North America Agriculture Micronutrients Market

North America Agriculture Micronutrients Market by Type (Zinc, Boron, Iron, Manganese, Molybdenum, Copper), Mode of Application (Soil, Foliar, Fertigation), Form (Chelated, Non-Chelated Micronutrients), Crop Type and Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

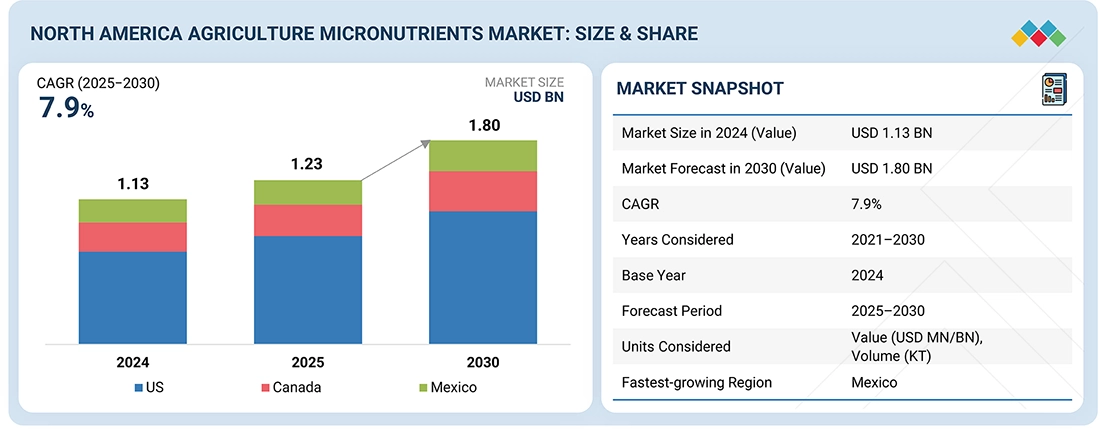

The North America agriculture micronutrients market is expected to grow from USD 1.23 billion in 2025 to USD 1.80 billion by 2030, as more focus is laid on balanced crop nutrition and on agronomic science based practices. Growth in the market is facilitated by increasing demand of micronutrients that improve crop production, quality, nutrient uptake efficiency and stress tolerance of cereals and grains, fruits and vegetables, oilseeds and pulses and other crops. The increasing recognition of the deficiency of micronutrients in soil and the use of modernized practices in fertilization of major agricultural zones remain the major supporting factors of market expansion.

KEY TAKEAWAYS

-

BY COUNTRYThe US is estimated to account for a significant share of 77% in 2025.

-

BY TYPEThe molybdenum segment is expected to dominate the market, accounting for 34.9% in 2025.

-

BY CROP TYPEThe fruits & vegetables segment is projected to register notable growth during the forecast period.

-

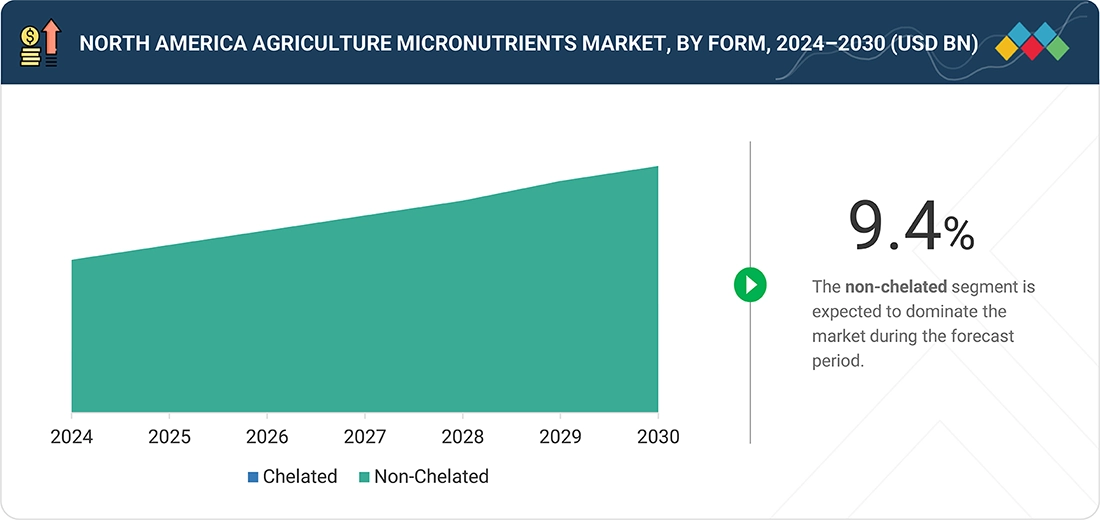

BY FORMThe non-chelated segment is estimated to hold a significant market share of 69.1% in 2025.

-

BY MODE OF APPLICATIONThe foliar segment is estimated to capture 36.9% of the agriculture micronutrients market in 2025.

-

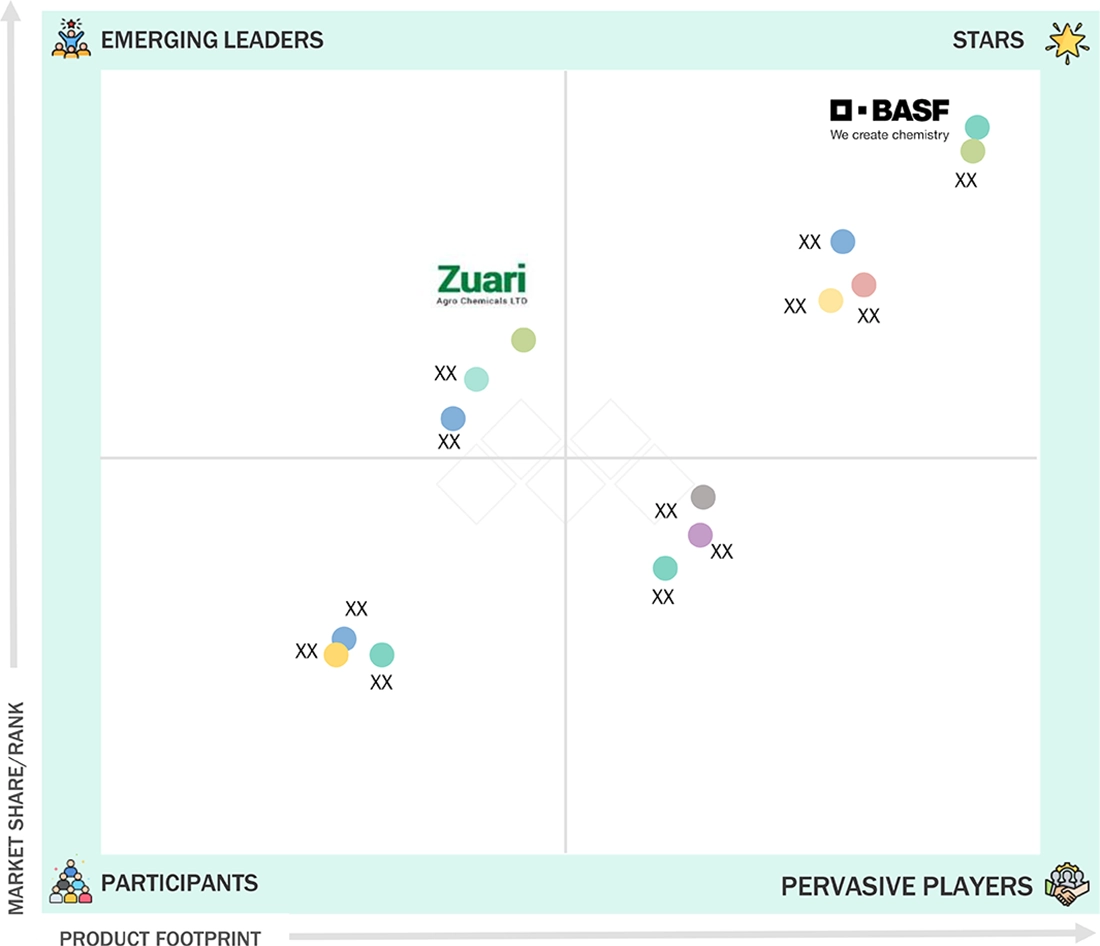

COMPETITIVE LANDSCAPE - KEY PLAYERSBASF SE, Nouryon, Nufarm, Yara International ASA, Syngenta AG, The Mosaic Company and Coromandel International Limited are the players identified as the major players in the agriculture micronutrients market.

-

COMPETITIVE LANDSCAPE - START-UPSManvert, Zuari Agrochemicals, Haifa Negev Technologies, Stoller Enterprises and ATP Nutrition have found base in the emerging players of agriculture micronutrients market.

The micronutrients market of the North America agriculture is steadily growing with the growing attention to the balanced crop nutrition, yield improvement, and efficiency in the usage of the nutrients. The use of micronutrients in the key types of crops is being encouraged by increasing awareness of the existence of micronutrient deficiencies in the soil, the adoption of modern farming techniques, and the application of these techniques.

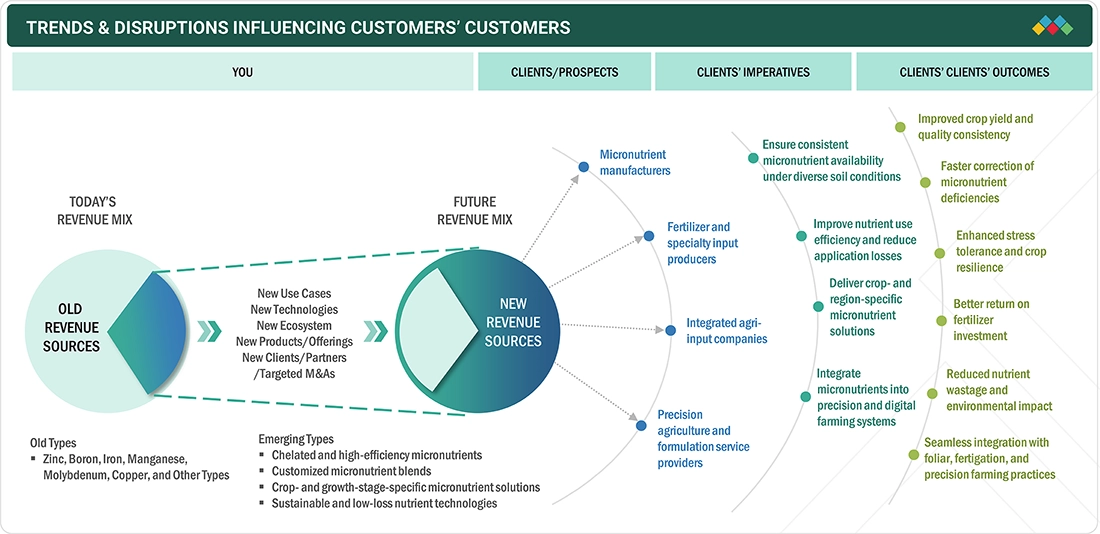

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Shift in customer preferences and agronomic practices directly affect the performance of end users of agriculture micronutrients market. Demand is changing due to the emergence of new areas of interest such as crop-specific nutrition, changing cropping regimes and alteration in application practices. These trends are changing or increasing at a high rate and this is affecting the buying habits and income levels of the end users hence affecting the overall performance and growth potential of the micronutrient companies in North America.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of commercial and intensive farming systems

-

Focus on improving crop yield, quality, and nutrient use efficiency

Level

-

Volatility in raw material and fertilizer input prices

-

Limited awareness and adoption among smallholder farmers

Level

-

Heightened demand for chelated and specialty micronutrient formulations

-

Adoption of precision agriculture and targeted nutrient application

Level

-

Price competition from conventional fertilizer products

-

Regulatory compliance and formulation standardization

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of commercial and intensive farming systems

The growth of commercial and intensive farming systems is raising the demand of using balanced application of micronutrients to combat the shortages of the soils and advance the yield, quality and nutrient efficiency of the crops.

Restraint: Volatility in raw material and fertilizer input prices

Volatility in the prices of fertilizers and raw materials increases the total input cost, constraining the use of micronutrient products especially in farming systems that are price sensitive and smallholder farmers.

Opportunity: Heightened demand for chelated and specialty micronutrient formulations

The increased use of chelated and specialty micronutrients with the help of precision agronomy is providing a new opportunity in terms of targeted and value crop nutrition solutions.

Challenge: Price competition from conventional fertilizer products

Price competition of the more traditional fertilizers and the fact that one has to meet the diverse regional regulations still continues to pose a challenge in the introduction of the advanced micronutrient formulations.

NORTH AMERICA AGRICULTURE MICRONUTRIENTS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Inclusion of chelated micronutrients in cereal, fruits and vegetables to solve nutrient deficiencies in soil to improve crop quantity and quality and sustainable soil management. | Improves nutrient availability, enhances crop yield and quality, and supports sustainable soil management |

|

Application to soil and fertiles Fertilizers enriched with micronutrients Builds balanced crop nutrition, enhances the efficiency of nutrient use, and facilitates precision agricultural activities. | Enables balanced crop nutrition, improves nutrient use efficiency, and supports precision agriculture practices |

|

Application of specialty chelating agents on micronutrient preparations on broad-acre and horticultural crops Increases the stability of micronutrients, enhances uptake in problematic soils, and lowers losses of micronutrients. | Enhances micronutrient stability, improves uptake under challenging soil conditions, and reduces nutrient losses |

|

Application of crop-specific micronutrient solution with crop protection measures enhances health of plants, enhances stress resistance and promotes integrated crop management approaches. | Strengthens plant health, improves stress tolerance, and supports integrated crop management strategies |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of micronutrient manufactures, producers of fertilizer and specialty inputs, distributors, regulatory agencies, research institutions, and end-use farming communities represent the North America agriculture micronutrients ecosystem. It is a rapidly growing, agronomy-based environment that is being developed through growing attention to soil health, nutritious cropping, and the sustainable development of yields. The market is a convergence of developed multinational companies and suppliers in the region which contributes to the creation of high level of micronutrient solutions that improves nutrient availability, crop productivity, stress resistance and long term soil fertility of agricultural systems worldwide.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Agriculture Micronutrients Market, By Type

The molybdenum market segment is estimated to be the most controlling one due to its vitality in the fixation of nitrogen, enzyme functionality, especially in legumes and cereal crops, and its growing use in response to a soil imbalance in nutrients to enhance crop output.

North America Agriculture Micronutrients Market, By Crop Type

The fruits and vegetables segment will experience a significant growth, since horticultural crops are highly sensitive to the use of micronutrients and they need very specific nutrition to enhance the quality of yield, shelf life and appearance.

North America Agriculture Micronutrients Market, By Form

The non-chelated part should have a large market share, as it is cost-effective, has a large availability, and it is used in large-scale farming as well as in small scale.

North America Agriculture Micronutrients Market, By Mode of Application

Foliar segment will dominate the market, which is supposed to be reinforced by fast nutrient absorption, delivery, and the ability to fix micronutrient deficiencies in a large number of crops in short time.

REGION

US is expected to dominate North America agriculture micronutrients market

It is anticipated that the US will control the North America market of micronutrients of agriculture because the country has a large and highly commercial farming industry, is more inclined to adopt advanced practices of crop nutrition, and is more concerned with enhancement of soil health and crop production.

NORTH AMERICA AGRICULTURE MICRONUTRIENTS MARKET: COMPANY EVALUATION MATRIX

In the North America agriculture micronutrients market, leading companies such as BASF SE and Yara International ASA (Star) hold strong market positions, supported by their large-scale production capabilities, extensive micronutrient portfolios, and well-established global distribution networks. Their integration with fertilizer and crop nutrition programs and focus on consistent, science-backed micronutrient solutions strengthen their dominance. Meanwhile, Manvert (Emerging Leader) is expanding its presence through specialized micronutrient blends and customized crop nutrition solutions that address region-specific soil deficiencies and meet evolving crop productivity and quality demands.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- BASF SE (Germany)

- Yara International ASA (Norway)

- Nouryon (Netherlands)

- Syngenta AG (Switzerland)

- The Mosaic Company (US)

- Coromandel International Limited (India)

- Nufarm Limited (Australia)

- Haifa Negev Technologies Ltd (Israel)

- Manvert (Spain)

- Zuari Agrochemicals Ltd (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.13 BN |

| Market Forecast in 2030 (Value) | USD 1.80 BN |

| Growth Rate | CAGR of 7.9% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN), Volume (KT) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | US, Canada, Mexico |

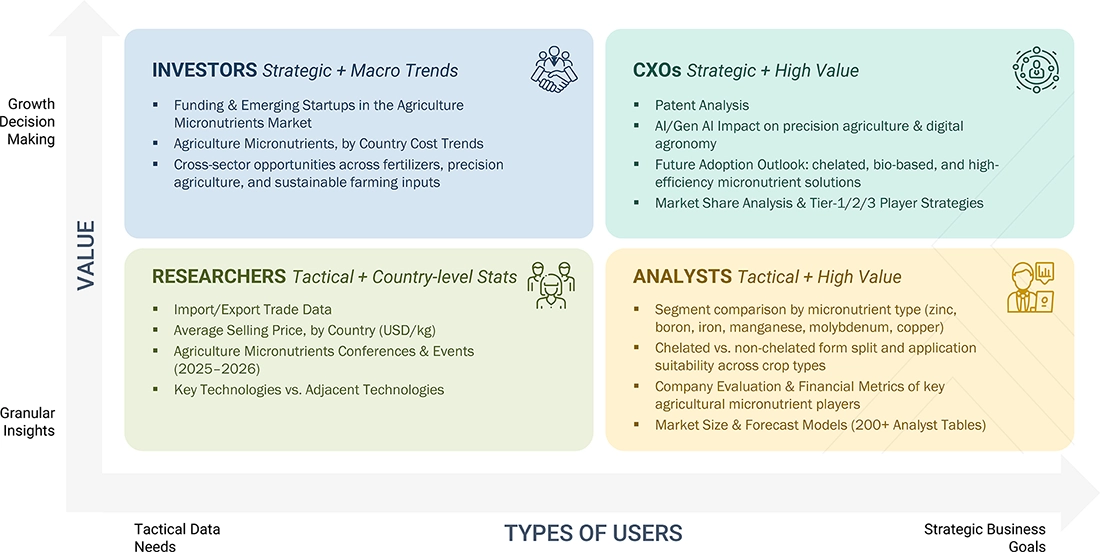

WHAT IS IN IT FOR YOU: NORTH AMERICA AGRICULTURE MICRONUTRIENTS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based agriculture micronutrient manufacturers | Detailed analysis of the North America agriculture micronutrients market by micronutrient type (zinc, boron, iron, manganese, molybdenum, copper, and others), form (chelated and non-chelated), mode of application (soil, foliar, fertigation), and crop type (cereals & grains, fruits & vegetables, oilseeds & pulses, and others). Comprehensive competitive landscape assessment covering key micronutrient manufacturers, fertilizer companies, and specialty input suppliers, including evaluation of production capabilities, product portfolios, and distribution presence. Customer landscape evaluation across growers, agri-input distributors, and cooperatives, along with market benchmarking, pricing dynamics, and regulatory review for North America agriculture micronutrients in the US. | Identified and profiled 20+ agriculture micronutrient manufacturers and suppliers operating in North America, including global leaders, regional players, and specialty micronutrient providers. Tracked adoption trends for micronutrient application across major crop segments, highlighting demand driven by yield optimization, soil health improvement, and sustainable farming practices. Mapped regulatory and compliance requirements for micronutrient usage in agriculture, supporting client decision-making on product positioning, formulation strategy, and market entry. |

| North America Agriculture Micronutrients – Type, Form & Application Segment Assessment | Segmentation of agriculture micronutrient demand by micronutrient type, crop type, form, and mode of application. Benchmarked adoption and usage patterns of micronutrients across cereals, horticultural crops, and oilseeds, with emphasis on nutrient deficiency correction, yield response, and crop quality improvement. Assessed switching barriers for farmers and distributors, including cost sensitivity, formulation effectiveness, compatibility with existing fertilization practices, and regulatory compliance. | Delivered revenue share and growth outlook for key micronutrient segments across crop categories. Identified substitution risks and opportunities between conventional micronutrient products and chelated or specialty formulations in cost-sensitive markets. Mapped regulatory frameworks and approval pathways relevant to North America agriculture micronutrients, enabling clearer go-to-market and product differentiation strategies. |

RECENT DEVELOPMENTS

- October 2025: Sumitomo Chemical introduced a special manganese and zinc rice micronutrient pack specifically made to match soils in a paddy that have lost volcanic ash. This is a technological advancement that enhances nutritional value of grain and also its stability in yield which is in line with the Japanese food security activities.

-

September 2025: Otsuka AgriChem got MAFF authorisation on a green product of chelated iron that will improve vegetable crop vigour in greenhouse farming. The launch favors the use of precision fertigation systems, consumption reduced by a fifth, and the system fulfills stringent environmental requirements.

-

August 2025: Nippon Soda invented a multi-micronutrient (boron-copper) slow-release granule in fruit orchards, introduced during the period of growth of the fruit export. It also facilitates consistent ripening and shelf life supported by field tests in the Yamanashi Prefecture that indicated 12 percent growth in productivity.

-

May 2024: Yara International ASA and BASF SE announced a strategic partnership to co-develop and commercialize next-generation micronutrient fertilizers, with a focus on sustainable, high-efficiency solutions for global agricultural applications.

Table of Contents

Methodology

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the agricultural micronutrient market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

The secondary sources referred for this research study include government sources, such as the Food and Agriculture Organization (FAO), International Fertilizer Association (IFA), Micronutrient Manufacturers Association (MMA), the ministries of the agricultural department in various countries, corporate filings (such as annual reports, press releases, investor presentations, and financial statements), and trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research and manufacturers' annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and paid databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The North America Agriculture Micronutrients Market comprises multiple stakeholders, including raw material suppliers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce to the manufacturers, and importers & exporters of agricultural micronutrients from the demand side including distributors, wholesalers, and key opinion leaders through questionnaires, emails, and telephonic interviews.

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the North America Agriculture Micronutrients Market . These approaches were also used extensively to estimate the size of various dependent submarkets.

The following figure represents the overall market size estimation process employed for the purpose of this study.

Bottom-Up Approach

Through the bottom-up approach, the data extracted from secondary research was utilized to validate the market segment sizes obtained. The approach was employed to arrive at the overall size of the North America Agriculture Micronutrients Market in particular regions, and its share in the market was validated through primary interviews conducted with fungicide manufacturers, suppliers, dealers, and distributors.

With the data triangulation procedure and validation of data through primaries, the overall size of the parent market and each segmental market were determined.

Top-Down Approach

For the estimation of the North America Agriculture Micronutrients Market , the size of the most appropriate immediate parent market was considered to implement the top-down approach. For the North America Agriculture Micronutrients Market , the specialty fertilizers market was considered as the parent market to arrive at the market size, which was again used to estimate the size of individual markets (mentioned in the market segmentation) through percentage shares arrived from secondary and primary research.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall agricultural micronutrient market and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

Agricultural micronutrients can be defined as nutrients required in small amounts, which are necessary for plant growth. Due to their requirement in limited quantities, micronutrients are also known as trace elements. These micronutrients, also known as trace elements, play a crucial role in various physiological processes within plants, including enzyme activation, photosynthesis, and nutrient uptake. The primary agricultural micronutrients include iron (Fe), manganese (Mn), zinc (Zn), copper (Cu), molybdenum (Mo), and boron (B).

Stakeholders

- Agricultural micronutrient manufacturers, formulators, and blenders

- Fertilizer traders, suppliers, distributors, importers, and exporters

- Raw material suppliers and technology providers to agricultural micronutrient manufacturers

- Agricultural co-operative societies

- Fertilizer associations and industry bodies:

- Food and Agriculture Organization (FAO)

- International Fertilizer Association (IFA)

- Micronutrient Manufacturers Association (MMA)

- The Fertilizer Institute (TFI)

- Government agricultural departments and regulatory bodies:

- US Environmental Protection Agency (EPA)

- Association of American Plant Food Control Officials (AAFCO)

- European Commission

- Ministry of Agriculture (MOA), China

- Department of Agriculture, Forestry, and Fisheries (DAFF), South Africa

- US Department of Agriculture (USDA)

Report Objectives

Market Intelligence

Determining and projecting the size of the North America Agriculture Micronutrients Market, based on type, form, crop type, mode of application, and regional markets, over a five-year period, ranging from 2023 to 2028

Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

Analyzing the demand-side factors based on the following:

- Impact of macro- and microeconomic factors on the market

- Shift in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling the key players in the agricultural micronutrientss market.

- Determining the share of key players operating in the North America Agriculture Micronutrients Market

-

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the value chain and products across the key regions and their impact on the prominent market players.

- Analyzing the market dynamics, competitive situations, and trends across the regions, and their impact on prominent market players.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Agriculture Micronutrients Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Agriculture Micronutrients Market