North American NDT and Inspection Market Size, Share & Analysis, 2030

North American NDT and Inspection Market by Technique (Ultrasonic Testing, Visual, Magnetic Particle, Liquid Penetrant, Eddy-Current, Radiographic, Acoustic Emission), Inspection Service, Equipment Rental, and Calibration – Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The NDT and inspection market in North America is projected to expand steadily from USD 5.16 billion in 2025 to USD 7.71 billion by 2030 at a CAGR of 8.4%. The regional market growth is supported by a large base of aging oil & gas, power, aerospace, and infrastructure assets and a strong regulatory focus on safety and environmental compliance. Furthermore, the increasing adoption of advanced ultrasonic testing, digital radiography, remote and drone-based inspection, and NDT 4.0 solutions that integrate sensors, IoT connectivity, and AI-enabled analytics drives the market. Asset owners are shifting from purely code-driven periodic testing toward risk-based and condition-based inspection programs, while service providers and equipment OEMs capture new value pools in data management, integrity-management software, and long-term asset health contracts.

KEY TAKEAWAYS

-

By CountryThe US NDT and inspection market accounted for a 76.7% market share share in 2024

-

By TechniqueBy technique, the ultrasonic testing segment accounted for the largest market share in 2024

-

By VerticalBy vertical, the aerospace segment is expected to register the highest CAGR of 11.1%

-

By ServiceBy service, the inspection services segment is expected to record a significant CAGR in the North American NDT and inspection market during the forecast period.

-

Competitive LandscapeSGS SA, Bureau Veritas, Baker Hughes Company, Applus+, and MISTRAS Group were identified as some of the star players in the NDT and inspection market (North America), given their strong market share, service, and technique footprint

-

Competitive LandscapeStartups such as ND Testing, Industrial Inspection & Analysis, Inc., Jesse Garant Metrology Center, Giatec Scientific Inc., and Voliro AG have gained traction in NDT and inspection by advanced sensing through digital and robotic platforms, real-time data streaming, cloud-based analytics, and AI-driven diagnostics for automated defect recognition in industrial and infrastructure inspection.

The market is growing rapidly due to the increasing need to maintain and extend the life of aging bridges, pipelines, power plants, and industrial facilities. Assets operating beyond their design life are more prone to corrosion, fatigue, and hidden defects, driving the demand for advanced inspection techniques, such as phased-array ultrasonic testing (PAUT), digital radiography, and continuous structural monitoring. The need for proactive and predictive maintenance drives spending on NDT equipment, services, and data-driven inspection solutions across the region.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Clients’ businesses are reshaped by a shift from traditional NDT revenues (ultrasonic, radiography, visual, and other conventional inspections) toward new, technology-led revenue streams such as IoT-enabled monitoring, AI-driven analytics, drone and automated ultrasonic inspection, digital radiography, terahertz, and near-infrared spectroscopy. The image illustrates this transition being driven by trends, including a shift from manual to autonomous/assisted inspection, digitalization and real-time data ecosystems, the acceleration of digital radiography, growth in advanced ultrasonic and specialty methods, integrated asset-integrity and outcome-based models, and expansion into renewable energy projects. These disruptions are particularly impacting clients in manufacturing, oil & gas, aerospace, automotive, power, marine and medical/healthcare, who in turn are reallocating spend toward drone-based inspection, IoT, AI in NDT, phased-array ultrasonics, liquid penetrant testing and time-of-flight diffraction solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Implementation of stringent industry regulations to enhance safety, reliability, and compliance

-

Growing focus on asset integrity and life-extension of aging infrastructure

Level

-

High upfront cost of advanced NDT equipment and software

-

Shortage of skilled and certified NDT personnel

Level

-

Expanding aircraft fleet to meet rising air passenger traffic

-

Growing demand for miniaturized and portable NDT devices

Level

-

Increasing complexity of modern industrial structures and materials

-

High acquisition and maintenance costs of advanced NDT equipment and software.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Implementation of stringent industry regulations to enhance safety, reliability, and compliance

Market growth is primarily driven by the critical need for asset integrity and increasingly stringent regulatory mandates across key North American industries. The aging public and industrial infrastructure, including bridges, pipelines, and power plants, requires extensive and regular inspections to prevent catastrophic failures and minimize repair costs. Furthermore, the continuous expansion and rising demand in the oil & gas, aerospace, and power generation sectors necessitate robust NDT for quality assurance and safety compliance.

Restraint: High upfront cost of advanced NDT equipment and software

The market faces significant financial and operational friction due to the high capital cost of advanced NDT equipment, such as industrial CT scanners and advanced phased array systems, which limits adoption, especially among smaller firms. Compounding this is the acute shortage of certified NDT technicians in North America, as an aging workforce retires faster than new entrants are certified, slowing service delivery and technological adoption.

Opportunity: Expanding aircraft fleet to meet rising air passenger traffic

Expanding aircraft fleets to meet rising air passenger traffic create a strong structural opportunity for the NDT and inspection market. As airlines and lessors add new aircraft and extend the life of existing fleets, the volume and frequency of mandatory inspections increase across the full lifecycle—from manufacturing and assembly to in-service maintenance, repair, and overhaul. This enlarges the addressable base for advanced NDT solutions (ultrasonic, radiography, eddy current, and emerging digital methods), supports higher recurring service revenues, and encourages OEMs, MROs, and airlines to adopt more automated, data-driven inspection technologies to minimize downtime and ensure regulatory compliance.

Challenge: Increasing complexity of modern industrial structures and materials

The industry is challenged by the growing technical complexity of modern materials like composites and new alloys used in aerospace and automotive sectors, demanding substantial R&D and high-cost equipment for reliable defect detection. Additionally, the reliance on digital data and cloud platforms introduces cybersecurity concerns for critical infrastructure assets, while the scarcity of professionals proficient in AI-assisted analytics (NDT data scientists) hinders the full operationalization of advanced software solutions.

North American NDT and Inspection Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses drone fleets with high-resolution visual and infrared cameras to inspect pipelines, flare stacks, and elevated structures across refineries and midstream assets. Automated flight paths and digital image capture are used to detect corrosion, leaks, and coating damage over long distances. | Earlier detection of integrity issues, reduced need for scaffolding and rope access, lower safety risk to personnel, and significantly faster coverage of large assets with reduced inspection cost. |

|

Deploys portable digital radiography systems to examine insulated and process piping welds in petrochemical plants and power facilities. Technicians collect high-resolution digital X-ray images in the field, often with minimal insulation removal. | Faster image acquisition and review versus film, fewer re-shots, reduced radiation area time and downtime, and improved weld and corrosion assessment through clearer images and permanent digital records. |

|

Provides phased-array ultrasonic testing (PAUT) using automated scanners on pipeline, pressure-vessel, and structural welds for new construction and in-service inspections. Encoded scans generate detailed cross-sectional views and data files for archiving and re-analysis. | Higher probability of detection and more accurate sizing of planar flaws, elimination of radiation hazards associated with RT, shorter inspection windows, and robust digital documentation to support code compliance and life-cycle integrity management. |

|

Delivers integrated asset-integrity programs for tanks, piping, and buried lines, combining corrosion mapping, guided-wave UT, PAUT, and risk-based inspection planning. Inspection data is centralized in integrity software to support long-term decision making. | Improved visibility of corrosion and defect trends, optimized inspection intervals and scopes, fewer unplanned leaks and outages, and better justification of maintenance budgets and repairs for regulators and management. |

|

Utilize drones equipped with magnetic or other NDT sensors to survey above-ground and buried pipelines and difficult-to-reach steel structures. Flights generate georeferenced anomaly maps for follow-up detailed inspection. | Rapid, non-contact screening of long pipeline corridors and tall structures, reduced field crew exposure and site disruption, lower overall survey cost, and more frequent monitoring that supports proactive risk management. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market operates as a well-integrated ecosystem encompassing component suppliers, equipment manufacturers, service providers, and end users. Key input and component suppliers, including CeramTec, Hamamatsu, PI, Analog Devices, and Morgan Advanced Materials, supply critical materials and components that form the foundation of NDT technologies. Equipment designers and manufacturers such as Evident, Sonatest, Magnaflux, Waygate Technologies, and Eddyfi Technologies develop advanced inspection instruments and solutions tailored for diverse industrial applications. Specialized service providers, including SGS, Bureau Veritas, Applus+, Acuren, and Mistras, deliver testing and inspection services that help end users maintain quality, safety, and regulatory compliance. Prominent end users—spanning the automotive, aerospace, oil & gas, and manufacturing sectors—include companies such as Toyota, Tata Steel, ExxonMobil, Boeing, and Airbus, which leverage NDT solutions to ensure operational efficiency and reliability. Overall, the ecosystem exhibits a vertically connected framework where suppliers, manufacturers, and service providers collectively facilitate seamless, high-quality non-destructive testing operations across North America.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North America NDT and Inspection Market, By Technique

Acoustic Emission (AE) Testing is projected to register the highest CAGR in the market during the forecast period, driven by its ability to detect active defects and monitor structural integrity in real time. This technique is increasingly adopted across industries such as aerospace, oil & gas, and power generation for its sensitivity to crack formation, corrosion, and leak detection without causing damage to the tested components. The growing emphasis on predictive maintenance and safety compliance is fueling the accelerated adoption of AE testing solutions in the region.

North America NDT and Inspection Market, By Service

In 2024, inspection services account for the largest share of the market, driven by the high demand for third-party expertise in ensuring asset integrity, safety, and regulatory compliance. These services are widely used across various sectors, including oil & gas, aerospace, automotive, and manufacturing, to detect defects, prevent failures, and minimize operational downtime. The reliance on specialized service providers allows companies to access advanced testing capabilities and maintain consistent quality standards, solidifying inspection services as the leading segment in the region.

North America NDT and Inspection Market, By Vertical

In 2024, the oil & gas vertical dominates the market, holding the largest share due to the sector’s stringent safety, reliability, and regulatory requirements. NDT solutions are extensively employed to inspect pipelines, refineries, storage tanks, and offshore facilities, enabling early detection of corrosion, cracks, and structural defects. The critical need to prevent operational failures, environmental hazards, and costly downtime drives sustained demand for advanced inspection technologies, making Oil & Gas the leading end-user segment in the region.

REGION

Mexico to be the fastest-growing country during the forecast period

Mexico is expected to witness the highest CAGR in the North American NDT and inspection market, driven by rapid urbanization and extensive infrastructure development. The country is investing heavily in expanding urban mobility, including highways, metro systems, and smart city projects, as well as enhancing utilities and construction activities. These developments increase the demand for non-destructive testing services to ensure the structural safety and durability of critical assets. Growing construction and industrial projects require continuous monitoring of materials and structures to prevent failures. Additionally, the focus on modernizing transportation networks and urban infrastructure boosts the adoption of advanced NDT techniques. As a result, the country's infrastructure growth is a major factor supporting its strong market expansion

The Asia Pacific NDT and Inspection market is projected to reach USD 6.91 billion by 2030 from USD 4.30 billion in 2025, at a CAGR of 10.0% from 2025 to 2030. The regional market is driven by rapid infrastructure development, expansion of manufacturing and energy assets, and stricter safety and compliance mandates across emerging and developed economies. Industries are increasingly adopting advanced techniques, such as digital radiography, PAUT, robotics, and IoT-enabled monitoring, to improve inspection accuracy and reduce downtime. The region is also witnessing a strong push toward automation and AI-based defect recognition to address skill shortages and enhance operational efficiency. These trends are accelerating the transition from traditional periodic inspections to data-centric, continuous asset-integrity management models.

The European NDT and inspection market is projected to expand steadily from USD 3.48 billion in 2025 to USD 4.80 billion by 2030 at a CAGR of 6.7%. The regional market is driven by expanding aerospace and automotive production, which demands high precision and safety in components. The increasing use of lightweight composites, advanced alloys, and additive manufacturing parts requires advanced inspection methods, including ultrasonic testing, CT scanning, and digital radiography. The focus on Industry 4.0, automation, and predictive maintenance enhances operational efficiency and boosts reliance on NDT solutions. Rising production volumes, electric vehicle adoption, and aerospace fleet modernization further increase the need for regular testing, in-line inspection, and regulatory compliance, supporting steady regional market expansion..

North American NDT and Inspection Market: COMPANY EVALUATION MATRIX

SGS SA (Star) leads with a dominant market share and an expansive service and technique footprint, supported by strong regional presence, broad testing portfolios, and advanced digital inspection platforms that support complex applications in oil & gas, aerospace, power, and infrastructure. Intertek Inc. (Emerging Leaders) is strengthening its position by using its quality-assurance network to deliver NDT services across manufacturing, energy, and infrastructure, combining conventional testing with advanced methods and sector-specific expertise, resulting in a broad but slightly less deep footprint than the star players.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- SGS SA (Switzerland)

- Bureau Veritas (France)

- Baker Hughes Company (US)

- Applus+ (Spain)

- MISTRAS Group (US)

- Intertek Group plc (UK)

- Wabtec Corporation (US)

- Ashtead Technology (Scotland)

- Amerapex Corporation (US)

- Acuren (US)

- TEAM, Inc. (US)

- FPrimeC Solutions Inc. (Canada)

- Carestream Health (US)

- Magnaflux (US)

- Eddyfi Technologies (Canada)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 5.16 Billion |

| Market Forecast in 2030 (Value) | USD 7.71 Billion |

| Growth Rate | CAGR of 8.4% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) & Volume (Thousands Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | US, Canada, Mexico |

WHAT IS IN IT FOR YOU: North American NDT and Inspection Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading NDT Equipment OEM |

|

|

| Inspection Service Providers (NDT Contractors) |

|

|

| Aerospace & Aviation Tier-1 Suppliers |

|

|

| Oil & Gas Pipeline Operators |

|

|

| Power Generation & Renewable Asset Operators |

|

|

RECENT DEVELOPMENTS

- July 2025: SGS signed an agreement to acquire ATS, a leading US-based provider of specialized non-destructive testing (NDT), inspection, calibration, and forensic solutions, strengthening SGS’s North American market presence.

- May 2025: Intertek launched SupplyTek, an end-to-end global market access solution providing consulting, training, and assurance services for quality, safety, and sustainability in complex supply chains.

- April 2024: Waygate Technologies, a subsidiary of Baker Hughes Company, launched an advanced ultrasonic gauge offering 0.001 mm accuracy for precise NDT measurements in industrial applications.

- June 2023: Applus+ signed an agreement in March 2023 and completed in June 2023 the sale of its US NDT and inspection business serving the oil & gas sector to Ten Oaks Group.

- January 2023: Bureau Veritas inaugurated its new regional headquarters in Riyadh, Saudi Arabia, strengthening its footprint with six offices and five laboratories. The expansion supports Vision 2030, enabling the company to deliver testing, inspection, and certification services, with emphasis on sustainability, ESG, and risk management.

Table of Contents

Methodology

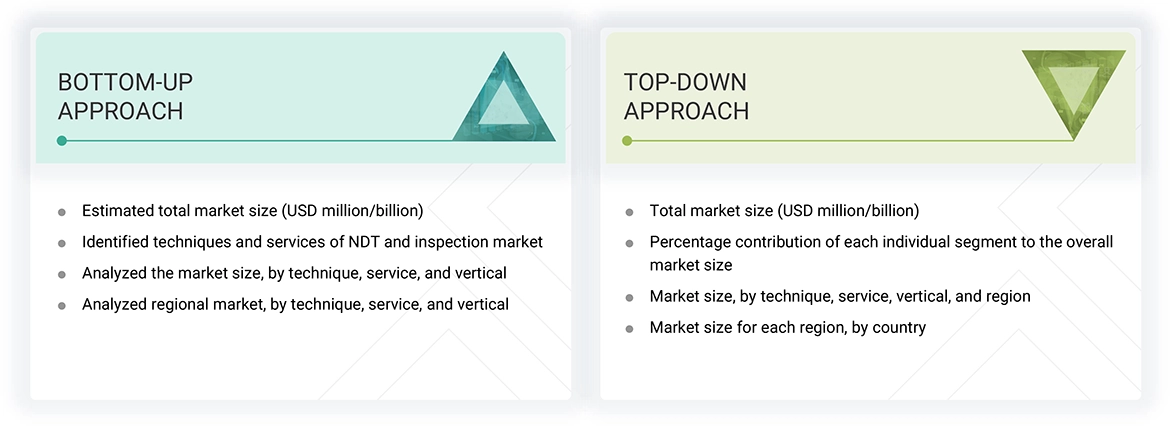

The research study involved four major activities in estimating the size of the North American NDT and inspection market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

The North American NDT and inspection market report estimates the market size using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

Extensive primary research has been conducted after understanding the North American NDT and inspection market scenario through secondary research. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the North American NDT and inspection market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying stakeholders in the North American NDT and inspection market, including regulatory bodies (e.g., ASME, ISO, API), certification agencies, industry associations, consulting firms, equipment manufacturers, service providers, and end users across industries such as oil & gas, aerospace, automotive, power, and public infrastructure

- Analyzing major providers of NDT equipment and services and their key offerings, including ultrasonic testing (UT), radiographic testing (RT), eddy-current testing (ECT), magnetic particle testing (MPT), liquid penetrant testing (LPT), acoustic emission testing (AET), visual inspection systems, and other emerging techniques (e.g., terahertz imaging and near-infrared spectroscopy)

- Studying trends of NDT adoption across sectors such as manufacturing, oil & gas, aerospace, automotive, power, and public infrastructure

- Tracking recent market developments, including regulatory updates, technology advancements (e.g., AI- and IoT-integrated inspection platforms, robotic and drone-based inspection systems), product innovations, facility expansions, and mergers & acquisitions by key players to forecast market size and emerging opportunities

- Conducting multiple discussions with key opinion leaders, including equipment OEMs, service providers, quality assurance consultants, and regulatory auditors to understand real-time adoption trends, technical challenges, and the rising focus on predictive maintenance, automation, and data-driven inspection strategies

- Validating market estimates through in-depth consultations with industry experts—ranging from R&D heads of leading NDT equipment manufacturers to asset integrity managers and technical advisors—and aligning insights with domain specialists at MarketsandMarkets for accurate and reliable market projections

North American NDT and Inspection Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall North American NDT and inspection market has been divided into several segments and subsegments. The data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply-side perspectives. Along with data triangulation and market breakdown, the market has been validated through top-down and bottom-up approaches.

Market Definition

The non-destructive testing (NDT) and inspection market comprises technologies and services used to assess the quality, integrity, and performance of materials or structures without causing damage. NDT techniques, such as ultrasonic, radiographic, eddy-current, visual, and magnetic particle testing, enable flaw detection, stress analysis, and material characterization across critical applications. Inspection, including both visual and instrument-based methods, ensures compliance with quality standards, specifications, and regulations. NDT and inspection are essential for ensuring operational safety, product reliability, and process efficiency across industries such as aerospace, manufacturing, oil & gas, automotive, and power. The market is evolving with digital advancements, such as AI, IoT, robotics, and cloud-based platforms, for real-time monitoring and data-driven decision-making.

Key Stakeholders

- Original Equipment Manufacturers (OEMs)

- NDT Equipment Distributors and Suppliers

- Suppliers of Accessories and Consumables for NDT Equipment

- Providers of North American NDT and inspection Services

- Research Organizations, Testing Laboratories, and Consulting Firms

- Government Bodies, Regulatory Authorities, and Policymakers

- Industry Associations, Standards Bodies, and Alliances (e.g., ASNT

- Venture Capitalists and Private Equity Firms

Report Objectives

- To define, describe, segment, and forecast the size of the North American NDT and inspection market, by technique, service, vertical, and region, in terms of value

- To describe the North American NDT and inspection market based on application

- To forecast the market size for the technique segmentation for ultrasonic testing (UT) equipment, in terms of volume

- To offer detailed information on drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the North American NDT and inspection market value chain

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To study the impact of AI/Gen AI and the 2025 US tariff on the market under study, along with the macroeconomic outlook for each region

- To analyze opportunities for various stakeholders by identifying the high-growth segments of the market

- To benchmark the key players and analyze their market position in terms of revenue, market share, and core competencies2, and a detailed competitive landscape for the market leaders

- To analyze competitive developments such as product/service launches, agreements, partnerships, collaborations, acquisitions, and investments carried out by players in the North American NDT and inspection market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North American NDT and Inspection Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North American NDT and Inspection Market