North America Epigenetics Market Size, Growth, Share & Trends Analysis

North America Epigenetics Market by Product & Service [Enzymes, Kits & Reagents (Antibodies), Software], Method [DNA Methylation, Histone Modification], Technique [NGS, PCR], Application [Oncology, Immunology, Developmental Biology]-Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

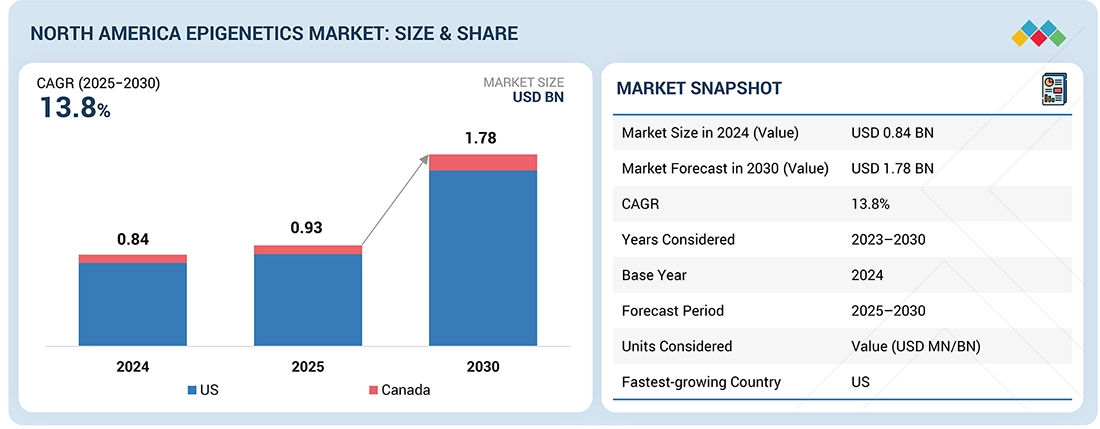

The North America epigenetics market, valued at USD 0.84 billion in 2024, stood at USD 0.93 billion in 2025 and is projected to advance at a resilient CAGR of 13.8% from 2025 to 2030, culminating in a forecasted valuation of USD 1.78 billion by the end of the period. Growth of the North America epigenetics market is driven by a strong, well-funded life sciences ecosystem, with rising oncology and precision-medicine programs that rely on methylation and chromatin profiling.

KEY TAKEAWAYS

-

By CountryThe US dominated the North America epigenetics market with a share of 91.1% in 2024.

-

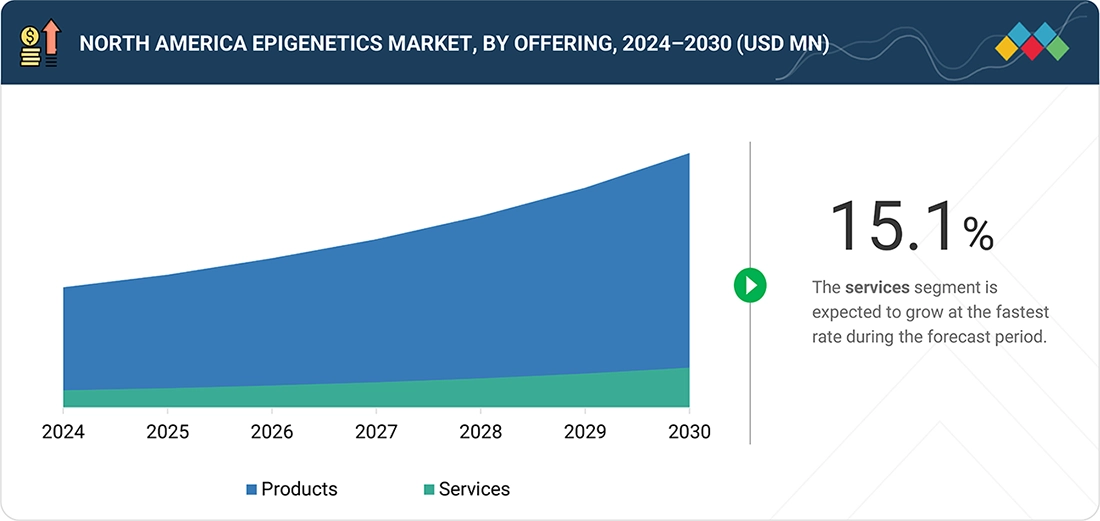

By OfferingBy offering, the North America epigenetics market services segment is expected to register the highest growth rate.

-

By TechnologyBy technology, the Next-generation Sequencing (NGS) segment accounted for the largest market share in 2024.

-

By MethodBy method, the DNA methylation segment is projected to grow at the fastest rate from 2025 to 2030.

-

Competitive LandscapeCompanies such as Thermo Fisher Scientific, Illumina, and Merck KGaA were identified as some of the key players in the North America epigenetics market, given their strong market share and product/service footprint.

-

Competitive LandscapeCompanies such as Epicypher and Integrated DNA Technologies, Inc., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The North America epigenetics market is experiencing strong growth, driven by rising demand for precise biomarker discovery and multi-omics research supporting oncology, immunology, and precision medicine programs. Increased use of DNA methylation and chromatin profiling workflows across drug discovery, companion diagnostics, and translational studies, along with strong funding, active biopharma pipelines, and broad adoption across academic centers, CROs, and clinical labs, is sustaining market momentum in the region.

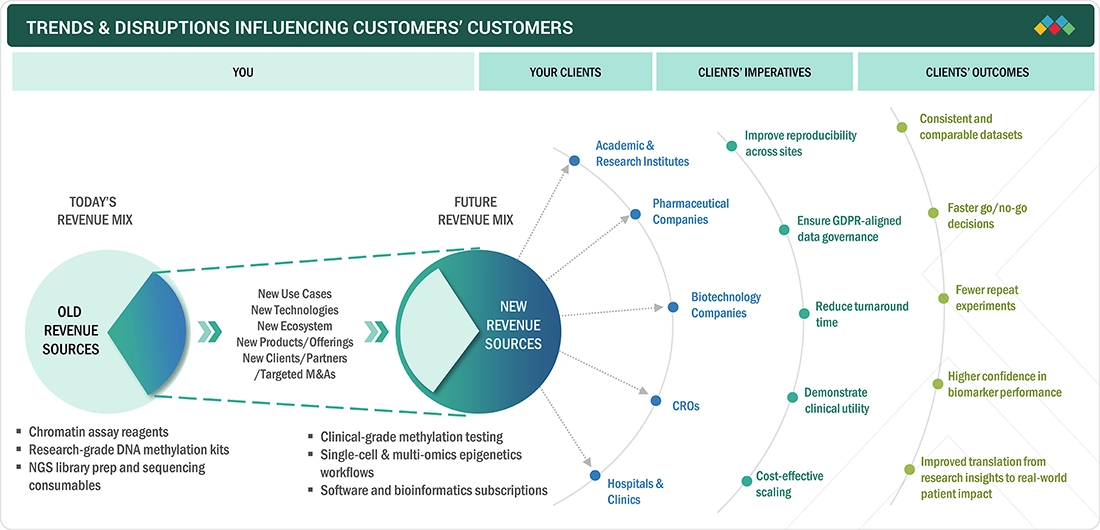

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on stakeholders’ businesses in the North America epigenetics market stems from the shift toward precision oncology and personalized care, along with rapid advances in NGS, methylation profiling, chromatin analysis, and multi-omics tools that improve sensitivity, throughput, and data quality. Biopharmaceutical and biotechnology companies, diagnostic labs, CROs, and academic institutes are the major consumers of epigenetics solutions. These solutions are extensively used in cancer research and drug development, biomarker discovery, patient stratification, therapy, and therapy response monitoring. An increasing focus on epigenetic targets and the integration of epigenetic markers into translational and clinical workflows are making epigenetics a core capability across R&D and diagnostics in the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising focus on precision oncology and biomarker-led drug development

-

Strong publicly funded research base

Level

-

Strict data governance requirements around privacy, consent, and cross-site data sharing.

Level

-

Expansion of clinical methylation testing for early cancer detection and MRD monitoring

-

Faster adoption of single-cell and multi-omics platforms in translational research

Level

-

Lack of standardization across assays, pipelines, and reference datasets

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising focus on precision oncology and biomarker-led drug development

This trend is driven by strong momentum in precision oncology, where epigenetic signatures are now informing clinical and development decisions in North America. Biopharma companies are increasingly leveraging methylation and chromatin markers for patient stratification and biomarker-driven trial design. Therefore, demand for robust sample preparation, sequencing, and downstream analytics solutions for epigenetics workflows across discovery and translational research pipelines is expected to increase.

Restraint: Strict data governance around privacy, consent, and cross-site data sharing

Epigenetics datasets are high-volume and often linked to identifiable clinical information, which raises the stakes for privacy and consent. Institutions need to establish strict governance over data access, storage, and exchange across sites. In some instances, multi-center studies are involved. These constraints can lengthen study timelines and slow the pace at which real-world evidence efforts scale. This further increases compliance and operational overhead for laboratories and diagnostic developers.

Opportunity: Expansion of clinical methylation testing for early cancer detection and MRD monitoring

Liquid biopsy methylation analyses are also becoming a scalable opportunity, supported by the strong signal sensitivity and specificity of clinical methylation testing. These analyses enable relevant applications in early detection, treatment response, and recurrence evaluation, and monitoring for Minimal Residual Disease (MRD). Rising adoption of liquid biopsies and precision medicine is likely to drive test kit volumes, creating opportunities for novel panels and expanded indications.

Challenge: Lack of standardization across assays, pipelines, and reference datasets

The market exhibits limited harmonization across assay protocols, analytical pathways, and common reference baselines. Variations in sample handling, sequencing chemistry, and bioinformatics processes can impact outcomes. The lack of universally accepted references and data sets further complicates validation and external benchmarking.

NORTH AMERICA EPIGENETICS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Janssen teams conducted an epigenome-wide association study in Alzheimer’s disease using the Illumina Infinium MethylationEPIC BeadChip. The study replicated and identified methylation signals linked to pathology in brain regions of interest. | Supports biomarker discovery programs in CNS. Strengthens evidence for disease-linked pathways that can guide target evaluation and patient stratification approaches. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The North America epigenetics market ecosystem comprises reagent and kit suppliers for DNA methylation and chromatin workflows; vendors of sequencing and single-cell platforms; and automation providers who streamline sample-to-data processing. It also includes bioinformatics and software players that provide epigenomic pipelines, multi-omics integration, and secure cloud computing for large datasets. Service providers, such as CROs, support outsourced epigenetic profiling, assay development, and data interpretation at scale. The main end users are biopharma and biotech companies; academic and government research institutes; and hospitals and diagnostic laboratories, which employ these solutions in precision oncology, biomarker-led drug development, and novel methylation-based clinical testing.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America epigenetics market, By Offering

In 2024, kits and reagents dominated the North America epigenetics market because most epigenetics workflows run on repeatable, per-sample consumables—bisulfite conversion, methylation library prep, antibodies, and chromatin assay kits—creating steady replenishment demand. They are also the fastest to adopt across labs, as ready-to-use kits standardize protocols, cut workflow variability, and support high sample throughput without major capex.

North America epigenetics market, By Method

In North America, DNA methylation methods dominated in 2024 because methylation is one of the most clinically relevant and well-validated epigenetic signals, with strong utility in cancer detection, patient stratification, and monitoring. It also benefits from mature, scalable workflows that are easier to standardize and run at high throughput than many chromatin-based assays.

North America epigenetics market, By End user

Academic & research institutes dominated in 2024 because North America has a large, well-funded research base conducting high volumes of epigenetics studies across oncology, immunology, and neuroscience. These labs also adopt new epigenetic methods early and purchase a steady mix of kits, reagents, sequencing services, and analysis tools to support grants, publications, and collaborative programs.

REGION

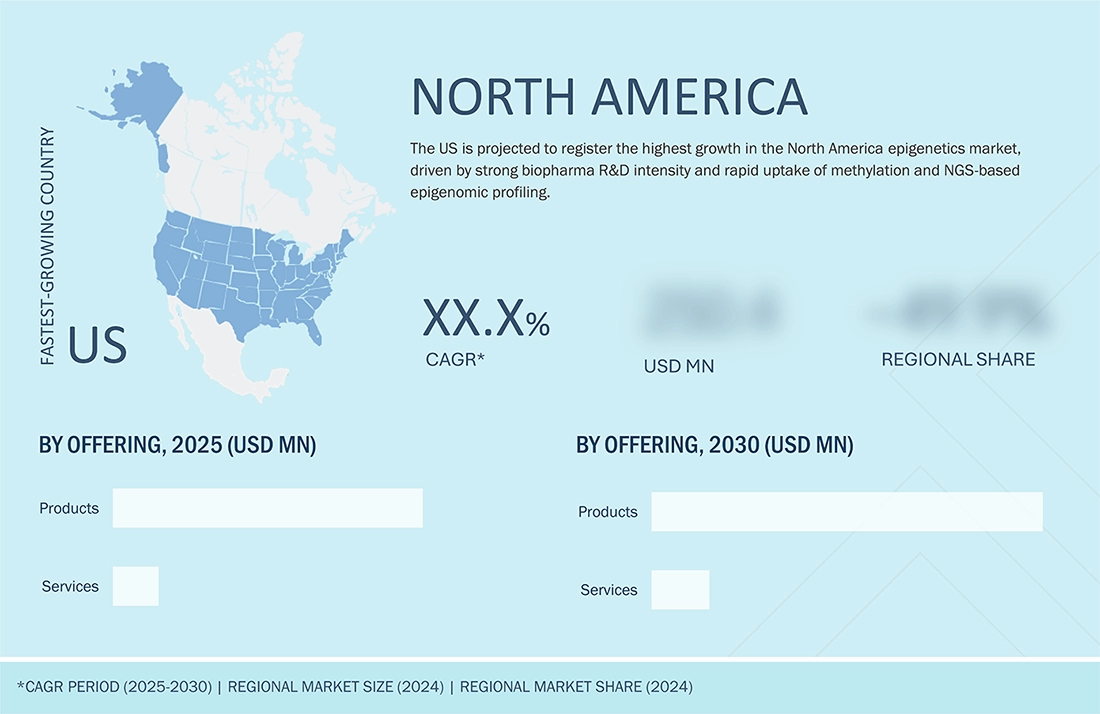

The US to be the fastest-growing country in the North America Epigenetics market during the forecast period

The US is the fastest-growing market in North America, driven by a dense biopharma ecosystem and strong federal and private R&D funding that accelerates epigenetics adoption in drug discovery and translational research. Growth is further supported by faster uptake of methylation-based assays in oncology pathways, including liquid biopsy use cases such as early detection and monitoring.

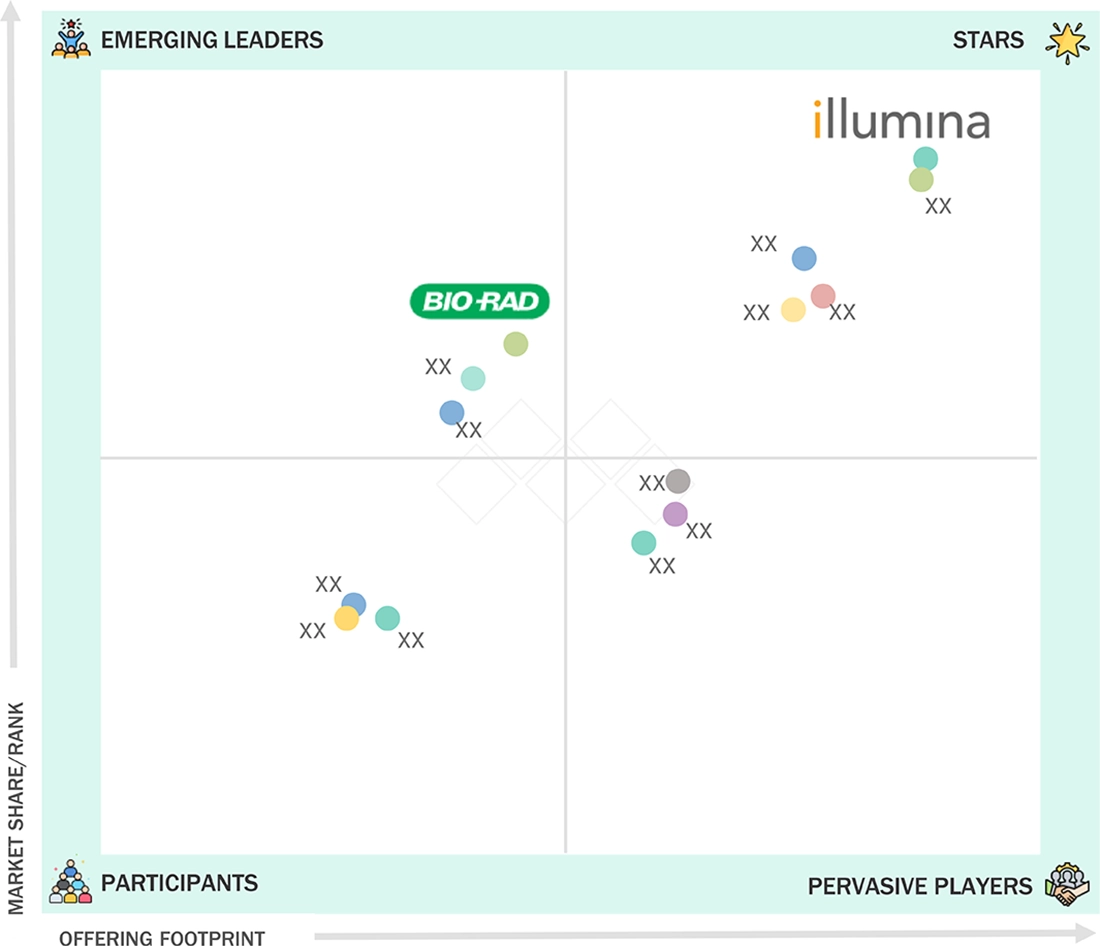

NORTH AMERICA EPIGENETICS MARKET: COMPANY EVALUATION MATRIX

In the North America epigenetics market matrix, Illumina (Star) leads because of its large NGS installed base and widespread use of its platforms and informatics in methylation sequencing and chromatin profiling workflows. Bio-Rad Laboratories (Emerging Leader) is gaining traction through strong life-science tools, including sample prep and ddPCR systems that support methylation analysis and biomarker validation, aligning well with growing translational and clinical research demand.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Thermo Fisher Scientific, Inc. (US)

- Merck KGaA (Germany)

- Illumina, Inc. (US)

- PacBio (US)

- Danaher (US)

- Bio-Rad Laboratories, Inc. (US)

- Active Motif (US)

- New England Biolabs (US)

- Zymo Research Corporation (US)

- Revvity (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.84 Billion |

| Market Forecast in 2030 (Value) | USD 1.78 Billion |

| Growth Rate | CAGR of 13.8% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | US, Canada |

| Parent & Related Segment Reports |

Epigenetics Market Europe Epigenetics Market Asia Pacific Epigenetics Market |

WHAT IS IN IT FOR YOU: NORTH AMERICA EPIGENETICS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| U.S.-based oncology-focused biotechnology company |

|

|

| Clinical laboratories and reference lab |

|

|

RECENT DEVELOPMENTS

- October 2025: Illumina launched a 5-base sequencing solution that enables simultaneous detection of genetic variants and DNA methylation from a single sample, supporting integrated genomic and epigenomic analysis.

- January 2025: New England Biolabs launched the EM-seq v2 kit, a high-performance enzyme-based alternative to bisulfite sequencing to identify 5mC and 5hmC.

- November 2024: PacBio launched the company’s first benchtop long-read sequencing platform. Vega helps researchers looking to adopt long-read sequencing across various applications, including targeted sequencing, RNA sequencing, and small genome sequencing.

Table of Contents

Methodology

This research involved extensively using secondary sources, directories, and databases to gather valuable information for analyzing the North America Epigenetics Market. In-depth interviews were conducted with various key respondents, including industry leaders, subject-matter experts (SMEs), C-level executives of major market players, and industry consultants, to obtain and verify critical qualitative and quantitative data and to evaluate the market's growth prospects. The market size, estimated through secondary research, was then triangulated with inputs from primary research to determine the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive technical, market-oriented, and commercial study of the North America Epigenetics Market. The secondary sources used for this study include World Health Organization (WHO), World Intellectual Property Organization (WIPO), International Union of Biochmistry and Molecular Biology (IUBMB), National Institutes of Health (NIH), National Human Genome Research Institute (NHGRI), Centers for Disease Control and Prevention (CDC), American Cancer Society (ACS), American Society for Biochemistry and Molecular Biology (ASBMB), Canadian Society for Molecular Biosciences (CSMB), National Institute of Environmental Health Sciences (NIEHS), Canadian Institutes of Health Research (CIHR), Genome Canada, and Central Drugs Standard Control Organisation (CDSCO); ACS Journals; Corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the North America Epigenetics Market, which was validated through primary research. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the North America Epigenetics Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

After estimating the overall market size through the market size estimation process, the total market was divided into several segments and subsegments. To complete the overall market engineering process and obtain precise statistics for all segments and subsegments, data triangulation and market breakdown procedures were used whenever applicable. The data was triangulated by analyzing various factors and trends from both the demand and supply sides.

Market Definition

Epigenetics involves assessing individual behaviors and environmental factors that may influence gene functions. Unlike genetic changes, epigenetic modifications can be reversed and do not alter the DNA sequence. The report provides both qualitative and quantitative analyses of various products and services used in epigenetics research by end users such as academic and research institutions, pharmaceutical and biotechnology companies, and hospitals and clinics.

Stakeholders

- Contract research organizations (CROs)

- Contract development and manufacturing organizations (CDMOs)

- Pharmaceutical & biopharmaceutical companies

- Life science companies

- Academic & research institutes

- Private research institutes

- Venture capitalists & investors

- Market research & consulting firms

- Government associations

- Medical institutions & universities

- Hospitals & clinics

Report Objectives

- To define, describe, and forecast the North America Epigenetics Market by offering, method, technology, application, end user (product), end user (service), and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall North America Epigenetics Market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and analyze their market shares and core competencies

- To track and analyze competitive developments, such as product launches, agreements, partnerships, acquisitions, and R&D activities

- To analyze and provide funding & investment activities, brand/product comparative analysis, and vendor valuation & financial metrics of the North America Epigenetics Market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Epigenetics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Epigenetics Market