North America Fuel Additives Market

North America Fuel Additives Market by Type (Deposit Control, Cetane Improvers, Lubricity Improvers, Cold Flow Improvers, Stability Improvers, Corrosion Inhibitors), Application (Diesel, Gasoline, Aviation Fuel), and Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

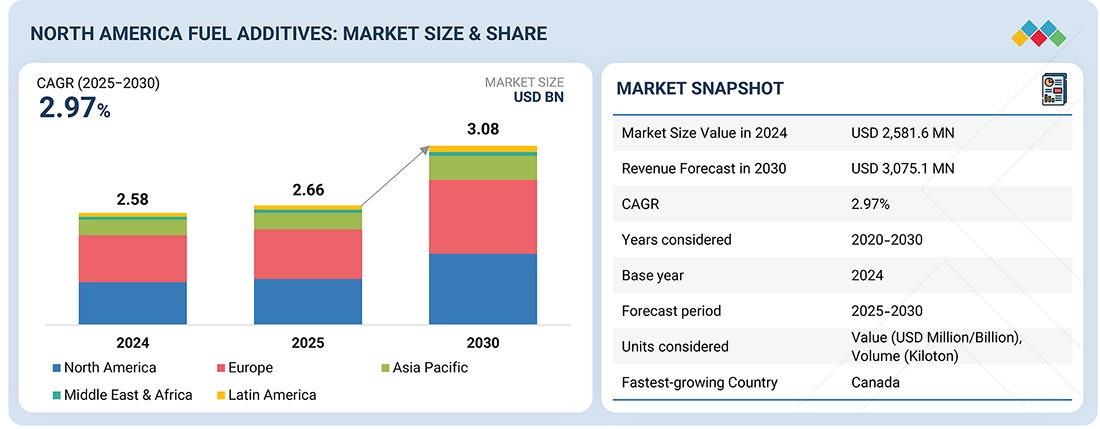

The North America fuel additives market is projected to grow from USD 2.66 billion in 2025 to USD 3.08 billion by 2030, at a CAGR of 2.97%, in terms of value. The North America fuel additives market is growing because the EPA is enforcing stricter emission standards. This pressure is causing refiners and fuel suppliers to adopt better additive formulations. The increasing use of ethanol blends, renewable diesel, and ultra-low-sulfur fuels is raising the need for additives that improve stability, compatibility, and engine protection. High demand from the commercial transportation, industrial equipment, and marine sectors is also helping the market expansion. Overall, the region’s emphasis on cleaner fuels, operational efficiency, and regulatory compliance is leading to steady growth in valuable additive solutions.

KEY TAKEAWAYS

-

BY COUNTRYThe US dominated the North America fuel additives market in 2024, accounting for a market share of 84.6%, in terms of value.

-

BY APPLICATIONThe diesel application is projected to register the highest CAGR of 3.42% during the forecast period, in terms of value.

-

BY TYPEThe lubricity improvers segment is projected to be the fastest-growing type of the North America fuel additives market with a CAGR of 3.51%, in terms of value, between 2025 and 2030.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSInnospec Inc., Afton Chemical Corporation, and Lubrizol Corporation are identified as key players in the North America fuel additives market. These companies have strong market presence and extensive product portfolios.

-

COMPETITIVE LANDSCAPE - STARTUPSPower Service Products, Inc., Huntsman International LLC, and Eastman Chemical Company, among other emerging players, have carved out solid positions within specialized niche segments, highlighting their potential to evolve into future market leaders.

The North America fuel additives market is experiencing steady growth. This is due to stricter emission regulations, the demand for cleaner-burning fuels, and the increased use of renewable and low-sulfur fuel blends. Refiners, fuel blenders, and fleet operators are turning to better additive solutions to improve engine performance, keep fuel stable, and meet changing environmental standards. Ongoing improvements in technology, along with the region’s emphasis on operational efficiency and sustainability, are generating consistent opportunities for valuable additive products.

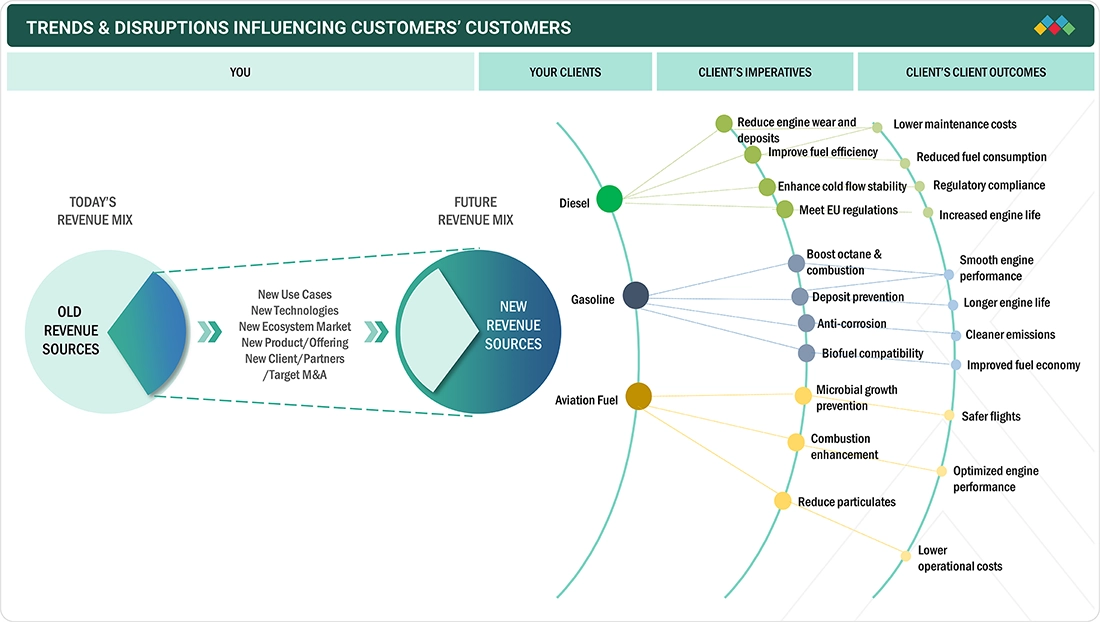

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. In the North America fuel additives market, changing customer trends and new disruptions are changing how refiners, fuel distributors, and fleet operators manage their businesses. Stricter emission rules, new engine technologies, and the increasing use of renewable and low-carbon fuels are driving these groups to rethink their additive strategies. They want to maintain fuel quality, meet regulations, and safeguard asset performance. As end users improve their buying and operating methods in response to these changes, their costs, efficiency, and revenue are increasingly affected. This ultimately influences additive consumption patterns and the market's future demand outlook.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

EPA and CARB tightening fuel-quality and emissions norms

-

Biofuel growth & blending mandates

Level

-

Rising penetration of EVs reducing long-term gasoline demand

-

Refinery rationalization and capacity shifts

Level

-

Higher biofuel blend formulations

-

Expansion of premium-grade fuel programs

Level

-

Price sensitivity in consumer aftermarket

-

Operational risk from rapid policy shifts

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: EPA and CARB tightening fuel-quality and emissions norms

Stricter fuel-quality and emissions standards set by the EPA (Environmental Protection Agency) and CARB (California Air Resources Board) are pushing refiners and fuel blenders in the US to adopt high-performance additive packages to meet compliance requirements. These regulations put limits on engine deposits, sulfur content, corrosion, and particulate formation. This leaves refiners with little choice but to improve fuel formulations using detergents, deposit-control chemistries, corrosion inhibitors, and lubricity improvers. As a result, using additives has become a regulatory requirement rather than an optional choice. This creates steady demand for fuel-additive solutions in the North American market.

Restraint: Refinery rationalization and capacity shifts

Refinery changes and shifts in capacity in the US are limiting the traditional fuel additives market. Many conventional refineries are either converting to renewable diesel or SAF production or operating at lower utilization rates. These changes reduce the available output of gasoline and diesel, which mainly rely on detergents, stabilizers, lubricity improvers, and deposit-control additives. As the installed base of fossil-fuel refining capacity contracts, the amount of conventional fuels entering the distribution system falls. This limits the ongoing demand for legacy fuel additives and creates a long-term barrier to market growth in North America.

Opportunity: Expansion of premium-grade fuel programs

The growth of premium fuel programs by major US fuel retailers is opening up market opportunities for suppliers of high-performance additives. These programs help fuel brands differentiate by improving engine cleanliness, combustion efficiency, and performance benefits. To deliver these value propositions, retailers are increasingly depending on detergent systems, friction modifiers, and combustion-improver chemistries that go beyond basic regulatory needs. This change increases the amount of additives used, allowing suppliers to offer premium formulations that boost revenue. This trend is strengthening the demand for advanced additive packages throughout the market in North America.

Challenge: Price sensitivity in consumer aftermarket

Price sensitivity in the North American consumer aftermarket poses a challenge for the market. Retailers and distributors often focus on low-cost or private-label fuel additives. This practice reduces shelf space and visibility for higher-performance options. Consumers' cost-driven purchasing habits make it hard for additive manufacturers to justify premium prices. This situation limits the use of improved chemistries and narrows profit margins. Consequently, suppliers find it difficult to stand out based on technology or performance. Ultimately, this situation hampers innovation and slows the overall growth potential of the regional fuel additives market.

NORTH AMERICA FUEL ADDITIVES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of anti-icing agents, thermal stability additives, and lubricity improvers in jet fuel for high-altitude and long-range operations | Improved flight safety, reduced icing risk, stable engine performance, fewer in-service disruptions |

|

Use of cetane improvers and injector-cleaning additives in high-load diesel engines across locomotive fleets | Improved fuel combustion, reduced emissions, lower maintenance frequency |

|

Use of detergent packages, friction modifiers, and anti-knock agents in premium gasoline sold at retail stations across the US | Cleaner engines, smoother acceleration, improved mileage, stronger fuel brand differentiation |

|

Deployment of proprietary detergent additives and antioxidants in gasoline blends for widespread consumer and commercial use | Reduced deposit formation, better combustion, extended engine lifespan |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

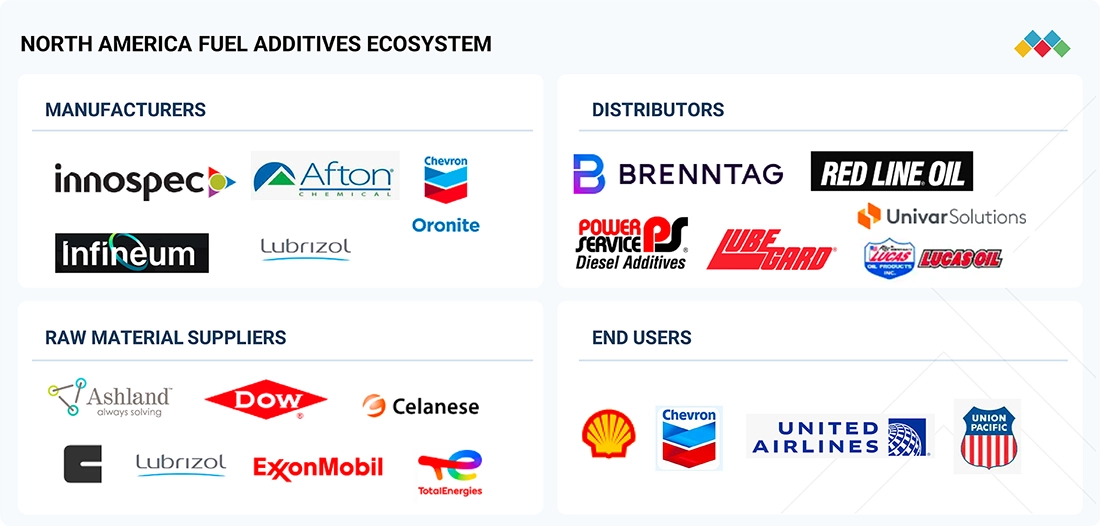

MARKET ECOSYSTEM

The North America fuel additives market consists of a well-established network of additive manufacturers, refineries, fuel blenders, distributors, and industrial end users. Market dynamics are influenced by changing EPA emission regulations, stricter fuel-quality requirements, and the ongoing shift to cleaner fuels, like ultra-low-sulfur gasoline and diesel, renewable diesel, and advanced ethanol blends. These regulatory and technological factors push manufacturers to improve detergency, corrosion inhibition, cold-flow performance, and engine performance. Distributors and fuel marketers provide a steady supply to automotive fleets, marine operators, aviation companies, and off-road industrial segments. End users impact demand based on priorities like operational efficiency, asset longevity, and compliance with environmental standards. Overall, the ecosystem is driven by regulations, focused on innovation, and oriented toward high performance, reliability, and compatibility with North America’s diverse and modern fuel infrastructure.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Fuel Additives Market, By Type

In?????? 2024, deposit control additives accounted for the largest share of the North America fuel additives market, in terms of value. This is mainly due to the region's high vehicle use, the common use of ethanol-blended gasoline, and strict performance expectations from both consumers and fleet operators. Ethanol blends often lead to increased deposit formation in injectors and intake systems. This makes it essential to use detergents to maintain fuel economy and prevent drivability problems. Moreover, manufacturers in this region are adopting new engine designs that are more sensitive to deposit buildup. This trend increases the need for effective deposit control additives. These factors together make deposit control additives the dominant segment in the market in North America.

North America Fuel Additives Market, By Application

In 2024, the gasoline segment led the fuel additives market in North America. The region has one of the highest gasoline consumption rates in the world. This high demand comes from a large fleet of passenger vehicles and long-distance commuting patterns. The widespread use of ethanol-blended gasoline presents specific challenges related to stability, corrosion, and deposits, which require regular additive treatment. Additionally, modern gasoline engine technologies like GDI and turbocharged systems increase the need for improved additives to prevent performance loss and emissions problems. These regional fuel traits and operating conditions make gasoline applications the most additive-intensive and commercially significant segment in North America.

REGION

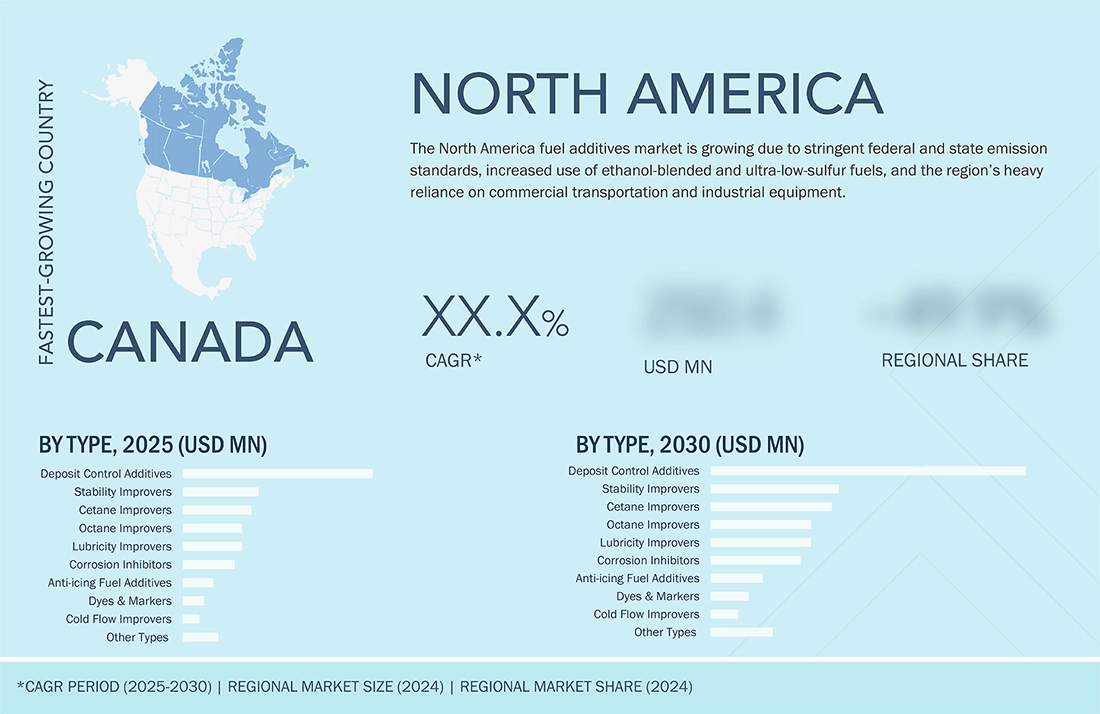

the US led the North America fuel additives market in 2024, in terms of value.

The US dominated the North America fuel additives market in 2024, in terms of value. The country as the largest and most fuel-intensive transportation network. This network is supported by a wide base of passenger vehicles, heavy-duty trucking activity, and a strong reliance on gasoline and ethanol-blended fuels. The country’s strict EPA performance and emission requirements further increase the use of additives in refining, distribution, and fleet operations. Additionally, the US has a large share of the region’s refining capacity and fuel distribution infrastructure. This drives higher consumption of deposit control, stabilizing, and performance-boosting additives. This combination of scale, regulatory pressure, and complex fuel characteristics makes the US the leading market in North America.

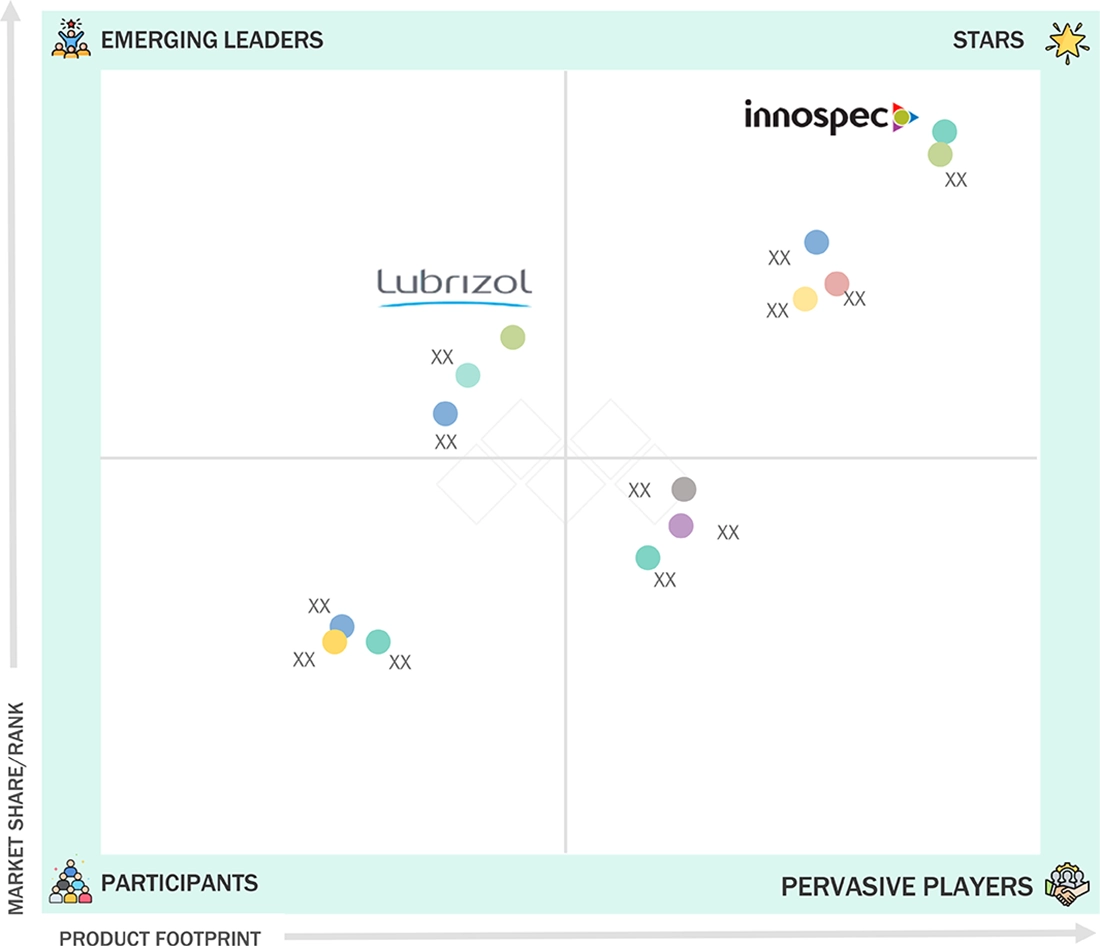

NORTH AMERICA FUEL ADDITIVES MARKET: COMPANY EVALUATION MATRIX

In the North America fuel additives market, Innospec Inc. (Star) leads with a strong market share and an extensive portfolio of fuel additives, including cetane improvers, detergents, and lubricity enhancers, serving diesel, gasoline, and industrial fuel segments. The Lubrizol Corporation (Emerging Leader) is gaining traction with specialized and cost-efficient additive formulations, expanding its presence in niche applications such as biofuel-compatible and premium fuel solutions. While Innospec Inc. dominates through scale, innovation, and broad regional reach, Lubrizol Corporation demonstrates strong potential to move toward the leaders’ quadrant as demand for high-quality, regulatory-compliant, and performance-driven fuel additives continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 2.58 Billion |

| Revenue Forecast in 2030 | USD 3.08 Billion |

| Growth Rate | CAGR of 2.97% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Type: Deposit control additives, cetane improvers, lubricity improvers, cold flow improvers, stability improvers, octane improvers, corrosion inhibitors, anti-icing fuel additives, dyes & markers, and other types (depressants and conductivity improvers) By Application: Diesel, gasoline, aviation fuel, and others applications |

| Regional Scope | North America |

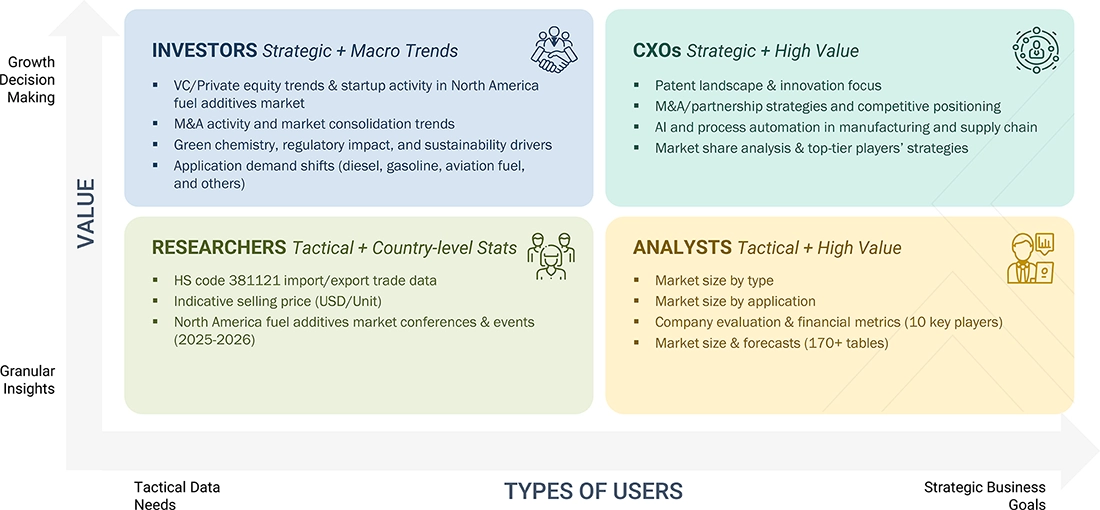

WHAT IS IN IT FOR YOU: NORTH AMERICA FUEL ADDITIVES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North American fuel distributor upgrading its premium-fuel offering |

|

|

| Customer behavior and demand trends | Analysis of end user preferences, fleet adoption patterns, and purchasing criteria | Guides marketing, sales, and product strategy |

RECENT DEVELOPMENTS

- June 2024 : BASF SE announced a long-term supply agreement for chemically recycled circular benzene from post-consumer end-of-life plastics. Encina Development Group, LLC will supply recycled chemicals and BASF SE benefits from an increased circular economy with the addition of more recycled raw materials into its processes.

- July 2024 : The Lubrizol Corporation introduced Lubrizol PV1710. This new passenger car engine oil additive solution is developed to meet the upcoming ILSAC GF-7 standards.

- June 2022 : Chevron acquired Renewable Energy Group (REG), a leading producer of renewable fuels. This acquisition strengthens Chevron's position in the renewable fuel additives market, supporting its energy transition strategy.

- March 2022 : Monument Chemical broke ground on a new operating area in Brandenburg, KY, to expand Afton's custom manufacturing capacity. This expansion supports Afton's growing demand for oil additives and represents a major investment in long-term growth. The new facility will handle increased volume and enhance production capabilities.

Table of Contents

Methodology

The study involved four major activities in estimating the market size for North America Fuel Additives Market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The North America Fuel Additives Market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized from key opinion leaders in various applications for the North America Fuel Additives Market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the North America Fuel Additives Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the fuel additives industry.

Market Definition

Fuel additives are chemicals used to improve the efficiency of fuel. These additives help fuels in meeting emission control standards and improve engine or vehicle performance. Apart from these functions, fuel additives also help in the reduction of corrosion and enhance combustion in various applications in the commercial, automotive, industrial, and aerospace sectors. They are compounds formulated to enhance the quality and efficiency of fuels.

Key Stakeholders

- Fuel additives manufacturers

- Fuel additives suppliers

- Raw material suppliers

- Service providers

- Application sector companies

- Government bodies

Report Objectives

- To define, describe, and forecast the North America Fuel Additives Market in terms of value

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by ingredient type, end-use industry, and region

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To analyze the impact of COVID-19 on the market and end-use industries

- To strategically profile key players and comprehensively analyze their growth strategies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional end-use industry

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Fuel Additives Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Fuel Additives Market