Open Gear Lubricants Market

Open Gear Lubricants Market by Base Oil (Mineral Oil, Synthetic Oil, and Bio-based Oil), End-use Industry (Mining, Cement, Construction, Power Generation, Oil & Gas, Marine), and Region (Asia Pacific, North America, Europe) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The open gear lubricants market is projected to reach USD 907.9 million by 2030 from USD 738.1 million in 2024, at a CAGR of 3.51% from 2024 to 2030. Open gear lubricants market has grown as the demand for increasing demand in end-use industries such as mining, marine, and power generation. These factors drive the open gear lubricants market. Also, the open gear lubricants manufacturers have opportunity such as increasing in demand of advanced additives and nano-lubricants and growing demand from marine and offshore sector. Along with the drivers and opportunities, impact of geopolitical factors and economic slowdown, and stringent environmental regulations are the major restraint for the market growth.

KEY TAKEAWAYS

-

BY BASE OILBased on base oil, open gear lubricants market is segmented into synthetic base oil, mineral base oil, bio-based base oil. Mineral base oil emerges first in the opened gear lubricants market due to its widespread availability, cost benefits, and applicability in different types of industries. These mineral-based lubricants derived from crude oil refining are being extensively applied into industries such as mining, cement, power generation, and construction because of their fairly balanced property of lubricity, thermal stability, and anti-wear at a relatively lower cost than synthetic alternatives.

-

BY END-USE INDUSTRYThe open gear lubricants market covered mining, cement, construction, power generation, oil & gas, marine, and other end-use industries. Among these, mining industry held the largest share owing to the extreme operational conditions faced by equipment such as draglines, crushers, mills, and hoists. Cement and construction sectors contributed significantly, requiring reliable lubrication for kilns, crushers, and rolling mills. Power generation relied on open gear lubricants for turbines, conveyors, and other critical machinery. Across all sectors, high-performance formulations enhanced operational reliability, reduced unplanned downtime, extended equipment service life, and enabled safer, more efficient maintenance practices.

-

BY REGIONAsia Pacific accounted for the largest share, in terms of value, in 2023. Industrial operators in Asia Pacific are increasingly prioritizing predictive maintenance and operational efficiency to minimize downtime and maintenance costs. The growing reliance on heavy machinery in mining, cement, and power generation has amplified the need for durable, high-performance open gear lubricants that can withstand extreme loads and abrasive conditions. This focus on extending equipment life, ensuring consistent performance, and reducing unplanned stoppages is driving strong adoption of advanced lubricant formulations across the region, reinforcing Asia Pacific’s leading position in the global open gear lubricants market.

-

COMPETITIVE LANDSCAPEMajor players of open gear lubricants market included FUCHS SE, Klüber Lubrication, Carl Bechem GmbH, CSW Industrials, Inc., and Shell plc, focusing on performance optimization, advanced additives, and environmentally compatible formulations. These companies collaborated with OEMs and industrial operators to develop condition-monitoring solutions and predictive maintenance strategies. Investments in research and development have led to high-adhesion, low-washout, and temperature-stable lubricants that extend maintenance intervals and improve gear reliability. The competitive focus on innovation, sustainability, and strategic partnerships has strengthened market positioning while meeting growing industrial demands for efficient, high-performance lubrication solutions across challenging operational environments.

Open gear lubricants form a film over the surfaces of gears, which reduces friction, wear, and metal contact, even under the most extreme pressure and harshest operating conditions. Such lubricants are engineered for the application of forces distributed over heavy loads in slow gear contact speeds while exposed to external contaminants, ranging from dust and moisture to extreme temperatures. Open gear lubricants with solid additives such as graphite and molybdenum disulfide or even extreme pressure (EP) additives improve the load-carrying ability and gain some resistance against pitting and scuffing. The blend frequently incorporates tackiness and adhesiveness properties to ensure continuous coverage of the gears, even in outdoor or exposed conditions. Open gear lubricants ensure improved efficiency of equipment, longevity of gears, and reduced downtime, all these features make them critical in the heavy industrial sector.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on industrial operators emerges from evolving operational needs or maintenance disruptions. End users such as mining, cement, power generation, and other heavy industries are the clients of open gear lubricant manufacturers, and their machinery and gear-driven equipment are the target applications. Changes in production schedules, extreme operational conditions, or maintenance requirements will influence the performance and costs for these end users. The resulting effect on equipment reliability and maintenance expenditure will subsequently impact the revenues of lubricant suppliers, shaping demand, formulation development, and strategic priorities in the open gear lubricants market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for open gear lubricants in various end-use industries

-

Growth in demand for bio-based open gear lubricants

Level

-

Geopolitical instability and economic slowdown

-

Difficulties in lubricant application and incompatibility with modern high-performance machinery

Level

-

Rising demand from marine and offshore industries

-

Stringent equipment maintenance standards

Level

-

Balancing Cost and Performance

-

Development of eco-friendly formulations without compromising efficiency

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Growing demand in end-use industries

The market for open gear lubricants is driven by the increasing demand from different industries like mining, marine, power generation, construction, cement, and oil & gas. Specialized lubricants are precisely responsible for improving reliability, optimizing performance, and reducing downtime of equipment in difficult environments. The Simandou Iron Ore Project in Guinea and the Koodaideri Iron Ore Mine in Australia are large-scale mining projects anticipated to fuel the consumption of lubricants. Heavy machines, such as excavators, crushers, and haul trucks, call for high-performance open-gear lubricants with a strong load-bearing capacity, anti-wear properties, and resistance to contaminants. The marine industry is also witnessing growth, especially in offshore programs such as the Dogger Bank Wind Farm in the North Sea, which is soon to be the largest offshore wind project in the world. Such projects will require open gear lubricants for vessels, cranes, and gear systems that work in severely corrosive saltwater environments.

Impact of geopolitical factors and economic slowdown

Market restraints for open gear lubricants are predominantly geopolitical and economic slowdowns. Trade restrictions, sanctions, and political disturbances in major oil-producing countries generally hinder the supply chain of base oils and additives, leading to price fluctuations and shortages. Conflicts such as the Russia-Ukraine war have affected the availability of crude oil, influencing raw material costs and production costs. Moreover, economic downturns affect market growth by reducing production in industries and infrastructure projects, resulting in reduced heavy machinery demand and, as a result, low consumption of open gear lubricants. Sectors such as mining, construction, and oil & gas, which are the prime consumers of open gear lubricants, are frequently using these during times of recession, limiting procurement. Thus, market growth is significantly impacted by economic variations and geopolitical uncertainties.

Growing demand from marine and offshore sector

The open gear lubricants market has a tremendous opportunity because of the immense demand within the marine and offshore sectors. International trade, offshore energy project developments, and massive amounts of money pumped into maritime infrastructure are factors creating demand for high-performance lubricants. An open gear system works under extreme conditions, which can comprise high humidities, salt needs, and heavy loads on board vessels, cranes, winches, and offshore drilling equipment. There is also a shift toward advanced synthetic and bio-based lubricants, which ideally provide very good corrosion resistance and long service life while improving environmental regulations. The demand is further augmented by offshore wind farms and deep-sea oil exploration. With an increase in marine activities, the market for specialized open gear lubricants will witness corresponding growth, contributing to the operational efficiency and durability of the equipment.

Balancing cost & performance

The key problem affecting the industry for open-gear lubricants is to balance cost and performance. Extremely high-performance lubricants are needed in industries such as mining, marine, and power generation for the various mechanisms to obtain durability, wear reduction, and efficiency; however, high-performance synthetic and specialty lubricants require a great price tag that many cost-sensitive industries find hard to swallow. Furthermore, eco-friendly pressures in the formulations add to the production costs needed to set the product. While lower-cost alternatives may exist, they affect the product’s durability, leading to more maintenance and downtime. Striking a balance between low pricing and excellent lubrication performance is critical for market players. The real challenge will be innovation in formulation technologies that provide solutions that are competitive in pricing yet high in quality.

Open Gear Lubricants Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Open-gear lubricants used on large turbine gears exposed to weather and variable loads, especially in offshore and onshore wind farms. | Provides better corrosion resistance and wear protection under harsh conditions, extends gear life, helps reduce downtime and maintenance cost. |

|

Heavy open-gear drives in mining operations (e.g. conveyors, crushers) require lubricants able to handle extreme dust, impact, and load. | Ensures reliable gear protection, less wear under shock loads, improves equipment lifespan, lowers risk of failures in remote sites. |

|

Open-gear systems on rotary kilns and large cement mill drives exposed to high temperature and dust environments. | Maintains lubricant film at elevated temperatures, resists particulate abrasion, reduces unplanned shutdowns, improves kiln running efficiency. |

|

Use of open-gear lubricants on locomotive exposed pinions and track components for safety-critical joints. | Enhances adhesion under heavy vibration, protects against moisture ingress and corrosion, improves reliability, lowers long-term maintenance costs. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The open gear lubricants ecosystem involves analyzing the interconnected relationships among various stakeholders, including base oil suppliers, lubricant manufacturers, distributors, contractors, and industrial end users. Base oil suppliers provide essential raw materials such as mineral oils, synthetic oils, and bio-based oils to lubricant manufacturers. These manufacturers blend advanced additives and formulate high-performance open gear lubricants tailored for heavy-duty machinery. Distributors and suppliers then connect manufacturers with end users in mining, cement, power generation, and other end-use industries, optimizing the supply chain, improving operational efficiency, and ensuring reliable delivery of critical lubrication solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Open Gear Lubricants Market, By Base Oil

Open gear lubricants based on mineral oil will continue to dominate the market because they provide cost benefits, are easily available, and have a history of proven performance in industrial applications. These lubricants are extremely effective in carrying loads, preventing wear, and compatibility with mass usage; hence, they find applications in the most important sectors, such as mining, cement, power generation, and construction. Furthermore, development in additive technology has contributed to increasing thermal stability, oxidation resistance, and separation of water from mineral oils for lubricants, which have consequently improved their market position. Synthetics demonstrate superior properties; however, their development costs prohibit mass application. Thus, mineral oils remain the largest class in terms of usage as they continue to provide low-cost options that meet the basic performance requirements for heavy-duty applications.

Open Gear Lubricants Market, By End-use Industry

Mining is projected to be the fastest-growing end-use industry of the open gear lubricants market during the forecast period, due to several key factors. The increase in deep mining operations due to depleted surface mineral reserves created demand for lubricants that withstand the pressures and temperatures presented in such harsh conditions. The adoption of automation and AI and IoT-enabled mining equipment soared, hence the need for superior lubricants that extend machinery life and efficiency. Stricter environmental regulations also affect this market, forcing mining companies toward low-toxicity, biodegradable lubricants that pass their sustainability goals.

REGION

Asia Pacific held the largest share in the global open gear lubricants market in 2023

Asia Pacific dominated the open gear lubricants market in 2023. The dominance is primarily driven by rapid infrastructure development and industrial expansion across countries like China, India, and Indonesia. Increasing investments in large-scale mining, cement plants, and power generation facilities are creating a higher demand for heavy-duty machinery, which requires reliable lubrication for optimal performance. The region’s focus on industrial modernization, coupled with rising mechanization and automation of equipment, further boosts the adoption of high-performance open gear lubricants, supporting operational efficiency, reduced downtime, and extended equipment life across critical industrial sectors.

Open Gear Lubricants Market: COMPANY EVALUATION MATRIX

FUCHS SE leads the open gear lubricants market with a robust global presence and extensive product portfolio, catering to industries such as mining, cement, and power generation. The company focuses on high-performance formulations that enhance equipment reliability, reduce wear, and improve maintenance efficiency under extreme operating conditions. FUCHS SE’s emphasis on sustainability, including eco-friendly lubricants and low-emission solutions, strengthens its market leadership. Its consistent innovation in adhesion, thermal stability, and contamination resistance ensures broad adoption across heavy industries, making it the preferred partner for industrial operators seeking long-term performance and operational cost savings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2023 | USD 713.4 Million |

| Revenue Forecast in 2030 | USD 907.9 Million |

| Growth Rate | CAGR of 3.51% from 2024-2030 |

| Actual data | 2019-2030 |

| Base year | 2023 |

| Forecast period | 2024-2030 |

| Units considered | Value (USD Million), Volume (Ton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Open Gear Lubricants Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Open Gear Lubricants Manufacturer |

|

|

| Asia Pacific-based Open Gear Lubricants Manufacturer |

|

|

RECENT DEVELOPMENTS

- January 2025 : FUCHS SE acquired Boss Lubricants GmbH & Co. KG, enhancing its specialty lubricants portfolio. This strategic move allowed FUCHS to expand its operations and strengthen its position in the market. The acquisition was part of FUCHS’ broader strategy to increase its offerings and capabilities in the lubricants sector, providing its customers with a more comprehensive range of products. Through this acquisition, FUCHS further solidified its role as a leading global supplier of specialty lubricants.

- November 2024 : FUCHS SE successfully acquired STRUB & Co. AG, a Swiss lubricants company. This strategic move provided FUCHS with direct market access in Switzerland, consolidating its Swiss business activities and expanding its presence with a local research and production plant. STRUB & Co. AG, a family-run company founded in 1921, specializes in developing, producing, and distributing industrial lubricants and specialty products, particularly within the Swiss market.

- May 2024 : Klüber Lubrication announced a significant expansion of its operations facility in Mysore, which is set to be fully operational by the beginning of 2027. Klüber Corporation India’s manufacturing plant in Mysore is spread over 17,000 sq. m. and produces world-class specialty lubricants. The company recently announced an investment of USD 16.88 million that will further bolster its operations in the country and reiterate its commitment to “Make in India” by increasing domestic production.

- April 2024 : FUCHS SE acquired the LUBCON Group, a German-based manufacturer of high-performance specialty lubricants. This strategic move allowed FUCHS to enhance its product portfolio in specialty lubrication solutions and bolster its global competitiveness. LUBCON, with its 13 operating entities and five production facilities across Germany, Poland, the Philippines, India, and the US, brought extensive expertise in developing greases, oils, and pastes used in sectors like railways, roller bearings, and pharmaceuticals.

- April 2021 : Shell Oil’s subsidiary, SOPUS Products, and Whitmore Manufacturing (a CSWI subsidiary) formed a joint venture named Shell & Whitmore Reliability Solutions, LLC. The joint venture will market, distribute, and sell lubricants, greases, coolants, and reliability products to the North American rail and mining sectors.

Table of Contents

Methodology

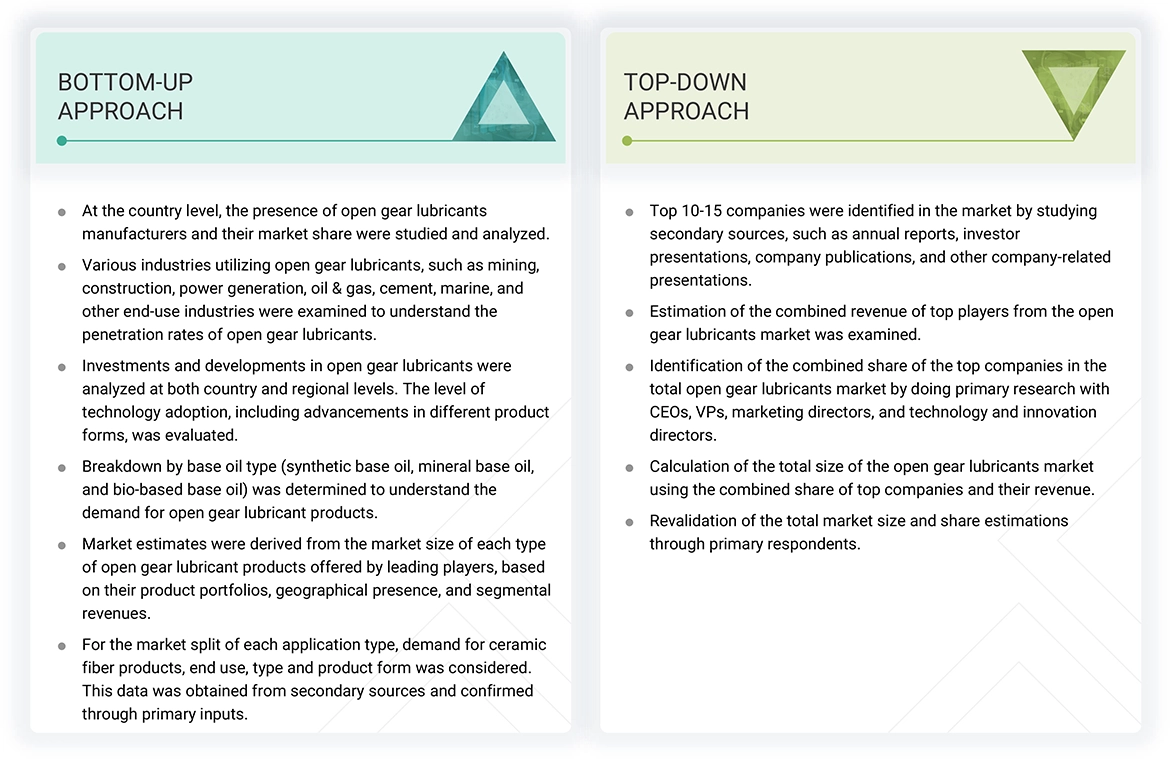

The study involved four major activities in estimating the market size for open gear lubricants. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

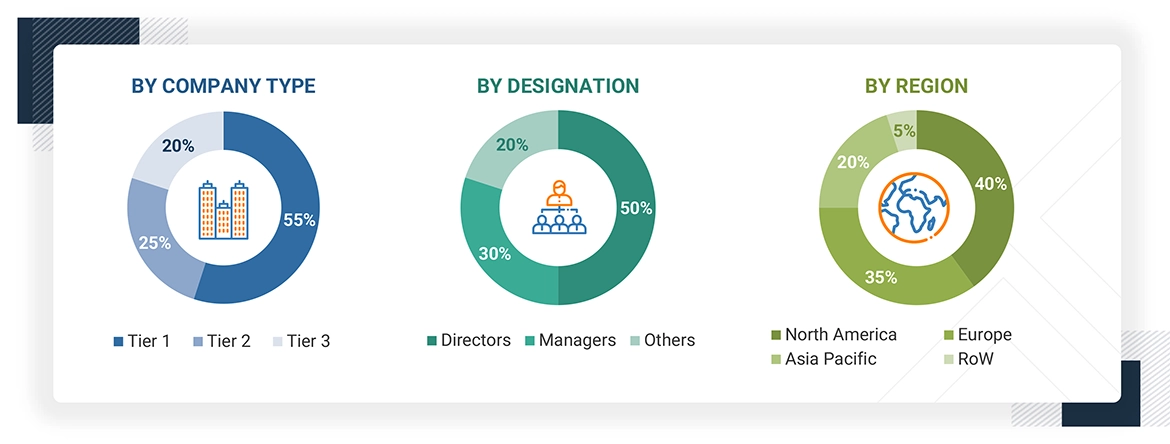

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The open gear lubricants market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the automotive, medical, construction and others. The supply side is characterized by advancements in technology and diverse end-use industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative informations.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| FUCHS SE | Director of Marketing | |

| Klüber Lubrication | Manager- Sales & Marketing | |

| Carl Bechem GmbH | Sales Manager | |

| CSW Industrials, Inc. | Production Manager | |

| Shell plc | Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the open gear lubricants market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Open Gear Lubricants Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the open gear lubricants industry.

Market Definition

According to the American Gear Manufacturers Association (AGMA), open gear lubricants are specialized products designed for large, slow-moving, heavily loaded open gears typically used in the mining, cement, and power generation industries. These lubricants include high-viscosity base oils, asphaltic compounds with volatile solvents, and polymer-thickened products. The extreme pressure and anti-scuff additives are specially incorporated into these lubricants for heavy loads and extreme conditions. They are designed to provide high load-carrying capacity, resist water washout, and form a protective film to minimize wear and friction under severe operating conditions.

Stakeholders

- Open Gear Lubricants Manufacturers

- Open Gear Lubricants Traders, Distributors, and Suppliers

- End-use Market Participants of Different Segments of Open Gear Lubricants

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

Report Objectives

- To define, describe, and forecast the open gear lubricants market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by base oil type, end-use industries, and region

- To forecast the size of the market for five main regions: Europe, North America, Asia Pacific, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To strategically profile key players and comprehensively analyze their growth strategies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Open Gear Lubricants Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Open Gear Lubricants Market