

Implementation of GBG’s ID verification solution (via ID3global) for Revolut to accelerate user identity verification during sign-up and KYC, cutting manual processes and streamlining onboarding. | Sign-up time drastically dropped (from ~70 minutes to ~2 minutes), improving user experience and pass-rate. This speed and reliability helped onboarding scale for a large global customer base, while reducing risk and compliance overhead. |

|

Implemented biometric enrollment and secure ID issuance for civil registries, enabling large-scale national identity programs. | Reduced identity fraud, ensured unique identification, enabled public service access, and supported social inclusion. |

|

Automated ID, video, and biometric verification for payments, gaming, and telecom to meet KYC/AML. | Faster customer onboarding (under 60 seconds in many cases), lower fraud risk thanks to AI and biometric checks, global scalability, and improved user experience. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Middle East & Africa identity verification ecosystem comprises biometrics, authentication facilities, document checks, identity databases, fraud detection systems, and compliance platforms that work together to provide a secure approach to identity verification. Biometric and authentication layers establish a user’s identity, while verification platforms support compliant onboarding and risk assessment. Sectors such as BFSI, retail, healthcare, government, and gaming rely on these capabilities to minimize fraud, protect sensitive information, and secure digital interactions in an increasingly online environment.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Middle East & Africa Identity Verification Market, by Offering

The solutions segment is expected to account for the largest revenue share in 2025, driven by growing demand for safe, automated identity verification services. Organizations are employing AI-driven document verification solutions, biometric verification, and risk analysis to combat the growing threats related to fraud. These solutions help to improve the security and accelerate onboarding.

Middle East & Africa Identity Verification Market, by Type

The biometric solutions segment is expected to lead the Middle East & Africa identity verification market in 2025, as governments, banks, and enterprises accelerate adoption of fingerprint, facial, iris, and voice authentication. These technologies offer high accuracy, convenience, and real-time identity assurance, helping combat identity theft and digital fraud. Their uptake is particularly strong in financial services, public-sector authentication programs, healthcare access systems, and telecom SIM registration environments.

Middle East & Africa Identity Verification Market, by Organization Size

The large enterprises segment is anticipated to capture the largest revenue share in 2025, supported by the need to manage vast user databases, strengthen compliance, and mitigate fraud risks. Large banks, telecom operators, government agencies, and MNCs increasingly deploy advanced identity verification platforms with biometric checks, automated KYC workflows, and continuous monitoring to secure transactions, maintain audit integrity, and support multi-location operations.

Middle East & Africa Identity Verification Market, by Deployment Mode

On-premises solutions are expected to account for the largest share of the Middle East & Africa identity verification market in 2025. It is preferred for achieving total control over citizen and customer information. Stringent data sovereignty policies have increased demand for on-premises solutions. These solutions can handle a large number of identities and support legacy environments.

Middle East & Africa Identity Verification Market, by Application

The KYC, KYB, and onboarding segment is projected to dominate in 2025, fueled by expanding digital banking, mobile-money services, fintech growth, and rising e-commerce penetration. Organizations are adopting biometric verification, AI-driven document authentication, and automated risk scoring to reduce onboarding fraud, meet regulatory requirements, and improve customer experience. Faster, compliant identity verification has become essential as digital transactions rise across the region.

Middle East & Africa Identity Verification Market, by Vertical

The BFSI segment is anticipated to account for the largest share of the Middle East & Africa identity verification market in 2025. The rising adoption of safe digital payment systems, mobile banking, remittance, and instant money transfers is fueling this growth. The growing awareness of digital fraud threats is prompting banks and fintech companies to adopt sophisticated verification technology.

REGION

South Africa to be the fastest-growing region in Middle East & Africa identity verification market during the forecast period

South Africa is one of the fastest-growing identity verification markets in the Middle East & Africa. The rise in digital services, along with a surge in cybercrime incidents, is a key driver of demand for identity verification solutions. As digitalization expands and the need to safeguard user information grows, the adoption of these solutions in South Africa is expected to continue rising.

MIDDLE EAST & AFRICA IDENTITY VERIFICATION MARKET: COMPANY EVALUATION MATRIX

In the Middle East & Africa identity verification market, LexisNexis Risk Solutions (Star) leads with AI-driven identity verification, fraud detection, and compliance solutions across banking, fintech, telecom, and public sectors. IDEMIA (Emerging Leader) strengthens its position through high-assurance biometric authentication, automated document verification, and scalable onboarding. As demand for secure and compliant verification grows, IDEMIA is well positioned to move closer to the leaders’ segment in the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- LexisNexis Risk Solutions (US)

- IDEMIA (France)

- Thales (France)

- Entrust (US)

- Experian (Ireland)

- Jumio (US)

- GBG (UK)

- AU10TIX (Israel)

- Trulioo (Canada)

- uqudo (UK)

- AuthBridge (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.02 Billion |

| Market Forecast in 2030 (Value) | USD 2.38 Billion |

| Growth Rate | CAGR of 15.2% from 2025–2030 |

| Years Considered | 2019–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

WHAT IS IN IT FOR YOU: MIDDLE EAST & AFRICA IDENTITY VERIFICATION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (MEA) | Product Analysis: Middle East & Africa identity verification product landscape offering a detailed comparison of each vendor's solutions, including biometric authentication, AI-powered identity matching, document verification, and fraud detection capabilities. | Enhanced understanding of vendor positioning, product differentiation, and innovation strategies to guide informed business decisions in the Middle East & Africa identity verification market. |

| Leading Service Provider (MEA) | Company Information: In-depth profiling and evaluation of additional market participants (up to 5), highlighting their technological expertise, solution portfolios, product functionalities, and strategic initiatives tailored to the Middle East & Africa region. | Comprehensive view of the regional identity verification ecosystem, highlighting growth opportunities, emerging technological trends, and potential areas for strategic partnerships or collaborative initiatives. |

RECENT DEVELOPMENTS

- December 2025 : Idemia Public Security signed a strategic MoU with Matarat Holding to deploy advanced biometric technologies across 27 airports in Saudi Arabia. This supports Vision 2030 goals for smart, seamless travel and improves passenger experience through digital identity and biometrics.

- October 2025 : Jumio launched selfie.DONE, a reusable identity solution that allows trusted users to re-verify with just a selfie. While launched globally, this enhances ongoing identity workflows for enterprises scaling in MEA with repeat onboarding needs.

- September 2025 : Shufti Pro rolled out a Self-Service Portal that allows businesses to activate identity verification, KYC, and AML workflows instantly, removing procurement delays and helping faster market entry across regions including MEA.

- March 2025 : Experian launched Experian Assistant, an AI-powered virtual assistant in Ascend, streamlining identity verification and real-time fraud analytics for financial institutions.

- February 2025 : Thales introduced the OneWelcome FIDO Key Lifecycle Management solution to manage FIDO security passkeys at scale, strengthening passwordless authentication and simplifying secure access for enterprises.

Table of Contents

Methodology

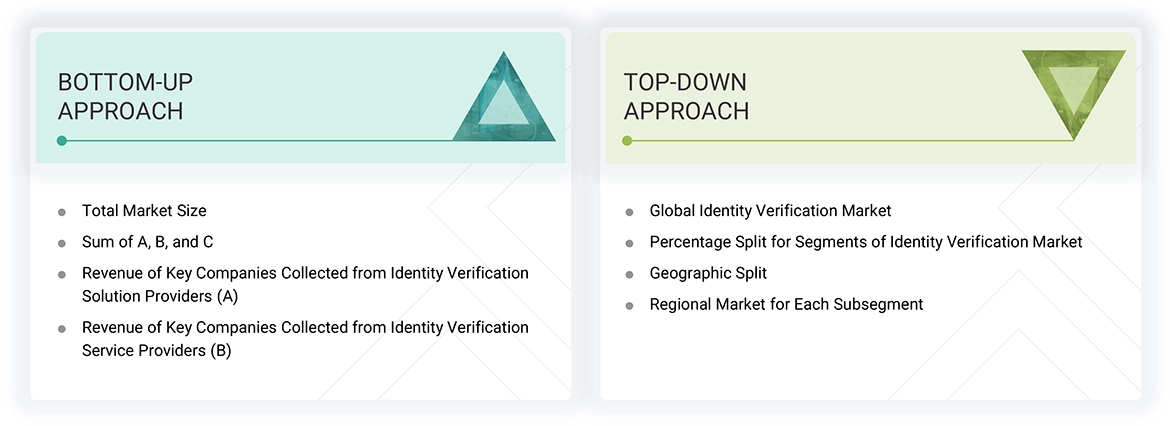

This study involved estimating the current Middle East & Africa identity verification market size. Exhaustive secondary research was carried out to collect information on the Middle East & Africa identity verification industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Middle East & Africa identity verification market.

Secondary Research

The market for companies offering Middle East & Africa identity verification solutions and services was arrived at by using secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of Middle East & Africa identity verification vendors, forums, certified publications, and whitepapers. Secondary research was used to obtain essential information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Middle East & Africa identity verification market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types, industry trends, competitive landscape of Middle East & Africa identity verification hardware, software, and services offered by various market players, and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the Middle East & Africa identity verification market and the size of various other dependent sub-segments. The research methodology used to estimate the market size included the following details: key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, as well as extensive interviews for key insights with industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Middle East & Africa Identity Verification Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to MarketsandMarkets, identity verification is a process of verifying an individual’s identity by using publicly or privately available databases. The solutions offered in the identity verification market help organizations verify an individual's identity quickly and easily, thereby actively improving customer experience and complying with privacy laws, anti-money laundering (AML) legislation, and know-your-customer (KYC) requirements.

Stakeholders

- Government agencies

- Consulting firms

- Information technology (IT) security agencies

- Raw material/component suppliers

- Research organizations and consulting companies

- Government bodies, such as regulating authorities and policymakers

- Venture capitalists and private equity firms

- Chief technology and data officers

- Middle East & Africa identity verification service professionals

- Business analysts

- Information technology (IT) professionals

- Consultants/consultancies/advisory firms

Report Objectives

- To define, describe, and forecast the Middle East & Africa identity verification market based on offering, type, deployment mode, organization size, application, vertical, and region

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the primary factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To profile the key players of the market and comprehensively analyze their market size and core competencies

- To track and analyze competitive developments, such as product launches, mergers and acquisitions, partnerships, agreements, and collaborations in the Middle East & Africa identity verification market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Middle East & Africa Identity Verification Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Middle East & Africa Identity Verification Market