North America Anti-Drone Market

North America Anti-Drone Market by Electronic System, Kinetic System, Laser System, Hybrid System, Ground-based, Handheld, UAV-based, Detection, Detection & Disruption, Military & Defense, Commercial, and Homeland Security - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

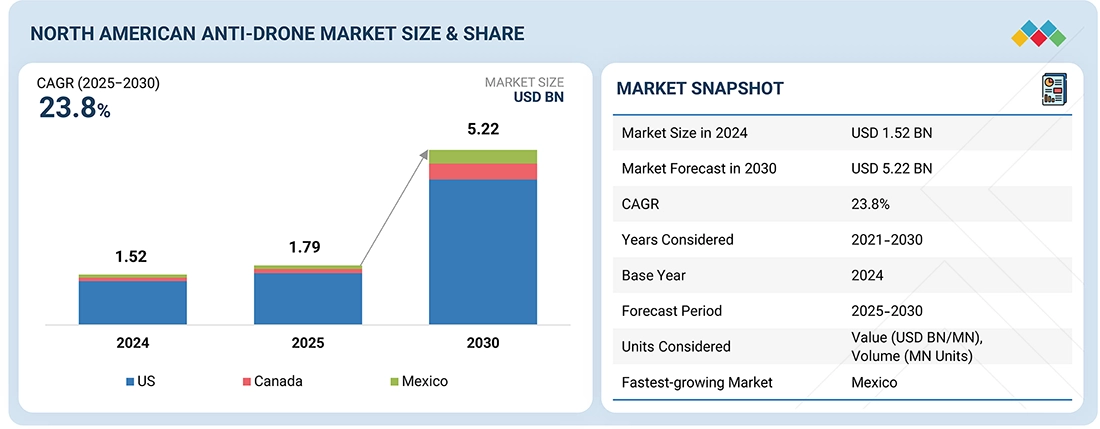

The North America anti-drone market is projected to reach USD 5.22 billion by 2030 from USD 1.79 billion in 2025, at a CAGR of 23.8% from 2025 to 2030. The regional market is driven by the rapid rise in unauthorized drone intrusions across critical infrastructure, defense bases, airports, and public events, prompting agencies to adopt advanced counter-UAS systems. Increasing investments by the US Department of Defense and homeland security bodies are accelerating the deployment of radar, RF, EO/IR, and AI-enabled detection and mitigation platforms. The strong defense industrial base, coupled with active R&D programs in electronic warfare and autonomous threat neutralization, further strengthens adoption. Additionally, growing commercial drone traffic and evolving regulatory frameworks requiring enhanced airspace protection continue to fuel long-term market demand.

KEY TAKEAWAYS

-

BY COUNTRYBy country, the US dominated the North America anti-drone market with a share of 86.5% in 2024.

-

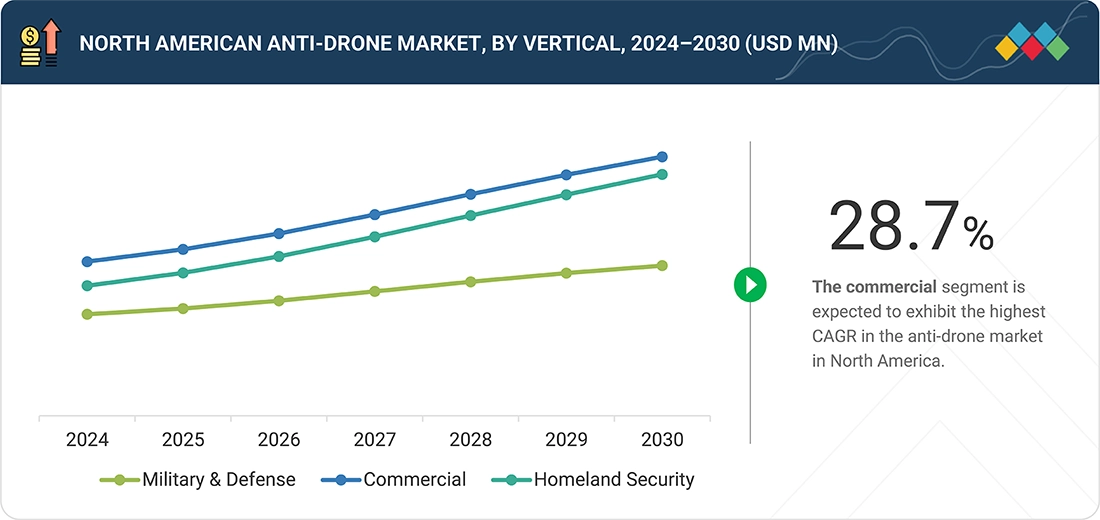

BY VERTICALBy vertical, the commercial segment will grow the fastest at a CAGR of 28.7% during the forecast period.

-

BY PLATFORM TYPEBy platform type, the ground-based segment is expected to dominate with a market share of ~74–78% in 2024.

-

BY SYSTEM TYPEBy system type, the laser systems segment is expected to register the highest growth rate during the forecast period.

-

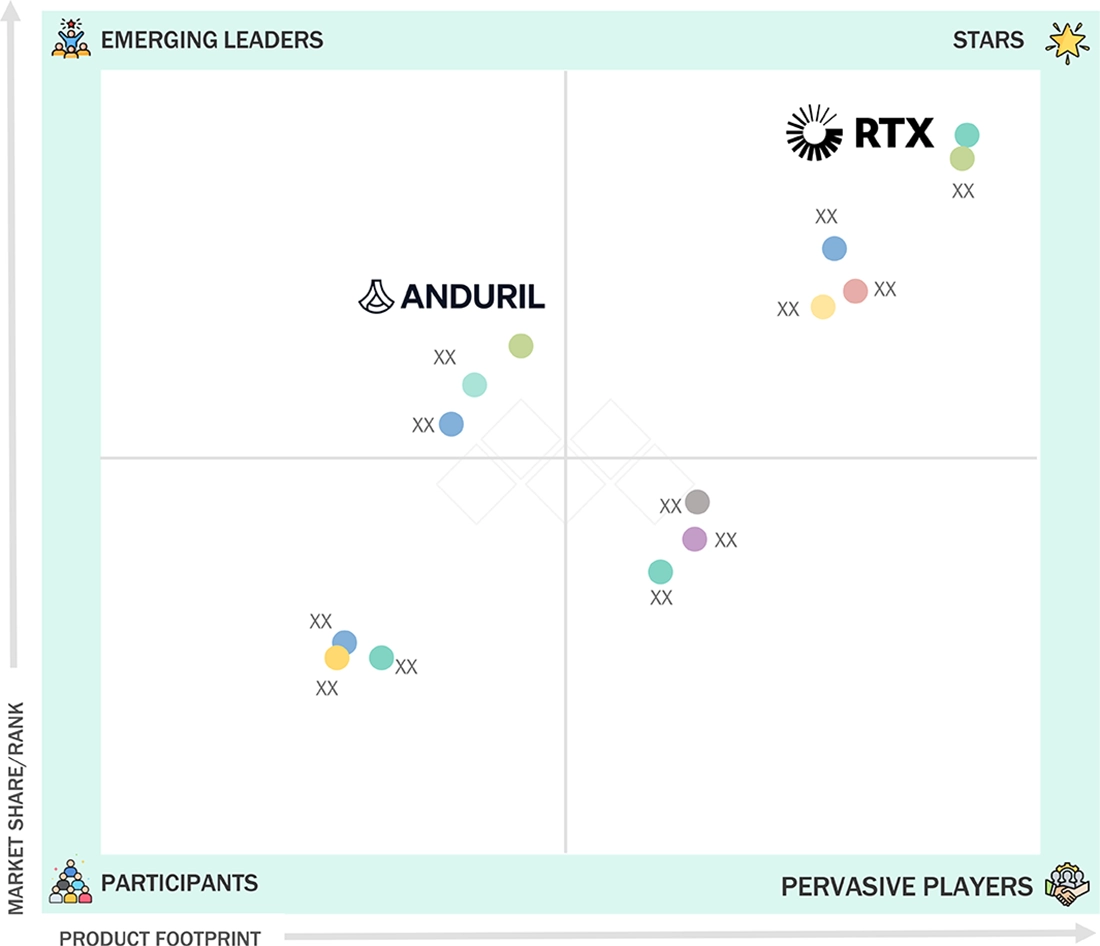

COMPETITIVE LANDSCAPE - KEY PLAYERSRTX and Lockheed Martin were identified as some of the star players in the North America anti-drone market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESFortem Technologies and BluetHalo, among others, have distinguished themselves among SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The North America anti-drone market is driven by rising unauthorized drone activity across military sites, airports, and critical infrastructure, prompting stronger adoption of layered counter-UAS systems. In the US, robust federal defense spending, DHS-led security programs, and increasing drone incidents near restricted airspace accelerate market growth. Canada is advancing procurement for border protection and safeguarding energy facilities, particularly in remote and high-risk regions. Mexico is experiencing growing demand as security forces and critical infrastructure operators respond to the use of drones in surveillance and illicit cross-border activities, driving investments in detection and monitoring technologies.

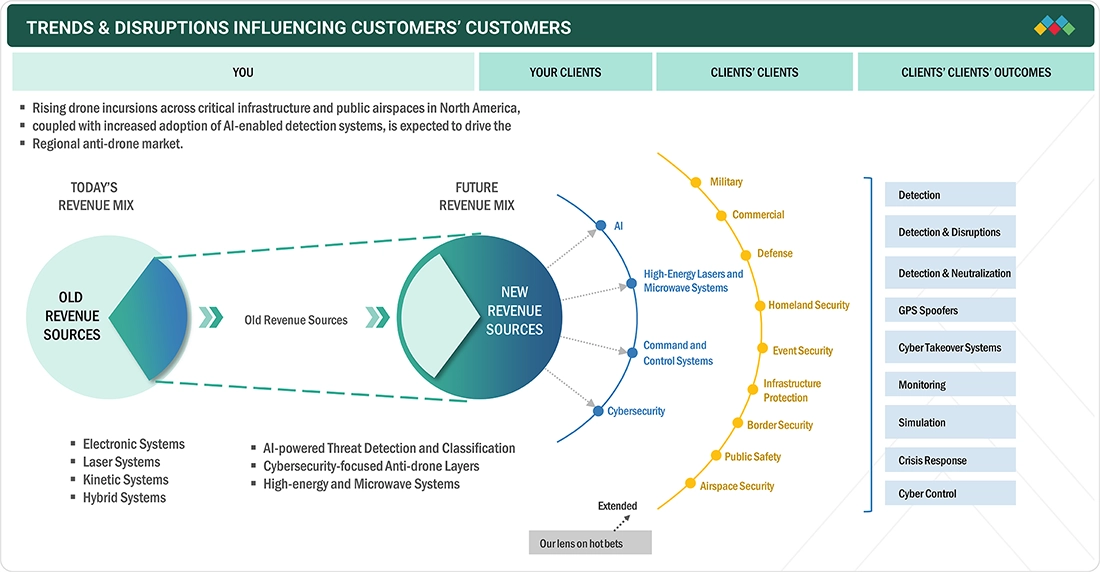

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The North America anti-drone market is transitioning from conventional radar, kinetic, and hybrid systems toward AI-driven detection, cybersecurity-centric layers, and high-energy or microwave-based solutions. This shift is fueled by increasing drone incursions across military facilities, airports, borders, and public venues, demanding faster and more autonomous threat response. Defense, homeland security, infrastructure protection, and public safety agencies are emerging as priority adopters, shaping future revenue streams. The market’s trajectory reflects growing emphasis on automation, cross-domain command-and-control, and advanced mitigation technologies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High Federal and Defense Investments

-

Expansion of AI-Enabled Surveillance Infrastructure

Level

-

Regulatory Constraints on Drone Neutralization

-

High Deployment and Integration Costs

Level

-

Growing Demand for Cyber-Based Mitigation

-

Adoption of Anti-Drone Systems by Airports and Stadiums

Level

-

High False-Positive Rates in Dense Urban Environments

-

Rapid Evolution of Low-Cost, Autonomous Drones

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High Federal and Defense Investments

The US Department of Defense, Homeland Security, and federal law enforcement agencies are directing substantial funding toward counter-UAS modernization programs. These investments support large-scale deployment of radar, RF analytics, electro-optical sensors, cyber takeover tools, and directed-energy systems across bases and border zones. Canada is similarly expanding its defense procurement to address evolving aerial threats. This sustained government spending forms one of the most powerful growth drivers in the region.

Restraint: High Deployment and Lifecycle Costs

In North America, especially the US, drone interdiction—jamming, kinetic engagement, or cyber takeover—is tightly regulated and largely restricted to federal entities. State police, airports, and private facilities cannot freely deploy mitigation tools, limiting widespread adoption. This regulatory barrier slows commercial market growth and creates operational gaps for organizations seeking immediate protection. Regulatory uncertainty therefore remains a key restraint for broader counter-UAS implementation.

Opportunity: Growing Demand for Cyber-Based Mitigation

The region’s strong cybersecurity ecosystem and AI capabilities support rapid expansion of non-kinetic, cyber takeover solutions. Organizations prefer these methods as they minimize collateral damage and comply with evolving regulatory standards. AI-driven analytics also enhance threat classification accuracy in complex urban settings. This convergence creates a sizable opportunity for next-generation software-centric anti-drone solutions.

Challenge: High False-Positive Rates in Dense Urban Environments

North America cities present highly congested RF environments, making drone detection and classification significantly more complex. Anti-drone sensors must differentiate malicious drones from delivery drones, hobbyist aircraft, and numerous RF-emitting devices. This increases false positives and complicates real-time decision-making for security teams. Ensuring accuracy requires sophisticated AI models and continuous sensor calibration, posing operational and technical challenges.

NORTH AMERICA ANTI-DRONE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

RTX deployed its counter-UAS detection suite, including low-altitude surveillance radars and RF analytics, at multiple US military bases to strengthen monitoring of small UAV activity near restricted airspace. The deployment focused on enhancing perimeter awareness and enabling rapid threat classification. | Improved real-time detection of low-altitude drones | Enhanced perimeter security coverage | Faster operator response through automated alerts |

|

Lockheed Martin implemented its counter-UAS fusion software and miniature interceptor technologies during US Army evaluations to support layered air defense against hostile drones. The system combined sensor fusion, AI-driven classification, and precision neutralization tools. | Delivered accurate target identification with reduced false positives | Improved engagement effectiveness | Faster decision-making in contested airspace |

|

Anduril deployed its Lattice AI operating system and autonomous Interceptor drones along portions of the US southern border and select federal sites to provide continuous surveillance and automated interception of unauthorized drones. | Enabled persistent autonomous monitoring | Decreased dependence on manual operators | Enhanced interception efficiency through AI-driven classification |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The North America anti-drone ecosystem comprises four key participant stages that collectively drive innovation, deployment, and operational use of counter-UAS technologies. At the R&D Engineers stage, organizations such as Oklahoma State University, the US Air Force Research Laboratory, and DARPA lead advancements in radar processing, electronic warfare techniques, and autonomous counter-UAS algorithms. Manufacturers include major defense companies, such as RTX, Anduril, Lockheed Martin, and Northrop Grumman, which develop integrated detection, tracking, and mitigation systems for military and homeland security applications. In the Distributors stage, firms such as Liteye and AeroDefense provide system integration, field support, and procurement facilitation across commercial and government sectors. Finally, the End Users stage—represented by the US Department of Defense and the US Army—drives large-scale adoption, operational testing, and mission-critical deployment of anti-drone solutions across defense installations and strategic infrastructure.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America Anti-Drone Market, By System Type

Laser systems are projected to exhibit the fastest CAGR owing to accelerated adoption of directed-energy technologies across US defense programs. These systems offer high precision, low engagement costs, and effective response capabilities against drone swarms, making them attractive for long-term operational deployment. Ongoing field evaluations and increasing budget allocations for directed-energy initiatives further strengthen their growth outlook. Consequently, laser systems are positioned to expand rapidly across North America defense applications.

North America Anti-Drone Market, By Platform Type

The UAV-based platform type is anticipated to record the fastest CAGR as mobile airborne platforms gain preference for wide-area surveillance, rapid repositioning, and agile threat engagement. Defense and homeland security agencies in North America are increasingly integrating interceptor drones and airborne sensor payloads to complement fixed-site detection assets. This capability to counter evolving aerial threats in dynamic environments significantly enhances operational flexibility. As a result, demand for UAV-based counter-UAS platforms is expected to grow at an accelerated pace.

North America Anti-Drone Market, By Application

The detection application is expected to lead the North America anti-drone market as it forms the foundational layer for all counter-UAS operations. Airports, defense facilities, border zones, and critical infrastructure operators prioritize robust multi-sensor detection systems to ensure early situational awareness. Investments in radar, RF analytics, EO/IR sensors, and AI-driven detection technologies continue to rise across the region. Given its essential role in enabling downstream mitigation, detection maintains the largest share of market demand.

North America Anti-Drone Market, By Vertical

The military & defense vertical is expected to lead the North America anti-drone market due to sustained federal funding, extensive modernization programs, and the increasing frequency of unmanned incursions across sensitive defense installations. This segment requires advanced, multi-layered counter-UAS architectures capable of delivering continuous surveillance and rapid threat response. Strong procurement momentum from the US Department of Defense further reinforces its dominant market position. As a result, Military & Defense remains the primary demand center for sophisticated anti-drone solutions.

REGION

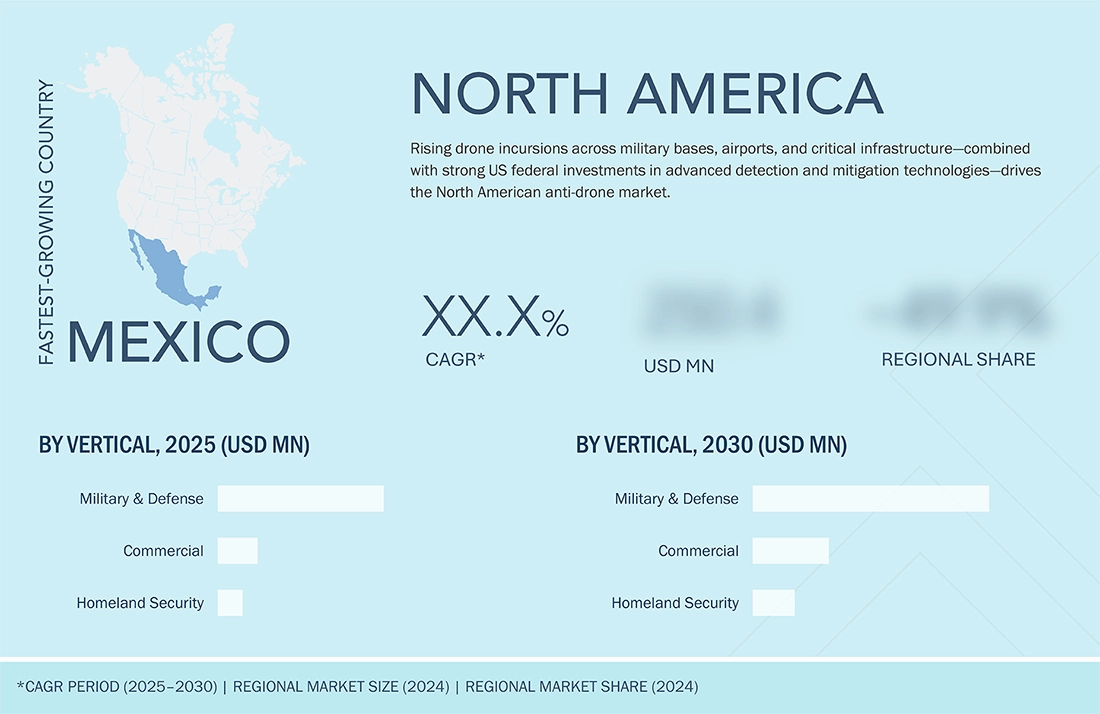

Mexico is expected to be fastest-growing country across North America Anti-Drone market during forecast period

Mexico is expected to exhibit the fastest CAGR due to the increasing use of drones for illicit cross-border activities, surveillance, and smuggling, driving the adoption of counter-UAS technologies by security and law enforcement agencies. The country is strengthening investments in airspace monitoring, border protection, and critical infrastructure security, creating new demand for advanced detection and tracking systems. Growing collaboration with US defense and homeland security bodies further accelerates technology transfer and capability development. As a result, the country is positioned for accelerated market expansion compared with other countries in the region.

NORTH AMERICA ANTI-DRONE MARKET: COMPANY EVALUATION MATRIX

The competitive landscape positions companies according to their market influence and breadth of counter-UAS capabilities, highlighting distinctions between established leaders and rapidly emerging innovators. RTX stands out with a broad, mature product portfolio and strong presence in defense procurement, reflecting high adoption across large-scale military and homeland security programs. Anduril demonstrates rapid upward momentum driven by AI-native platforms and autonomous interception systems, positioning it as a disruptive force gaining share in both government and border security applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- RTX (US)

- Lockheed Martin Corporation (US)

- Anduril Industries (US)

- Moog Inc. (US)

- Boeing (US)

- Detect, Inc. (US)

- Accipiter Radar (Canada)

- ApolloShield (US)

- Northrop Grumman (US)

- Battelle Memorial Institute (US)

- Fortem Technologies (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.52 Billion |

| Market Forecast in 2030 (Value) | USD 5.22 Billion |

| Growth Rate | CAGR of 23.8% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion/Million) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | US, Canada, and Mexico |

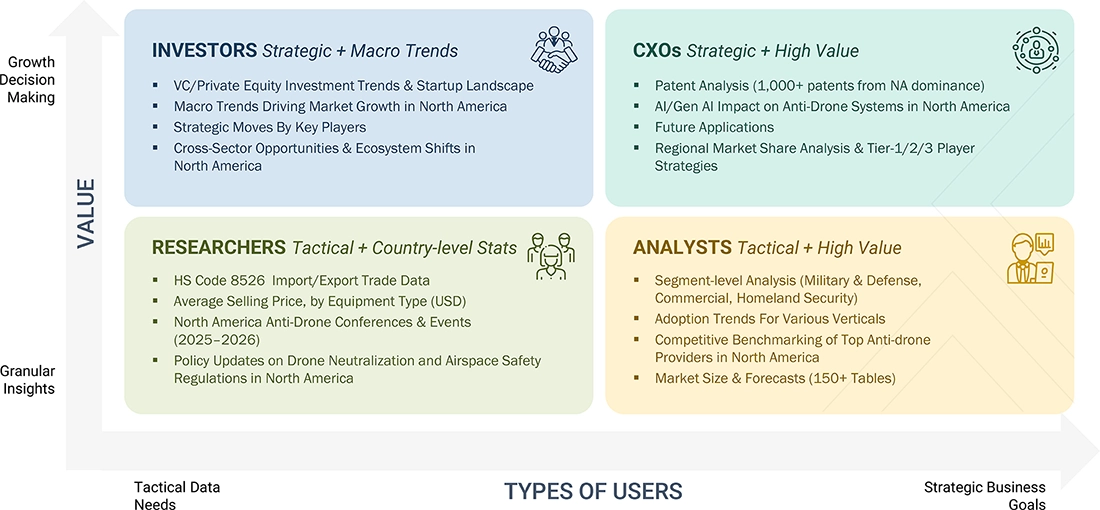

WHAT IS IN IT FOR YOU: NORTH AMERICA ANTI-DRONE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US Defense OEM | Detailed benchmarking of counter-UAS technologies—radar, RF analytics, AI-enabled detection, cyber takeover tools, and high-energy laser systems—across leading North America vendors (RTX, Lockheed Martin, Northrop Grumman, Anduril) |

|

| US Homeland Security Agency | Assessment of counter-UAS deployment models for airports, border zones, and public safety operations, with emphasis on regulatory compliance under DHS and FAA frameworks |

|

| North America Defense Integrator | Performance evaluation of AI/ML-based detection, sensor-fusion engines, and automated classification workflows across multi-sensor counter-UAS architectures |

|

RECENT DEVELOPMENTS

- May 2025 : Raytheon (division of RTX) secured a USD 1 billion defense agreement with Qatar for the FS-LIDS counter-drone system, a fixed-site solution integrating radar, EO/IR cameras, electronic warfare, and kinetic interceptors designed to detect, track, and neutralize small and low-flying drones, including swarms. The deal includes ten systems, 200 Coyote Block 2 interceptors, and comprehensive support services.

- February 2025 : Lockheed Martin unveiled a scalable, layered defense system engineered to detect, track, identify, and neutralize unmanned aerial systems (UAS). Built on a modular, open-architecture design, the system integrates combat-tested command and control, AI-driven detection and tracking software, cost-effective sensors, and a growing range of effectors. It is optimized for rapid deployment and easy integration with existing defense infrastructures.

- November 2024 : Lockheed Martin integrated its Q-53 multi-mission radar with Anduril's Lattice C2 environment during the US Central Command Desert Guardian exercise. This collaboration enhanced drone threat detection and tracking capabilities by creating a unified operational air picture, enabling faster and smarter decision-making in contested environments.

Table of Contents

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North America Anti-Drone Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North America Anti-Drone Market