MXene Market

MXene Market by Type (Ti-based, V-based, Nb-based, Mo-based, Others), Production Method (HF Chemical Etching, Fluoride-free Etching, Electrochemical Etching), Form (Powder, Wet Paste), End User, and Region – Global Forecast to 2032

OVERVIEW

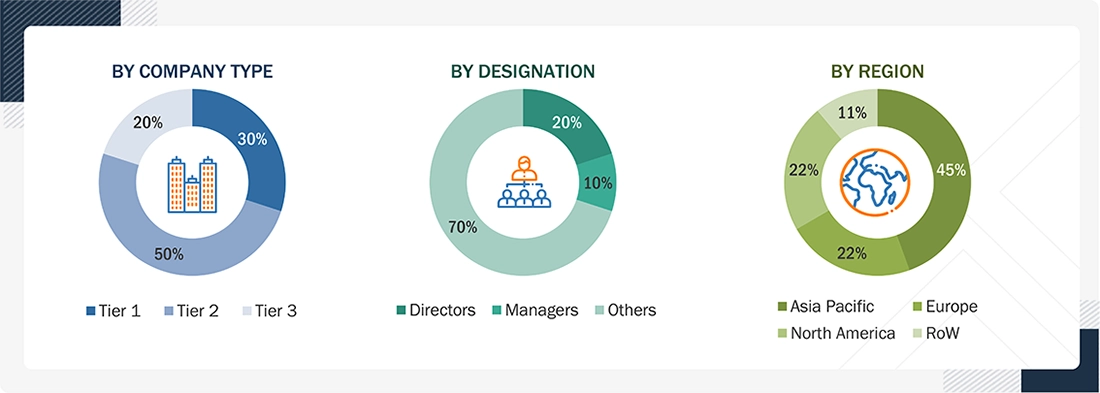

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global MXene market is valued at USD 0.05 billion in 2026 and is projected to reach USD 0.29 billion by 2032, registering a CAGR of 35.6% during the forecast period. Demand is driven by growing use in energy storage systems, such as batteries and supercapacitors, due to high electrical conductivity and surface area. Rising adoption in EMI shielding, sensors, and advanced electronics is further supporting market growth. Increased investments in nanomaterials research and commercialization are accelerating MXene-based applications across industries.

KEY TAKEAWAYS

-

MXENE MARKET, BY REGIONBy region, Asia Pacific is expected to grow at a CAGR of 37.1% during the forecast period.

-

MXENE MARKET, BY TYPEBy type, the Ti based segment is expected to dominate the market during the forecast period.

-

MXENE MARKET, BY PRODUCTION METHODBy production method, the electrochemical etching segment is expected to grow at the highest CAGR during the forecast period.

-

MXENE MARKET, BY FORMBy form, the powder segment dominated the market with a share of 75.5% in 2025.

-

MXENE MARKET, BY END USERBy end user, the energy storage segment is expected to register the fastest CAGR of 40.6% during the forecast year.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSBeijing Beike New Material Technology (China), Merck (Germany), Alfa Chemistry (US), American Elements (US), and XFNANO (China) were identified as some of the star players in the global MXene market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESEpoch Material Co., Ltd. (India), NanoCarbonTech (Poland), and Nanoplexus (UK), among others, have established themselves as specialized MXene material suppliers by building strong positions in high-performance nanomaterials. These companies are strengthening their market presence by offering application-specific MXene formulations for energy storage, EMI shielding, and advanced coatings, while adopting targeted expansion and partnership strategies to scale their commercial footprint in the global MXene market.

Major materials and advanced manufacturing companies are integrating MXene-based materials into energy storage, electronics, and sensing platforms to enhance performance and enable miniaturization. Several MXene producers have expanded the commercialization of MXene powders, inks, and coatings for use in lithium-ion batteries, supercapacitors, EMI shielding, and flexible electronics. These developments are accelerating the adoption of MXenes as a next-generation 2D material and strengthening their role in enabling high-performance, lightweight, conductive material systems across multiple industries, including automotive, consumer electronics, healthcare, and others.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The MXene market is being shaped by a shift from traditional carbon- and metal-based materials toward high-performance 2D materials that enable new applications in energy storage, EMI shielding, and flexible electronics. Growing demand from battery manufacturers, electronics material suppliers, and sensor companies is creating new revenue streams for MXene producers. These trends are driven by end-user industries, including electric vehicles, consumer electronics, and medical devices, that seek lighter, smaller, and more efficient components.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid adoption of MXenes in energy storage for lithium-ion batteries and supercapacitors

-

Growing use of MXenes in electromagnetic interference (EMI) shielding for electronics

Level

-

High cost of MXene synthesis and processing

-

Limited large-scale manufacturing capabilities

Level

-

High cost of MXene synthesis and processing

-

Increasing demand for high-performance EMI shielding in EVs and 5G devices

Level

-

Integrating MXenes into existing manufacturing lines

-

Lack of long-term performance data

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid adoption of MXenes in energy storage for lithium-ion batteries and supercapacitors

The rapid adoption of MXenes in lithium-ion batteries and supercapacitors is driving market growth due to their high electrical conductivity and large surface area, which improve energy density and charging speed. This makes MXenes increasingly attractive for next-generation energy storage systems used in electric vehicles and portable electronics.

Restraint: High cost of MXene synthesis and processing

The MXene market faces constraints due to the high cost of synthesis and processing, as production involves complex etching, purification, and handling of sensitive materials. These cost factors limit large-scale adoption, particularly in price-sensitive applications.

Opportunity: High cost of MXene synthesis and processing

Ongoing research into scalable, low-cost MXene production methods is creating opportunities to lower manufacturing costs and improve material availability. As production processes mature, MXenes are expected to become more commercially viable across multiple industries.

Challenge: Integrating MXenes into existing manufacturing lines

Integrating MXenes into existing manufacturing lines remains a key challenge because of differences in material handling, coating, and processing requirements. Manufacturers need to modify equipment and workflows to fully leverage MXene-based solutions at scale.

MXENE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Beijing Beike supplies MXene powders and dispersions for integration into flexible pressure sensors, wearable electronics, EMI shielding films, and energy-storage electrodes used in consumer electronics, healthcare monitoring devices, and industrial IoT systems | Enables high-sensitivity sensing, lightweight and flexible electronic components, improved signal integrity through EMI shielding, and higher energy density in supercapacitors and batteries, supporting miniaturized and high-performance electronic systems |

|

Merck deploys MXene materials in advanced electronics and life-science applications, including printed electronics, biosensors, electrochemical sensing platforms, and conductive coatings for semiconductor and diagnostic devices | Supports high electrical conductivity, chemical stability, and biocompatibility, enabling faster biosignal detection, improved chip-level interconnects, and reliable functional coatings for next-generation electronics and medical diagnostics |

|

Alfa Chemistry supplies research-grade MXenes for R&D in catalysis, gas sensing, electrochemical energy storage, and surface-functionalized nanomaterials across academic and industrial laboratories | Accelerates materials innovation, enables customized MXene formulations, and supports faster development cycles for energy, sensing, and catalytic applications through high-purity and tunable MXene chemistries |

|

American Elements provides MXene nanomaterials and composites for use in EMI shielding, conductive inks, thermal management coatings, and lithium-ion and sodium-ion battery electrodes for aerospace, defense, and electronics industries | Improves thermal and electrical performance, reduces electromagnetic interference, enhances battery charge–discharge efficiency, and enables lightweight, high-performance material systems for advanced industrial and defense applications |

|

XFNANO supplies MXene nanosheets and colloidal dispersions for flexible electronics, transparent conductive films, water purification membranes, and chemical sensors used in smart devices, environmental monitoring, and filtration systems | Enables high surface area and conductivity, improves water filtration efficiency, supports low-power sensing, and allows thin, transparent, and flexible device architectures for next-generation smart materials and sustainability solutions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The MXene industry ecosystem comprises raw material suppliers and material manufacturers, supported by research institutions advancing MXene synthesis, performance, and applications. Industry associations and standards bodies play a key role in validation, regulation, and technology alignment, while end users across energy storage, electronics, and advanced materials drive commercial adoption and scale-up of MXene-based solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MXene Market, By Type

Ti-based MXenes dominate the market because they offer high electrical conductivity, chemical stability, and ease of processing. These properties make them suitable for major applications, including batteries, supercapacitors, sensors, and EMI shielding.

MXene Market, By Production Method

By production method, electrochemical etching is the fastest-growing because it is safer, more controllable, and more scalable than traditional chemical etching. It yields higher material quality and supports large-volume MXene production for commercial applications.

MXene Market, By Form

The powder form of MXene dominates the market because it is easy to store, transport, and integrate into coatings, inks, electrodes, and composites. This makes it suitable for a wide range of industrial and research-based MXene applications.

MXene Market, By End User

The energy storage end user segment is growing fastest due to rising demand for high-performance batteries and supercapacitors. MXenes improve charge capacity, conductivity, and cycle life, making them attractive for electric vehicles and grid energy storage systems.

REGION

Asia Pacific is expected to be the fastest-growing region across the global MXene market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the MXene market, driven by strong demand from battery manufacturing, electronics, and advanced materials industries across China and India. The region benefits from high investments in electric vehicles, energy storage, and semiconductor manufacturing, which are key application areas for MXenes. In addition, the presence of key regional suppliers, including Beijing Beike New Material Technology (China), Shanghai Hegi Chemical Technology Co., Ltd. (China), and Epoch Material Co., Ltd. (India), is accelerating commercialization and broader adoption of MXene-based materials.

MXENE MARKET: COMPANY EVALUATION MATRIX

In the global MXene market matrix, Beijing Beike New Material Technology and Merck (Star) lead with a strong market presence and a broad MXene product portfolio, driving large-scale adoption across multiple industries, including energy storage, electronics and semiconductors, automotive, aerospace and defense, healthcare and life sciences, water and environmental services, and industrial manufacturing. Otto Chemie Pvt. Ltd. (Emerging Leader) is strengthening its market position through specialized MXene materials for targeted applications such as energy storage research, advanced electronic components, and industrial material development. This focus on application-specific offerings supports growing adoption in niche segments and contributes to the company’s expanding role in the global MXene market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Beijing Beike New Material Technology (China)

- Merck (Germany)

- Alfa Chemistry (US)

- American Elements (US)

- XFNANO (China)

- Japan Material Technologies Corporation (Japan)

- ACS Material, LLC (US)

- 2D Semiconductors (US)

- Otto Chemie Pvt. Ltd. (US)

- SixCarbon Technology (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 0.04 Billion |

| Market Forecast in 2032 (Value) | USD 0.029 Billion |

| Growth Rate | CAGR of 35.6% from 2026–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2025 |

| Forecast Period | 2026–2032 |

| Units Considered | Value (USD BN), Volume (KG) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, RoW |

WHAT IS IN IT FOR YOU: MXENE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Energy Storage Material Manufacturer |

|

|

| Water Purification Technology Developer |

|

|

| EMI Shielding Solutions Provider |

|

|

RECENT DEVELOPMENTS

- January 2026 : Researchers from UChicago PME, in collaboration with the University of Illinois Chicago and Vanderbilt University, have developed a new MXene synthesis method that significantly lowers production costs while improving material quality. The technique, reported in Nature Synthesis, achieves approximately 90% purity, eliminates hazardous chemicals, and reduces manufacturing costs by more than 100-fold compared with conventional processes.

- July 2025 : Drexel University initiated a three-year, USD 5 million multinational research collaboration, named MX-Innovation, focused on scaling MXene nanomaterials for clean drinking water and biomedical applications. The program is supported by Khalifa University’s Research & Innovation Center for Graphene and 2D Materials (RIC2D) and involves academic and industrial partners from Italy and Ukraine to accelerate the commercialization of two-dimensional materials across water, energy, healthcare, and advanced technology sectors.

- May 2024 : Drexel University allocated USD 150,000 each to MXene, Inc., 1DNano, and AER Cosmetics under its Innovation Fund to support the commercialization of nanomaterials and sustainable technologies. The funding accelerated MXene production for multi-sector applications, HDN-based green hydrogen solutions, and low-waste cosmetic innovations.

Table of Contents

Methodology

The research process for this study involved the systematic gathering, recording, and analysis of data on customers and companies operating in the MXene market. This process involved the extensive use of secondary sources, directories, and databases (Factiva and Oanda) to identify and collect valuable information for the comprehensive, technical, market-oriented, and commercial study of the MXene market. In-depth interviews were conducted with primary respondents, including experts from core and related industries, as well as preferred manufacturers, to obtain and verify critical qualitative and quantitative information and assess growth prospects. Key players in the MXene market were identified through secondary research, and their market rankings were determined through a combination of primary and secondary research. This research involved studying the annual reports of top players and conducting interviews with key industry experts, including CEOs, directors, and marketing executives.

Secondary Research

Various sources were utilized in the secondary research process to identify and collect information relevant to this study. These include company annual reports, press releases, investor presentations, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases. Secondary research was primarily used to gather key information about the industry’s value chain, the total pool of market players, market classification according to industry trends at the most detailed level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, including drivers, restraints, opportunities, challenges, and industry trends, as well as the key strategies adopted by players operating in the MXene market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Extensive primary research has been conducted following the acquisition of knowledge about the MXene market scenarios through secondary research. Several primary interviews were conducted with experts from the demand (end user industry and region) and supply side (type, production method, form) across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 60% and 40% of the primary interviews were conducted from the supply and demand sides, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

Notes: The three tiers of companies have been defined based on their total/segmental revenue as of 2025: Tier 1 = > USD 1 billion, Tier 2 = USD 1 billion–USD 500 million, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the small satellite market.

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods were implemented to estimate and validate the size of the MXene market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through a combination of primary and secondary research. This entire research methodology involved studying the annual and financial reports of the top players, as well as conducting interviews with experts (including CEOs, VPs, directors, and marketing executives) to gather key insights (both quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

MXene Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the estimation process, as explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and obtain precise statistics for all segments and subsegments, market breakdown and data triangulation procedures were employed, as applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market has been validated using both top-down and bottom-up approaches.

Market Definition

The MXene market covers the global ecosystem involved in development, production, processing, and commercialization of MXenes. MXenes are two-dimensional inorganic materials derived from MAX phases and are valued for their high electrical conductivity, tunable surface chemistry, and large surface area.

The market is segmented by type such as Ti-based MXenes and V-based MXenes, with additional categories including Nb-based and Mo-based MXenes. Production methods include HF chemical etching and fluoride-free etching, while electrochemical etching represents another key method. The market is also segmented by form, including powder MXenes and wet paste MXenes. MXenes are adopted across energy storage and electronics industries, with growing use in automotive and aerospace applications. Healthcare and industrial manufacturing represent additional end users, while advances in scalable production and material performance optimization continue to support market growth across regions.

Key Stakeholders

- Raw material and MAX phase precursor suppliers

- Chemical etchants and process reagent suppliers

- MXene material manufacturers and producers

- Chemical distributors and specialty material suppliers

- Formulators and application solution integrators

- Equipment and processing technology providers

- End-user industries and OEMs

- Research institutions, academia, and innovation centers

Report Objectives

- To describe and forecast the size of the MXene market, by type, production method, form, and end user industry, in terms of value

- To describe and forecast the market size for four major regions—North America, Europe, Asia Pacific, and RoW, in terms of value

- To describe and forecast the market size, by type, in terms of volume

- To provide a detailed overview of the MXene technologies and throughputs

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges, influencing the market growth

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, value chain analysis, trends/disruptions impacting customers' business, the impact of AI/Gen AI, key conferences and events, pricing analysis, Porter’s five forces analysis, 2025 US tariff impact, and regulations pertaining to the market under study

- To strategically analyze micromarkets with regard to individual market trends, growth prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with a detailed competitive landscape for the market leaders

- To analyze major growth strategies, such as product launches, expansions, joint ventures, and acquisitions, adopted by key market players to enhance their market position

- To describe macroeconomic factors impacting market growth in each region

- To analyze the AI/Gen AI impact on the MXene market

- To analyze the 2025 US tariff impact on the MXene market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the MXene Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in MXene Market