North America Video Surveillance Market Size, Share & Analysis, 2031

North America Video Surveillance Market by Offering (Cameras, Monitors, Storage Devices, Accessories), Software (VMS, VAS), Camera (PTZ, Dome, Box & Bullet, Panoramic, Bodyworn, Fisheye) - Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The video surveillance market in North America is projected to grow from USD 13.93 billion in 2025 to USD 21.19 billion by 2031, registering a CAGR of 7.2%. Market expansion is driven by the presence of leading technology vendors, and the early adoption of innovations such as edge computing, thermal imaging, and integrated security platforms continues to strengthen market growth across the US and Canada.

KEY TAKEAWAYS

-

BY COUNTRYThe US leads the North America Video Surveillance Market in 2024 with a market share of 83.2%.

-

BY OFFERINGThe Software segment is projected to grow at the highest CAGR of 9.8% from 2025 to 2031.

-

BY VERTICALThe Infrastructure segment is projected to witness the highest CAGR of 9.4% during the forecast period.

-

COMPETITIVE LANDSCAPEHoneywell International Inc. and Motorola Solutions, Inc. were identified as key players in the market, given their strong market share and extensive product portfolios.

The video surveillance market in North America is poised for strong growth, driven by rising security concerns, increasing urbanization, and the need for advanced monitoring in commercial, industrial, and public infrastructure. The adoption of AI-powered analytics, cloud-based surveillance, and IoT-integrated systems is driving demand for smarter, real-time security solutions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In North America, the surveillance market is evolving in response to digital transformation, cloud computing, AI, and IoT. Organizations are shifting to IP cameras, AI analytics, and cloud platforms for scalable, centralized video management and real-time information. IoT devices connect surveillance systems to enable automated alerts and predictive monitoring, while AI enhances facial recognition, behavior analysis, and anomaly detection. These advances address the need for improved situational awareness, enhanced safety, remote access, and increased efficiency. As smart city efforts expand and threats intensify, many businesses are opting for subscription models like VSaaS for flexibility and integration.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing adoption of AI-powered analytics is accelerating the shift toward intelligent and proactive surveillance systems

-

Rising investments in public safety, critical infrastructure protection, and smart city programs are boosting surveillance deployments

Level

-

Stringent data privacy regulations and concerns over surveillance misuse are slowing market expansion

Level

-

Strong demand for cloud-based and VSaaS platforms is opening new recurring-revenue avenues for vendors

-

Expansion of IoT-connected devices is enabling integrated, real-time monitoring across sectors

Level

-

Cybersecurity risks and vulnerabilities in connected surveillance systems remain a major operational concern

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of AI-powered analytics is accelerating the shift toward intelligent and proactive surveillance systems

AI-driven features, such as facial recognition, behavior analysis, anomaly detection, and automated alerts, are transforming traditional video surveillance into intelligent security ecosystems. In North America, enterprises and public agencies are increasingly deploying AI-enabled solutions to enhance situational awareness, reduce manual monitoring workloads, and support faster decision-making. The region’s strong culture of technology adoption, paired with the need for real-time threat detection, continues to accelerate the uptake of advanced analytics across commercial, industrial, and government sectors.

Restraint: Stringent data privacy regulations and concerns over surveillance misuse are slowing market expansion

The North American market is under increasing rules about data privacy, camera use, facial recognition, and video storage. Laws like CCPA, CPRA, and local rules, plus public worries about misuse of surveillance, can slow down new projects or make compliance expensive. Companies need strong cybersecurity and data management systems, which can add difficulty and delay market growth.

Opportunity: Strong demand for cloud-based and VSaaS platforms is opening new recurring-revenue avenues for vendors

Enterprises in the region are rapidly moving toward cloud-managed video systems and subscription-based Video Surveillance as a Service (VSaaS) models. This shift is driven by the need for scalable storage, remote access, lower upfront investment, and simplified maintenance. Vendors benefit from long-term recurring revenue, while customers gain flexibility and centralized control, making cloud adoption one of the strongest growth opportunities in the market.

Challenge: Cybersecurity risks and vulnerabilities in connected surveillance systems remain a major operational concern

As surveillance systems become more connected and cloud-dependent, they face heightened exposure to cyberattacks, ransomware, unauthorized access, and device-level exploits. Ensuring strong encryption, firmware security, and continuous monitoring has become critical but challenging, especially for organizations managing large or distributed camera networks. Cybersecurity threats pose reputational, financial, and operational risks that complicate adoption and remain a significant concern for end users.

North America Video Surveillance Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Gangneung city had over 2,000 IP cameras but lacked centralized control and unified analytics, making it difficult for operators to monitor video feeds, respond to incidents, and conduct efficient investigations. The city implemented the Briefcam Video Analytics Platform, featuring deep-learning object detection, classification, face & license-plate recognition, and the patented VIDEO SYNOPSIS for streamlined search and real-time alerts. | Gangneung’s control center could detect urgent situations in real-time, accelerate post-event investigations, such as tracking suspects and locating missing persons, and scale its surveillance infrastructure for future growth, significantly enhancing city-wide security operations. |

|

Greater Dayton School (GDS) faced challenges due to inadequate video security and poor-quality two-way radios, which limited effective monitoring, communication, and overall campus safety. The school upgraded to Motorola Solutions’ Avigilon cameras, smart sensors, and advanced radios, including Avigilon Unity Video, Unity Access, HALO Smart Sensor, IP Video SentiERS, TLK 100, and MOTOTRBO ION radios. | The upgraded Motorola Solutions ecosystem improved video quality, enabled AI-powered incident investigations, enhanced staff communication, and strengthened campus security, helping GDS work toward its goal of becoming the safest school in Ohio. |

|

Ipswich City Council needed to modernize its outdated Safe City surveillance system (from 1994) by integrating IP cameras and unifying adjacent systems, requiring a scalable and flexible video management solution. The city upgraded to Genetec Security Center’s Qmnicast VMS, managing over 500 cameras and enabling real-time mobile access for law enforcement. | The upgrade resulted in a 78% reduction in crime, faster real-time response times, and enhanced collaboration with police, significantly improving public safety and operational efficiency. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The North America Video Surveillance Market ecosystem comprises a diverse network of hardware manufacturers, software developers, cloud service providers, integrators, and end users that collectively shape the region’s security landscape. Leading global and regional players supply IP cameras, NVRs, and advanced sensors, while software and analytics vendors deliver AI-driven capabilities, including facial recognition, behavioral analysis, and real-time alerts. Video management software (VMS) providers and cloud platforms enable scalable storage, remote monitoring, and centralized control, supported by integrators who design and deploy customized surveillance solutions across various sectors, including commercial, government, industrial, and residential. The ecosystem also includes cybersecurity specialists and IoT device providers, who ensure secure and interconnected operations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Video Surveillance Market, By Offering

The hardware category leads the North American video surveillance market due to the widespread adoption of advanced surveillance devices such as IP cameras, network recorders, and access control systems across commercial, industrial, and government sectors. Increasing security concerns, rising criminal activities, and stringent regulatory compliance requirements are prompting organizations to invest heavily in robust and reliable hardware solutions. Additionally, ongoing technological advancements, including high-resolution imaging, AI-enabled cameras, and integration with smart infrastructure, further reinforce hardware demand in the region.

North America Video Surveillance Market, By Vertical

The infrastructure segment is expected to grow at a significant CAGR in the North American video surveillance market, supported by the growing need for scalable, flexible, and integrated surveillance systems that can support expanding networks of cameras and devices. Increasing investments in cloud-based storage, data centers, and advanced networking infrastructure, coupled with the adoption of AI and IoT-enabled surveillance solutions, are fueling rapid infrastructure upgrades. Moreover, rising security and compliance requirements across sectors such as transportation, government, and critical infrastructure are accelerating demand for robust and future-ready surveillance infrastructure in the region.

REGION

US to hold largest market share North America Night Vision Device Market during forecast period

The US is expected to hold the largest market share due to its advanced infrastructure, widespread adoption of smart city initiatives, and strong security regulations across public and private sectors. High demand from government, transportation, and critical infrastructure projects, coupled with significant investments in AI-enabled and IP-based surveillance systems, further reinforces its large market share

The Asia Pacific video surveillance market is projected to grow from USD 30.89 billion in 2025 to USD 52.00 billion by 2031, registering a CAGR of 9.1%. Market expansion is driven by rapid urbanization, smart city investments, and widespread adoption of AI-powered security technologies across public and commercial sectors.

North America Video Surveillance Market: COMPANY EVALUATION MATRIX

In the North America Video Surveillance Market matrix, Honeywell International Inc. (Star) leads with a comprehensive portfolio of advanced security solutions, including high-performance cameras, intelligent video analytics, and integrated access control systems. Its strong presence across government, commercial, and industrial sectors, combined with ongoing investments in AI-driven and IoT-enabled surveillance technologies, reinforces its dominance. Honeywell’s focus on innovation, reliability, and scalable solutions positions it as a key player in both traditional and next-generation video surveillance applications across the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Motorola Solutions, Inc.

- Teledyne Technologies Incorporated

- Honeywell International Inc.

- Eagle Eye Networks

- ADT

- Genetec Inc.

- March Networks

- Verkada, Inc.

- Camcloud

- Ivideon

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 13.36 Billion |

| Market Forecast in 2031 (Value) | USD 21.19 Billion |

| Growth Rate | CAGR of 7.2% from 2025-2031 |

| Years Considered | 2021-2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Countries Covered | US, Canada, Mexico |

WHAT IS IN IT FOR YOU: North America Video Surveillance Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Improve city-wide surveillance efficiency |

|

|

| Secure critical infrastructure (energy plants, airports) |

|

|

| Retail loss prevention and customer analytics |

|

|

RECENT DEVELOPMENTS

- June 2025: Honeywell International Inc. (US) launched the 50 Series CCTV portfolio, its first locally designed and manufactured camera line in India. Developed with VVDN Technologies, it aligns with the Aatmanirbhar Bharat initiative and meets Class 1 certification standards.

- May 2023: Motorola Solutions Inc. (US) partnered with the UK government to provide 13,000 VB400 body-worn cameras to His Majesty’s Prison and Probation Service officers across England and Wales. The deployment will help enhance officer safety, trust, and transparency for staff and prisoners by capturing objective video and audio evidence. This camera offers high-quality video and audio capture and has an automatic pre-recording capability, maintaining a record of every interaction.

- February 2023: ADT LLC. launched the ADT+ App, which offers a self-setup line of DIY smart home security products, including Google Nest offerings. The app allows customers to easily access and control their ADT devices through an intuitive app experience.

Table of Contents

Methodology

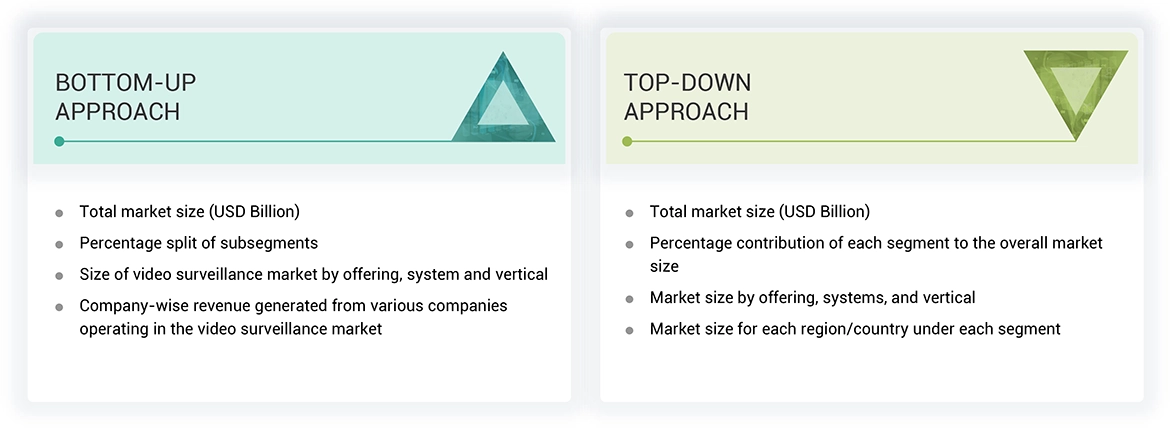

The study employed four primary activities to determine the market size of the North America video surveillance industry. Exhaustive secondary research was conducted to gather information on the market, as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the size of the North America video surveillance market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. Various secondary sources were consulted during the secondary research process to identify and collect information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, and articles by recognized authors; websites; directories; and databases. Secondary research has primarily been utilized to gather key information about the value chain of the North America video surveillance market, including key players, market classification, and segmentation according to industry trends, as well as geographic markets and key developments from both market- and technology-oriented perspectives. The secondary research referred to for this research study involves various white papers, such as Video Analytics and Surveillance white paper by Hewlett Packard Enterprise Development LP., and other multiple sources Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect valuable information for a technical, market-oriented, and commercial study of the North America video surveillance market.

Primary Research

During the primary research process, various primary sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information relevant to this report. Primary sources from the supply side include key industry participants, subject-matter experts (SMEs), and C-level executives and consultants from various key companies and organizations in the North America video surveillance ecosystem. After completing the market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to verify and validate the critical market numbers obtained.

Primary data has been collected through questionnaires, emails, and telephone interviews. During the canvassing of primaries, various departments within organizations, including sales, operations, and administration, were covered to provide a holistic perspective in our report. This, along with the opinions of in-house subject matter experts, has led us to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were utilized to estimate and validate the size of the North America video surveillance market and its submarkets. Secondary research was conducted to identify the key players in the market, and primary and secondary research were used to determine their market share in specific regions. The entire process involved studying the annual and financial reports of top players and conducting extensive interviews with industry leaders, including CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

North America Video Surveillance Market: Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the North America video surveillance market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both the top-down and bottom-up approaches.

Market Definition

Video surveillance systems utilize cameras to observe and record the behavior and activities of individuals, as well as to monitor specific areas, thereby enhancing safety and security. These systems help protect individuals, assets, and facilities cost-effectively. The video surveillance market involves the development, production, and distribution of technologies that capture, analyze, and manage visual data to support security and situational awareness. It includes products such as cameras, video management systems, analytics software, and storage solutions used across various sectors, including public safety, retail, and infrastructure. These systems provide real-time and recorded footage for incident prevention, detection, and investigation while also helping improve operational efficiency. Advances in AI analytics, high-resolution imaging, cloud-based storage, and smart device integration have enhanced system performance and automation. However, concerns around privacy, data protection, and ethical use of surveillance data highlight the need for clear regulations and responsible implementation practices.

Key Stakeholders

- Raw material vendors

- Component (image sensor, lens, and module) providers

- Software providers

- Video surveillance cameras and other hardware manufacturers

- Original equipment manufacturers (OEMs)

- Video surveillance system integrators

- Service providers

- Technology standards organizations, forums, alliances, and associations

- Governments, financial institutions, and investment communities

- Research organizations

- Analysts and strategic business planners

- Venture capitalists, private equity firms, and startup companies

- Distributors

- End users from different verticals, such as infrastructure, commercial, institutional, industrial, and residential

Report Objectives

- To describe and forecast the North America video surveillance market in terms of value based on offering, system type, and vertical

- To describe and forecast the market size for North America video surveillance cameras in terms of volume

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To understand the impact of AI/GenAI on the market

- To provide a detailed overview of the supply chain of the North America video surveillance ecosystem

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for various stakeholders by identifying high-growth segments of the market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on different parameters within the broad categories of business strategy excellence and strength of product portfolio

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape of the market

- To analyze competitive developments, such as acquisitions, product launches, expansions, and partnerships, in the market

- To provide a detailed overview of the ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, average selling price (ASP) analysis, AI/gen AI impact analysis, Porter five forces analysis, macroeconomic outlook, regulations, and certifications

- To analyze the impact of the macroeconomic outlook on the North America video surveillance market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to five)

- Additional country-level analysis of the North America video surveillance market

Product Analysis

- Product matrix, which provides a detailed comparison of each company's product portfolio in the North America video surveillance market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Video Surveillance Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Video Surveillance Market