North America Refrigerants Market

North America Refrigerants Market by Type (HFC, HFO, Isobutane, Propane, Ammonia, Carbon Dioxide, Others) & Application (Refrigeration Systems, Chillers, Air Conditioning Systems, and MAC) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The North America refrigerants market is projected to grow from USD 1.75 billion in 2025 to USD 2.41 billion by 2030, at a CAGR of 6.36% during the forecast period. The growth is driven by the region’s strong regulatory push toward low-GWP alternatives, the federal AIM Act HFC phase-down schedule, and state-level restrictions led by the California Air Resources Board (CARB). The market is shifting rapidly away from high-GWP HFCs, including R-404A, R-410A, and R-134a, toward climate-friendly HFOs, HFO blends, CO2, and propane. Growth is further supported by the rising demand for energy-efficient HVAC systems, large-scale replacement of aging commercial refrigeration units, and the surge in cold-chain expansion for pharmaceuticals, food logistics, and e-commerce. The increasing adoption of heat pumps in residential and commercial buildings, alongside OEM transitions to A2L refrigerants across chillers, rooftop units, and packaged systems, is boosting market momentum.

KEY TAKEAWAYS

-

BY TYPEThe HFO segment is projected to be the fastest-growing refrigerant type, with a CAGR of 14.87% in terms of value between 2025 and 2030.

-

BY APPLICATIONThe MAC application is projected to register the highest CAGR of 6.87%, in terms of value, during the forecast period.

-

BY COUNTRYThe US dominated the North America refrigerants market in 2024, accounting for a market share of 78.3% in terms of value.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSHoneywell International Inc., The Chemours Company, Arkema, A-Gas International Limited, and Orbia Advance Corporation are identified as key players in the North America refrigerants market. These companies have strong market presence and extensive product portfolios.

-

COMPETITIVE LANDSCAPE - STARTUPSAGC Inc., Quimobásicos, S.A. de C.V., and Refrigerants Services Inc., among other emerging players, have carved out solid positions in specialized niche segments, highlighting their potential to become future market leaders.

The North America refrigerants market is growing as industries face stricter climate regulations, accelerated HFC phase-downs, and rising compliance pressures under the AIM Act and EPA SNAP rules. Increasing emphasis on low-GWP alternatives is driving rapid substitution of legacy HFCs with next-generation HFOs, HFO blends, CO2, and propane across HVAC, refrigeration, and heat-pump applications. Expanding cold-chain infrastructure and widespread modernization of commercial cooling systems are further boosting demand for environmentally compliant refrigerants.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The consumers business influence on the North America refrigerants market is largely driven by tightening environmental regulations, rapid policy shifts under the AIM Act, and the accelerating need for low-GWP refrigerants across commercial and industrial cooling systems. Key sectors such as residential and commercial HVAC, supermarkets, cold-chain logistics, automotive air conditioning, and industrial refrigeration represent the largest consumers of compliant refrigerants for regulatory alignment and operational reliability.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid transition toward low-GWP refrigerants driven by AIM Act and EPA regulations

-

Strong demand growth from commercial refrigeration, supermarkets, and cold-chain expansion

Level

-

High cost of next-generation refrigerants and system retrofits

-

Supply constraints and limited domestic production of certain low-GWP alternatives

Level

-

Accelerated adoption of HFOs, CO2, and hydrocarbon refrigerants across new systems

-

Growing cold-chain infrastructure and expansion of temperature-controlled logistics

Level

-

Managing phaseout timelines while ensuring system compatibility and product availability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid transition toward low-GWP refrigerants driven by AIM Act and EPA regulations

The North America refrigerants market is being strongly driven by the accelerated transition toward low-GWP refrigerants as mandated by the AIM Act and reinforced through EPA regulatory frameworks. These policies are phasing down high-GWP HFCs and pushing end users, including commercial refrigeration, industrial cooling, and residential HVAC, to adopt climate-friendly alternatives. As manufacturers and system operators work to remain compliant, they are increasingly investing in HFOs, natural refrigerants, and retrofittable low-GWP blends. This regulatory momentum is also prompting large-scale equipment modernization, boosting demand for efficient, certified refrigerants that meet stringent environmental performance criteria. The shift is reshaping the regional market landscape, encouraging faster product innovation and creating sustained growth opportunities for suppliers aligned with the new compliance standards.

Restraint: High cost of next-generation refrigerants and system retrofits

A key restraint for the North America refrigerants market is the substantial cost burden associated with transitioning from older HFC-based systems to equipment compatible with low-GWP refrigerants. Many legacy units cannot be easily retrofitted and instead require complete system overhauls, which can be expensive for supermarkets, industrial facilities, and HVAC operators. The need for additional safety features, especially for mildly flammable A2L refrigerants, further increases installation and training expenses. These financial barriers slow replacement cycles, leading many end users to delay upgrades despite regulatory pressure. As a result, adoption rates for next-generation refrigerants remain uneven across sectors, particularly among small and mid-sized businesses with limited capital budgets.

Opportunity: Growing cold-chain infrastructure and expansion of temperature-controlled logistics

North America’s rapidly expanding cold-chain ecosystem is unlocking major opportunities for refrigerant suppliers as demand surges across pharmaceuticals, frozen foods, and e-commerce grocery fulfillment. New cold-storage warehouses, micro-fulfillment centers, and last-mile refrigerated transport fleets are adopting advanced refrigeration systems that require reliable, energy-efficient refrigerants with strong thermal stability. The rise in biologics manufacturing, vaccine distribution networks, and high-value perishables further reinforces the need for precise, temperature-controlled environments, driving higher consumption of both traditional and low-GWP refrigerants. As companies invest in new facilities to improve supply chain resilience, refrigerant suppliers benefit from continuous replacement cycles, higher system installations, and long-term service contracts linked to these expanding logistics assets.

Challenge: Managing phaseout timelines while ensuring system compatibility and product availability

Managing phaseout timelines is a major challenge for the North America refrigerants market, as companies must balance regulatory deadlines with the practical realities of system compatibility and supply availability. The staggered phaseout of high-GWP HFCs under the AIM Act creates pressure on OEMs, distributors, and service contractors to align equipment upgrades, refrigerant transitions, and inventory planning within tight windows. However, not all existing systems can immediately transition to low-GWP alternatives, and mismatches between refrigerant readiness and available equipment often slow progress. At the same time, inconsistent availability of new refrigerants, components, and certified technicians complicates compliance efforts. This makes it difficult for end users to meet mandated timelines without disruption, while also ensuring that performance, safety, and operational reliability are maintained throughout the transition.

NORTH AMERICA REFRIGERANTS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of next-generation low-GWP refrigerants (R-454B, R-513A) in chillers, rooftop systems, and heat pumps | Implementation of lifecycle refrigerant tracking across service networks | Lower greenhouse gas emissions, compliance with AIM Act and CARB rules, and enhanced system reliability |

|

Integration of alternative, climate-friendly refrigerants into residential HVAC lines | Deployment of optimized heat-exchanger designs to minimize charge volumes | Higher energy efficiency, reduced refrigerant consumption, and improved performance in extreme climates |

|

Adoption of refrigerants like R-454B and R-1234ze in commercial HVAC equipment | Installation of predictive leak analytics and advanced recovery solutions | Reduced operational costs, minimized refrigerant leakage, and stronger regulatory alignment |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the North America refrigerants market is shaped by a mature network of chemical manufacturers, HVAC-R equipment producers, distributors, regulatory agencies, and end-use industries that operate under strict environmental policies. The AIM Act, EPA SNAP rules, and state-level HFC phase-down measures drive continuous innovation toward low-GWP refrigerants such as HFOs, CO2, and hydrocarbons. OEMs and distributors play a central role in supporting supermarkets, cold storage operators, automotive AC suppliers, and commercial HVAC contractors with compliant, energy-efficient refrigerant solutions. The ecosystem is further strengthened by growing demand for retrofits, sustainability-focused procurement, and expanding cold chain logistics. As a result, the North America market functions as a regulation-driven, technology-intensive ecosystem that prioritizes efficiency, compliance, and reliability across all refrigeration and HVAC applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Refrigerants Market, by Type

HFCs remained the dominant refrigerant type in North America, largely due to their entrenched use in existing HVAC and refrigeration systems. Despite their current prevalence, HFCs are expected to grow at the slowest pace among refrigerants, driven by regulatory measures like the AIM Act and EPA restrictions that encourage a shift toward low-GWP alternatives. HFOs and other next-generation refrigerants are gradually gaining traction as industries prepare for a long-term transition to environmentally friendly solutions, ensuring a measured but steady market evolution.

North America Refrigerants Market, by Application

Refrigeration systems in North America emerged as the second-fastest-growing application during the forecast period, reflecting increasing demand across commercial, industrial, and cold chain operations. Expansion in sectors like food processing, logistics, and commercial cold storage, coupled with the push for energy-efficient and compliant solutions, supports the steady uptake of refrigerants. Even with automation and improved system efficiency, the need for reliable cooling infrastructure keeps demand robust in this segment.

REGION

US accounted for largest share of North America refrigerants market in 2024

The US dominates the North America refrigerants market, driven by an accelerated shift toward low-GWP and natural refrigerants prompted by federal regulations and environmental mandates. The expansion of commercial refrigeration, industrial cooling, and HVAC infrastructure, coupled with technological innovations in energy-efficient and smart refrigerant systems, is boosting consumption. Growing awareness of sustainability and corporate commitments to reduce carbon footprints are encouraging early adoption of alternative refrigerants. Moreover, government incentives and industry programs supporting retrofitting of existing systems further strengthen market leadership.

NORTH AMERICA REFRIGERANTS MARKET: COMPANY EVALUATION MATRIX

In the North America refrigerants market, Honeywell International Inc. (Star) leads with a strong market share and comprehensive product portfolio, supported by advanced low-GWP, HFC, and HFO refrigerants catering to HVAC, commercial refrigeration, cold-chain, and industrial applications. Its scale, innovation-driven solutions, regulatory compliance, and broad distribution network have established it as a preferred partner for global OEMs and contractors. A-Gas International Limited (Emerging Leader) is gaining traction with its sustainable refrigerant solutions, reclamation and recovery services, and growing presence in retrofit and low-GWP refrigerant segments. While Honeywell dominates through scale, innovation, and regional reach, A-Gas demonstrates strong potential to advance toward the leaders’ quadrant as regulatory-driven demand for eco-friendly, low-GWP refrigerants and retrofit solutions accelerates.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Honeywell International Inc. (US)

- Arkema (France)

- The Chemours Company (US)

- Linde plc (Ireland)

- Daikin Industries Ltd. (Japan)

- Orbia Advanced Corporation, S.A.B. DE C.V. (Mexico)

- AGC Inc. (Japan)

- Quimobásicos, S.A. de C.V. (Mexico)

- Gas Servei (Spain)

- A-Gas International Limited (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.66 Billion |

| Market Forecast in 2030 (Value) | USD 2.41 Billion |

| Growth Rate | CAGR of 6.36% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Volume (Kiloton), Value (USD Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America |

WHAT IS IN IT FOR YOU: NORTH AMERICA REFRIGERANTS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North America Refrigerants Technology & Product Trends |

|

|

| Customer Intelligence on Key End-use Industries | Delivered insights on buying patterns, price sensitivity, and key selection criteria from major customer groups | Enables client to tailor product positioning and pricing strategies to match customer expectations |

RECENT DEVELOPMENTS

- April 2024 : Honeywell International Inc. announced a collaboration with BOSCH, where BOSCH's new line of heat pumps will feature Honeywell's energy-efficient, low global warming potential (GWP) Solstice 454B refrigerant

- May 2023 : The Chemours Company signed an agreement with Zhejiang Juhua Co., Ltd. to expand the production capacity of its ultra-low global warming potential (GWP) HFO foaming agent, Opteon 1100, and specialty fluids, Opteon SF33. The expansion will triple the capacity of HFO-1336MZZZ, meeting the increasing demand for sustainable, energy-efficient solutions. The new production is expected to begin by the end of 2025, with full capacity anticipated in early 2026.

- January 2020 : Central England Co-Operative selected Honeywell’s Solstice L40x refrigerant for its new food chilling systems.

- December 2019 : Honeywell partnered with Daikin to expand its Solstice N40 (R-448A) refrigerant market in Japan.

Table of Contents

Methodology

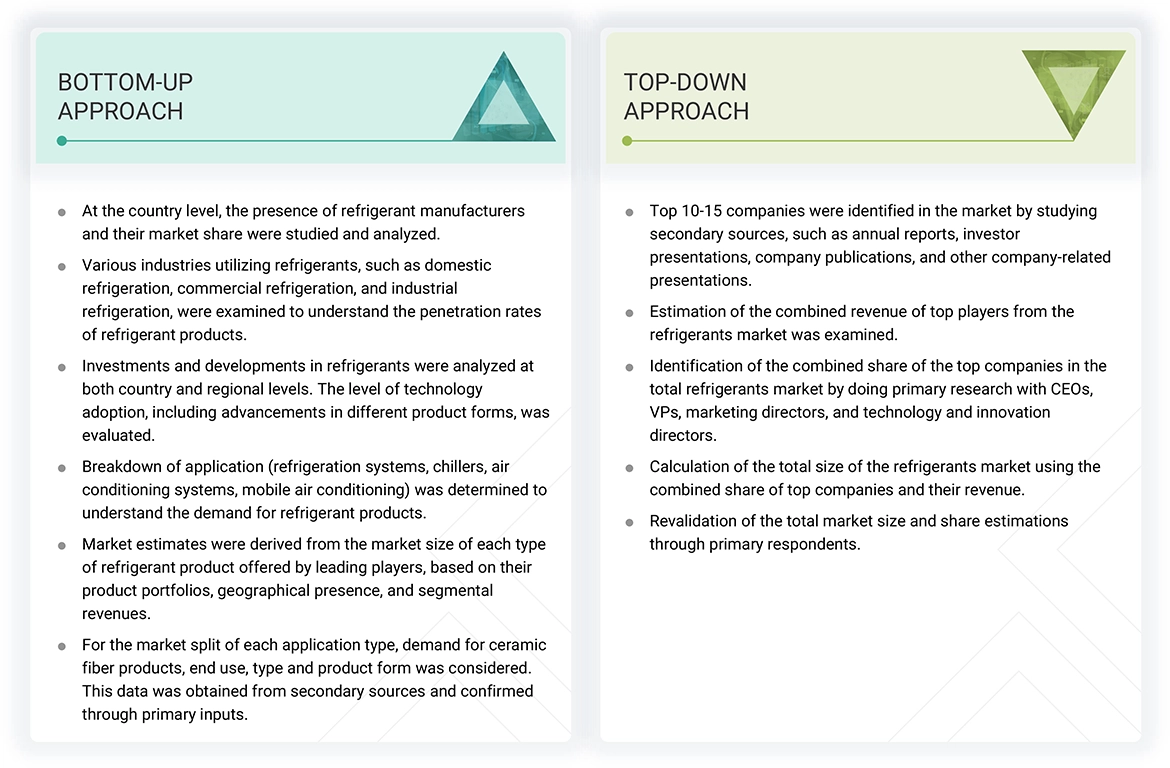

The study involved four major activities in estimating the market size for north america refrigerants. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The North america refrigerants market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the automotive, medical, construction and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative informations.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Honeywell International Inc. | Director of Marketing | |

| The Chemours Company | Manager- Sales & Marketing | |

| The Linde Group | Sales Manager | |

| Arkema | Production Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the North america refrigerants market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

North america refrigerants Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the north america refrigerants industry.

Market Definition

According to the International Institute of Refrigeration, refrigerants are cooling mediums that absorb heat at low temperatures and pressure and release heat at high temperatures and pressure. Fluorocarbons are the most widely used north america refrigerants in equipment, such as refrigerators and air conditioners. However, due to their high ozone depleting potential (ODP) and global warming potential (GWP), they are being replaced by greener north america refrigerants such as propane, isobutane, ammonia, and carbon dioxide, among others, such as water and propene.

Stakeholders

- North america refrigerants Manufacturers

- Refrigerants Traders, Distributors, and Suppliers

- End-use Market Participants of Different Segments of Refrigerants

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

Report Objectives

- To define, describe, and forecast the north america refrigerants market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by type, application, and region

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To strategically profile key players and comprehensively analyze their growth strategies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Refrigerants Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Refrigerants Market