North America Gluten-Free Products Market

North America Gluten-Free Products Market by Type (Bakery Products, Snacks & RTE Products, Pizzas & Pastas, Condiments & Dressings), Form, Distribution Channel (Conventional Stores, Specialty Stores, Drugstores & Pharmacies), Source – Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

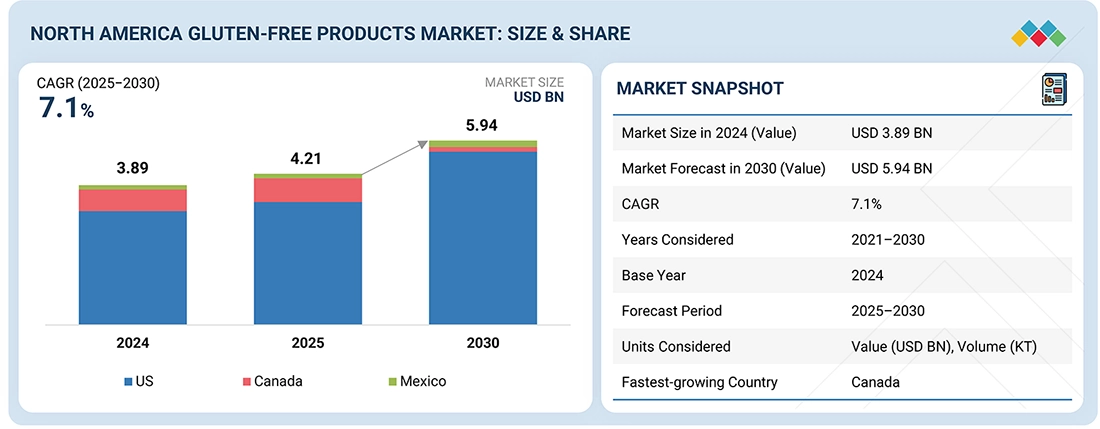

The North America gluten-free products market is projected to grow from USD 4.21 billion in 2025 to USD 5.94 billion by 2030 at a CAGR of 7.1%. North America represents the largest regional market for gluten-free products, driven by high consumer awareness regarding celiac diseases and gluten sensitivity, strong lifestyle-driven adoption, and a highly developed packaged food ecosystem.

KEY TAKEAWAYS

-

By CountryThe US is estimated to account for the largest share (81.4%) of the gluten-free products market in 2025.

-

By TypeThe snacks & RTE products segment is projected to grow at the highest rate from 2025 to 2030.

-

By Distribution ChannelThe conventional stores segment is estimated to dominate the North America gluten-free products market with a share of 70.9% in 2025.

-

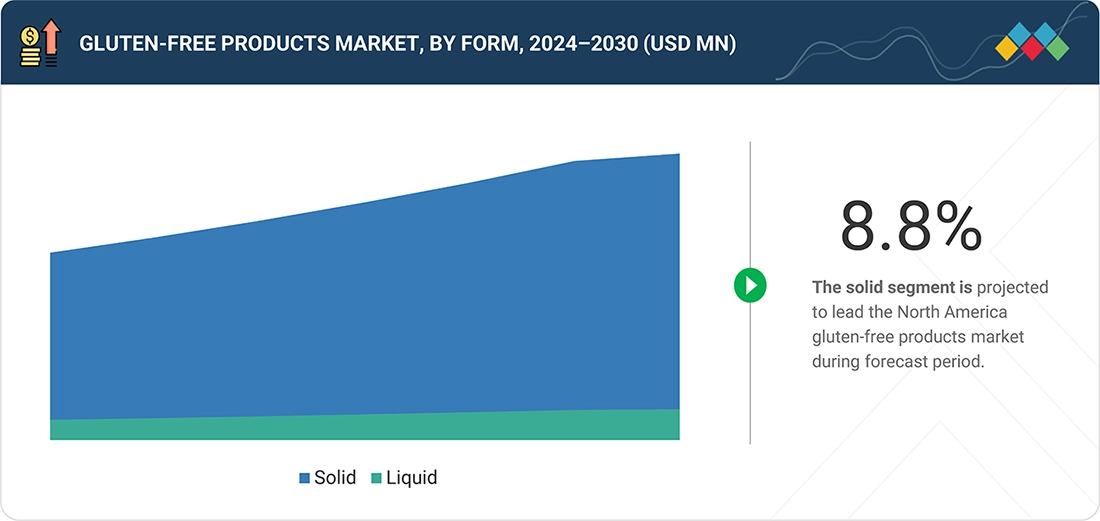

By FormThe solid segment is estimated to account for a larger market share (90.3%) than the liquid segment in 2025.

-

Competitive Landscape - Key PlayersThe Kraft Heinz Company, General Mills, Inc., and Conagra Brands, Inc. are identified as star players in the gluten-free products market, given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsKatz Gluten Free, Enjoy Life (US) among others have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The growth of the North America gluten-free products market is supported by high consumer awareness regarding gluten intolerance and celiac diseases and an advanced packaged food ecosystem capable of rapidly scaling innovation. The market in North America continues to benefit from the convergence of gluten-free positioning with digestive health, clean-label, plant-based, and allergen-free trends, expanding consumption beyond medically required diets.

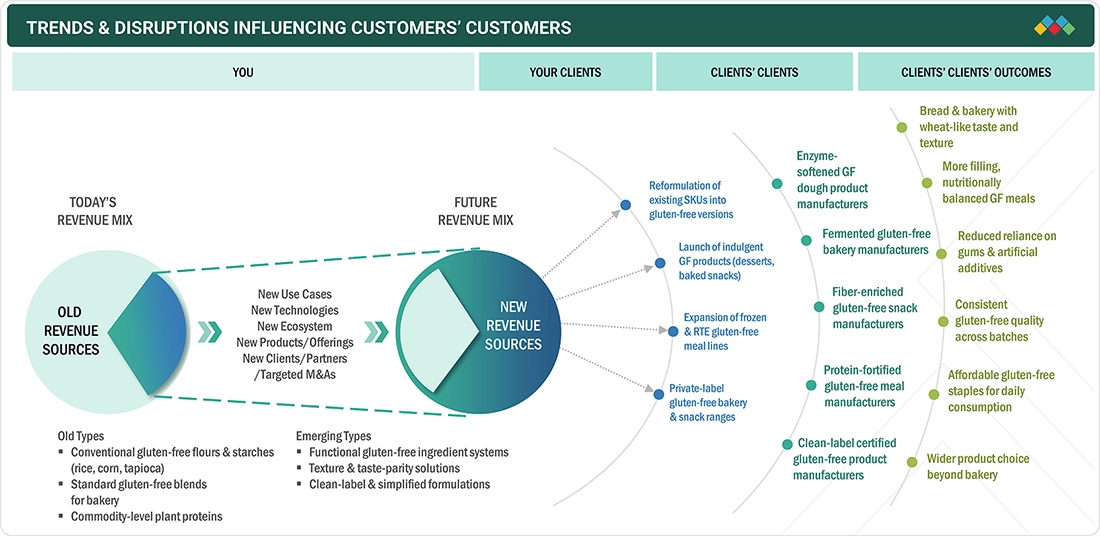

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The North America gluten-free products market is defined by a transition toward premium, functional foods where lifestyle consumers outnumber those with medical requirements. Additionally, industry leaders are investing in large-scale facility expansions and innovative "clean-label" snack formulations to meet the rapid growth of online and mainstream retail demand.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High prevalence and diagnosis of celiac diseases and gluten sensitivity

-

Strong demand for clean-label, free-from, and functional foods

Level

-

High price of premium and conventional products

-

Taste and texture parity challenges in bakery and snacks

Level

-

Innovation in gluten-free bakery, snacks, and ready-to-eat meals

-

Expansion of foodservice and quick-service restaurants

Level

-

Stringent labeling, certification, and compliance requirements

-

Cross-contamination risks in large-scale manufacturing

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High prevalence and diagnosis of celiac diseases and gluten sensitivity

North America, particularly the US and Canada, has one of the highest diagnosis rates of celiac diseases globally, supported by advanced screening, gastroenterology access, and public awareness. In parallel, non-celiac gluten sensitivity remains widely self-reported, expanding the addressable consumer base beyond medically diagnosed patients. Major healthcare institutions and advocacy groups continue to promote early diagnosis, reinforcing long-term demand for certified gluten-free products across retail and foodservice.

Restraint: High price of premium and conventional products

Gluten-free products in North America continue to carry a notable price premium due to high ingredient costs (e.g., alternative flours), dedicated manufacturing lines, and certification expenses. Inflationary pressures on raw materials and logistics over the past two years have further widened the gap, limiting penetration among price-sensitive consumers and slowing volume growth in mass-market channels.

Opportunity: Innovation in gluten-free bakery, snacks, and ready-to-eat meals

Innovation momentum in North America is strong, particularly in frozen bakery, premium snacks, and ready-to-eat meals. Brands are leveraging advanced processing, enzyme technology, and alternative grains (e.g., ancient grains, pulse-based flours) to improve quality and nutrition. Also, retailers are expanding gluten-free private labels, accelerating category normalization and shelf presence.

Challenge: Stringent labeling, certification, and compliance requirements

North America enforces strict gluten-free labeling thresholds (e.g., FDA’s <20 ppm standard in the US), requiring rigorous testing, documentation, and audits. Certification bodies add another compliance layer, increasing operational complexity and cost, especially for small and mid-sized manufacturers. Additionally, regulatory scrutiny has intensified as gluten-free claims proliferate across categories.

GLUTEN-FREE PRODUCTS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cargill expanded its gluten-free ingredient portfolio by offering rice- and corn-based flours, tapioca starches, texturizing systems, and clean-label binders for gluten-free bakery, snacks, and ready meals. It supports manufacturers with application labs focused on gluten-free dough rheology and texture optimization. | Enable food manufacturers to achieve better texture, volume, and shelf life in gluten-free bakery and snacks | Improve cost efficiency and formulation consistency at industrial scale |

|

ADM introduced gluten-free flour blends, plant proteins, and functional fibers designed to enhance nutritional density and mouthfeel in gluten-free baked goods, cereals, and snack products. It supports gluten-free claims through traceable sourcing and allergen-controlled processing. | Strengthen manufacturers’ ability to launch nutrient-enhanced, clean-label gluten-free products | Address consumer demand for protein, fiber, and better-for-you positioning |

|

Ingredion provided clean-label starches, rice flours, and pulse-based ingredients tailored for gluten-free bakery, sauces, and snacks. The company works closely with brands on reformulation of mainstream SKUs into gluten-free variants. | Help brands maintain label simplicity, stable texture, and scalable production | Enable faster gluten-free line extension of existing products |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Major players in the North America gluten-free products market include gluten-free product manufacturers, such as Ingredion, Bunge, Cargill, ADM, Kraft Heinz, and Hain Celestial. These companies serve as the backbone of the gluten-free products ecosystem in North America by providing scale, formulation expertise, and certified gluten-free liquid inputs. The ecosystem is further strengthened by gluten-free product manufacturers (emerging players), such Raisio and Banza. These players produce gluten-free products and have developed unique and clean-label formulations. The role of these participants is supported by oversight from global and national regulatory authorities that ensure safety, quality, and compliance are maintained in the consumption of these products. The regulatory framework for gluten-free labeling, safety, and compliance within North America is shaped by the Codex Alimentarius and the European Food Safety Authority (EFSA). End users in this ecosystem include large food and beverage companies that produce gluten-free products. Some of these players are Barilla, Conagra Brands, Kellanova, and General Mills. These companies rely heavily on the gluten-free liquid ingredients developed by large ingredient suppliers to create ready-to-eat or convenience items that promote wellness. Thus, the North America gluten-free products market ecosystem is driven by innovation related to awareness regarding digestive health, demand for clean-label products, and lifestyle-driven avoidance of gluten in the region.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Gluten-free Products Market, By Type

By type, the bakery products segment is projected to dominate the gluten-free market during the forecast period. The growth of the segment can be attributed to the broad consumption of gluten-free ingredients in daily diets, including bread, cakes, and cookies.

North America Gluten-free Products Market, By Distribution Channel

The conventional stores segment is projected to lead the market during the forecast period. The growth can be attributed to the popularity of conventional stores, which include supermarkets, hypermarkets, and internet retailers. The comprehensive accessibility of conventional stores and extensive range of products make them the primary choice of consumers seeking gluten-free food.

North America Gluten-free Products Market, By Form

The solid segment is projected to lead the market during the forecast period owing to the long shelf life of solid gluten-free products and their widespread use in commercial manufacturing.

REGION

US to lead North America gluten-free products market during forecast period

The gluten-free market in US benefits from clear regulatory frameworks and well-established labeling standards, which support consumer trust and consistent product positioning. Additionally, high awareness of people regarding food intolerance and allergies—reinforced by medical screening and public health communication—has expanded gluten-free consumption beyond clinical need, particularly in bakery, pasta, and snack categories. All these factors are driving the growth of the US gluten-free products market.

GLUTEN-FREE PRODUCTS MARKET: COMPANY EVALUATION MATRIX

In the North America gluten-free products market evaluation matrix, The Kraft Heinz Company, The Hain Celestial Group, General Mills Inc. (Stars) lead with a strong market presence supported by their extensive production capabilities, broad gluten-free products portfolios, and well-established distribution networks across the distribution channel sectors. Their scale, innovation in nutrition solutions, and deep integration with large commercial operations reinforce their dominant position. On the other hand, Conagra Brands, Inc. and Kellanova (Emerging Leaders) are boosting the growth of the market by investing in product innovation and expanding their production capacity to meet market demand.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- The Kraft Heinz Company (US)

- The Hain Celestial Group (US)

- General Mills Inc. (US)

- Conagra Brands, Inc. (US)

- Kellanova (US)

- Barilla G. e R. Fratelli S.p.A. (Italy)

- Raisio Oyj (Finland)

- Dr. Schär AG/SPA (Italy)

- Ecotone (France)

- Enjoy Life (US)

- Alara Wholefoods Ltd (UK)

- Katz Gluten Free (US)

- Genius Foods (UK)

- Silly Yaks – For Real Taste (Australia)

- Norside Foods Ltd (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.89 BN |

| Market Forecast in 2030 (Value) | USD 5.94 BN |

| Growth Rate | CAGR of 7.1% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (KT) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Countries Covered | US, Canada, Mexico |

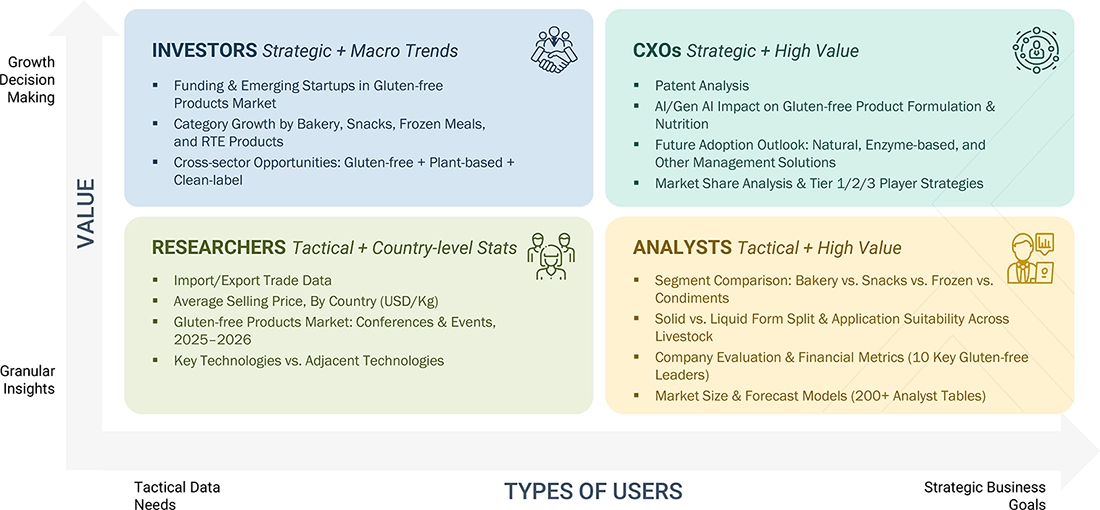

WHAT IS IN IT FOR YOU: GLUTEN-FREE PRODUCTS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Gluten-free Product Manufacturer |

|

|

| Gluten-free Product Manufacturer |

|

|

RECENT DEVELOPMENTS

- July 2024 : Ore-Ida and GoodPop, brands of The Kraft Heinz Company, joined forces with frozen novelties in the creation of Fudge n' Vanilla French Fry Pops, manufactured using vanilla oat milk, a chocolate fudge shell, and crispy potato bits. With strategic placement into the gluten-free category, these two innovative, first-of-their-kind products were expected to place the companies in an excellent position to meet the increasing consumer demand for unique and allergen-friendly snacks.

- March 2024 : Garden Veggie, a brand of the Hain Celestial Group, introduced Flavor Burst Tortilla Chips. These gluten-free tortilla chips were expected to be available in vegetable-infused flavors like Nacho Cheese and Zesty Ranch. This innovation is expected to help the company grow by providing consumers with healthy and nutritious gluten-free snacking options.

- February 2024 : General Mills' yogurt brand, Yoplait, launched Yoplait Original with Chocolate Shavings in Cherry, Raspberry, and Strawberry flavors to add creaminess to this guilt-free treat of real chocolate. These gluten-free product offerings are expected to give the company a competitive edge in the market.

Table of Contents

Methodology

The study involved major segments in estimating the current size of the North America gluten-free products market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the North America gluten-free products market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the North America gluten-free products market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across North America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to North America gluten-free products type, form, distribution channel and region. Stakeholders from the demand side, who use gluten-free ingredients, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of North America gluten-free products and the outlook of their business, which will affect the overall market.

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total market size. These approaches were also used to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall North America gluten-free products market and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

- According to the Food and Drug Administration (FDA), gluten-free products are food products that do not contain any of the following:

- An ingredient that is any type of wheat, rye, barley, or crossbreeds of these grains

- An ingredient derived from these grains, and that has not been processed to remove gluten

- An ingredient derived from these grains that has been processed to remove gluten, if it results in the food containing 20 or more parts per million (ppm) gluten.

Key Stakeholders

- Supply-side: Gluten-free products manufacturers, suppliers, distributors, importers, and exporters

- Gluten-free products additive manufacturers and traders

- Demand-side: Gluten-free product manufacturers

- Regulatory side: Concerned government authorities, commercial research & development (R&D) institutions, and other regulatory bodies.

- Associations and industry bodies such as:

- Food and Drug Administration (FDA)

- European Food Safety Authority (EFSA)

- Food Standards Australia New Zealand (FSANZ)

- Gluten-Free Certification Organization (GFCO)

- National Foundation for Celiac Awareness (NFCA)

- Gluten-Free Standards Organization (GFSA)

- International Certification Services (ICS)

Report Objectives

- To define, segment, and forecast the North America gluten-free products market based on type, form, source, distribution channel and region from 2020 to 2023 and a forecast period from 2024 to 2029

- To provide detailed information about the key factors, including drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify attractive opportunities in the market by determining the largest and fastest-growing segments across regions

-

To analyze the demand-side factors based on the following:

- Impact of macro and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Strategically profile the key players and comprehensively analyze their core competencies

- Competitive developments, such as partnerships, mergers & acquisitions, new product developments, and expansions & investments in the North America gluten-free products market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

PRODUCT ANALYSIS

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

GEOGRAPHIC ANALYSIS

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of the Europe Gluten-free products market into key countries

- Further breakdown of the Rest of Asia Pacific Gluten-free products market into key countries

- Further breakdown of the South America Gluten-free products market into key countries

COMPANY INFORMATION

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Gluten-Free Products Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Gluten-Free Products Market