North America Unmanned Underwater Vehicle Market

North America Unmanned Underwater Vehicle Market by AUV (Shallow, Medium, Large), ROV (Observation Class, Medium/Small, Work Class), Application (Military, Oil & Gas, Oceanography, Search & Salvage), Propulsion, System, Speed, Shape, Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The unmanned underwater vehicle (UUV) market in North America is projected to grow from USD 1.53 billion in 2025 to USD 2.26 billion by 2030 at a CAGR of 8.1%. In terms of volume, the market is projected to reach 8,569 units by 2030 from 4,833 units in 2025. Market growth is supported by expanding offshore wind development and subsea infrastructure upgrades across the US and Canada, which are increasing demand for advanced AUV and ROV inspection, mapping, and maintenance capabilities.

KEY TAKEAWAYS

-

By CountryThe US UUV market accounted for an 82.4% share in 2025.

-

By TypeTHe autonomous underwater vehicle (AUV) segment is projected to register the highest CAGR (8.3%) during the forecast period.

-

By ApplicationMilitary & defense is projected to be the leading segment during the forecast period.

-

Competitive Landscape - Key PlayersL3Harris Technologies, Inc., Teledyne, and Oceaneering were identified as star players in the unmanned underwater vehicle (UUV) market in North America, given their strong market share and product footprint.

-

Competitive Landscape - SMEsMarineNav, Deep Trekker, and Poseidon Robotics, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The unmanned underwater vehicle (UUV) market in North America is witnessing steady growth, driven by growing investments in seabed monitoring and environmental research, as US and Canadian agencies expand ocean observation programs that rely on autonomous systems for high-resolution data collection across coastal and Arctic waters.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customer businesses in the unmanned underwater vehicle market in North America is shaped by changing operational needs and more advanced underwater mission requirements across the US and Canada. Defense groups, offshore energy operators, and hydrographic agencies are relying more on UUVs for maritime security, subsea infrastructure inspection, and large-scale environmental monitoring. The shift toward autonomous detection, longer endurance missions, advanced sensing, and hybrid UUV ROV capabilities is changing how these operations are planned and carried out. As a result, demand is growing for reliable UUV platforms, integrated payloads, and data-focused underwater systems that can support more complex mission profiles across the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surge in Defense-led Seabed Warfare and Autonomy Programs

-

Growth of Offshore Wind and Subsea Asset Monitoring

Level

-

High Total Cost of Ownership for Advanced UUV Platforms

-

Regulatory Complexities in Operating Autonomous Systems Underwater

Level

-

Expansion of Arctic Domain Awareness and Climate Monitoring Missions

-

Autonomy Upgrades and AI-driven Mission Software

Level

-

Communication Limitations in Deepwater and GNSS-denied Environments

-

Talent Shortage for UUV Pilots, Data Analysts, and Marine Robotic Technicians

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surge in Defense-led Seabed Warfare and Autonomy Programs

The US Navy’s push toward modernization, including programs like XL UUVs and new seabed warfare efforts, is driving demand for advanced AUVs with better endurance, larger payload capacity, and more autonomy. These long-term programs help keep procurement budgets more stable and encourage continued investment in mission systems, sensors, and integration capabilities across the North American market.

Restraint: High Total Cost of Ownership for Advanced UUV Platforms

The cost of acquiring, integrating, maintaining, and customizing UUV payloads remains high for many commercial operators, especially those working in offshore energy or infrastructure monitoring. These expenses often slow broader adoption and make the market more dependent on well-funded defense and energy organizations that can absorb higher capital investments.

Opportunity: Expansion of Arctic Domain Awareness and Climate Monitoring Missions

Growing interest in Arctic surveillance in Canada and the US has led to polar research missions creating new demand for endurance-class AUVs that can operate under extreme conditions. These missions create new opportunities for UUV manufacturers that focus on advanced navigation, environmental sensing, and long-duration energy systems.

Challenge: Communication Limitations in Deepwater and GNSS-denied Environments

Operating in deepwater Gulf areas and high latitude Arctic regions brings real challenges for communication, navigation, and overall mission execution. These harsh environments limit how autonomous UUVs can perform and increase the need for backup assets and contingency planning, which adds to operational complexity and higher costs.

North America Unmanned Underwater Vehicle Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

ROVs are deployed for inspection and maintenance of deepwater pipelines and subsea structures in the Gulf of Mexico. These missions identify corrosion, structural anomalies, and integrity concerns for offshore operators. | Improves subsea asset reliability, reduces diver dependence, and minimizes downtime through accurate condition monitoring |

|

AUVs equipped with synthetic aperture sonar perform high-resolution seabed mapping and boulder detection for offshore wind developments. They also support cable route engineering surveys along the US East Coast. | Enables precise foundation planning, lowers geotechnical risks, and accelerates permitting for large offshore wind projects |

|

Compact ROVs are used by aquaculture farms to inspect net pens, mooring lines, and underwater enclosures. These systems monitor net integrity, biofouling levels, and fish behavior during routine operations. | Strengthens farm biosecurity, reduces operational labor, and supports frequent inspections without divers |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The unmanned underwater vehicle (UUV) ecosystem operates through a defined value chain that includes platform manufacturers, subsystem suppliers, and multi-sector end users. AUV and ROV manufacturers provide the core vehicles used for defense, inspection, and research missions, while system and mission payload suppliers deliver navigation, sensing, and communication technologies that determine operational capability. End users across defense, offshore energy, port security, and environmental sectors apply these systems for surveillance, subsea monitoring, and scientific analysis. This structure enables coordinated development of platforms and mission payloads to meet diverse underwater operational needs in North America.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Unmanned Underwater Vehicle (UUV) Market, By Type

ROVs hold the largest share of the North America UUV market because they play an essential role in deepwater inspection, intervention, and maintenance work across major offshore regions. Energy operators and service providers depend on them for reliable performance during complex subsea operations. Their ability to handle a wide range of tasks and operate safely in challenging environments makes them the preferred choice for most commercial missions.

Autonomous Underwater Vehicle (AUV) Market, By Type

This market is dominated by large AUVs that can operate over 1,000 meters, supporting Canada's expanding Arctic and ocean science projects and the US Navy's deepwater operations. They are ideal for mapping, surveillance, and other high-value underwater missions due to their extended endurance, large payload capacity, and the ability to operate in locations lacking GNSS coverage.

Remotely Operated Vehicle (ROV) Market, By Size

Work-class ROVs lead the UUV market in North America because offshore operators need vehicles that can manage heavy-duty construction, pipeline repairs, and structural inspections. Their power, tooling versatility, and proven stability in deepwater conditions make them indispensable across both commercial and defense applications. This combination of capability and reliability keeps work-class systems in high demand throughout the region.

REGION

US to be fastest-growing country in North America unmanned underwater vehicle (UUV) market during forecast period

The US is projected to be the fastest-growing market during the forecast period, driven by accelerating investment in autonomous undersea warfare programs, including XLUUV and LDUUV initiatives, which are expanding demand for advanced AUV platforms, sensing payloads, and mission integration services.

North America Unmanned Underwater Vehicle Market: COMPANY EVALUATION MATRIX

In the unmanned underwater vehicle market matrix, L3Harris (Star) stands out with a strong competitive position backed by a wide range of products and a solid presence in both defense and commercial areas. Its advanced AUV platforms and mission systems are commonly used for naval surveillance, subsea inspection, and ocean research, which helps the company maintain its leading role across key operations. Meanwhile, Forum Energy Technologies (Emerging Leader) continues to build its position through specialized ROV platforms and mission-focused subsea tools aimed at offshore and industrial use.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- L3Harris Technologies, Inc. (US)

- Teledyne SeaBotix (US)

- Oceaneering International, Inc. (US)

- Forum Energy Technologies (US)

- VideoRay LLC (US)

- Deep Ocean Engineering, Inc. (US)

- Blue Robotics, Inc. (US)

- Phoenix International Holdings, Inc. (US)

- Oceanbotics Inc. (US)

- Poseidon Robotics LLC (US)

- Strategic Robotic Systems (US)

- SEAMOR Marine Ltd. (Canada)

- MarineNav Ltd. (Canada)

- International Submarine Engineering Ltd. (Canada)

- Deep Trekker Inc. (Canada)

- Submersible Systems Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.43 Billion |

| Market Forecast in 2030 (Value) | USD 2.26 Billion |

| Growth Rate | CAGR of 8.1% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | US and Canada |

WHAT IS IN IT FOR YOU: North America Unmanned Underwater Vehicle Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries |

|

| Emerging Leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for more targeted understanding of total addressable market |

RECENT DEVELOPMENTS

- July 2025 : L3Harris Technologies, Inc. delivered three Iver4 580 AUVs to the Royal Navy for Project Wilton under the Mine Hunting Capability program. The systems support unmanned mine-hunting and survey operations at depths of up to 300 m and include hot-swappable aft sections for modular payload integration.

- February 2025 : Teledyne Technologies Incorporated signed a multi-year framework agreement with Sweden’s Defence Materiel Administration for the delivery and support of Gavia AUVs for mine countermeasure operations. The agreement allows future payload additions and includes long-term in-country support through Teledyne FLIR AB.

- January 2025 : Oceaneering International, Inc. secured a three-year contract from Eni Exploration Angola to provide work-class ROVs, ROV tooling, IWOCs, satellite communication, and subsea inspection and remediation services for Block 15 offshore operations.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the North America unmanned underwater vehicle (UUV) market. Exhaustive secondary research was done to collect information on the North America UUV market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analysis was conducted to estimate the overall market size. After that, market breakdown and data triangulation procedures were employed to estimate the sizes of various segments and subsegments within the market.

Secondary Research

During the secondary research process, various sources were consulted to identify and collect information for this study. The secondary sources included government sources, such as SIPRI; corporate filings, including annual reports, press releases, and investor presentations from companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

Extensive primary research was conducted after acquiring information regarding the North America UUV market scenario through secondary research. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

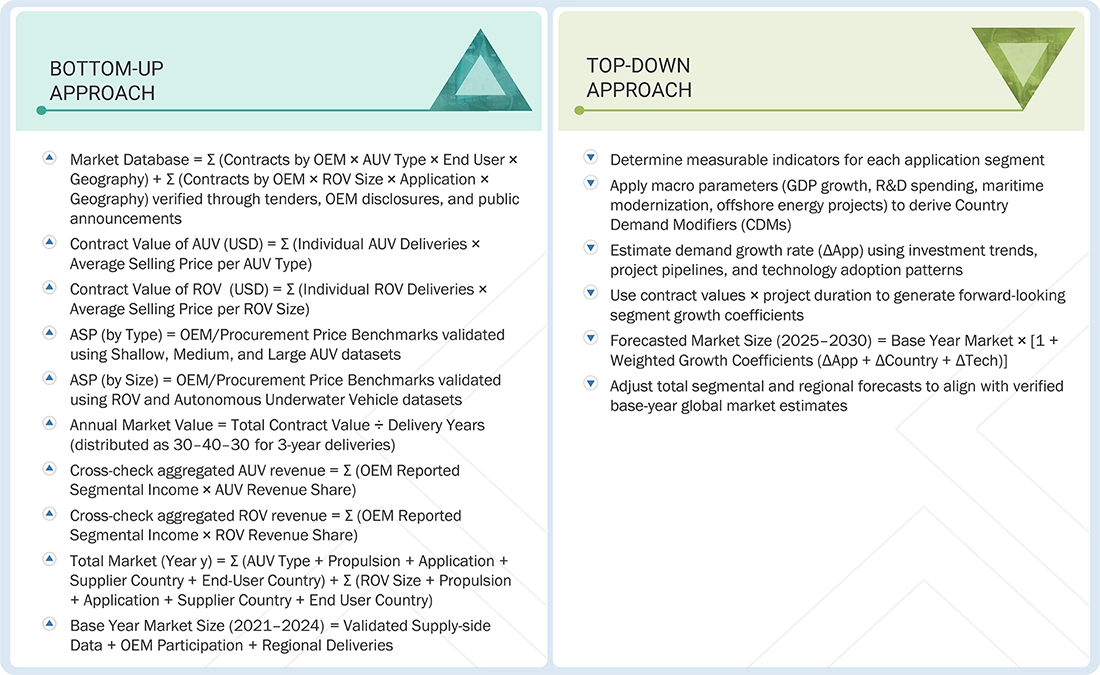

The top-down and bottom-up approaches were used to estimate and validate the size of the North America UUV market. The research methodology used to estimate the size of the market included the following details:

- Key players in the North America UUV market were identified through secondary research, and their market shares were determined through a combination of primary and secondary research. This included a study of the annual and financial reports of the top market players, as well as extensive interviews with leaders, including directors, engineers, marketing executives, and other key stakeholders of leading companies operating in the market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the North America UUV market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

North America Unmanned Underwater Vehicle Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the total market was divided into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using top-down and bottom-up approaches.

Market Definition

The North America unmanned underwater vehicle (UUV) is a self-propelled underwater robotic system used for autonomous or remotely supervised operations across defense, commercial, and research activities. It supports missions such as seafloor mapping, inspection, surveillance, and data collection, enabling efficient underwater tasks without exposing personnel to operational risks.

Key Stakeholders

- Manufacturers and OEMs

- Component and Subsystem Suppliers

- System Integrators

- End Users

- Service Providers

- Regulatory and Certification Bodies

- Research & Technology Institutions

- Investors and Funding Agencies

Report Objectives

- To define, describe, and forecast the North America unmanned underwater vehicle (UUV) market based on type, shape, speed, propulsion, application, system, and cost

- To identify and analyze the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the degree of competition in the market by analyzing recent developments adopted by leading market players

- To provide a detailed competitive landscape of the market, along with a ranking analysis of key players, and an analysis of startup companies in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

- To provide a detailed competitive landscape of the market, along with a market share analysis and revenue analysis of key players

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the North America unmanned underwater vehicle (UUV) market

- Profiling of other market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the North America unmanned underwater vehicle (UUV) market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Unmanned Underwater Vehicle Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Unmanned Underwater Vehicle Market