North American Robotic Vision Market

North American Robotic Vision Market by Type (2D Vision, 3D Vision Systems), Component (Cameras, LED Lighting, Optics, Processors & Controllers, Frame Grabbers, Deep Learning Software), Deployment (Robotic Guidance System, Robotic Cells) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The North American robotic vision market is projected to reach USD 1.45 billion by 2030 from USD 0.95 billion in 2025, at a CAGR of 8.9% between 2025 and 2030. Robotic vision systems provide reliable and consistent results as they eliminate defective goods from the supply chain and enable product traceability. Compared with photoelectric sensor-based applications, robotic vision systems are a better alternative. Many companies have adopted this technology, recognizing its value in improving product quality, enabling flexible manufacturing, and increasing throughput.

KEY TAKEAWAYS

-

BY COUNTRYThe US is projected to register a CAGR of 9.3% between 2025 and 2030.

-

BY COMPONENTThe cameras segment accounted for a 41.0% share of the North American robotic vision market in 2024.

-

BY TYPEBy type, the market for 3D vision systems segment is projected to grow at the highest rate during the forecast period.

-

BY INDUSTRYBy industry, the food & beverages segment is projected to register a CAGR of 10.9% during the forecast period.

-

COMPETITIVE LANDSCAPECognex Corporation, Teledyne Technologies Inc., KEYENCE CORPORATION, Omron Corporation, and FANUC CORPORATION were identified as some star players in the North American robotic vision market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPEBaumer, ADLINK Technology Inc., and wenglor sensoric GmbH, among others, have distinguished themselves among SMEs by securing strong footholds in specialized niche areas.

The North American robotic vision market is projected to grow strongly over the next decade, driven by labor shortages, reshoring of manufacturing, and the surge in e-commerce and EV production. Automotive, electronics, food & beverage, and logistics facilities are rapidly adopting AI-powered 3D vision and deep-learning systems for random bin-picking, defect detection, and traceability in high-mix, high-throughput environments. This shift toward flexible, lights-out automation boosts the deployment of advanced robotic vision solutions across the region.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

End users of robotic vision systems and system integrators have been leveraging imaging, optics, technologies, and software. Even though the robotic vision system is a relatively mature technology, decreasing component cost, software cost, and engineering costs, combined with increased ease of use and application expansion, continue to drive the revenue of component and system suppliers serving the robotic vision market. The adoption of robotic vision systems for applications such as inspection, quality testing, and surface processing is expected to be the new revenue pocket for market players. Niche industries, such as healthcare and food & beverages, are expected to be the new revenue pockets for the market players.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising emphasis on machine automation to enhance industrial operations

-

Growing adoption of 3D vision systems in industrial robotics

Level

-

High initial installation costs

-

Complexities in creating standard vision systems for different manufacturing applications

Level

-

Rising implementation of robotic vision systems in food & beverages industry

-

Government-driven programs to enhance industrial automation

Level

-

Complexities in integrating robots into vision systems

-

Issues related to complex inspections involving deviation and unpredictable defects

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising emphasis on machine automation to enhance industrial operations

North American industries are aggressively pursuing machine automation to combat chronic labor shortages, rising wages, and the need for 24/7 production in reshored manufacturing and e-commerce logistics. Robotic vision systems are central to this shift, enabling flexible, high-precision operations, such as bin-picking, quality inspection, and adaptive assembly with minimal human intervention. Supported by federal incentives and Industry 4.0 initiatives, this emphasis on automation is rapidly boosting productivity, resilience, and competitiveness across automotive, electronics, food & beverages, and warehousing sectors.

Restraint: High initial installation costs

Limited technical awareness and a lack of in-house expertise remain major barriers to broader adoption of robotic vision systems in North America. Despite the proven advantages in flexibility, quality control, and labor savings, mid-sized manufacturers and logistics operators still perceive the technology as complex, expensive, or applicable only to high-volume OEMs. As a result, while large automotive, electronics, and e-commerce players rapidly deploy advanced 3D and AI-enhanced vision solutions, smaller Tier-2/3 suppliers and regional warehouses often stick to traditional fixed automation or basic 2D systems, slowing overall market penetration outside the leading early-adopter segments.

Opportunity: Rising implementation of robotic vision systems in food & beverages industry

North America’s food & beverages sector is swiftly adopting robotic vision systems to ensure hygiene compliance, zero-defect quality, and high-speed handling of diverse products. AI-powered 3D vision excels in detecting irregular shapes, transparent packaging, and contaminants in wash-down environments while meeting strict FSMA traceability rules. Driven by labor shortages and 24/7 demands, vision-guided robots are transforming depalletizing, packing, and inspection tasks, boosting efficiency and resilience across processing and distribution facilities.

Challenge: Complexities in integrating robots into vision systems

Integrating robotic vision systems in North America is hindered by compatibility issues across robot brands, custom programming demands, and challenges from variable lighting, reflective surfaces, and high-speed motion. These factors often lead to lengthy commissioning, high engineering costs, and steep learning curves, particularly for mid-sized manufacturers. Such complexities slow widespread adoption despite the proven benefits in productivity and quality.

NORTH AMERICAN ROBOTIC VISION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployed vision-enabled robotic arms and integrated vision/AI systems (e.g., Sparrow, Sequoia) in multiple U.S. fulfillment centers to support automated picking, sorting, and tote handling | Higher picking accuracy and throughput | Reduced manual labor on repetitive tasks | Faster fulfillment cycles during peak demand |

|

Robot-guided visual inspection system implemented for engine valve-bridge placement and assembly verification using Cognex vision tools | Ensured correct part placement | Reduced assembly errors and rework | Improved quality control on high-volume engine lines |

|

Large-scale rollout of vision-guided robotic inspection and laser measurement systems across assembly plants to improve panel fit and dimensional quality | Improved fit/finish quality | Reduced manual inspection workload | Lower warranty/repair rates through automated measurement |

|

Clinical adoption of robot-assisted surgical platforms that rely on high-definition stereoscopic vision for instrument guidance and intraoperative imaging (e.g., da Vinci systems used in multiple centers | Enhanced surgical precision and visualization | Reduced incision size | Faster recovery times | Enablement of complex procedures with improved ergonomics |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

A robust ecosystem of established hardware/software providers supports the North America robotic vision market, which includes key players, such as Cognex Corporation (US), Basler AG (Germany), KEYENCE CORPORATION (Japan), Teledyne Technologies Inc. (US), and OMRON Corporation (Japan). These companies offer advanced imaging technologies tailored to the needs of diverse industries. The strong presence of industrial giants reflects the growing demand for automation, quality control, and intelligent inspection solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

North American Robotic Vision Market, By Type

The 3D vision system segment is experiencing the fastest growth rate in North America as industrial automation is rapidly shifting toward complex, unstructured tasks, such as random bin-picking, mixed-load depalletizing, and adaptive EV battery assembly. These tasks require depth perception and spatial awareness, making 3D technology the essential solution for the flexible, lights-out manufacturing demanded by reshoring and labor-constrained plants.

North American Robotic Vision Market, By Component

The cameras segment held the largest market share in North America in 2024, primarily because they are the fundamental, indispensable hardware component at the very start of any robotic vision process. The camera is responsible for the crucial initial step of image capture, and its cost forms a substantial portion of the system’s total bill of materials. Furthermore, the surging demand for specialized high-resolution, high-frame-rate, and 3D smart cameras drives this segment’s dominant value across the region.

North American Robotic Vision Market, By Industry

The automotive industry exhibits the largest and most sustained share in North America due to its massive scale of high-precision assembly lines and the ongoing construction of EV and battery gigafactories. Robotic vision systems are indispensable for body-in-white welding, powertrain assembly, delicate cell handling, and 100% quality/traceability inspection under strict IATF 16949 and safety standards, solidifying automotive’s dominant position throughout the forecast period.

REGION

US is expected to be fastest-growing country across North American robotic vision market during forecast period

The US is recording the fastest growth rate in the North American robotic vision market, fueled by its dominant industrial base in automotive, electronics, and semiconductor sectors, where vision-guided systems are essential for precision assembly, defect detection, and adaptive automation amid the surge in EV battery gigafactories and reshoring initiatives.

NORTH AMERICAN ROBOTIC VISION MARKET: COMPANY EVALUATION MATRIX

In the North America Robotic Vision market matrix, KEYENCE CORPORATION (Japan) and Teledyne Technologies Inc. (US) lead with a strong market presence and a wide product portfolio, driving large-scale adoption across various industries, including food & beverages, and automotive.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Cognex Corporation

- KEYENCE CORPORATION

- FANUC CORPORATION

- Teledyne Technologies Inc.

- Omron Corporation

- SICK AG

- Basler AG

- Emerson Electric Co.

- Zebra Technologies Corp.

- ABB

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.88 BN |

| Market Forecast in 2030 (Value) | USD 1.45 BN |

| Growth Rate | 8.9% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America (US, Canada, and Mexico) |

WHAT IS IN IT FOR YOU: NORTH AMERICAN ROBOTIC VISION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive OEM | In-depth analysis of robotic vision adoption in body-in-white, powertrain, and EV battery assembly lines across U.S., Canada, and Mexico plants. | Benchmarking of 2D vs 3D vision ROI, supplier selection framework, and integration roadmap for IATF 16949-compliant traceability systems. |

| E-commerce & Logistics Operator | Detailed mapping of vision-guided robot deployment in mega-fulfillment centers and micro-fulfillment hubs in the U.S., with case studies of Amazon-scale automation. | Cost-benefit analysis of random bin-picking and depalletizing solutions, plus vendor-neutral comparison of leading smart-camera and 3D vision platforms. |

| Food & Beverage Manufacturer / Co-packer | Comprehensive review of wash-down-rated robotic vision systems for primary/secondary packaging, including FSMA and FDA traceability compliance strategies. | Technology selection matrix for high-speed inspection of irregular/shiny/transparent products and labor-saving automation justification models. |

| Semiconductor / Electronics Manufacturer | Focused assessment of high-resolution and line-scan vision systems for wafer handling, PCB assembly, and front-end/back-end processes in new U.S. fabs. | CHIPS Act funding impact analysis, cleanroom-compatible vision roadmap, and risk mitigation strategies for micron-level defect detection. |

RECENT DEVELOPMENTS

- August 2024 : Zebra Technologies Corp. introduced a series of cutting-edge AI enhancements to its Aurora machine vision software, adding deep learning capabilities for sophisticated visual inspection applications.

- August 2024 : Cognex Corporation enhanced its In-Sight SnAPP vision sensor with a new AI-powered counting tool. This tool helps in automating assembly verification and quantity checks for manufacturers. It simplifies counting complex parts, including reflective, distorted, and varying contrast objects.

- May 2023 : Teledyne DALSA announced the commencement of production for its Linea 2 4k Multispectral 5GigE line scan camera. This advanced camera elevates the capabilities of vision systems with its exceptional performance and value. It incorporates a 5GigE interface, providing five times the bandwidth of the Linea GigE camera, and represents a significant leap forward in terms of speed and data transfer capabilities.

Table of Contents

Methodology

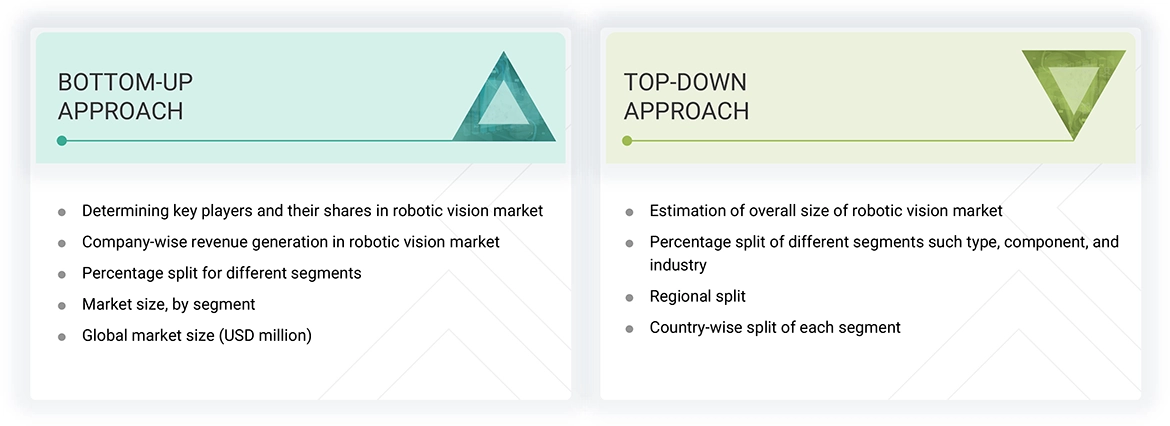

The study involved four main activities to estimate the current size of the north american robotic vision market. Extensive secondary research was conducted to gather information on the market, related markets, and the overall north american robotic vision landscape. These findings, along with assumptions and projections, were validated through primary research that included interviews with industry experts and key stakeholders across the value chain. Both top-down and bottom-up approaches were used to estimate the overall market size. Afterwards, market breakdown and data triangulation techniques helped determine the sizes of various segments and subsegments. Two primary sources, secondary and primary, were utilized to perform a comprehensive technical and commercial assessment of the north american robotic vision market.

Secondary Research

The secondary research process involved consulting various secondary sources to gather the necessary information for this study. These sources included annual reports, press releases, investor presentations by companies; white papers; journals and reputable publications; and articles from recognized authors, websites, directories, and databases. Secondary research was performed to acquire key information about the industry’s supply chain, the market’s value chain, the overall pool of key players, market segmentation based on industry trends (down to the most detailed level), regional markets, and significant developments from both market and technology perspectives. The collected secondary data was analyzed to estimate the overall market size, which was further validated through primary research.

Primary Research

After understanding the current state of the north american robotic vision market through secondary research, extensive primary research was conducted. Several interviews were carried out with experts from the demand and supply sides across four major regions: North America, Europe, the Asia Pacific, and the RoW. This primary data was gathered through questionnaires, emails, and phone calls.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were employed to estimate and validate the overall size of the north american robotic vision market. These methods have also been widely used to determine the size of various subsegments within the market. The following research methodology was applied to estimate the market size:

- Major players in the industry and markets were identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

North american robotic vision Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the north american robotic vision market using the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was also validated using both top-down and bottom-up approaches.

Market Definition

The integration of machine vision systems with industrial robots is called north american robotic vision. It involves combining advanced imaging and computer vision technologies with robotic systems to help machines perceive, interpret, and interact with their environment. This includes using cameras, sensors, and complex algorithms to capture and analyze visual data, enabling robots to perform tasks such as object recognition, navigation, inspection, and manipulation with high accuracy. The technology covers both 2D and 3D vision systems, which provide depth perception and spatial awareness essential for industries like manufacturing, automotive, logistics, and healthcare. By utilizing artificial intelligence and machine learning, north american robotic vision improves automation by supporting real-time decision-making and adapting to changing environments. It plays a key role in advancing Industry 4.0, boosting productivity, quality control, and safety in various operational areas.

Key Stakeholders

- Raw material and manufacturing equipment suppliers

- Government bodies, venture capitalists, and private equity firms

- North american robotic vision manufacturers

- North american robotic vision distributors

- North american robotic vision industry associations

- Professional service/solution providers

- Research institutions and organizations

- Standards organizations and regulatory authorities related to the north american robotic vision market

- System integrators

- Technology consultants

Report Objectives

- To define, describe, and forecast the north american robotic vision market, in terms of type, component, industry, and region, in terms of value

- To forecast the market, by component, in terms of volume

- To describe and forecast the market, in terms of value, with regard to four central regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing market growth

- To provide a detailed overview of the north american robotic vision value chain

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the north american robotic vision market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the north american robotic vision market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive strategies, such as product launches, expansions, mergers, and acquisitions, adopted by key players in the north american robotic vision market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the North American Robotic Vision Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in North American Robotic Vision Market